Escolar Documentos

Profissional Documentos

Cultura Documentos

Suffolk Bancorp First Quarter Report 2012

Enviado por

RiverheadLOCALDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Suffolk Bancorp First Quarter Report 2012

Enviado por

RiverheadLOCALDireitos autorais:

Formatos disponíveis

PRESS RELEASE

FOR IMMEDIATE RELEASE Contact: Press: Frank D. Filipo, Executive Vice President & Operating Officer (631) 208-2400

4 West Second Street Riverhead, NY 11901 (631) 208-2400 (Voice) - (631) 727-3214 (FAX) invest@suffolkbancorp.com

Investor: Brian K. Finneran Executive Vice President & Chief Financial Officer (631) 208-2400

SUFFOLK BANCORP ANNOUNCES RESULTS FOR THE FIRST QUARTER OF 2012 Riverhead, New York, May 4, 2012 Suffolk Bancorp (the Company) (NASDAQ - SUBK), parent company of Suffolk County National Bank (the Bank), today reported first quarter 2012 net income of $1.2 million, or $0.12 per diluted common share, compared to a net loss of $7.6 million, or $0.78 per diluted common share, a year ago. The increase in 2012 first quarter earnings was the result of a $20.0 million reduction in the provision for loan losses. The reduction in the provision for loan losses resulted from a lower level of criticized and classified assets in the first quarter of 2012 coupled with positive results from ongoing workout activities. Somewhat offsetting the foregoing improvements were a $4.2 million (22.8%) reduction in net interest income and an $832 thousand (6.0%) increase in total operating expenses, principally due to non-recurring fees paid to the Companys former independent registered public accounting firm in 2012. The reduction in net interest income resulted from a lower level of average interest-earning assets, primarily loans, coupled with a narrowing of the net interest margin in 2012 when compared to the year ago period. The reduction in the net interest margin is due to the higher level of non-accrual loans along with an increase in low-yielding overnight interest-bearing deposits in 2012. Commenting on the first quarter 2012 results, President and CEO Howard C. Bluver stated, I am pleased to report that we made real progress in the first quarter cleaning up many of the management and credit-related issues that posed significant challenges to the Bank in past years. First and foremost, we now have in place an executive and senior management team that I believe is second to none in the community banking sector. With the additions during the first quarter of a new Chief Financial Officer, a new Chief Lending Officer, a new Comptroller and a new head of Credit Administration, all of whom have significant industry experience, our team is now complete and ready to move forward. Secondly, our team made real progress on the asset side of the balance sheet. Although non-accrual loans increased slightly from year-end 2011, the Banks criticized and classified loan totals declined in the first quarter, versus both March 31 and December 31, 2011, as a result of more focused workout activities, securing additional collateral in certain cases, and upgrading loans where improving financial results warranted such action. We expect to continue an aggressive credit remediation posture throughout 2012 on both the non-accrual and criticized and classified loan pools and expect to see additional improvements in credit quality as the year progresses. The pace of these improvements, however, will depend in large part on local economic conditions. We remain comfortable with our allowance for loan losses, which amounted to $40.0 million at March 31, 2012, representing 4.26% of total loans outstanding. The Companys capital position remains strong with all ratios well in excess of the regulatory standard for a well capitalized institution. Our deposit franchise is among the best in the region with 80% of our total deposits in low cost, stable core deposit products, including 39% in demand deposit accounts. This product mix has served us well and provided the Company with a cost of funds of approximately 32 basis points during the first quarter of 2012; well below our peers. I am confident that the Banks strong franchise, our new management team and a commitment to credit remediation and cost containment will yield improved financial results in the coming quarters. Performance Highlights Capital The Companys Tier I Leverage ratio was 8.76% at March 31, 2012 versus 7.94% at March 31, 2011 and 8.85% at December 31, 2011. The Companys Total Risk-Based Capital ratio was 14.42% at March 31, 2012 versus 12.32% at March 31, 2011 and 14.26% at December 31, 2011. The Companys Tangible Common Equity ratio (non-GAAP financial measure) was 9.02% at March 31, 2012 versus 7.97% at March 31, 2011 and 9.05% at December 31, 2011.

