Escolar Documentos

Profissional Documentos

Cultura Documentos

19 Checklist Due Dilligence New

Enviado por

William Cajetan AlmeidaDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

19 Checklist Due Dilligence New

Enviado por

William Cajetan AlmeidaDireitos autorais:

Formatos disponíveis

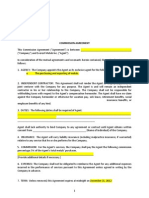

Due Diligence Checklist Please furnish for our review copies of the requested documents or indicate in writing on a copy

of this list that none exist. In addition, please provide a short summary of each oral agreement or arrangement and any circumstances that are responsive to the requests set forth below. Any documents identified as originals will be returned to you promptly. Unless otherwise indicated: (i)all requests are for any matters which are currently existing in effect or which have occurred within the last five years (even if they are not now existing or in effect if such matters are material), except as otherwise noted, and (ii) each request applies to the Company, all past and present subsidiaries and affiliates (if any) and all predecessors, whether corporations, partnerships or joint ventures (for purposes of this request, all such entities also are included in the term the Company and are referred to as such). Please provide copies of all of the indicated documents or the information requested as appropriate, to Nishith Desai Associates. "X" = Previously provided; "H" = Provided herewith; "I" = Inapplicable

X/ H/I Respon sible Appendi x No. Remarks

I.

BASIC CORPORATE CHARTER DOCUMENTS 1. Organization chart 2. Certified copy of the Certificate of incorporation and any amendments thereto 3. Certified copy of the Memorandum of Association 4. Certified copy of the Articles of Association 5. Changes in corporate name or objects clasue or any other alterations thereof; the supporting resolutions and the filings for the same 6. List of subsidiaries, affiliates, branches, partnerships, joint ventures, sales offices together with the following details: (i) Date of acquisition/ incorporation/commencement (ii) Date of closure/ disposal/ cessation 7. List of Board members as on date. 8. Members of Audit committee committee/Any other committee / Remuneration

["X" = Previously provided; "H" = Provided herewith; "I" = Inapplicable]

9. Name and address of Auditors 10. Name and address of Company Secretary/Compliance Officer 11. Name and address of legal advisor. 12. Minutes of the meetings of the Board of Directors, and committees of directors, including copies of notices of all such meetings where written notices were given, and copies of all written consents from date of incorporation to date. 13. Minutes of the meetings of the shareholders/ members from the date of incorporation to date. 14. Registers maintained by the Company (i) (ii) Register of charges Register of members

(iii) Register of shares bought back under section 77A (iv) Foreign register of members (v) Registers of particulars of contracts in which directors are interested under section 301 (vi) Register of directors, managing director, manager and secretary under section 303 (vii) Register of directors shareholding (viii) Register of loans under section 370

(ix) Register of investments or loans made, guarantee given or security provided under section 372A

(x)

Register of Renewed and Duplicate Certificates under Rule 7 of the Contracts (Issue of Share Certificates) Rules, 1960

15. All filings made with the Registrar of Companies upto date including but not limited to: (i) Annual Returns filed by the Company with the Registrar of Companies and the receipts relating thereto (ii) Balance Sheet filed with the Registrar of Companies and the receipts relating thereto (iii) Compliance reports by the Company Secretary and receipts relating thereto

["X" = Previously provided; "H" = Provided herewith; "I" = Inapplicable]

(iv) Form no. 2 / Form no. 23 / Form no. 25C and receipts relating thereto (v) Please also provide copies of all disclosures made u/s 299 in Form 24AA by all directors. 16. Please also provide copies of directors declaration u/s 274(1)(g) made for last two years 17. Copies of all Form 22A towards shareholders consent for calling any general meeting at shorter notice. 18. List of all cities and countries in which the Company contemplates undertaking business operations, either directly or through other parties. 19. Details of any resolutions passed under the Postal Ballot rules and the documents thereof. 20. Details of any past buy-back, rights issue and documents thereof. II. CAPITAL STOCK 1. Capitalization table showing summary of authorized, issued and paid-up capital 2. List of shareholders/ warrant holders/ debenture holders and the number of shares/ warrants/ debentures held by them 3. List of all stock transfer orders/legends 4. Samples of share certificates, options and any other outstanding securities 5. All material press releases issued by the Company especially in the last two months 6. Private placement memoranda 7. Agreements covering sale or issuance of shares 8. Any agreements and other documentation (including related permits) relating to repurchases (buy-back), redemptions, exchanges, conversions or similar transactions involving the Company's securities 9. All voting trust agreements, stockholder, or other similar agreements covering any portion of the Company's

["X" = Previously provided; "H" = Provided herewith; "I" = Inapplicable]

shares 10. All agreements containing registration rights or assigning such rights 11. All agreements containing preemptive rights, right of first refusal or other preferential rights to acquire securities and any waivers or assignment of such rights

III. DOCUMENTS FOR ANY MATERIAL SUBSIDIARY

Same as those listed under Items I, II & III above, in case of a subsidiary carrying on the business of insurance, then in addition to the above, the items listed under XII 3., 4. and 5.

