Escolar Documentos

Profissional Documentos

Cultura Documentos

BMI China Petrochemicals Report Q2 2011

Enviado por

Johnny SarponngDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

BMI China Petrochemicals Report Q2 2011

Enviado por

Johnny SarponngDireitos autorais:

Formatos disponíveis

www.businessmonitor.

com

Q2 2011

chiNa

petrochemicals report

INCLUDES BMI'S FORECASTS

issN 1749-219X

published by Business monitor international ltd.

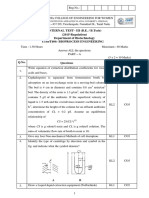

CHINA PETROCHEMICALS REPORT Q2 2011

INCLUDES 5-YEAR FORECASTS TO 2015

Part of BMIs Industry Survey & Forecasts Series

Published by: Business Monitor International Copy deadline: February 2011

Business Monitor International Mermaid House, 2 Puddle Dock, London, EC4V 3DS, UK Tel: +44 (0) 20 7248 0468 Fax: +44 (0) 20 7248 0467 Email: subs@businessmonitor.com Web: http://www.businessmonitor.com

2011 Business Monitor International. All rights reserved. All information contained in this publication is copyrighted in the name of Business Monitor International, and as such no part of this publication may be reproduced, repackaged, redistributed, resold in whole or in any part, or used in any form or by any means graphic, electronic or mechanical, including photocopying, recording, taping, or by information storage or retrieval, or by any other means, without the express written consent of the publisher.

DISCLAIMER All information contained in this publication has been researched and compiled from sources believed to be accurate and reliable at the time of publishing. However, in view of the natural scope for human and/or mechanical error, either at source or during production, Business Monitor International accepts no liability whatsoever for any loss or damage resulting from errors, inaccuracies or omissions affecting any part of the publication. All information is provided without warranty, and Business Monitor International makes no representation of warranty of any kind as to the accuracy or completeness of any information hereto contained.

China Petrochemicals Report Q2 2011

Business Monitor International Ltd

Page 2

China Petrochemicals Report Q2 2011

CONTENTS

Executive Summary ......................................................................................................................................... 5 SWOT Analysis ................................................................................................................................................. 7

China Petrochemicals Industry SWOT................................................................................................................................................................... 7 China Political SWOT ........................................................................................................................................................................................... 8 China Economic SWOT ......................................................................................................................................................................................... 9 China Business Environment SWOT .................................................................................................................................................................... 10

Global Overview ............................................................................................................................................. 11

Petrochemicals Market Overview ........................................................................................................................................................................ 11 Financial Results ................................................................................................................................................................................................. 15 Global Oil Products Price Outlook...................................................................................................................................................................... 16 Table: Oil Product Price Assumptions, Q410-Q411 (US$/bbl)............................................................................................................................ 16 Table: Oil Product Price Data And Forecasts, 2008-2015 (US$/bbl) ................................................................................................................. 19

Emerging Asia Petrochemicals Overview ................................................................................................... 21

Table: Asian Ethylene Projects ............................................................................................................................................................................ 23

China Market Overview .................................................................................................................................. 24

Table: Chinas Petrochemicals Sector HDPE Capacity ................................................................................................................................... 24 Table: Chinas Petrochemicals Sector LDPE Capacity .................................................................................................................................... 25 Table: Chinas Petrochemicals Sector LLDPE Capacity .................................................................................................................................. 25 Table: Chinas Petrochemicals Sector PP Capacity ......................................................................................................................................... 26 Table: Chinas Petrochemicals Sector Cracker Capacity ................................................................................................................................. 28 Table: Chinas Petrochemicals Sector PVC Capacity ...................................................................................................................................... 29 Table: Chinas Petrochemicals Sector PS Capacity ............................................................................................................................................ 32 Energy Inefficiencies And Bottlenecks ................................................................................................................................................................. 32 Production ........................................................................................................................................................................................................... 33 Table: Chinas Supply And Demand Volumes Of Major Petrochemical Products ............................................................................................... 34 Table: Cracker Capacity, 2006-2013 (000tpa) ................................................................................................................................................... 36

Industry Trends And Developments ............................................................................................................ 37

Table: Chinas Petrochemicals Sector Ethylene Projects ................................................................................................................................. 37 Table: Chinas Petrochemicals Sector PE Projects .......................................................................................................................................... 38 Table: Chinas Petrochemicals Sector PP Projects .......................................................................................................................................... 39 Table: Chinas Petrochemicals Sector PS Projects .......................................................................................................................................... 39 Upstream ............................................................................................................................................................................................................. 40 Olefins ................................................................................................................................................................................................................. 41 Intermediates ....................................................................................................................................................................................................... 42 Integrated Projects .............................................................................................................................................................................................. 44 Coal-Based Chemicals......................................................................................................................................................................................... 49 Other Projects...................................................................................................................................................................................................... 50 Regulatory Developments .................................................................................................................................................................................... 51

Business Environment .................................................................................................................................. 54

Petrochemicals Business Environment Ratings ................................................................................................................................................... 54 Table: Asia Pacific Petrochemicals Business Environment Ratings .................................................................................................................... 54 Chinas Foreign Investment Policy ...................................................................................................................................................................... 56

Business Monitor International Ltd

Page 3

China Petrochemicals Report Q2 2011

Foreign Trade Regime ......................................................................................................................................................................................... 57

Industry Forecast Scenario ........................................................................................................................... 59

Table: Chinas Petrochemicals Sector, 2007-2015 (000 tpa, unless otherwise stated)....................................................................................... 62 Macroeconomic Outlook...................................................................................................................................................................................... 63 Table: China Economic Activity; 2006-2015 .................................................................................................................................................... 66

Company Profiles ........................................................................................................................................... 67

China Petroleum & Chemical Corporation (Sinopec) ......................................................................................................................................... 67

Glossary Of Terms ......................................................................................................................................... 71

Table: Glossary Of Petrochemicals Terms .......................................................................................................................................................... 71

BMI Methodology ........................................................................................................................................... 72

How We Generate Our Industry Forecasts .......................................................................................................................................................... 72 Chemicals And Petrochemicals Industry ............................................................................................................................................................. 72 Cross Checks ....................................................................................................................................................................................................... 73 Business Environment Ratings ............................................................................................................................................................................. 74 Table: Petrochemicals Business Environment Indicators And Rationale............................................................................................................. 75 Weighting............................................................................................................................................................................................................. 75 Table: Weighting Of Indicators ........................................................................................................................................................................... 76

Business Monitor International Ltd

Page 4

China Petrochemicals Report Q2 2011

Executive Summary

Chinese petrochemicals output should continue to exhibit strong growth in 2011, but investment in the industry will be increasingly driven towards consolidation and boosting value of production, according to BMIs latest China Petrochemicals Report.

Demand has been healthy in the Chinese market with PE demand up 13% y-o-y to 17.4mn tonnes in 2010, while PP grew 6% to 13.9mn tonnes. This made China by far the worlds largest polymer consumer and importer. Imports included 1.38mn tonnes LDPE (up 3%), 2.48mn tonnes LLDPE (up 13%), 3.50mn tonnes HDPE (down 9%) and 4.80mn tonnes PP (down 6%). New domestic capacity helped reduce inflows of HDPE and PP.

In 2010, China Petrochemicals Corporation (Sinopec)s ethylene output grew 35% y-o-y, to 9.06mn tonnes, while plastic and resins output grew 26% to 13mn tonnes. Output of synthetic rubbers rose by nearly 10% to 967,000 tonnes while fibres output grew 7% to 1.4mn tonnes. However, Sinopecs urea output slumped 30% to 1.22mn tonnes. Sinopec, however, reported a drop in urea production by 30%, to 1.22mn tonnes. The companys refinery throughput was up 13%, at 211.13mn tonnes, and output of light chemical feedstock was 30% higher at 35mn tonnes.

