Escolar Documentos

Profissional Documentos

Cultura Documentos

The Mondragón Cooperative Corporation

Enviado por

Corazon ValdezDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

The Mondragón Cooperative Corporation

Enviado por

Corazon ValdezDireitos autorais:

Formatos disponíveis

The Mondragn Cooperative Corporation (MCC): An Introduction

by Fred Freundlich Ownership Associates, Inc., Bilbao, Spain Paper presented at Shared Capitalism: Mapping the Research Agenda A conference sponsored by the National Bureau of Economic Research Madison Hotel, Washington D.C., May 22 - 23, 1998

The Mondragn Cooperative Corporation, or MCC, is often considered the most successful example of worker-owned enterprise in the world. Taking its name from the small town in the Basque Country of Spain where it was founded, the MCCs reach now extends across Spain, Europe and the globe. Its highly integrated network of cooperative businesses competes successfully with conventional corporate rivals both locally and worldwide. This paper provides a brief introduction to the MCC and is divided into five sections: 1. Current Statistics 2. Historical Development 3. The Current Structure of the MCC 4. The Internal Structure of an MCC firm 5. The Evolving Role of the Bank-the Caja Laboral-and its Entrepreneurial Division Appendix A. The Dimensions of the Mondragn Cooperative Group

1. Current Statistics

What started as one firm and roughly 25 people in 1956 is now a major international business with a work force of over 34,000, employed in some 100 worker-owned enterprises and affiliated organizations, all of which are integrated into the Mondragn Cooperative Corporation (MCC). In 1997, MCC had total sales of approximately $5 billion, exported nearly half its industrial sales, and its Financial Group (bank and social security/pension fund) had nearly $7.5 billion of various financial assets under management. MCC firms are the leading producer of domestic appliances and machine tools in Spain, the largest domestically-based supermarket chain in the country, and the third largest supplier of automotive components in Europe. Among its other products and services, one finds automated manufacturing cells, satellite dishes, luxury buses, industrial presses, large metal structures, engineering consulting, and software development, to name a few. Solid comparative performance data on measures profitability and productivity are hard to come by. Further, the MCC accepts a number of costs, such as support for a variety of educational institutions, that ordinary corporations do not, which makes comparing margins deceptive. The comparative research that is available generally shows that the MCC outperforms its conventionally-owned counterparts. Preliminary data on the machine tool sector, for example, indicate that companies in MCCs machine tool division are approximately 5.6% more efficient (value of output for a given value of inputs) than competitors in the region for the period 19901993. See Appendix A for a summary of 1997 statistics and growth since 1972. The Mondragn group also has an exceptional record of employment growth, though a curious mix of factors explains this record. These factors cannot be examined here, but they include a strict no-layoff policy for members, an extraordinarily high enterprise survival rate, and the use of a certain number of temporary workers in companies operating in volatile markets.

2. Historical Development

The historical roots of Mondragn, not surprisingly, make a complicated story in themselves which I will just touch on here. To begin, the Basque Country, with substantial deposits of iron ore and