IV. CORPORATE FINANCE DATA 1. Consolidated audited financial statements and audited financial statements. 2. List of banks and investment banks used since inception and the services availed. 3. Loan agreements, including loans with affiliates,

subsidiaries and related parties. 4. Equity Financings Copies of any share purchase

agreements with shareholders and related documents. 5. 6. Convertible Debt Financings, if any. Bank line of credit agreements, including any

amendments, renewal letters, notices, waivers, etc. 7. 8. Lease Financings. Other agreements evidencing outstanding loans to or guarantees by the Company. 9. 10. 11. List of capital commitments Contingent liabilities Has there been any adverse remark or any adverse qualifications by the auditors on companys accounts in last five years. If so, the nature of said remarks or observation and companys view on the same

12.

["X" = Previously provided; "H" = Provided herewith; "I" = Inapplicable]

13. Has there been any change in accounting policies or accounting standards by the company? If yes, details thereof. V. OPERATIONS 1. List of major suppliers, showing the following details: (i) Total and type of purchases from each supplier during the last fiscal year (ii) Indication of which are sole sources, and contact names and phone numbers 2. Agreements relating to the above suppliers 3. List of top 5 accounts payable with contact names and phone numbers 4. Any other material contracts VI. CUSTOMER INFORMATION 1. List of top 30 customers for the past two financial years 2. List of strategic relationships (Contact name, Phone number, revenue contribution, marketing agreements) 3. Company-financed customer purchase agreements, if any 4. Service contracts and marketing agreements, if any 5. Forms of customers warranties and guarantees provided to

VII. CONTRACTS/AGREEMENTS 1. Sales, distribution, agreements manufacturing and marketing

2. Summary of the terms of the joint ventures, strategic alliances, and corporate partnership agreements 3. Non-compete agreements, affecting the ability of the Company to compete 4. Summary and copies of government contracts 5. Other material contracts VIII. LITIGATION

["X" = Previously provided; "H" = Provided herewith; "I" = Inapplicable]

1. Summary of pending / potential disputes and investigations, including any Central, State or Local government claims, investor grievances or any inquiries, showing the following details: (i) (ii) Description of dispute Potential damages

(iii) Responses, if any, including letters from attorneys or any other agreements affecting the same 2. All letters from counsel sent to auditors for year-end and current interim audits, i.e. "litigation letters." 3. 4. 5. 6. Any litigation settlement documents Any Labour Union/ Workmen/ employee disputes, charter of demands. Settlement documents in respect of the same, if any. Investor grievances and responses thereto List of all enquiries made by the stock exchanges, SEBI or any other regulatory authorities 7. Any correspondence from SEBI/Stock Exchange as to non compliance and companys reply thereto. 8. Description of any warranty claims that have been made against the Company, any subsidiary, or any partnership or joint venture and the resolution of such claim Any decrees, orders or judgments of courts or

9.

governmental agencies

IX. INSURANCE

1. Schedules or copies of all material insurance policies of the Company covering property, liabilities and operations X. PERSONNEL 1. Copies of Key Employment agreements 2. Confidentiality agreements with the Company 3. Non-compete contracts 4. Proprietary information and inventions agreements with the employees and Company

["X" = Previously provided; "H" = Provided herewith; "I" = Inapplicable]

5. Agreements for loans to and any other agreements (including consulting and employment contracts) with officers or directors, whether or not now outstanding, including (i) Loans to purchase shares (ii) Consulting contracts 6. Description of any transactions between the Company and any "insider" (i.e., any officer, director, or owner of a substantial amount of the Company's securities) or any associate of an "insider" or between or involving any 2 or more such "insiders." 7. Employee benefit, pension, profit sharing, compensation and other plans, Public Provident Fund, Gratuity, etc 8. Copies of any filings with statutory authorities 9. Confirm that there are no union contracts, collective bargaining agreements or any pending or threatened union negotiations, if yes, please provide copies 10. List of any policies/practices which the Company follows with respect to intellectual property 11. Employment agreements containing clauses relating to the ownership and use of intellectual property 12. If the Company has any Labour Unions, then the details regarding the same. XI. GOVERNMENTAL REGULATIONS AND FILINGS