In the first 11 months of 2010, ethylene output grew 35.5% y-o-y, to 12.89mn tonnes, primary plastics grew 19.1% y-o-y, to 38.77mn tonnes and plastic products grew 20.9% y-o-y, to 53.59mn tonnes. The growth trend was consistently upwards throughout 2010, indicating that a recovery was being sustained, despite the rapid rise in production in the Middle East and a large polymer inventory at the beginning of the year. However, key polyolefins consuming industries are experiencing the effects of tightened lending conditions amid government efforts to combat inflation. This situation has primarily affected the construction and automotive sectors, which had made orders on the basis of assumptions of strong growth levels.

China's annual PE demand is expected to grow by 8-9% in 2011, but new capacity will reduce imports by up to 14% from the 7.4mn tonnes imported in 2009, although this will be more at the expense of neighbouring Asian states while Middle Eastern suppliers will be unaffected. In terms of polymer capacities, we estimate that PE capacity grew by 1.65mn tpa and PP capacity grew 1.45mn tpa in 2010, ensuring that polymer market self-sufficiency should approach 75% PE and exceed 100% PP in 2011.

In the Asia Petrochemicals Business Environment Ratings matrix, Chinas score is 79.1 points, up 0.5 point since the previous quarter owing to an improvement in country risk scores. With South Koreas score declining in 2010, China has moved from third to second place in the regional ranking, just 0.5 points behind Japan and 1.1 points ahead of South Korea. Although Chinas petrochemicals market

Business Monitor International Ltd

Page 5

China Petrochemicals Report Q2 2011

ratings are the highest in Asia, it remains weighted down by a relatively poor financial and trade infrastructure and negative risks specific to the petrochemicals sector, namely reliance on imported feedstock and overcapacity in some segments.

Business Monitor International Ltd

Page 6

China Petrochemicals Report Q2 2011

SWOT Analysis

China Petrochemicals Industry SWOT

Strengths

Worlds largest producer of synthetic fibres and fourth largest producer of synthetic rubber. Fifth largest producer of ethylene. Strong domestic demand, led by rapid growth in personal consumption and consistently high rates of fixed investment, has ensured rapid growth in the sector. Vast Chinese textile sector will remain a major consumer of petrochemicals. New technology is being introduced mainly through joint venture mega-projects. Petrochemicals sector is an area of strategic importance in 2006-2010 Five-Year Plan. Better project approval processes, particularly for those including new refining capacity.

Weaknesses

Many small-scale Chinese petrochemicals firms are burdened by low levels of productive efficiency and poor economies of scale. Chinese firms lack investment in research and development (R&D) and primarily rely on imported technology. Profit margins remain slim for some producers due to inefficient production systems as well as a lack of reliable, easy-to-source feedstock. High crude prices and Chinas high energy import requirements mean that the petrochemicals sector is having to compete with other industrial areas for access to refined products and is seeing downward pressure on margins. Refiners suffering heavy losses, raising questions about ability to fund new capacity.

Opportunities

Industrial reform has led to consolidation within the sector and greater willingness to enter into JVs with foreign firms. China badly needs foreign petrochemicals technology and is actively encouraging foreign company JV projects with state-owned enterprises; in return China offers foreign companies a growing domestic market for their products and low construction and labour costs for building greenfield projects. WTO accession puts pressure on China to open markets and encourage greater participation in petrochemicals. This is likely to bring more expertise to the market.

Threats

Refinery capacity needs to be increased and feedstock distribution and transport system improved. Increases in oil prices are affecting stability in the domestic refining sector and further pressuring petrochemicals producers margins. The petrochemicals sector could find itself having to compete with other industry sectors for feedstock and if prices are high, it could see margins further eroded. If China accedes to US and Japanese pressure for a realignment of the yuan, the cost of imported feedstock could rise, putting at risk future plant development.

Business Monitor International Ltd

Page 7

China Petrochemicals Report Q2 2011

China Political SWOT

Strengths

The Communist Party of China, which has governed for the past 60 years, remains secure in its position as the sole political party in China. China's expanding economy is gradually giving it greater clout in international affairs, which will allow it to build politically important ties, especially with the developing world.

Weaknesses

As with any other one-party state, China's political system is inherently unstable and unable to respond to the wider changes taking place in society. Provincial governments often fail to enforce central government directives. Although bilateral ties have warmed since the election of Ma Ying-jeou as Taiwanese president in March 2008, China's relationship with Taiwan remains problematic, with Beijing refusing to rule out the threat of force in the event of a declaration of independence by Taiwan.

Opportunities

China is actively expanding its political and economic ties with major emerging markets such as Latin America, Africa and the Middle East. A new generation of leaders (the so-called 'fifth generation') is being prepared to take power in 2012-2013. This should ensure the continuation of reform and modernisation.

Threats

Growing corruption, widening inequalities, increasing rural poverty and environmental degradation have led to an increase in social unrest in recent years. The Communist Party is facing increasing factional rifts based on ideology and regionalism. While greater political debate would be welcomed by many, internal regime schisms could prove politically destabilising. China faces major challenges in ensuring that separatism in ethnically distinct regions such as Tibet and Xinjiang is kept at bay.

Business Monitor International Ltd

Page 8

China Petrochemicals Report Q2 2011

China Economic SWOT

Strengths

China is the fastest growing major economy in the world, and this has lifted hundreds of millions of people out of poverty over the past generation. China has a massive trade surplus and its huge foreign exchange reserves serve as a major cushion against external shocks. China's economic policymakers are committed to continuing their gradual reform of the economy.

Weaknesses

China's economic growth boom has led to major imbalances and environmental degradation. The country's dependency on exports to boost growth has made it vulnerable to the global recession. Private consumption remains weak at less than 40% of GDP. The close relations between provincial leaders and local businesses are fostering corruption, making it harder for the central government to enforce its policies.

Opportunities

China's economic growth is slowly becoming more broad-based, with domestic consumption likely to rise in importance vis--vis exports, thanks to a middle class of 200-300mn people. China's ongoing urbanisation will be a major driver of growth and new cities will emerge in less developed inland provinces. The UN forecasts China's urban population rising from 40% in 2005 to 73% in 2050: a gain of 500mn people. As China moves up the value chain, it will develop its own global brand name companies, fostering innovation and growth.

Threats

We believe that the global recession of 2008-2010 will mean an end to China's double-digit annual growth rate. Despite a halt to the appreciation of the yuan, the recession is leading to job losses in China's export sector and thus increasing social instability. An over-reliance on construction activity in economic growth could become a threat if credit flows are reduced and property prices begin to cool.

Business Monitor International Ltd

Page 9

China Petrochemicals Report Q2 2011

China Business Environment SWOT

Strengths

China is continuing to open up various sectors of its economy to foreign investment. With its vast supply of cheap labour, the country remains the top destination for foreign direct investment in the developing world.

Weaknesses

Foreign companies continue to complain about the poor protection of intellectual property in China. Chinese corporate governance is weak and non-transparent by Western standards. There is a considerable risk for foreign companies in choosing the right local partner.

Opportunities

China's ongoing urbanisation and infrastructure drive will provide major opportunities for foreign investment in landlocked provinces as well as the transfer of skills and know-how. The Chinese government is giving more protection and encouragement to the private sector, which is now the most dynamic in the economy and accounts for most of the country's job growth.

Threats

China's government will block attempts by foreign firms to take over assets of national importance. China is experiencing rising labour costs, prompting some investors to turn to cheaper destinations such as Vietnam.

