Escolar Documentos

Profissional Documentos

Cultura Documentos

Why Islamic Accounting is Necessary for Muslims

Enviado por

Hazrina GhaniDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Why Islamic Accounting is Necessary for Muslims

Enviado por

Hazrina GhaniDireitos autorais:

Formatos disponíveis

QUESTION: Why is there a need for Islamic Accounting?

ANSWER: Islamic accounting can be defined as the accounting process which provides appropriate information (not necessarily limited to financial data) to stakeholders of an entity which will enable them to ensure that the entity is continuously operating within the bounds of the Islamic Shariah and delivering on its socioeconomic objectives. Islamic accounting is also a tool, which enables Muslims to evaluate their own accountabilities to God. We need Islamic accounting because we are a muslim. As a muslim we must do our duties based on Islamic Shariah. Then, as a muslim, Islamic Accounting also is important because it can enables Muslims to evaluate their own accountabilities to God. If we are a responsible Muslims, we must do our duties with honest, trustworthy because such information must be free from any influence and cannot be provided for the interest of certain parties. In Islamic accounting system, accounting rules emphasis on morality and ethics based on the concept of hisbah. Accordingly, an accountant or Muhtasib must have the trust properties, real, responsible, fair and honourable in the discharge of his duties as a trustee. Besides that, the sources of Islamic accounting are based on the Quran

and Sunnah. All aspects of accounting that involves the procedures and activities must permitted by Islamic law. With this sources, Islamic Accounting can be different with conventional accounting where conventional accounting is include all data, transaction or information that not permitted by Islamic law like riba. As we know, riba is prohibited in Islam. So, any transaction, data or information that includes riba is not permitted. Then, Islamic accounting also concerned with truth and honesty with other people and then emphasizes the principle of accountability and also moral of people. So, that why an accountants must be a responsible, trustworthy, and have a high of moral. It is because an accountant is an individual who performs accounting tasks for individuals or companies. The exact material that an accountant handles varies depending on the size of the company and the accountant's specialization, but generally includes financial records, taxes, and

responsibility for the issuing of financial reports. So, an accountant must be someone that not takes any interest for him or herself. Besides that, we need Islamic Accounting because we need to record Islamic financial transaction that free from any haram sources. For example, if we do any transaction,we dont know whether the transaction that we doing is included with the transaction that not permitted in Islam. So, in Islamic Accounting, the transaction that maybe has includes with haram transaction will be deduct in income statement and this is different with conventional accounting where the income that not halal is also included as a income. Islamic accounting also is based on the current value. It is different with conventional accounting where conventional accounting mainly uses historic cost to measure and values assets and liabilities which restricts this model due to assumptions of the monetary unit and its inflation. From an Islamic point of view, both financial and non-financial measures regarding the specific events and transactions are measured and reported. To calculate the amount of Zakat, assets need to be measured in contemporary terms, not in historical cost. The dual system of asset valuation using both historical cost and market selling prices is likely to enable Islamic organizations to accommodate contracts and to discharge their social obligations. So, the conclusion is, Islamic Accounting is important and needed in our life.

Você também pode gostar

- Objectives of Islamic AccountingDocumento3 páginasObjectives of Islamic AccountingNur Rasyidah Ab HalimAinda não há avaliações

- Islamic Accounting Vs Conventional Accounting - Assigment 2Documento3 páginasIslamic Accounting Vs Conventional Accounting - Assigment 2ahmedAinda não há avaliações

- Compare The Characteristic of Islamic Accounting Versus ConventionalDocumento13 páginasCompare The Characteristic of Islamic Accounting Versus ConventionalHafiz BajauAinda não há avaliações

- 1-Compare The Characteristic of Islamic Accounting Versus ConventionalDocumento13 páginas1-Compare The Characteristic of Islamic Accounting Versus ConventionalHafiz BajauAinda não há avaliações

- An Introduction To Islamic Accounting Theory and Practice PDFDocumento256 páginasAn Introduction To Islamic Accounting Theory and Practice PDFArif Witjaksoeno100% (6)

- Meaning of Islamic AccountingDocumento19 páginasMeaning of Islamic Accountingturk66650% (2)

- CHP - 05 The Need For Islamic Accounting-PF2-Estab of Isl OrgDocumento55 páginasCHP - 05 The Need For Islamic Accounting-PF2-Estab of Isl OrgDr. Shahul Hameed bin Mohamed Ibrahim100% (5)

