Escolar Documentos

Profissional Documentos

Cultura Documentos

EPBM 12 IT Q Paper

Enviado por

Bhaskar BasakDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

EPBM 12 IT Q Paper

Enviado por

Bhaskar BasakDireitos autorais:

Formatos disponíveis

INDIAN INSTITUTE OF MANAGEMENT CALCUTTA EPBM-XII

Information Technology for Competitive Advantage 1. Sulabh supermarket is determined to please its customers with a customer loyalty card. At

present 30% of all shoppers are loyal to Sulabh. A loyal Sulabh customer shops at Sulabh outlet 80% of the time. A non-loyal (Sulabh) customer on the other hand shops 10% of the time. A typical customer spends Rs. 150 per week and Sulabh is operating on a 4% profit margin. The customer loyalty card will cost Sulabh an average of 10 paisa per rupee spent. We believe Sulabhs share of loyal customers will increase by an unknown amount between 2% and 10%. We also believe that the fraction of the time a loyal customer shops at Sulabh will increase by an amount between 5% and 15%. Should Sulabh adopt a customer loyalty card? Should Sulabh adopt the card if its profit margin in 8% instead of 4%? Prepare a spreadsheet in support of your recommendation. Make it sufficiently flexible and illustrative. [20]

2. Read the case Destiny Consulting Group given in the annexure and answer the following

questions.

a. Open a worksheet and in Sheet 1, write a few lines on what you think were the

flaws in Carols understanding?

b. In Sheet 2, replicate the Questionable Spreadsheet with Data Table using Excel.

Insert a chart PBT against HQ Expend. The chart should appear on a separate chart-sheet. Based on the spreadsheet table how many mistakes you can identify in the model that Carol has implemented in this worksheet?

c. In Sheet 3 build your model that addresses SQZ CEOs concern. Plot PBT obtained

from your model on the chart-sheet created earlier [5+20+25]

3. Given the increasing number of students in universities, a large number of courses are

offered every term. Each course has a different number of enrolled students and each classroom has different capacity, which makes the assignment of courses to classrooms complicated. Furthermore, it is not only enough to schedule a course in a classroom with a higher capacity than the number of enrolled students, since this can still lead to inefficient utilization of classrooms which can upset instructors and students. For example, given two courses with 6 and 19 enrolled students, respectively, and two classrooms with capacities of 20 and 50 students, respectively, both courses can fit in either of the classrooms. However, it would make more sense to assign the larger course to the larger classroom which will improve the students learning experience, allow additional students to attend

the class, and reduce the chances of cheating when conducting exams. Given a set of enrolments in courses and fixed-capacity classrooms, the objective is to minimize the total of the ratios of capacity to enrolments for the rooms allotted to courses. For the sake of simplicity, we assume students enrolling for courses are disjoint so that all the courses can be scheduled simultaneously. For example, consider a university consisting of 3 classrooms (Class A, Class B and Class C) and offering 3 courses (Course 1, Course 2 and Course 3). Lets also assume the capacities and enrolments shown in the Table below.

The optimal solution would be assigning Course 1 to Class A, 2 to C and 3 to B with a total value of 4.986. The solution of assigning 1 to B, 2 to C and 3 to A will lead to a higher value of 5.36. [30]

DESTINY CONSULTING GROUP (ABRIDGED)

Destiny Consulting Group (DCG) hibernated from September to April, and then came alive like a hungry bear in the summer months, when its principals, rising second-year MBA students, worked on projects for small companies. DCGs mission was to provide experience and much-needed compensation for its principals and to give high value-added advice to its loyal clients. Carol Smith had started with DCG two weeks earlier and had a live project that she had named the Downsize Debate, on which she had already given an interim report. The Downsize Debate Her first day on the job, a company had presented the question whether it should downsize a subsidiary by reducing its headquarters expenditures. In her interim report, Smith suggested reducing this expense by $1 million from its current level of $3.1 million, which would increase aftertax profit by $610,000. She included a printout of a pared-down spreadsheet in her report to the companys president. To her surprise, the president asked for the electronic file for the spreadsheet upon receipt of the report. He said that he was intrigued by her recommendation and wanted to try out some other downsizing possibilities. Smith now had in front of her a distressing memo from the president (Exhibit 1). After reflecting on the memo, Smith knew that, in her exuberance to provide a quick response on her initial project, she had acted hastily. Of course, she did not think that the headquarters of the SQZ subsidiary should be wiped out entirely. What kind of ruthless maniac does he think I am, anyway? she said out loud to herself. That thinking applied to the company as a whole would take out even President Lewis, to say nothing about fees for consultants. She had to admit, though, that the spreadsheet really supported cutting them out. She pulled the spreadsheet up on her screen to see what was going on.