Business Monitor International Ltd

Page 10

China Petrochemicals Report Q2 2011

Global Overview

Petrochemicals Market Overview

Table: World Ethylene Production By Country, 2010 And 2015 (000 tonnes capacity)

Country US China Saudi Arabia South Korea Japan Germany Iran Canada Thailand Taiwan Netherlands India Brazil France Russia United Kingdom Singapore Qatar Belgium UAE Malaysia Kuwait Spain Mexico Argentina Poland South Africa Hungary

2010 26,390 16,260 12,670 7,480 7,350 5,745 5,376 5,052 4,425 4,045 3,980 3,885 3,440 3,135 3,280 2,840 2,790 2,600 2,540 2,000 1,740 1,700 1,645 1,580 700 700 650 620

2015f 25,500 25,700 16,520 7,580 6,000 5,505 11,076 5,202 4,425 6,145 3,980 9,405 3,700 3,135 5,220 2,840 3,790 4,200 2,540 3,500 1,740 1,700 1,645 2,580 700 700 650 620

Business Monitor International Ltd

Page 11

China Petrochemicals Report Q2 2011

Table: World Ethylene Production By Country, 2010 And 2015 (000 tonnes capacity)

Country Indonesia Venezuela Ukraine Czech Republic Turkey Australia Bulgaria Israel Azerbaijan Egypt Nigeria Central Asia Slovakia Romania Algeria Colombia Chile

2010 620 600 550 545 520 515 450 450 370 300 300 240 210 200 130 120 60

2015f 620 1,900 550 595 520 515 450 450 370 300 300 1,490 210 200 1,230 120 60

e/f = estimate/forecast. Source: BMI

BMI forecasts 6% growth in international petrochemicals shipments in 2011 as the industry moves from recovery to expansion, having returned to pre-crises levels by end-2010. Global industry shipments rose 9% in 2010 in a stronger than expected recovery, although growth was largely concentrated in the Middle East and Asia with plants in mature markets witnessing low levels of capacity utilisation as well as closures. BMI estimates global olefins demand of 121mn tonnes in 2010 and forecasts 128mn tonnes in 2011.

Business Monitor International Ltd

Page 12

China Petrochemicals Report Q2 2011

Emerging markets in the Middle East, Eastern Europe, Asia and South America, most notably the BRIC countries, will drive growth, with petrochemicals growth in these markets estimated at 12% in 2010 and set to continue at 8% in 2011 and 2012. Meanwhile, developed countries are unlikely to see growth in petrochemicals sales of more than 3% over the next two years and domestic industries, which are overwhelmingly fed by naphtha, will struggle to compete with the ethane-fed capacities in the Middle East. The exception is the US, which

Source: BMI

China 10% South America 4% AsiaPacific (excl. China) 23%

Ethylene Capacities By Region 2009 Estimate

Western Europe 15% Eastern Europe 5% Middle East and Africa 17% NAFTA 26%

benefits from access to cheap domestic gas feedstock. By 2010, the crude oil-to-natural gas price ratio reached 20:1 with gas priced at US$4/mn btu and oil at US$80/bbl, well above the historical average of 8:1. As a result, naphtha-reliant PE producers in Asia and Europe have felt the downturn much more than ethane-based production in the Middle East and North America.

Emerging Asian economies are set to witness a slowdown from the rate of growth reported in 2010 as a result of a withdrawal of fiscal and monetary stimuli. This will represent a major challenge to petrochemicals production. According to the Asian Development Bank, average GDP growth in emerging Asia is likely to be 7.3% in 2011, down from 8.6-8.8% in 2010. However, ASEAN is likely to see a decline in growth from 7.5% to 5.4%, forecasts ADB, which will impact negatively on the performance of petrochemicals industries in Malaysia, Indonesia and the Philippines. For the whole of emerging Asia, BMI forecasts petrochemicals output growth of 10%, down from 15% in 2010 with South Korea, Singapore and Taiwan likely to see the strongest growth rates of growth, supported by capacity expansion. While growth is set to slow, the industry in Asia was already back to pre-crisis levels by mid2010 with output now rising on the back of capacity expansion.

The robust recovery was positive for margins and profits, a trend that should continue in 2011. However, segments that rely on construction, particularly PVC, will see more tepid growth than those reliant on the automotive sector, which is helping drive growth in engineering plastics. Positive trends should also continue in specialty plastics and polyester fibres.

Business Monitor International Ltd

Page 13

China Petrochemicals Report Q2 2011

There will also be a geographical concentration in petrochemicals capacities, with a continuing shift away from developed markets. Over the 201015 period, global ethylene capacity should rise by 25% to 176mn tpa. By 2015, Western Europe and North America will see their share of global capacity fall to 11% and 19% respectively from 14% and 23% in 2010. Over the period, Eastern Europe including the CIS and Turkey will increase its share by one percentage point to 6% while Asia, excluding China, will remain at a 23% share. The thrust of growth will come from Middle East and China, with capacity growing 52% and 58% respective to 39.9mn tpa and 25.7mn tpa respectively. What will be lacking in emerging markets is downstream diversification, which limits the value added to the industry.

Source: BMI

China 12% South America 5% NAFTA 19% Middle East and Africa 23% AsiaPacific (excl. China) 25% Western Europe Eastern 11% Europe 5%

Ethylene Capacities By Region 2014 Forecast

In the Middle East, there is a great emphasis on basic petrochemicals with little specialisation or innovation. Companies such as Sabic are attempting to address this over coming years, with most new investment likely to be focused on stepping up technological capacities and diversification. The Gulf regions petrochemicals industry will attract around US$50bn in investment in 2010-2015, a significant proportion of which will go towards diversification away from commodity chemicals.

European petrochemicals demand performed above expectations in H110, but moderated in H210 in the wake of the sovereigns debt crisis. Margins were also under pressure among higher cost European producers owing to increased capacity in Asia and the Middle East. However, they remain optimistic over the long term, with LyondellBasell forecasting cracker operating rates rising from a low of 80% in 2009 to 90% in 2014, while polymer operating rates are set to rise from 79% to 86-88% over the same period. The key to reviving margins in Europe will be feedstock flexibility and cost negotiation. But in the long term, consolidation and the shutdown of plants with low capacity and isolated from downstream and upstream facilities.

Business Monitor International Ltd

Page 14

China Petrochemicals Report Q2 2011

Financial Results

Table: Financial Results Of Major Petrochemicals Companies, 2009

Revenues BASF (Germany) Chevron Phillips (US) Dow Chemical (US) DuPont (US) ExxonMobil (US)

1

Revenue change 2008-2009, % -18.6 -32.0 -21.8 -14.4 na -10.0 -39.2 -13.5 -39.3 -31.6 -14.2 -9.4

2

Net income EUR1.41bn US$615mn US$648mn US$1.8bn US$2.3bn TWD27.5bn -US$2.9bn JPY12.8bn US$3.1bn SAR9.1bn CNY1.56bn JPY14.7bn

Net income growth, 2008-2009, % -51.6 +122.8 +11.9 -12.9 -21.7 +39.7 na na

2 3

Net profit margin, % 4.4 7.1 2.2 6.9 na 16.8 -9.4 0.5 1.2 8.8 3.0 0.9

EUR50.7bn US$8.7bn US$44.9bn US$26.1bn na TWD180.1bn US$30.8bn JPY2.52trn US$250.4bn SAR103.1bn CNY51.7bn JPY1.62trn

Formosa Plastics (Taiwan) LyondellBasell (US) Mitsubishi Chemical (Japan) Royal Dutch Shell 4 (Netherlands/UK) Sabic (Saudi Arabia) Sinopec (China) Sumitomo Chemical (Japan)

1

+5,166.7 -58.6 na na

3 5 6

na = not available; Chemicals division revenue and earnings; From a net loss of US$7.3b; From a net 4 5 loss of JPYJPY67.2bn; Downstream revenue and earnings, including refined oil and inter-segment sales; 6 From a loss of CNY6.25bn; From a loss of JPY59.2b. Source: Company financial reports, FT, BMI

Business Monitor International Ltd

Page 15

China Petrochemicals Report Q2 2011

Global Oil Products Price Outlook

Blood On The Forecourts Once again, severe winter weather conditions have been a mixed blessing for the oil markets. Sentiment benefited, as did the price of heating oil, as businesses and consumers struggled to ensure supply. On the flip side, however, there were major disruptions to fuel movements and demand. Overall oil consumption during the winter months is unlikely to have benefited significantly from the unusually low temperatures and the positive pricing effect will prove temporary. However, the strength of underlying crude prices means that all refined products are priced at uncomfortable levels, which poses a threat to consumption.