PRESS RELEASE May 4, 2012 Page 2 of 5 Asset Quality Total non-accrual loans increased to $83.2 million or 8.85% of loans outstanding at March 31, 2012 versus $48.3 million or 4.40% of loans outstanding at March 31, 2011 and $80.8 million or 8.33% of loans outstanding at December 31, 2011. Total accruing loans delinquent 30 days or more amounted to 2.35% of loans outstanding at March 31, 2012 versus 1.64% of loans outstanding at March 31, 2011 and 3.56% of loans outstanding at December 31, 2011. Net loan recoveries of $51 thousand were recorded in the first quarter of 2012 versus net charge-offs of $851 thousand in the first quarter of 2011 and $4.5 million in the fourth quarter of 2011. The allowance for loan losses totaled $40.0 million at March 31, 2012, $47.5 million at March 31, 2011 and $40.0 million at December 31, 2011, representing 4.26%, 4.33% and 4.12% of total loans, respectively, at such dates. The allowance for loan losses as a percentage of non-accrual loans, excluding nonaccrual loans categorized as held for sale, was 48%, 98% and 49% at March 31, 2012, March 31, 2011 and December 31, 2011, respectively. The Company held other real estate owned of $2 million at March 31, 2012, $3 million at March 31, 2011 and $2 million at December 31, 2011. Core Deposits Core deposits totaled $1.0 billion at March 31, 2012 versus $1.1 billion at both March 31, 2011 and December 31, 2011. Core deposits represented 80% of total deposits in the quarter ended March 31, 2012, 79% of total deposits for the quarter ended March 31, 2011 and 81% for the quarter ended December 31, 2011. Demand deposits increased by 5.3% to $508 million at March 31, 2012 versus $482 million at March 31, 2011 and declined by 3.3% from $525 million at December 31, 2011. Demand deposits represented 39% of total deposits at March 31, 2012, 34% at March 31, 2011 and 40% at December 31, 2011. Loans Loans outstanding at March 31, 2012 declined by 14.5% to $940 million when compared to March 31, 2011 and by 3.1% from December 31, 2011. Net Interest Margin Net interest margin was 4.24% in the first quarter of 2012 versus 4.99% in the first quarter of 2011 and 4.75% in the fourth quarter of 2011. Performance Ratios Return on average assets and return on average common stockholders equity were 0.31% and 3.44%, respectively, in the first quarter of 2012 and (1.86%) and (22.47%), respectively, in the comparable 2011 period. For the fourth quarter of 2011, return on average assets and return on average common stockholders equity were 0.30% and 3.28%, respectively.

Suffolk Bancorp is a one-bank holding company engaged in the commercial banking business through the Suffolk County National Bank, a full service commercial bank headquartered in Riverhead, New York. SCNB is Suffolk Bancorps wholly owned subsidiary. Organized in 1890, the Suffolk County National Bank has 30 offices in Suffolk County, New York.

Safe Harbor Statement Pursuant to the Private Securities Litigation Reform Act of 1995 This press release includes statements which look to the future. These can include remarks about Suffolk, the banking industry, the economy in general, expectations of the business environment in which Suffolk operates, projections of future performance, and potential future credit experience. These remarks are based upon current management expectations, and may, therefore, involve risks and uncertainties that cannot be predicted or quantified and are beyond Suffolks control and are subject to a variety of uncertainties that could cause future results to vary materially from Suffolks historical performance, or from current expectations. Factors that could affect Suffolk Bancorp include particularly, but are not limited to: a failure by Suffolk to meet the deadlines under SEC rules for filing its periodic reports (or any permitted extension thereof), changes in interest rates; increases or decreases in retail and commercial economic activity in Suffolks market area; variations in the ability and propensity of consumers and businesses to borrow, repay, or deposit money, or to use other banking and financial services; results of regulatory examinations; any failure by Suffolk to comply with our written agreement with the OCC (the Agreement) or the individual minimum capital ratios for the Bank established by the OCC; the cost of compliance with the Agreement; any failure by Suffolk to maintain effective internal controls over financial reporting; larger-than-expected losses from the sale of assets; potential litigation or regulatory action relating to the matters resulting in Suffolks failure to file on time its Quarterly Report on Form 10-Q for the quarters ended March 31, 2011, June 30, 2011, and September 30, 2011 or resulting from the revisions to earnings previously announced on April 12, 2011 or the restatement of its financial statements for the quarterly period ended September 30, 2010 and year ended December 31, 2010; and the potential that net charge-offs are higher than expected or for further increases in our provision for loan losses. Further, it could take Suffolk longer than anticipated to implement its strategic plans to increase revenue and manage non-interest expense, or it may not be possible to implement those plans at all. Finally, new and unanticipated legislation, regulation, or accounting standards may require Suffolk to change its practices in ways that materially change the results of operations. #####

