Escolar Documentos

Profissional Documentos

Cultura Documentos

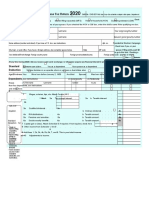

Copy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12

Enviado por

Andy Bipes0 notas0% acharam este documento útil (0 voto)

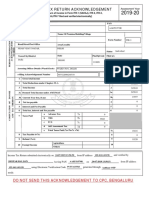

307 visualizações4 páginasThis document contains four copies of a Form W-2 Wage and Tax Statement for the year 2011. The Form W-2 provides information about an employee's wages, taxes, and other compensation for the tax year. It includes boxes for the employer and employee identification numbers and addresses, amounts of wages, taxes withheld, and other compensation details. The copies are labeled as being for filing with the employee's federal tax return, state/local tax returns, and as a record for the employee.

Descrição original:

Título original

Tax Form

Direitos autorais

© Attribution Non-Commercial (BY-NC)

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoThis document contains four copies of a Form W-2 Wage and Tax Statement for the year 2011. The Form W-2 provides information about an employee's wages, taxes, and other compensation for the tax year. It includes boxes for the employer and employee identification numbers and addresses, amounts of wages, taxes withheld, and other compensation details. The copies are labeled as being for filing with the employee's federal tax return, state/local tax returns, and as a record for the employee.

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

307 visualizações4 páginasCopy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12

Enviado por

Andy BipesThis document contains four copies of a Form W-2 Wage and Tax Statement for the year 2011. The Form W-2 provides information about an employee's wages, taxes, and other compensation for the tax year. It includes boxes for the employer and employee identification numbers and addresses, amounts of wages, taxes withheld, and other compensation details. The copies are labeled as being for filing with the employee's federal tax return, state/local tax returns, and as a record for the employee.

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 4

b Employer identification number (EIN)

c Employers name, address, and ZIP code

1 Wages, tips, other compensation

3 Social security wages

5 Medicare wages and tips

7 Social security tips

9 Advance EIC payment

11 Nonqualified plans

2 Federal income tax withheld

4 Social security tax withheld

6 Medicare tax withheld

8 Allocated tips

10 Dependent care benefits

a Employees social security number

14 Other

13

Statutory

employee

Retirement

plan

Third-party

sick pay

12a

C

o

d

e

12b

12c

12d

$

$

$

$

$

C

o

d

e

C

o

d

e

C

o

d

e

C

o

d

e

12e

b Employer identification number (EIN)

c Employers name, address, and ZIP code

This information is being furnished to the

Internal Revenue Service.

Copy B To Be Filed With

Employees FEDERAL

Tax Return

1 Wages, tips, other compensation

3 Social security wages

5 Medicare wages and tips

7 Social security tips

9 Advance EIC payment

11 Nonqualified plans

2 Federal income tax withheld

4 Social security tax withheld

6 Medicare tax withheld

8 Allocated tips

10 Dependent care benefits

a Employees social security number

14 Other

13

Statutory

employee

Retirement

plan

Third-party

sick pay

See instructions for box 12 12a

C

o

d

e

12b

12c

12d

$

$

$

$

$

C

o

d

e

C

o

d

e

C

o

d

e

C

o

d

e

12e

This information is being furnished to the Internal

Revenue Service. If you are required to file a tax

return, a negligence penalty or other sanction may

be imposed on you if this income is taxable and you

fail to report it.

b Employer identification number (EIN)

c Employers name, address, and ZIP code

1 Wages, tips, other compensation

3 Social security wages

5 Medicare wages and tips

7 Social security tips

9 Advance EIC payment

11 Nonqualified plans

2 Federal income tax withheld

4 Social security tax withheld

6 Medicare tax withheld

8 Allocated tips

10 Dependent care benefits

a Employees social security number

14 Other

13

Statutory

employee

Retirement

plan

Third-party

sick pay

See instructions for box 12 12a

C

o

d

e

12b

12c

12d

$

$

$

$

$

C

o

d

e

C

o

d

e

C

o

d

e

C

o

d

e

12e

Copy C For EMPLOYEES

RECORDS. (See Notice to

Employee on back.)