Table: Oil Product Price Assumptions, Q410-Q411 (US$/bbl)

Gasoline Rotterdam Premium Unleaded NY Harbour Unleaded Singapore Premium Unleaded Global average Jet/kerosene Rotterdam NY Harbour Singapore Global average Gasoil Rotterdam Mediterranean Singapore Global average Naphtha Rotterdam Mediterranean Singapore Global average

Q410 94.61 94.65 95 94.75

Q111e 97.89 96.79 98.75 97.81

Q211f 89.69 87.63 87.95 88.42

Q311f 86.06 84.47 84.25 84.93

Q411f 94.14 94.18 94.53 94.28

99.72 99.97 98.57 99.42

97.68 99.16 96.46 97.76

91.35 90.89 90.35 90.87

90.2 90.38 88.61 89.73

99.23 99.47 98.08 98.93

97.45 97.46 97.33 97.41

95.04 95.19 96.27 95.5

89.56 89.77 89.94 89.76

88.45 88.42 88.13 88.33

96.97 96.98 96.85 96.93

87.6 87.71 88.02 87.78

87.86 87.38 88.42 87.89

76.86 76.7 78.08 77.21

74.07 73.68 73.67 73.8

87.16 87.27 87.58 87.34

e/f = estimate/forecast. Source: BMI

Business Monitor International Ltd

Page 16

China Petrochemicals Report Q2 2011

In December 2010 International Energy Agency (IEA) region enduser prices rose by 3.6% in US dollar terms (excluding tax), with gasoline up 3.5% and diesel prices 2.9% higher. Heating oil and lowsulphur fuel oil increased by 4.6% and 3.5%, respectively. Compared with December 2009 average price levels in surveyed IEAmember countries saw a 15.9% yearonyear (y-o-y) increase. The big price gains were automotive diesel (20.3%) and heating oil (19.5%). Canada saw gasoline prices rise by a steep 25.8% yoy, while the British heating oil price increased by 33.9%.

It is becoming evident that consumers are reducing fuel purchases as a reaction to record pump prices. The return of cold weather will no doubt maintain support for heating oil, but automotive diesel and gasoline sales will continue to struggle. As in the summer of 2008, prices have reached a level where socalled 'demand destruction' becomes a major factor. It can be seen that the US and European markets were changed permanently by the last period of record pump prices. Should we have a prolonged period of pump price strength, there will be blood on the forecourts as consumers reduce journey times and the move towards more efficient vehicles accelerates.

In Britain and indeed in Europe motor vehicle fuel economy is improving by 34% a year, with an obvious knock-on effect in terms of gasoline and diesel use. With the US planning higher standards for car fuel efficiency, gasoline producers in developed markets will continue to have a hard time, with most new growth in fuels demand coming from the nonOECD world. Even here, however, reductions in fuel subsidies and price liberalisation could mean that higher pump prices have a

Uncomfortable Levels Oil Product Price Data And Forecasts, 2008-2014 (US$/bbl)

e/f = estimate/forecast. Source: International Energy Agency, BMI forecasts

negative impact on demand trends at a critical time for the oil market.

US gasoline consumption in 2010 was a disappointment, and there is no reason to expect anything better in 2011. Even the Energy Information Administration (EIA) sees a likely increase in US fuels consumption of no more than 160,000b/d (0.8%), followed by 170,000b/d growth in 2012. Consumption

Business Monitor International Ltd

Page 17

China Petrochemicals Report Q2 2011

continues to be dominated by gasoline, where price sensitivity is at its greatest. In 2008 US gasoline demand fell 2.6% y-o-y thanks to the higher cost of the fuel during the summer months. It will take very little to trigger a similar outcome in 2011. Given that throughout the OECD it was much the same story in 2008, demand projections for 2011 look particularly vulnerable in a high-price environment.

At present the EIA forecasts an increase in regulargrade gasoline retail prices from US$2.78 per gallon in 2010 to US$3.17 in 2011 (+14%). Onhighway diesel fuel retail prices, which averaged US$2.99/gallon in 2010, are predicted to be US$3.40 in 2011. Not only is the crude price effect reflected in these price projections, but the US body expects wider gasoline and distillate refining margins to contribute to higher retail prices. The EIA warns that there is an 8-10% risk of summer 2011 gasoline pump prices exceeding US$4.00/gallon.

Revised Forecasts In Q410 BMI estimates that the global wholesale price for premium unleaded gasoline was US$94.75/bbl. This compares with US$83.16 in Q310. Gasoline prices in Q410 were up 16.4% from US$81.41 in Q409. For the whole of 2010 the BMI calculation for gasoline is an average US$88.36/bbl. The overall y-o-y rise in 2010 gasoline prices is put at 25.9%.

For Q111 we assume a global unleaded price of US$97.81/bbl, up 3.2% from Q410 and a y-o-y rise of 11.6%. The full year 2011 wholesale gasoline price forecast is US$91.36/bbl, up 3.4% y-o-y.

In Q410 gasoil averaged US$97.41/bbl, based on a BMI-calculated composite global price. This was a yo-y rise of 19.8%. For 2010 as a whole BMI calculations suggest an average price of US$89.32/bbl, peaking in December 2010 at more than US$101/bbl. The full-year outturn is a 29.5% y-o-y increase. It can be seen that gasoil outperformed gasoline in price terms, as economic recovery stimulated demand.

For Q111 we assume a global gasoil price of US$95.50/bbl, representing a downturn from the Q410 level as weather factors subside, but a y-o-y rise of 13.5%. The full year 2011 wholesale gasoil price forecast is US$92.63/bbl, up 3.7% y-o-y.

Jet prices averaged an estimated US$99.42/bbl in Q410, using the composite for New York, Singapore and Rotterdam. The y-o-y increase was just over 19%, with jet almost matching the gain in gasoil prices. Quarter-on-quarter (q-o-q) the increase was 13.2%. For 2010 as a whole the level is believed to have been US$91.00/bbl. This compares with US$70.66/bbl in 2009 (+28.8%).

For Q111 we assume a global wholesale jet price of US$97.76/bbl, again representing a slight downturn from the Q4 level, but a y-o-y rise of 13.2%. The full year 2011 wholesale jet price forecast is US$94.32/bbl, or a y-o-y increase of 3.6%.

Business Monitor International Ltd

Page 18

China Petrochemicals Report Q2 2011

Table: Oil Product Price Data And Forecasts, 2008-2015 (US$/bbl)

Gasoline Rotterdam Premium Unleaded NY Harbour Unleaded Singapore Premium Unleaded Global average Jet/kerosene Rotterdam NY Harbour Singapore Global average Gasoil Rotterdam Mediterranean Singapore Global average Naphtha Rotterdam Mediterranean Singapore Global average

2008 100.12 102.54 102.64 101.77

2009 70.6 69.7 70.21 70.17

2010e 88.96 87.77 88.36 88.36

2011f 91.94 90.77 91.37 91.36

2012f 97.69 96.44 97.08 97.07

2013f 103.44 102.11 102.79 102.78

2014f 103.44 102.11 102.79 102.78

2015f 103.44 102.11 102.79 102.78

126.61 127.13 121.11 124.95

70.81 71.18 69.99 70.66

91.22 91.69 90.1 91

94.61 94.98 93.37 94.32

100.53 100.91 99.21 100.22

106.44 106.85 105.05 106.11

106.44 106.85 105.05 106.11

106.44 106.85 105.05 106.11

122.62 121.75 119.53 121.3

68.74 69.13 69.01 68.96

89.23 89.28 89.46 89.32

92.5 92.59 92.8 92.63

98.29 98.38 98.6 98.42

104.07 104.17 104.4 104.21

104.07 104.17 104.4 104.21

104.07 104.17 104.4 104.21

87.31 86.2 88.7 87.4

58.76 58.38 60.75 59.3

78.71 78.43 79.23 78.79

81.49 81.26 81.94 81.56

86.58 86.34 87.06 86.66

91.67 91.42 92.18 91.76

91.67 91.42 92.18 91.76

91.67 91.42 92.18 91.76

e/f = estimate/forecast. Source: 2000-2006 data: Energy Information Administration; 2007-2010 data: International Energy Agency; forecasts: BMI

In Q410 naphtha averaged US$87.78/bbl on an estimated global basis, compared with US$72.27/bbl in Q310 and US$73.44 in Q409. We put the 2010 average naphtha price at US$78.79/bbl, up almost 33% yo-y. Thanks to the growth of petrochemicals demand in Asia, naphtha was once again the star performer in 2010, having also beaten the other key products in 2009.