coal within its borders and nearby, developed an industrial tradition over the centuries. Iron and steel industries, metalworking of various kinds, and shipbuilding all prospered in the late nineteenth and twentieth centuries. In 1941, into an environment in the Basque Country of poverty and repression following the Spanish Civil War, the Archbishop of the region sent a young priest, Jose Maria Arizmendiarrieta. His quiet but forceful and charismatic leadership played a critical role in the development of the cooperatives, another complex story. In short, it should be said that it was he who inspired and did much of the legwork in support of several of the groups early institutional innovations; indeed he is perhaps most responsible for making institutional adaptation an integral part of the culture of the Mondragn network. Arizmendiarrieta began with education. In 1943, he established a small technical school for young people. As the years passed, he organized local associations of all kinds, usually under the protective auspices of the Church, and, based on his reading in social science and Catholic Social Doctrine, he gradually and unwittingly introduced the participants to a humanist kind of philosophy as well to new ideas about economic and social relations. Over the years, a nucleus of committed youth formed around Arizmendiarrieta, and, eventually, five of that group, graduates of his technical school, earned degrees in engineering and, in 1955-56, formed a business making simple paraffin stoves called Ulgor. As the economy recovered from the war, new businesses found relatively easy local and regional markets for their goods. There was domestic competition, but the Spanish market was highly protected from outside pressure in the 1950s and 1960s-a key factor in Mondragns companies ability to get themselves up and running. Ulgor experienced substantial success in those years, as did several other cooperative businesses that had been formed in its wake. Arizmendiarrieta soon convinced the group that they should have a direct source of capital-their own bank-and in 1959 helped them establish the Caja Laboral Popular. More on the bank later. By the mid-1960s then, Mondragn firms had become established; several had grown to reasonable size, and the number of firms in the group increased to over 30. They all became legally affiliated with the Caja Laboral by signing a "Contract of Association", adopted the same set of cooperative corporate by-laws, and sent representatives to the Cajas General Assembly for making overall group policy. Business continued to be good and several other important Mondragn institutions took shape: an engineering college in 1968; the precursor to the supermarket/retail chain, Eroski, in 1969; Lagun Aro, the networks independent social security and pension service became independent from the Caja in 1973, and, in 1974, Ikerlan, the groups main R&D center opened its doors. Business growth continued apace through this period and by 1975 Mondragn firms employed nearly 14,000. The group has continued to expand since then, but not explosively, as in the early years. The same crises that affected the rest of the industrialized world since the mid-1970s, first in energy prices and then economic restructuring, also hit hard in Mondragn. The group has remained quite successful from that time to the present, but it has had to face its share of economic challenges, and its focus has shifted from rapid growth to consolidation and meeting the increasing challenges of international competition. A defining feature of the Mondragn cooperatives throughout their history has been the ability to adapt their overall institutional structures to changing circumstances. In the early years, most of the cooperatives operated more or less independently from day to day, while they were joined through the Caja. But, as markets became larger and competitive, the firms began to see advantages in joining forces. Starting as early as the mid-1960s, and then to a much greater extent in the late 1970s and 1980s, the companies formed regional sub-groups to provide themselves more comprehensive strategic management and related services. By the late 1980s, the group as a whole felt that this arrangement was no longer adequate. Markets were global and Spain had become integrated into the competitive environment of the European Union.

3. Current Structure

The Mondragn group responded to these competitive pressures in several ways, but the most significant response was a special brand of legal-structural unification. The new structure, created in 1991, gathered all the enterprises and support organizations under one corporate roof, the MCC. The regional subgroups were mostly dissolved and the individual co-operative enterprises were grouped instead by industrial sector within the MCCs new structure: three main business groups (Financial, Industrial, and Retail) and, within the Industrial Group, seven different divisions. The MCC as a whole is now managed by a President and his General Council, which is

comprised of nine vice-presidents (one per group or division) and the directors of the six MCC Central Departments. MCC officials emphasize that the purpose of the reorganization was most definitely not centralized operational control, but rather, closer coordination of activities within common business sectors, improved economies of scale, and greatly strengthened strategic planning. The Caja Laboral remains a central institution, but now devotes itself to the banking business more strictly defined. Its venture capital, consulting and group policy-making functions have largely been moved elsewhere (see below and Section 5). The new MCC management bodies are accountable to two representative governance structures, a Cooperative Congress and a Standing Committee. The Cooperative Congress is made up of representatives elected from all the cooperatives in the Corporation (in indirect proportion to their size) and is the basic policy-making body for the MCC as a whole, replacing the Cajas General Assembly. The Standing Committee consists of 17 people elected from among the previously elected Governing Councils of the sectoral groups and divisions. The Standing Committee appoints the President of the MCC (the CEO), must approve the Presidents choices for the General Council, and generally serves as an internal board of directors. While the MCC now appears at first glance to be much more like a conventional conglomerate, key Mondragn principles are still in place. Each individual cooperative firm remains, legally and, to a large degree, functionally, an autonomous unit controlled ultimately by its General Assembly of worker-members. Each firm joined (or, in a few cases, rejected joining) the MCC by a vote of its General Assembly, and can vote to leave at any time. Still, the new arrangements have generated controversy within the group over issues such as the centralization of authority, the bureaucratic distancing of senior management from the membership, and others. This is where the MCC stands today. It has become a multi-billion dollar international enterprise with an inventive internal structure that aims to strengthen both competitiveness and worker ownership.

