Escolar Documentos

Profissional Documentos

Cultura Documentos

A Golden Handshake-CiteHR

Enviado por

Arun BalajiDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

A Golden Handshake-CiteHR

Enviado por

Arun BalajiDireitos autorais:

Formatos disponíveis

A golden handshake is a hefty severance package which is offered to senior executives and other high ranking employees.

Often, the terms of a golden handshake are included in a hiring contract, and they are viewed as insurance against sudden or involuntary job termination. A golden handshake may also be offered to an employee to encourage him or her to retire; this is common in systems like schools, where long-term employees make more money, and it can be more cost efficient to hire entry level teachers. The specifics of a golden handshake vary, depending on the position. Typically it includes a lump sum of money, and it may also include stock options or securities, continued insurance coverage, or payment into retirement accounts. A golden handshake also typically includes a few weeks of full pay, especially if the employment termination was sudden, allowing the former employee a chance to recover. Corporate executives are especially subject to shifting allegiances and company restructuring. As a result, many demand golden handshake contracts to ensure that they will be compensated if their positions suddenly evaporate or radically change. Executives can also be made obsolete through rearrangement of departments, or they may be fired for poor performance or due to other issues with the company. Most executives are aware that their job security is very low, especially if they were brought into positions of high authority. Golden handshakes can also be sweeteners for mandatory retirement. In industries where retiring long-term employees is a cost effective business decision, a golden handshake is almost used like a punishment. If the employee declines to retire, the offer will be retracted, and the employee may take a loss. Employees may also be asked to retire due to declining job performance or age, in which case a company may wish to provide a recognition of the employee's years of loyal service. In an instance where a golden handshake is part of an employment contract, it pays to read the terms carefully, and to clarify questionable terms. Employees may want to ask whether golden handshakes will still be offered if companies liquidate or go into bankruptcy, for example. It is also important to ask about conditions in which the severance package will not be offered. If a golden handshake is being offered to you to convince you to retire, read the offer carefully and don't be afraid to bargain; you may be able to get a better deal by being forward about your desires.

A golden handshake is a clause in an executive employment contract that provides the executive with a significant severance package in the case that the executive loses his or her job through firing, restructuring, or even scheduled retirement. This can be in the form of cash, equity, and other benefits, and is often accompanied by an accelerated vesting of stock options. Typically, "golden handshakes" are offered only to high-ranking executives by major corporations and may entail a value measured in millions of dollars. Golden handshakes are given to offset the risk inherent in taking the new job, since high-ranking executives have a high likelihood of being fired and since a company requiring an outsider to come in at such a high level may be in a precarious financial position. Their use has caused

some investors concern since they do not specify that the executive had to perform well. In some high-profile instances, executives cashed in their stock options, while under their stewardship their companies lost millions of dollars and thousands of workers were laid off. Golden Handshake, The ICICI Bank Way : ICICI Bank seems to have bucked the trend among new generation private sector banks by announcing a VRS for its employees. It appears manpower planning through shedding, is one of the few remaining drawn out action plans of ICICI Bank. Though, for the countrys second largest commercial bank with around 11,000 employees managing Rs 1,00,000 crore assets, VRS may not have been an after thought, and must have been chalked out even before the reverse-merger. Yet, being a sensitive issue, it announced the details of the VRS just a fortnight back. The bank has a growing customer base of more than 5 million customer accounts through a technology-backed multichannel access network. This includes, about 450 branches and extension counters, about 1,700 ATMs, call centres and internet banking. Going by the statements of ICICI Bank executive director Kalpana Morparia, unlike its public sector bank counterparts, the pruning exercise by the bank is intended to add quality manpower and not just a number game. The bank has plans to go in for simultaneous recruitment drive in a ratio of 3:2, as it is opening up 60 more branches in the current fiscal. In order to address the interests of its employees seeking alternative options or are desirous of early retirement after a long stint with the organisation, the bank had decided to offer an early retirement option. The option would be available to all employees who have completed 40 years of age and seven years of the service with the bank (including entities that have merged with the bank) as on July 31, 2003. The option may be exercised by eligible employees at any time between July 1-31, 2003. Under the option, those who seek to leave would be given three months salary for every year of service completed or one months salary for balance of services, whichever is lower, she added. ICICI bank recognises the importance of organisational excellence in its business, says Ms Morparia. Developing and deploying world class skills in a variety of areas such as technology, financial engineering and transaction processing, portfolio management, credit evaluation, product design and maintain enduring relationships with the banks retail and whole sale customers, are essential elements of the banks strategy, she explained. "The focus on human resources management as a key organisational activity has resulted in the creation of an exceptional pool of talent, a performance - oriented organisational