For Q111 we assume a global wholesale naphtha price of US$87.89/bbl, virtually unchanged from Q410, but a y-o-y rise of 12.2%. The full year 2011 wholesale naphtha price forecast is US$81.56/bbl, up 3.5% y-o-y.

Looking further ahead, we see gasoline prices rising to US$97.07/bbl in 2012, and stabilising around US$102.78/bbl from 2013. Gasoil is expected to climb to US$98.42 in 2012, reaching a plateau of just

Business Monitor International Ltd

Page 19

China Petrochemicals Report Q2 2011

over US$104 from 2013. The price of jet is forecast to average US$100.22/bbl in 2012 before levelling out at just over US$106from 2013. For naphtha the 2012 estimate is US$86.66, rising to a plateau of almost US$91.80 from 2013.

Business Monitor International Ltd

Page 20

China Petrochemicals Report Q2 2011

Emerging Asia Petrochemicals Overview

The targets of investment in the global petrochemicals industry are the Middle East and Asia, but China is likely to take the lion's share of growth in capacity over the next five years with 3.1mn tpa currently under construction through JVs involving BP, ExxonMobil, BASF and Shell. Japan, Korea and Taiwan are important players on the mainland Chinese market, with a growing proportion of their exports sold to markets in eastern and southern China. China is planning further expansion under its 11th five-year plan, which started in April 2006. The size of the Chinese market and its rapid growth in demand for petrochemicals is pushing up Asian ethylene feedstock prices and causing supply problems throughout the region. To address the problem, Chinese ethylene production is scheduled to reach 21.38mn tpa by 2012, with seven major ethylene projects capable of producing 6.2mn tpa of ethylene, including an increase in the total production capacity of existing ethylene plants by 4.38mn tpa. The largest projects involve leading petrochemicals majors, particularly Shell. The chief risk factor for the Chinese petrochemical sector is the rapid rise in global petrochemicals investment, which is leading to high demand for engineering contractors, particularly in the Middle East. This could create bottlenecks in the Chinese petrochemical industry, further exacerbating the problem of feedstock shortages throughout Asia and pushing up prices.

Restrictions on raw materials mean that Japan is unlikely to raise its total capacity above 7.2mn tpa. Instead, Japanese petrochemicals producers are shifting their investment to eastern Asia and the Middle East to build projects that will eventually export to China. In South Korea, where petrochemicals contribute 20-25% of GDP with ethylene capacity of 5.45mn tpa, growth is also likely to be stimulated by Chinese demand. Taiwan's ability to take advantage of Chinese growth is constrained by political disputes with the mainland, although this has not stopped some companies from investing in the mainland. Taiwan has an ethylene capacity of 2.42mn tpa.

While Shell has concentrated its investments in China, Dow Chemical is turning its attention to India, which has greater unrealised potential for expansion. Foreign companies have yet to take part in largescale Indian projects such as cracker development due to the relatively small scale of operations. The Indian government has placed petrochemicals at the heart of its development strategy with the creation of a number of petrochemicals zones. Nevertheless, despite strong levels of economic growth, expansion in the Indian petrochemical industry is proceeding at a slower rate than China. Around 70% of the Indian market is dominated by two Indian corporations: Reliance Industries Ltd (RIL) and Indian Petrochemical Corporation Ltd (IPCL). Plans are in place to construct its second integrated oil refinery in the Jamnagar Special Economic Zone, adjacent to its existing oil refinery in Gujarat. Dow Chemical is funding the zone's petrochemicals production. Meanwhile, the state-owned oil refiner Indian Oil Corporation Ltd (IOCL) is expanding into the petrochemicals sector with the construction of Haldia

Business Monitor International Ltd

Page 21

China Petrochemicals Report Q2 2011

Petrochemicals and plans for further petrochemicals operations in West Bengal, Orissa and Haryana. Private industrial conglomerates such as the Tata Group are also planning to enter the petrochemical sector.

The growth in demand for feedstock from China and India is proving to be a serious problem for petrochemicals industries in smaller emerging Asian economies. The Philippines aims to move away from its petrochemical industry's dependency on imported feedstock, but progress is slow and the sector is burdened by failed projects and high levels of corporate debt as well as cheaper and more competitive imports. Planned developments, including a new naphtha cracker at Batangas, expected to be operational in 2008, will see ethylene capacity of 320,000tpa and polymer production capacity of 1.16mn tpa by 2011. However, this will not be enough to satisfy local demand and the Philippines will remain dependent on imports. Indonesia is also a significant net importer of basic petrochemicals as a result of setbacks in its new facility and expansion projects since the 1997 Asian financial crisis. Rising feedstock prices are also depressing profit margins and affecting competitiveness. A petrochemicals national strategy developed by the local industry, the government and Japanese investors, published in March 2007, envisages that over 50% of national ethylene demand will be met by imports up until 2010. The Chandra Asri Petrochemical Centre (CAPC) expanded ethylene capacity to 620,000tpa and propylene capacity to 279,000tpa in 2007 to cope with demand, but Indo Olefin Petrochemical's 800,000tpa ethylene project is unlikely to go ahead due to a lack of financial backing.

Malaysia's petrochemicals industry is growing and is supported by its well-developed oil and gas sector. According to the Third Industrial Master Plan (IMP3) (2006-2020) for the petrochemicals industry, the Malaysian government is planning to develop Bintulu (Sarawak), Gurun (Kedah), Tanjung Pelepas (Johor) and Labuan into new petrochemical zones. The government is also planning to focus on realising the full potential of the existing petrochemical zones. The plan would require total investment of around MYR34bn (US$9.32bn) for the next 15 years. The petrochemicals industry is expected to remain a key contributor to Malaysia's manufacturing sector. Chemical Market Associates (CMA) forecasts Malaysia's average annual growth rate for PE and PP in 2004-2009 to be 7.0% and 6.5% respectively.

While the Philippines and Indonesia are struggling in an increasingly competitive environment, Thailand is pressing ahead with its plans to double petrochemicals capacity over the next five years. But new plants will have to satisfy environmental regulations to be introduced this year or the petrochemical industry's growth potential will be severely curtailed. The focus of investment is Map Ta Phut, which will contain a US$1.7bn ethane cracker producing 1mn tpa of ethylene to feed PE plants at the complex to be opened in Q409. A second cracker with a capacity of 1.7mn tpa of ethylene and propylene is also planned. Thailand's PTT Chemical is partnering with Dow Chemical, Siam Cement and Toyo Engineering to develop the complex, which will make the country a significant supplier of synthetic resins.

Business Monitor International Ltd

Page 22

China Petrochemicals Report Q2 2011

Elsewhere in Indo-China, Vietnam is showing little interest in developing its petrochemicals sector. Vietnam has little capacity for domestic production of either ethylene or the basic polymers derivatives PE and PP and its main thrust of development is in fertiliser production for domestic use.

