Escolar Documentos

Profissional Documentos

Cultura Documentos

HDFC - Annual Report 2010

Enviado por

Sagari KiriwandeniyaDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

HDFC - Annual Report 2010

Enviado por

Sagari KiriwandeniyaDireitos autorais:

Formatos disponíveis

HDFC Annual Report 2010

THE NATION

HDFC Bank of Sri Lanka

Annual Report 2010

H

D

F

C

B

a

n

k

o

f

S

r

i

L

a

n

k

a

|

A

n

n

u

a

l

R

e

p

o

r

t

2

0

1

0

SHELTERING

Contents

Corporate Information

Name

HDFC Bank of Sri Lanka. ( Housing Development Finance

Corporation Bank of Sri Lanka).

Registered and Head Ofce

Address

P.O. Box 2085, Sir Chitampalam A Gardiner Mawatha,

Colombo 02.

Telephone : 2356800, 2446241, 2446239, 2447354, 2451462, 2446391

Fax : 2446392, 2356829, 2356827, 2432190

Web Site : www.hdfc.lk E-mail : hdfc@hdfc.lk

Legal Form

A licensed specialized bank under the provisions of Housing

Development Finance Corporation, Act No. 07 of 1997,

amended by Act No. 15 of 2003.

Stock Market Listing

The ordinary shares of the Bank are listed in the Colombo

Stock Exchange (CSE)

Board of Directors

Mrs. S. N. Wickramasinghe (Chairman)

Mr. W. A. Terence Fernando

Mr. W.J. L Upali Wiayaweera

Mrs. K. W. Piyaseeli Dayarathne

Dr. D. S. Wiesinghe

Mr. W.D.R. D. Goonaratne

Mrs. Chandanie Wiayawardhana

Mr. S. A. Jayantha Samaraweera

Mr. A. M. Chandrasagara

Company Secretary

Mrs. Dharshani De Silva

Atorney at Law & Notary Public,

Company Secretary, Commissioner of Oaths.

Tel. 2423362

E-mail secretary@hdfc.lk

Registrars

SSP Corporate Services (Pvt.) Limited

101, Inner Flower Road, Colombo 03.

Tel. 2573894 Fax : 2573609

E-mail : sspsec@sltnet.lk

Year of Incorporation originally

1984

Credit Rating

The Bank has been assigned BBB+ ( lka) by Fitch Ratings Lanka

Ltd.,

Bankers

Bank of Ceylon, Corporate Branch, Echelon Square, Colombo 01

Sampath Bank

No.110, Sir James Pieris Mawatha, Colombo 02

Peoples Bank

No. 75, Sir Chitampalam A Gardiner Mawatha, Colombo 02.

Commercial Bank of Ceylon Limited

Commercial House, Union Place Branch, Colombo 02

Pan Asia Banking Corporation Ltd,

Colombo Road, Gampaha

Corporate Management

Mr. Suresh Amerasekera - General manager /CEO

Mr. S. Dissanayake - DGM (Finance)

Mr. D. Vidana Pathirana - AGM (Business Development &

Marketing)

Mr. W. M. A. Bandara - AGM (Information Technology)

Mr. A. J. Atukorala - Chief Internal Auditor

Mr. S. A. Alahakoon - Head of Credit

Mr. L. Edirisinghe - Head of Human Resources

Mr. A. M. D. G. Abeyawardena - Head of Treasury

Mr. M. Y. Piyasena - Senior Manager (Recoveries)

Board Integrated Risk Management Commitee

Mrs. S. N. Wickramasinghe (Chairman of the Commitee)

Mrs. C. Wiayawardhana

Mr. A. M. Chandrasagara

Dr. D. S. Wiesinghe

Board Nomination Commitee

Mrs. S. N. Wickramasinghe (Chairman of the Commitee)

Mr. W. J. L. U. Wiayaweera

Mrs. K. W. P. Dayarathne

Board Audit Commitee

Mr. A. M. Chandrasagara (The Chairman of the Commitee)

Mr. W. A. T. Fernando

Mrs. C. Wiayawardhana

Board HR and Remuneration Commitee

Mrs. S. N. Wickramasinghe (Chairman of the Commitee)

Mr. W. J. L. U. Wiayaweera

Mrs. K. W. P. Dayarathne

Investor Information

Deputy General Manager (Finance)

P.O. Box 2085, Sir Chitampalam A Gardiner Mawatha,

Colombo 02.

T.P 2356800, 2446241, 2446239. D/L 2451464, Fax 2356829

E-mail dgmfnance@hdfc.lk

Auditors

Auditor General - Department of Auditor General,

Torrington Square, Colombo 07

Our Vision 2

Our Mission 2

Our Objectives 3

Values 3

What We Have Achieved in 2010 4

What We Have Gained in 2010 5

Event Calendar 6

Our Products and Services 8

Chairmans Statement 10

General Manager/ Chief Executive

Officers Review 14

Board of Directors 18

Profiles of the Board of Directors 19

Corporate Management 21

Senior Management 24

Regional Managers 26

Managers 27

Branch Managers 27

HDFC Bank of Sri Lanka - Branch Locations 28

Our Branch Network 29

Management Discussion and Analysis 31

Financial Review 41

Risk Management 43

Sustainability Report 53

Assurance Report 98

Global Reporting Initiative (GRI) Index 100

Corporate Governance 109

Attendance for Board Meetings 2010 144

Attendance for Board

Sub Committee Meetings 2010 145

Statement of Internal Control 147

Financial Reports

Report of the Board of Directors 151

Reports of the Board Sub Committees 156

The Board of Directors Responsibilities

for Financial Reporting 161

Auditors Report 162

Consolidated Income Statement 164

Consolidated Balance Sheet 165

Consolidated Cash Flow Statement 166

Consolidated Statement of

Change in Equity 167

Significant Accounting Polices 168

Notes to the Financial Statement 171

Maturity Analysis 180

Statement of Value Added 181

Capital Adequacy - Solo Basis 182

Ten Year Statistical Summary 184

Graphical Review 185

Share Information 186

Notice of the Annual General Meeting 189

Notes 190

Form of Proxy 191

Corporate Information Inner Back Cover

tHe

nAtionS

HAVen

Produced by Copyline (Pvt) Ltd Printed by Graphitec (Pvt) Limited

Shelter is one of the basic requirements for a human being.

It is almost as important as the food we eat and the clean

water we drink. A home is ones castle, a source of pride and

joy and synonymous with the idea of togetherness, peace and

most importantly, family. Here at HDFC, we are commited to

providing afordable housing to the entire country, regardless

of caste or creed, championing the development that has been

aforded to a liberated Sri Lanka. We believe that we are one

nation, one family and mother Lanka, our one home.

HDFC Annual Report 2010

HDFC Annual Report 2010 2

Our Vision

To be the premier fnancial service institution for the purpose of

enhancement of lifestyle of Sri Lanka.

Our Mission

To be a dominant player in the fnancial service sector by

delivering innovative solutions to meet the needs of housing

and construction sector with best in industry service excellence

creating superior long-term shareholder value and contributing

to economic development in Sri Lanka through an inspired team.

HDFC Annual Report 2010 3

Values

The foundation of our success story.

Transparency : being honest and candidly accountable.

Fairness : stakeholders viewing as winners.

Openness : respecting each other and showing genuine interest.

Our Objectives

Customer : to provide a caring customer service, anticipating solutions required by our customers and innovatively

satisfying them beyond expectations.

Shareholders : to optimize return on shareholders funds.

Organisation : to commit ourselves to the highest standards in corporate and business ethics whilst maintaining

fnancial stability and growth.

Employees : to motivate, develop, recognise and reward our employees.

Community : to be strongly commited to contribute to the national goal of providing shelter for all.

Industry : seting industry benchmarks of international standard in delivering customer value through out

comprehensive product range and customer service in all our activities.

Ethics : maintaining the highest ethical standards of a leading corporate citizen.

Our deposit and savings customer base improved from 177,000 to 216,000 showing an improvement of 42%.

