Escolar Documentos

Profissional Documentos

Cultura Documentos

01 Ryanair (Ronny TAN)

Enviado por

Ronny TanDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

01 Ryanair (Ronny TAN)

Enviado por

Ronny TanDireitos autorais:

Formatos disponíveis

Abstract The major issues in Ryanairs entry strategy are (a) penetrating the market, (b) increasing revenue,

and (c) decreasing cost. To augment its existing launch strategy, I recommend Ryanair to (a) continue and expand its aggressive marketing campaign in order to maintain and expand market awareness. To increase revenue, I recommend Ryanair to (a) expand to new and long-haul routes, (b) develop ancillary income streams, and (c) impose penalty fees. To exert tighter costs control, it could (b) establish a no-frills pay-what-you-use itemized service model, (b) hedge fuel contracts, and (c) standardise and simplify aircraft acquisition. Major Issues Air travel demand between Dublin and London has probably stabilized over the 10 years from the stagnant market share of 0.5 million passengers. Ryanair's entry strategy is focused on breaking this duopoly as well as to entice existing rail/ferry travellers with the introduction of a low-cost alternative. In the immediate term, the most critical issue for Ryanairs management at this point of their launch is to penetrate the conscience of its target market, i.e. fareconscious travellers, so as to grab and secure market share. To this end, it has adopted a multi-prong marketing entry strategy: 1. 2. 3. 4. 5. Demonstrate ability to successfully run an airline by operating the Waterford-Gatwick and Dublin-Luton services, to generate customer confidence in its punctuality, lost baggage, and safety record Adopt a simplified a single-class single-fare structure to facilitate price comparisons Aggressively price its fare 1 IP less than flag carriers lowest discount rates targets to lure fare-conscious travellers, including existing rail/ferry travellers Target rail/ ferry passengers with a nine times reduction in travel time for only twice the fare Offer meals and amenities comparable to flag carriers to match proclaimed high quality service

Other major issues Ryanair needs to address include (a) increasing revenue and (b) decreasing costs, both which directly impacts profits. To this end, its route and fleet management strategies entail: 1. Fly point-to-point directly to (a) minimize travelling time for customers and (b) avoid head-on competition with existing flag carriers hub-spoke routes. This will boost passenger traffic and revenue. It will also avoid costs associated with passenger and baggage transfers at connecting airports Choose lucrative route which has sufficient passenger volume to absorb their entry and provide reasonable return on capital investment Offer four daily flights to maximise flexibility and attract potential travellers Operate from secondary airports where traffic is lower to minimize aircraft turnaround time and maximize aircraft utilization, hence increasing revenue-generating flight time. Secondary airports also incur lower landing, ground handling charges Operate small-capacity turboprops to increase seat occupancy and reduce fuel costs (BAs bigger capacity planes for the London-Dublin route only managed 67% occupancy)

2. 3. 4.

5.

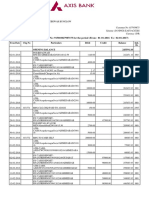

Assessment of Strategy Most of the abovementioned strategies are in line with Ryanairs intent to differentiate itself from flag carriers and operate as a low-cost airline. For instance, most of its marketing strategies will be highly effective in gaining initial market share, while its route and fleet strategies gives it competitive advantages in revenue and cost over its rivals. Nonetheless, some mid-to-longer term concerns become apparent on deeper analysis: Sustainable Profitability Ryanair's strategy to launch with the cheapest single-fare single-class no-restriction ticket would certainly obtain market share quickly. However, sustainability requires Ryanair to keep its operating expenses low. Yet, Ryanair opted to offer full service (meals and amenities). This imposes significant strain on operating costs. Moreover, they intend to deploy a larger aircraft in the future. This will increase aircraft maintenance costs as they will have to train engineers and service two different types of aircrafts. Preliminary analysis would conclude that Ryanair is cutting its operating margin very tightly. From Exhibit 4, the average cost per passenger (155 IP) is higher than the ticket price proposed by Ryanair (98 IP). While it should enjoy some cost savings from depreciation, fuel, landing and handling charges (which account for 60.8% of total operating costs), whether it makes a profit or not crucially depends on whether savings exceed 36.8% compared to a flag carrier. Indeed, if Ryanair continues to provide full services, its cost structure may not be sufficiently lower to generate a profit.