b Employer identification number (EIN)

c Employers name, address, and ZIP code

1 Wages, tips, other compensation

3 Social security wages

5 Medicare wages and tips

7 Social security tips

9 Advance EIC payment

11 Nonqualified plans

2 Federal income tax withheld

4 Social security tax withheld

6 Medicare tax withheld

8 Allocated tips

10 Dependent care benefits

a Employees social security number

14 Other

13

Statutory

employee

Retirement

plan

Third-party

sick pay

12a

C

o

d

e

12b

12c

12d

$

$

$

$

$

C

o

d

e

C

o

d

e

C

o

d

e

C

o

d

e

12e

Copy 2 To Be Filed With

Employees STATE, CITY or

LOCAL Income Tax Return

e Employees first name and initial Last name

f Employees address and ZIP code

e Employees first name and initial Last name

f Employees address and ZIP code

e Employees first name and initial Last name

f Employees address and ZIP code

e Employees first name and initial Last name

f Employees address and ZIP code

20 Locality name 15 State Employers state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax

20 Locality name 15 State Employers state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax

20 Locality name 15 State Employers state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax

20 Locality name 15 State Employers state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax

Copy 2 To Be Filed With

Employees STATE, CITY or

LOCAL Income Tax Return

1A-w 1B-w 673307

Suff.

Suff.

Suff.

Suff.

23069.61

23069.61

2730.73

2730.73

24741.07

24741.07

1039.12

1039.12

24741.07

24741.07

358.75

358.75

0.00

0.00

X

X

X

X

23069.61

23069.61

2730.73

2730.73

24741.07

24741.07

1039.12

1039.12

24741.07

24741.07

358.75

358.75

0.00

0.00

1 of 1

1 of 1

1 of 1

1 of 1

ID:10974000000000000145405344

ID:10974000000000000145405344

ID:10974000000000000145405344

ID:10974000000000000145405344

33-0479906

33-0479906

33-0479906

33-0479906

PETCO ANIMAL SUPPLIES,INC

PETCO ANIMAL SUPPLIES,INC

PETCO ANIMAL SUPPLIES,INC

PETCO ANIMAL SUPPLIES,INC

SAN DIEGO, CA 92121-2270

SAN DIEGO, CA 92121-2270

SAN DIEGO, CA 92121-2270

SAN DIEGO, CA 92121-2270

474-19-2490

474-19-2490

474-19-2490

474-19-2490

CHRYSTAL RAYNE BIPES

CHRYSTAL RAYNE BIPES

CHRYSTAL RAYNE BIPES

CHRYSTAL RAYNE BIPES

8200 SCANDIA TRAIL NORTH

8200 SCANDIA TRAIL NORTH

8200 SCANDIA TRAIL NORTH

8200 SCANDIA TRAIL NORTH

FOREST LAKE, MN 55025

FOREST LAKE, MN 55025

FOREST LAKE, MN 55025

FOREST LAKE, MN 55025

9125 REHCO ROAD

9125 REHCO ROAD

9125 REHCO ROAD

9125 REHCO ROAD

D

D

D

D

1671.46

1671.46

1671.46

1671.46

MN

MN

MN

MN

2997985

2997985

2997985

2997985

23069.61

23069.61

23069.61

23069.61

1126.00

1126.00

1126.00

1126.00

Form W-2 Wage and Tax Statement 2011 Department of the Treasury-Internal Revenue Service OMB # 1545-0008 Copy B To Be Filed With Employee's FEDERAL Tax Return

Form W-2 Wage and Tax Statement 2011 Department of the Treasury-Internal Revenue Service OMB # 1545-0008 Copy 2 To Be Filed With Employee's State, CITY or Local Tax Departments

Form W-2 Wage and Tax Statement 2011 Department of the Treasury-Internal Revenue Service OMB # 1545-0008 Copy 2 To Be Filed With Employee's State, CITY or Local Tax Departments

Form W-2 Wage and Tax Statement 2011 Department of the Treasury-Internal Revenue Service OMB # 1545-0008 Copy C for Employee's Records

Notice to Employee

Refund. Even if you do not have to file a tax return, you should file to get a

refund if box 2 shows federal income tax withheld or if you can take the

earned income credit.

Earned income credit (EIC). You may be able to take the EIC for 2011 if (a)

you do not have a qualifying child and you earned less than $13,660 ($18,740 if

married filing jointly), (b) you have one qualifying child and you earned less than

$36,052 ($41,132 if married filing jointly), (c) you have two qualifying children

and you earned less than $40,964 ($46,044 if married filing jointly), or (d) you

have three or more qualifying children and you earned less than $43,998

($49,078 if married filing jointly). You and any qualifying children must have

valid social security numbers (SSNs). You cannot take the EIC if your

investment income is more than $3,150. Any EIC that is more than your tax

liability is refunded to you, but only if you file a tax return.

Clergy and religious workers. If you are not subject to social security and

Medicare taxes, see Pub. 517, Social Security and Other Information for

Members of the Clergy and Religious Workers.

