Escolar Documentos

Profissional Documentos

Cultura Documentos

Important Budget Provisions 12-13

Enviado por

Ajeenkkya Shinde0 notas0% acharam este documento útil (0 voto)

6 visualizações2 páginasThreshold exemption limit raised from Rs. 1. Lacs to 2.00 lacs and for Senior Citizen (Age above 60 years) from Rs. 2. Lacs to 2. Lacs. No change in corporate income tax rates. Surcharge of 5% on domestic companies is unchanged (If the total income exceeds Rs. 1 Cr.) Further the existing surcharge of 2% on foreign companies is also unchanged.

Descrição original:

Direitos autorais

© Attribution Non-Commercial (BY-NC)

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoThreshold exemption limit raised from Rs. 1. Lacs to 2.00 lacs and for Senior Citizen (Age above 60 years) from Rs. 2. Lacs to 2. Lacs. No change in corporate income tax rates. Surcharge of 5% on domestic companies is unchanged (If the total income exceeds Rs. 1 Cr.) Further the existing surcharge of 2% on foreign companies is also unchanged.

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

6 visualizações2 páginasImportant Budget Provisions 12-13

Enviado por

Ajeenkkya ShindeThreshold exemption limit raised from Rs. 1. Lacs to 2.00 lacs and for Senior Citizen (Age above 60 years) from Rs. 2. Lacs to 2. Lacs. No change in corporate income tax rates. Surcharge of 5% on domestic companies is unchanged (If the total income exceeds Rs. 1 Cr.) Further the existing surcharge of 2% on foreign companies is also unchanged.

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 2

Offshore Accounting and Taxation Services Private Limited Budget 2012-13: Important Changes specifically applicable to Corporates and

its employees (Direct taxes)

1. Threshold exemption limit raised from Rs. 1.80 lacs to 2.00 lacs and for Senior Citizen (Age above 60 years) from Rs. 2.40 lacs to 2.50 lacs. No change in corporate income tax rates. 10% slabs will start from basic exemption limit to Rs. 5 lacs, 20% will start from Rs. 5 lacs to 10 lacs and 30% will be applicable for income above Rs. 10 lacs. 2. Surcharge of 5% on domestic companies is unchanged (If the total income exceeds Rs. 1 Cr.) Further the existing surcharge of 2% on foreign companies is also unchanged. 3. MAT provisions is also made applicable to all persons other than companies w.e.f. 1st April 2012 (AY 2013-14) Rate of tax basic 18.5% plus 3% cess and surcharge of 5% if income above Rs. 1 crore. 4. Deduction under section 80TTA in respect of interest on deposits in savings accounts to the extent of Rs. 10,000/- applicable to individuals and HUFs. (Interest income from banking company, co-operative society and post office). 5. Deduction under section 80D Includes expenditure on preventive health check up Amount shall not exceed Rs. 5,000 (Health checkup of self, spouse, dependent children and parents). Overall limit of deduction under this section remains Rs. 15,000. 6. Deduction u/s. 80C LIC premium exemption Premium paid on insurance policy issued on or after 1st April 2012 shall be available only, if the premium payable does not exceed 10% of actual capital sum assured. 7. Due date for furnishing Tax Audit Report by assesses who have undertaken international transactions is 30th November of the assessment year. 8. TDS applicable on remuneration or fee or commission by whatever name called (other than what is already covered by section 192) to a director of a company under section 194J. (Effective from 1st July 2012). 9. Fees and penalty for delay in furnishing TDS / TCS statement and penalty for incorrect information in TDS / TCS statement : Fees of Rs. 200 per day shall be levied u/s. 234E for the period of delay Penalty ranging from Rs. 10,000 to Rs. 100,000 shall be levied for nonfurnishing or incorrect filing of TDS / TCS statements within the prescribed time u/s. 271H.

Budget 2012-13: Important Changes specifically applicable to Corporate (Service taxes)

1. Service tax rates have been changed from present 10% to 12% (Effective rate will be now 12.36%) 2. Composition rate for works contract would be now 4.944% (4.8% plus 3% cess) 3. Basic exemption limit of Rs. 10 lacs, means aggregate value of taxable services charged or required to be charged during the financial year. Exempt services will not be included in the definition of aggregate value. 4. Tax by both mechanism: Special provisions for tax to be paid by both are being incorporated for the first time i.e. service providers and receivers both have to pay tax in the following cases : Renting or hiring of motor vehicles, to the extent of 60% by service receiver ad balance by provider in case of abatement otherwise 100% by receiver. Applicable only if provider is Proprietor/PF/LLP/AOP and receiver is company. Manpower supply, to the extent of 75% by receiver and balance by provider. Applicable only if provider is Proprietor/PF/LLP/AOP and receiver is company. Works contract, to the extent of 50% by each. Applicable only if provider is Proprietor/PF/LLP/AOP and receiver is company.

