Escolar Documentos

Profissional Documentos

Cultura Documentos

Background To The Study

Enviado por

Olivia Nielsen BarDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Background To The Study

Enviado por

Olivia Nielsen BarDireitos autorais:

Formatos disponíveis

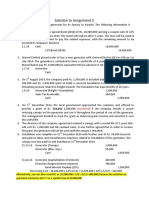

THE EFFECTS OF INTEREST RATE CONTROL ON BORROWING OF MONEY (LOAN)

CASE STUDY EQUITY BANK 1.1 BACKGROUND TO THE STUDY

Interest rate control is a concept used by the central bank to control the amount of money in circulation. The aim is usually to: 1. Discourage borrowing from commercial banks thereby reducing the amount of money in circulation when it is in excess of a certain limit 2. Encourage borrowing from commercial banks thereby increasing the amount of money in circulation when it is below a certain limit There are a number of strategies employed by the central bank to achieve this: 1. Bank rate/Discount rate Commercial banks usually resort to borrowing from the central bank whenever they have a shortage of funds. A high bank rate charged means that the commercial banks will also have to charge high interest rates thereby discouraging borrowing by individuals. On the other hand if the bank rate is low it implies that commercial banks are in a position to charge lower interest rate on the loans advanced to individuals thereby encouraging borrowing. 2. Moral suasion In this strategy, the central bank implores commercial banks to lower the interest rate that they charge on loans advanced to borrowers. This has the effect of encouraging borrowing of loans when the interest rates are reduced. 3. Compulsory Deposit The central bank keeps varying the levels of compulsory deposit from time to time. This has the effect of regulating the amount of money available to the commercial banks which they can issue to loan seekers. When the compulsory deposit is increased, banks have relatively less money to lend and they then tend to increase interest charged on these loans thus discouraging borrowing. On the other hand when the compulsory deposit is reduced, banks will have more money to lend and will therefore reduce the interest rates they charge consequently encouraging borrowing. 4. Open market operation The central bank buys or sells government bonds with the aim of controlling the short term interest and by extension the money supply in the economy. When the central bank wants to reduce the money in the market, it sells these bonds. This has the effect of encouraging borrowing from commercial banks. On the

1

other hand, to increase the money in the market the central bank buys these bonds from the public. This has the effect of discouraging borrowing since there is enough money in circulation. 5. Liquidity ratio The central bank determines the liquidity ratio that commercial banks are required to maintain. Whenever the central bank wants to curb the ability of commercial banks to advance loans to borrowers, it lowers the value of liquid assets that the commercial banks can maintain. This means that commercial banks will have fewer assets that they can readily convert to money. Since they have less money they therefore tend to increase interest rates thus discouraging borrowing .Conversely to increase the ability of commercial banks advancing money to borrowers, the central bank increases the value of liquid assets that commercial banks are required to hold. This means they have a lot of assets that can easily be converted to cash that can be given to borrowers. This means that they are likely to have more money to lend. They therefore decrease interest rates charged on loans thereby encouraging borrowing which consequently increasing the amount of money in supply. 6. Cash ratio The central bank will from time to time vary the amount of money that commercial banks are required for their normal operations. This has the effect of regulating the amount of money that is available to the commercial banks to advance as loans to their customers. In situations where the central bank wants to discourage borrowing, the cash ration is raised so that less money is available for lending. Conversely, to encourage borrowing, the central bank, the central bank will reduce the cash ratio so that more money is then available for lending by the commercial banks to their customer and subsequently increase the money in circulation. This study is intended to point out the effects of interest rate control on borrowing from the commercial banks. It endeavors to point out whether the effects of interest rate control (if any) have been achieved as intended by the central bank. We point out whether this policy has achieved the intended purposes.

You have been doing a good job so far. However, there are a few things you must never forget.

1. Always present the background of the problem in paragraph form. Resist the temptation to number. Keep it prose. 2. CITATIONS ARE A MUST. What you have done constitutes plagiarism.

Formatted: Numbered + Level: 1 + Numbering Style: 1, 2, 3, + Start at: 1 + Alignment: Left + Aligned at: 0.6" + Indent at: 0.85"

1.2 STATEMENT OF THE PROBLEM

The interest rate control policy has not been effective in controlling the borrowing of money in Kenya. Despite the measures put in place by the central bank, borrowing of money in Kenya has not been regulated as is reflected by the high inflation rates that have continued to rise therefore putting into doubt the effectiveness of these measures. Could have said more . If you review literature more, you find gaps which you justify here

1.3 PURPOSE AND OBJECTIVE OF THE STUDY 1.3.1 GENERAL OBJECTIVE

The general objective is to study the effects that have been produced by interest rate control measures put into place by the central bank.