1. Registration with the various governmental agencies and bodies, including but not limited to registrations under: (i) (ii) (iii) (iv) (v) (vi) Employees Provident Funds Act, 1952 Employees Insurance Act, 1948 Profession Tax All applicable Shops & Establishment Act Income Tax Act, 1961 Industrial Disputes Act, 1949

["X" = Previously provided; "H" = Provided herewith; "I" = Inapplicable]

(vii)

Central Sales Tax Act, 1956

(viii) Payment of Gratuity Act, 1972 (ix) 2. Any other applicable Act

Summary of all material inquiries by a governmental agency (if any)

3. (if any) 4.

Status of governmental contracts subject to renegotiation

Permits for conduct of business List of all filings, applications, approvals, etc. done with the Reserve Bank of India

5.

6.

List of all applications made to and approvals received from the Foreign Investment Promotion Board or any other governmental agency XII. TAX LIABILITY [A] DIRECT TAXES 1. Copies of income tax returns filed alongwith all the annexures

2. 3.

Tax audit reports alongwith the annexures Details of advance taxes paid during the current financial year together with requisite supportings and any potential liability which may arise at the time of the next instalment for short payment or deferment of advance tax Withholding taxes (i) Taxability and/or potential liability to TDS in respect of payments made to non-residents on account of any of the following items: Royalty (including software imports) Fees for technical services Interest on borrowed funds Consultancy fees Any other payments

4.

(ii) Certificate from the auditors that taxes have been properly deducted at source, wherever applicable, and have been deposited within the specified time

["X" = Previously provided; "H" = Provided herewith; "I" = Inapplicable]

5. Tax liability in respect of business income or any other income outside India and details thereof 6. Details of pending tax litigations, if any, in any other jurisdiction arising out of such tax liability 7. Tax liability arising out of ESOP schemes already implemented 8. Status of assessments (in the following format)

9.

Assessment Year

Status (completed/ pending)

Pending at which level

Dispute details

Tax liability (Rs.)

Interest liability (Rs.)

Provision made, if yes, details (Rs.)

10.

Details of any penalty / tax recovery proceedings

initiated against the Company 11. Details of applications, if any, made to the Authority

for Advance Ruling 12. Details of applications, if any, made to Income Tax Authorities under section 195 or 197 of the Income Tax Act, 1961 13. Copies of TDS returns filed

["X" = Previously provided; "H" = Provided herewith; "I" = Inapplicable]

14. (i)

Transfer pricing regulations Whether the transfer pricing regulations are

applicable to the company, if yes, provide details (ii) Whether the company has complied with all the procedures required under Chapter X including submission of the accountants report within the prescribed time (iii) If not, the potential liability for non-compliance 15. Carry forward and set-off of losses (i) Details of change in shareholding, if any, which has impacted the eligibility of the company to carry forward and set-off losses as per the provisions of section 79 (ii) Certificate from the auditor that the company is eligible to carry forward and set-off losses as per the provisions of section 79 [B] INDIRECT TAXES 1. Details of Companys services / products (raw materials, consumables, finished products) assessable to indirect taxes 2. Details of any taxes/duties, interest and/or

penalties outstanding thereon 3. Details of returns filed, whether filed within the

statutory time period 4. Details any penalty / tax recovery proceedings

initiated against the Company, if any 5. Details of applications, if any, made to the

Authority for Advance Rulings 6. Status of assessments (in the following format)

1 0

["X" = Previously provided; "H" = Provided herewith; "I" = Inapplicable]

Assessment Year

Status (completed/ pending)

Pending at which level

Dispute details

Tax liability (Rs.)

Interest liability (Rs.)

Provision made, if yes, details (Rs.)

XIII. ENVIRONMENTAL MATTERS 1. 2. 3. 4. 5. 6.

XIV. ASSETS List of all cities and countries and states where property is owned or leased and the documents with respect to the same.

1 1

["X" = Previously provided; "H" = Provided herewith; "I" = Inapplicable]

DETAILS OF PROPERTY

LOCATION OF

PROPERTY

OWNERSHIP DETAILS

YEAR OF PURCHASE

ENCUMBERANCES DETAILS DATE

LITIGATION DETAILS DATE

INSURED

(Yes/No)

IMMOVEABLE Freehold Leasehold Building Machinery Equipment Utilities Spare Capacity MOVEABLE

Charge, lien, pledge, hypothecation, mortgage, easements and any others. 1 2

If insured, give details thereof.

