Escolar Documentos

Profissional Documentos

Cultura Documentos

Bank Card Types & Features

Enviado por

alex_212Descrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Bank Card Types & Features

Enviado por

alex_212Direitos autorais:

Formatos disponíveis

Bank Cards

Bank-issued plastic card with a magnetic stripe that holds machine readable identification code. Bank cards are used for electronic commerce (with magnetic stripe readers or viaInternet) and for banking transactions through automaticteller machines (ATMs). Two main types of bank cards are: credit cards (which allow drawing of funds up to an approved credit limit) and debit cards (which allow drawing of funds up to the available balance in cardholder's account).

Credit cards

small plastic card issued to users as a system of payment. allows its holder to buy goods and services based on the holder's promise to pay for these goods and services (continuing balance of debt) the information on the card is read by automated teller machines (ATMs), store readers, and bank and Internet computers. The first universal credit card -- one that could be used at a variety of stores and businesses -- was introduced by Diners Club, Inc., in 1950. With this system, the credit-card company charged cardholders an annual fee and billed them on a monthly or yearly basis. Advantages:

Free, short-term credit - as long as you always pay your balance in full by the due date shown on your statement. Credit cards offer a safe and convenient way to pay for goods and services both in the UK and abroad,

particularly if you are purchasing over the internet, phone or by mail order. Purchase protection - under Section 75 of the 1974 Consumer Credit Act card issuers and retailers take joint responsibility for faulty purchases, If you pay for something with a credit card, valued between 100 and 30,000, that turns out to be faulty or which you do not receive because the company goes bust, you can claim a refund from the card provider. Protection against fraud if you are the innocent victim of fraud you will not be expected to pay if a criminal uses your card. A truly global currency, as credit cards are accepted in virtually every country around the world. Disadvantages:

You will incur interest if you are unable to repay your balance in full every month. Interest rates vary

significantly so if you cant afford to clear your debt you should look for a card that offers a competitive rate of interest. The amount you can spend on a credit card is capped so you may not have access to as much money as you expected.

Debit cards

a plastic card that provides the cardholder electronic access to his or her bank account/s at a financial institution can be used as an alternative payment method to cash when making purchases the funds paid using a debit card are transferred immediately from the bearer's bank account Advantages of debit cards

A consumer who is not credit worthy and may find it difficult or impossible to obtain a credit card can more

easily obtain a debit card, allowing him/her to make plastic transactions. For example, legislation often prevents minors from taking out debt, which includes the use of a credit card, but not online debit card transactions. Like credit cards, debit cards are accepted by merchants with less identification and scrutiny than personal checks, thereby making transactions quicker and less intrusive.

Unlike a credit card, which charges higher fees and interest rates when a cash advance is obtained, a debit card

may be used to obtain cash from an ATM or a PIN-based transaction at no extra charge, other than a foreign ATM fee. It is easy to obtain a debit card Disadvantages of debit cards

Use of a debit card is not usually limited to the existing funds in the account to which it is linked, most banks

allow a certain threshold over the available bank balance which can cause overdraft fees if the users transaction does not reflect available balance. Many banks are now charging over-limit fees or non-sufficient funds fees based upon pre-authorizations, and even attempted but refused transactions by the merchant (some of which may be unknown until later discovery by account holder). [8] In some countries debit cards offer lower levels of security protection than credit cards. Theft of the users PIN using skimming devices can be accomplished much easier with a PIN input than with a signature-based credit transaction. However, theft of users' PIN codes using skimming devices can be equally easily accomplished with a debit transaction PIN input, as with a credit transaction PIN input, and theft using a signature-based credit transaction is equally easy as theft using a signature-based debit transaction. In many places, laws protect the consumer from fraud much less than with a credit card. While the holder of a credit card is legally responsible for only a minimal amount of a fraudulent transaction made with a credit card, which is often waived by the bank, the consumer may be held liable for hundreds of dollars, or even the entire value of fraudulent debit transactions. The consumer also has a shorter time (usually just two days) to report such fraud to the bank in order to be eligible for such a waiver with a debit card,[8] whereas with a credit card, this time may be up to 60 days. A thief who obtains or clones a debit card along with its PIN may be able to clean out the consumer's bank account, and the consumer will have no recourse.

