Escolar Documentos

Profissional Documentos

Cultura Documentos

The OTC Bulletin Board

Enviado por

Ayesha AhmadDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

The OTC Bulletin Board

Enviado por

Ayesha AhmadDireitos autorais:

Formatos disponíveis

Over the Counter Bulletin Board

The OTC Bulletin Board (OTCBB) is a regulated quotation service that displays real-time quotes, last-sale prices, and volume information in over-the-counter (OTC) equity securities. An OTC equity security generally is any equity that is not listed or traded on NASDAQ or a national securities exchange. OTCBB securities include national, regional, and foreign equity issues, warrants, units, American Depositary Receipts (ADRs), and Direct Participation Programs (DPPs).

Features

The OTCBB: provides access to more than 3,300 securities; includes more than 230 participating Market Makers; electronically transmits real-time quote, price, and volume information in domestic securities, foreign securities and ADRs; and displays indications of interest and prior-day trading activity in DPPs

Pink Sheet

A daily publication compiled by the National Quotation Bureau with bid and asks prices of over-the-counter (OTC) stocks, including the market makers who trade them. Unlike companies on a stock exchange, companies quoted on the pink sheets system do not need to meet minimum requirements or file with the SEC. Pink sheets also refers to OTC trading. The pink sheets got their name because they were actually printed on pink paper. You can tell whether a company trades on the pink sheets because the stock symbol will end in ".PK".

Third and Fourth Market

The third market comprises OTC transactions between broker-dealers and large institutions. The fourth market is made up of transactions that take place between large institutions. These don't concern individual investors because they involve significant volumes of shares to be transacted per trade. These markets deal with transactions between broker-dealers and large institutions through over-the-counter electronic networks. The main reason these third and fourth market transactions occur is to avoid placing these orders through the main exchange, which could greatly affect the price of the security. Because access to the third and fourth markets is limited, their activities have little effect on the average investor.

Third Market Trading by non-exchange-member brokers/dealers and institutional investors of exchange-listed stocks. In other words, the third market involves exchange-listed securities that are being traded over-the-counter between brokers/dealers and large institutional investors. Before selling an exchange-listed security to a non-member, a member firm must fill all limit orders on the specialist's book at the same price or higher. Typical institutional investors who take part in the third market include investment firms and pension plans. Fourth Market The trading of exchange-listed securities between institutions on a private over-thecounter computer network, rather than over a recognized exchange such as the New York Stock Exchange (NYSE) or Nasdaq. Trades between institutions will often be made in large blocks and without a broker, allowing the institutions to avoid brokerage fees. For example, when a mutual fund and a pension fund enter into a large block trade with each other, this would generally occur in the fourth market and usually over an electronic communication network. By executing the transaction this way, both parties avoid brokerage and exchange transaction fees. They also avoid the possibility of distorting the market price or the volume traded on an exchange.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Balancing Risk and Reward: Ed PadonDocumento6 páginasBalancing Risk and Reward: Ed Padonapi-19771937Ainda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Performance of Hedge Funds in India - Indian Finance AssociationDocumento4 páginasPerformance of Hedge Funds in India - Indian Finance AssociationpradeepAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- What Is Dabba Trading?Documento7 páginasWhat Is Dabba Trading?Akshat VermaAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Matrimony IPODocumento476 páginasMatrimony IPOvicr100Ainda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Analysis of Pakistan Petroleum LimitedDocumento52 páginasAnalysis of Pakistan Petroleum LimitedMBA...KID100% (2)

- An Introduction To Derivative Securities Financial Markets and Risk Management 1st Edition 2013 Jarrow ChatterjeaDocumento881 páginasAn Introduction To Derivative Securities Financial Markets and Risk Management 1st Edition 2013 Jarrow Chatterjeahuhata100% (5)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Franklin Mint Corporation, Franklin Mint Limited, and McGregor Swire Air Services Limited v. Trans World Airlines, Inc., 690 F.2d 303, 2d Cir. (1982)Documento14 páginasFranklin Mint Corporation, Franklin Mint Limited, and McGregor Swire Air Services Limited v. Trans World Airlines, Inc., 690 F.2d 303, 2d Cir. (1982)Scribd Government DocsAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- India Business QuizDocumento10 páginasIndia Business QuizDeep Patel100% (1)

- International Financial Markets-Chapter 8Documento12 páginasInternational Financial Markets-Chapter 8Marlou AbejuelaAinda não há avaliações

- A Study On The Impact of Dividend Announcement On Stock PriceDocumento9 páginasA Study On The Impact of Dividend Announcement On Stock PriceVidya Hegde KavitasphurtiAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Forward ContractDocumento31 páginasForward ContractsandipAinda não há avaliações

- Speakers ProfilesDocumento2 páginasSpeakers ProfilesMichelle Yvonne ClerigoAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Factsheet Nifty50 ShariahDocumento2 páginasFactsheet Nifty50 ShariahAjmal Lakshadweep AJAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Directives On Fiduciary InvestmentsDocumento13 páginasDirectives On Fiduciary InvestmentskbreaderAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Eurodollar University Full SlideDeckDocumento62 páginasEurodollar University Full SlideDeckabc_dAinda não há avaliações

- 2005 RollofhonourDocumento2 páginas2005 Rollofhonouruk_okAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Case - Salvo ChemicalDocumento12 páginasCase - Salvo ChemicalsabihaAinda não há avaliações

- HDFC Ar 17Documento3 páginasHDFC Ar 17baz chackoAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Kamal Sarkar: Academic QualificationsDocumento1 páginaKamal Sarkar: Academic QualificationsKing SarkarAinda não há avaliações

- Forex Profits PDFDocumento35 páginasForex Profits PDFOmar Cendron100% (1)

- Performance Highlights: Company Update - Capital GoodsDocumento13 páginasPerformance Highlights: Company Update - Capital GoodsAngel BrokingAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Paul Tudor JonesDocumento11 páginasPaul Tudor JonesPalanisamy BalasubramaniAinda não há avaliações

- API 553 Refinery Control ValvesDocumento519 páginasAPI 553 Refinery Control ValvesvasudhaAinda não há avaliações

- Financial Market - A Study of Indian Capital Market by CA Hemraj KumawatDocumento13 páginasFinancial Market - A Study of Indian Capital Market by CA Hemraj Kumawatijr_journalAinda não há avaliações

- Spin Off and Equity Carve Out: Case: Nestle and Alcon - The Value of A ListingDocumento30 páginasSpin Off and Equity Carve Out: Case: Nestle and Alcon - The Value of A ListingAmol MahajanAinda não há avaliações

- 1 Financial Market ContrDocumento16 páginas1 Financial Market ContrAsghar AliAinda não há avaliações

- Ecier: LimitedDocumento15 páginasEcier: Limitedanand_parchureAinda não há avaliações

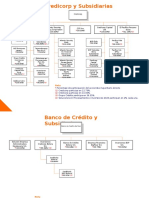

- Organigrama CredicorpDocumento7 páginasOrganigrama CredicorpCarlos RamosAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- SwingSET IntroductionDocumento40 páginasSwingSET IntroductionlessthanrandomAinda não há avaliações

- Project Report FormatDocumento67 páginasProject Report FormatVijay RathiAinda não há avaliações