Escolar Documentos

Profissional Documentos

Cultura Documentos

Test 3 No Answers

Enviado por

Yosuke NekomuraDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Test 3 No Answers

Enviado por

Yosuke NekomuraDireitos autorais:

Formatos disponíveis

Acct.

3312 Spring 2011 Test 3

Name: __________________________

Page 1

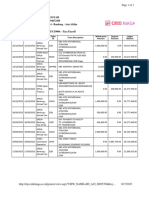

1. Pension Worksheet Howard Corp. sponsors a defined-benefit pension plan for its employees. On January 1, Avera 2011, the following balances related to this plan. ge remai Plan assets ning $550,000 servic e life of Projected benefit obligation active 650,000 emplo yees 10 Pension asset/liability years 100,000 Cr Instr uctio Prior service cost ns 75,000 (a) Comp ute OCI Loss pensi 75,000 on expen se for Howa As a result of the operation of the plan during 2011, the actuary provided the following rd additional data at December 31, 2011. Corp. for Service cost for 2011 the $ 75,000 year 2011 Actual return on plan assets in 2011 by 45,000 prepa ring a Amortization of prior service cost pensi 20,000 on works Contributions in 2011 heet. 115,000 Benefits paid retirees in 2011 (b) Prepa re the Settlement rate journ al entry 70,000 7%

2. Lessee accountingcapital lease. Krause Company on January 1, 2011, enters into a ten-year non-cancelable lease, for equipment having an estimated useful life of 10 years and a fair value to the lessor, Daly Corp., at the inception of the lease of $3,000,000. Krause's incremental borrowing rate is 8%. Krause uses the straight-line method to depreciate its assets. The lease contains the following provisions: 1. Rental payments of $225,500 including $10,000 for property taxes (estimated to be $20,00 per year), payable at the beginning of each six-month period.

2. A guarantee by Krause Company that Daly Corp. will realize $100,000 from selling the asset at the expiration of the lease. Instructions

(a) What is the present value of the minimum lease payments? (PV factor for annuity due of 20 semi-annual payments at 8% annual rate, 14.13394; PV factor for amount due in 20 interest periods at 8% annual rate, .45639.) (Round to nearest dollar.) (b) What journal entries would Krause record during the first year of the lease? (Include an amortization schedule through 1/1/12 and round to the nearest dollar.)

Page 3

3. Error corrections and adjustments. The The controller for Haley Corporation is concerned about certain business transactions that contr the company experienced during 2011. The controller, after discussing these matters with oller various individuals, has come to you for advice. The transactions at issue are presented estim below. ates that 1. an The company has decided to switch from the direct write-off method in accounting additi for bad debt expense to the percentage-of-sales approach. Assume that Haley onal Corporation has recognized bad debt expense as the receivables have actually $60,4 become uncollectible in the following way: 00 will be charg 2010 ed off 2011 in 2012: From 2010 sales $10,4 29,800 00 10,000 applic able From 2011 sales to 2010 43,000 sales and $50,0 00 to 2011 sales. 2. Inven tory has been shipp ed on consi gnme nt. These transa ctions have been recor

Page 5

Você também pode gostar

- Harvard Financial Accounting Final Exam 3Documento10 páginasHarvard Financial Accounting Final Exam 3Bharathi Raju25% (4)

- Wiley - Practice Exam 1 With SolutionsDocumento10 páginasWiley - Practice Exam 1 With SolutionsIvan Bliminse80% (5)

- Intermediate Accounting Exam SolutionsDocumento11 páginasIntermediate Accounting Exam SolutionsDean Craig80% (5)

- Co Makers StatementDocumento1 páginaCo Makers Statementbhem silverioAinda não há avaliações

- NVCC Accounting ACC 211 EXAM 1 PracticeDocumento12 páginasNVCC Accounting ACC 211 EXAM 1 Practiceflak27bl2Ainda não há avaliações

- ACCO 310/4: Concordia University John Molson School of Business Department of AccountingDocumento10 páginasACCO 310/4: Concordia University John Molson School of Business Department of AccountingMiruna CiteaAinda não há avaliações