American Express Black Card, officially called the Centurion Card

It's a charge card Charge card-A card that charges no interest but requires the user to pay his/her balance in full upon receipt of the statement, usually on a monthly basis. While it is similar to a credit card, the major benefit offered by a charge card is that it has much higher, often unlimited, spending limits. It comes with a variety of services and perks that are unusual for a credit card. (tickets, private jets, At many hotels/resorts and certain major airlines and cruise lines, a Centurion will get you automatic upgradesfrom coach to first-class, for example, or from a regular room to a luxury suite, free meals, gift certificates in hotel gift shops, spa treatments, free companion flights and a subscription to Black Inc. magazine, the only magazine published solely for those who have a Black Card, Translator, personal concierge, personal shopper ) It's black. The card is made out of titanium, not plastic American Express' most exclusive card, and was once only available by personal invitation from American Express Today you must own first a platinum card and spend more than 250. 000$ in a year For the privilege of opening a Centurion account, you will pay a one-time fee of$5,000. To keep your account, you'll pay an annual fee of $2,500.

Você também pode gostar

- Hacking Point of Sale: Payment Application Secrets, Threats, and SolutionsNo EverandHacking Point of Sale: Payment Application Secrets, Threats, and SolutionsNota: 5 de 5 estrelas5/5 (1)

- Safari - Oct 13, 2020 at 6:15 PMDocumento1 páginaSafari - Oct 13, 2020 at 6:15 PMJaboris JohnAinda não há avaliações

- San Diego ListingsDocumento16 páginasSan Diego Listingsapi-345566077Ainda não há avaliações

- Hotel VoucherDocumento2 páginasHotel VoucherjoserslealAinda não há avaliações

- Credit Card Transaction Using Face Recognition AuthenticationDocumento7 páginasCredit Card Transaction Using Face Recognition AuthenticationRanjan BangeraAinda não há avaliações

- Numbers Sheet Name Numbers Table Name Excel Worksheet Name: Bank Info For Agency Reg ExampleDocumento5 páginasNumbers Sheet Name Numbers Table Name Excel Worksheet Name: Bank Info For Agency Reg ExampleIskandar DormanAinda não há avaliações

- Accessing Megabank TrainingDocumento52 páginasAccessing Megabank TrainingbholisinghAinda não há avaliações

- American Express® International Dollar CardDocumento1 páginaAmerican Express® International Dollar Cardfranck petbeamAinda não há avaliações

- Debit Card & Credit Card: Presented By:-Amrish SaddamDocumento22 páginasDebit Card & Credit Card: Presented By:-Amrish Saddamprakash singh bishtAinda não há avaliações

- AMERICAN EXPRESS CardNetDocumento1 páginaAMERICAN EXPRESS CardNetChandan SinghaAinda não há avaliações

- Marriott Bonvoy World Mastercard Credit Card: Welcome To A World of Unparalleled Travel BenefitsDocumento8 páginasMarriott Bonvoy World Mastercard Credit Card: Welcome To A World of Unparalleled Travel BenefitsAdeel ArshadAinda não há avaliações

- Free of Charge PSN Gift Card Constraints 2020fucnn PDFDocumento2 páginasFree of Charge PSN Gift Card Constraints 2020fucnn PDFpetpath2Ainda não há avaliações

- Code ListDocumento192 páginasCode ListMohammad Alamgir HossainAinda não há avaliações

- Target P PDocumento29 páginasTarget P Papi-316581998Ainda não há avaliações

- PNG Spring05Documento16 páginasPNG Spring05David SarifAinda não há avaliações

- Credit Card Line of Agreement and Disclosure StatementDocumento4 páginasCredit Card Line of Agreement and Disclosure StatementEdwin RomanAinda não há avaliações

- Electronic Payment System: It Refers To Paperless Monetary TransactionsDocumento14 páginasElectronic Payment System: It Refers To Paperless Monetary TransactionsAkash KapoorAinda não há avaliações

- Activate Your BPI Credit CardDocumento3 páginasActivate Your BPI Credit CardAl Patrick Dela CalzadaAinda não há avaliações

- Book 2Documento4 páginasBook 2June Marie Rom ApaoAinda não há avaliações

- BDO Credit CardDocumento4 páginasBDO Credit CardAldrin SorianoAinda não há avaliações

- Bank AccountsDocumento42 páginasBank Accountsbelil206Ainda não há avaliações

- PP Live 2017Documento2 páginasPP Live 2017Arwan Suryadi PramantaAinda não há avaliações

- 4 41641 Attacks On Point of Sale SystemsDocumento12 páginas4 41641 Attacks On Point of Sale Systemsanna leeAinda não há avaliações

