Escolar Documentos

Profissional Documentos

Cultura Documentos

Valuation of Inverse IOs and Other MBS Derivatives

Enviado por

goldboxDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Valuation of Inverse IOs and Other MBS Derivatives

Enviado por

goldboxDireitos autorais:

Formatos disponíveis

G L O B A L F I X E D - I N C O M E R E S E A R C H

August 1998

Mortgage Research

United States

Y.K. Chan (212) 783-6627

y.k..chan@ssmb.com

Valuation of Inverse IOs and Other MBS Derivatives

Salomon Smith Barney is a service mark of Smith Barney Inc. Smith Barney Inc. and Salomon Brothers Inc are affiliated but separately registered broker/dealers under common control of Salomon Smith Barney Holdings Inc. Salomon Brothers Inc and Salomon Smith Barney Holdings Inc. have been licensed to use the Salomon Smith Barney service mark. This report was produced jointly by Smith Barney Inc. and Salomon Brothers Inc and/or their affiliates.

August 1998

Valuation of Inverse IOs and Other MBS Derivatives

Contents

I. Fear of Unmodeled Prepayment Risks II. The Breakeven Prepayment Model and the Implied Prepayment Model III. Prices of Prepayment Risk and the Implied Prepayment Model IV. Performance of Three Methods in the Prediction of MBS Strip Prices VII. Valuation of CMO Derivatives 3 4 6 7 8

Figures

Figure 1. RMS Error (per 100 face amount) in Predicting Monthly Price Movements Figure 2. OAS of FHL.PC.177 PO and IO Projected with Constant Prices of Prepayment Risks, 8 Jul 98 Figure 3. Future Values and ROR of Collateral and Replicating Portfolio Using Inverse IO, PO Interest Rate Benchmarks and Cash 7 7 10

The author would like to thank Robert Kulason, Lakhbir Hayre and Michael Schumacher for numerous helpful comments on a draft of this report, Eileen Farmarco for the preparation of the paper, and Kyle Webb for the editing.

August 1998

Valuation of Inverse IOs and Other MBS Derivatives

I. Fear of Unmodeled Prepayment Risks

Thanks to the recent refinancing wave, MBS derivatives that suffer from prepayments have cheapened. For example, the OAS of Fannie Mae Trust 240 IO has widened from 24bp on April 14, 1998 to 413bp on August 14, 1998. Because the OAS has, by definition, been adjusted for rate risks, and is calculated with a prepayment model that has been revised to reflect the increased efficiency in 1 refinancing activities, it seems that investors fear yet higher levels of refinancing efficiency and demand a commensurate risk premium. Whether or not the fear is justified, only time will tell. Meanwhile, investors not averse to prepayment risks can find many cheap securities that could be rewarding should future refinancing efficiency turn out to be milder than that priced in the current market. Some of these securities have OASs in the thousands for the simple reason that their prepayment risks are leveraged manifold. One example of these structured securities is an inverse IO, a security that receives no principal and that has a coupon that is inversely proportional to LIBOR, with a cap and a floor. Effectively, the holder invests in a fixed-coupon bond, finances part of it at LIBOR, and buys a cap on the financing rate. The cap is on the prepayable balance and is therefore subject to prepayment risk. The leveraging multiplies whatever prepayment risks that come with the fixed-coupon bond. Another example is a support bond that accompanies a PAC in a CMO. It can be regarded as a fixed-rate tranche financed by selling the PAC. Since the PAC has little prepayment risk, that in the support bond is leveraged up. In order to assess the relative value of such securities, we need a method to quantify the prepayment risk in each, and at the same time, extract the risk premiums from the market.

See Update to Salomon Smith Barney Prepayment Model, Bond Market Roundup: Strategy, Salomon Smith Barney, May 29, 1998.

August 1998

Valuation of Inverse IOs and Other MBS Derivatives

II. The Breakeven Prepayment Model and the Implied Prepayment Model

Traders and investors have long been aware of the need to account for unmodeled prepayment risks in the valuation of structured securities. One method is to apply a multiplier to the prepayment model so as to cause a PO/IO pair to have equal OAS at the pairs market prices. The breakeven multiplier and breakeven OAS thus obtained will represent the information as to the markets price of prepayment risks. Together, they are used to price any CMO whose collateral is 2 similar to that for the strip pair. One drawback to the breakeven method is that CMOs without any prepayment risk would be priced at the breakeven OAS even when some such bonds are actively trading at a different OAS. Examples are wide-banded PACs and floaters with high caps and low floors. An attempt to circumvent this difficulty would be to replace the breakeven OAS with the OAS of agency debentures and keep the breakeven multiplier. This, however, would somewhat misprice the strips and could severely misprice some structured bonds. For example suppose the breakeven OAS is 50bp and the breakeven multiplier is 120%. Pricing a PAC with these parameters has the same effect as pricing it at an OAS of 50bp at the 100% model if the PAC band is unlikely to be broken. If the PAC is trading at 40bp OAS at 100% prepayment model we would be off by 10bp. If the PAC/support ratio is 4:1, then the support class would be mispriced by roughly 40bp OAS. An extension to the breakeven method is to replace the PO/IO pair with a large, representative set of MBS pass-throughs and strips. Several prepayment model parameters, along with an OAS, are adjusted so as to minimize the discrepancy between the resulting model prices of the selected benchmarks and their respective market prices. The implied prepayment model and the implied OAS are then used to price CMOs. One disadvantage in the context of pricing specific CMOs is that we do not fully use the market price information of the specific PO/IO pair whose collateral most resembles that of the CMO, even when such is available. Another, as in the case of the breakeven method, is that the implied OAS may not be suitable for bonds free of prepayment risks. These considerations lead us to the following scheme: The OAS is fixed at a level obtained from prepayment riskfree bonds, for example the agency OAS or some fixed level below the LIBOR swap spread. Then, two selected prepayment model parameters are adjusted so as to produce exactly the market prices of a specific PO/IO pair. Two prepayment model parameters are needed because these are two prices, PO and IO, to match. An example of a pair of prepayment parameters that can be used is the 3 refinancing speed multiplier and housing turn-over speed multiplier.