4. Internal Structure of an MCC Company

Virtually all the co-operative companies in the MCC have the same by-laws and internal structure. The General Assembly of worker-members is the highest authority in the firm and makes decisions based on the principle of one member-one vote. It must meet at least once a year (and usually meets twice), sets or revises basic company policy (within the general framework of MCC policies), reviews and approves annual business plans, and elects a Governing Council (an internal Board of Directors) and a President of the Governing Council. The Council members and President serve four-year terms and may be re-elected. The Governing Council appoints-and can remove-the CEO, must approve his or her choices for senior executives. It meets bi-weekly or monthly to make or revise policy proposals for the General Assembly to consider and to monitor the management teams and the companys performance and its implementation of company policy. MCC enterprises also have a Social Council which meets monthly and is composed of representatives elected by department who serve two-year terms and may be re-elected. The Social Council serves to facilitate communication between management and the frontline and to represent frontline workers perspective in discussions with senior management. It will take up any matter of importance to the work force, but usually focuses its communications with management and its constituents on concerns related to the working conditions, health and safety, work calendar and staffing and work relations. That is a brief summary of company governance in Mondragn-how basic policy and long-term issues are decided. The structures for day-to-day business management, on the other hand, are very similar to those in conventional companies. Many MCC firms, just as other leading conventional companies, have implemented cutting-edge, high-involvement systems-work teams at different levels, flattened hierarchies, various participatory Total Quality and Customer Satisfaction initiatives, etc. Other MCC firms are more traditional or still making their way in this realm. It is, however, an explicit MCC policy priority for its companies to promote and develop participatory management practices, both for philosophical reasons and for business performance reasons.

5. The Evolving Role of the Bank-The Caja Laboral-and its Entrepreneurial Division

Earlier I mentioned the Mondragn groups high rate of start-up success and enterprise survival. A key reason for this success is the groups development of "support institutions" from the very beginning One of these that I mentioned earlier is the business groups, at first based on region, and later based on sector. But perhaps the most important of these support institutions, especially in the first two decades, was the groups bank, the Caja Laboral. Employee-owned firms have traditionally had great difficulty getting adequate financing. Father Arizmendiarrieta, in part because of this problem, inspired the early leaders in Mondragn to create a finance organization. Starting in a small room with a handful of people and funds, the Caja Laboral now has $5.6 billion in deposits and serves MCC companies, the conventional business community and the general public through some 250 branches around the Basque Country. Without a doubt, the Caja Laboral played a fundamentally important role in supporting the development of the cooperatives, particularly in the early going. It did so by design-it was created specifically to offer patient capital, to cater generally to the financial needs of both new cooperative enterprises and other cooperatives experiencing difficulties. The Caja fulfilled another key supporting role over the years through a unique internal organization called the "Entrepreneurial Division". This divisions job was to provide extensive management and technical consulting to new and expanding ventures, and to troubled firms in the network. The assistance of the Entrepreneurial Divisions was crucial to the long-term success of many enterprises in the group. The Cajas role has changed markedly in the last decade, however. As the cooperative companies got larger and more established, and as their financial needs and the market and regulatory environment evolved, the MCC and the Caja made the strategic decision for the Caja to focus more on traditional consumer and business banking. In 1991 the Entrepreneurial Division was dissolved. However, the centrally important functions of the former Caja and Entrepreneurial Division have by no means been abandoned. They simply have been transferred to other institutional locations within the MCC. An institution called the Central Intercooperative Fund, to which each co-operative company contributes 10% of profits every year, and other similar institutions, provide the patient venture capital, while the management and technical assistance is provided by MCCs Central Departments or its sectoral division staff. In addition, a portion of the former staff of the Entrepreneurial Division created a new MCC cooperative, LKS Consulting (and later another, LKS Engineering), which sells consulting services to the cooperatives and other organizations. ***** In conclusion, the Mondragn Cooperative Corporation is an outstanding success. While not without its own challenges, the MCC offers important lessons for any enterprise considering employee involvement in business ownership.

