Escolar Documentos

Profissional Documentos

Cultura Documentos

Tax Assignment

Enviado por

kaRan GUptДDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Tax Assignment

Enviado por

kaRan GUptДDireitos autorais:

Formatos disponíveis

ASSIGNMENT

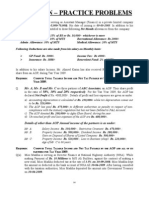

Corporate Taxation Q1) Discuss the evolution of Income tax law in India? Q2) Explain the following terms: (i) Previous Year, (ii) Assessee , (iii)Income, (iv) Casual Income Q3) Income Tax is a tax on income and not on receipts. Discuss this statement and give the essential characteristics of the term Income ? Q4) Define the term Income. Distinguish between the gross total income and total income? Q5) The following are the incomes of Shri Ram Prasad for te previous year 2007-08: a) Profit from business in Iran received in India Rs. 5000; b) Income from House property in Iran received in India Rs.500; c) Income from house property in Pakistan deposited in a bank there Rs.1000; d) Profits of Business established in Pakistan deposited in a bank there Rs.20,000 (out of Rs.20,000 a sum of Rs.10,000 is brought into India)-this business is controlled from India; e) Accrued in India but received in England Rs.2000; f) Profits earned from Business in Kanpur Rs.6000 g) Income from agriculture in England it is all spent on the education of children in London Rs.5000 h) Past untaxed foreign Income brought into India during the previous year Rs.10,000 From the above particulars ascertain the taxable income of Shri.Ram Prasad for the p.y 2007-2008 if Sh.Ram Prasad is I) a resident II) a not ordinary resident and a non resident . Q6) Enumerate any fifteen items of income which are totally exempt?

Q7)Write note on any one of the following: Profits of newly established industrial undertaking in free trade Zone. Profits of Newly established 100% export oriented undertakings. Q8) What is meant by perquisites? What are tax free prequisities? Q9) What are the provisions of the Income tax act regarding Leave travel concession? Q10) Mr.Gupta is the General manager of transport company drawing salary of Rs.11,00 pm.The company has provided him with accommodation for which 10% of his salary is deducted .Actual rent paid by the company for the accommodation is Rs.54,000 p.a.He is also receiving entertainment allowance of Rs.500 p.m.He is provided by the company with large car for hhis personal and offical use.Expenses for personal use are borne by the assessee himself.Members of assessees family have a visited a no.of places in a compnays buses for which no.fare has been charged.Total fare for all these visits during the accounting year amounted to Rs.7200.He is in receipt of bonus equivalent to 2months salary .Compute his taxable income under the head salary for the A.Y 2008-2009. Q11) X retires from service on 30th November 2007 and he is in receipt of Rs.3000 p.m. as pension upto 31st January 2008 payable on the last day of each month. On 1st Feb,2008he gets two-thirds of his pension commuted for Rs.1,20,000 Determine the chargeable pension in case he is former employee of : a) Central Government b) Punjab government c) ABC ltd.assuming he is not in receipt of gratuity . Q12)Define annual valueand state the deductions that are allowed from the annual value in computing the income from house property? Q13) Mr.A is the owner of a house in Mumbai completely let out for residential purposes ,consisting of two flats of different sizes .They are let out at Rs.5000p.m and Rs.7000 p.m resp.Municipal value of the house of Rs.96,000.The rate of municipal tax is @ 15% p.a The particulars are as follows: The house is newly constructed ,construction was completed on ist April 2003.

Interest on loan of Rs.1,00,000 taken on 1.4.2000 @ 10%p.a to construct the house,is Rs.10,000 for the Year. Interest for the preceding three years was also paid but not claimed as deduction. Collection Charges claimed by him were Rs.700 but actual expenses were Rs.500 for the year. Compute his income from house property for the A.Y 2008-2009 Q14) In computing income from Business what are the provisions relating to following expenses: Expenses on Scientific Research; Deduction in respect of Preliminary Expenses; Bad debts Q15) On the basis of Trading and P& l account of Mr.Harish calculate his income from Business/Profession for the assessment year 2008-2009: Salary 1,00,000 Gross Profit 3,96,260 Advertising 45,500 Rent on Property 48,000 Office Expenses 92,500 Refund of 3,000 income Tax Insurance 86000 Bad Debts 7800 expenses recovery Fire Insurance 3400 (H.p) Life Insurance 5000 premium Depreciation on 13,000 Motor Tax Provision 26,000 Entertainment 18,500 Expenses Cost of Patent 21,000 Motor expenses 12,000 Bad Debts 2500 General 3000 Expenses Net Profit 1,04,060 4,55,060 4,55,060

Other Informations: Advertising includes:1)Goods presented to customers (30 articles @ Rs.800 each); 2)T.V.prize to customers ( two T.V @ Rs.4500 per set);3)Diaries/calendars trs.3000; 4) Balance amount Newspapers Advertisement. Salary paid to one employee @ Rs.8000 p.m Recovery of Bad debts includes Rs.6000 which was not accepted by I.T.O.for deduction in 2006-2007 Cost of the motor is Rs.1,00,000 on which depreciation allowed @ 15% p.a.