PRESS RELEASE May 4, 2012 Page 3 of 5

CONSOLIDATED STATEMENT OF CONDITION

(unaudited, in thousands of dollars except for share data)

March 31, 2012 ASSETS Cash and Cash Equivalents Non-interest Bearing Deposits Interest Bearing Deposits Federal Funds Sold Total Cash and Cash Equivalents Federal Reserve Bank, Federal Home Loan Bank, and Other Stock Investment Securities: Available for Sale, at Fair Value Held to Maturity (Fair Value of $9,988 and $10,466, respectively) Total Investment Securities Total Loans, Net of Unearned Discount Allowance for Loan Losses Net Loans Premises & Equipment, Net Deferred Taxes Income Tax Receivable Other Real Estate Owned, Net Accrued Interest and Loan Fees Receivable Prepaid FDIC Assessment Goodwill and Other Intangibles Other Assets TOTAL ASSETS LIABILITIES & STOCKHOLDERS' EQUITY Demand Deposits Saving, N.O.W. & Money Market Deposits Time Certificates of $100,000 or More Other Time Deposits Total Deposits Federal Home Loan Bank Borrowings Unfunded Pension Liability Capital Leases Accrued Interest Payable Other Liabilities TOTAL LIABILITIES Commitment and Contingent Liabilities STOCKHOLDERS' EQUITY Common Stock (par value $2.50; 15,000,000 shares authorized; 9,726,814 and 9,712,070 shares outstanding at March 31, 2012 and 2011, respectively) Surplus Retained Earnings Treasury Stock at Par (4,005,270 and 4,002,158 shares, respectively) Accumulated Other Comprehensive Loss, Net of Tax TOTAL STOCKHOLDERS' EQUITY TOTAL LIABILITIES & STOCKHOLDERS' EQUITY 2011

35,509 176,795 1,150 213,454 2,536 287,539 9,194 296,733 939,736 40,008 899,728 27,854 19,552 4,721 1,800 6,133 1,508 2,414 6,222 1,482,655 508,075 537,681 179,983 85,537 1,311,276 19,003 4,719 348 11,382 1,346,728

31,136 50,981 82,117 4,263 391,072 9,713 400,785 1,098,823 47,539 1,051,284 25,219 20,917 3,333 3,261 7,946 1,843 2,451 7,799 1,611,218 482,479 629,369 208,739 94,810 1,415,397 40,000 10,531 2,913 561 11,161 1,480,563

$ $

$ $

34,330 24,037 92,471 (10,013) (4,898) 135,927 1,482,655

34,293 23,788 83,806 (10,013) (1,219) 130,655 1,611,218

PRESS RELEASE May 4, 2012 Page 4 of 5

CONSOLIDATED STATEMENTS OF INCOME (unaudited, in thousands of dollars except for share and per share data) Three Months Ended March 31, 2012 2011 INTEREST INCOME Loans and Loan Fees United States Treasury Securities Obligations of States & Political Subdivisions (tax-exempt) Obligations of States & Political Subdivisions (taxable) Collateralized Mortgage Obligations Mortgage-Backed Securities U.S. Government Agency Obligations Federal Funds Sold & Interest Due from Banks Dividends Total Interest Income INTEREST EXPENSE Saving, N.O.W. & Money Market Deposits Time Certificates of $100,000 or more Other Time Deposits Interest on Borrowings Total Interest Expense Net Interest Income Provision for Loan Losses Net Interest Income After Provision for Loan Losses OTHER INCOME Service Charges on Deposit Accounts Other Service Charges, Commissions & Fees Fiduciary Fees Net Gain on Sale of Securities Available for Sale Other Operating Income Total Other Income OTHER EXPENSE Total Employee Compensation Net Occupancy Expense Equipment Expense Outside Services FDIC Assessments OREO Expense Other Operating Expense Total Other Expense Income (Loss) Before Provision for Income Taxes Provision for (Benefit from) Income Taxes NET INCOME (LOSS) Average: Common Shares Outstanding Dilutive Stock Options Average Total Basic $ Diluted $ $ 12,394 1,521 5 1,194 7 77 46 15,244 317 439 280 1,036 14,208 14,208 950 750 201 (4) 358 2,255 8,584 1,454 512 1,146 70 47 2,792 14,605 1,858 690 1,168 9,726,814 9,726,814 0.12 0.12 $ $ $ 16,448 70 1,896 15 1,628 8 154 16 84 20,319 634 582 357 339 1,912 18,407 19,971 (1,564) 1,005 667 225 324 2,221 7,545 1,534 482 888 1,131 140 2,053 13,773 (13,116) (5,542) (7,574) 9,705,888 9,705,888 (0.78) (0.78)