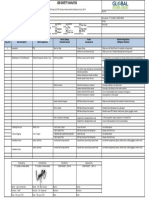

APPENDIX A: The Dimensions of the Mondragn Cooperative Group.

Current Statistics

(in US$, assuming 146 pesetas/$ for 1997; figures approximate) SALES & EXPORTS, 1997: Industrial Division Retail Division -----------------Total $2,295 billion $2,626 billion -----------------$5.021 billion (an 11.6% increase over 1996)

Exports, Industrial Div. $1.06 billion (46% of sales)

FINANCIAL DIVISION, 1997 Net Credit Investment Funds under management WORK FORCE* Industrial Division Retail Division Financial Division Corporate & related* -----------------Total 18,797 (55%) 13,291 (39%) 1,814 (6%) 495 (1%) -----------------34,397 (100%) $3.0 billion $7.4 billion (bank + social security & pension fund)

*includes staff at the Mondragn University and other, related institutions. Online Resources: Articles & Publications home | what's new | services | ownership culture survey | online resources | about us | contact us Ownership Associates, Inc., 122 Mt. Auburn Street, Cambridge, MA 02138 tel: 617-868-4600, fax: 617-868-7969, e-mail: oa@ownershipassociates.com

1991 - 2010 Ownership Associates, Inc.

Website updated: April 12, 2009

Você também pode gostar

- Mondragón 1Documento10 páginasMondragón 1Thomas W ChoateAinda não há avaliações

- The Mondragon SucessDocumento14 páginasThe Mondragon SucessSri HimajaAinda não há avaliações

- Making Mondragón: The Growth and Dynamics of the Worker Cooperative ComplexNo EverandMaking Mondragón: The Growth and Dynamics of the Worker Cooperative ComplexAinda não há avaliações

- Humanising Work: Co-operatives, credit unions and the challenge of mass unemploymentNo EverandHumanising Work: Co-operatives, credit unions and the challenge of mass unemploymentAinda não há avaliações

- Yes, There Is An Alternative To Capitalism Mondragon Shows The WayDocumento3 páginasYes, There Is An Alternative To Capitalism Mondragon Shows The Waypapios12345Ainda não há avaliações

- Mondragon CorpDocumento52 páginasMondragon CorpimelAinda não há avaliações

- Co-Operative Banks-A Helping Hand For Small and Medium EnterprisesDocumento4 páginasCo-Operative Banks-A Helping Hand For Small and Medium EnterprisesSandhya GAinda não há avaliações

- Summary Of "The Mercosur Of Civil Society" By Gerardo Caetano: UNIVERSITY SUMMARIESNo EverandSummary Of "The Mercosur Of Civil Society" By Gerardo Caetano: UNIVERSITY SUMMARIESAinda não há avaliações

- Irish Business and Society: Governing, Participating and Transforming in the 21st CenturyNo EverandIrish Business and Society: Governing, Participating and Transforming in the 21st CenturyAinda não há avaliações

- Multinational Corporations and Development in AfricaDocumento18 páginasMultinational Corporations and Development in Africaolarewaju AnimasahunAinda não há avaliações

- The Role of Cooperative Enterpreneurship and Firms in Organising Economic ActivitiesDocumento24 páginasThe Role of Cooperative Enterpreneurship and Firms in Organising Economic ActivitiesThach BunroeunAinda não há avaliações