PDF to Word

Você também pode gostar

- Due Dilligence Check ListDocumento4 páginasDue Dilligence Check Listrajesh.joshi100% (2)

- Standard Due Diligence QuestionsDocumento5 páginasStandard Due Diligence QuestionsFati MamatiAinda não há avaliações

- Legal Due DiligenceDocumento9 páginasLegal Due Diligencekavanya suroliaAinda não há avaliações

- Pe Due Diligence Checklist - UkDocumento4 páginasPe Due Diligence Checklist - Ukapi-19783268Ainda não há avaliações

- SLA - Due DiligenceDocumento2 páginasSLA - Due DiligenceSamhitha KumbhajadalaAinda não há avaliações

- Different Types of Due DiligenceDocumento6 páginasDifferent Types of Due DiligenceMamta VishwakarmaAinda não há avaliações

- Unilever Business Valuation - UCSDDocumento11 páginasUnilever Business Valuation - UCSDsloesp100% (1)

- Financial Due DilligenceDocumento8 páginasFinancial Due DilligenceBibhas SarkarAinda não há avaliações

- Petroleum Bulk Procurement Agency (PBPA)Documento190 páginasPetroleum Bulk Procurement Agency (PBPA)David BaltazaryAinda não há avaliações

- Due Diligence ChecklistDocumento6 páginasDue Diligence ChecklistNimmala GaneshAinda não há avaliações

- Mergers and Acquisitions - Financial Due Diligence - BDO AustraliaDocumento2 páginasMergers and Acquisitions - Financial Due Diligence - BDO AustraliaPat LozanoAinda não há avaliações

- TermsAndConditions PDFDocumento36 páginasTermsAndConditions PDFElijah Agboola OvergiftedAinda não há avaliações

- Role of Corporate Boards and Governance CodesDocumento17 páginasRole of Corporate Boards and Governance CodesOyeleye TofunmiAinda não há avaliações

- Some Basics of Venture Capital: Michael Kearns Chief Technology Officer Syntek CapitalDocumento21 páginasSome Basics of Venture Capital: Michael Kearns Chief Technology Officer Syntek CapitaldippuneAinda não há avaliações

- Chapter 16.1 Due Diligence, Investigation and Forensic AuditDocumento13 páginasChapter 16.1 Due Diligence, Investigation and Forensic AuditJagrit Oberoi0% (1)

- September 14 Gary Kadi MI SeminarDocumento2 páginasSeptember 14 Gary Kadi MI SeminarHenryScheinDentalAinda não há avaliações

- The M&A Process and It's AlligatorsDocumento7 páginasThe M&A Process and It's AlligatorsAn NguyenAinda não há avaliações

- Polystyrene Recycling System - StyromeltDocumento2 páginasPolystyrene Recycling System - StyromeltDuncan HarrisonAinda não há avaliações

- Leave BenifitsDocumento76 páginasLeave Benifitsprateeksaxena88Ainda não há avaliações

- Due DiligenceDocumento18 páginasDue DiligenceAlesha Horn100% (1)

- S7. Due DiligenceDocumento40 páginasS7. Due DiligenceJinal VasaAinda não há avaliações

- Market Share. Marketing.Documento15 páginasMarket Share. Marketing.khizrakaramatAinda não há avaliações

- Strategic Alliance - Case Study On Titan Industries (India) and Timex Watches (USA)Documento30 páginasStrategic Alliance - Case Study On Titan Industries (India) and Timex Watches (USA)Supriya GoreAinda não há avaliações

- Investment AppraisalDocumento23 páginasInvestment AppraisalHuzaifa Abdullah100% (2)

- Fluctuations in The Indian Stock MarketDocumento90 páginasFluctuations in The Indian Stock MarketAbhishek JainAinda não há avaliações

- CSB Joint Venture ToolkitDocumento15 páginasCSB Joint Venture ToolkitImraan_001100% (1)

- Due Diligence ChecklistDocumento12 páginasDue Diligence ChecklistNigel A.L. Brooks100% (1)

- Purchase Price AllocationDocumento8 páginasPurchase Price AllocationTharnn KshatriyaAinda não há avaliações

- 10+ Pitch Deck Slides For Successful Fundraising in 2023: Title SlideDocumento17 páginas10+ Pitch Deck Slides For Successful Fundraising in 2023: Title SlideMULUSEWAinda não há avaliações