culture and has imparted agility to the organisation, enabling it to capitalise on opportunities and deliver value to its stakeholders," she says. The bank, according to her, seeks to imbibe total commitment towards exceptional standard performance and productivity, adaptability to change according to the organisational needs, meet the demands of the business environment and willingness to learn and acquire new capabilities. "We believe in defining clear performance for employees and empowering them to achieve their goals. This has helped to create a culture of high performance across the organisation. The bank has also structured process of identifying and developing leadership potential," she observes. Justifying the VRS, the bank explained that it has adopted proactive strategies to meet the competitive challenges in the financial services sector. A key element of this strategy, is a vibrant and flexible organisation capable of swiftly adapting to the demands of change. The top officials explain that the bank views its human capital as a key source of competitive advantage. Conse-quently, the development and management of human capital, is an integral element of the banks strategy and key management activity. Different business across the group, have over the past few months used successfully the six sigma methodology, to focus on customer satisfaction and enhance efficiency in operation. Application of six sigma techniques in regional processing centres, branch layout and design, and the home finance and demat services business, have reduced turnaround time and increased operational efficiency. In recognition of the critical importance of excellence in internal processes and delivery to customers, the bank has set up an organisational excellence group, headed by senior general manager reporting to the managing director and CEO. This group will be responsible for institutionalisation of quality initiatives (including six sigma), build the skills necessary for implementing and accelerating quality initiatives, report to the management -- the progress and value generated from these initiatives and replicate the success across ICICI Bank as well as group companies. After 2002, human resources division of the bank, has focused on smooth integration of the employees and human resource management systems and continuous improvement in the process of recruitment, training and performance management. The integration process involved defining the organisation structure of the merged entity, placement of people in various position across the business and corporate groups, and integration of the grade and remuneration structure for the employees of the four entities.

The organisational structure was announced in February 2002, soon after the announcement of the merger and became effective on May 3, 2002. The people placement was based on appropriate competency profiting tools and matching employees profiles to job specification. The grade integration process has also been completed using job evaluation techniques. Despite the fact that ICICI Bank is Indias second largest bank, it had just 7,700 employees as on March 2002, demonstrating the banks unique technology driven, productivity focused business model. The recruitment process has been streamlined and a uniform recruitment policy and process has been implemented across the merged organisation. Robust ability-testing and competency-profiling tools are being used to strengthen the campus recruitment process and match the profiles of employees with the needs of the organisation. ICICI Bank officials further claim that the institution continues to be preferred employer at the leading business schools and higher education institutions across the country, offering a range of career opportunities across the entire spectrum of financial services. ICICI Bank also undertakes lateral recruitment to ring new skills, competencies and experience into the organisation and meet the requirements of rapidly growing business. A six sigma initiative has been undertaken for the lateral recruitment process to improve capabilities in this area. The bank also encourages cross-functional movement, enrich employees knowledge and experience and give them a holistic view of the organisation, while ensuring optimum utilisation of its human capital. The rapidly changing business environment, and the constant challenges it poses to organisations and business, make it imperative to continuously enhance knowledge and skill sets across the organisation. Golden handshake to cost JetLite Rs 5 crore Manisha Singhal / Mumbai September 13, 2008, 0:09 IST Value-carrier JetLite, formerly full-service airline Air Sahara, which was bought by Naresh Goyal last year, will offer a voluntary separation scheme (VSS) to 750 employees who have been with the airline for one year or below, Chief Operating Office Rajiv Gupta confirmed today. Markets end cautious ahead of Budget Day Railways face shortage of 1000 coaches Nalco's Iranian JV faces diplomatic, funding hurdles: CMD