- Wire Transfer Quick Reference Guide For CustomersDocumento2 páginasWire Transfer Quick Reference Guide For Customersash_iitrAinda não há avaliações

- Learning Task 1 - Special Journals & Subsidiary Ledgers, Problem #5Documento9 páginasLearning Task 1 - Special Journals & Subsidiary Ledgers, Problem #5Feiya LiuAinda não há avaliações

- Everything You Need to Know About Electronic BankingDocumento8 páginasEverything You Need to Know About Electronic BankingKarlene BacorayoAinda não há avaliações

- Credit Card Security Devices ExplainedDocumento33 páginasCredit Card Security Devices ExplainedMikiAinda não há avaliações

- SOC Credit Card MayDocumento20 páginasSOC Credit Card MayBDT Visa PaymentAinda não há avaliações

- Web VulnDocumento3 páginasWeb VulnwarnoAinda não há avaliações

- Unit 5 E Commerce Payment SystemDocumento4 páginasUnit 5 E Commerce Payment SystemAltaf HyssainAinda não há avaliações

- American Express Travel PDFDocumento4 páginasAmerican Express Travel PDFfooAinda não há avaliações

- KSFE Chitty 054000001548 Payment Receipt DuplicateDocumento1 páginaKSFE Chitty 054000001548 Payment Receipt DuplicateIjas AslamAinda não há avaliações

- Martview Guide-MarketingDocumento4 páginasMartview Guide-MarketingIsabel GarciaAinda não há avaliações

- Lifestyle: Merchant EstablishmentDocumento1 páginaLifestyle: Merchant EstablishmentSeshankSkAinda não há avaliações

- D11 FTD Cash-Flo Voice Authorization NumbersDocumento2 páginasD11 FTD Cash-Flo Voice Authorization NumbersMariam Nawabi100% (1)

- User LogsDocumento7 páginasUser LogsJuan Carlos Custodio JaquezAinda não há avaliações

- 066-078 SmartCards tcm28-36814Documento13 páginas066-078 SmartCards tcm28-36814kokome35Ainda não há avaliações

- 4Documento6 páginas4Ianis-Vlad UrsuAinda não há avaliações

- WH Credit Card DataDocumento39 páginasWH Credit Card DataFlaviub23Ainda não há avaliações

- Special MT103Documento1 páginaSpecial MT103Eller100% (1)

- HCBC CC InfoDocumento5 páginasHCBC CC Infooninx26Ainda não há avaliações

- VeriFone PCCharge User ManualDocumento219 páginasVeriFone PCCharge User ManualWagner la PazAinda não há avaliações

- Cards: March XX, 2010Documento57 páginasCards: March XX, 2010Keerti MannanAinda não há avaliações

- Evaluation of Some Online Banks, E-Wallets and Visa/Master Card IssuersNo EverandEvaluation of Some Online Banks, E-Wallets and Visa/Master Card IssuersAinda não há avaliações

- Chapter-1 Introduciton: 1.1 What Is Debit C Ard?Documento60 páginasChapter-1 Introduciton: 1.1 What Is Debit C Ard?glorydharmarajAinda não há avaliações

- Canara Credit Cards User Manual Cor 4Documento11 páginasCanara Credit Cards User Manual Cor 4Parag BarmanAinda não há avaliações

- You’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountNo EverandYou’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountNota: 2 de 5 estrelas2/5 (1)

- GURU POLYMER Account Statement May 2022Documento2 páginasGURU POLYMER Account Statement May 2022Suman jhaAinda não há avaliações

- Logs Link de ConfianzaDocumento12 páginasLogs Link de ConfianzaJESUS ANTONIO ARTUNDUAGA MUÑOZAinda não há avaliações

- Survey of Popularity of Credit Cards Issued by Different Banks PDFDocumento3 páginasSurvey of Popularity of Credit Cards Issued by Different Banks PDFArvindKushwaha100% (1)

- Most Important ThingDocumento1 páginaMost Important ThingzazaazAinda não há avaliações

- Mobile APN settings for GPRS networks around the worldDocumento6 páginasMobile APN settings for GPRS networks around the worldPramod DixitAinda não há avaliações

- Introduction To Fleet CardDocumento5 páginasIntroduction To Fleet CardAbhinaw SurekaAinda não há avaliações

- Indictment Conspiracy #1Documento76 páginasIndictment Conspiracy #1Lauren JohnstonAinda não há avaliações

- Boa Bank StatementDocumento7 páginasBoa Bank Statementtieashamassey100% (1)