- Vendor Evaluation From Buyer PerspectiveDocumento22 páginasVendor Evaluation From Buyer PerspectiveJiaul HaqueAinda não há avaliações

- PMT Business Plan Report 19201 19205 19208Documento22 páginasPMT Business Plan Report 19201 19205 19208Sunaiyna VarmaAinda não há avaliações

- JV ContratcDocumento6 páginasJV Contratcnesrinakram100% (1)

- Assist Real Estate Investors Purchase Property with ConfidenceDocumento2 páginasAssist Real Estate Investors Purchase Property with ConfidenceCyprian CypuAinda não há avaliações

- PWC Navigating Joint Ventures and Business Alliances PDFDocumento36 páginasPWC Navigating Joint Ventures and Business Alliances PDFkapurrohit4891100% (1)

- Managing ConsultancyDocumento27 páginasManaging ConsultancyChintan AcharyaAinda não há avaliações

- Business Plan ProcessDocumento12 páginasBusiness Plan ProcessNeeraj AgarwalAinda não há avaliações

- August 12, 113: This Sample Due Diligence Checklist From Astute DiligenceDocumento10 páginasAugust 12, 113: This Sample Due Diligence Checklist From Astute DiligenceCA Govinda Raju KAinda não há avaliações

- Mandate TemplateDocumento6 páginasMandate TemplateStephenAinda não há avaliações

- Merger & AcquisitionDocumento17 páginasMerger & AcquisitionWei LienAinda não há avaliações

- Northumbria University Capital Expenditure Policy: Document HistoryDocumento7 páginasNorthumbria University Capital Expenditure Policy: Document HistorySaikumar SelaAinda não há avaliações

- Due Dilligence Report-Full ReportDocumento2 páginasDue Dilligence Report-Full ReportOladipupo Mayowa Paul100% (1)

- Mergers and AcquisitionsDocumento46 páginasMergers and Acquisitionszyra liam styles0% (1)

- Tolins Study ReportDocumento34 páginasTolins Study ReportBalu Jagadish50% (2)

- Valuation Concepts and Issues (IASB 2007)Documento70 páginasValuation Concepts and Issues (IASB 2007)So LokAinda não há avaliações

- Demand ManagementDocumento22 páginasDemand Managementpatil_962113756Ainda não há avaliações

- MGCCT ProspectusDocumento700 páginasMGCCT ProspectusMarc EdwardsAinda não há avaliações

- Ip Due DiligenceDocumento13 páginasIp Due DiligenceyoshimgamtAinda não há avaliações

- Checklist For TakeoverDocumento17 páginasChecklist For Takeoverpreeti211100% (1)

- Due Diligence Checklist PDFDocumento5 páginasDue Diligence Checklist PDFLjupco TrajkovskiAinda não há avaliações

- Sport England Athletics Design Guidance 2008Documento46 páginasSport England Athletics Design Guidance 2008piugabiAinda não há avaliações

- 5 Capital Expenditure Decisions 19.4.06Documento37 páginas5 Capital Expenditure Decisions 19.4.06sandip gaudana75% (4)

- Venture Capital Financing: MBA 6314/TME 3413 October, 2003Documento66 páginasVenture Capital Financing: MBA 6314/TME 3413 October, 2003Ashwin ShettyAinda não há avaliações

- Guide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesNo EverandGuide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesAinda não há avaliações

- Investment Project AnalysisDocumento44 páginasInvestment Project AnalysisNgan Kim CaoAinda não há avaliações

- LEGAL DUE DILIGENCE - Comprehensive CHK ListDocumento28 páginasLEGAL DUE DILIGENCE - Comprehensive CHK Listarskassociates0% (1)

- Due Diligence ChecklistDocumento13 páginasDue Diligence ChecklistanandAinda não há avaliações

- Checklist - LDDDocumento6 páginasChecklist - LDDadministratorAinda não há avaliações

- Finance Due DelegenceDocumento12 páginasFinance Due DelegenceMohammed Abu-ElezzAinda não há avaliações

- Due Diligence Request List for FinancingDocumento16 páginasDue Diligence Request List for Financingcah2009a100% (1)

- Product Highlights: Sun Grepa Power Builder 10Documento9 páginasProduct Highlights: Sun Grepa Power Builder 10Cyril Joy NagrampaAinda não há avaliações

- Start Up Expenses and CapitalizationDocumento2 páginasStart Up Expenses and CapitalizationVishal ChoudharyAinda não há avaliações