Table: Asian Ethylene Projects

Company PetroChina PetroChina PetroChina PetroChina Sinopec/BASF* Sinopec Sinopec Sinopec PetroChina Sinopec/Aramco/ExxonMobil Sinopec/KPC Shide/SABIC Sinopec Sinopec YNCC LG Daesan Lotte Daesan Formosa Petrochemicals CPC IOC ONGC OIC Haldia Petrochemicals Siam Cement SP Chemicals ExxonMobil* Royal Dutch Shell ExxonMobil

Location Lanzhou Daqing Dushanzi Fushun Nanjing Tianjin Zenhai Guangzhou Chengdu Fujian Guangdong Dalian Shanghai Wuhan Yeochun Daesan Daesan Mailiao Kaohsiung Panipat Mangalore Paradip Haldia Extra Map Ta Phut Phu Yen Singapore Singapore Singapore

Country China China China China China China China China China China China China China China South Korea South Korea South Korea Taiwan Taiwan India India India India India Vietnam Singapore Singapore Singapore

Start-up Late 2006 2007/2008 2008 2008 2009 2010 2010 2010 2010 2010 2010 2010 na na Nov 2006 2007 2008 Q1 2007 2010 2009 2010 2011 Q1 2008 2010 2012 Q4 2006 2009/2010 na

Capacity, tpa 360,000 320,000 1,000,000 860,000 150,000 1,000,000 1,000,000 1,000,000 800,000 800,000 1,000,000 1,000,000 1,000,000 800,000 350,000 210,000 350,000 1,200,000 1,200,000 800,000 1,100,000 2,950,000 140,000-168,000 800,000 1,500,000 75,000 800,000 na

* Expansion, capacity refers to addition;

At the planning stages; na = not available/applicable. Source: Reuters

Business Monitor International Ltd

Page 23

China Petrochemicals Report Q2 2011

China Market Overview

Chinas petrochemicals sector has become the countrys third largest industry behind textiles and machinery, and is of great importance to the economy. The sector reported profits of CNY300bn (US$37.9bn) during the first eight months of 2006, according to the governments State Development and Reform Commission, a rise of 22.5% y-o-y. The sector processed 199.15mn tonnes of crude oil during the period, up 5.7% on the previous year.

China has several thousand petrochemicals production facilities under construction, which are likely to contribute to an increase in production capacity in the coming years. However, these include many smallscale operations as well as the more notable mega-projects described below, and some of the former may never see the light of day given current government concerns about environmental damage from certain projects located along major rivers.

Table: Chinas Petrochemicals Sector HDPE Capacity

Company

Daqing Petrochemical Co Jilin Petrochemicals Ltd (JLPL) Liaoyang Petrochemical Co (LYPC) Maoming Petrochemical Corp (MPCC) Shanghai Golden Phillips Petrochemical Co Ltd Shanghai Petrochemical Co Ltd (SPC) Shanghai Secco Petrochemical Co Ltd (Secco) Sinopec Beijing Yanshan Petrochemical Co Ltd (BYPC) Yangzi Petrochemical Co Ltd (YPC)

Region

Heilongjiang Jilin Liaoning Guangdong Shanghai Shanghai Shanghai Beijing Jiangsu

Location

Daqing Jilin Liaoyang Maoming Jinshan Jinshan Caojing Beijing Nanjing

Capacity, tpa

240,000 300,000 70,000 350,000 150,000 250,000 300,000 160,000 280,000

Source: BMI

Chinas petrochemicals industry has been successful in obtaining considerable scale, due to the rapid developments in the seventh, eighth and ninth five-year plan periods. Substantial restructuring, amendment in investment plans and technological innovations in the ninth five-year plan period (19962000) resulted in increased enterprise scale, production capacity and technological equipment. This plan formed the basis for strategic development and planning in the 10th five-year plan period (2001-2005). Furthermore, rapid economic globalisation and sector reforms in the country are expected to help the Chinese petrochemicals industry grow in the future.

Business Monitor International Ltd

Page 24

China Petrochemicals Report Q2 2011

As GDP rises in the country and heads toward the US$3,000 per capita level (it is forecast to be just short of this by 2010 compared with an estimated US$1,679 in 2006), demand for plastics and chemicals is expected to grow sharply. Underpinning much of Chinese petrochemicals demand is the countrys largescale textile sector, which continues to grow and is expected to remain a major source of consumption for many products for the foreseeable future. Furthermore, demand for plastics and packaging in China is expected to account for 30% of total world consumption by 2010.

Table: Chinas Petrochemicals Sector LDPE Capacity

Company BASF-YPC Co Ltd CNOOC and Shell Petrochemicals Co Ltd (CSPCL) Daqing Petrochemical Co Daqing Petrochemical Co Maoming Petrochemical Corp (MPCC) Maoming Petrochemical Corp (MPCC) PetroChina Lanzhou Petrochemical Corp PetroChina Lanzhou Petrochemical Corp Qilu Petrochemical Co Ltd Shanghai Petrochemical Co Ltd (SPC) Sinopec Beijing Yanshan Petrochemical Co Ltd (BYPC) Sinopec Beijing Yanshan Petrochemical Co Ltd (BYPC)

Region Jiangsu Guangdong Heilongjiang Heilongjiang Guangdong Guangdong Gansu Gansu Shandong Shanghai Beijing Beijing

Location Nanjing Huizhou Daqing Daqing Maoming Maoming Lanzhou Lanzhou Zibo Jinshan Beijing Beijing

Capacity, tpa 400,000 250,000 65,000 200,000 110,000 250,000 40,000 200,000 140,000 160,000 180,000 200,000

Source: BMI

Table: Chinas Petrochemicals Sector LLDPE Capacity

Company CNOOC and Shell Petrochemicals Co Ltd (CSPCL) Daqing Petrochemical Co Dushanzi Petrochemical Fushun Petrochemical Co Guangzhou Petrochemical General Works Jilin Petrochemicals Ltd (JLPL) Maoming Petrochemical Corp (MPCC) Panjin Ethylene Corp PetroChina Lanzhou Petrochemical Corp

Region Guangdong Heilongjiang Xinjiang Liaoning Guangdong Jilin Guangdong Liaoning Gansu

Location Huizhou Daqing Dushanzi Fushun Guangzhou Jilin City Maoming Panjin Lanzhou

Capacity, tpa 200,000 85,000 200,000 85,000 260,000 275,000 220,000 130,000 60,000

Business Monitor International Ltd

Page 25

China Petrochemicals Report Q2 2011

Table: Chinas Petrochemicals Sector LLDPE Capacity

Company PetroChina Lanzhou Petrochemical Corp Qilu Petrochemical Co Ltd Shanghai Secco Petrochemical Co Ltd (Secco) Tianjin United Chemical Corp (TUCC) Yangzi Petrochemical Co Ltd (YPC) Zhongyuan Petrochemical Co Ltd

Region Gansu Shandong Shanghai Tianjin Jiangsu Henan

Location Lanzhou Zibo Caojing Tianjin Nanjing Puyang

Capacity, tpa 300,000 100,000 300,000 120,000 200,000 250,000

Source: BMI

Table: Chinas Petrochemicals Sector PP Capacity

Company Anqing Co Changling Petrochemical Co CNOOC and Shell Petrochemicals Co Ltd (CSPCL) CNPC Ningxia Dayuan Refining & Chemical Co Dalian Petrochemical Corp Dalian Petrochemical Corp Daqing Petrochemical Co Daqing Refining & Chemical Dushanzi Petrochemical Formosa Plastics Industrial Co (Ningbo) Fujian Petrochemical Co Ltd (FPCL) Fushun Petrochemical Co Gansu Langang Petrochemical Co Guangzhou Petrochemical General Works Guangzhou Petrochemical General Works Hebei Gaocheng Ruixing Chemical Co Ltd Heilongjiang Qihua Chemicals Co Ltd Huabei Oilfield Refinery Jilin Petrochemicals Ltd (JLPL) Jinan Co Jinxi Petrochemical

Region Anhui Hunan Guangdong Ningxia Liaoning Liaoning Heilongjiang Heilongjiang Xinjiang Zhejiang Fujian Liaoning Gansu Guangdong Guangdong Hebei Heilongjiang Hebei Jilin Shandong Liaoning