- Ac220 (Uitm) Far 600-Islamic AccountingDocumento22 páginasAc220 (Uitm) Far 600-Islamic AccountingizahyrAinda não há avaliações

- Differences Between Islamic and Conventional AccountingDocumento4 páginasDifferences Between Islamic and Conventional AccountingAnis SofiaAinda não há avaliações

- Topic 7 Impairment of Assets A122 1Documento36 páginasTopic 7 Impairment of Assets A122 1Mei Chien Yap50% (2)

- Conventional AccountingDocumento2 páginasConventional AccountingChoi Minri0% (1)

- CHP - 06 Islamic Accounting Literature ReviewDocumento66 páginasCHP - 06 Islamic Accounting Literature ReviewDr. Shahul Hameed bin Mohamed Ibrahim100% (4)

- Introduction To Accounting 1st SemDocumento15 páginasIntroduction To Accounting 1st SemANJALI KUMARI100% (1)

- Incomplete RecordsDocumento43 páginasIncomplete RecordsBinexAinda não há avaliações

- Islamic Accounting: Duties of Accountant According To QuranDocumento6 páginasIslamic Accounting: Duties of Accountant According To QuranismailAinda não há avaliações

- Study Note - 7: Accounting For Non-Profit Making OrganisationsDocumento143 páginasStudy Note - 7: Accounting For Non-Profit Making OrganisationsharonsimithAinda não há avaliações

- Delima ReportDocumento16 páginasDelima ReportEstrada Alf100% (7)

- Financial Accounting PPT 123Documento29 páginasFinancial Accounting PPT 123An KitAinda não há avaliações

- PSA Assignment (Completed)Documento25 páginasPSA Assignment (Completed)pavishalekhaAinda não há avaliações

- L1a - Financial AccountingDocumento42 páginasL1a - Financial AccountingandyAinda não há avaliações

- Far410 Chapter 1 Fin Regulatory FrameworkDocumento19 páginasFar410 Chapter 1 Fin Regulatory Frameworkafdhal50% (4)

- Islamic Accounting Topics: Zakat, Waqaf, BankingDocumento2 páginasIslamic Accounting Topics: Zakat, Waqaf, BankingAhmad Saifuddin Che AbdullahAinda não há avaliações

- Accounting Policies, Changes in Accounting Estimates and Errors: MFRS 108Documento9 páginasAccounting Policies, Changes in Accounting Estimates and Errors: MFRS 108Nurul AsmidaAinda não há avaliações

- Tutorial 12 PDFDocumento5 páginasTutorial 12 PDFtan keng qi100% (1)

- Approaches To The Formulation of Accounting Theory PDFDocumento31 páginasApproaches To The Formulation of Accounting Theory PDFwajeeda awadAinda não há avaliações

- AFT 1043 Basic Accounting: Group AssignmentDocumento4 páginasAFT 1043 Basic Accounting: Group AssignmentWenXin ChiongAinda não há avaliações

- Ccounting Concepts and PrinciplesDocumento33 páginasCcounting Concepts and PrinciplesAllen CarlAinda não há avaliações

- Read The Following Excerpt From A Complaint Filed by TheDocumento1 páginaRead The Following Excerpt From A Complaint Filed by TheLet's Talk With Hassan0% (1)

- CHPT 19 Answer MFRS 118 Revenue-180214 - 050144Documento3 páginasCHPT 19 Answer MFRS 118 Revenue-180214 - 050144Navin El Nino50% (2)

- Slide Chicken Run Case-MAF 680-Final Year Accounting Student UiTM Shah AlamDocumento40 páginasSlide Chicken Run Case-MAF 680-Final Year Accounting Student UiTM Shah AlamAHmad AMirul AMin MOhd100% (1)

- MFRS 108 Changes in Accounting PoliciesDocumento21 páginasMFRS 108 Changes in Accounting Policiesnatasha thaiAinda não há avaliações

- Tutorial 11 PDFDocumento9 páginasTutorial 11 PDFtan keng qi100% (4)

- Assignment 2 Bkaf 3083Documento5 páginasAssignment 2 Bkaf 3083Nur Adilah Dila100% (1)

- Record The Following Transactions On Page 2 of The Journal:: InstructionsDocumento3 páginasRecord The Following Transactions On Page 2 of The Journal:: InstructionsItsF2bleAP 37100% (1)