- Summary Of "The Red Rose Of Nissan" By John Holloway: UNIVERSITY SUMMARIESNo EverandSummary Of "The Red Rose Of Nissan" By John Holloway: UNIVERSITY SUMMARIESAinda não há avaliações

- CCGL 9069-SummaryDocumento3 páginasCCGL 9069-Summary吳嘉希Ainda não há avaliações

- The OECD and the Challenges of Globalisation: The governor of the world economyNo EverandThe OECD and the Challenges of Globalisation: The governor of the world economyAinda não há avaliações

- Cooperative in GermanyDocumento13 páginasCooperative in GermanyPrincess MoralesAinda não há avaliações

- The Social Economy in The UK: Roger Spear, CRU, Open University, UKDocumento20 páginasThe Social Economy in The UK: Roger Spear, CRU, Open University, UKjisanus5salehinAinda não há avaliações

- The Spanish Insurance Market in 2017: MAPFRE Economic ResearchDocumento162 páginasThe Spanish Insurance Market in 2017: MAPFRE Economic ResearchĐặng Xuân HiểuAinda não há avaliações

- Licensed larceny: Infrastructure, financial extraction and the global SouthNo EverandLicensed larceny: Infrastructure, financial extraction and the global SouthNota: 4.5 de 5 estrelas4.5/5 (2)

- Achieving Workers' Rights in the Global EconomyNo EverandAchieving Workers' Rights in the Global EconomyAinda não há avaliações

- The Machine That Changed the World: The Story of Lean Production-- Toyota's Secret Weapon in the Global Car Wars That Is Now Revolutionizing World IndustryNo EverandThe Machine That Changed the World: The Story of Lean Production-- Toyota's Secret Weapon in the Global Car Wars That Is Now Revolutionizing World IndustryNota: 4 de 5 estrelas4/5 (8)

- Business Establisher: A Comprehensive Guide For EntrepreneursNo EverandBusiness Establisher: A Comprehensive Guide For EntrepreneursAinda não há avaliações

- Ensayo Trabajo Practico InglesDocumento7 páginasEnsayo Trabajo Practico InglesvillamizaracevedofrancymilenaAinda não há avaliações

- Show Me the Money: How to Find the Cash to Get Your Business Off the GroundNo EverandShow Me the Money: How to Find the Cash to Get Your Business Off the GroundAinda não há avaliações

- Glob MNCDocumento51 páginasGlob MNCopanxAinda não há avaliações

- What It Takes To Be An Entrepreneur in Romania: Tatiana SEGALDocumento11 páginasWhat It Takes To Be An Entrepreneur in Romania: Tatiana SEGALAlex ObrejanAinda não há avaliações

- Mckinsey Executive SummaryDocumento26 páginasMckinsey Executive SummarynroposAinda não há avaliações

- Stuart Larkin RiddDocumento69 páginasStuart Larkin Riddcekk99Ainda não há avaliações

- El Infonavit. Retrovisión y Perspectivas: ¿De institución social del estado mexicano a institución financiera de mercado?No EverandEl Infonavit. Retrovisión y Perspectivas: ¿De institución social del estado mexicano a institución financiera de mercado?Ainda não há avaliações

- Mondragon A Better Way To Go To WorkDocumento5 páginasMondragon A Better Way To Go To WorkAnantaAinda não há avaliações

- The OECD and The World Market: Antecedents of GlobalizationDocumento16 páginasThe OECD and The World Market: Antecedents of GlobalizationPaul CammackAinda não há avaliações

- 2006 - 2010 Activity ReviewDocumento38 páginas2006 - 2010 Activity ReviewRay CollinsAinda não há avaliações

- The Social Licence for Financial Markets: Reaching for the End and Why It CountsNo EverandThe Social Licence for Financial Markets: Reaching for the End and Why It CountsAinda não há avaliações

- Lecture Notes For Industrial EconomicsDocumento18 páginasLecture Notes For Industrial Economicsnv71% (21)

- Transformation Manifesto Applied To The Economist GroupDocumento3 páginasTransformation Manifesto Applied To The Economist GroupNicole StankovAinda não há avaliações