Understanding PAC IOs, Salomon Smith Barney , October 1992.

For the conceptual understanding of the discussion the reader can keep this pair in mind although the Salomon Smith Barney implementation uses a different pair.

August 1998

Valuation of Inverse IOs and Other MBS Derivatives

The implied prepayment model, along with the OAS, are used to price only CMOs whose collateral resembles that of this reference strip pair.

August 1998

Valuation of Inverse IOs and Other MBS Derivatives

III. Prices of Prepayment Risk and the Implied Prepayment Model

Another method to account for prepayment risks is to first define prepayment risks as the price sensitivities to two model parameters when the latter change slightly from zero. A prepayment riskfree bond would be priced at the OAS of agency debentures. Others are subject to additional price concessions that are multiples of their respective prepayment risks. The two multipliers are chosen so that the reference PO/IO pair, after the discounts, would be priced exactly at market levels. The multipliers thus obtained are the prices of prepayment risks associated with the PO/IO pair. One drawback of this method is that, unlike the implied prepayment method, it could produce negative prices. Actually, the implied prepayment parameters can be regarded as a refinement of the prices of prepayment risks just described, and can 4 be called prices of prepayment risk for that reason. Hereafter, we will use the two terms interchangeably.

4 To see this, let f(security,p1,p2) denote the price at the nominal OAS of a security with the prepayment parameters p1 and p2 whose nominal values are zero. The prices of risk r1 and r2 are defined such that

market price of PO = f ( PO,0,0) + r1 * f ( PO,0,0) / p1 + r 2 * f ( PO,0,0) / p2 market price of IO = f (IO,0,0) + r1 * f (IO,0,0) / p1 + r 2 * f (IO,0,0) / p2

The expressions on the right hand sides are the first order terms of the Taylor expansion. Therefore, ignoring second order error, we have market price of PO = f(PO,r1,r2) market price of IO = f(IO,r1,r2) This is none other than the definition of the implied prepayment.

August 1998

Valuation of Inverse IOs and Other MBS Derivatives

IV. Performance of Three Methods in the Prediction of MBS Strip Prices

In addition to arriving at a fair price today, the implied prepayment method can be used to give scenario horizon prices in a rate-of-return analysis. The implied prepayment parameters (a.k.a. prices of prepayment risks) will be held constant, along with the nominal OAS (plus any additional OAS as the trade price would determine) at the horizon. Figure 1 compares the historical performance of price prediction using this method with the OAS method and the breakeven method. The Root-Mean-Square (RMS) of price prediction errors are listed for five PO/IO Trusts and their respective collaterals. The OAS method outperforms in the case of collateral. The implied prepayment method and the breakeven method have comparable errors, significantly smaller in RMS than the OAS method in the case of strips.

Figure 1. RMS Error (per 100 face amount) in Predicting Monthly Price Movements

Security Method TR.240 Since Feb94 TR.252 Feb94 TR.237 Dec93 TR.270 Aug95 TR.268 Jul95

PO IO COL PO IO COL PO IO COL

OAS OAS OAS Breakeven Parameters Breakeven Parameters Breakeven Parameters Implied Prepayment Model Implied Prepayment Model Implied Prepayment Model

0.74 0.86 0.36 0.65 0.78 0.39 0.65 0.79 0.37

0.91 0.93 0.37 0.70 0.76 0.47 0.70 0.73 0.45

1.05 1.09 0.46 0.87 0.91 0.63 0.90 0.81 0.56

0.71 0.68 0.30 0.77 0.76 0.29 0.78 0.75 0.31

0.74 0.68 0.30 0.71 0.64 0.27 0.73 0.64 0.30

Source: Smith Barney Inc./Salomon Brothers Inc.

To give some intuition, we use the implied prepayment method to predict the prices of a PO/IO pair and then derive their OAS (the usual one relative to the nominal prepayment model) and the breakeven parameters. These are listed in Figure 2. The method thus predicts an OAS widening of 326bp for the IO in a 50bp rally, and a tightening of 119bp in a 50bp selloff.

Figure 2. OAS of FHL.PC.177 PO and IO Projected with Constant Prices of Prepayment Risks, 8 Jul 98

Scenario -50bp -25bp 0bp +25bp +50bp

PO OAS IO OAS BE Multiplier BE OAS

Source: Smith Barney Inc./Salomon Brothers Inc.

-112bp 777 129.2% 35bp

-93bp 572 127.3% 38bp

-79bp 451 125.9% 38bp

-71bp 379 124.8% 38bp

-67bp 332 124.0% 38bp

Assured that the implied prepayment method performs at least as well as the breakeven method in the case of strips, we are ready to apply it to CMO derivatives.