3G spectrum auction from April 9 BSNL offers free content, installation of broadband services More The company will pay around Rs 5 crore for the severance package. JetLite executives said employees who are being offered the VSS include 400 from airport services, 160 from engineering services, 100 from sales and marketing and the rest from purchase, stores and administration. The first phase of the restructuring exercise will be followed by further downsizing in departments like HR and the airlines blue-collar employees (numbering about 800). There is a possibility of downsizing at least 50 per cent of the employees from these segments," said Gupta. The compensation package that Jet Airways has worked out will be based on the number of months that an employee has worked with the organisation. S Chalke, general manager, HR, Jet Airways, explained that the airline will pay a months salary for employees who have worked for a month, six months salary to employees who have worked for six months and a years gross salary for employees who have worked for a year. The last category has at least 450 employees. Naresh Goyal-promoted full service carrier Jet Airways bought Air Sahara in 2007 for Rs 1,450 crore and renamed it JetLite. JetLite has 2,300 employees. Jets move at downsizing JetLite has already raised questions at its Delhi headquarters over whether the the airline will face operational problems caused by a lack of manpower. Jet has allowed us to retain only 20 people manning 24 flights in Delhi, said a JetLite executive. The executive added that the request that 21 of the 117 staffers in Delhi be asked to leave was turned down. Instead 90-odd have been asked to go, so there is a shortfall and a possibility that Jet might have to recruit employees soon for the airline if operations are to run smoothly, the executive said. Aviation analysts suggest that Jets move to cut manpower may be premature. We are just 15 days away from a promising inbound traffic flow period. There has been a dip in air turbine fuel costs and airlines will soon rethink capacity additions, said Mark Martin, senior aviation advisor, KPMG. He pointed out that Jet is expanding internationally and will need manpower. They should have reacted early to work towards the integration of both airlines from the start, just as Kingfisher Airlines has been able to successfully merge Deccan into its fold with a different product offering, Martin added.

Você também pode gostar

- Downsizing in Axis BankDocumento10 páginasDownsizing in Axis BankkrupamayekarAinda não há avaliações

- Style: It Is Also Referred To As Culture by Some People. It Refers To How Things Are Done in ADocumento3 páginasStyle: It Is Also Referred To As Culture by Some People. It Refers To How Things Are Done in AasaqAinda não há avaliações

- Human Resources Development SbiDocumento8 páginasHuman Resources Development SbiShraddha KshirsagarAinda não há avaliações

- Kotak Mahindra BankDocumento13 páginasKotak Mahindra BankKunal Singh100% (1)

- Syn Emp RetensionDocumento13 páginasSyn Emp RetensionRanbir SinghAinda não há avaliações

- PFM 2Documento4 páginasPFM 2DeepthiAinda não há avaliações

- 1) Identify The Shift in The Strategy of Serandib BankDocumento6 páginas1) Identify The Shift in The Strategy of Serandib BankNaveen GunasekaraAinda não há avaliações

- SHRM Chap 13 01102021Documento37 páginasSHRM Chap 13 01102021Eiren Pangkey GuloAinda não há avaliações

- CMSPL ProfileDocumento11 páginasCMSPL Profilesagar_salunkhe_1Ainda não há avaliações

- Strategic ManagementDocumento10 páginasStrategic ManagementIlakkya KumarAinda não há avaliações

- Thesis On Recruitment and Selection of HFC BankDocumento5 páginasThesis On Recruitment and Selection of HFC Bankkrystalgreenglendale100% (1)

- Evaluation of Performance Appraisal at Icici Bank HyderabadDocumento74 páginasEvaluation of Performance Appraisal at Icici Bank Hyderabadanon_65620974478% (9)

- Report On Dhaka BankDocumento23 páginasReport On Dhaka BankJizzle JeennyAinda não há avaliações

- Managing Change in Organizations: Submitted byDocumento7 páginasManaging Change in Organizations: Submitted bya_biyaniAinda não há avaliações

- HRM in Indian Banking IndustryDocumento18 páginasHRM in Indian Banking IndustrySebak Roy50% (2)

- Process For MappingDocumento14 páginasProcess For MappingNana Ama Segua Afari-AikinsAinda não há avaliações