- Tutorial 10 PDFDocumento9 páginasTutorial 10 PDFtan keng qi100% (4)

- Chapter 1-Fundamentals of Financial AccountingDocumento20 páginasChapter 1-Fundamentals of Financial AccountingAudrey ReyesAinda não há avaliações

- DEBT-EQUITY RATIO ANALYSISDocumento9 páginasDEBT-EQUITY RATIO ANALYSISSHRI0588Ainda não há avaliações

- Cash - TeachersDocumento12 páginasCash - TeachersJustin ManaogAinda não há avaliações

- Project Report On Financial Statement / Accounting of Islamic BankingDocumento65 páginasProject Report On Financial Statement / Accounting of Islamic Bankingmohibkhan86Ainda não há avaliações

- Megan MediaDocumento8 páginasMegan Mediarose0% (1)

- Introduction to Islamic Finance: Key Principles and FrameworkDocumento89 páginasIntroduction to Islamic Finance: Key Principles and FrameworkNURUL ANIS SAFRUDDINAinda não há avaliações

- Accounting For NPO PDFDocumento31 páginasAccounting For NPO PDFNicole TaylorAinda não há avaliações

- Calculate profit from incomplete recordsDocumento8 páginasCalculate profit from incomplete recordshabibahAinda não há avaliações

- Financial Ratios in ContractsDocumento2 páginasFinancial Ratios in ContractsDeyeck VergaAinda não há avaliações

- Islamic Accounting Need or FormalityDocumento24 páginasIslamic Accounting Need or Formalityoma1100Ainda não há avaliações

- AAOIFI - Introduction: 2-How AAOIFI Standards Support Islamic Finance IndustryDocumento3 páginasAAOIFI - Introduction: 2-How AAOIFI Standards Support Islamic Finance Industryshahidameen2Ainda não há avaliações

- Drafting Financial Statements (International Stream) : Monday 1 December 2008Documento9 páginasDrafting Financial Statements (International Stream) : Monday 1 December 2008salaam7860Ainda não há avaliações

- Balance SheetDocumento16 páginasBalance SheetFam Sin YunAinda não há avaliações

- Financial Accounting and Reporting: Consolidated FundDocumento42 páginasFinancial Accounting and Reporting: Consolidated FundHAFIZAH BINTI MAT NAWIAinda não há avaliações

- Financial Reporting FoundationDocumento4 páginasFinancial Reporting FoundationAre FixAinda não há avaliações

- Chapter 1 BAC 100 PDFDocumento32 páginasChapter 1 BAC 100 PDFacademianotes75% (4)

- Legal Framework of Islamic Capital MarketDocumento21 páginasLegal Framework of Islamic Capital MarketMahyuddin Khalid100% (2)

- Substance Over FormDocumento2 páginasSubstance Over Formsimson singawahAinda não há avaliações

- Specifies Income SmoothingDocumento4 páginasSpecifies Income Smoothingsyahirah rossyaAinda não há avaliações

- Islamic Accounting Vs Conventional Accounting - Assigment 2Documento3 páginasIslamic Accounting Vs Conventional Accounting - Assigment 2ahmedAinda não há avaliações

- 1 Fundamentals of Islamic AccountingDocumento14 páginas1 Fundamentals of Islamic Accountingfidha Pa100% (1)

- Overview of Islamic AccountingDocumento25 páginasOverview of Islamic AccountingNovi WulandariAinda não há avaliações

- Atp T4 Q2Documento1 páginaAtp T4 Q2Ling Xuan ChinAinda não há avaliações

- Accounting SystemsDocumento1 páginaAccounting SystemsHafij UllahAinda não há avaliações

- Lecture 7Documento44 páginasLecture 7Amran Bin Ismail RunsAinda não há avaliações

- Book Review by Abhay Kumar (JNU), SEMINAR, No. 678, February 2016Documento4 páginasBook Review by Abhay Kumar (JNU), SEMINAR, No. 678, February 2016Hadee SaberAinda não há avaliações

- Durood NariyaDocumento5 páginasDurood NariyaIrfan100% (1)

- Umar Ibn Al Khattab His Life and Times Vol 1 and 2Documento543 páginasUmar Ibn Al Khattab His Life and Times Vol 1 and 2Rehan AfzalAinda não há avaliações

- AKF - Guidelines - FINAL v5Documento50 páginasAKF - Guidelines - FINAL v5Sally MaierAinda não há avaliações