Corrections. If your name, SSN, or address is incorrect, correct Copies B, C,

and 2 and ask your employer to correct your employment record. Be sure to

ask the employer to file Form W-2c, Corrected Wage and Tax Statement, with

the Social Security Administration (SSA) to correct any name, SSN, or money

amount error reported to the SSA on Form W-2. If your name and SSN are

correct but are not the same as shown on your social security card, you

should ask for a new card that displays your correct name at any SSA office

or by calling 1-800-772-1213. You also may visit the SSA at

www.socialsecurity.gov.

Cost of employer-sponsored health coverage (if such cost is provided by

the employer). The reporting in Box 12, using Code DD, of the cost of

employer-sponsored health coverage is for your information only. The amount

reported with Code DD is not taxable.

Credit for excess taxes. If you had more than one employer in 2011 and

more than $4,485.60 in social security and/or Tier I railroad retirement (RRTA)

taxes were withheld, you may be able to claim a credit for the excess against

your federal income tax. If you had more than one railroad employer and more

than $3,088.80 in Tier II RRTA tax was withheld, you also may be able to

claim a credit. See your Form 1040 or Form 1040A instructions and Pub. 505,

Tax Withholding and Estimated Tax

Instructions for Employee

Box 1. Enter this amount on the

wages line of your tax return.

Box 2. Enter this amount on the

federal income tax withheld line of your

tax return. Box 8. This amount is not

included in boxes 1, 3, 5, or 7. For

information on how to report tips on

your tax return, see your Form 1040

instructions.

Unless you have records that show

you did not receive the amount

reported in box 8 as allocated tips, you

must file Form 4137, Social Security

and Medicare Tax on Unreported Tip

Income, with your income tax return to

report the allocated tip amount. On

Form 4137 you will figure the social

security and Medicare tax owed on the

allocated tips shown on your Form(s)

W-2 that you must report as income

and on other tips you did not report to

your employer. By filing Form 4137,

your social security tips will be credited

to your social security record (used to

figure your benefits).

Box 10. This amount is the total

dependent care benefits that your

employer paid to you or incurred on

your behalf (including amounts from a

section 125 (cafeteria) plan). Any

amount over $5,000 is also included in

box 1. Complete Form 2441, Child and

Dependent Care Expenses, to

compute any taxable and nontaxable

amounts.

Box 11. This amount is (a) reported in

box 1 if it is a distribution made to you

from a nonqualified deferred

compensation or nongovernmental

section 457(b) plan or (b) included in

box 3 and/or 5 if it is a prior year

deferral under a nonqualified or

section 457(b) plan that became

taxable for social security and

Medicare taxes this year because

there is no longer a substantial risk of

forfeiture of your right to the deferred

amount.

Box 12. The following list explains the

codes shown in box 12. You may need

this information to complete your tax

return. Elective deferrals (codes D, E,

F, and S) and designated Roth

contributions (codes AA, BB, and EE)

under all plans are generally limited to

a total of $16,500 ($11,500 if you only

have SIMPLE plans; $19,500 for

section 403(b) plans if you qualify for

the 15-year rule explained in Pub.

571). Deferrals under code G are

limited to $16,500. Deferrals under

code H are limited to $7,000.

However, if you were at least age

50 in 2011, your employer may have

allowed an additional deferral of up to

$5,500 ($2,500 for section 401(k)(11)

and 408(p) SIMPLE plans). This

additional deferral amount is not

subject to the overall limit on elective

deferrals. For code G, the limit on

elective deferrals may be higher for the

last 3 years before you reach

retirement age. Contact your plan

administrator for more information.

Amounts in excess of the overall

elective deferral limit must be included

in income. See the Wages, Salaries,

Tips, etc. line instructions for Form

1040.

Note. If a year follows code D through

H, S, Y, AA, BB, or EE, you made a

make-up pension contribution for a

prior year(s) when you were in military

service. To figure whether you made

excess deferrals, consider these

amounts for the year shown, not the

current year. If no year is shown, the

contributions are for the current year.

AUncollected social security or

RRTA tax on tips. Include this tax on

Form 1040. See Total Tax in the

Form 1040 instructions.

BUncollected Medicare tax on tips.

Include this tax on Form 1040. See

Total Tax in the Form 1040

instructions.

CTaxable cost of group-term life

insurance over $50,000 (included

in boxes 1, 3 (up to social security

wage base), and 5) DElective

deferrals to a section 401(k) cash or

deferred arrangement. Also includes

deferrals under a SIMPLE retirement

account that is part of a section 401(k)

arrangement.