- Compensation ManagementDocumento86 páginasCompensation Managementhabeeb0% (1)

- Promotion Study Material For BankDocumento271 páginasPromotion Study Material For BankJack Meena100% (1)

- Union BankDocumento7 páginasUnion BankChoice MyAinda não há avaliações

- Business CreditBuildiBusiness Credit A Comprehensive Guide for Small Business OwnersNo EverandBusiness CreditBuildiBusiness Credit A Comprehensive Guide for Small Business OwnersAinda não há avaliações

- A Study of Increasing Employee AttritionDocumento14 páginasA Study of Increasing Employee AttritionharshadaAinda não há avaliações

- HR Quarterly PWCDocumento19 páginasHR Quarterly PWCaxitmAinda não há avaliações

- Management Hierarchy: Askari Bank LimitedDocumento14 páginasManagement Hierarchy: Askari Bank LimitedEeshaa MalikAinda não há avaliações

- HR Policy UBI & Yes BankDocumento20 páginasHR Policy UBI & Yes BankGaurav Kumar97% (34)

- HR Practices of Reliance Jio 1Documento6 páginasHR Practices of Reliance Jio 1Drishti AsherAinda não há avaliações

- Employee Handbook 2016 CrescendoDocumento40 páginasEmployee Handbook 2016 CrescendoPrashant BhardwajAinda não há avaliações

- Executive Summary:: (CITATION Abb05 /L 1033)Documento19 páginasExecutive Summary:: (CITATION Abb05 /L 1033)Vishnu NairAinda não há avaliações

- Chapter 1Documento14 páginasChapter 1Azaan MalikAinda não há avaliações

- Strategic HRM JUNE 2022Documento10 páginasStrategic HRM JUNE 2022Rajni KumariAinda não há avaliações

- BRACDocumento38 páginasBRACMahmudur Rahman100% (3)

- HR Policies Group Presentation (Kritika Maloo)Documento12 páginasHR Policies Group Presentation (Kritika Maloo)kritika malooAinda não há avaliações

- A Case Study On Employee Retention Strategies in It IndustryDocumento6 páginasA Case Study On Employee Retention Strategies in It IndustryAnonymous CwJeBCAXpAinda não há avaliações

- HR Practices of ICICI and SBIDocumento6 páginasHR Practices of ICICI and SBIAmit Kumar45% (11)

- Rohan Proj - Report Loan SyndicationDocumento75 páginasRohan Proj - Report Loan Syndicationriranna100% (5)

- Pms of Axis BankDocumento51 páginasPms of Axis BankAmar Nath100% (2)

- Receivables Management - Mba Project ReportDocumento76 páginasReceivables Management - Mba Project ReportRoja N57% (7)

- Quantitative techniques-II AssignmentDocumento6 páginasQuantitative techniques-II Assignmentjattboy1Ainda não há avaliações

- Unit 3 Human Resource Management Task 1Documento13 páginasUnit 3 Human Resource Management Task 1AimenWajeeh100% (1)

- MFS CaseDocumento2 páginasMFS CaseTushar ChaudhariAinda não há avaliações

- Research Project ReportDocumento71 páginasResearch Project ReportDewank PathakAinda não há avaliações

- Determining Training Needs at Summit Credit Union Case Study SolutionDocumento3 páginasDetermining Training Needs at Summit Credit Union Case Study SolutionsabbirAinda não há avaliações

- Term Paper - CompensationDocumento8 páginasTerm Paper - CompensationMontasir RossiAinda não há avaliações

- Final Report of VCEDocumento19 páginasFinal Report of VCEsarojram1108Ainda não há avaliações

- SHRM Term PaperDocumento18 páginasSHRM Term PaperKevanAinda não há avaliações

- Shakshi Jasrotia Project Report On Grievance HandlingDocumento60 páginasShakshi Jasrotia Project Report On Grievance HandlingAnjali SatiAinda não há avaliações

- Premier Bank ReportDocumento10 páginasPremier Bank ReportraktimbeastAinda não há avaliações

- HR Management Report VitalStrats Creative SolutionsDocumento9 páginasHR Management Report VitalStrats Creative SolutionsLara Ysabelle CappsAinda não há avaliações