- Against the Grain: Insights from an Economic ContrarianNo EverandAgainst the Grain: Insights from an Economic ContrarianAinda não há avaliações

- Upskill: 6 Steps to Unlock Economic Opportunity for AllNo EverandUpskill: 6 Steps to Unlock Economic Opportunity for AllAinda não há avaliações

- Capital for Champions: SPACs as a Driver of Innovation and GrowthNo EverandCapital for Champions: SPACs as a Driver of Innovation and GrowthAinda não há avaliações

- Tarea 3 (5 Paginas)Documento6 páginasTarea 3 (5 Paginas)Ariadne NicolleAinda não há avaliações

- "The History of An Experience": Mondragon Corporacion CooperativaDocumento49 páginas"The History of An Experience": Mondragon Corporacion CooperativaAnantaAinda não há avaliações

- Bba Thesis TopicsDocumento5 páginasBba Thesis Topicshwxmyoief100% (2)

- Module 3 The Contemporary World 1st Sem 2022Documento8 páginasModule 3 The Contemporary World 1st Sem 2022Jesse CunananAinda não há avaliações

- Lecture Notes For Industrial EconomicsDocumento18 páginasLecture Notes For Industrial EconomicsJaga SwainAinda não há avaliações

- The Development of Cooperation inDocumento6 páginasThe Development of Cooperation inRiska NasutionAinda não há avaliações

- The Role of Cooperative Societies in Economic Development: Munich Personal Repec ArchiveDocumento21 páginasThe Role of Cooperative Societies in Economic Development: Munich Personal Repec ArchiveBiruktawite SolomonAinda não há avaliações

- Brand Breakout: How Emerging Market Brands Will Go GlobalNo EverandBrand Breakout: How Emerging Market Brands Will Go GlobalAinda não há avaliações

- Law and Economics Yearly Review: Volume 8 - Part 2 - 2019 ISSN 2050-9014Documento38 páginasLaw and Economics Yearly Review: Volume 8 - Part 2 - 2019 ISSN 2050-9014AMNA KHAN FITNESSSAinda não há avaliações

- Ibm AssignentDocumento3 páginasIbm Assignentaqsa tahirAinda não há avaliações

- International Business in Changing Global Environment: Ivica KatavićDocumento13 páginasInternational Business in Changing Global Environment: Ivica KatavićShobhit ShuklaAinda não há avaliações

- Compare and Contrast Arrival's Prospects For Internationalisation Student's Name-Student's ID - Institute's NameDocumento16 páginasCompare and Contrast Arrival's Prospects For Internationalisation Student's Name-Student's ID - Institute's NameR AryaAinda não há avaliações

- Overview of MNCS in IndiaDocumento12 páginasOverview of MNCS in IndiaAshish pariharAinda não há avaliações

- International Business - Losni ManokaranDocumento12 páginasInternational Business - Losni ManokaranManokaran Losni0% (1)

- Strategic Cost Management: Discussion QuestionsDocumento45 páginasStrategic Cost Management: Discussion QuestionsAswat AlfiandiAinda não há avaliações

- Exercise 5 VATDocumento3 páginasExercise 5 VATQuenie De la CruzAinda não há avaliações

- Plant Human Resources Manager-DUBAIDocumento2 páginasPlant Human Resources Manager-DUBAIJc Duke M EliyasarAinda não há avaliações

- Test Bank For Essentials of Marketing Research A Hands-On Orientation 1e Naresh MalhotraDocumento28 páginasTest Bank For Essentials of Marketing Research A Hands-On Orientation 1e Naresh Malhotrasobiakhan52292Ainda não há avaliações

- E3sconf Netid2021 02032Documento7 páginasE3sconf Netid2021 02032prabathnilanAinda não há avaliações

- Lone Pine Café: Transaction Sheet For 1st Nov 05Documento6 páginasLone Pine Café: Transaction Sheet For 1st Nov 05Dhanu ArunAinda não há avaliações