We granted 10,739 housing loans valued at LKR 3,069 Mn compared to 5,977 facilities in 2009 worth LKR 1,404 Mn.

We enhanced customer access points from 25 branch to 28 branches and 11 ATMs to 225 ATMs with a Strategic alliance with

Sampath Bank island wide.

We gave direct employment opportunities to 61 young men and women increasing the total staf to 425.

We achieved 18% decline in cost per employee while increasing the basic wage by 15%

Achieved yearly targets of becoming carbon neutral.

We invested over LKR 4 Mn for community sustenance.

Goals Ahead- Medium Term

2009 - Actual 2010 - Actual 2011 Budget 2013 - Goal

Return on equity (%) 3.3% 6.9% 15.7% 18.5%

Return on assets .39% .81% 1.80% 2%

Proft Afer Tax (Rs. Mn.) 56 135 318 500

Cost to income ratio (%) 63% 81% .80 % 43%

Customer deposits 6,115 7,975 10,000 17,500

Total Assets (Rs. Mn.) 14,301 15,927 19,031 30,000

Shareholder funds (Rs. Mn.) 1,721 1,809 2,196 2,700

No of branches 25 28 34 50

Staf Strength 364 425 450 500

ATM access 11 225 300 500

We are along the path to sound and stable growth.

What We Have Achieved in 2010

LKR 4 Mn.

LKR 3,069 Mn.

for community sustenance.

for housing loans

4 HDFC Annual Report 2010

HDFC Annual Report 2010 5

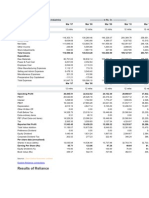

Financial Highlights

What We Have Gained in 2010

Bank

2010 2009 Change

Rs.000 Rs.000 %

Results for the year

Gross Income 2,250,286 2,268,698 (0.81)

Proft before Taxation 291,090 168,494 72.76

Provision for Taxation 155,749 112,043 39.01

Proft afer Taxation 135,341 56,450 139.75

Revenue to the Governments 155,786 112,145 38.91

At the year end

Shareholders, Fund (Capital & Reserves) 1,848,658 1,721,196 7.41

Deposits from Customers 7,702,928 6,114,802 25.97

Gross loans & Advance to Customers 13,143,944 12,111,772 8.52

Total Assets 15,373,832 14,301,441 7.50

Information per Ordinary share

Earnings (Basic) (Rs.) 20.91 8.72 139.75

Dividends (Rs.) 5.00 5.00 -

Net Assets Value per Ordinary Share (Rs.) 285.68 265.99 7.41

Market Value at the Year End (Rs.) 550.00 147.75 272.25

Financial Ratios

Return on Average shareholders Fund (%) 7.58 3.28 131.41

Return on Average Assets (%) 0.91 0.39 131.97

Price Earnings (Time) - Ordinary share 26.30 16.94 55.26

Dividend Yield (%) 0.91 3.38 (73.14)

Dividend Cover 4.18 1.74 139.75

Share Holders Equity to Total Assets (%) 12.02 12.04 (0.09)

Earning Yield Ratio (%) 3.80 5.90 (35.59)

Statutory Ratios

Liquid Assets (%) 20.92% 21.19% (1.27)

Capital Adequacy -

Tier I (%) - Minimum Required 5% 21.09% 17.63% 19.65

Tier II (%) - Minimum Required 10% 22.18% 18.66% 18.83

06 07 08 09 10

0

3,000

6,000

9,000

12,000

15,000

Rs. Mn.

Loan Advance & Deposits

Loans & Advances

Total Deposits

06 07 08 09 10

(100)

0

100

200

300

400

Rs. Mn.

Proft growth

Proft (Rs. Mn) Afer Tax

Proft (Rs. Mn) Before Tax

06 07 08 09 10

0

3,000

6,000

9,000

15,000

12,000

Rs. Mn.

Total Assets

06 07 08 09 10

0

500

1,000

1,500

2,500

2,000

Rs. Mn.

Gross Income

06 07 08 09 10

0

200

400

600

800

1,000

Rs. Mn.

Income Growth

Net Interest Income

Non Interest Income

06 07 08 09 10

(10)

(5)

0

5

10

15

%

Return on Assets & Equity

Return on Avg shareholders funds

Return on Avg assets

Event Calendar

ATM sharing with Sampath

Bank -18

th

February 2010

New Chairman Assuming

Duties 26

th

May 2010

Relocation of Awissawella

Branch - 24

th

July 2010

Cycle Race sponsored by

HDFC Bank - 28

th

April 2010

Vavuniya Opening Branch

- 8

th

June 2010

Distribution of glasses

among the eye patients

- 13

th

August 2010

Eye Camp held at Manning

Market - 6

th

May 2010

Relocation of Chilaw Branch

- 14

th

June 2010

Habitat Day Walk

- 4

th

October 2010

6 HDFC Annual Report 2010

Relocation of Tangalle

Branch 25

th

October 2010

Thilna Tharu All Island Art

Competitions Exhibition

- 18

th

November 2010

Relocation of Kegalle Branch

- 08

th

December 2010

HDFC wins Golden MACO

Award - 14

th

September 2010

Tree Planting Ceremony

- 15

th

November 2010

CSR project at Butala

- 15

th

November 2010

HDFC Bank wins NBEA

Award of NCCSL

- 18

th

November 2010.

Colombo Branch opening

afer refurbishment

- 23

rd

December 2010

Trincomalee Branch Opening

- 30

th

December 2010

7 HDFC Annual Report 2010

Our Products and Services

Situ Sevana

Hassle free customised home

loan with value added services on

preparation of loan documents,

focused for Wider Income Group

exceeding Rs.1million (with Tax

relief ).

Kedella

Home loan scheme for low

and middle income families on

primary mortgage of the property

Sirisara Home Loan.

Home improvement loan

A home loan scheme for the

existing customers on the

remortgage of the property to

purchase home accessories , home

improvement , landscaping ,

curtaining etc.

Thilina Home Loan

A mortgage loan for the parent

/ guardian of the Thilina Minor

Account holder and up to 4 times

of the balance in the Thilina

savings Account on concessionary

rates of interest.

Thilina Rekawarana

Its a uniquely designed

investment plan to guarantee

childrens future fnancial security.

Parents/ Guardians are ofered

several optional monthly deposit

plans and the Bank agrees to give

a guaranteed sum to the child

upon reaching the age of 18 years.

Vishrama Udana

A fxed deposit scheme earning

above market interest, focused

exclusively for Senior Citizens for

over 55 years of age.

8 HDFC Annual Report 2010

Vishrama Udana

Hassle free home loan for EPF

members against EPF balance ,

HDFC provides a superior service

by giving within one day.

Guru Sevana

A customised loan scheme for

government, teachers on personal

guarantee and repayable in 5

Years.

Prathilaba

A regular savings account

with special benefts and cash

withdrawals can be made 4 times

a month and the same interest

will be calculated. Customers can

access their accounts 24 x 7 x 365

days of the year through more

than 200 ATMs.

Dhana Nidhana

HDFC Dhana Nidahana Pass-

through Investment Certifcate

is a long term investment plan

spanning 7 14 years with a

guaranteed return on investment

at maturity.

Arumbu

Arumbu is a specially designed

investment plan for Tamil

speaking community of the

country and ofers same benefts

as Thilina Rekawarana.

shcharya

Ascharya investment Certifcates

which was introduced in

November 2010 availing an

opportunity for every Sri Lankan

to be a partner in making Sri

Lanka the emerging wonder in

Asia while assuring a beter

future for themselves.

9 HDFC Annual Report 2010

Chairmans Statement

I believe that you, as a shareholder, could take joy and be

content in being a partner of a business which enables you to

realise your fnancial, social and spiritual aspirations.

Chairman

10 HDFC Annual Report 2010

HDFC Annual Report 2010 11

It is with great pleasure that I present

to you the Annual Report and Audited

Financial Statements of HDFC for

the fnancial year 2010. I take this

opportunity to thank the Board of

Directors for their positive contribution

in steering the Bank towards achieving

its goals on a sustainable basis.