EARNINGS (LOSS) PER COMMON SHARE

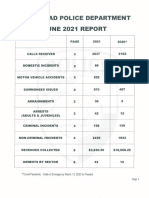

PRESS RELEASE May 4, 2012 Page 5 of 5

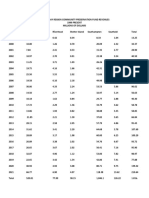

STATISTICAL SUMMARY

(unaudited, in thousands of dollars except for share and per share data)

Three Months Ended March 31, 2012 2011 EARNINGS Earnings (Loss)-Per-Share - Basic Cash Dividends-Per-Share Net Income (Loss) Net Interest Income AVERAGE BALANCES Average Assets Average Loans Average Investment Securities Average Interest-Earning Assets Average Deposits Average Borrowings Average Interest-Bearing Liabilities Average Equity RATIOS Return on Average Assets Return on Average Equity Average Equity/Average Assets Average Loans/Average Deposits Net Interest Margin (FTE) Efficiency Ratio Tier 1 Leverage Ratio End of Period Tier 1 Risk-Based Capital Ratio End of Period Total Risk-Based Capital Ratio End of Period ASSET QUALITY during period: Net (Recoveries) Charge-offs $ Net (Recoveries) Charge-offs/Average Loans (annualized) at end of period: Total Non-Performing Loans $ Foreclosed Real Estate ("OREO") Total Non-Performing Assets Allowance/Non-Performing Loans Allowance/Total Loans Shares Outstanding Common Equity Book Value Per Common Share Tangible Common Equity Tangible Book Value Per Common Share Tangible Common Equity Ratio LOAN DISTRIBUTION at end of period: Commercial, Financial & Agricultural Loans Commercial Real Estate Mortgages Real Estate - Construction Loans Residential Mortgages (1st and 2nd Liens) Home Equity Loans Consumer Loans Other Loans Total Loans (Net of Unearned Discounts) 0.31% 3.44% 9.16% 72.38% 4.24% 84.66% 8.76% 13.14% 14.42% (50) (0.02%) 83,152 1,800 84,952 48.11% 4.26% 9,726,814 135,927 13.97 133,513 13.73 9.02% 211,184 412,723 48,284 152,318 77,015 37,790 422 939,736 $ (1.86%) (22.47%) 8.30% 78.40% 4.99% 63.74% 7.94% 11.04% 12.32% 851 0.31% 48,339 3,261 51,600 98.35% 4.33% 9,712,070 130,655 13.45 128,204 13.20 7.97% 255,607 437,302 76,645 183,971 83,167 61,644 487 1,098,823 $ 1,493,617 951,003 319,327 1,414,426 1,313,875 800,867 136,813 $ 1,647,044 1,113,812 402,765 1,555,324 1,420,729 42,983 970,365 136,708 $ 0.12 1,168 14,208 $ (0.78) (7,574) (1,564)

EQUITY $ $

Você também pode gostar

- Draft Scope Riverhead Logistics CenterDocumento20 páginasDraft Scope Riverhead Logistics CenterRiverheadLOCALAinda não há avaliações

- Kenneth RothwellDocumento5 páginasKenneth RothwellRiverheadLOCALAinda não há avaliações

- RXR/GGV Qualified & Eligible Documents (Final 09.26.22)Documento23 páginasRXR/GGV Qualified & Eligible Documents (Final 09.26.22)RiverheadLOCALAinda não há avaliações

- Riverhead Town Proposed Battery Energy Storage CodeDocumento10 páginasRiverhead Town Proposed Battery Energy Storage CodeRiverheadLOCALAinda não há avaliações

- Robert E. KernDocumento3 páginasRobert E. KernRiverheadLOCALAinda não há avaliações

- Riverhead Town Board Comprehensive Plan Status Discussion Feb. 17, 2022Documento30 páginasRiverhead Town Board Comprehensive Plan Status Discussion Feb. 17, 2022RiverheadLOCALAinda não há avaliações

