Escolar Documentos

Profissional Documentos

Cultura Documentos

Chapter 17 Solution To Difficult Problem

Enviado por

bennetta24Descrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Chapter 17 Solution To Difficult Problem

Enviado por

bennetta24Direitos autorais:

Formatos disponíveis

Cardinal Paz Corp.

carries an account in its general ledger called Investments, which contained

debits for investment purchases, and no credits, with the following descriptions.

Feb. 1, 2012

Sharapova Company common stock, $100 par, 200 shares $ 37,400

April 1

U.S. government bonds, 11%, due April 1, 2022, interest payable

April 1

and October 1, 110 bonds of $1,000 par each .110,000

July 1

McGrath Company 12% bonds, par $50,000, dated March 1, 2012,

purchased at 104 plus accrued interest, interest payable

annually on March 1, due March 1, 2032 .54,000

Instructions

(Round all computations to the nearest dollar.)

(a) Prepare entries necessary to classify the amounts into proper accounts, assuming that all the

securities are classified as available-for-sale.

(b) Prepare the entry to record the accrued interest and the amortization of premium on December

31, 2012, using the straight-line method.

(c) The fair values of the investments on December 31, 2012, were:

Sharapova Company common stock $ 31,800

U.S. government bonds .124,700

McGrath Company bonds ...58,600

What entry or entries, if any, would you recommend be made?

(d) The U.S. government bonds were sold on July 1, 2013, for $119,200 plus accrued interest. Give

the proper entry.

SOLUTION

(a)

Debt Investments (Available-for-Sale) ...............................162,000*

Equity Investments (Available-for-Sale) ................................37,400

Interest Revenue ($50,000 X .12 X 4/12) ............................... 2,000

Investments ..............................................................................

*[$110,000 + ($50,000 X 1.04)]

201,400

(b)

December 31, 2012

Interest Receivable ....................................................................8,025

Debt Investments (Available-for-Sale) ....................................

Interest Revenue.......................................................................

[Accrued interest

[ $50,000 X .12 X 10/12 =

$5,000

[Premium amortization

[ 6/236 X $2,000 =

(51)

[Accrued interest

[ $110,000 X .11 X 3/12 =

3,025

$7,974]

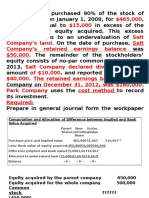

(c)

51

7,974

December 31, 2012

Available-for-Sale Portfolio

Securities

Sharapova Company stock

U.S. government bonds

McGrath Company bonds

Total

Previous fair value adjustment balance

Cost

$ 37,400

110,000

51,949*

$199,349

Fair Value

$ 31,800

124,700

58,600

$215,100

Unrealized

Gain (Loss)

$ (5,600)

14,700

6,651

15,751

0

$15,751

Fair value adjustmentDr.

($50,000 X 1.04) $51

Fair Value Adjustment (Available-for-Sale) ............................15,751

Unrealized Holding Gain or Loss

Equity ............................................................................

(d)

15,751

July 1, 2013

Cash ($119,200 + $3,025)............................................ 122,225

Debt Investments (Available-for-Sale) ............................

Interest Revenue

($110,000 X .11 X 3/12) ...............................................

Gain on Sale of Investments ............................................

110,000

3,025

9,200

Você também pode gostar

- ACY4001 Individual Assignment 2 SolutionsDocumento7 páginasACY4001 Individual Assignment 2 SolutionsMorris LoAinda não há avaliações

- Advanced Accounting Jeter Chapter 4Documento55 páginasAdvanced Accounting Jeter Chapter 4Hanna GabriellaAinda não há avaliações

- Udah Bener'Documento4 páginasUdah Bener'Shafa AzahraAinda não há avaliações

- ACCT550 Homework Week 1Documento6 páginasACCT550 Homework Week 1Natasha DeclanAinda não há avaliações

- CH16Documento80 páginasCH16mahinAinda não há avaliações

- Forum 6Documento1 páginaForum 6cecillia lissawatiAinda não há avaliações

- Tugas Chapter 15Documento12 páginasTugas Chapter 15Ach Junaidi Irham FauziAinda não há avaliações

- ch04 PDFDocumento4 páginasch04 PDFMosharraf HussainAinda não há avaliações

- E10 16Documento1 páginaE10 16september manisAinda não há avaliações

- Problem 21.3Documento3 páginasProblem 21.3Fayed Rahman MahendraAinda não há avaliações

- Pertemuan 14 - Investasi Saham (20% - 50%) PDFDocumento17 páginasPertemuan 14 - Investasi Saham (20% - 50%) PDFayu utamiAinda não há avaliações

- Bab 6 Intercompany Profit TransactionsDocumento2 páginasBab 6 Intercompany Profit TransactionsAnonymous dMkY9G2Ainda não há avaliações