1.3.2 SPECIFIC OBJECTIVES

To determine if the interest rate control measures put in place by the central bank has produced the desired effects. Tryh always at least three for a masters proposal

1.4 RESEARCH QUESTIONS AND HYPOTHESIS 1.4.1 RESEARCH QUESTIONS

1. Has interest rate control produced any effects on borrowing patterns in Kenya? 2. Has interest rate control produced the desired effects on the borrowing patterns in Kenya?

1.4.2 HYPOTHESIS

Ho: Interest rate control has no effect on borrowing of money. Ho: Interest rate control has not produced the desired effects as intended by the central bank on borrowing of money.

1.5 SIGNIFICANCE OF THE STUDY

3

This study aims to explain whether there are any effects on borrowing that result from interest rate control. The study also aims to show why despite the interest rate control measures put in place by the central bank, the borrowing of money has not been effective as evidenced by the ever increasing levels of inflation. To the government/central bank This study will point out the effects of the interest rate control methods employed by the central bank if any. It will show if the methods were effective and whether they can be improved to achieve the desired effects.

To the commercial banks This study will give a chance for any flaws to be corrected. The commercial banks can then liaise with the central bank in streamlining these strategies. This will save the commercial banks from disruptions that arise from the central bank changing policy from time to time. The commercial banks can also be in a position to provide the required amount of credit to borrowers at stable rates. To the loan borrowers This study will upon implementation stabilize the high rates of inflation thus saving them from losses that are accrued as a result of inflation. This also has the effect of ensuring that the right amount of credit is always available to borrowers.

1.6 LIMITATIONS OF THE STUDY

This study is faced with many challenges. The main ones are: 1. Access to information and data that is relevant to the study. Many banks keep their information with high secrecy. This means that accessing enough information on this subject is a big challenge. 2. Diversity of the Kenyan economy. This implies that the effects that result from interest rate control are not uniform across the country and that different regions will react differently to this policy. The findings of this study might not be a reflection of the entire country from people of all walks of life.

1.7 ASSUMPTIONS OF THE STUDY

Several assumptions are made in this study: 1) Interest rate control measures have been put in place by the central bank appropriately to take care of high/low levels of borrowing money from commercial banks. 2) It is assumed that commercial banks offer loans to borrowers at the same interest rates. 3) The central bank institutes interest rate control measures in a timely and swift manner to regulate the borrowing patterns. 4) Interest rate control is applied uniformly to all the Kenyan banks at the same time across the country.

1.8 XX

1.9 DEFINITIONS OF THE TERMS

I. Central bank This is a financial institution that manages a nations currency, money supply and interest rates. Commercial bank This is a type of financial institution that provides transactional, savings and accepts deposits from the public. Interest rate control Is a concept/mechanism used by the central bank and by extension the commercial banks to raise/lower the interest rates charged on loans to individual borrowers thus influencing the borrowing patterns Bank rate/Discount rate

5

II.

III.

IV.

This is the amount of interest charged on the loans that are advanced to commercial banks by the central bank. V. Compulsory Deposit This is the amount of money that commercial banks are required to maintain with the central bank. Open market operation This is the activity of the central bank buying or selling or buying government bonds on the open market. Liquidity ratio This is the ratio of liquid assets to the other assets that the bank is holding. Cash ratio This is the amount of money that commercial banks are required to hold for their normal operations. Interest rate This is the rate at which interest is paid by a borrower for the use of money they borrowed from the lender.

VI.

VII.

VIII.

IX.

2.1 LITERATURE REVIEW 2.1.1 THEORITICAL LITERATURE 2.1.2 EMPIRICAL LITERATURE

6

Você também pode gostar

- Articles of Association 1774Documento8 páginasArticles of Association 1774Jonathan Vélez-BeyAinda não há avaliações

- Doing Business in Canada GuideDocumento104 páginasDoing Business in Canada Guidejorge rodriguezAinda não há avaliações

- CIR vs RUEDA Estate Tax Exemption for Spanish NationalDocumento1 páginaCIR vs RUEDA Estate Tax Exemption for Spanish NationalAdriel MagpileAinda não há avaliações

- Elc 2009 - Study Pack FullDocumento355 páginasElc 2009 - Study Pack FullAllisha BowenAinda não há avaliações