- Solution To Mid-Term Exam ADM4348M Winter 2011Documento17 páginasSolution To Mid-Term Exam ADM4348M Winter 2011SKAinda não há avaliações

- Review Problems 1rDocumento8 páginasReview Problems 1rYousefAinda não há avaliações

- Workshop Solutions T1 2014Documento78 páginasWorkshop Solutions T1 2014sarah1379Ainda não há avaliações

- ch01 Introduction Acounting & BusinessDocumento37 páginasch01 Introduction Acounting & Businesskuncoroooo100% (1)

- Week 6 Financial Accoutning Homework HWDocumento7 páginasWeek 6 Financial Accoutning Homework HWDoyouknow MEAinda não há avaliações

- Infocept Pte LTD - 2021Documento47 páginasInfocept Pte LTD - 2021Lin ZincAinda não há avaliações

- p2 (Int) CR Mt2a Qs j09Documento7 páginasp2 (Int) CR Mt2a Qs j09Kyaw Htin WinAinda não há avaliações

- Comprehensiveexam eDocumento10 páginasComprehensiveexam eNghiaBuiQuangAinda não há avaliações

- Discontinued Operations Acctg. Test BankDocumento12 páginasDiscontinued Operations Acctg. Test BankDalrymple CasballedoAinda não há avaliações

- Comprehensive Exam EDocumento10 páginasComprehensive Exam Ejdiaz_646247100% (1)

- Ecomprehensiveexam eDocumento12 páginasEcomprehensiveexam eDominic SociaAinda não há avaliações

- Weygandt Accounting Principles 10e PowerPoint Ch11Documento60 páginasWeygandt Accounting Principles 10e PowerPoint Ch11billy93Ainda não há avaliações

- Case Set 7 - Subsequent Events and Going ConcernDocumento5 páginasCase Set 7 - Subsequent Events and Going ConcernTimothy WongAinda não há avaliações

- Chapter 3 Quick StudyDocumento10 páginasChapter 3 Quick StudyPhạm Hồng Trang Alice -Ainda não há avaliações

- Aud and atDocumento21 páginasAud and atVtgAinda não há avaliações

- 564 WK 2 HWDocumento7 páginas564 WK 2 HWPetraAinda não há avaliações

- ComprehensiveexamDocumento14 páginasComprehensiveexamLeah BakerAinda não há avaliações

- 2nd Yr Midterm (2nd Sem) ReviewerDocumento19 páginas2nd Yr Midterm (2nd Sem) ReviewerC H ♥ N T Z60% (5)

- ACCT 3001 Exams 1 and 2 All QuestionsDocumento7 páginasACCT 3001 Exams 1 and 2 All QuestionsRegine VegaAinda não há avaliações

- Ch11 - Current Liabilities and Payroll AccountingDocumento52 páginasCh11 - Current Liabilities and Payroll AccountingPrincess Trisha Joy Uy100% (1)

- Common Types of ProvisionsDocumento7 páginasCommon Types of ProvisionsiyexrahmanAinda não há avaliações

- 4 5809728989157133277Documento7 páginas4 5809728989157133277yoniakia2124Ainda não há avaliações

- Final Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems inDocumento8 páginasFinal Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems insafiqulislamAinda não há avaliações

- Final Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems inDocumento8 páginasFinal Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems insafiqulislamAinda não há avaliações

- ADV2Documento3 páginasADV2Rommel RoyceAinda não há avaliações

- Review Session1-MidtermDocumento7 páginasReview Session1-MidtermBich VietAinda não há avaliações

- Cash BasisDocumento4 páginasCash BasisMark DiezAinda não há avaliações

- Final Exam IntermediateDocumento6 páginasFinal Exam Intermediategizachew alekaAinda não há avaliações

- Drills Acc 108 Sem EnderDocumento10 páginasDrills Acc 108 Sem Enderbrmo.amatorio.uiAinda não há avaliações

- Tax PDFDocumento13 páginasTax PDFMinie KimAinda não há avaliações

- Multiple Choices and Exercises - AccountingDocumento33 páginasMultiple Choices and Exercises - Accountinghuong phạmAinda não há avaliações