EElective deferrals under a section

403(b) salary reduction agreement

FElective deferrals under a section

408(k)(6) salary reduction SEP

GElective deferrals and employer

contributions (including nonelective

deferrals) to a section 457(b) deferred

compensation plan

HElective deferrals to a section

501(c)(18)(D) tax-exempt organization

plan. See Adjusted Gross Income in

the Form 1040 instructions for how to

deduct.

JNontaxable sick pay (information

only, not included in boxes 1, 3, or 5)

K20% excise tax on excess golden

parachute payments. See Total Tax

in the Form 1040 instructions.

LSubstantiated employee business

expense reimbursements (nontaxable)

MUncollected social security or

RRTA tax on taxable cost of group-

term life insurance over $50,000

(former employees only). See Total

Tax in the Form 1040 instructions.

NUncollected Medicare tax on

taxable cost of group-term life

insurance over $50,000 (former

employees only). See Total Tax in

the Form 1040 instructions.

PExcludable moving expense

reimbursements paid directly to

employee (not included in boxes 1, 3,

or 5)

QNontaxable combat pay. See the

instructions for Form 1040 or Form

1040A for details on reporting this

amount.

REmployer contributions to your

Archer MSA. Report on Form 8853,

Archer MSAs and Long-Term Care

Insurance Contracts.

SEmployee salary reduction

contributions under a section 408(p)

SIMPLE (not ncluded in box 1) T

Adoption benefits (not included in box

1). Complete Form 8839, Qualified

Adoption Expenses, to compute any

taxable and nontaxable amounts.

VIncome from exercise of

nonstatutory stock option(s) (included

in boxes 1, 3 (up to social security

wage base), and 5). See Pub. 525 and

instructions for Schedule D (Form

1040) for reporting requirements.

WEmployer contributions (including

amounts the employee elected to

contribute using a section 125

(cafeteria) plan) to your health savings

account. Report on Form 8889, Health

Savings Accounts (HSAs).

YDeferrals under a section 409A

nonqualified deferred compensation

plan

ZIncome under section 409A on a

nonqualified deferred compensation

plan. This amount is also included in

box 1. It is subject to an additional

20% tax plus interest. See Total Tax

in the Form 1040 instructions.

AADesignated Roth contributions

under a section 401(k) plan

BBDesignated Roth contributions

under a section 403(b) plan

DDCost of employer-sponsored

health coverage. The amount

reported with Code DD is not

taxable.

EEDesignated Roth contributions

under a governmental section 457(b)

plan. This amount does not apply to

contributions under a tax-exempt

organization section 457(b) plan.

Box 13. If the Retirement plan box is

checked, special limits may apply to

the amount of traditional IRA

contributions you may deduct.

Note. Keep Copy C of Form W-2 for at

least 3 years after the due date for

filing your income tax return. However,

to help protect your social security

benefits, keep Copy C until you begin

receiving social security benefits, just

in case there is a question about your

work record and/or earnings in a

particular year. Compare the Social

Security wages and the Medicare

wages to the information shown on

your annual (for workers over 25)

Social Security Statement.

CALIFORNIA NOTICE TO EMPLOYEES

Based on your annual earnings, you may be eligible to receive the earned income tax credit from the federal government. The earned

income tax credit is a refundable federal income tax credit for low-income working individuals and families. The earned income tax credit

has no effect on certain welfare benets. In most cases, earned income tax credit payments will not be used to determine eligibility for

Medicaid, supplemental security income, food stamps, low-income housing or most temporary assistance for needy families payments.

Even if you do not owe federal taxes, you must le a tax return to receive the earned income tax credit. Be sure to ll out the earned

income tax credit form in the federal income tax return booklet.

The New Jersey Earned Income Tax Credit (NJEITC) is a credit for certain residents who work and have earned income. The

credit reduces the amount of New Jersey tax you owe and may also give you a refund, even if you are not required to pay income

tax to New Jersey.

Most residents who are eligible and le for a Federal earned income tax credit can also receive the NJEITC. There are several criteria

which must be met to qualify for the Federal earned income tax credit. See the information below on how to contact the Internal Revenue

Service to nd out if you are eligible for the Federal earned income tax credit. Note: You dont qualify for the NJEITC if you and your

spouse/civil union partner le separate income tax returns.

The amount of your NJEITC is a percentage of your Federal earned income tax credit. This year, the NJEITC amount is equal to 20% of

the Federal earned income tax credit. So, if your Federal earned income tax credit is $4,000, the amount of your NJEITC will be $800.

(2011 NJEITC = Federal EITC x 20%) Note: If you lived in New Jersey for only part of 2011, your NJEITC will be prorated based on the

number of months you were a New Jersey resident. (For this calculation, 15 days or more is a month.)