True value of your business

Housing fnance cannot be compared

to any other credit facility. It is an

asset class, backed by long term house

mortgages that generate long term

returns. It is a tangible asset creator and

wealth maximiser. Housing fnance is an

integral part of economic development

as it boosts savings, investments and

household wealth and results in a

benefcial spill-over efect on the entire

fnancial system. Each rupee invested in

the housing sector triggers a multiplier

increase in other sectors of the economy

and indirectly impacts employment,

fscal returns and consumption. A

decent house creates a harmonious

environment for the physical health,

education and well being of a family.

I believe that you, as a shareholder,

could take joy and be content in being

a partner of a business which enables

you to realise your fnancial, social and

spiritual aspirations.

Need of the hour

Human setlement is a prime factor in

assessing the physical quality of life and

economic growth of a country. Over

the last two decades there has been a

surge in the National Housing Stock and

homeownership in Sri Lanka, paving the

way to a signifcant improvement in the

quality of life of its people. The National

Housing Stock rose from 3.9 Million to

4.9 Million recording a 26% YoY increase,

with 78% of the households owning a

radio, 70% a television and 75% having

access to electricity facilities. Hence the

development that has taken place in

the housing industry has enabled Sri

Lanka to achieve several Millennium

Development Goals (MDGs) at an

early stage of its development process

compared to high income countries. Sri

Lanka has been successful in achieving

MDGs in the areas of health and

education and also made great strides in

poverty alleviation, infant and maternal

mortality and gender equality. Much of

the development has been fuelled by

the banking sector. Housing mortgage

market has a signifcant presence in the

fnancial sector of our economy. As per

the information released by the Central

Bank, the housing mortgage sector has

grown to a staggering LKR 172 Billion

accounting for 14% of total lendings of

the banking sector in March 2010.

However, in todays context it is

pertinent to assess whether the

housing fnance industry including

HDFC has contributed to a sustainable

development in the housing industry

and responded speedily to meet the

aspirations of the nation.

Accelerated growth

Sri Lankas housing needs are

signifcantly larger than the efective

demand. The housing shortage in our

country is estimated to be 350,000 units,

with an annual increase of 100,000 units.

Approximately one third of the existing

units are semi permanent while 0.7%

are slum dwellers. This clearly indicates

that there is no congruence between the

growth of the housing industry and the

demographic transition. In this context,

I believe that the banking industry has

a great responsibility to be an active

partner in addressing this pressing

national need. As per my analysis, the

main reasons for this gap are inadequate

access to housing fnance, high lending

rates, low penetration of banks to the

low income segment and the high cost

of housing. Poor credit information

also precludes low and middle income

earners from having access to afordable

housing. In order to accelerate the

HDFC Refocuses.

growth of the housing industry of our

country, we as bankers need to strike

a balance between banking practices

and the interest of the masses and align

our strategies with the governments

accelerated development road map.

Sustainable development

Countries around the world wrestle

with the challenge of sustainability;

promoting development that is equitable

and sustainable both socially and

environmentally. Sustainability should

be a core determinant of economic

and social development that brings

lasting social and economic benefts.

The governments vision for economic

development laid down in the Mahinda

Chinthana- A 10 year development

framework, aims to achieve an

accelerated growth, with particular

emphasis on achieving an equitable

development, both among sectors and

geographic regions. It also focuses on the

need to balance the overriding objectives

of economic growth and environmental

conservation. Acting within the

principles of economic, environmental

and social sustainability will be a great

challenge when meeting the Banks

objective of promoting national housing

stock and homeownership.

Mainstreaming national

development

The housing fnance industry has

continued to assist the growth of the

housing sector in Sri Lanka. However,

the housing industry needs to broaden

its spectrum to position itself as

a poverty alleviator, employment

generator, wealth creator and a social

stabilizer.

Commercial banking sector has created a

dynamic scenario in the housing fnance

market, ofering several on the shelf

fnancial products and options to expand

the industry. However, it is pertinent to

assess whether the dynamism has been

focused to atain long term economic

HDFC Annual Report 2010 12

gains rather than short term benefts.

Although there has been a substantial

improvement in housing conditions,

lifestyles and quality of life of the

people during the last two decades,

in my assessment, the growth has not

translated into a poverty reduction. This

was in spite of the several concerted

eforts made by the government to

reduce concentration in Colombo and

suburbs. These eforts needs to be

further strengthened and supported.

As specialists in the industry, we

need to evaluate the proportion of

the population who have access to

afordable housing fnance. Sri Lankas

efective demand for housing fnance is

largely generated by the high income

population of the country who constitute

two thirds of the countrys mortgage

market. As per the industry analysis

30% of the population is outside the

perimeters of afordable housing. For

a majority, housing fnance is a luxury

and is rationed in favour of high income

salaried employees and those who could

ofer land as collateral.

Our nations economic sustainability

largely depends on improving the

quality of life of the balance 70% of

the population. Facilitating access

to housing fnance to this segment

would prevent slum proliferation,

promote savings, boost construction

and generate employment. Thus HDFC

could play a vital role in boosting an

equitable economic growth and enabling

households to build assets and improve

their living conditions and thereby

achieve poverty reduction.

While focusing on sustainable economic

development, housing fnance market

should also focus on the sustainability

of the industry. We could learn much

from the subprime mortgage market

crisis which hit the Western world. The

ideal loan facility for a housing loan

borrower is a facility which is simple

and straightforward with monthly

installments that complement the

repayment capacity of the borrower.

Complex interest calculation, balloon

payments or loans with exotic structures

where interest is kept artifcially low

and then increased to high foating

rates during times of volatility are not

favorable to the housing industry.

At HDFC, we remain commited to

our mandate of providing afordable

housing to the low and middle income

segment of our nation, whose well being

justifes our existence. HDFC along with

the other participants in the housing

fnance industry should prioritise the

provision of afordable housing to

the masses which would propel the

sustainability of the industry.

Sustainable living and

environment

The process of house construction

requires a large amount of capital,

natural resources, earthmoving and

management of substantial amount

of solid waste. Homes are not just

houses; but environments which project

aspirations of individual families. A

cluster of homes form neighborhoods

and a cluster of neighborhoods form

towns and cities. Thus the manner

in which houses are planned, built

and developed has an impact on the

environment and ecosystem of the

country

Afordability also plays a vital role in

building a home. If the house is not

cost efective, it would not ofer cost

saving technologies and will not suit the

modern lifestyles of its dwellers.

HDFC re-focuses

Over the last 25 years, HDFC has made a

signifcant contribution to the economy

of our nation as a Building Society, State

Corporation and a Bank. HDFC has

provided afordable housing fnancing

solutions to the masses and gained wide

acceptance from the low and middle

income segment of our society. Over the

last two decades, HDFC has granted 80%

of its facilities to the low and middle

income segment which represent 70% of

the countrys population.

Refocused strategies during the year,

fostered HDFC to record the highest

market capitalization of LKR2.7billion at

the Colombo Stock Exchange, refecting

the confdence placed by the public and

private investors in the bank. It also

highlights the positive perception and

trust placed by the public in HDFC as a

sound institution with promising growth

prospects, steered by a management

team of high caliber and a strong Board

of Directors.

Refocusing HDFC as a bank providing

a speedy service, whilst balancing

economic, social and environmental

objectives and working actively

alongside the governments initiatives

in achieving the development goals

laid out in Mahinda Chinthanaya was a

challenging task, since assuming duties

as chairman of HDFC.

Chairmans Statement contd.

In accordance with my vision sus-

tainability promotion and sustain-

able development should be the

core determinants of HDFC Bank,

the kind of development that

HDFC was created to foster.

Stakeholder engagements

As mentioned earlier, our shareholders

can take pride that HDFC listing

recorded the highest market

capitalisation in the CSE in 2010.

During the period under review, HDFC

recorded a 140% increase in proft afer

tax and 8% growth in total assets. The

number of housing loans granted rose to

10739 families compared to 5977 families

in 2009. The Savings fund, which was

a strategic priority in 2010 , achieved a

remarkable growth of 76% YoY to reach

the LKR one billion benchmark.