- CH 19 SMDocumento26 páginasCH 19 SMNafisah MambuayAinda não há avaliações

- Question and Answer - 60Documento31 páginasQuestion and Answer - 60acc-expertAinda não há avaliações

- InstructionsDocumento2 páginasInstructionsGabriel SAinda não há avaliações

- Materi Persentasi SIA (Semester 4)Documento3 páginasMateri Persentasi SIA (Semester 4)Rahmad Bari BarrudiAinda não há avaliações

- To Take Into Account 2Documento12 páginasTo Take Into Account 2Anii HurtadoAinda não há avaliações

- The Controller of The Ijiri Company Wants You To Estimate A Cost Function From The Following Two Observations in A General Ledger Account Called MaintenanceDocumento3 páginasThe Controller of The Ijiri Company Wants You To Estimate A Cost Function From The Following Two Observations in A General Ledger Account Called MaintenanceElliot RichardAinda não há avaliações

- Komissarov Sa Has A Debt Investment in The Bonds IssuedDocumento2 páginasKomissarov Sa Has A Debt Investment in The Bonds IssuedDoreenAinda não há avaliações

- Tugas Pertemuan 12 - Alya Sufi Ikrima - 041911333248Documento3 páginasTugas Pertemuan 12 - Alya Sufi Ikrima - 041911333248Alya Sufi IkrimaAinda não há avaliações

- BMGT 321 Chapter 11 HomeworkDocumento9 páginasBMGT 321 Chapter 11 HomeworkarnitaetsittyAinda não há avaliações

- Chapter 16 Homework SolutionsDocumento11 páginasChapter 16 Homework Solutionsyuri100% (2)

- Contoh Dan Soal Cash FlowDocumento9 páginasContoh Dan Soal Cash FlowAltaf HauzanAinda não há avaliações

- ch11 DepriciationDocumento19 páginasch11 DepriciationKatie Vo50% (2)

- CH 09Documento21 páginasCH 09Ahmed Al EkamAinda não há avaliações

- ch11 SolDocumento20 páginasch11 SolJohn Nigz PayeeAinda não há avaliações

- Chapter 4Documento25 páginasChapter 4Anonymous XOv12G67% (3)

- Latihan Soal Pertemuan Ke-6Documento15 páginasLatihan Soal Pertemuan Ke-6gloria rachelAinda não há avaliações

- Jawaban Intermedit Kieso s21-1 Dan s21-2Documento5 páginasJawaban Intermedit Kieso s21-1 Dan s21-2muhammad ridwan dudutAinda não há avaliações

- Benefits AccountingDocumento4 páginasBenefits AccountingJulian Christopher Torcuator50% (2)

- Accounting For Derivatives and Hedging Activities: Answers To QuestionsDocumento22 páginasAccounting For Derivatives and Hedging Activities: Answers To QuestionsGabyVionidyaAinda não há avaliações

- CH 03 Financial Statements ExercisesDocumento39 páginasCH 03 Financial Statements ExercisesJocelyneKarolinaArriagaRangel100% (1)

- Lucky Carrot : Show Transcribed Image TextDocumento2 páginasLucky Carrot : Show Transcribed Image TextAchmad RizalAinda não há avaliações

- Soal Myob PT DinamikaDocumento5 páginasSoal Myob PT DinamikaRaden Andini AnggreaniAinda não há avaliações

- Chapter 12: Derivatives and Foreign Currency Transactions: Advanced AccountingDocumento52 páginasChapter 12: Derivatives and Foreign Currency Transactions: Advanced AccountingindahmuliasariAinda não há avaliações

- Accounting For LeasesDocumento112 páginasAccounting For LeasesPoomza TaramarukAinda não há avaliações

- ACC-423 Learning Team B Week 2 Textbook ProblemsDocumento10 páginasACC-423 Learning Team B Week 2 Textbook ProblemsdanielsvcAinda não há avaliações

- Coolplay Corp Is Thinking About Opening A Soccer Camp inDocumento2 páginasCoolplay Corp Is Thinking About Opening A Soccer Camp inMuhammad ShahidAinda não há avaliações

- Rangkuman Chapter 9 Cost of CapitalDocumento4 páginasRangkuman Chapter 9 Cost of CapitalDwi Slamet RiyadiAinda não há avaliações

- Chapter 10 - Standard CostingDocumento20 páginasChapter 10 - Standard CostingEnrique Miguel Gonzalez Collado100% (1)

- Kuis Akuntansi ManajemenDocumento5 páginasKuis Akuntansi ManajemenBelinda Dyah Tri YuliastiAinda não há avaliações

- Consolidated Financial Statement Practice 3-2Documento2 páginasConsolidated Financial Statement Practice 3-2Winnie TanAinda não há avaliações

- Bab 2Documento6 páginasBab 2Elsha Cahya Inggri MaharaniAinda não há avaliações

- Prak. ALK Latihan Cash Flow - Assyva Naila Agustine - 023002001093Documento2 páginasPrak. ALK Latihan Cash Flow - Assyva Naila Agustine - 023002001093nanaAinda não há avaliações