Competitor Response In the immediate term, AL and BA may: (a) maintain current prices, or (b) start a price war with Ryanair. In the mid-tolonger term, both could (a) maintain status quo or (b) transform themselves to compete with Ryanair. Marginal cost would have to be higher than marginal benefits for BA or AL to retaliate. Both companies have a significant disadvantage, they have a cost structure difficult to cut as most are fixed costs. It is also difficult to base their strategy on differentiation as Ryanair claims to offer similar first-rate customer service. Nonetheless, AL and BA may react by: 1. 2. Establish new discounts within their fare structures Cut costs and improve efficiency of their long-haul services, possibly through outsourcing of secondary functions, reducing physical retail outlets, or mothballing aircrafts during extreme cyclical periods of low air travel demand to reduce surplus capacity Drop ancillary businesses in hotel and business management. That said, they could pursue alternative business models via partnerships rather than ownership of expensive capital assets. This will still allow them to generate income from bundled packages Establish their own short-haul low-cost subsidiaries to garner a foothold in the low-cost market Cut losses on short-haul routes and focus on high-margin long-haul, business class travellers

3.

4. 5.

Recommended Actions (a) Maintain and Expand Market Awareness Continue and expand its aggressive marketing campaign. Given its status as a new entrant, Ryanair has the luxury of behaving as a maverick upstart in its marketing efforts. For instance, it could also shake up the cosy industry by offering a lowest price money-back guarantee, and engage in publicity stunts and ads that directly compare or attack competitive airlines. In addition, it could offer ridiculously cheap (99 pence) albeit limited seats on regular flights, and organize lotteries to give away free seats for every 1 millionth customer. (b) Increase Revenue Expand to new and long-haul routes. Newer competitors would eventually appear. Yet new income streams and growth needs to be found. When demand has been fully met by capacity on Ryanairs existing routes, it should consider expanding into new and longer-haul routes, e.g. transAtlantic while still operating under the low-cost model. While this will stretch passengers tolerance for how long they can endure budget flights, the expanding global market for cheap air travel should offer sufficient demand. In line with this recommendation, Ryanair would need to lobby national governments to relax the degrees of freedom for onward flights Develop ancillary income streams. In adjunct to flight ticket sales, ancillary sales can become an important component of the low-cost model to generate additional high net margins. These could include corporate partnerships to benefit from car hire, hotel bookings, rail booking and travel insurance and credit card deals. Impose penalty fees. Ryanair could introduce a no-refund, no-show ticket policy that minimizes administrative costs. (c) Decrease Costs Establish no-frills pay-what-you-use itemized model. To lower costs and boost revenue, Ryanair could unbundle and retract services taken for granted but not necessarily needed by passengers. Under this no-frills model, it could retract full meal services, and outsource catering to third-party operators who will pay Ryanair a flat per-flight fee for the right to sell food and drinks to passengers. Free newspapers and magazines could be removed, given that flights are shorter. Ryanair could instead charge for on-board gaming facilities, as well as checked and/or cabin baggage. Hedge fuel contracts. Fuel accounts for a substantial part (19.1%) of costs (based on BAs example). Given the relatively recent 1973 and 19179 Middle East Oil Crises, Ryanair could hedge its fuel requirements and price contracts for longer periods of 12-18 months to avoid fluctuating fuel costs and the need to charge customers fuel surcharges, unlike the case for other carriers. Standardise and simplify aircraft acquisition. In the mid-to-long term, Ryanair should standardise its fleet to as few aircraft type as possible, generating savings on training costs, maintenance supplies and labor costs as only one type of parts and skills are needed. The aircraft themselves could be no-frills, e.g. they can be ordered without window blinds, reclining seats, headrests or seat pockets, reducing both acquisition costs and delivery times. In sum, Ryanairs tight cost control is the backbone of its low-price strategy. Nonetheless, despite a relentless focus on costs, the airline should be careful not to compromise safety and to maintain an accident-free record. Ultimately, by focussing on its target market and consistently addressing their most important needs vis-a-vis pricing, flexibility, and punctuality, it should be able to provide superior service and beat its competition where it matters.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Project Change ManagementDocumento15 páginasProject Change ManagementTaskia FiraAinda não há avaliações

- Business Plan Pizza ShopDocumento11 páginasBusiness Plan Pizza ShopPaulaBrinzeaAinda não há avaliações