August 1998

Valuation of Inverse IOs and Other MBS Derivatives

VII. Valuation of CMO Derivatives

As illustration, we apply the implied prepayment method to the inverse IO, GNMA98.2-SW, which has a coupon of (8.5 - LIBOR1). The collateral is Ginnie Mae 7.0 with WAM=26.5 years. There is no Ginnie Mae Trust that can serve as the reference strips for this bond. As a conservative surrogate, we use the Trust FHL.PC.177 PO/IO pair whose collateral is a Freddie Mac Gold 7.0 with WAM= 27 years. From market prices for the Trust PO, we find the prices of prepayment risks using LIBOR for discounting so that a floater with uncapped coupon equal to one-month LIBOR will be priced at par. With this implied model, the prepayment risk-adjusted price of the inverse IO can be obtained. This is the fair price. If a trade occurs at a price other than the fair price, we can add a spread to the discounting rates so as to match the trade price. This spread is the prepayment risk adjusted OAS and measures the cheapness of the bond after prepayment risk. Because of the difference between CMO and LIBOR day counting, the floater OAS relative to Treasury would be approximately 10bp below the swap spread. Thus, we price prepayment risk-free bonds at approximately 10bp below the swap spread. A prepayment risk-adjusted OAS of 30bp for a prepayment risky CMO would, for example, be approximately 20bp over the swap spreads with the implied prepayment model. If the swap spread is 40bp then the OAS of this CMO relative to Treasury would be 60bp with the implied prepayment model. We use a price of 16 for GNMA98.2-SW on August 18, 1998. With the implied prepayment model, this corresponds to a prepayment riskadjusted OAS of -43bp. Thus, the bond is richer than would be indicated by the market prices of prepayment risks, except for the fact that the reference strip pair from Trust FHL.PC.177 is a conservative prepayment reference, since Ginnie Mae pass-throughs in general prepay more slowly than conventional pass-throughs of the same coupon and weighted average life. To get another indication of the value of the bond, we can combine it with some PO, interest-rate, and volatility benchmarks to form a portfolio that replicates the pass-through under a set of representative scenarios. Specifically, we use the prepayment riskadjusted OAS and the implied model to project the prices of the CMO, the PO, IO, and the collateral of FHL.PC.177 at the one-month horizon under various scenarios. The scenarios and the corresponding future values are listed in Figure 3. The scenario designated nc stands for no change in rates, volatility, or prices of prepayment risks. The scenario YC-- has ten-year rate shifted down 50bp and other rates and the volatilities shifted according to projections from empirical covariance, given the shift in the ten-year rate; the prices of prepayment risks are kept fixed in this scenario. The scenarios YC-, YC+, and YC++ are similarly obtained from the ten-year rate shift of -25bp, +25bp, and +50bp, respectively. The scenario 2TR+ means a shift of the curve by 10bp at the two-year point and 0bp at the five-year point (linear interpolation and constant extrapolation elsewhere). The scenario vc2+ and vs1+ have change of volatility of 1% for the two-year cap and the one-year into ten-year swaption, respectively. The scenario designated PPM1+1 stands for an increase of 1 point in the first price of prepayment risk. The meaning of the other scenarios should now be obvious. The letters in the benchmark names

8

August 1998

Valuation of Inverse IOs and Other MBS Derivatives

are self explanatory. Following the letters is a date of maturity or expiration, and then the coupon or strike, as the case may be. The interest-rate benchmarks are selffinanced.

August 1998

Valuation of Inverse IOs and Other MBS Derivatives

Figure 3. Future Values and ROR of Collateral and Replicating Portfolio Using Inverse IO, PO Interest Rate Benchmarks and Cash

Trade Date August 18, 1998

Yield Curve Scenario Future Value

3m 5.08

Face

6m 5.19

BASE

1Y 5.25

nc

2 5.34

YC--

3 5.34

YC-

5 5.34

YC+

10 5.41

YC++

30 5.56

2TR+ 5TR+ 30TR+ 2LB+ 5LB+ vc2+ vc5+ vs1+ vs5+ PPM1+1 PPM2+1

1 mon Portfolio I Components Collateral 370.41 378.09 380.2

1 mon 382.56

1 mon 381.82

1 mon 377.43

1 mon 373.92

1 mon 379.89

1 mon 379.85

1 mon 380.12

1 mon 379.46

1 mon 379.71

1 mon 380.18

1 mon 379.94

1 mon 380.03

1 mon 379.84

1 mon 380.16

1 mon 380.21

Portfolio II Components: (Benchmarks Financed, Treasuries at 5.00, Others at 5.59) GNMA98.2-2-SW FHL.PC.177-1 tre20000815_5.339 tre20030815_5.343 tre20080815_5.408 tre20280815_5.556 edf20000918_5.765 edf20030915_5.980 cap20000818_5.750 cap20030818_6.000 swn19990818_6.107 swn20030818_6.306 cal19981018_101.913 cal19981018_99.980 cal19981018_98.091 Cash(at 5.59) Portfolio I Portfolio II Advantage of II over I Scenario Annualized ROR: Portfolio I Portfolio II Advantage II over I

Source: Smith Barney Inc./Salomon Brothers Inc.

