Escolar Documentos

Profissional Documentos

Cultura Documentos

Investigates The Effects of Accounts Receivables Period

Enviado por

Smita DasDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Investigates The Effects of Accounts Receivables Period

Enviado por

Smita DasDireitos autorais:

Formatos disponíveis

investigates the effects of accounts receivables period, inventory period, cash conversion cycle, firm size, firm growth,

leverage and fixed financial assets on firm profitability. The dependent variable of the regression model is return on assets. Three of totally seven independent variables of the regression model are directly related with working capital management. These are accounts receivables period, inventory period and cash conversion cycle, respectively.

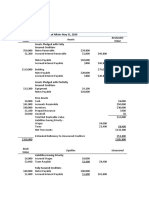

Table 1: Definitions of Variables

Table 2:

Descriptive statistics (5.843 ISE Listed Manufacturing Firms-19982007)

Variables ROA ACRP INVP CCC SIZE LEV FIX

Mean 0.0206 139.078 135.6185 153.1316 17.5674 0.4049 0.0365

Minimum -0.8724 50.5784 50.5120 59.5562 14.1020 -0.5320 0.0002

Maximum 0.6652 299.2946 299.2859 299.3328 19.4990 0.6490 0.1000

***, *Significant at 0.01 and 0.1 levels, respectively

Dependent Variable ROA Constant ACRP INVP CCC SIZE LEV FIX Adj R^2 F(sig.0.000) Durbin Watson

B value

t-value 1.709 -4.156 -4.794 -0.427 1.404 -9.979 1.015

sig 0.088 0.000 0.000 0.669 0.160 0.000 0.310

-0.056 -0.67 -0.006 0.018 -0.130 0.013 0.048 42.849 1.745

Regression model is as follows: ROAi = i+i1ACRPi+i2INVPi+i3CCCi+i4SIZEi+i5GROWTHi+i6LEVi+i7FIXi+i where, i is constant; i1-7 are coefficients of variables 1 thru 7 and i is residual term. EMPIRICAL RESULTS The relationships between dependent and independent variables are analysed by the regression model mentioned earlier. Descriptive statistics (Table 2) and empirical results are given in Table 2 and 3, respectively.

Empirical findings of the study indicate that ACRP and INVP, which are -as mentioned before- directly related variables with working capital management, have significantly negative effects on firm profitability. This means that while accounts receivables and inventory periods lengthen, profitability decreases, or vice versa. The other variables that have significant effects on firm profitability are GROWTH and LEV, affecting it positively and negatively, respectively (Table 3). This means that any increase in sales leads profits to grow, while any increase in debt causes profitability to fall. The other variables included in the regression model (CCC, SIZE and FIX) have no statistically significant effects on firm profitability. CONCLUSION In financial management, it is possible to mention that studies regarding working capital management are not as popular as the ones related with capital budgeting and capital structure. From this perspective, this study aims to analyze determinants of firm profitability by means of variables related with working capital management practices using a sample of Turkish manufacturing firms for the period of 1998-2007. Empirical results show that, for the mentioned sample and period, accounts receivables period, inventory period and leverage significantly and negatively affect profitability of Turkish manufacturing firms, while firm growth (in sales) significantly and positively. However, it is also concluded that cash conversion cycle, size and fixed financial assets have no statistically significant effects on firm profitability of Turkish manufacturing firms for the period of 1998-2007. Results suggest that firm profitability can be increased by shortening accounts receivables and inventory periods. The negative relationship between accounts receivable period and profitability may be due to that customers want more time to assess quality of products they buy from firms with declining profitability (Deloof, 2003). However, this empirical finding conflicts with some of financial models explaining trade credit. Trade credits are, in general, more profitable short-term investments than marketable securities (Emery, 1984b), so it is rational for, especially, high-profit firms that are more liquid, to transfer relatively high amounts of trade credit to their buyers. Because, according to the liquidity theory, liquid firms are less likely to demand trade credit and more likely to offer it. Another empirical finding is similar, the negative relationship between inventory period and profitability and this may be the result of declining sales leading to lower profits and more inventory, as stated in Deloof (2003) s study. Leverage is another variable affecting firm profitability negatively. This finding may be explained by the suggestions that highly-leveraged firms are softer competitors that will curtail investment (Myers, 2003), so their insufficient power of competition may lead decreases in profitability. The only variable in the

model of the study that has significantly positive effect on profitability is firm growth (in sales). In case of that firm may gain some advantages like monopoly or bargaining power due to growth as a reflection of economies of scale (Klter and Demirgne , 2007), a positive relationship between growth and profitability is expected.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Working Capital Management93Documento73 páginasWorking Capital Management93Smita DasAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Leadership GE CASE AnalysisDocumento19 páginasLeadership GE CASE Analysisavik_bang100% (11)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Working Capital Management93Documento73 páginasWorking Capital Management93Smita DasAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Comm CollegeDocumento3 páginasComm CollegeSmita DasAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- National Aluminium Company Limited (NALCO)Documento5 páginasNational Aluminium Company Limited (NALCO)Smita DasAinda não há avaliações