- Ac550 FinalDocumento4 páginasAc550 FinalGil SuarezAinda não há avaliações

- Midterm Winter 2013 With Final Winter 2013 For Posting FallDocumento10 páginasMidterm Winter 2013 With Final Winter 2013 For Posting FallMiruna CiteaAinda não há avaliações

- Collier 1ce Solutions Ch04Documento10 páginasCollier 1ce Solutions Ch04Oluwasola OluwafemiAinda não há avaliações

- Practice Exam Chapter 1-5 Part2Documento5 páginasPractice Exam Chapter 1-5 Part2John Arvi ArmildezAinda não há avaliações

- Chapter1 Current Liab, Prov & ContengeciesDocumento51 páginasChapter1 Current Liab, Prov & Contengeciessamuel hailuAinda não há avaliações

- Intermediate Financial Accounting I: Current Liabilities and ContingenciesDocumento37 páginasIntermediate Financial Accounting I: Current Liabilities and Contingenciesrain06021992Ainda não há avaliações

- FAR ReviewDocumento9 páginasFAR ReviewJude Vincent VittoAinda não há avaliações

- Kuis 2 AK 2 GNP 1314 - Leasing Tax - RegulerDocumento4 páginasKuis 2 AK 2 GNP 1314 - Leasing Tax - RegulerBastian Nugraha SiraitAinda não há avaliações

- Practice Exam Chapter 13-15Documento5 páginasPractice Exam Chapter 13-15John Arvi ArmildezAinda não há avaliações

- For CDEEDocumento7 páginasFor CDEEmikiyas zeyedeAinda não há avaliações

- ©dr. Chula King All Rights ReservedDocumento3 páginas©dr. Chula King All Rights ReservedstargearAinda não há avaliações

- Revision Question BankDocumento15 páginasRevision Question BankPuneet SharmaAinda não há avaliações

- Term Exam 2edited Answer KeyDocumento10 páginasTerm Exam 2edited Answer KeyPRINCESS HONEYLET SIGESMUNDOAinda não há avaliações

- Name - Course & Yr. - Schedule - Score - Test I. Multiple Choice. Encircle The Letter of The Best Answer in Each of The Given Question/sDocumento11 páginasName - Course & Yr. - Schedule - Score - Test I. Multiple Choice. Encircle The Letter of The Best Answer in Each of The Given Question/sAtty CpaAinda não há avaliações

- Online Quiz - PractiseDocumento8 páginasOnline Quiz - PractiseKatrina Eustace100% (1)

- CH 13Documento6 páginasCH 13Saleh RaoufAinda não há avaliações

- Fall10mid1 ProbandsolnDocumento8 páginasFall10mid1 Probandsolnivanata72Ainda não há avaliações

- Isc Specimen Question Paper Accounts 2014Documento9 páginasIsc Specimen Question Paper Accounts 2014BIKASH166Ainda não há avaliações

- Constraints::: Because This Statement Is Also Used by Banks, Shareholders, Etc., and Also As It Is TheDocumento11 páginasConstraints::: Because This Statement Is Also Used by Banks, Shareholders, Etc., and Also As It Is TheamaspyAinda não há avaliações

- 9.liability Questionnaire QUIZDocumento10 páginas9.liability Questionnaire QUIZMark GaerlanAinda não há avaliações

- ACC300 Principles of AccountingDocumento11 páginasACC300 Principles of AccountingG JhaAinda não há avaliações

- Test Bank For Introduction To Financial Accounting 11Th Edition Horngren Sundem Elliott Philbrick 9780133251036 Full Chapter PDFDocumento36 páginasTest Bank For Introduction To Financial Accounting 11Th Edition Horngren Sundem Elliott Philbrick 9780133251036 Full Chapter PDFjane.boyles334100% (12)

- Intermediate Accounting Kieso 14th ch8, 9, 10, 11Documento8 páginasIntermediate Accounting Kieso 14th ch8, 9, 10, 11Alessandro BattellinoAinda não há avaliações

- Summary of Richard A. Lambert's Financial Literacy for ManagersNo EverandSummary of Richard A. Lambert's Financial Literacy for ManagersAinda não há avaliações

- Fins2624 Problem Set 5 Tutorial QuestionDocumento5 páginasFins2624 Problem Set 5 Tutorial QuestionPhebieon MukwenhaAinda não há avaliações