100.00 47.15 175.86 -154.83 -15.17 4.11 692.54 235.86 70.96 -288.87 -69.19 9.51 69.81 -82.43 11.28 324.48

16.04 37.57 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 324.48 378.09 378.09 0.00

16.26 37.69 0.07 -0.06 -0.01 0.00 0.00 0.00 -0.04 0.28 0.05 0.00 -0.10 0.20 -0.01 325.96 380.20 380.30 0.10

16.28 41.51 1.49 -2.76 -0.60 0.28 0.94 0.43 -0.19 2.29 -2.41 0.28 1.19 -2.42 0.41 325.96 382.56 382.66 0.10

16.50 39.71 0.78 -1.40 -0.30 0.14 0.47 0.21 -0.14 1.40 -1.07 0.13 0.24 -0.89 0.19 325.96 381.82 381.92 0.10

15.63 35.98 -0.63 1.27 0.28 -0.13 -0.47 -0.21 0.15 -1.17 0.64 -0.08 -0.16 0.62 -0.16 325.96 377.43 377.53 0.10

14.76 34.47 -1.33 2.59 0.55 -0.25 -0.93 -0.43 0.40 -3.07 1.11 -0.14 -0.16 0.69 -0.22 325.96 373.92 374.02 0.10

16.13 37.68 -0.24 -0.04 -0.01 0.00 -0.02 0.00 0.01 0.42 0.02 0.00 -0.10 0.20 -0.01 325.96 379.89 379.99 0.10

16.03 37.66 0.07 0.59 -0.01 0.00 -0.14 0.01 -0.04 -0.35 0.06 0.02 -0.10 0.20 -0.01 325.96 379.85 379.95 0.10

16.29 37.63 0.07 -0.06 -0.01 -0.06 0.00 0.00 -0.04 0.28 0.07 -0.01 -0.10 0.20 -0.01 325.96 380.12 380.21 0.10

15.94 37.62 0.07 -0.06 -0.01 0.00 -0.16 0.00 0.01 -0.03 0.14 0.00 -0.10 0.20 -0.01 325.96 379.46 379.56 0.10

15.91 37.64 0.07 -0.06 -0.01 0.00 0.00 -0.06 -0.04 0.13 0.20 -0.03 -0.10 0.20 -0.01 325.96 379.71 379.81 0.10

16.25 37.69 0.07 -0.06 -0.01 0.00 0.00 0.00 -0.02 0.26 0.05 0.00 -0.10 0.20 -0.01 325.96 380.18 380.28 0.10

16.27 37.77 0.07 -0.06 -0.01 0.00 0.00 0.00 -0.04 -0.07 0.05 0.00 -0.10 0.20 -0.01 325.96 379.94 380.04 0.10

16.21 37.70 0.07 -0.06 -0.01 0.00 0.00 0.00 -0.04 0.29 -0.06 0.00 -0.09 0.16 -0.01 325.96 380.03 380.13 0.10

15.87 37.69 0.07 -0.06 -0.01 0.00 0.00 0.00 -0.04 0.29 0.05 0.02 -0.10 0.20 -0.01 325.96 379.84 379.94 0.10

16.20 37.71 0.07 -0.06 -0.01 0.00 0.00 0.00 -0.04 0.28 0.05 0.00 -0.10 0.20 -0.01 325.96 380.16 380.26 0.10

16.25 37.72 0.07 -0.06 -0.01 0.00 0.00 0.00 -0.04 0.28 0.05 0.00 -0.10 0.20 -0.01 325.96 380.21 380.31 0.10

6.87 7.19 0.32

14.8 15.14 0.33

12.31 12.64 0.33

-2.12 -1.81 0.31

-13.06 -12.76 0.30

5.86 6.19 0.32

5.72 6.04 0.32

6.6 6.92 0.32

4.44 4.76 0.32

5.27 5.59 0.32

6.82 7.14 0.32

6.01 6.33 0.32

6.32 6.64 0.32

5.69 6.02 0.32

6.74 7.06 0.32

6.91 7.24 0.32

10

August 1998

Valuation of Inverse IOs and Other MBS Derivatives

Figure 3 shows that using the CMO, some PO, some interest-rate benchmarks, some volatility instruments and cash we can replicate the Trust collateral. We can actually pick up about one tick in each of the scenarios. Annualized, this translates to a rate-of-return advantage of about 30bp. This appears to contradict the negative riskadjusted OAS of -43bp. One reason for the apparent discrepancy is that we use the 100% Salomon Smith Barney Prepayment Model in the one-month projection of cash flow and balances of the mortgage bonds, a less pessimistic view of next months prepayments than that of the implied model. There is no contradiction in using the best prepayment model for the projection of the cash flows on the one hand, and using available information on the market of prepayment risk premiums for the projection of prices on the other. This is akin to using the forward curve in pricing even though we may believe a no-change scenario is most likely. Note that in calculating the excess return of the replicating portfolio we do not necessarily advocate the replication. An investor may buy the inverse IO to take a position in future prepayment speed, in interest rates, in volatilities, or any combination. In that case, he would exclude the PO and/or some benchmarks in the replicating portfolio, or he might not hedge at all. The excess return in the replicating portfolio in Figure 3, however, shows that he is paying a fair price for the inverse IO, however it is used. There are limitations to the method. The first limitation is the assumption that the reference strips are a reasonable proxy for the collateral of the CMO in question. Also, we use two prepayment risk parameters which may fail to capture the risks that might affect particular classes of CMOs. For example, the market prices of risk derived from PO and IO may fail to adequately reflect investors' fear of very near term prepayments; the market often demands a higher risk premium for very short structured IOs. As for the excess return in the replicating portfolio, a hedge or replication constructed with the 15 scenarios listed in Figure 3 may not hold up in other scenarios; for example, there may be significant convexity effects when the yield curve shifts 50bp and the prices of prepayment risk also changes. Subject to these cautions, we have a method that realistically compares the relative value of CMOs regardless of their structure and leverage. The prepayment risk-adjusted OAS and the excess ROR of the replicating portfolio provide useful measures.