- N.Y. Downtown Revitalization Initiative Round Five GuidebookDocumento38 páginasN.Y. Downtown Revitalization Initiative Round Five GuidebookRiverheadLOCALAinda não há avaliações

- 5-10-2022 Budget Hearing Presentation UpdatedDocumento12 páginas5-10-2022 Budget Hearing Presentation UpdatedRiverheadLOCALAinda não há avaliações

- Riverhead Budget Presentation March 22, 2022Documento14 páginasRiverhead Budget Presentation March 22, 2022RiverheadLOCALAinda não há avaliações

- Peconic Bay Region Community Preservation Fund Revenues 1999-2021Documento1 páginaPeconic Bay Region Community Preservation Fund Revenues 1999-2021RiverheadLOCALAinda não há avaliações

- AKRF Public Outreach Report AttachmentsDocumento126 páginasAKRF Public Outreach Report AttachmentsRiverheadLOCALAinda não há avaliações

- Juan Micieli-MartinezDocumento3 páginasJuan Micieli-MartinezRiverheadLOCALAinda não há avaliações

- 2022 - 03 - 16 - EPCAL Resolution & Letter AgreementDocumento9 páginas2022 - 03 - 16 - EPCAL Resolution & Letter AgreementRiverheadLOCALAinda não há avaliações

- Riverhead Comprehensive Plan Update Public Outreach Compendium Feb 16, 2022Documento7 páginasRiverhead Comprehensive Plan Update Public Outreach Compendium Feb 16, 2022RiverheadLOCALAinda não há avaliações

- Pediatric Covid-19 Hospitalization ReportDocumento15 páginasPediatric Covid-19 Hospitalization ReportKevin TamponeAinda não há avaliações

- Yvette AguiarDocumento10 páginasYvette AguiarRiverheadLOCALAinda não há avaliações

- Riverhead Town Police Monthly Report July 2021Documento6 páginasRiverhead Town Police Monthly Report July 2021RiverheadLOCALAinda não há avaliações

- Catherine KentDocumento7 páginasCatherine KentRiverheadLOCALAinda não há avaliações

- Riverhead Town Police Report, March 2021Documento6 páginasRiverhead Town Police Report, March 2021RiverheadLOCALAinda não há avaliações

- Riverhead Town Police Monthly Report, June 2021Documento6 páginasRiverhead Town Police Monthly Report, June 2021RiverheadLOCALAinda não há avaliações

- 2021 General Election - Suffolk County Sample Ballot BookletDocumento154 páginas2021 General Election - Suffolk County Sample Ballot BookletRiverheadLOCALAinda não há avaliações

- Evelyn Hobson-Womack Campaign Finance DisclosureDocumento3 páginasEvelyn Hobson-Womack Campaign Finance DisclosureRiverheadLOCALAinda não há avaliações

- League of Women Voters of NYS 2021 Voters Guide: Ballot PropositionsDocumento2 páginasLeague of Women Voters of NYS 2021 Voters Guide: Ballot PropositionsRiverheadLOCAL67% (3)

- Riverhead Town Police Report, January 2021Documento6 páginasRiverhead Town Police Report, January 2021RiverheadLOCALAinda não há avaliações

- Aguiar-Kent Campaign Finance Report 32-Day Pre GeneralDocumento2 páginasAguiar-Kent Campaign Finance Report 32-Day Pre GeneralRiverheadLOCALAinda não há avaliações

- Riverhead Town Police Report, August 2021Documento6 páginasRiverhead Town Police Report, August 2021RiverheadLOCALAinda não há avaliações

- Old Steeple Church Time CapsuleDocumento4 páginasOld Steeple Church Time CapsuleRiverheadLOCALAinda não há avaliações

- "The Case of The DIsappering Landfill, or To Mine or Not To Mine" by Carl E. Fritz JR., PEDocumento10 páginas"The Case of The DIsappering Landfill, or To Mine or Not To Mine" by Carl E. Fritz JR., PERiverheadLOCALAinda não há avaliações

- NYSED Health and Safety Guide For The 2021 2022 School YearDocumento21 páginasNYSED Health and Safety Guide For The 2021 2022 School YearNewsChannel 9100% (2)