Você também pode gostar

- 28 5 Income TaxDocumento50 páginas28 5 Income Taxemmanuel JohnyAinda não há avaliações

- BC 501 Income Tax Law 740766763 PDFDocumento15 páginasBC 501 Income Tax Law 740766763 PDFSakshi JainAinda não há avaliações

- Finance Management Specialisation - Ii 304 - B: Direct TaxationDocumento3 páginasFinance Management Specialisation - Ii 304 - B: Direct TaxationRohit ParmarAinda não há avaliações

- Business Taxation MBA III 566324802Documento5 páginasBusiness Taxation MBA III 566324802mohanraokp2279Ainda não há avaliações

- Assignment MBA III: Business Taxation: TH THDocumento4 páginasAssignment MBA III: Business Taxation: TH THShubham NamdevAinda não há avaliações

- Mba 3 Sem Tax Planning and Management Jan 2019Documento3 páginasMba 3 Sem Tax Planning and Management Jan 2019Er Aftab ShaikhAinda não há avaliações

- I.TAx 302Documento4 páginasI.TAx 302tadepalli patanjaliAinda não há avaliações

- Income Tax Model PaperDocumento5 páginasIncome Tax Model PaperSrinivas YerrawarAinda não há avaliações

- ITL (2) (3rd) Dec2020Documento15 páginasITL (2) (3rd) Dec2020jassdeosi849Ainda não há avaliações

- PTP SolutionsDocumento5 páginasPTP SolutionsSanah SahniAinda não há avaliações

- Ed Practice Problems For TaxationDocumento6 páginasEd Practice Problems For TaxationKIYYA QAYYUM BALOCH100% (1)

- Model Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFDocumento5 páginasModel Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFShah SujitAinda não há avaliações

- +++C$C, CCC$ CDocumento7 páginas+++C$C, CCC$ CKomal Damani ParekhAinda não há avaliações

- Income Tax Question BankDocumento8 páginasIncome Tax Question Banksurya.notes19Ainda não há avaliações

- Chpter 1, Scope & Levy, Nat & POS, AllDocumento14 páginasChpter 1, Scope & Levy, Nat & POS, AllBhavika KhetleAinda não há avaliações

- 012-Practice Questions - Income TaxDocumento106 páginas012-Practice Questions - Income Taxalizaidkhan29% (7)

- F Business Taxation 671079211Documento4 páginasF Business Taxation 671079211anand0% (1)

- Questions 34nosDocumento21 páginasQuestions 34nosAshish TomsAinda não há avaliações

- Da 144Documento4 páginasDa 144GeethaAinda não há avaliações

- Income Tax Law and PracticeDocumento4 páginasIncome Tax Law and PracticeShruthi VijayanAinda não há avaliações

- Cim 8682 Taxation Question Paper (Ahemadabad)Documento3 páginasCim 8682 Taxation Question Paper (Ahemadabad)Pomi ShiyaAinda não há avaliações

- Income Tax II Illustration Computation of Total Income PDFDocumento7 páginasIncome Tax II Illustration Computation of Total Income PDFSubramanian SenthilAinda não há avaliações

- Model Question BBS 3rd Taxation in NepalDocumento6 páginasModel Question BBS 3rd Taxation in NepalAsmita BhujelAinda não há avaliações

- 18222rtp PCC May10 Paper5Documento37 páginas18222rtp PCC May10 Paper5Kamesh IyerAinda não há avaliações

- (April-18) (HBC-202) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Documento4 páginas(April-18) (HBC-202) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Bhuvaneswari karuturiAinda não há avaliações

- Taxtion II Nov Dec 2014Documento5 páginasTaxtion II Nov Dec 2014Md HasanAinda não há avaliações

- Mock Sep 2023 - Question PaperDocumento8 páginasMock Sep 2023 - Question Paperfahadkhn871Ainda não há avaliações

- Question Analysis: Taxation IDocumento9 páginasQuestion Analysis: Taxation IIQBALAinda não há avaliações

- CA IPCC Taxation Mock Test Series 1 - Sept 2015Documento7 páginasCA IPCC Taxation Mock Test Series 1 - Sept 2015Ramesh GuptaAinda não há avaliações

- GST Ca Interg9 QuestionDocumento6 páginasGST Ca Interg9 QuestionVishal Kumar 5504Ainda não há avaliações