- Assurance Services: Definition, Types and LimitationsDocumento146 páginasAssurance Services: Definition, Types and LimitationsMudassar Iqbal0% (1)

- Motion To DismissDocumento4 páginasMotion To DismissYulo Vincent Bucayu Panuncio100% (1)

- DOJ Manila Criminal Complaint Against Robbery SuspectsDocumento2 páginasDOJ Manila Criminal Complaint Against Robbery SuspectsDahn UyAinda não há avaliações

- Monetary PolicyDocumento11 páginasMonetary PolicyWaqar100% (1)

- Criminology and Criminal Justice AdministrationDocumento167 páginasCriminology and Criminal Justice AdministrationRahulAbHishekAinda não há avaliações

- Lecture 8 Monetary PolicyDocumento16 páginasLecture 8 Monetary PolicyAwab HamidAinda não há avaliações

- FM 130 Philippine Monetary PolicyDocumento5 páginasFM 130 Philippine Monetary PolicyHerminio NiepezAinda não há avaliações

- T&C Air BalancingDocumento4 páginasT&C Air BalancingAzwan SunlineAinda não há avaliações

- Philippine Monetary Policy OverviewDocumento12 páginasPhilippine Monetary Policy OverviewLyn AmbrayAinda não há avaliações

- Licensure Exams Criminologist ReviewDocumento34 páginasLicensure Exams Criminologist ReviewKulot SisonAinda não há avaliações

- Credit Control MethodsDocumento3 páginasCredit Control Methodsprasal67% (3)

- Mindanao Island 5.1 (PPT 1) Group 2Documento40 páginasMindanao Island 5.1 (PPT 1) Group 2Aldrin Gabriel BahitAinda não há avaliações

- Overview of Central BanksDocumento6 páginasOverview of Central BanksMehwish AsimAinda não há avaliações

- Monetary Policy LecDocumento30 páginasMonetary Policy LecsofiaAinda não há avaliações

- Lesson Plan on Organizations, Banking, and Credit Control MethodsDocumento8 páginasLesson Plan on Organizations, Banking, and Credit Control MethodsKrishnakanth MAinda não há avaliações

- Economic policies for StabilizationDocumento23 páginasEconomic policies for StabilizationMayurRawoolAinda não há avaliações

- Methods of Credit Control Used by Central BankDocumento5 páginasMethods of Credit Control Used by Central BankAnkit GuptaAinda não há avaliações

- Types of Monetary Policy: Definition: The Monetary Policy Is A Programme of Action Undertaken by The Central Banks andDocumento3 páginasTypes of Monetary Policy: Definition: The Monetary Policy Is A Programme of Action Undertaken by The Central Banks andShafeeq GigyaniAinda não há avaliações

- Analysis of Credit ControlDocumento6 páginasAnalysis of Credit ControlMihir ShahAinda não há avaliações

- Monetary policy instruments and objectives explainedDocumento4 páginasMonetary policy instruments and objectives explainedfarisktsAinda não há avaliações

- The Top Four Techniques of Credit Control Adopt by Central Bank. The Technique Are: 1. The Bank Rate 2. Open Market OperationsDocumento4 páginasThe Top Four Techniques of Credit Control Adopt by Central Bank. The Technique Are: 1. The Bank Rate 2. Open Market OperationsAbdul WahabAinda não há avaliações

- Methods of Credit Control Used by Central BankDocumento5 páginasMethods of Credit Control Used by Central BanknitinAinda não há avaliações

- Monetary Policy TechniquesDocumento4 páginasMonetary Policy TechniquesAshishAinda não há avaliações

- Term PaperDocumento8 páginasTerm PaperKetema AsfawAinda não há avaliações

- Function of Central Bank and Instruments of Monetary Policy: 1. Monopoly of Note IssueDocumento5 páginasFunction of Central Bank and Instruments of Monetary Policy: 1. Monopoly of Note IssueDrishyaAinda não há avaliações

- CURRENTLYDocumento5 páginasCURRENTLYMuhammad Asim Hafeez ThindAinda não há avaliações

- Reserve Bank of IndiaDocumento25 páginasReserve Bank of IndiaUdayan SamirAinda não há avaliações

- Topic 6 Monetary Policy Eco551Documento41 páginasTopic 6 Monetary Policy Eco551Hafiz akbarAinda não há avaliações

- Ch. 3 Tools of Monetary PolicyDocumento29 páginasCh. 3 Tools of Monetary PolicycarsongoticosegalesAinda não há avaliações