HDFC Annual Report 2010 13

We continued to remain commited to

our valued customers, by expanding

our loans and savings facilities.

During the year, we increased our

geographical presence by opening two

branches in Vavniya and Trincomalee

thus increasing our branch network to

28. We also continued to expand our

customer reach using the network of 225

Automated Teller Machines with the

strategic alliance entered with Sampath

Bank PLC.

As a just and fair employer we recruited

61 young men and women during the

year and made upward revisions to our

emolument packages. Environmental

and community policies were

introduced during the year to cement

our commitment to environmental and

social accountability.

We achieved two awards during the year

bringing together our performance and

sustainability review. This year we have

taken another step towards integrating

fnancial and non-fnancial reporting

aligned with GRI guidelines.

This commendable performance of

HDFC is atributed to the favorable

macroeconomic environment and

strategic refocusing which took place

midyear.

Macroeconomic environment

and outlook

Year 2010, will be remembered as the

frst fscal year afer terrorism was

defeated and the proclamation of an

end to a war that took its toll on the

countrys physical and social fabric for

nearly years. Sri Lanka is now enjoying

the long awaited peace. South Asias

GDP has posted the second fastest pace

of growth among the developing regions

afer East Asia and the Pacifc. The

peaceful environment , strong political

stability and leadership coupled with the

economic recovery of the South Asian

Region enabled Sri Lanka to achieve a

positive contribution from all sectors of

the economy and recorded a grow th

rate of above 8%.

During the year under review, the

annual average infation and market

interest rates registered single digits,

creating a conducive environment for

credit growth. Triggered by the positive

outlook of the economy there was a

healthy infow of capital in terms of

Foreign Direct Investments (FDIs).

Supported by these developments, Sri

Lanka is geared to achieve a high growth

forecast during the next six years, thus

creating a promising future for the

housing market in Sri Lanka in the

medium term.

I believe that the banking industry has

a special role to play in transforming

the benefts of these developments

equally among the various income

groups and in the geographical regions

particularly in the North and East. While

acknowledging this responsibility our

current focus is to spread our service

into a wider rural base to grow both

our savings and lending portfolios. Our

future strategy therefore will be based

on a paradigm of capturing the non-

inclusive fnancial sector through the

mobile banking service enabling them

access to formal housing fnance. and

innovative marketing tools.

At the same time we will strengthen our

branch network, adding new customer

centers and expand our ATMs presence

throughout the island strategically.

Current backlog of the housing stock

is substantially due to inadequate

dwelling in the North and East. We see

this as an opportunity in the North and

East especially in the agriculture sector

housing.

While we are poised to atract the right

customers with tailor made products

to suit the diverse customer segments

located in diferent parts of the island,

HDFC will have to face the challenge

of possible negative consequences due

to the relaxation of parate execution

rights adopted by the government since

the loan amounts of the majority of our

customers are below LKR 5Million.

Acknowledgement

I wish to take this opportunity to extend

my appreciation to His Excellency the

President Mahinda Rajapakse for his

support and vision which has taken

Sri Lanka to new heights, Hon Wimal

Weerawansa Minister of Construction,

Engineering Services, Housing and

Common Amenities for his constant

encouragement, Secretary to the

Treasury, Dr.P.B. Jayasundera, the

Governor of the Central Bank of Sri

Lanka, Mr. Ajith Nivard Cabraal and

other regulators for their guidance and

assistance extended to us.

I also wish to express my sincere

appreciation to my fellow Directors

for their unstinting support since their

appointment. My strategy to strengthen

the Banks Board of Directors with

professionals has paid much dividends.

A special thank you to Mr Ajith

Fernando who resigned from the Board

on 1st January 2011, for his valuable

support and contribution to the Bank

during the past six and a half years.

I also take this opportunity to thank the

General Manager/CEO, Corporate and

Executive Management and all other

members of the staf for their dedicated

service.

Finally I wish to extend my deep

appreciation to our valued shareholders,

customers and business partners for the

confdence and trust placed in us.

Mrs. Siromi Wickramasinghe

Chairman

HDFC Bank of Sri Lanka.

General Manager/Chief Executive Ofcers Review

The Bank continued to implement and embarked on several

strategies and initiatives which enabled us to meet the desired

objectives that we had set out to meet.

CEO/General Manager

14 HDFC Annual Report 2010

HDFC Annual Report 2010 15

Macro and micro economic

conditions

The year 2010 was a year of turnaround

for Sri Lanka with the end of the ethnic

confict which ravaged the nation for

3 decades and the establishment of a

strong political Government which

paved the way for a stable economic

growth. The Sri Lankan economy

recovered strongly and moved onto

a higher plateau of growth recording

an impressive GDP growth of 7.8

percent during the frst half of 2010.

The restoration of peace, a strong

macroeconomic environment, improved

business confdence and the gradual

recovery of the global economy from

its economic recession triggered the

above growth. Infation continued to

remain at a single digit throughout

the year. The annual average rate of

infation, was 5.9 per cent in 2010 and

was the second lowest annual average

(end year) infation rate recorded since

1999. The year-on-year infation stood

at 6.9 per cent in December 2010. The

low infation outlook enabled the

Central Bank to relax its monetary

policy resulting in lower interest rates

in all market segments supporting the

recovery of domestic economic activity.

The exchange rate too remained stable

throughout the year with the recovery of

the external trade and increase in export

earnings. Both exports and imports

recovered rapidly during the frst eight

months of 2010. Increased remitances

assisted to of-set the widening

trade defcit partly. The Balance of

Payments (BOP) recorded a surplus

by mid October 2010, with higher

foreign fnancial infows, including

disbursements under the IMF-Stand-

By Arrangement (SBA) facility and

proceeds from the third international

sovereign bond issue in October 2010,

thus raising the external reserves to the

highest ever level recorded.

The above favorable economic

conditions supported the countrys

growth potential by paving the way

to expand the investments made in all

sectors of the economy including new

growth areas. The end of the prolonged

ethnic confict and the improved

macroeconomic environment presented

Sri Lanka with a great opportunity

to achieve a sustainable growth and

development. The need for housing

grew tremendously. In this context we

remained commited to our primary

mandate of providing housing fnance

for the citizens of our county and

contributed positively to the Mahinda

Chinthanaya development goals during

the year.

Strategies implemented and

outcome

The bank continued to implement and

embarked on several strategies and

initiatives which enabled us to meet the

desired objectives that we had set out to

meet.

During the year we continued with our

repositioning strategy aggressively to

create more public awareness. In this

context we continued to execute our

image building and expansion strategy

which was launched in 2009. We

relocated fve of our existing branches

in Chilaw, Awissawella, Tangalle,

Badulla, and Kegalle which were not

in customer convenient locations to

strategic locations, to enhance customer

accessibility and convenience. Our

main branch at the National Housing

Development Authority too was

refurbished to ofer industry standard

facilities to customers and staf while

we also revamped and remodeled some

of our other branches to improve their

outlook and create a customer friendly

ambiance. A conducive environment was

created within the branches to motivate

our staf to provide a proactive and

excellent service to our customers.

HDFC was the frst specialised bank in

housing to move into the North and East

during 2010 with the opening of two

branches in Vavuniya and Trincomalee

thus increasing our branch network to

28. As a result of the strategic alliance

with Sampath Bank, we were able to

expand our customer reach with the

network of 225 ATMs spread across the

country. This strategy was adopted to

enhance our customer reach in a cost

efective manner and obtain a beter

return from the capital simultaneously.

Consequently, we were able to provide

our customers with the added beneft of

opening a savings account from any part

of the county. This had a positive impact

on our savings base which reached the

LKR One Billion mark during 2010. We

have the necessary infrastructure to

further develop our savings base.

During the year we focused on

upgrading our IT security standards

especially of the Palm Top Banking

operation which literally takes our

banking to the doorstep of the customer.

We launched a new minor savings

product named Arambu (meaning

fower bud) customised for the Tamil

speaking population. This product was

introduced as an investment plan for

the children to bloom when they reach

adulthood, identifying the vacuum in

the market for this type of a product.