- Requirements:: Taxation-Ii Time Allowed - 3 Hours Total Marks - 100Documento5 páginasRequirements:: Taxation-Ii Time Allowed - 3 Hours Total Marks - 100Srikrishna DharAinda não há avaliações

- 11 La 402 BTDocumento4 páginas11 La 402 BTmuhzahid786Ainda não há avaliações

- Test Series: October, 2014 Mock Test Paper - 2 Intermediate (Ipc) : Group - I Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100Documento8 páginasTest Series: October, 2014 Mock Test Paper - 2 Intermediate (Ipc) : Group - I Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100TejTejuAinda não há avaliações

- Important QuestionsDocumento3 páginasImportant QuestionsPratham BhardwajAinda não há avaliações

- Itcst Nov06Documento27 páginasItcst Nov06api-3825774Ainda não há avaliações

- Aditya Sharma - II Mid Term Paper Shikha MamDocumento9 páginasAditya Sharma - II Mid Term Paper Shikha MamAditya SharmaAinda não há avaliações

- Icai 3Documento14 páginasIcai 3Raghav TibdewalAinda não há avaliações

- Bosmtpinterp 4 QDocumento12 páginasBosmtpinterp 4 QUrvi MishraAinda não há avaliações

- 4) TaxationDocumento25 páginas4) TaxationvgbhAinda não há avaliações

- Income Tax Assessment and Procedure - 1Documento3 páginasIncome Tax Assessment and Procedure - 1amaljacobjogilinkedinAinda não há avaliações

- September: (CBCS) (F +R) (2016-17 and Onwards)Documento7 páginasSeptember: (CBCS) (F +R) (2016-17 and Onwards)Gracy GeorgeAinda não há avaliações

- (April-18) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Documento4 páginas(April-18) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Bhuvaneswari karuturiAinda não há avaliações

- Income Tax Practice QuestionsDocumento18 páginasIncome Tax Practice QuestionsNuman Rox0% (2)

- Direct TaxationDocumento39 páginasDirect TaxationSethu SangurajanAinda não há avaliações

- 4 (A) Income Tax-1Documento4 páginas4 (A) Income Tax-1anjanaAinda não há avaliações

- CA Inter Taxation Mock Test - 02.08.2018 - Only QuestionDocumento7 páginasCA Inter Taxation Mock Test - 02.08.2018 - Only QuestionKaustubhAinda não há avaliações

- SVKM'S Nmims Anil Surendra Modi School of Commerce Sybcom Sem Iii (2019-22) Subject Name: Direct Taxation No. of Hours: 2 Hours InstructionsDocumento20 páginasSVKM'S Nmims Anil Surendra Modi School of Commerce Sybcom Sem Iii (2019-22) Subject Name: Direct Taxation No. of Hours: 2 Hours InstructionsMadhuram SharmaAinda não há avaliações

- Tax Management ModelDocumento17 páginasTax Management ModelZacharia VincentAinda não há avaliações

- ACC 203 Taxation in NepalDocumento9 páginasACC 203 Taxation in NepalSophiya PrabinAinda não há avaliações

- Income Tax 1 - 20223Documento3 páginasIncome Tax 1 - 20223nimalpes21Ainda não há avaliações

- Aditya Sharma - II Mid Term Paper Shikha Mam 1Documento11 páginasAditya Sharma - II Mid Term Paper Shikha Mam 1Aditya SharmaAinda não há avaliações

- CAF-6 Mock Paper by SkansDocumento6 páginasCAF-6 Mock Paper by SkansMehak AliAinda não há avaliações

- PCC May 2008 Held On 7/5/2008: Answer All QuestionsDocumento17 páginasPCC May 2008 Held On 7/5/2008: Answer All Questionsapi-206947225Ainda não há avaliações

- Capii Income Tax and Vat July2015Documento15 páginasCapii Income Tax and Vat July2015casarokarAinda não há avaliações

- Income Tax S5 Set IDocumento5 páginasIncome Tax S5 Set ITitus ClementAinda não há avaliações

- Salary - Practice QuestionsDocumento8 páginasSalary - Practice Questionssyedameerhamza762Ainda não há avaliações

- March 09 TaxDocumento4 páginasMarch 09 TaxmimriyathAinda não há avaliações

- Bcom 402Documento220 páginasBcom 402Prabhu SahuAinda não há avaliações

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisAinda não há avaliações

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionAinda não há avaliações

- Heidelbergcement India Limited: Two Lakh Sixty Three Thousand Nine Hundred Fifty Three RupeesDocumento1 páginaHeidelbergcement India Limited: Two Lakh Sixty Three Thousand Nine Hundred Fifty Three RupeesPankaj PandeyAinda não há avaliações