- Chapter 35.PDF AbriviationDocumento5 páginasChapter 35.PDF Abriviationvenkataswamynath channaAinda não há avaliações

- Country of GuyanaDocumento3 páginasCountry of Guyanasaeed_r2000422Ainda não há avaliações

- Research Paper Topics On Property ManagementDocumento6 páginasResearch Paper Topics On Property Managementlsfxofrif100% (1)

- Meet Your TeamDocumento2 páginasMeet Your TeamAyushman MathurAinda não há avaliações

- F6mys 2009 Dec QDocumento10 páginasF6mys 2009 Dec QDave Loh Chong HowAinda não há avaliações

- TAX UPDATE ON SALARY IN PAKISTAN FOR TAX YEAR 2020Documento1 páginaTAX UPDATE ON SALARY IN PAKISTAN FOR TAX YEAR 2020Malik Muhammad MuzamilAinda não há avaliações

- Employee Motivation ProjectDocumento82 páginasEmployee Motivation ProjectMohitraheja007100% (1)

- HARRELL AND OWENS FARM v. FEDERAL CROP INSURANCE CORPORATION Et Al ComplaintDocumento22 páginasHARRELL AND OWENS FARM v. FEDERAL CROP INSURANCE CORPORATION Et Al ComplaintACELitigationWatchAinda não há avaliações

- Health Insurance Premium Receipt-RaviDocumento2 páginasHealth Insurance Premium Receipt-RaviSanjay Balamurthy100% (1)

- List of Attorneys March 2018Documento21 páginasList of Attorneys March 2018LOVETH KONNIAAinda não há avaliações

- CL2017 - 26 - Guidelines On The Voluntary Cessation of Non-Life Insurance Business in The PhilippinesDocumento5 páginasCL2017 - 26 - Guidelines On The Voluntary Cessation of Non-Life Insurance Business in The PhilippinesRick SanchezAinda não há avaliações

- KERALA Hospital List PDFDocumento17 páginasKERALA Hospital List PDFKannan V Kumar50% (2)

- 2013 Frontier - CWA Agreement 4Documento281 páginas2013 Frontier - CWA Agreement 4Kyle LangsleyAinda não há avaliações

- Role of Financial Institutions For Funding EnterpriseDocumento2 páginasRole of Financial Institutions For Funding EnterpriseJahanzeb PashaAinda não há avaliações

- Ra 9520 Chapter VDocumento8 páginasRa 9520 Chapter VLorribelle OcenarAinda não há avaliações

- Transport Management & Motor Vehicle Act (PE AUE 611 B) : Model Question BankDocumento18 páginasTransport Management & Motor Vehicle Act (PE AUE 611 B) : Model Question BankSouvik BanerjeeAinda não há avaliações

- Asset Protection PlanDocumento36 páginasAsset Protection PlanJPF100% (2)

- Over View of Rupali Insurance Company LimitedDocumento24 páginasOver View of Rupali Insurance Company LimitedSumona Akther RichaAinda não há avaliações

- Auto Insurance ProjectDocumento83 páginasAuto Insurance ProjectSachin Hegde100% (1)

- Policy Issues and Access Cost and QualityDocumento6 páginasPolicy Issues and Access Cost and Qualityapi-240946281Ainda não há avaliações

- Indian Insurance Sector Development FactorsDocumento4 páginasIndian Insurance Sector Development Factorsselva kumarAinda não há avaliações

- TXN 2301E PC05.CaseDocumento6 páginasTXN 2301E PC05.Casejobarateta0% (2)

- Sargent 2014 Price BookDocumento452 páginasSargent 2014 Price BookSecurity Lock DistributorsAinda não há avaliações

- Shriram City Union Finance - Shriramcity - inDocumento20 páginasShriram City Union Finance - Shriramcity - inRamesh GaonkarAinda não há avaliações

- Car Insurance AssignmentDocumento19 páginasCar Insurance AssignmentSidAinda não há avaliações

- Solicitation, Offer, and Award: IMPORTANT - The "Offer" Section On The Reverse Must Be Fully Completed by OfferorDocumento25 páginasSolicitation, Offer, and Award: IMPORTANT - The "Offer" Section On The Reverse Must Be Fully Completed by Offerorniraj sainiAinda não há avaliações

- RAROC A Tool For Factoring RiskDocumento5 páginasRAROC A Tool For Factoring RiskSuhail KhanAinda não há avaliações

- MahaRERA FAQDocumento15 páginasMahaRERA FAQDhiren PrajAinda não há avaliações