As she worked, Smith thumbed through the notes of her conversations with Lewis and others. SQZ was a price taker, which was why she had simplified matters by using margin in her spreadsheet instead of having an explicit price and variable cost, which would net out to give margin. This approach still seemed fine to her. She checked her estimates of various numbers as well. Market share, for example, had been at various levels historically, but was always very close to SQZs advertising share (SQZs portion of total industry advertising expenditures). Her notes indicated that the rest of the industry was spending $1.5 million on advertising. Using this number, she calculated SQZs advertising share to be 45.3 percent, which was, in fact, the number she had in the spreadsheet. This apparently checked out, so she went on to consider the other source of headquarters (HQ) spending for personnel. HQ headcount worked on quality control and cost containment. Quality control was necessary to retain product competitiveness. It had been done every year for at least the last 10 years, because quality standards were continuously moving up. Lewis had declared that if it were not done at all, the company would need to discount price in order to compete. Similarly, cost containment had been done by HQ people in recent years through supervision of the assembly process and cost-reducing projects, which generally had led to price cuts in the industry. If the people who worked on cost containment were gone, variable costs might creep up. Smith had no idea what the effects of reducing headcount would be. She might try, say, $6 per unit if headcount were completely eliminated and a proportionate amount if headcount were partially reduced, just to see what would happen. She would not show this to Lewis; in fact, at this stage she saw her task as one of preparing to ask Lewis the right questions, not give answers. She would complete her understanding of the quantities and relationships in her spreadsheet, then note where the gaps in her understanding were.

Exhibit 1 DESTINY CONSULTING GROUP (ABRIDGED) The Critical Memo To : From : Subject Carol Smith John Lewis, President : Downsizing Study

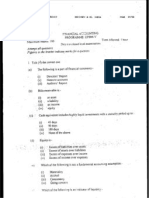

Thanks for your prompt report about downsizing our SQZ subsidiary. The sober question were all pondering is the level of headquarters (HQ) expenditures for SQZ. Your preliminary recommendation was to cut HQ expenditures by $1 million, based on your analysis, which was supported by the spreadsheet. I used your spreadsheet to test some other levels of spending. To my surprise, the profit got better and better as HQ expenditures were reduced, as you can see in my data table shown along with the spreadsheet below. This indicates we should reduce these expenditures to zero! This analysis seems nave. The spreadsheet apparently ignores several important considerations. Please tell me what is missing and how you would improve the spreadsheet. Headquarters expenditures go for three different activities. Forty percent is spent directly on advertising. The other 60 percent pays the salaries and support expenses of people who carry out two activities: quality control and cost containment. I see that you preserved the 60-40 split between headcount and advertising; this is still our planned allocation. Wont reductions in these activities hurt us? Our analysis has to consider the consequence of cutbacks. Im more than willing to articulate more on these consequences in our next meeting. The Questionable Spreadsheet with Data Table Downsize Debate (all units in thousand unless otherwise indicated) HQ Expend PBT HEADQUARTERS EXPENDITURES (000) $3,100 $977 Market Size (in thousand units) 300 0 4077 Market Share 45% 500 3577 Margin (per unit) $30 1000 3077 1500 2577 Headquarters headcount expense $1,860 2000 2077 Advertising expenditures $1,240 2500 1577 Unit volume 136 3000 1077 3500 577 Contribution $4,077 4000 77 Fixed cost $3,100 4500 -423 -------5000 -923 Profit before tax $977 5500 -1423 Taxes $381 -------Profit after tax $596