11

ADDITIONAL INFORMATION AVAILABLE UPON REQUEST Salomon Smith Barney is a service mark of Smith Barney Inc. Smith Barney Inc. and Salomon Brothers Inc are affiliated but separately registered broker/dealers under common control of Salomon Smith Barney Holdings Inc. Salomon Brothers Inc and Salomon Smith Barney Holdings Inc. have been licensed to use the Salomon Smith Barney service mark. This report was produced jointly by Smith Barney Inc. And Salomon Brothers Inc and/or their affiliates. Smith Barney Inc. and/or Salomon Brothers Inc including subsidiaries and/or affiliates ("the Firm"), may from time to time perform investment banking or other services for, or solicit investment banking or other business from, any company mentioned in this report. The Firm may trade the securities of the company or companies in this report for customer accounts and its own accounts. The Firm may also issue options on the securities of the company or companies in this report and may trade for its own accounts, or the accounts of customers, in options that have been issued by others. The Firm, and any of the individuals preparing this report, may at any time have a long and/or short position in any security of the companies in this report or in any options on any such security. An employee of the Firm may be a director of a company mentioned in this report. This material is furnished on the understanding that Salomon Smith Barney Inc. is not undertaking to manage money or act as a fiduciary with respect to your account or any of your managed or fiduciary accounts and that our services do not serve as a primary basis for any investment decision made with respect to such accounts. This material provides information and/or alternatives we believe to be appropriate for consideration. The decision whether or not to adopt any strategy or engage in any transaction is not our responsibility. The investment strategies outlined in this report involve inherent risks and are not appropriate for every investor. Some of the strategies may involve transactions in derivatives, including futures and options. You should refrain from entering into such transactions unless you fully understand the terms and risks of the transactions, including the extent of your potential risk of loss, which can be equal to, or in certain instances greater than, the amount of your initial investment. Options referred to in this report (other than options on futures) are over the counter ("OTC") options only, and are not traded on an exchange or cleared by a clearinghouse. Your counterparty in an OTC transaction would be the Firm or an affiliate of the Firm. Although the statements of facts in this report have been obtained from and are based upon sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed. All opinions and estimates included in this report constitute the Firms judgment as of the date of this report and are subject to change without notice. This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Investing in foreign securities entails certain risks. The securities of non-US issuers may not be registered with, nor be subject to the reporting requirements of, the US Securities and Exchange Commission. There may be limited information available on foreign securities. Foreign companies are generally not subject to uniform audit and reporting standards, practices and requirements comparable to those in the US. Securities of some foreign companies may be less liquid and their prices more volatile than securities of comparable US companies. In addition, exchange rate movements may have an adverse effect on the value of an investment in a foreign stock and its corresponding dividend payment for US investors. Non-Institutional investors who have received this report from the Firm may be prohibited in certain states from purchasing securities mentioned in this report from the Firm. Please ask your Financial Consultant for additional details. This publication has been jointly approved for Japanese regulatory purposes by offices of the Firm doing business in the regions of the contact persons listed on the cover page hereof. This publication has been jointly approved for distribution in the UK by Smith Barney Europe Limited and Salomon Brothers International Limited, which are regulated by the Securities and Futures Authority (SFA). The investments and services contained herein are not available to private customers in the United Kingdom. The Firm's research opinions may differ from those of The Robinson-Humphrey Company, LLC, a wholly owned brokerage subsidiary of Smith Barney Inc. Smith Barney Inc. and Salomon Brothers Inc, 1998. All rights reserved. Any unauthorized use, duplication or disclosure is prohibited by law and will result in prosecution.

(8, 14, 24) FI08F366

Você também pode gostar

- Fixed Income Relative Value Analysis: A Practitioners Guide to the Theory, Tools, and TradesNo EverandFixed Income Relative Value Analysis: A Practitioners Guide to the Theory, Tools, and TradesAinda não há avaliações

- RMBS Trading Desk Strategy Guide to IO/PO SecuritiesDocumento29 páginasRMBS Trading Desk Strategy Guide to IO/PO SecuritiesDimitri DelisAinda não há avaliações

- RMBS Trading Desk Strategy on Agency ARM MBS PrepaymentsDocumento11 páginasRMBS Trading Desk Strategy on Agency ARM MBS PrepaymentsJay KabAinda não há avaliações

- A Guide To Commercial Mortgage-Backed SecuritiesDocumento50 páginasA Guide To Commercial Mortgage-Backed SecuritiesJay Kab100% (1)

- Salom Brothers Prepayment ModelDocumento42 páginasSalom Brothers Prepayment Modelsouravroy.sr5989100% (1)