We see an immense potential for this

product in the North, East and the

plantation sector of our county.

In order to stay ahead of competition

we need to maintain a high standard of

customer care. Since HDFCs conversion

from a state corporation to a licensed

specialised bank 7 year ago, we had to

create a paradigm shif in the mindset

of our employees to be more customer

oriented, productive, proactive and

quality conscious. In this context we

HDFC Annual Report 2010 16

continued to provide comprehensive

training and development specifcally

in the area of customer care to our

staf, thus increasing the training man

hours by 130% during the year. We

also formulated a career development

and promotion plan to identify the

hidden talents of our staf members and

extend promotions. Approximately 72

employees were promoted during the

year while we recruited 76 men and

women from all provinces of Sri Lanka.

Five area managers were appointed

to strengthen the operations of the

bank with each manager overseeing

cluster of branches. This strategy was

implemented to provide a speedy and

proactive service to our customers.

In order to improve the efciency of

the bank, the Operations Division

was strengthened to oversee and

manage the operational risk factor.

This strategy enabled us to minimise

manual operations, eliminate non value

adding processes and the quality of

the operation manuals, and various

operational guidelines of the Bank

The share price of HDFC stood at LKR

550 as at 31 December 2010. During

the year HDFC achieved the highest

recorded share price since its listing in

the Colombo Stock Exchange (CSE). This

is atributed to the enhanced investor

confdence and boom in the CSE. The

capital adequacy ratio which amounted

to 21.09% in 2010, is almost double

the industry norm. Our shareholders

perceive that we have the capacity to

double our portfolio without raising

capital from the market which is an

added advantage,

Remarkable performance

The above strategies enabled The Bank

to record a stable performance during

the year, despite providing LKR 120

Million for our subsidiary, HDFC RED,

the Bank recorded a Net Proft Afer Tax

(NPAT) of LKR 133 Million recording

a Year on Year (YoY) growth of 132 per

cent. The proft was achieved despite

a downward interest rate revision in

advances. The net income escalated from

LKR 634 Million to LKR 825 Million in

2010, recording an YoY increase of 30

percent. Favourable micro and macro

economic conditions caused the cost of

funds to declined sharply during the

year. As a result we were able to improve

our low cost funding base which grew

From LKR 592 Million in 2009 to LKR

1,042 Million in the year under review.

We also succeeded in bringing down the

Non Performing Loan ratio net of EPF

and provision to 9 per cent during the

year, which is below the industry norm

applicable to housing loan segment. Net

NPL declined by 15 per cent YoY from

LKR939 Million to LKR794 Million in

the year under review. Consequent to

the branch expansion and repositioning

strategy, our deposit base increased by

26 percent YoY to reach LKR 7.7 Billion.

The new advances grew by a staggering

118 per cent YoY; from LKR 1.4 Billion

to LKR 3 Billion in 2010. The liquidity

ratio of the Bank was managed to

maintain a balance between the statutory

requirement and proftability.

Recognition of our service

In recognition of HDFCs performance

during 2009, we were awarded the

prestigious MACO Award, for the

contribution made to the housing

development in Sri Lanka. We were

also the runner up for the National

Business Excellence Award organised

by the National Chamber of Commerce

of Sri Lanka for the specialised banks

category. Further we were also presented

with the ACCA Award for sustainability

for small income category and for the

frst time entry.

Challenges ahead

The greatest challenge faced by HDFC

is managing the interest rate risk. Being

a long term lender, the bank is exposed

to the interest rate risk when the long

term advances are not matched with

long term funds. In the absence of a

long term money market, a dearth in

long term funds exists. Even though

we have succeeded in reducing the

maturity gaps to a certain extent, further

measures have to taken to stabilise our

future proftability. In this context, we

strive to achieve a sustainable growth

by accessing long term funding lines to

match the planned growth in advances.

Another challenge for the bank is to ofer

more atractive fxed rates to increase the

market share and utilise the available

capital to provide atractive returns to

the share holders. In order to minimise

the impact of any adverse efect due to

unfavorable macro and micro economic

indicators, proper matching of assets

and liabilities is crucial.

Strategic direction

Though we have the capacity and the

infrastructure to grow our advances

aggressively, we will adopt a prudent

approach in growing our loan portfolio.

We aim to achieve a sustainable growth

in our loan portfolio while managing

the inherent interest rate risk. Our new

corporate plan which was rolled out

this year addresses this factor. We will

also expand our lending to atract the

middle and upper income segment

without restricting ourselves to servicing

General Manager/Chief Executive ofcers Review contd.

HDFC Annual Report 2010 17

the low and middle income segment

of our country. We have the expertise

to process a loan within a short time

span of two weeks. We are confdent

that the expertise and competencies

we have gained in the area of housing

fnance will give us a competitive edge

in atracting the middle and high income

segment of our country.

We will also increase our low cost fund

base by developing new products and

striving to improve the share holder

returns while concentrating on internal

processes to develop risk management

techniques. We will also continue with

our image building and expansion

strategy which has enabled us to atract

borrowers from all income groups of the

country. We have strategised to increase

our branch network to 50 within the next

3 years.

Appreciation

I take this opportunity to extend my

appreciation to the Governor of the

Central Bank of Sri Lanka and the

Ministry of Finance and Planning

for their cooperation and guidance

throughout the year. I also wish to thank

the Chairman and the Board of Directors

for their continuous support and

encouragement. A special thank you to

my team who gave their best at all times

to produce these results.

Suresh Amerasekera

CEO/General Manager

HDFC Bank of Sri Lanka.

From lef to right (Standing)

Mrs. C. Wiayawardhana

Mr. W. D. R. D. Goonaratne

Dr. D. S. Wiesinghe

Mr. A. M. Chandrasagara

Mr. W. J. L. U. Wiayaweera

From lef to right (Seated)

Mr. S. A. J. Samaraweera

Mrs. S. N. Wickramasinghe (Chairman)

Mrs. K. W. P. Dayarathne

Mr. W. A. T. Fernando

Board of Directors

18 HDFC Annual Report 2010

HDFC Annual Report 2010 19

Profles of the Board of Directors

Mrs. S. N. Wickramasinghe

Chairman (Non executive,

Independent Director)

Mrs. Siromi Wickramasinghe was

appointed as the Chairman of HDFC

Bank in May 2010.

She held many senior managerial

positions in various fnancial institutions

including the post of DGM, Haton

National Bank PLC, GM /CEO,

Lankaputhra Development Bank,

Director Commercial Bank of Ceylon

PLC, and Director Sri Lanka Banks

Association (Guarantee) Ltd.

She was also a Commission Member of

the Securities and Exchange Commission

of Sri Lanka (SEC) and the Chairman of

Ceybank Asset Management (Pvt.) Ltd

an associate company of Bank of Ceylon.

She is also an Atorney at Law of

the Supreme Court of Sri Lanka and

Commissioner of Oaths, and is a Fellow

of the Chartered Management Institute

U.K.

Mr. W. A. T. Fernando

(Non executive, Independent Director)

Mr. Ajith Fernando was appointed as a

Director of the HDFC Bank in June 2004

and he had resigned from the Board in

January 2011. He is a Fellow Member of

the Chartered Institute of Management

Accountants, United Kingdom and holds

a MA in Financial Economics from the

University of Colombo. He counts over

20 years experience in capital markets

of Sri Lanka. In 2000 he founded Capital

Alliance and is currently the group CEO

of the Capital Alliance Group which

includes Capital Alliance Ltd, a Primary

Dealer for Government Securities,

appointed by the Central Bank of Sri

Lanka and Capital Alliance Securities

(Pvt.) Ltd, a trading member of the

Colombo Stock Exchange. In addition

he also serves on the boards of Ceylon

Tea Brokers PLC and Senkadagala

Finance Ltd in addition to many private

companies. He is Deputy Chairman of

the Financial Ombudsmans ofce and a

Director of the Lanka Financial Services

Bureau.