PAT $596 2487 2182 1877 1572 1267 962 657 352 47 -258 -563 -868

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Problems - Income TaxationDocumento4 páginasProblems - Income Taxationpedrosagucio44% (9)

- Aicpa Rel Questionss Far 2015Documento33 páginasAicpa Rel Questionss Far 2015soej1004100% (4)

- New Heritage Doll CompanyDocumento5 páginasNew Heritage Doll CompanyAnonymous xJLJ4CKAinda não há avaliações

- Main SOCE Forms 1 2 3 SheetsDocumento3 páginasMain SOCE Forms 1 2 3 SheetsJohn Rey Villafuerte88% (8)

- Ohada Accounting PlanDocumento72 páginasOhada Accounting PlanNchendeh Christian100% (3)

- P&L StatementDocumento2 páginasP&L StatementiPakistan100% (8)

- Professionalism Skills For Workplace Success 3rd Edition Anderson Test BankDocumento12 páginasProfessionalism Skills For Workplace Success 3rd Edition Anderson Test BankMichaelGarciamwpge100% (18)

- Accounting as an Information SystemDocumento9 páginasAccounting as an Information SystemDyvine100% (1)

- IT Question Paper of EPBM 13Documento2 páginasIT Question Paper of EPBM 13Pravin KohaleAinda não há avaliações

- MMIDocumento5 páginasMMISreekanth NagloorAinda não há avaliações

- EPBM 8 IT Q PaperDocumento10 páginasEPBM 8 IT Q PaperBhaskar BasakAinda não há avaliações

- EPBM 14 IT Q PaperDocumento3 páginasEPBM 14 IT Q PaperBhaskar Basak100% (1)

- EPBM 7 Micro Q PaperDocumento6 páginasEPBM 7 Micro Q PaperBhaskar BasakAinda não há avaliações

- Cost Acc EPBM 11 Q PaperDocumento4 páginasCost Acc EPBM 11 Q PaperBhaskar BasakAinda não há avaliações

- Indian Institute of Management Calcutta Epbm-Vi, Vii 'End Term Examination, 2007 Operations ManagementDocumento11 páginasIndian Institute of Management Calcutta Epbm-Vi, Vii 'End Term Examination, 2007 Operations ManagementBhaskar BasakAinda não há avaliações

- Om Epbm 9Documento5 páginasOm Epbm 9Bhaskar Basak100% (1)

- Om Epbm 8Documento6 páginasOm Epbm 8Bhaskar Basak100% (1)

- Cost Acc EPBM 3 Q PaperDocumento1 páginaCost Acc EPBM 3 Q PaperBhaskar BasakAinda não há avaliações

- Epbm VDocumento5 páginasEpbm VChandan KumarAinda não há avaliações

- HRM EPBM 14 Q PaperDocumento4 páginasHRM EPBM 14 Q PaperBhaskar Basak33% (3)

- Cost Acc EPBM 4 Q PaperDocumento2 páginasCost Acc EPBM 4 Q PaperBhaskar BasakAinda não há avaliações

- EPBM 2 MM1 Q PaperDocumento5 páginasEPBM 2 MM1 Q PaperBhaskar BasakAinda não há avaliações

- Micro Course Outline RevisedDocumento3 páginasMicro Course Outline RevisedBhaskar BasakAinda não há avaliações

- EPBM 5 Micro Q PaperDocumento5 páginasEPBM 5 Micro Q PaperBhaskar BasakAinda não há avaliações

- EPBM 7 BS 1 Q PapersDocumento11 páginasEPBM 7 BS 1 Q PapersBhaskar BasakAinda não há avaliações

- EPBM 4 Micro Q PaperDocumento5 páginasEPBM 4 Micro Q PaperBhaskar Basak100% (1)

- EPBM 5 BS 1 Q PaperDocumento8 páginasEPBM 5 BS 1 Q PaperSaikat PanAinda não há avaliações