- (Bank of America) Hybrid ARM MBS - Valuation and Risk MeasuresDocumento22 páginas(Bank of America) Hybrid ARM MBS - Valuation and Risk Measures00aaAinda não há avaliações

- Analyzing CDS Credit Curves - A Fundamental PerspectiveDocumento11 páginasAnalyzing CDS Credit Curves - A Fundamental PerspectiveMatt WallAinda não há avaliações

- The Handbook of Convertible Bonds: Pricing, Strategies and Risk ManagementNo EverandThe Handbook of Convertible Bonds: Pricing, Strategies and Risk ManagementAinda não há avaliações

- Barclays Introduction To Inverse IODocumento20 páginasBarclays Introduction To Inverse IOsriramkannaAinda não há avaliações

- Lehmansn 1Documento17 páginasLehmansn 1sajivshriv100% (1)

- Life Settlements and Longevity Structures: Pricing and Risk ManagementNo EverandLife Settlements and Longevity Structures: Pricing and Risk ManagementAinda não há avaliações

- JP Morgan - Trading Credit Curves 2Documento37 páginasJP Morgan - Trading Credit Curves 2PeterAinda não há avaliações

- European Fixed Income Markets: Money, Bond, and Interest Rate DerivativesNo EverandEuropean Fixed Income Markets: Money, Bond, and Interest Rate DerivativesJonathan A. BattenAinda não há avaliações

- Lehman - Can Convexity Be ExploitedDocumento15 páginasLehman - Can Convexity Be Exploitedmsk_196412100% (1)

- Trading the Fixed Income, Inflation and Credit Markets: A Relative Value GuideNo EverandTrading the Fixed Income, Inflation and Credit Markets: A Relative Value GuideAinda não há avaliações

- Lehman Futures ModelDocumento12 páginasLehman Futures ModelzdfgbsfdzcgbvdfcAinda não há avaliações

- CLO Investing: With an Emphasis on CLO Equity & BB NotesNo EverandCLO Investing: With an Emphasis on CLO Equity & BB NotesAinda não há avaliações

- Forward Rate BiasDocumento9 páginasForward Rate BiasHafsa Hina100% (2)

- CLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketNo EverandCLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketAinda não há avaliações

- Nomura CDS Primer 12may04Documento12 páginasNomura CDS Primer 12may04Ethan Sun100% (1)

- Asset Swap SpreadsDocumento40 páginasAsset Swap Spreadszdfgbsfdzcgbvdfc100% (3)

- Inside the Yield Book: The Classic That Created the Science of Bond AnalysisNo EverandInside the Yield Book: The Classic That Created the Science of Bond AnalysisNota: 3 de 5 estrelas3/5 (1)

- (Lehman) O'Kane Turnbull (2003) Valuation of CDSDocumento19 páginas(Lehman) O'Kane Turnbull (2003) Valuation of CDSGabriel PangAinda não há avaliações

- Trading Fixed Income and FX in Emerging Markets: A Practitioner's GuideNo EverandTrading Fixed Income and FX in Emerging Markets: A Practitioner's GuideAinda não há avaliações

- (Lehman Brothers) Estimating Implied Default Probabilities From Credit Bond PricesDocumento12 páginas(Lehman Brothers) Estimating Implied Default Probabilities From Credit Bond Pricesforeas100% (1)

- Handbook of Fixed-Income SecuritiesNo EverandHandbook of Fixed-Income SecuritiesPietro VeronesiNota: 4 de 5 estrelas4/5 (12)

- Barclays DUS Primer 3-9-2011Documento11 páginasBarclays DUS Primer 3-9-2011pratikmhatre123Ainda não há avaliações

- Investing in Junk Bonds: Inside the High Yield Debt MarketNo EverandInvesting in Junk Bonds: Inside the High Yield Debt MarketNota: 3 de 5 estrelas3/5 (1)

- A Look at DurationDocumento45 páginasA Look at Durationjames.kwokAinda não há avaliações

- Introduction to Fixed Income Analytics: Relative Value Analysis, Risk Measures and ValuationNo EverandIntroduction to Fixed Income Analytics: Relative Value Analysis, Risk Measures and ValuationAinda não há avaliações

- Lehman Brothers NonAgency Hybrids A PrimerDocumento16 páginasLehman Brothers NonAgency Hybrids A PrimerMatthew HartAinda não há avaliações

- Practical Portfolio Performance Measurement and AttributionNo EverandPractical Portfolio Performance Measurement and AttributionNota: 3.5 de 5 estrelas3.5/5 (2)

- Introduction To Specified Pool SectorDocumento15 páginasIntroduction To Specified Pool Sectormoveld100% (2)

- The Trader's Guide to the Euro Area: Economic Indicators, the ECB and the Euro CrisisNo EverandThe Trader's Guide to the Euro Area: Economic Indicators, the ECB and the Euro CrisisAinda não há avaliações

- Interest Rate Parity, Money Market Basis Swaps, and Cross-Currency Basis SwapsDocumento14 páginasInterest Rate Parity, Money Market Basis Swaps, and Cross-Currency Basis SwapsReema RatheeAinda não há avaliações

- Ginnie Mae 2007 Bank of America PrimerDocumento37 páginasGinnie Mae 2007 Bank of America PrimerJylly Jakes100% (2)