- Interim Report 21BSP3460 - Pooja SureshDocumento19 páginasInterim Report 21BSP3460 - Pooja SureshChahat PartapAinda não há avaliações

- INTRODUCTIONDocumento3 páginasINTRODUCTIONlaiba.imtaiz2002Ainda não há avaliações

- Effect of Compensation and Motivation On Employee Performance in IndonesiaDocumento9 páginasEffect of Compensation and Motivation On Employee Performance in IndonesiaAríesAinda não há avaliações

- New Microsoft Word DocumentDocumento2 páginasNew Microsoft Word DocumentAshif AhmedAinda não há avaliações

- Contemporary Issues in Employee Development-1Documento13 páginasContemporary Issues in Employee Development-1hafizshoaib5567Ainda não há avaliações

- Mylan Fact+SheetDocumento2 páginasMylan Fact+SheetArun BalajiAinda não há avaliações

- Cse Syllabus Vi SemesterDocumento18 páginasCse Syllabus Vi SemesterArun BalajiAinda não há avaliações

- Jquery 1.6 Visual Cheat SheetDocumento4 páginasJquery 1.6 Visual Cheat SheetAntonio Lupetti100% (1)

- Book3 PDFDocumento2 páginasBook3 PDFArun BalajiAinda não há avaliações

- Book3 PDFDocumento2 páginasBook3 PDFArun BalajiAinda não há avaliações

- Book3 PDFDocumento2 páginasBook3 PDFArun BalajiAinda não há avaliações

- Asaddayon Sesame Street: Citing Your Images Use Small PrintDocumento30 páginasAsaddayon Sesame Street: Citing Your Images Use Small PrintArun BalajiAinda não há avaliações

- 433 Industrial RelationsDocumento164 páginas433 Industrial RelationsSuren TheannilawuAinda não há avaliações

- Book3 PDFDocumento2 páginasBook3 PDFArun BalajiAinda não há avaliações

- Asaddayon Sesame Street: Citing Your Images Use Small PrintDocumento30 páginasAsaddayon Sesame Street: Citing Your Images Use Small PrintArun BalajiAinda não há avaliações

- Asaddayon Sesame Street: Citing Your Images Use Small PrintDocumento30 páginasAsaddayon Sesame Street: Citing Your Images Use Small PrintArun BalajiAinda não há avaliações

- Book3 PDFDocumento2 páginasBook3 PDFArun BalajiAinda não há avaliações

- Asaddayon Sesame Street: Citing Your Images Use Small PrintDocumento30 páginasAsaddayon Sesame Street: Citing Your Images Use Small PrintArun BalajiAinda não há avaliações

- Asaddayon Sesame Street: Citing Your Images Use Small PrintDocumento30 páginasAsaddayon Sesame Street: Citing Your Images Use Small PrintArun BalajiAinda não há avaliações

- Asaddayon Sesame Street: Citing Your Images Use Small PrintDocumento30 páginasAsaddayon Sesame Street: Citing Your Images Use Small PrintArun BalajiAinda não há avaliações

- TestDocumento6 páginasTestArun BalajiAinda não há avaliações

- Book3 PDFDocumento2 páginasBook3 PDFArun BalajiAinda não há avaliações

- Book3 PDFDocumento2 páginasBook3 PDFArun BalajiAinda não há avaliações

- TestDocumento6 páginasTestArun BalajiAinda não há avaliações

- Leave Application Procedure & PolicyDocumento3 páginasLeave Application Procedure & PolicyAyu Sofi IszuanAinda não há avaliações

- CV For Digital Marketing ProfileDocumento1 páginaCV For Digital Marketing ProfileAadithya SAinda não há avaliações

- BUS 509 Course Unit OutlineDocumento17 páginasBUS 509 Course Unit OutlineReena RathiAinda não há avaliações

- Market PlanDocumento13 páginasMarket PlankipkatahAinda não há avaliações

- Grow With TikTok Starter Lab For Sharing v2Documento87 páginasGrow With TikTok Starter Lab For Sharing v2firdauz100% (1)