- HRM Q Paper Image FilesDocumento4 páginasHRM Q Paper Image FilesBhaskar BasakAinda não há avaliações

- HRM Epbm 6-7 Q - PaperDocumento5 páginasHRM Epbm 6-7 Q - PaperBhaskar BasakAinda não há avaliações

- EPBM 4 BS 1 Q PaperDocumento8 páginasEPBM 4 BS 1 Q PaperBhaskar BasakAinda não há avaliações

- EPBM 5 FA QuestionDocumento6 páginasEPBM 5 FA QuestionBhaskar BasakAinda não há avaliações

- DMCIHI - 030 SEC Form 20-IS - Definitive Info Statement - April 6 PDFDocumento315 páginasDMCIHI - 030 SEC Form 20-IS - Definitive Info Statement - April 6 PDFgilbert213Ainda não há avaliações

- Intern Ship ProjectDocumento75 páginasIntern Ship Projecttarun nemalipuriAinda não há avaliações

- Chapter07 XlssolDocumento49 páginasChapter07 XlssolEkhlas AmmariAinda não há avaliações

- Lesson 6 Tax Planning With Reference To Specific Magement DecisionDocumento49 páginasLesson 6 Tax Planning With Reference To Specific Magement DecisionkelvinAinda não há avaliações

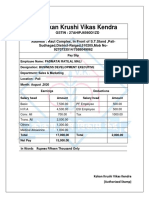

- Kokan Krushi Vikas Kendra pay slipsDocumento3 páginasKokan Krushi Vikas Kendra pay slipsDevenAinda não há avaliações

- AF210 ASSIGMENTDocumento14 páginasAF210 ASSIGMENTdiristiAinda não há avaliações

- L5 - ABFA1173 POA (Lecturer)Documento6 páginasL5 - ABFA1173 POA (Lecturer)Tan SiewsiewAinda não há avaliações

- The Business Plan WorksheetDocumento13 páginasThe Business Plan WorksheetMadduma, Jeromie G.Ainda não há avaliações

- ACC 577 Week 1 QuizDocumento8 páginasACC 577 Week 1 QuizMaryAinda não há avaliações

- Central Bay Reclamation and Dev. Corp. vs. COA and PRADocumento14 páginasCentral Bay Reclamation and Dev. Corp. vs. COA and PRAsamantha.makayan.abAinda não há avaliações

- Knowledge ReportDocumento15 páginasKnowledge ReportarsenalmanikandanAinda não há avaliações

- EC - Lecture 001 - Principles of Engineering EconomicsDocumento8 páginasEC - Lecture 001 - Principles of Engineering EconomicsDIANNEMICHELLE PINEDAAinda não há avaliações

- 19541journal Feb2009Documento167 páginas19541journal Feb2009Divya SrikanthAinda não há avaliações

- Garlic & Ginger Paste Project ProfilesDocumento7 páginasGarlic & Ginger Paste Project ProfilesArshad SheikAinda não há avaliações

- Crispynach Business PlanDocumento47 páginasCrispynach Business PlanBaby PinkAinda não há avaliações

- Mindtree Shareholders Report Q2 FY23Documento6 páginasMindtree Shareholders Report Q2 FY23Punith DGAinda não há avaliações

- Lego Group Annual Report 2015Documento72 páginasLego Group Annual Report 2015Josue Teni BeltetonAinda não há avaliações

- Nguyễn Minh Nhật KNC03 31221024307 P1.2LO 45Documento4 páginasNguyễn Minh Nhật KNC03 31221024307 P1.2LO 45Bảo KhangAinda não há avaliações

- Ch09 PDFDocumento37 páginasCh09 PDFAsh1Ainda não há avaliações

- Anaysis of Financial Statement of U.P.C.LDocumento73 páginasAnaysis of Financial Statement of U.P.C.Lmo_hit123Ainda não há avaliações

- Accounting ProjectDocumento36 páginasAccounting ProjectNin QetelauriAinda não há avaliações

- Income tax deductions under 40 charsDocumento4 páginasIncome tax deductions under 40 charsAgie MarquezAinda não há avaliações