To receive the NJEITC, you must le a New Jersey resident income tax return. This is true even if you are not required to le a tax return

because your income is below New Jerseys minimum ling threshold.

For more information about the Federal earned income tax credit, visit: www.irs.gov/individuals or call the IRS at 1-800-829-1040.

For more information about the NJEITC:

Call the New Jersey Division of Taxation at 609-292-6400.

Listen to recorded information or order forms by calling the Divisions Automated Tax Information System from a Touch-tone

phone: 1-800-323-4400 (within NJ, NY, PA, DE, MD) or 609-826-4400.

Visit the NJ Division of Taxations Web site at: www.state.nj.us/treasury/taxation

2011 Federal Earned Income Tax Credit

State of New Jersey

Department of the Treasury

Division of Taxation

IMPORTANT NOTICE TO NEW JERSEY RESIDENTS

For information regarding your eligibility to receive the earned income tax credit, including information on how to obtain the IRS Notice

797 or any other necessary forms and instructions, contact the Internal Revenue Service at 1-800-829-3676 or through its Web site at

www.irs.gov.

2011 NJ Earned Income Tax Credit (NJEITC)

DID YOU KNOW THAT FEDERAL AND NJ STATE EARNED INCOME TAX CREDITS ARE AVAILABLE TO CERTAIN LOW-

INCOME WORKING INDIVIDUALS AND FAMILIES?

THESE CREDITS CAN REDUCE THE AMOUNT OF INCOME TAX YOU OWE OR INCREASE YOUR INCOME TAX REFUND.

AND, YOU CAN RECEIVE THE CREDITS EVEN IF YOU DIDNT EARN ENOUGH INCOME TO BE REQUIRED TO FILE A TAX

RETURN.

TEXAS NOTICE TO EMPLOYEES

WAS YOUR FAMILYS INCOME LAST YEAR LESS THAN $49,078?

YOU MAY BE ENTITLED TO AN INCOME TAX REFUND.

The Earned Income Tax Credit (EITC) campaign is a program to help Texas families get the dollars they deserve. The EITC is a refund

to qualied taxpayers even if you dont owe any taxes on your income! Each year, the EITC brings more than a billion federal income

tax dollars back home and into Texans pockets.

You may qualify, if:

You had three or more children who lived with you for more than six months of the year and your family income was less than

$49,078; or

You had two children who lived with you for more than six months of the year and your family income was less than $46,044; or

Your family earned less than $41,132 in adjusted gross income in 2011 and you had a child who lived with you for more than six

months of the year; or

You had no qualifying children and your family income was less than $18,740.

For more detailed information, you may visit the Comptrollers Window on State Government Website at www.window.state.tx.us/

taxinfo/eitc/ or call the IRS at (800) 829-1040 or simply dial 211.

ILLINOIS NOTICE TO EMPLOYEES

Claim Your Earned Income Tax Credit (EITC)!! The Tax Break for Hard-Working People - And YOU Could Qualify!

How do I Apply?

You can only get the EITC if you apply for it on your federal income tax return and you can get it even if you do not owe

federal income taxes.

You must have received earned income in 2011 to qualify - that includes wages reported on Form W-2 or self-employment

reported on Form 1099-MISC or other earnings.

If you were raising children in 2011, le federal Form 1040 or 1040A and attach Schedule EIC. If you were not raising

children, le any federal income tax return.

If you worked in the last 3 years and you did not claim the EITC in those years but were eligible, you can still apply for EITC

benets by ling an amended tax return.

Illinois also has a State EITC!

Illinois residents who claim the federal EITC may also get a State EITC which can be worth up to $288! The State EITC is

worth 5 percent of the federal EITC and is fully refundable.

Need help ling your taxes?

There are programs throughout Illinois where families with incomes under $50,000 and individuals with incomes under

$25,000 can get free electronic tax preparation and access to nancial services.

Call 312-630-0273 in Cook county or 888-827-8511 outside of Cook county;

Call 312-409-1555 in Cook, DuPage, Kane, and Lake counties; 312-701-1326 (TTY).

You may also call the IRS at 800-829-1040 or 800-829-4059 (TTY).

Note: EITC payments will not affect any DHS benets you are currently receiving.

What is it worth?

If you worked in 2011, you could claim the EITC and reduce your federal income taxes and/or get a bigger refund if:

Your household earnings were less than $43,998 (or $49,078 if married ling jointly) and

you were raising three or more children in your home you could get up to $5,751!

Your household earnings were less than $40,964 (or $46,044 if married ling jointly) and

you were raising two children in your home you could get up to $5,112!

Your household earnings were less than $36,052 (or $41,132 if married ling jointly) and

you were raising one child in your home you could get up to $3,094!