- FIM Tutorial 5 (Week 6)Documento4 páginasFIM Tutorial 5 (Week 6)Cindy LewAinda não há avaliações

- Conduct of Monetary PolicyDocumento16 páginasConduct of Monetary PolicyuzmaAinda não há avaliações

- The Tools of Monetary PolicyDocumento53 páginasThe Tools of Monetary Policyrichard kapimpaAinda não há avaliações

- Lesson 5 - DFI 301 MONETARY POLICYpptxDocumento26 páginasLesson 5 - DFI 301 MONETARY POLICYpptxsaiidAinda não há avaliações

- Methods of Credit Creation by Central BanksDocumento9 páginasMethods of Credit Creation by Central BanksEPP-2004 HaneefaAinda não há avaliações

- Central Bank Monetary Policy Effects on EconomyDocumento10 páginasCentral Bank Monetary Policy Effects on EconomyCLEO COLEEN FORTUNADOAinda não há avaliações

- Differences Between A Central Bank and Commercial BankDocumento4 páginasDifferences Between A Central Bank and Commercial BankMuhammadZariyan AsifAinda não há avaliações

- Chapter Two-Central BankDocumento7 páginasChapter Two-Central BankTanmoy SahaAinda não há avaliações

- Monetary Policy-1Documento4 páginasMonetary Policy-1PETER MUSISIAinda não há avaliações

- Bahasa Inggris UTSDocumento52 páginasBahasa Inggris UTSFania LutuAinda não há avaliações

- Ashraf Sir AssignmentDocumento12 páginasAshraf Sir AssignmenthimelAinda não há avaliações

- Conduct of Monetary Policy Goal and TargetsDocumento12 páginasConduct of Monetary Policy Goal and TargetsSumra KhanAinda não há avaliações

- Econtwo Final ExamsDocumento5 páginasEcontwo Final ExamsAl ChuaAinda não há avaliações

- Monetary PolicyDocumento35 páginasMonetary PolicyMegi EzugbaiaAinda não há avaliações

- Government Policies and Financial Services (Commercial Banks)Documento14 páginasGovernment Policies and Financial Services (Commercial Banks)Ahmed El KhateebAinda não há avaliações

- Assignment of Macroeconomics Consumer Behavior, Central Bank, Monetary PolicyDocumento23 páginasAssignment of Macroeconomics Consumer Behavior, Central Bank, Monetary PolicyarjunAinda não há avaliações

- Monetary and Fiscal PolicyDocumento26 páginasMonetary and Fiscal PolicyTisha GabaAinda não há avaliações

- FI - M Lecture 8-Central Banks-Monetary Policy - PartialDocumento49 páginasFI - M Lecture 8-Central Banks-Monetary Policy - PartialMoazzam ShahAinda não há avaliações

- Monetary Policy ToolsDocumento7 páginasMonetary Policy ToolsDeepak PathakAinda não há avaliações

- Price Stability:: Objectives of Monetary PolicyDocumento9 páginasPrice Stability:: Objectives of Monetary Policyroa99Ainda não há avaliações

- Unit 5 - Central BankDocumento21 páginasUnit 5 - Central Banktempacc9322Ainda não há avaliações

- TUT Macro Unit 8 (Answer)Documento2 páginasTUT Macro Unit 8 (Answer)张宝琪Ainda não há avaliações

- Fabrikam Technology IncDocumento20 páginasFabrikam Technology IncPranshiAinda não há avaliações

- Economics 8Documento3 páginasEconomics 8M IMRANAinda não há avaliações

- Macro Stabilizing PolicesDocumento18 páginasMacro Stabilizing PolicesSujan BhattaraiAinda não há avaliações

- Monetary Policy Role in Economic GrowthDocumento11 páginasMonetary Policy Role in Economic GrowthR AhulAinda não há avaliações

- CATDocumento7 páginasCATJackson KasakuAinda não há avaliações

- Understanding Monetary Policy: Tools and Objectives to Manage InflationDocumento22 páginasUnderstanding Monetary Policy: Tools and Objectives to Manage InflationVishal MahathaAinda não há avaliações

- Homework Assignment - 5 AnswersDocumento9 páginasHomework Assignment - 5 AnswersDaphne de l'EstracAinda não há avaliações

- How productivity affects currency supply through monetary policy toolsDocumento2 páginasHow productivity affects currency supply through monetary policy toolsBrian JavierAinda não há avaliações

- ECO 551 Chapter 6 Central Bank Monetary PolicyDocumento35 páginasECO 551 Chapter 6 Central Bank Monetary PolicyaisyahAinda não há avaliações