Location Anqing Yueyang Huizhou Yinchuan Dalian Dalian Daqing Daqing Dushanzi Ningbo Quanzhou Fushun Lanzhou Guangzhou Guangzhou Gaocheng Qiqihar Renqiu Jilin City Jinan Huludao

Capacity, tpa 30,000 100,000 240,000 30000 125,000 200,000 100,000 300,000 100,000 450,000 70,000 90,000 110,000 50,000 110,000 20,000 20,000 100,000 55,000 70,000 30,000

Business Monitor International Ltd

Page 26

China Petrochemicals Report Q2 2011

Table: Chinas Petrochemicals Sector PP Capacity

Company Jiujiang Co Liaoyang Petrochemical Co (LYPC) Luoyang Petrochemical General Factory Maoming Petrochemical Corp (MPCC) Maoming Petrochemical Corp (MPCC) Panjin Ethylene Corp PetroChina Lanzhou Petrochemical Corp PetroChina Lanzhou Petrochemical Corp Qilu Petrochemical Co Ltd Shandong Dongming Petrochemical Group Shanghai Petrochemical Co Ltd (SPC) Shanghai Petrochemical Co Ltd (SPC) Shanghai Secco Petrochemical Co Ltd (Secco) Shaoxing Sanyuan Petrochemical Co Shijiazhuang Refining & Chemical Co Ltd (SRCC) Sinopec Beijing Yanshan Petrochemical Co Ltd (BYPC) Sinopec Beijing Yanshan Petrochemical Co Ltd (BYPC) Sinopec Beijing Yanshan Petrochemical Co Ltd (BYPC) Sinopec Hainan Refining & Chemical Co (HRCC) Sinopec Hubei Xinghua Co Ltd Sinopec Jingmen Petrochemical Complex Sinopec Qingdao Refining and Chemical Co Ltd Tianjin United Chemical Corp - (TUCC) West Pacific Petrochemical Co (WEPEC) Wuhan Phoenix Co Ltd Xinjiang Dushanzi Tianli High & New Tech Co Ltd (DTTC) Yanchang Petroleum Group Yangzi Petrochemical Co Ltd (YPC) Zhenghe Group Zhenhai Refining and Chemical Co Ltd (ZRCC) Zhongyuan Petrochemical Co Ltd

Region Jiangxi Liaoning Henan Guangdong Guangdong Liaoning Gansu Gansu Shandong Shandong Shanghai Shanghai Shanghai Zhejiang Hebei Beijing Beijing Beijing Hainan Hubei Hubei Shandong Tianjin Liaoning Hubei Xinjiang Shaanxi Jiangsu Shandong Zhejiang Henan

Location Jiujiang Liaoyang Luoyang Maoming Maoming Panjin Lanzhou Lanzhou Zibo Heze Jinshan Jinshan Caojing Shaoxing Shijiazhuang Beijing Beijing Beijing Yangpu Jingmen Jingmen Qingdao Tianjin Dalian Wuhan Dushanzi Yanan Nanjing Guangrao Ningbo Puyang

Capacity, tpa 120,000 60,000 80,000 170,000 300,000 50,000 40,000 300,000 70,000 40,000 230,000 260,000 250,000 300,000 100,000 60,000 165,000 200,000 210,000 20,000 120,000 200,000 60,000 100,000 100,000 30,000 100,000 360,000 60,000 200,000 80,000

Source: BMI

Business Monitor International Ltd

Page 27

China Petrochemicals Report Q2 2011

Table: Chinas Petrochemicals Sector Cracker Capacity

Company BASF-YPC Co Beijing Eastern Petrochemical Co, Eastern Chemical Works CNOOC and Shell Petrochemicals Co Ltd (CSPCL) Daqing Petrochemical Co Dushanzi Petrochemical Fushun Petrochemical Co Guangzhou Petrochemical General Works Jilin Petrochemicals Ltd (JLPL) Liaoyang Petrochemical Co (LYPC) Maoming Petrochemical Corp (MPCC) Maoming Petrochemical Corp (MPCC) Panjin Ethylene Corp PetroChina Lanzhou Petrochemical PetroChina Lanzhou Petrochemical Qilu Petrochemical Co Shanghai Petrochemical Co (SPC) Shanghai Petrochemical Co (SPC) Shanghai Secco Petrochemical Co (Secco) Sinopec Beijing Yanshan Petrochemical Co (BYPC) Tianjin United Chemical Corp (TUCC) Yangzi Petrochemical Co Zhongyuan Petrochemical

Region Jiangsu Beijing Guangdong Heilongjiang Xinjiang Liaoning Guangdong Jilin Liaoning Guangdong Guangdong Liaoning Gansu Gansu Shandong Shanghai Shanghai Shanghai Beijing Tianjin Jiangsu Henan

Capacity, tpa 600,000 180,000 800,000 600,000 220,000 150,000 260,000 850,000 200,000 380,000 640,000 180,000 450,000 250,000 840,000 150,000 700,000 900,000 760,000 200,000 650,000 200,000

Source: BMI

Business Monitor International Ltd

Page 28

China Petrochemicals Report Q2 2011

Table: Chinas Petrochemicals Sector PVC Capacity

Company Anhui Chlor-Alkali Chemical Group Co Baoding Electrochemical Factory Baotou Tomorrow Technology Co Beiyuan Chemical Industry Co Benxi Chemical Industry Group Co Cangzhou Cangjing Chemical Co Changzhou Chemical Plant Chengdu Huarong Chemical Co Ltd (CHCCL) Chenzhou Electrochemical Chenzhou Huaxiang Chemical Industry Co China Zenith Chemical Group Dezhou Petrochemical Plant Formosa Plastics Industrial Co (Ningbo) Fujian Nanping Rongchang Chemical Co Gansu Yanguoxia Chemical Plant Guangxi Liuzhou Dongfeng Chemical Co Guizhou Zunyi Alkali Plant Haiji Chloralkali Chemical Industry Co (HCACC) Handan Fuyang Chemical Group Co Ltd Hangzhou Electrochemical Group Co (HEGC) Haohua Yuhang Chemical Industrial Co Harbin Huaer Chemical Co Hebei Baoshuo Co Hebei Cangzhou Dahua Group Co Hebei Jinniu Chemical Hebei Shenghua Chemical Industry Co Heilongjiang Qihua Chemicals Co Henan Jiyuan City Resin Plant Henan Shenma Chloride & Alkali Chemical Industry Co Hubei Yichang Shanshui Hubei Yihua Chemical Industry Co Hubei Yihua Chemical Industry Co Hunan Zhuzhou Chemical Industry Group Co Inner Mongolia Huanghe Chemical Group Co Inner Mongolia Linhai Chemical Industry Co

Region Anhui Hebei Inner Mongolia Shaanxi Liaoning Hebei Jiangsu Sichuan Hunan Hunan Heilongjiang Shandong Zhejiang Fujian Gansu Guangxi Guizhou Inner Mongolia Hebei Zhejiang Henan Heilongjiang Hebei Hebei Hebei Hebei Heilongjiang Henan Henan Hebei Hubei Hubei Hunan Inner Mongolia Inner Mongolia

Location Hefei Baoding Baotou Shenmu Benxi Cangzhou Changzhou Pengzhou Chenzhou Chenzhou Mudanjiang Dezhou Ningbo Fuwen Yanguoxia Liuzhou Zunyi Wuhai Handan Hangzhou Jiaozuo Harbin Baoding Cangzhou Cangzhou Zhangjiakou Qiqihar Jiyuan Pingdingshan Yichang Yichang Yichang Zhuzhou Wuhai Wulateqian

Capacity, tpa 20,000 110,000 30,000 100,000 15,000 300,000 130,000 80,000 50,000 50,000 60,000 60,000 400,000 15,000 10,000 10,000 60,000 60,000 15,000 60,000 180,000 25,000 100,000 60,000 230,000 50,000 100,000 45,000 200,000 20,000 100,000 120,000 100,000 30,000 150,000