Your household earnings were less than $13,660 (or $18,740 if married ling jointly), you had no children,

and you were between the ages of 25 and 64 you could get up to $464!

There are special rules to determine which children qualify.

In most cases, all household members must have Social Security Numbers.

Você também pode gostar

- Monica L Lindo Tax FormDocumento2 páginasMonica L Lindo Tax Formapi-299234513Ainda não há avaliações

- U.S. Individual Income Tax Return: Filing StatusDocumento3 páginasU.S. Individual Income Tax Return: Filing StatuspyatetskyAinda não há avaliações

- Loan AppDocumento9 páginasLoan Appanon-209253Ainda não há avaliações

- Tax - 2020-2021 PDFDocumento2 páginasTax - 2020-2021 PDFShanto ChowdhuryAinda não há avaliações

- 2021 Tax Return: Prepared ByDocumento6 páginas2021 Tax Return: Prepared BySolomonAinda não há avaliações

- Laura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyDocumento144 páginasLaura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyGabe KaminskyAinda não há avaliações

- W2 PreviewDocumento1 páginaW2 Previewmrs merle westonAinda não há avaliações

- CLR 2020 Tax ReturnDocumento14 páginasCLR 2020 Tax ReturnAlexander Barno AlexAinda não há avaliações

- Resume of Msnetty42Documento2 páginasResume of Msnetty42api-25122959Ainda não há avaliações

- Ralston Medina W2Documento2 páginasRalston Medina W2bussinesl las100% (1)

- U.S. Individual Income Tax Return: Filing StatusDocumento2 páginasU.S. Individual Income Tax Return: Filing StatuspeachyAinda não há avaliações

- 2021 - TaxReturn 2pagessignedDocumento3 páginas2021 - TaxReturn 2pagessignedDedrick RiversAinda não há avaliações

- Sanogo 2019 TFDocumento40 páginasSanogo 2019 TFbassomassi sanogoAinda não há avaliações

- Square 2022 W-2Documento2 páginasSquare 2022 W-2Zane CardinalAinda não há avaliações

- 2019 Chandler D Form 1040 Individual Tax Return - Records-ALDocumento7 páginas2019 Chandler D Form 1040 Individual Tax Return - Records-ALwhat is thisAinda não há avaliações

- Kia Lopez Form 1040Documento2 páginasKia Lopez Form 1040Stephanie RobinsonAinda não há avaliações

- M. Giraldo PDFDocumento3 páginasM. Giraldo PDFMayken GiraldoAinda não há avaliações

- 941 1st QTR 2010Documento2 páginas941 1st QTR 2010Larry BartonAinda não há avaliações

- 1098-T Copy B: Tuition StatementDocumento2 páginas1098-T Copy B: Tuition StatementJonathan EllisAinda não há avaliações

- 1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Documento2 páginas1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Lane ElliottAinda não há avaliações

- Matthew Wozniak W2 2021 W2 202233131923Documento3 páginasMatthew Wozniak W2 2021 W2 202233131923MwAinda não há avaliações

- TaxForms PDFDocumento2 páginasTaxForms PDFLMN214100% (1)

- 2010 Psztur R Form 1040 Individual Tax ReturnDocumento20 páginas2010 Psztur R Form 1040 Individual Tax ReturnJaqueline LeslieAinda não há avaliações

- Hynum Greg Angela - 20i - CCDocumento76 páginasHynum Greg Angela - 20i - CCAdmin OfficeAinda não há avaliações

- Mart1552 21i FCDocumento23 páginasMart1552 21i FCOlga M.Ainda não há avaliações

- Profit or Loss From Business: Linda Gercken 156-56-8670Documento2 páginasProfit or Loss From Business: Linda Gercken 156-56-8670ROB100% (1)

- Ajax PDFDocumento2 páginasAjax PDFGeorge AndoneAinda não há avaliações

- 2021TaxReturnPDF 221003 100736Documento18 páginas2021TaxReturnPDF 221003 100736Tracy SmithAinda não há avaliações

- Master Promissory Note (MPN) Direct Subsidized Loans and Direct Unsubsidized Loans William D. Ford Federal Direct Loan ProgramDocumento15 páginasMaster Promissory Note (MPN) Direct Subsidized Loans and Direct Unsubsidized Loans William D. Ford Federal Direct Loan Programdog dogAinda não há avaliações

- Nolasco W2Documento2 páginasNolasco W2MARCOS NOLASCOAinda não há avaliações

- Income Tax Return Ay 2019-20Documento1 páginaIncome Tax Return Ay 2019-20ramanAinda não há avaliações