- CA LISA Virtualization - PresentationDocumento15 páginasCA LISA Virtualization - Presentationsharmila boseAinda não há avaliações

- Maintenance Planning, Coordination, Scheduling and ExecutionDocumento19 páginasMaintenance Planning, Coordination, Scheduling and ExecutionBayu Prayoga Part II100% (1)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Documento1 páginaTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)anu balakrishnanAinda não há avaliações

- 6 Arbes Vs PolisticoDocumento3 páginas6 Arbes Vs PolisticoAnonymous GMUQYq8Ainda não há avaliações

- Declaration of Travis Crabtree - Trademark EngineDocumento4 páginasDeclaration of Travis Crabtree - Trademark EngineLegalForce - Presentations & ReleasesAinda não há avaliações

- CurriculumVitae 1Documento2 páginasCurriculumVitae 1Adams S. Bol-NabaAinda não há avaliações

- 1 CISSP 1er Dummy Examen Respuestas y Explicaciones - QADocumento58 páginas1 CISSP 1er Dummy Examen Respuestas y Explicaciones - QAIvan MartinezAinda não há avaliações

- Highland Bankruptcy FilingDocumento16 páginasHighland Bankruptcy FilingZerohedge100% (1)

- CE462-CE562 Principles of Health and Safety-Birleştirildi PDFDocumento663 páginasCE462-CE562 Principles of Health and Safety-Birleştirildi PDFAnonymous MnNFIYB2Ainda não há avaliações

- OpenX Reference GuideDocumento36 páginasOpenX Reference Guidedclark127Ainda não há avaliações

- As 12marks BestAnswer BushraFurqanDocumento1 páginaAs 12marks BestAnswer BushraFurqankazamAinda não há avaliações

- Case Studies On The Letters of CreditDocumento3 páginasCase Studies On The Letters of Creditomi0855100% (1)

- Investment Decision RulesDocumento14 páginasInvestment Decision RulesprashantgoruleAinda não há avaliações

- Customer Management and Organizational Performance of Banking Sector - A Case Study of Commercial Bank of Ethiopia Haramaya Branch and Harar BranchesDocumento10 páginasCustomer Management and Organizational Performance of Banking Sector - A Case Study of Commercial Bank of Ethiopia Haramaya Branch and Harar BranchesAlexander DeckerAinda não há avaliações

- Bim WhitepaperDocumento21 páginasBim WhitepaperpeterhwilliamsAinda não há avaliações

- Cif Palm Kernel ShellDocumento14 páginasCif Palm Kernel ShellPanwascam PurwoharjoAinda não há avaliações

- PDFDocumento7 páginasPDFNikhilAKothariAinda não há avaliações

- Initiatives & Bench Marking: Strategy For Approaching Zero Defects For RmgsDocumento30 páginasInitiatives & Bench Marking: Strategy For Approaching Zero Defects For RmgsYogesh SharmaAinda não há avaliações

- Management AccountingDocumento304 páginasManagement AccountingRomi Anton100% (2)

- Revised Accreditation Form 1 Pharmacy Services NC IIIDocumento23 páginasRevised Accreditation Form 1 Pharmacy Services NC IIICamillAinda não há avaliações

- Aaltola 2018Documento27 páginasAaltola 2018YukiAinda não há avaliações

- M&S HRMDocumento17 páginasM&S HRMDavis D ParakalAinda não há avaliações

- Sourcing Manager or Supply Chain Manager or Commodity Manager orDocumento2 páginasSourcing Manager or Supply Chain Manager or Commodity Manager orapi-121441611Ainda não há avaliações

- Feedback Industry Report BicycleDocumento24 páginasFeedback Industry Report BicycleajaxorAinda não há avaliações

- The-One-Day-Audit-5-Real-Life-ExamplesDocumento4 páginasThe-One-Day-Audit-5-Real-Life-ExamplesDawson EllisonAinda não há avaliações

- Kaizen Definition & Principles in Brief: A Concept & Tool For Employees InvolvementDocumento5 páginasKaizen Definition & Principles in Brief: A Concept & Tool For Employees InvolvementMuna EyobAinda não há avaliações

- Twofour54 Tadreeb Corporate Overview PDFDocumento17 páginasTwofour54 Tadreeb Corporate Overview PDFSolo PostAinda não há avaliações

- Assessing ROI On CloudDocumento6 páginasAssessing ROI On CloudLeninNairAinda não há avaliações