Mr. W. J. L. U. Wiayaweera

(Non executive, Independent Director)

Mr. Upali Wiayaweera was appointed

as a Director of the HDFC Bank in June

2006 and is also functioning as the

Secretary to the Ministry of Labour and

Labour Relations. He is a Director of

National Institute of Occupational safety

and Health, Srama Vasana Fund and

National Institute of Labour Studies.

He has been posted to the Sri Lanka

Administrative Service in 1984. He has

joined the Department of Labour in

1985 and has held several important

posts; Assistant Commissioner of

Labour, Senior Assistant Commissioner

of Labour, Deputy Commissioner of

Labour, Commissioner of Labour,

Commissioner General of Labour. In

1997, he was posted as the Consular in

the Sri Lankan Embassy in the State of

Kuwait followed by the posting in the

Sri Lankan Embassy in the Kingdom of

Saudi Arabia as the Consular in 1999.

In year 2000 he was appointed as the

Commissioner of Labour Standards.

He was also a director of National

Child protection Authority. He holds a

B.Com (special) Degree from University

of Kelaniya and PGD in Public

Administration from SLIDA (Sri Lanka).

Mrs. K. W. P. Dayarathne

(Non executive, Independent Director)

Mrs. Dayarathne was appointed

as a Director of the HDFC Bank in

June 2009 and also functions as the

Additional Secretary of the Ministry

of Construction, Engineering Services,

Housing and Common Amenities. She

belongs to the Sri Lanka Administrative

Service and began her career as an

Assistant Controller of the Department

of Immigration and Emigration in 1985.

She has served as an Assistant Director

of the Department of Social Service,

Assistant Commissioner and a Deputy

Commissioner of the Department of

Poor Relief, Deputy Commissioner of the

Samurdhi Commissioners Department,

Deputy Director of the Ministry of Youth

Afairs, Senior Assistant Secretary of

the Ministry of Housing Development

and Senior Assistant Secretary of the

Ministry of Housing and Constructions.

She holds a B.Sc Public Administration

(special) Degree from the University

of Sri Jayewardenepura, Master in

Public Management, PGD in Public

Administration and MS.c in Public

Administration in SLIDA (Sri Lanka)

and PGD in Social Development from

the University of Massy in New Zealand.

Dr. D. S. Wiesinghe

(Non executive, Independent Director)

Dr. Wiesinghe, former Deputy Governor

of the Central Bank of Sri Lanka joined

the Board on June 2010. He has more

than 35 years experience in central

banking particularly in monetary

policy, exchange rate policy, operations

of the Bank in fnancial markets and

economic research. He was the Deputy

Governor in charge of Economic and

Price Stability, one of the two key

objectives of the Bank. In his capacity

HDFC Annual Report 2010 20

as the Deputy Governor, he served as

the Chairman of the Monetary Policy

Commitee and member of Financial

System Stability Commitee. He was

heavily involved in policy formulation

and implementation and advising the

Governor and the Monetary Board on

the same.

During his tenure at the Central Bank,

Dr. Wiesinghe held the posts of Asst.

Governor in charge of Economic and

Price Stability, Director of Domestic

Operations Department; Additional

Director of Centre for Banking Studies;

Additional Director, Deputy Director

and Senior Economist of the Department

of Economic Research; Additional

Director, Deputy Director and Assistant

Director of the Department of Statistics;

Research Economist of the South

East Asian Central Banks (SEACEN)

Research and Training Centre, Malaysia.

He has several publications to his credit

and has represented the Bank at several

international seminars.

Dr. Wiesinghe is a graduate of the

University of Colombo with BA (First

class) and B Phil. (Second class) in

Economics and had a brief tenure at the

same University as an Asst. Lecturer in

Economics. He had his graduate studies

at the University of Warwick, UK. where

he earned his PhD and MA in the same

feld of studies.

Mr. W. D. R. D. Goonaratne

(Non executive, Non Independent

Director)

Mr. Raja Goonaratne was appointed

as Director of the HDFC Bank in June

2010, and is an elected director of HDFC

representing the National Housing

Development Authority which is the

major shareholder of the Bank. He is a

senior lecturer in law in the academic

staf of the Department of Legal Studies,

Faculty of Humanities and Social

Sciences of the Open University of Sri

Lanka. At present, he works as the

National Housing Commissioner. He is

academically qualifed with LL.B (Hon)

Colombo, LL. M (Monash Australia),

Diploma in Forensic Medicine and also

of he is professionally qualifed as an

Atorney-at-Law of Supreme Court of Sri

Lanka. He is also a member of the Board

of the National Housing Developer

Authority.

Mrs. C. Wiayawardhana

(Non executive, Independent Director)

Mrs. Chandanie Wiewardhana holds

a Bachelor of Arts (Hons.) Degree from

the University of Ruhuna (1992) and

Master of Arts in Development Studies

from the Institute of Social Studies, the

Netherlands (2000). She was appointed

as a Director of the HDFC Bank in June

2010. Currently she is a Director in

the Department of Fiscal Policy of the

Ministry of Finance & Planning. She

joined the Sri Lanka Planning Service

as an Assistant Director in 1994 and has

previously worked at the Department

of National Planning for 10 years and

at the Department of National Budget

for 6 years. In addition to her duties

at the Department of Fiscal Policy,

she represents the Treasury on the

Director Boards of National Housing

Development Authority, Condominium

Management Authority and Waters

Edge Ltd. She was a Director of State

Mortgage and Investment Bank.

Mr. S. A. J. Samaraweera

(Non executive, Non Independent

Director)

Mr. Jayantha Samaraweera was

appointed as a Director of the HDFC

Bank in June 2010. Currently he is

the Chairman of National Housing

Development Authority, Board Director

of Tea, Rubber & Coconut Estates

Control of Fragmentation Board, Urban

Setlement Development Authority and

Urban Development Authority.

He was a member of Parliament of the

Democratic Socialist Republic of Sri

Lanka during years 2004 2010. In 1999

he was elected to the Western Provincial

Council as a member.

Mr. Samaraweera holds a Diploma in

Journalism from the University of Sri

Jayawardenapura, Sri Lanka.

Mr. A. M. Chandrasagara

(Non executive, Independent Director)

Mr. A.M. Chandrasagara was appointed

as a Director of HDFC Bank in June

2010 and functions as the Chairman

of the Board Audit Commitee. He

is also a Director of CRIB. He has 40

years of experience in the Peoples

Bank in the felds of General Banking,

Accounting, Finance, Inspection and

Internal Auditing. He is a Fellow of

the Institute of Bankers of Sri Lanka

(FIBSL) and an Associate Member of the

Institute of Chartered Accountants of Sri

Lanka (ACASL). He holds a Diploma in

Information Systems, Security, Control

and Audit conducted by the Institute of

Chartered Accountants of Sri Lanka and

a Diploma in Accountancy.

Profles of the Board of Directors contd.

HDFC Annual Report 2010 21

Corporate Management

Suresh Amerasekera

General Manager/CEO

S. Dissanayake

Deputy General Manager (Finance)

D. V. Pathirana

Assistant General Manager (Business

Development & Marketing)

W. M. A. Bandara

Assistant General Manager -

Information Technology

A. J. Atukorala

Chief Internal Auditor/Compliance Ofcer

S. A. Alahakoon

Head of Credit

A. M. D. G. Abeyawardena

Head of Treasury

L. Edirisinghe

Head of Human Resourses

M. Y. Piyasena

Senior Manager (Recoveries)

HDFC Annual Report 2010 22

acts as the Chief Operations Ofcer and

the Credit Division, Recovery Division,

Administration division, Technical

& Premises Maintenance, Valuation

Division and Branch Operations were

under his supervision until end of the

year

D. V. Pathirana

Assistant General Manager (Business

Development & Marketing)

Mr. D.V.Pathirana is an Associate

Member of the Institute of Charted

Accounts of Sri Lanka (ACA) and a

Fellow a Member of the Institute of

Certifed Management Accountants

of Sri Lanka (FCMA). He holds a

Bachelor of Science (Special Public

Administration) Degree from the

University of Sri Jayawardanapura, He

has over 25 years experience in the felds

of Auditing, Accounting, Financing,

Management, Management Accounting,

Banking, Projects and Investment

Promotion both in Sri Lanka and

overseas. He is currently responsible for

Business Development and Marketing.