- Financial Soundness Indicators for Financial Sector Stability in Viet NamNo EverandFinancial Soundness Indicators for Financial Sector Stability in Viet NamAinda não há avaliações

- JPM MBS Primer PDFDocumento68 páginasJPM MBS Primer PDFAndy LeungAinda não há avaliações

- Agencies JPMDocumento18 páginasAgencies JPMbonefish212Ainda não há avaliações

- (Bank of America) Introduction To Agency CMO StructuresDocumento23 páginas(Bank of America) Introduction To Agency CMO StructuresfardatedAinda não há avaliações

- (Bank of America) Pricing Mortgage-Back SecuritiesDocumento22 páginas(Bank of America) Pricing Mortgage-Back Securitiesbhartia2512100% (4)

- JPM CDS PrimerDocumento11 páginasJPM CDS PrimerJorge AraujoAinda não há avaliações

- Cds PrimerDocumento15 páginasCds PrimerJay KabAinda não há avaliações

- YieldBook MBS Volatility Skew and Valuation of MTG (2005)Documento25 páginasYieldBook MBS Volatility Skew and Valuation of MTG (2005)fengn100% (1)

- (Bank of America) Residential Mortgages - Prepayments and Prepayment ModelingDocumento31 páginas(Bank of America) Residential Mortgages - Prepayments and Prepayment ModelingJay KabAinda não há avaliações

- Salomon Smith Barney Principles of Principal Components A Fresh Look at Risk Hedging and Relative ValueDocumento45 páginasSalomon Smith Barney Principles of Principal Components A Fresh Look at Risk Hedging and Relative ValueRodrigoAinda não há avaliações

- IR - Quant - 101105 - Is It Possible To Reconcile Caplet and Swaption MarketsDocumento31 páginasIR - Quant - 101105 - Is It Possible To Reconcile Caplet and Swaption MarketsC W YongAinda não há avaliações

- Lehman Brothers - Quantitative Portfolio Strategy - Currency Hedging in Fixed Income PortfoliosDocumento8 páginasLehman Brothers - Quantitative Portfolio Strategy - Currency Hedging in Fixed Income PortfoliosJulien Allera100% (1)

- CMS Inverse FloatersDocumento8 páginasCMS Inverse FloaterszdfgbsfdzcgbvdfcAinda não há avaliações

- (Lehman Brothers, Tuckman) Interest Rate Parity, Money Market Baisis Swaps, and Cross-Currency Basis SwapsDocumento14 páginas(Lehman Brothers, Tuckman) Interest Rate Parity, Money Market Baisis Swaps, and Cross-Currency Basis SwapsJonathan Ching100% (1)

- (Merrill Lynch) Credit Derivatives Handbook 2006 - Volume 2Documento196 páginas(Merrill Lynch) Credit Derivatives Handbook 2006 - Volume 2tndiemhangAinda não há avaliações

- GSEs in Shadow Banking - Fed 20100701Documento1 páginaGSEs in Shadow Banking - Fed 20100701goldboxAinda não há avaliações

- Introduction To SQL JOINDocumento8 páginasIntroduction To SQL JOINgoldboxAinda não há avaliações

- Quick Guide FASB CodificationDocumento2 páginasQuick Guide FASB CodificationgoldboxAinda não há avaliações

- Fed ABS Inflows PaperDocumento70 páginasFed ABS Inflows PapergoldboxAinda não há avaliações

- SQL Server 2012 Licensing Guide Apr2012Documento21 páginasSQL Server 2012 Licensing Guide Apr2012goldboxAinda não há avaliações

- American Jobs Act - FinalDocumento155 páginasAmerican Jobs Act - FinalNational JournalAinda não há avaliações

- Patrick Morgan: HighlightsDocumento1 páginaPatrick Morgan: HighlightsGhazni ProvinceAinda não há avaliações

- LatAm Fintech Landscape - 2023Documento3 páginasLatAm Fintech Landscape - 2023Bruno Gonçalves MirandaAinda não há avaliações

- What is Operations ResearchDocumento10 páginasWhat is Operations ResearchSHILPA GOPINATHANAinda não há avaliações

- 227 - Unrebutted Facts Regarding The IRSDocumento5 páginas227 - Unrebutted Facts Regarding The IRSDavid E Robinson100% (1)

- Quant Checklist 463 by Aashish Arora For Bank Exams 2024Documento102 páginasQuant Checklist 463 by Aashish Arora For Bank Exams 2024sharpleakeyAinda não há avaliações

- Chapter 12 Solutions ManualDocumento82 páginasChapter 12 Solutions ManualbearfoodAinda não há avaliações

- MAS Annual Report 2010 - 2011Documento119 páginasMAS Annual Report 2010 - 2011Ayako S. WatanabeAinda não há avaliações

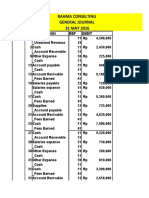

- Rahma ConsutingDocumento6 páginasRahma ConsutingEko Firdausta TariganAinda não há avaliações

- Low Cost Housing Options for Bhutanese RefugeesDocumento21 páginasLow Cost Housing Options for Bhutanese RefugeesBala ChandarAinda não há avaliações

- A Study On Investors Buying Behaviour Towards Mutual Fund PDF FreeDocumento143 páginasA Study On Investors Buying Behaviour Towards Mutual Fund PDF FreeRathod JayeshAinda não há avaliações