- Mergers and Acquisitions ReportDocumento13 páginasMergers and Acquisitions ReportApoorva SaxenaAinda não há avaliações

- Lessee Information StatementDocumento4 páginasLessee Information StatementDarryl Jay Medina67% (3)

- Culminating Activitytask For EntrepreneurshipDocumento12 páginasCulminating Activitytask For EntrepreneurshipJudy Ann TumaraoAinda não há avaliações

- White Star Capital 2021 Greater China Venture Capital LandscapeDocumento61 páginasWhite Star Capital 2021 Greater China Venture Capital LandscapeWhite Star Capital100% (3)

- Assessment of Vat AdministrationDocumento30 páginasAssessment of Vat Administrationshimelis100% (1)

- OUTLINE AGREEMENT PresentationDocumento7 páginasOUTLINE AGREEMENT PresentationK SANMUKHA PATRAAinda não há avaliações

- dc2020-02-0002 DOE RA 11361Documento24 páginasdc2020-02-0002 DOE RA 11361Nina Rachell RodriguezAinda não há avaliações

- PPT7-Indonesia State Government Accounting System Including Standard JournalDocumento71 páginasPPT7-Indonesia State Government Accounting System Including Standard Journalratna sulistianaAinda não há avaliações

- Bill of Supply For Electricity: BSES Rajdhani Power LimitedDocumento2 páginasBill of Supply For Electricity: BSES Rajdhani Power LimitedRamesh RawatAinda não há avaliações

- Unit 27: Understanding Health and Safety in The Business WorkplaceDocumento15 páginasUnit 27: Understanding Health and Safety in The Business WorkplaceMahmudur RahmanAinda não há avaliações

- Topic 2 Discovering Business Opportunities-EaDocumento14 páginasTopic 2 Discovering Business Opportunities-EaNorahAinda não há avaliações

- ISM CPSM Exam-SpecificationsDocumento7 páginasISM CPSM Exam-SpecificationsmsajanjAinda não há avaliações

- Tata Motors Company AnalysisDocumento9 páginasTata Motors Company AnalysisManikanta SanigaramAinda não há avaliações

- British Teen FashionDocumento19 páginasBritish Teen FashionChanges School of EnglishAinda não há avaliações

- Study The Level of Customer Satisfaction Towrads Bajaj Allianz Final ReportDocumento47 páginasStudy The Level of Customer Satisfaction Towrads Bajaj Allianz Final ReportKashish RohillaAinda não há avaliações

- Marketplace: Publisher GuideDocumento43 páginasMarketplace: Publisher Guidechandra100% (1)

- Quick Bill Summary: Change To Your ServiceDocumento2 páginasQuick Bill Summary: Change To Your ServiceCAIRO100% (1)

- Assignment 4Documento2 páginasAssignment 4lovejoy makeredzaAinda não há avaliações

- Accounting 3 4 Module 5bDocumento2 páginasAccounting 3 4 Module 5bMariel Ann RebancosAinda não há avaliações

- Application Account Payables Title: Retainage Invoice: OracleDocumento24 páginasApplication Account Payables Title: Retainage Invoice: OraclesureshAinda não há avaliações

- GAM 1 Chapter 6Documento12 páginasGAM 1 Chapter 6Aldriel GabayanAinda não há avaliações

- Module 4 Macro Perspective of Tourism EditedDocumento13 páginasModule 4 Macro Perspective of Tourism EditedFinn DanganAinda não há avaliações

- 3.topic 1 - Intro HRMDocumento22 páginas3.topic 1 - Intro HRMA Ahmad NazreenAinda não há avaliações

- Accounting Project - EMBA Cohort 43 Group33 - FinalSubmissionDocumento4 páginasAccounting Project - EMBA Cohort 43 Group33 - FinalSubmissionodlivingstonAinda não há avaliações

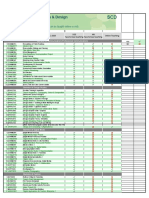

- SCD Course List in Sem 2.2020 (FTF or Online) (Updated 02 July 2020)Documento2 páginasSCD Course List in Sem 2.2020 (FTF or Online) (Updated 02 July 2020)Nguyễn Hồng AnhAinda não há avaliações