- 5th Masters in Public Policy and Management (MPPM) CourseDocumento4 páginas5th Masters in Public Policy and Management (MPPM) CourseRahat Bin Rahman BaniAinda não há avaliações

- Musabaqah 2022Documento6 páginasMusabaqah 2022Abdulmajed Unda MimbantasAinda não há avaliações

- Method of Building New Terms in Arabic - English-ArabicDocumento10 páginasMethod of Building New Terms in Arabic - English-ArabicArsen ArakelyanAinda não há avaliações

- Spanish Is Easier Than French - Not!Documento25 páginasSpanish Is Easier Than French - Not!muzak24hAinda não há avaliações

- Islamic Perspective on the Functions and Concept of MoneyDocumento20 páginasIslamic Perspective on the Functions and Concept of Moneyfurla bbyAinda não há avaliações

- Law Essay 1Documento1 páginaLaw Essay 1ABDULLAH KHALID Gulberg BoysAinda não há avaliações

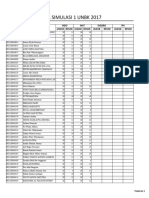

- UNBK 2017 SIMULATION RESULTS 1Documento5 páginasUNBK 2017 SIMULATION RESULTS 1Evri Guru SpenskaAinda não há avaliações

- NO NO. Pendaftaran NAMA Keterangan Jumslah SeluruhDocumento19 páginasNO NO. Pendaftaran NAMA Keterangan Jumslah SeluruhSyariful AnwarAinda não há avaliações

- The Christian Coptic Orthodox Church of EgyptDocumento6 páginasThe Christian Coptic Orthodox Church of EgyptIsla GratiaAinda não há avaliações

- Button ButtonDocumento31 páginasButton ButtonMudassar DaadAinda não há avaliações

- Shirk K Chor DarwazeDocumento382 páginasShirk K Chor DarwazeIslamic Reserch Center (IRC)Ainda não há avaliações

- Taqiyya As Viewed by The Quran and SunnahDocumento4 páginasTaqiyya As Viewed by The Quran and SunnahPhilip AndrewsAinda não há avaliações

- Halal CertificationDocumento12 páginasHalal CertificationNur Athirah Muhamad SobriAinda não há avaliações

- 0-Part 1 Book 92Documento49 páginas0-Part 1 Book 92M Imtiaz Shahid100% (1)

- Famous Egyptian WritersDocumento2 páginasFamous Egyptian WritersJoyce EscullarAinda não há avaliações

- Doa Sesudah SalatDocumento1 páginaDoa Sesudah Salatahmad2ilkom2008Ainda não há avaliações

- Sample Exam 1Documento11 páginasSample Exam 1habiba_il786Ainda não há avaliações

- The Sufi Shaykh and The Sultan: A Conflict of Claims To Authority in Medieval India Author(s) : Simon Digby Source: Iran, 1990, Vol. 28 (1990), Pp. 71-81 Published By: Taylor & Francis, LTDDocumento12 páginasThe Sufi Shaykh and The Sultan: A Conflict of Claims To Authority in Medieval India Author(s) : Simon Digby Source: Iran, 1990, Vol. 28 (1990), Pp. 71-81 Published By: Taylor & Francis, LTDsreya guhaAinda não há avaliações

- QDocumento12 páginasQtimesdAinda não há avaliações

- Salat IstikharaDocumento3 páginasSalat Istikharacheiamin100% (1)

- Malaysia: Report On The Implementation of The Action Plan of MelakaDocumento8 páginasMalaysia: Report On The Implementation of The Action Plan of MelakaAzmah Binti AliAinda não há avaliações

- Muslim Invaders Destroyed India's Advanced CivilizationDocumento4 páginasMuslim Invaders Destroyed India's Advanced CivilizationstochosAinda não há avaliações

- Kitabul Aqaid by Mufti Muhammad JashimuddinDocumento378 páginasKitabul Aqaid by Mufti Muhammad JashimuddinBanda Calcecian100% (4)

- Nickl 2021Documento16 páginasNickl 2021Gohminam ChanAinda não há avaliações

- Teh Gallop, Annabel - PerséeDocumento3 páginasTeh Gallop, Annabel - PerséeAlwi SabatAinda não há avaliações

- Soal Bahasa Inggris Kelas 7Documento2 páginasSoal Bahasa Inggris Kelas 7YPI Badril HudaAinda não há avaliações