- U.S. Individual Income Tax Return: Filing StatusDocumento2 páginasU.S. Individual Income Tax Return: Filing StatusSammi Bowe100% (1)

- 2022 Calderon C Form 1040 Individual Tax Return - RecordsDocumento46 páginas2022 Calderon C Form 1040 Individual Tax Return - RecordsSali CaliAinda não há avaliações

- Important Information About Your Unemployment Insurance ClaimDocumento3 páginasImportant Information About Your Unemployment Insurance ClaimSolomonAinda não há avaliações

- VA Attendant EnrollmentDocumento2 páginasVA Attendant EnrollmentJeannie ArringtonAinda não há avaliações

- Michael Easley 1040 2017Documento2 páginasMichael Easley 1040 2017MichaelAinda não há avaliações

- LifeDocumento11 páginasLifejasAinda não há avaliações

- U.S. Individual Income Tax Return: Filing StatusDocumento2 páginasU.S. Individual Income Tax Return: Filing Statusfelix angomasAinda não há avaliações

- Ka/Lfh: Lee A Vinal Inc 401 Aiken Ave DRACUT, MA 01826Documento4 páginasKa/Lfh: Lee A Vinal Inc 401 Aiken Ave DRACUT, MA 01826Jonathan Seagull LivingstonAinda não há avaliações

- MGPTaxReturn 2020Documento64 páginasMGPTaxReturn 2020KGW NewsAinda não há avaliações

- Profit or Loss From Business: Schedule C (Form 1040) 09Documento2 páginasProfit or Loss From Business: Schedule C (Form 1040) 09John Bean100% (1)

- Captura de Pantalla 2022-02-05 A La(s) 4.03.49 A.M.Documento4 páginasCaptura de Pantalla 2022-02-05 A La(s) 4.03.49 A.M.Adriana AnsurezAinda não há avaliações

- Income Tax ReturnDocumento5 páginasIncome Tax Returnevalle13100% (1)

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramDocumento8 páginasFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramOsayameGaius-ObasekiAinda não há avaliações

- Profit or Loss From Business: Edwin Der 353-46-3457 PhotographerDocumento2 páginasProfit or Loss From Business: Edwin Der 353-46-3457 PhotographerJames100% (1)

- 2015 Tax Return Documents (US Auto Motors LLC) Revised PDFDocumento20 páginas2015 Tax Return Documents (US Auto Motors LLC) Revised PDFzlAinda não há avaliações

- Zambrano Tax-Pro & Services 2752 Eagle Canyon DR S Kissimmee, FL 34746 407-334-2907Documento15 páginasZambrano Tax-Pro & Services 2752 Eagle Canyon DR S Kissimmee, FL 34746 407-334-2907Yaidhyt PradoAinda não há avaliações

- Imigracion 2Documento15 páginasImigracion 2erickAinda não há avaliações

- File by Mail Instructions For Your 2009 Federal Tax ReturnDocumento11 páginasFile by Mail Instructions For Your 2009 Federal Tax ReturnjakeAinda não há avaliações

- Master Promissory Note (MPN) Direct Subsidized Loans and Direct Unsubsidized Loans William D. Ford Federal Direct Loan ProgramDocumento15 páginasMaster Promissory Note (MPN) Direct Subsidized Loans and Direct Unsubsidized Loans William D. Ford Federal Direct Loan Programodontologia unibeAinda não há avaliações

- Please Review The Updated Information Below.: For Begins After This CoversheetDocumento3 páginasPlease Review The Updated Information Below.: For Begins After This CoversheetDavid FreiheitAinda não há avaliações

- Form1095a 2017 PDFDocumento8 páginasForm1095a 2017 PDFTina ReyesAinda não há avaliações

- 2021-2022 Tax ReturnDocumento3 páginas2021-2022 Tax ReturnMmmmmmmAinda não há avaliações

- OMB Control No. 2900-0086 Respondent Burden: 15 MinutesDocumento2 páginasOMB Control No. 2900-0086 Respondent Burden: 15 MinutesPatrickCharlesAinda não há avaliações

- FD 941 Apr-Jun 2017 PDFDocumento3 páginasFD 941 Apr-Jun 2017 PDFScott WinklerAinda não há avaliações

- W2 & Earnings: Kelly L WellsDocumento5 páginasW2 & Earnings: Kelly L Wellshala100% (1)

- Rhonda TX RTNDocumento18 páginasRhonda TX RTNobriens05Ainda não há avaliações

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionAinda não há avaliações

- W 2Documento3 páginasW 2lysprr33% (3)