W. M. A. Bandara

Assistant General Manager -

Information Technology

Mr.W.M.A.Bandara is the Assistant

General Manager- Information

Technology of the HDFC Bank. He holds

a Bachelor of Science Degree from the

University of Colombo followed by a

Post Graduate Diploma in Information

Technology from University of Stirling,

Scotland. He has over 20 years of

experience as an IT professional with

over 5 years experience in senior

managerial capacity. He has extensive

experience in installing, confguring

and maintaining a wide range of UNIX

based system, specialised in confguring

and maintaining Informix Database,

Network administrative activities and

Project Management. He has atended

key training course relevant IT industry

at international organizations such as

CICC-Japan and IBM-Malaysia. He had

also worked in NEC Corporation in

Japan for one year.

A. J. Atukorala

Chief Internal Auditor/Compliance Ofcer

Mr. Atukorala joined the bank as the

Chief Internal Auditor in July 2009. He

was also appointed as the Compliance

Ofcer from July 2010. He possesses

extensive experience for more than

23 years in General and Information

Systems auditing in both public and

private sector banks. He is an Associate

Member of Chartered Institute of

Management Accountants, UK and a

BSc graduate of University of Colombo.

Also he holds the titles of the Certifed

Information Systems Auditor and

Certifed Information Security Manager

awarded by the Information Systems

Audit and Control Association , USA

and is a Diploma holder in Computer

Systems Design awarded by the National

Institute of Business Management, Sri

Lanka. Further he has multi-disciplinary

exposure in both manufacturing and

service industries.

S. A. Alahakoon

Head of Credit

Mr. S.A. Alahakoon is a Senior Banker

with over 32 years of experience. He

holds a B.com (Special) Degree from the

University of Sri jayawardanapura. He

held many senior managerial positions

in various fnancial institutions including

the CEO/General Manager Global Trust

Suresh Amerasekera

General Manager/CEO

Mr. Suresh Amerasekara a senior banker

with nearly 30 years of experience

in Commercial Banking has being

appointed as the CEO/GM at HDFC

Bank with efect from October 2008. He

had his initial training from the Colombo

branches of State Bank of India, Bank of

America and Citi Bank He was atached

to Seylan Bank as an Assistant General

Manager in charge of Colombo suburban

region with 15 Branches, till he joined

HDFC Bank.

He holds a MBA (International)

from Edith Cowan University, Perth,

Australia. An Advanced Diploma in

Management Accounting awarded by

the Chartered Institute of Management

Accountants UK. He also has completed

a Postgraduate Certifcate in Asset

Liability Management from the Post

Graduate Institute of Management.

S. Dissanayake

Deputy General Manager (Finance)

Mr. S. Dissanayake is an Associate

Member of the Institute of Chartered

Accountants of Sri Lanka (ICASL). He

holds a Bachelor of Science (special-

Business Administration) degree, from

the University of Sri Jayewardenepura.

He counts more than 24 years experience

in public and private sector where

he headed the fnance section of the

state sector institutions for several

years. He joined HDFC in December

1995 as Assistant General Manager

(Finance) and has been heading the

Finance division since the assumption

of the new portfolio as Deputy General

Manager (Finance) for over 10 years.

In addition to the Head of Finance he

Corporate Management contd.

HDFC Annual Report 2010 23

Financial Services Ltd, General Manager

Abans Financial Services Limited,

Asstant General Manager (Credit) L.B.

Finance Ltd., Senior Manager Leasing/

Finance, Manager, Sanasa Development

Bank, has 17 years work experience in

the peoples Bank. he is an Associate

member of the Institute of Chartered

Accountants of Sri Lanka & Associate

Member of the Institute of Bankers of Sri

Lanka.

L. Edirisinghe

Head of Human Resourses

Mr. Leslie Edirisinghe holds a

B Sc Special Degree in Business

Administration at the University of Sri

Jayewardenepura and has obtained a

national Diploma in Human Resource

Management of the Institute of

Personnel Management of Sri Lanka.

He is also an Associate Member of the

Institute of Personnel Management of Sri

Lanka (AMIPM) and his main forte lies

in Human Resource Management and

Training and Development.

He has over two decades of professional

career experience in Human Resource

Management and Training and

Development in both public and private

sectors, locally and overseas.

A. M. D. G. Abeyawardena

Head of Treasury

Mr.A.M.D.G. Abeywardena possesses

experience for more than 28 years of

which nearly 21 years have been in

Treasury Management. He has worked

in Several Leading Commercial and

Specialised Banks for 23 years of which

16 years in the Senior Managerial

capacity. Before joining HDFC, he was

atached to a leading Conglomerate in

the country as the Asst. Group Treasurer.

He has atended several Key Training

Programmes relevant to Treasury

Management both locally and overseas.

M. Y. Piyasena

Senior Manager (Recoveries)

Mr.M.Y. Piyasena holds a Bachelor

of Science (Business Administration)

Special Degree with second upper

merit division from University of Sri

Jayawardenapura in 1981. He has

over 27 years experience in the feld of

Auditing, Financial Management and

Loan Recoveries. He Joint HDFC in 1998

as a Chief Internal Auditor and has being

heading as a Chief Internal Auditor up

to 2004. Presently, he is heading the Loan

Recoveries Department in the capacity of

Senior Manager (Recoveries).