- Íq2F %$Q%# W (Ywhî Ìç ! Î: Total Due R 857.57Documento4 páginasÍq2F %$Q%# W (Ywhî Ìç ! Î: Total Due R 857.57Mindrys100% (2)

- Bill FormDocumento4 páginasBill Formdushyant1987Ainda não há avaliações

- BSP Memorandum No. M-2018-013Documento2 páginasBSP Memorandum No. M-2018-013supremo10Ainda não há avaliações

- Invoice - NMC - Voice Conference - Rentals - Mar-2022Documento1 páginaInvoice - NMC - Voice Conference - Rentals - Mar-2022Sujatha NarasaraopetAinda não há avaliações

- Amity Business School: MBA Legal Aspects of Business Ms. Shinu VigDocumento20 páginasAmity Business School: MBA Legal Aspects of Business Ms. Shinu VigAamir MalikAinda não há avaliações

- FOMB - Letter - Senate of Puerto Rico - Response Letter Section 204 (A) (6) SB 1304 - February 7, 2024Documento3 páginasFOMB - Letter - Senate of Puerto Rico - Response Letter Section 204 (A) (6) SB 1304 - February 7, 2024Metro Puerto RicoAinda não há avaliações

- Introduction of Tax PlanningDocumento17 páginasIntroduction of Tax PlanningNurmanAinda não há avaliações

- Section 3: The Tax System and The Philippines Development ExperienceDocumento13 páginasSection 3: The Tax System and The Philippines Development ExperiencePearl ArcamoAinda não há avaliações

- RMO - NO. 9-2018 - DigestDocumento5 páginasRMO - NO. 9-2018 - DigestCliff DaquioagAinda não há avaliações

- Basic Principles LectureDocumento6 páginasBasic Principles LecturetherezzzzAinda não há avaliações

- Form PDF 870914450231220Documento8 páginasForm PDF 870914450231220Sachin KumarAinda não há avaliações

- Statement of Axis Account No:914010049504553 For The Period (From: 23-01-2019 To: 02-09-2020)Documento4 páginasStatement of Axis Account No:914010049504553 For The Period (From: 23-01-2019 To: 02-09-2020)Chandrani ChatterjeeAinda não há avaliações

- 0055450928Documento1 página0055450928chandramouliyadavAinda não há avaliações

- CS Executive Old Paper 4 Tax Laws and Practice SA V0.3Documento33 páginasCS Executive Old Paper 4 Tax Laws and Practice SA V0.3Raunak AgarwalAinda não há avaliações

- FLIGHT Billing 2Documento2 páginasFLIGHT Billing 2Baby AnnAinda não há avaliações

- Direct Tax Laws & International Taxation Mock Test Paper SeriesDocumento11 páginasDirect Tax Laws & International Taxation Mock Test Paper SeriesDeepsikha maitiAinda não há avaliações

- Buku Besar PT Miracle IndahDocumento54 páginasBuku Besar PT Miracle IndahYunitaAinda não há avaliações

- Application For Tax Clearance Certificate - DM06 TlaliDocumento1 páginaApplication For Tax Clearance Certificate - DM06 TlaliRaphoto MoketeAinda não há avaliações

- Ilovepdf MergedDocumento4 páginasIlovepdf MergedShikhar GuptaAinda não há avaliações

- GSRTCDocumento1 páginaGSRTCMayuAinda não há avaliações

- Income Tax Ordinance 1984 - Amended Upto July 2022Documento382 páginasIncome Tax Ordinance 1984 - Amended Upto July 2022Sumit GAinda não há avaliações

- Halliburton Supplier Lifecycle Performance Supplier Registration GuideDocumento28 páginasHalliburton Supplier Lifecycle Performance Supplier Registration GuideISAACAinda não há avaliações

- Oracle ARDocumento6 páginasOracle ARMr. JalilAinda não há avaliações

- Chapter C:4 Corporate Nonliquidating Distributions Discussion QuestionsDocumento29 páginasChapter C:4 Corporate Nonliquidating Distributions Discussion QuestionsYang LiAinda não há avaliações

- Quali Review Statement of Cash Flows Complete SolutionDocumento5 páginasQuali Review Statement of Cash Flows Complete SolutionPaul Ivan CabanatanAinda não há avaliações

- Chapter 1 HomeworkDocumento3 páginasChapter 1 HomeworkEmily ClevelandAinda não há avaliações

- Release 13 21.B UK Payroll SetupDocumento146 páginasRelease 13 21.B UK Payroll SetupKiran JAinda não há avaliações

- Order 113-1683370-5035408Documento1 páginaOrder 113-1683370-5035408ianAinda não há avaliações

- BWG B Si - 91772 1Documento1 páginaBWG B Si - 91772 1Azaz ShaikhAinda não há avaliações