- TGDocumento2 páginasTGpr995Ainda não há avaliações

- Instapdf - In-Fortune-500-Companies-List GL 1 CMGFHC Ga T1J4UWpwSHNCOXZweFRMY0hUTzFiVWVwSm1VR1d5WEZSXzlQcjF3SWxxSy11eEwtQXV0NmJZUFNpMzROQWxQbw..-662Documento79 páginasInstapdf - In-Fortune-500-Companies-List GL 1 CMGFHC Ga T1J4UWpwSHNCOXZweFRMY0hUTzFiVWVwSm1VR1d5WEZSXzlQcjF3SWxxSy11eEwtQXV0NmJZUFNpMzROQWxQbw..-662Darlene BlayaAinda não há avaliações

- Subsidiarys of Citigroup Inc. 2009 Exhibit21-01Documento5 páginasSubsidiarys of Citigroup Inc. 2009 Exhibit21-01CarrieonicAinda não há avaliações

- LIBRO 9 Derecho RomanoDocumento30 páginasLIBRO 9 Derecho RomanoDomingo VasquezAinda não há avaliações

- EconomyDocumento373 páginasEconomyadmorseAinda não há avaliações

- Creditcardrush JSON 2Documento31 páginasCreditcardrush JSON 2grand theftAinda não há avaliações

- Tax Guide For Small BusinessDocumento54 páginasTax Guide For Small BusinessRaja PKAinda não há avaliações

- 2019 All-State Girls VolleyballDocumento1 página2019 All-State Girls VolleyballHonolulu Star-AdvertiserAinda não há avaliações

- Measuring The Economy's PerformanceDocumento6 páginasMeasuring The Economy's PerformanceМаксим ПобережныйAinda não há avaliações

- Shunzeric Farm LLCDocumento2 páginasShunzeric Farm LLCtcamon26Ainda não há avaliações

- mts0719 PDFDocumento202 páginasmts0719 PDFDevon Gilbert YatesAinda não há avaliações

- Fortune 2000Documento45 páginasFortune 2000Jhon ArunAinda não há avaliações

- Public Ittikal Sequel FundDocumento10 páginasPublic Ittikal Sequel FundFayZ ZabidyAinda não há avaliações

- US Internal Revenue Service: p3381Documento3 páginasUS Internal Revenue Service: p3381IRSAinda não há avaliações

- Form 1040 SeniorDocumento4 páginasForm 1040 SeniorStuti TiwariAinda não há avaliações

- Solved Latesha A Single Taxpayer Had The Following Income and DeductionsDocumento1 páginaSolved Latesha A Single Taxpayer Had The Following Income and DeductionsAnbu jaromiaAinda não há avaliações

- US-China Trade Conflict - The Bottom Line PDFDocumento8 páginasUS-China Trade Conflict - The Bottom Line PDFMurad Ahmed NiaziAinda não há avaliações

- 252 - U.S. Treasury Forclosing On The Federal Reserve BankDocumento2 páginas252 - U.S. Treasury Forclosing On The Federal Reserve BankDavid E Robinson100% (6)

- Form 941 SummaryDocumento5 páginasForm 941 SummaryCatori-Dakoda Eil100% (1)

- Self-Registers Bank Account @cashout - KingdomDocumento16 páginasSelf-Registers Bank Account @cashout - Kingdomradohi6352100% (1)

- Filing Requirementsestimated Returns and PaymentsDocumento8 páginasFiling Requirementsestimated Returns and Paymentsbest tax filerAinda não há avaliações

- 10000005551Documento119 páginas10000005551Chapter 11 DocketsAinda não há avaliações

- Non Negotiable: 142 GeneralDocumento1 páginaNon Negotiable: 142 General9wvsbwngcrAinda não há avaliações

- Economic CartoonsDocumento39 páginasEconomic CartoonsPriscilla SamaniegoAinda não há avaliações

- ECON MID Test Pre withoutANSDocumento6 páginasECON MID Test Pre withoutANSSamuel YehAinda não há avaliações

- En 05 10031 2017 PDFDocumento1 páginaEn 05 10031 2017 PDFmichael caseyAinda não há avaliações

- Reg ListDocumento7 páginasReg ListJAGUAR GAMINGAinda não há avaliações

- Budget 2017 Per PDFDocumento418 páginasBudget 2017 Per PDFNick AshleyAinda não há avaliações

- W-2 Form George PDFDocumento1 páginaW-2 Form George PDFGeorge LucasAinda não há avaliações

- Part D PowerpointDocumento14 páginasPart D PowerpointMark ReinhardtAinda não há avaliações

- Credit Cards American Express - JpegDocumento3 páginasCredit Cards American Express - JpegSantiago Dlr83% (6)