HDFC Annual Report 2010 24

Senior Management

Mrs. W. W. D. S. C. Perera

Manager - Legal

Mrs. H. S. Gunathilake

Manager - Business Development &

Marketing

Mrs. K. T. D. D. De Silva

Company Secretary

Mr. C. R. P. Balasooriya

Manager - Treasury

Mr. H. A. Anura

Accountant - Finance

Mrs. W. N. D. Botheju

Accountant - Payment

HDFC Annual Report 2010 25

Mr. M. S. Mohamed Rila

Manager - Technical

Mr. I. Nishantha

Manager - Project & Credit

Administration

Mrs. C. P. K. Hewage

Manger - Human Resource

Mr. P. S. Pitawela

Manager - Administration

Mr. W. M. Chandrasena

Manager - Valuation

HDFC Annual Report 2010 26

Regional Managers

Mr. R. M. Sugathapala

Area Manager - Badulla

Mr. K.Wiesiri

Area Manager - Chilaw

Mrs. R. R. Gunewardena

Area Manager - Colombo

Mr. H. M. Thilakarathne

Area Manager - Kegalle

Mr. N. C. Ranjith

Area Manager - Galle

HDFC Annual Report 2010 27

A. M. Neelachndra

Data Base Administrator

Mrs. L. A. S. C. Ariyaratna

Manager Business Development

K. R. M. A. Bandara

Manager - Internal Audit

Manager - Property

Ms. G. L. Pandigama

G. D. K. H. Perera

Manager - Mobile Banking

Mrs. K. H. D. Priyanka

Manager - Public Relations & Publicity

Mr. B W M C Kumarasiri

Rathnapura

Mr. E. D. D. Sampath

Hyde Park

Mr. G. W. A. N. Kalinda

Tangalle

Mr. L. S. B. Ratnayake

Nuwara Eliya

Mr. M. L. R. Kumara

Galle

Mr. N. M. Jayawardena

Piliyandala

Mr. R. A. J. N. Ranasinghe

Ja Ela

Mr. T. B. Karunabandu

Gampaha

Mr. T. Kandiah

Baticaloa

Mr. W. D. K. Senewirathne

Kurunegala

Mr. W. Gunasinghe

Homagama

Mr. T. Jegadeepan

Vauvniya

Mr. K. D. Ruwansiri

Badulla

Mr. N. S. Meegastenna

Awissawella

Mr. S. H. K. Gamage

Anuradhapura

Mr. W. B. Rajasinghe

Embilipitiya

Mrs. N. A. A. N. S. Nissanka

Kandy

Mrs. D. T. A. Jayasinghe

Horana

Ms. K. W. Y. Indira

Matara

Ms. L. Gunethilake

Colombo

Ms. M. G. D. P. Senevirathne

Ampara

Ms. S. A. K. Abeykoon

Kegalle

Ms. J. Samantha

Nugegoda

Mr. H.M.U. Samaraweera

Chilaw

Mr. D.K.P. De Silva

Kalutara

Ms. J.A.L.K. Jayalath

Trincomalee

Mr. I.K. Dawatanga

Matale

Mr. K.M.S.W. Bandara

Monaragala

Managers Branch Managers

HDFC Annual Report 2010 28

HDFC Bank of Sri Lanka

Branch Network

Vavuniya

Northern

North

Central

Central

Uva

Southern

S

a

b

a

r

a

g

a

m

u

w

a

W

e

s

t

e

r

n

Eastern

North

Western

Trincomalee

Anuradhapura

Matale

Kandy

Baticaloa

Chilaw

Kurunegala

Colombo

Hyde-park

Gampaha

Badulla

Ampara

Monaragala

Tangalle

Matara

Galle

Jaela

Embilipitiya

Ratnapura

Kegalle

Awissawella

Homagama

Kaluthara

Horana

Piliyandala

Nuwara Eliya

Nugegoda

HDFC Annual Report 2010 29

Our Branch Network

Colombo

P.O. Box 2085

Sir Chitampalam A Gardiner

Mawatha, Colombo 2.

Nugegoda

1st Floor Railway Station

Nugegoda

Hyde Park Corner

No. 63, Hide Park Corner

Colombo 02

Kandy

NHDA Building

Yatinuwara Veediya

Kandy

Kegalle

1st Floor ,

Royal Shopping Complex

Main Street, Kegalle

Matale

26 1/1, City Plaza Building,

Main Street, Matale

Kalutara

13, Gnanodaya Mw

Kalutara South

Gampaha

101/1, Colombo Road

Gampaha

Matara

9, HGPM Building

Kotuwegoda, Matara

Galle

No 4, Sri Dewamiththa Mawatha

Galle

Baticaloa

58/1.Baily Road,

Baticaloa

Trincomalee

N.C. Road

Trincomalee

Badulla

71 / 1 LG

New Passara Road

Badulla

Chilaw

2nd Floor, Sky Line Building

Colombo Road

Chilaw

Ratnapura

No. 51 1/1

Main Street

Ratnapura

Tangalle

150,

Matara road,

Tangalle

Ja-Ela

No 38/1,Old Negambo Road,

Main Street, Ja Ela

Kurunegala

No 12/B,

1st Floor

Dambulla Road

Kurunegala

Anuradhapura

No 396/14 , Court Place

Bandaranayaka Mawatha

Anuradhapura

Vavuniya

No. 68, Station Road

Vavuniya

Monaragala

No 310/A

Kachcheriya Junction

Wellavaya Road,

Monaragala

Homagama

No 94, 1st Floor,

High-level Road

Homagama

Nuwara - Eliya

No.72, Park Road

Nuwara - Eliya

Ampara

Uhana Road Ampara

Avissawella

90/B, 1st Floor,

Yatiyantota Road, Awissawella

Horana

No.231, Panadura Road,

Horana

Piliyandala

No.21,Vidyala Mawatha,

Piliyandala

Embilipitiya

No. 93 B, Malwata Building

New Town Road,

Embilipitiya

HDFC Annual Report 2010 30

Responding to the changing

landscape

HDFC Annual Report 2010 31

Management Discussion and Analysis

Business and operating

environment.

Corporate Profle.

HDFC was originally established as a

Building Society in 1984 and converted

to a Public Corporation under the

provision of Housing Development

Finance Corporation Act No 07 of

1997 and obtained the status of a

Licensed Specialised Bank (LSB) under

the Housing Development Finance

Corporation amended Act No. 15 of

2003. HDFC marked its 26th year in

2010 since incorporation as a Building

Society and seventh milestone as a

licensed specialised bank. The year

2010 also marked the completion of fve

years since listing at the Colombo Stock

Exchange(CSE).

The Government of Sri Lanka holds

approximately 51% of HDFC, largely

through the National Housing

Development Authority, which is a State

Corporation tasked with formulating

and implementing the states overall

housing policy. The Bank Board

of Directors are representatives of

various governmental institutions and

ministries, several of which are involved

in housing and development. Three

directors represent the private investors.

Business Overview.

Over this period HDFC has achieved a

steady growth in assets, shareholders

funds and proftability while sustaining

internal processes , capacities and

strength. Bank also has gained wide

recognition from the society as a leading

player in housing fnance particularly

in the low and middle income market

and as an award winning responsible

corporate citizen.

Corporate Milestones

1984 Incorporated as a Building

Society

2000 Converted to a public

corporation.

2003 Obtained the status of a

Licensed Specialised Bank

2004 Winner NCCSL Business

Excellence Award Financial

Service Sector.

2005 Listed at Colombo Stock

Exchange.

2005 Winner- NCCSL Business

Excellence Award Financial

Service Sector.

2006 Runner up- NCCSL Business

Excellence Award Financial

Service Sector

2007 HDFC ranked as 14th best

brand among the 20 largest

state enterprises.

2010 Runner up- NCCSL Business

Excellence Award Financial

Service Sector

2010 Winner- ACCA Sustainability

Reporting Award 2010- Small

scale Category.

2010 Winner- ACCA Sustainability

Reporting Award 2010- First

time entry group.

2010 Winner Golden Maco Award

2010.

During the year whilst achieving

substantial improvement in fnancial

performance and growth the Bank

was also able to win prestigious social

awards as tabulated in the corporate

milestones. HDFC was able to record a

substantial improvement in the volume

and value of its market share in the low

and middle income housing fnance

market and also savings and deposit

markets with innovative products ,

services and processes.

With these achievements we believe that

our corporation has taken robust steps

ahead with the direction of the strategic

vision and mission to be the premier

fnancial service institution for the

purpose of enhancement of lifestyles of

Sri Lanka and to be a dominant player in

the fnancial service sector by delivering

innovative solutions to meet the needs of

housing.

Highlights - 2010

Proft afer tax. LKR -M 135

Shareholders fund LKR -M 1,848

Total Assets LKR -M 15,373

Branches 28

Staf 425

ATM access 225

Total customer base 346,243

HDFC, in our daily operation we

respect our values and also paid

particular emphasis to quantify and

communicate our performance towards

the interest of the diferent important

stakeholders groups annually through

the Sustainability Report prepared in

compliance with the globally accepted

guidelines of GRI.

Macro Economic Environment.

The housing and housing fnance

industry largely depends on locally

and globally sourced raw materials and

savings, hence inherently sensitive to

global and domestic macroeconomic

environment and changes in related

policies. Thus in the process of

evaluating the Bank performance, it is to

be emphasized in particular the existing

and projected economic outlook and to

HDFC Annual Report 2010 32

the variables such as infation, interest

and fscal policies etc

Economic Analysis.

World economy is expected to record

an approximate growth of 4.8% in

accordance with IMF world economic

outlook report , October 2010. Economic

recovery continued to strengthen

worldwide but the strong growth in

emerging and developing countries

anchored world economic growth

while advanced economies indicated

a moderate but sustained recovery.

Emerging and developing economies

are expected to grow by 7.1 per cent

strongly supported by China and

India while advanced economies are

projected to expand at 2.7 per cent in

2010. Developing Asia is expecting

higher price levels in 2011 alongside its

robust economic recovery. This regional

economies would efect very positive

infuence on the Sri Lanka economic in

medium term.

Domestic Economy.

The Sri Lankan economy rebound

was aided by the post-war confdence,

expansionary fscal policy, declining

interest rates and a large infow of

foreign capital as global fnancial

markets thawed. The economic growth

reached approximately 8 per cent

during the year 2010 more than double

2009s 3.5% GDP growth rate, triggered

by the growth in key sectors of the

economy according to the Central Bank