- CCDocumento2 páginasCCTungstenCarbideAinda não há avaliações

- PaypalDocumento24 páginasPaypalMarine EssenceAinda não há avaliações

- Statement of Cash FlowsDocumento12 páginasStatement of Cash Flowsnot funny didn't laughAinda não há avaliações

- ASSIGNMENT OF ACCOUNTING II JJJJDocumento5 páginasASSIGNMENT OF ACCOUNTING II JJJJJunaid AhmedAinda não há avaliações

- Stale Dated Checks: March 2017Documento5 páginasStale Dated Checks: March 2017Aman Kumar SinghAinda não há avaliações

- Midterm Review - Key ConceptsDocumento10 páginasMidterm Review - Key ConceptsGurpreetAinda não há avaliações

- CA FOUNDATION BILLS OF EXCHANGE GUIDEDocumento13 páginasCA FOUNDATION BILLS OF EXCHANGE GUIDEAshish VermaAinda não há avaliações

- SwapsDocumento13 páginasSwapsHitesh ShadijaAinda não há avaliações

- Durianpay Registration Form - Social SellersDocumento2 páginasDurianpay Registration Form - Social SellersAndhika Kurnia NasutionAinda não há avaliações

- IBPS Maharashtra TAIT Online Test Marks 2023Documento2.000 páginasIBPS Maharashtra TAIT Online Test Marks 2023Aslam BagwanAinda não há avaliações

- Finman QuizDocumento65 páginasFinman QuizChrista LenzAinda não há avaliações

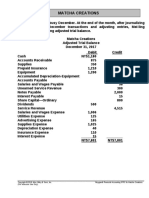

- MC4 Matcha Creations: (For Instructor Use Only)Documento2 páginasMC4 Matcha Creations: (For Instructor Use Only)Reza eka PutraAinda não há avaliações

- 2014.12 2015.01 Q&ABooklet P1 EnglishDocumento24 páginas2014.12 2015.01 Q&ABooklet P1 EnglishKxlxm KxlxmAinda não há avaliações

- StudyDocumento10 páginasStudyirahQAinda não há avaliações

- Onlinestatement (1) LWDocumento3 páginasOnlinestatement (1) LWDustin Knechtel-wickertAinda não há avaliações

- MGT604 Quizes Mega FileDocumento51 páginasMGT604 Quizes Mega FileAbdul Jabbar0% (1)

- Topic 4 - The Meso Level - Financial InfrastructureDocumento22 páginasTopic 4 - The Meso Level - Financial InfrastructureEmmanuel EscabarAinda não há avaliações

- BB Loan Classification and ProvisioningDocumento16 páginasBB Loan Classification and ProvisioningMuhammad Ali Jinnah100% (1)

- Cash FlowsDocumento10 páginasCash FlowsNuha RehnumaAinda não há avaliações

- Ethiopian Financial Institution and Capital Market: Term PaperDocumento23 páginasEthiopian Financial Institution and Capital Market: Term Paperhabtamu0% (1)

- Work Book RBPC - Without AnswersDocumento21 páginasWork Book RBPC - Without AnswersVipin VipsAinda não há avaliações

- A Study of Bank Audit ProcessDocumento61 páginasA Study of Bank Audit ProcessSunil PawarAinda não há avaliações

- Economic Cost vs Accounting Cost AnalysisDocumento8 páginasEconomic Cost vs Accounting Cost AnalysisSrushti GhuleAinda não há avaliações

- Construction Company Audit StrategyDocumento2 páginasConstruction Company Audit Strategynicole bancoroAinda não há avaliações

- Study of Loans & Advances at AMRELI NAGRIK SAHAKARI BANK LTDDocumento84 páginasStudy of Loans & Advances at AMRELI NAGRIK SAHAKARI BANK LTDjagrutisolanki01Ainda não há avaliações

- p3246 Flexplus GuideDocumento21 páginasp3246 Flexplus Guideadheera20Ainda não há avaliações

- Audit work papers for accounts receivable and allowance for doubtful accountsDocumento2 páginasAudit work papers for accounts receivable and allowance for doubtful accountsALMA MORENAAinda não há avaliações

- PT Barito Pacific TBK - Fy 2020Documento210 páginasPT Barito Pacific TBK - Fy 2020Muhammad MuhammadAinda não há avaliações

- Worksheet Dasar-Dasar AkuntansiDocumento50 páginasWorksheet Dasar-Dasar AkuntansiSun dusiyahAinda não há avaliações