- Audit Procedure of BankDocumento65 páginasAudit Procedure of BankSachin Pacharne0% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Accoutancy Sample Paper 2023Documento44 páginasAccoutancy Sample Paper 2023Yashabh JosephAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Internship Report On The Bank of PunjabDocumento91 páginasInternship Report On The Bank of PunjabArslan73% (22)

- BurkinaFaso L'OccitaneDocumento20 páginasBurkinaFaso L'OccitaneSonam RaghuwanshiAinda não há avaliações

- SpecialCircumstances AppealForm PDFDocumento2 páginasSpecialCircumstances AppealForm PDFEsplanadeAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Inventory Management BasicsDocumento22 páginasInventory Management BasicssumeetgkdAinda não há avaliações

- 1 Session OneDocumento6 páginas1 Session OneHardik ShahAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- AP Microeconomics 2010 Free-Response Questions: The College BoardDocumento4 páginasAP Microeconomics 2010 Free-Response Questions: The College BoardMichelle ChanAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Cover Sheet: 632-8014 Atty. William S. PamintuanDocumento18 páginasCover Sheet: 632-8014 Atty. William S. Pamintuanfaith accountingAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- I601 Final - NikeDocumento6 páginasI601 Final - NikeAjeya krishnaAinda não há avaliações

- BCG MatrixDocumento22 páginasBCG Matrixnomanfaisal1Ainda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Book Value Assets Realizable Value: Nama: Firda Arfianti NIM: 2301949596Documento2 páginasBook Value Assets Realizable Value: Nama: Firda Arfianti NIM: 2301949596FirdaAinda não há avaliações

- Mba Project TajhotelDocumento20 páginasMba Project TajhotelAnkit KumarAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Module 7 CVP Analysis SolutionsDocumento12 páginasModule 7 CVP Analysis SolutionsChiran AdhikariAinda não há avaliações

- Hots Business StudiesDocumento37 páginasHots Business StudiesDaniel RobertAinda não há avaliações

- Roy of The Rovers - Nobby's NutsDocumento7 páginasRoy of The Rovers - Nobby's NutsCyril "Storky" KnightAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Company Regulation SampleDocumento13 páginasCompany Regulation SampleJames Oludele Etu67% (3)

- Topic No. 1 - Statement of Financial Position PDFDocumento4 páginasTopic No. 1 - Statement of Financial Position PDFSARAH ANDREA TORRESAinda não há avaliações

- Summary BP - Assignment Semester 1Documento9 páginasSummary BP - Assignment Semester 1Ashvin GraceAinda não há avaliações

- ATEC Deck Sept 2017Documento24 páginasATEC Deck Sept 2017medtechyAinda não há avaliações

- Inventory and Cost of Goods Sold Quiz - Accounting CoachDocumento3 páginasInventory and Cost of Goods Sold Quiz - Accounting CoachSudip BhattacharyaAinda não há avaliações

- Chapter 8Documento75 páginasChapter 8Nguyen NguyenAinda não há avaliações

- Going GlobalDocumento15 páginasGoing GlobalSolitaire LotusAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Economic Value AddedDocumento2 páginasEconomic Value AddedRahul BattooAinda não há avaliações

- Accounting Cycle McqsDocumento7 páginasAccounting Cycle McqsasfandiyarAinda não há avaliações

- Accounting Test 1Documento4 páginasAccounting Test 1Nanya BisnestAinda não há avaliações

- Bureau of Customs: Certificate of Accreditation As ImporterDocumento1 páginaBureau of Customs: Certificate of Accreditation As ImporterJaneal RezariAinda não há avaliações

- Case For DigestDocumento11 páginasCase For DigestAudreyAinda não há avaliações

- "Sui Southern Gas Company Limited": Strategic Management Report OnDocumento25 páginas"Sui Southern Gas Company Limited": Strategic Management Report OnAsif MominAinda não há avaliações

- The Dividend PolicyDocumento10 páginasThe Dividend PolicyTimothy Nshimbi100% (1)