- Tugas 5 - AKL 1Documento3 páginasTugas 5 - AKL 1Geroro D'PhoenixAinda não há avaliações

- 18-32 (Objectives 18-2, 18-3, 18-4, 18-6)Documento8 páginas18-32 (Objectives 18-2, 18-3, 18-4, 18-6)image4all100% (1)

- Quiz 2 SolutionsDocumento5 páginasQuiz 2 Solutions820090150% (2)

- The Respective Normal Account Balances of Sales RevenueDocumento12 páginasThe Respective Normal Account Balances of Sales RevenueRBAinda não há avaliações

- AIS E12 CH04Documento67 páginasAIS E12 CH04SHERRY XUAinda não há avaliações

- Chapter 2 AdaptasiDocumento35 páginasChapter 2 AdaptasiGerhard Gank Anfield LiverpudlianAinda não há avaliações

- Contoh Eliminasi Lap - Keu KonsolidasiDocumento44 páginasContoh Eliminasi Lap - Keu KonsolidasiLuki DewayaniAinda não há avaliações

- Module 4 Exercises - JFCDocumento10 páginasModule 4 Exercises - JFCJARED DARREN ONGAinda não há avaliações

- P4-3 WPDocumento4 páginasP4-3 WPAna LailaAinda não há avaliações

- Practice Questions For BAAC 550 Question 1 Property, Plant and Equipment (15 Marks, 15 Minutes)Documento19 páginasPractice Questions For BAAC 550 Question 1 Property, Plant and Equipment (15 Marks, 15 Minutes)Jasmine HuangAinda não há avaliações

- Common Stock and Treasury Stock TutorialDocumento3 páginasCommon Stock and Treasury Stock TutorialSalma HazemAinda não há avaliações

- Lancer Inc Starts A Subsidiary in A Foreign Country On: Unlock Answers Here Solutiondone - OnlineDocumento1 páginaLancer Inc Starts A Subsidiary in A Foreign Country On: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghAinda não há avaliações

- ACCT551 - Week 7 HomeworkDocumento10 páginasACCT551 - Week 7 HomeworkDominickdadAinda não há avaliações

- Homework Week7Documento3 páginasHomework Week7Arista Yuliana SariAinda não há avaliações

- CH 17Documento4 páginasCH 17HàMềm0% (1)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialAinda não há avaliações

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNNo Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNNota: 4.5 de 5 estrelas4.5/5 (3)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNo EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNota: 4.5 de 5 estrelas4.5/5 (14)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNota: 4.5 de 5 estrelas4.5/5 (32)

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceNo EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceNota: 4 de 5 estrelas4/5 (1)

- Corporate Finance Formulas: A Simple IntroductionNo EverandCorporate Finance Formulas: A Simple IntroductionNota: 4 de 5 estrelas4/5 (8)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNo EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamAinda não há avaliações

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthNo EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthNota: 4 de 5 estrelas4/5 (20)

- Creating Shareholder Value: A Guide For Managers And InvestorsNo EverandCreating Shareholder Value: A Guide For Managers And InvestorsNota: 4.5 de 5 estrelas4.5/5 (8)

- The Value of a Whale: On the Illusions of Green CapitalismNo EverandThe Value of a Whale: On the Illusions of Green CapitalismNota: 5 de 5 estrelas5/5 (2)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNo EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNota: 3.5 de 5 estrelas3.5/5 (8)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisNo EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisNota: 5 de 5 estrelas5/5 (6)

- Mastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsNo EverandMastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsNota: 4.5 de 5 estrelas4.5/5 (21)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingNo EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingNota: 4.5 de 5 estrelas4.5/5 (17)

- Product-Led Growth: How to Build a Product That Sells ItselfNo EverandProduct-Led Growth: How to Build a Product That Sells ItselfNota: 5 de 5 estrelas5/5 (1)

- An easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyNo EverandAn easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyNota: 3 de 5 estrelas3/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistNo EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistNota: 4.5 de 5 estrelas4.5/5 (73)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successNo EverandReady, Set, Growth hack:: A beginners guide to growth hacking successNota: 4.5 de 5 estrelas4.5/5 (93)

- The Illusion of Innovation: Escape "Efficiency" and Unleash Radical ProgressNo EverandThe Illusion of Innovation: Escape "Efficiency" and Unleash Radical ProgressAinda não há avaliações

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistNo EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistNota: 4 de 5 estrelas4/5 (32)

- Finance Basics (HBR 20-Minute Manager Series)No EverandFinance Basics (HBR 20-Minute Manager Series)Nota: 4.5 de 5 estrelas4.5/5 (32)

- Mind over Money: The Psychology of Money and How to Use It BetterNo EverandMind over Money: The Psychology of Money and How to Use It BetterNota: 4 de 5 estrelas4/5 (24)