- Central Banking and Monetary Policy RolesDocumento38 páginasCentral Banking and Monetary Policy RolesKetema AsfawAinda não há avaliações

- Monetary Policy New 1Documento15 páginasMonetary Policy New 1Abdul Kader MandolAinda não há avaliações

- Prof PCDocumento2 páginasProf PCGeraldine DumasAinda não há avaliações

- Emeka FMT CompletedDocumento51 páginasEmeka FMT CompletedErhueh Kester AghoghoAinda não há avaliações

- Monetary PolicyDocumento31 páginasMonetary PolicyMuhammad TayyabAinda não há avaliações

- Globalization and LiberalizationDocumento4 páginasGlobalization and LiberalizationOlivia Nielsen BarAinda não há avaliações

- 09 CisDocumento2 páginas09 CisOlivia Nielsen BarAinda não há avaliações

- CloverDocumento11 páginasCloverOlivia Nielsen BarAinda não há avaliações

- Kenya VISION 2030-Final Report-October 2007Documento180 páginasKenya VISION 2030-Final Report-October 2007Kenneth MichaelAinda não há avaliações

- Rural Development in Sub-Saharan AfricaDocumento62 páginasRural Development in Sub-Saharan AfricaOlivia Nielsen BarAinda não há avaliações

- Sustainable Development Concept ExplainedDocumento6 páginasSustainable Development Concept ExplainedOlivia Nielsen BarAinda não há avaliações

- Differences Between Ummah and NationDocumento24 páginasDifferences Between Ummah and NationMaryam KhalidAinda não há avaliações

- Question Bank of Sem - 1 To Sem-9 of Faculty of Law PDFDocumento203 páginasQuestion Bank of Sem - 1 To Sem-9 of Faculty of Law PDFHasnain Qaiyumi0% (1)

- Memorandum of AgreementDocumento4 páginasMemorandum of AgreementCavite PrintingAinda não há avaliações

- THE - ARAB - SPRING - NEW - FORCES (The Legacy of The Arab SpringDocumento93 páginasTHE - ARAB - SPRING - NEW - FORCES (The Legacy of The Arab SpringRuber DiazAinda não há avaliações

- Acre v. Yuttiki, GR 153029Documento3 páginasAcre v. Yuttiki, GR 153029MiguelAinda não há avaliações

- John Hankinson AffidavitDocumento16 páginasJohn Hankinson AffidavitRtrForumAinda não há avaliações

- Unit-1 - AR ACTDocumento174 páginasUnit-1 - AR ACTgeorgianaborzaAinda não há avaliações

- Assignment 2 SolutionDocumento4 páginasAssignment 2 SolutionSobhia Kamal100% (1)

- Psbank Auto Loan With Prime Rebate Application Form 2019Documento2 páginasPsbank Auto Loan With Prime Rebate Application Form 2019jim poblete0% (1)

- RP-new Light DistrictsDocumento16 páginasRP-new Light DistrictsShruti VermaAinda não há avaliações

- NaMo Case StudyDocumento4 páginasNaMo Case StudyManish ShawAinda não há avaliações

- Rem 2 NotesDocumento1.655 páginasRem 2 NotesCerado AviertoAinda não há avaliações

- CV Sajid HussainDocumento3 páginasCV Sajid HussainSajid HussainAinda não há avaliações

- Will NEET PG 2023 Be Postponed Students ApproachDocumento1 páginaWill NEET PG 2023 Be Postponed Students ApproachBhat MujeebAinda não há avaliações

- Follow Up of DCPS Emergency Response Planning and ReadinessDocumento12 páginasFollow Up of DCPS Emergency Response Planning and ReadinessABC7NewsAinda não há avaliações

- Understanding Symbols of Peace & War in International OrganizationsDocumento3 páginasUnderstanding Symbols of Peace & War in International OrganizationsNouha MezlougAinda não há avaliações

- Elements of Cost SheetDocumento11 páginasElements of Cost SheetPratiksha GaikwadAinda não há avaliações

- Denatured Fuel Ethanol For Blending With Gasolines For Use As Automotive Spark-Ignition Engine FuelDocumento9 páginasDenatured Fuel Ethanol For Blending With Gasolines For Use As Automotive Spark-Ignition Engine FuelAchintya SamantaAinda não há avaliações

- Tax Invoice for 100 Mbps Home InternetDocumento1 páginaTax Invoice for 100 Mbps Home Internetpriyank31Ainda não há avaliações