Budget 2012-13: Important Changes specifically applicable to Corporate (Excise duty)

1. Basic excise duty changed from present 10% to 12%.

Você também pode gostar

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- For Zomato Limited (Formerly Known As Zomato Private Limited and Zomato Media Private Limited)Documento1 páginaFor Zomato Limited (Formerly Known As Zomato Private Limited and Zomato Media Private Limited)Info Loaded100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- Benefits of Wage Earner, Taxable and Non-Taxable BenefitsDocumento33 páginasBenefits of Wage Earner, Taxable and Non-Taxable BenefitsCassandra Dianne Ferolino MacadoAinda não há avaliações

- Delivery Challan/ Tax InvoiceDocumento2 páginasDelivery Challan/ Tax InvoiceshaikhAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Cir vs. FilinvestDocumento4 páginasCir vs. FilinvestAlphaZuluAinda não há avaliações

- Form 16 ExcelDocumento2 páginasForm 16 Excelapi-372756271% (7)

- Narayana Group of Schools: Bill of Supply OriginalDocumento1 páginaNarayana Group of Schools: Bill of Supply OriginalSk NurhasanAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- CH 2Documento29 páginasCH 2syahirahAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Voylite Labs Private LimitedDocumento1 páginaVoylite Labs Private LimitedSunil PatelAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Activity and Tutorial 1,2,3Documento4 páginasActivity and Tutorial 1,2,3NUR AFFIDAH LEEAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

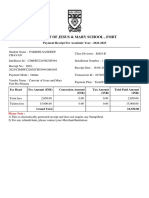

- Convent of Jesus & Mary School, Fort: Payment Receipt For Academic Year - 2022-2023Documento2 páginasConvent of Jesus & Mary School, Fort: Payment Receipt For Academic Year - 2022-2023KDAinda não há avaliações

- E-Way Bill: Government of IndiaDocumento1 páginaE-Way Bill: Government of IndiaAbdul WajidAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- SBN-0270: Capital Gains Tax and Documentary Stamp Tax Exemption For Expropriated LandsDocumento4 páginasSBN-0270: Capital Gains Tax and Documentary Stamp Tax Exemption For Expropriated LandsRalph RectoAinda não há avaliações

- Take Home Exercise No 6 - Source of Profits (2023S)Documento3 páginasTake Home Exercise No 6 - Source of Profits (2023S)何健珩Ainda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- تقرير فحص ضريبيDocumento3 páginasتقرير فحص ضريبيSmart Certified Translation ServicesAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- FABM2Documento27 páginasFABM2Shai Rose Jumawan QuiboAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Tax Exemption & ConcessionDocumento1 páginaTax Exemption & Concessionßïshñü PhüyãlAinda não há avaliações

- Pascual v. CIR (Estember 3B)Documento2 páginasPascual v. CIR (Estember 3B)MasterboleroAinda não há avaliações

- Onett Developer TemplateDocumento6 páginasOnett Developer Templatejoeye louieAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Vanik Education PVT LTD: GSTIN - 21AAFCV2531H1ZQDocumento1 páginaVanik Education PVT LTD: GSTIN - 21AAFCV2531H1ZQNRUSINGHA PATRAAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Aacpt8112a 2021 110889938Documento77 páginasAacpt8112a 2021 110889938vnpAinda não há avaliações

- W-8ben For CDN Beachbody Coaches SampleDocumento1 páginaW-8ben For CDN Beachbody Coaches Sampleapi-295933330Ainda não há avaliações

- Hax To Save Tax Income Tax Calculator by Labour Law AdvisorDocumento15 páginasHax To Save Tax Income Tax Calculator by Labour Law AdvisorponmaniAinda não há avaliações

- HFMDocumento1 páginaHFMJPAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Invoice of EarphonesDocumento1 páginaInvoice of EarphonesSai TejaAinda não há avaliações

- Calculation of Total Tax Incidence (TTI) For ImportDocumento4 páginasCalculation of Total Tax Incidence (TTI) For ImportMd. Mehedi Hasan AnikAinda não há avaliações

- RentoMojo - Start Renting - Furniture, Appliances, Electronics (2) 1Documento2 páginasRentoMojo - Start Renting - Furniture, Appliances, Electronics (2) 1Trilok AshpalAinda não há avaliações

- HDFC FD PDFDocumento2 páginasHDFC FD PDFghesiaAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Abrpb4480f 2020-21Documento2 páginasAbrpb4480f 2020-21Subray N BanaulikarAinda não há avaliações

- PSNT of MFSDocumento8 páginasPSNT of MFSPayal ParmarAinda não há avaliações

- Chart of AccountsDocumento3 páginasChart of AccountsOzioma Ihekwoaba0% (1)