- Service Marketing 3 - (Marketing Mix)Documento123 páginasService Marketing 3 - (Marketing Mix)Soumya Jyoti BhattacharyaAinda não há avaliações

- Solution Manual For Financial Management 13th Edition by TitmanDocumento3 páginasSolution Manual For Financial Management 13th Edition by Titmanazif kurnia100% (1)

- Saral Gyan Stocks Past Performance 050113Documento13 páginasSaral Gyan Stocks Past Performance 050113saptarshidas21Ainda não há avaliações

- Social Security in America (Full Book) - Publication of The Social Security AdministrationDocumento328 páginasSocial Security in America (Full Book) - Publication of The Social Security AdministrationNikolai HamboneAinda não há avaliações

- How George Soros Made $8 BillionDocumento2 páginasHow George Soros Made $8 BillionAnanda rizky syifa nabilahAinda não há avaliações

- Document ManagementDocumento55 páginasDocument Managementrtarak100% (1)

- Jharkhand Govt Gazette Regarding Stipend For LawyersDocumento6 páginasJharkhand Govt Gazette Regarding Stipend For LawyersLatest Laws TeamAinda não há avaliações

- Questionnaire ThesisDocumento3 páginasQuestionnaire ThesisAnonymous 0kDzzBgr15Ainda não há avaliações

- CA. Ranjay Mishra (FCA)Documento14 páginasCA. Ranjay Mishra (FCA)ZamanAinda não há avaliações

- Acquisition Analysis and RecommendationsDocumento49 páginasAcquisition Analysis and RecommendationsAnkitSawhneyAinda não há avaliações

- Pro Forma Invoice: Proline TechnologiesDocumento1 páginaPro Forma Invoice: Proline TechnologiesKanth KodaliAinda não há avaliações

- Hair Salon Business Plan ExampleDocumento20 páginasHair Salon Business Plan ExampleJamesnjiruAinda não há avaliações

- Bank Mandiri ProfileDocumento2 páginasBank Mandiri ProfileTee's O-RamaAinda não há avaliações

- Project Financing AssignmentsDocumento17 páginasProject Financing AssignmentsAlemu OlikaAinda não há avaliações

- NC-III Bookkeeping Reviewer NC-III Bookkeeping ReviewerDocumento34 páginasNC-III Bookkeeping Reviewer NC-III Bookkeeping ReviewerSheila Mae Lira100% (2)

- Regional Trial Court counter affidavit disputes estafa chargesDocumento8 páginasRegional Trial Court counter affidavit disputes estafa chargesHabib SimbanAinda não há avaliações

- KWP/ADV/2022/ Date: 14/04/2022: REF NO: BOB/KAWEMPE/ADV/2022-65 Dated 14/04/2022Documento2 páginasKWP/ADV/2022/ Date: 14/04/2022: REF NO: BOB/KAWEMPE/ADV/2022-65 Dated 14/04/2022BalavinayakAinda não há avaliações

- Rural Marketing Assignment PDFDocumento6 páginasRural Marketing Assignment PDFSriram RajasekaranAinda não há avaliações

- The MBA DecisionDocumento7 páginasThe MBA DecisionFiry YuanditaAinda não há avaliações

- Goaltrust PDFDocumento16 páginasGoaltrust PDFbri teresiAinda não há avaliações

- Value: The Four Cornerstones of Corporate FinanceNo EverandValue: The Four Cornerstones of Corporate FinanceNota: 4.5 de 5 estrelas4.5/5 (18)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelAinda não há avaliações

- Joy of Agility: How to Solve Problems and Succeed SoonerNo EverandJoy of Agility: How to Solve Problems and Succeed SoonerNota: 4 de 5 estrelas4/5 (1)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000No EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Nota: 4.5 de 5 estrelas4.5/5 (86)

- Finance Basics (HBR 20-Minute Manager Series)No EverandFinance Basics (HBR 20-Minute Manager Series)Nota: 4.5 de 5 estrelas4.5/5 (32)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNo EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNota: 4.5 de 5 estrelas4.5/5 (14)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistNo EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistNota: 4.5 de 5 estrelas4.5/5 (73)

- Product-Led Growth: How to Build a Product That Sells ItselfNo EverandProduct-Led Growth: How to Build a Product That Sells ItselfNota: 5 de 5 estrelas5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanNo EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanNota: 4.5 de 5 estrelas4.5/5 (79)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsAinda não há avaliações

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisNo EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisNota: 5 de 5 estrelas5/5 (6)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)No EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Nota: 4.5 de 5 estrelas4.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialAinda não há avaliações

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityNo EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityNota: 4.5 de 5 estrelas4.5/5 (4)

- Note Brokering for Profit: Your Complete Work At Home Success ManualNo EverandNote Brokering for Profit: Your Complete Work At Home Success ManualAinda não há avaliações

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursNo EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursNota: 4.5 de 5 estrelas4.5/5 (34)

- Financial Risk Management: A Simple IntroductionNo EverandFinancial Risk Management: A Simple IntroductionNota: 4.5 de 5 estrelas4.5/5 (7)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNNo Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNNota: 4.5 de 5 estrelas4.5/5 (3)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNo EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNota: 3.5 de 5 estrelas3.5/5 (8)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthNo EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthAinda não há avaliações