- Pre-Sales Analyst: Internal Use - ConfidentialDocumento2 páginasPre-Sales Analyst: Internal Use - ConfidentialAmarjeet KrishhnanAinda não há avaliações

- Tayactac AIS With Analytics Workbook v2023Documento58 páginasTayactac AIS With Analytics Workbook v2023kentharvaeAinda não há avaliações

- FIN Money & Banking Chap 9 - Transactions Costs, Asymmetric Information, and The Structure of The Financial SystemDocumento2 páginasFIN Money & Banking Chap 9 - Transactions Costs, Asymmetric Information, and The Structure of The Financial SystemGene'sAinda não há avaliações

- Part 2 Competency Exam - WORKSHEETDocumento4 páginasPart 2 Competency Exam - WORKSHEETCondoriano BatumbakalAinda não há avaliações

- Name of Products To Be SurveyDocumento3 páginasName of Products To Be SurveyMadelyn ArimadoAinda não há avaliações

- Omicron/Tekton Construction Joint VentureDocumento3 páginasOmicron/Tekton Construction Joint VentureRalph GalvezAinda não há avaliações

- HY80 Alloy Steels PDFDocumento3 páginasHY80 Alloy Steels PDFLuis GarciaAinda não há avaliações

- CB 2020 - Furniture - Packaging - GuidelinesDocumento31 páginasCB 2020 - Furniture - Packaging - Guidelines44abcAinda não há avaliações

- RF 10-04 Rev 01 - Terms and Conditions For Halal Certification BodiesDocumento4 páginasRF 10-04 Rev 01 - Terms and Conditions For Halal Certification BodiesHasan Al khooriAinda não há avaliações

- Certificate of IncorporationDocumento1 páginaCertificate of IncorporationEntropy_UK_Ltd_2012Ainda não há avaliações

- JSA LandFill KHPT-BBB JODocumento1 páginaJSA LandFill KHPT-BBB JOICEDA HumAinda não há avaliações

- Contingency CalculatorDocumento3 páginasContingency CalculatorFunny NameAinda não há avaliações

- Programme - Abstracts - EUFIRE 2020Documento63 páginasProgramme - Abstracts - EUFIRE 2020Monica GhergheAinda não há avaliações

- Meet Yogesh Patel First Report SipDocumento11 páginasMeet Yogesh Patel First Report SipMeet PatelAinda não há avaliações

- Can Abusive Leadership Yield Positive Results? Role of Family Motivation As A ModeratorDocumento4 páginasCan Abusive Leadership Yield Positive Results? Role of Family Motivation As A ModeratorGener Lemon DalayAinda não há avaliações

- Din en 13599 - 2014Documento23 páginasDin en 13599 - 2014alferedAinda não há avaliações

- Executive SummaryDocumento7 páginasExecutive SummaryAnnamalai S100% (1)

- Camargo v. AbbVieDocumento103 páginasCamargo v. AbbVieCrainsChicagoBusinessAinda não há avaliações

- 3) Can A Corporation Have Conscience of Its OwnDocumento32 páginas3) Can A Corporation Have Conscience of Its OwnMugdha TipugadeAinda não há avaliações

- Asnakew Final MSC Thesis Approved@DOE11Documento84 páginasAsnakew Final MSC Thesis Approved@DOE11zewdu mekonnenAinda não há avaliações

- DDA Strategic PlanDocumento92 páginasDDA Strategic PlanJudith AinembabaziAinda não há avaliações

- Guarani Ñe'Ẽ Ha Iñe'Ẽporãhaipyre: TembiaporãDocumento3 páginasGuarani Ñe'Ẽ Ha Iñe'Ẽporãhaipyre: TembiaporãGabrielaAinda não há avaliações

- IKEA's Global Sourcing ChallengeDocumento15 páginasIKEA's Global Sourcing ChallengeFIN GYAAN100% (1)

- Savo Rev16Documento38 páginasSavo Rev16Sameh Yassien100% (1)