- Zoltan Pozsar - Global Money Notes #1-26 (2015-2019) - Excess Reserves - Federal Reserve PDFDocumento521 páginasZoltan Pozsar - Global Money Notes #1-26 (2015-2019) - Excess Reserves - Federal Reserve PDFNameAinda não há avaliações

- Insurance & Risk ManagementDocumento4 páginasInsurance & Risk ManagementTeju PaputejAinda não há avaliações

- HDFC Bank - Research Insight 3Documento7 páginasHDFC Bank - Research Insight 3Sancheet BhanushaliAinda não há avaliações

- Chapter 1 - Financial Reporting and Accounting StandardsDocumento13 páginasChapter 1 - Financial Reporting and Accounting StandardsPeri BabsAinda não há avaliações

- A I T CLO E: February 2020Documento54 páginasA I T CLO E: February 2020Kunal Goel100% (1)

- Instruments of Tax SavingDocumento10 páginasInstruments of Tax Savinganilpipaliya117Ainda não há avaliações

- Assupol Life Cover - WebDocumento5 páginasAssupol Life Cover - WebtebkataneAinda não há avaliações

- Case Study - Bordeos, Kristine - Sec 5Documento6 páginasCase Study - Bordeos, Kristine - Sec 5Kristine Lirose BordeosAinda não há avaliações

- 01B Moving Money Through TimeDocumento3 páginas01B Moving Money Through TimeNatalie RamosAinda não há avaliações

- HBC 2109 & HPS 2403 Insurance and Risk ManagementDocumento3 páginasHBC 2109 & HPS 2403 Insurance and Risk Managementcollostero6Ainda não há avaliações

- Latsol AklDocumento10 páginasLatsol AklAlya Sufi IkrimaAinda não há avaliações

- Rajghat Besant School Fees For New Students: 2018-19Documento2 páginasRajghat Besant School Fees For New Students: 2018-19Nikita AnandAinda não há avaliações

- BankDocumento73 páginasBankSunil NikamAinda não há avaliações

- LLC Resolution To Open A Bank Account - Baymis LLCDocumento1 páginaLLC Resolution To Open A Bank Account - Baymis LLCSerkan idilAinda não há avaliações

- Advanced Accounting II AssignmentDocumento3 páginasAdvanced Accounting II AssignmentMelkamu Moges100% (2)

- Asset and Liability ManagementDocumento57 páginasAsset and Liability ManagementMayur Federer Kunder100% (2)

- Account StatementDocumento12 páginasAccount StatementSanjeev JoshiAinda não há avaliações

- Room Reservation FormDocumento2 páginasRoom Reservation FormJohn Mark Rijon AbalunanAinda não há avaliações

- STMT CASH 001 CAKZ005793 Nov2022Documento8 páginasSTMT CASH 001 CAKZ005793 Nov2022Monique GarzaAinda não há avaliações

- FM3A - Javier, Angelica Mae S - Quiz 1 - FM105Documento3 páginasFM3A - Javier, Angelica Mae S - Quiz 1 - FM105Kimberly Solomon JavierAinda não há avaliações

- Business Finance Prelim To Finals ReviewerDocumento127 páginasBusiness Finance Prelim To Finals ReviewerMartin BaratetaAinda não há avaliações

- Financial Statement AnalysisDocumento13 páginasFinancial Statement AnalysisFaiza ShaikhAinda não há avaliações

- NETS Prepaid Card Vs NETS FlashPay Comparison - v3.4Documento1 páginaNETS Prepaid Card Vs NETS FlashPay Comparison - v3.4TestAinda não há avaliações

- MUTASI NIAGA-5 - MergedDocumento5 páginasMUTASI NIAGA-5 - Mergedoky daniAinda não há avaliações

- Tybaf - Dhruvil Jain - 038Documento5 páginasTybaf - Dhruvil Jain - 038DhruviAinda não há avaliações

- Asset RevaluationDocumento6 páginasAsset RevaluationAbdul Sameeu MohamedAinda não há avaliações

- Account StatementDocumento1 páginaAccount StatementИван ИвановAinda não há avaliações