- Navy Environmental Concerns Survey For CalvertonDocumento3 páginasNavy Environmental Concerns Survey For CalvertonRiverheadLOCALAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- VLCC Profit Loss 2012 PDFDocumento45 páginasVLCC Profit Loss 2012 PDFAnkit SinghalAinda não há avaliações

- Quiz Gen Math AnnuitiesDocumento1 páginaQuiz Gen Math AnnuitiesAnalyn Briones100% (2)

- Financial EngineeringDocumento26 páginasFinancial EngineeringjuhikohliAinda não há avaliações

- How To Get Started in Property DevelopmentDocumento42 páginasHow To Get Started in Property DevelopmentBrett Coombs100% (1)

- FRM 2022 Learning ObjectivesDocumento70 páginasFRM 2022 Learning ObjectivesPreeti KumariAinda não há avaliações

- 22049896 - Presentation Submission for session 11 - Nguyễn Hữu Minh TuấnDocumento11 páginas22049896 - Presentation Submission for session 11 - Nguyễn Hữu Minh TuấnTuấn NguyễnAinda não há avaliações

- FAR05Documento5 páginasFAR05Mitchie FaustinoAinda não há avaliações

- ObliCon Case Digests - Amber Gagajena PDFDocumento96 páginasObliCon Case Digests - Amber Gagajena PDFNowell SimAinda não há avaliações

- 2003 Bosi-Giarda-Onofri OverviewBudgetPolicy WPDocumento22 páginas2003 Bosi-Giarda-Onofri OverviewBudgetPolicy WPAntonio Annicchiarico RenoAinda não há avaliações

- Financial Management Key TermsDocumento36 páginasFinancial Management Key TermsMurli SavitaAinda não há avaliações

- Chapter 2 Macro SolutionDocumento16 páginasChapter 2 Macro Solutionsaurabhsaurs80% (10)

- Accounting With Ifrs Essentials An Asia Edition 1St Edition Full ChapterDocumento32 páginasAccounting With Ifrs Essentials An Asia Edition 1St Edition Full Chaptergloria.goodwin463100% (20)

- 0455 w17 QP 11Documento12 páginas0455 w17 QP 11Priya AngelAinda não há avaliações

- Sinking Fund MethodDocumento4 páginasSinking Fund MethodDianne Aicie ArellanoAinda não há avaliações

- Jacqueline Ponce de Leon A Descendent of Juan Ponce deDocumento1 páginaJacqueline Ponce de Leon A Descendent of Juan Ponce deMuhammad ShahidAinda não há avaliações

- New-ListingDocumento1 páginaNew-ListingTeam BouddhaAinda não há avaliações

- MOD1 Capital MarketDocumento17 páginasMOD1 Capital MarketMAGSINO, ANGELINE S.Ainda não há avaliações

- CSXDocumento130 páginasCSXmarcelluxAinda não há avaliações

- State Finances in Haryana - Manju DalalDocumento26 páginasState Finances in Haryana - Manju Dalalvoldemort1989Ainda não há avaliações

- FIN3103 ExamDocumento20 páginasFIN3103 ExamKevin YeoAinda não há avaliações

- Memorandum of UCC-8 and Book EntryDocumento108 páginasMemorandum of UCC-8 and Book EntrySylvester Moore100% (1)

- 8th Maths Chapter 8Documento25 páginas8th Maths Chapter 8Ankita PattnaikAinda não há avaliações

- Valuation of CollateralDocumento24 páginasValuation of CollateralLuningning Carios100% (1)

- Demand and Supply - Concepts and Applications (2) (1) (Compatibility Mode)Documento11 páginasDemand and Supply - Concepts and Applications (2) (1) (Compatibility Mode)Aminul Islam AminAinda não há avaliações

- 2021 Carlyle Investor Day PresentationDocumento229 páginas2021 Carlyle Investor Day PresentationJay ZAinda não há avaliações

- Chapter 7 (II) - Current Asset ManagementDocumento23 páginasChapter 7 (II) - Current Asset ManagementhendraxyzxyzAinda não há avaliações

- Other Annuity TypesDocumento7 páginasOther Annuity TypesLevi John Corpin AmadorAinda não há avaliações

- Pre Closestatement PDFDocumento2 páginasPre Closestatement PDFashokgiri6Ainda não há avaliações

- Fundamentals of Investing: Fourteenth Edition, Global EditionDocumento47 páginasFundamentals of Investing: Fourteenth Edition, Global EditionFreed DragsAinda não há avaliações