Business Monitor International Ltd

Page 29

China Petrochemicals Report Q2 2011

Table: Chinas Petrochemicals Sector PVC Capacity

Company Inner Mongolia Sanlian Chemical Co Jiangsu GPRO Beifang Chlor-Alkali Co Jiangsu Jiangdong Chemical Co Jiangsu Meilan Chemical Co Jiangsu Yinka Chemical Co Jiangyin Huashi Jiaozuo Chemical & Power Group Co Jilantai Salt Chemical Group Co Jilin Petrochemicals Ltd (JLPL) Jinhua Chemical Corp (JHCC) Jining Zhongyin Electrochemical Co Juhua Group Corp Leshan Yongxiang Resin Nanning Chemical Industry Co Ningxia Electrochemical Plant Ningxia Jinyuyuan Chemical Group Co Ningxia West PVC Ningxia Yinglite Chemical Panjin Liaohe Group Co Qilu Petrochemical Co Qingdao Haijing Chemical (Group) Co Shaanxi Jintai Chlor-Alkali Chemical Shandong Chloralkali Resins Co Shandong Haihua Alkali & Resin Co Shandong Hengtong Chemical Industry Co Shandong Huantai Bohui Corp Shanghai Chlor-Alkali Chemical Co Ltd (SCAC) Shanghai Tianyuan Chemical Group Corp Shanghai Tianyuan Huasheng Chemical Co Shanxi Yungang Organic Chemical Group Co Shanxi Yushe Chemical Co Shenyang Chemical Co Sichuan Jinlu Resin Co Siping Haohua Chemical Co Southeast Electro-Chemical Co (SEEC)

Region Inner Mongolia Jiangsu Jiangsu Jiangsu Jiangsu Jiangsu Henan Inner Mongolia Jilin Liaoning Shandong Zhejiang Sichuan Guangxi Ningxia Ningxia Ningxia Ningxia Liaoning Shandong Shandong Shaanxi Shandong Shandong Shandong Shandong Shanghai Shanghai Shanghai Shanxi Shanxi Liaoning Sichuan Jilin Fujian

Location Hohhot Xuzhou Changzhou Taizhou Wuxi Jiangyin Jiaozuo Jilantai Jilin City Huludao Jining Quzhou Leshan Nanning Shizuishan Qingtongxia Shizuishan Shizuishan Panjin Zibo Qingdao Yulin Weifang Weifang Linyi Zibo Wujing Shanghai Caojing Datong Yushe Shenyang Deyang Siping Fuzhou

Capacity, tpa 30,000 100,000 150,000 40,000 10,000 80,000 130,000 200,000 20,000 130,000 50,000 65,000 100,000 160,000 50,000 160,000 275,000 200,000 80,000 600,000 160,000 100,000 100,000 100,000 120,000 200,000 410,000 10,000 20,000 10,000 400,000 130,000 340,000 80,000 100,000

Business Monitor International Ltd

Page 30

China Petrochemicals Report Q2 2011

Table: Chinas Petrochemicals Sector PVC Capacity

Company Suzhou Huasu Plastics Co (SHP) Taiyuan Chemical Industry Group Co Tangshan Sanyou Chemical Industries Co Tianjin Chemical Plant of Tianjin Bohai Chemical Industrial Tianjin Dagu Chemicals Tianjin Dagu Chemicals Tianjin LG-Dagu Chemical Co Tosoh Guangzhou Chemical Industries Co (TGC) Weifang Yaxing Chemical Co Wuhan Gedian Chemical Industry Group Co Wuhu Chemical Plant Wuxi Greenapple Chemical Industry Co Xian Chemical Plant Xiaoshan Lianfa Electrochemistry Co Xinjiang Shihezi Zhongfa Chemical Co Xinjiang Tianye Co Xinjiang Zhongtai Chemical Industry Co Xinjiang Zhongtai Chemical Industry Co Xinwen Mining Co Xinxiang Resin Plant Xinyi Electrochemical Plant Xuzhou Tiancheng Chlor-Alkali Co Yangquan Coal Industry Group Yibin Tianyuan Co Yunnan Chemical Plant Yunnan Salt Chemical Co Zhengzhou Chemical Plant

Region Jiangsu Shanxi Hebei Tianjin Tianjin Tianjin Tianjin Guangdong Shandong Hubei Anhui Jiangsu Shaanxi Zhejiang Xinjiang Xinjiang Xinjiang Xinjiang Shandong Henan Jiangsu Jiangsu Shanxi Sichuan Yunnan Yunnan Henan

Location Suzhou Taiyuan Tangshan Tianjin Tianjin Tianjin Tianjin Guangzhou Weifang Wuhan Wuhu Wuxi Xian Hangzhou Shihezi Shihezi Urumqi Urumqi Taian Xinxiang Xinyi Peixian Yangquan Yibin Kunming Kunming Zhengzhou

Capacity, tpa 130,000 150,000 300,000 120,000 200,000 280,000 340,000 220,000 40,000 60,000 20,000 100,000 50,000 20,000 50,000 320,000 160,000 140,000 100,000 15,000 50,000 100,000 100,000 500,000 25,000 130,000 12,000

Source: BMI

Business Monitor International Ltd

Page 31

China Petrochemicals Report Q2 2011

Table: Chinas Petrochemicals Sector PS Capacity

Company Daqing Petrochemical Co Formosa Plastics Industrial Co (Ningbo) Fujian Fangxing Petrochemical Co Guangzhou Petrochemical General Works Panjin Ethylene Corp Qilu Petrochemical Co Quanzhou QuanGang Ocean Polystyrene Resin Co SAL Petrochemical (Zhangjiagang) Co Shanghai Secco Petrochemical Co (Secco) Sinopec Beijing Yanshan Petrochemical Co Ltd (BYPC) SK Networks Zhanjiang Xinzhongmei Chemical Co Zhenjiang Chi Mei Chemical Co

Region Heilongjiang Zhejiang Fujian Guangdong Liaoning Shandong Fujian Jiangsu Shanghai Beijing Guangdong Guangdong Jiangsu

Location Daqing Ningbo

Capacity, tpa 25,000 200,000 120,000

Guangzhou Panjin Zibo Quanzhou Zhangjiagang Caojing Beijing Shantou Zhanjiang Zhenjiang

50,000 30,000 35,000 120,000 120,000 300,000 50,000 150,000 100,000 360,000

Source: BMI, ICIS

Energy Inefficiencies And Bottlenecks

Although Chinas petrochemicals industry is growing rapidly, it faces several challenges. Economic growth since the reforms of the 1980s has resulted in imbalances in the petrochemicals sectors industrial structure, particularly relating to energy and raw materials supply. This could potentially lead to a reduced incentive to increase production in an economy that is already unable to meet its domestic demand from the local market. In an effort to stabilise production and advance the industrys competitiveness at a global level, the government has introduced measures to optimise the industrial structure of the petrochemicals sector. These measures are primarily aimed at improving the production of agricultural petrochemicals and the diversification of products to reduce dependency on exports. The government is also promoting investment in advanced technologies in eastern areas.

The China Petroleum and Chemical Industry Planning Institute has proposed four guidelines for the development of the countrys petrochemicals industry during the 11th five-year plan (2006-2010):

The optimisation of crude supply and refining capacity with an improvement in distribution processes

Business Monitor International Ltd

Page 32

China Petrochemicals Report Q2 2011

Better crude and petroleum product storage and transport facilities, including improved import handling and distribution systems, more terminal and strategic supply bases, better pipeline infrastructure and lower transport costs

The introduction of measures and technology to make production more energy efficient and thus increase competitiveness

Increased production of resins, fibres and rubber.

Efforts are being made to ensure the optimum use of rich energy resources in the western region. According to CPCIA estimates, energy consumption in the petrochemicals sector accounts for about 40% of total domestic consumption. The sectors energy consumption per unit produced is 4.1 times higher than in the US and Canada. The association has also proposed increased government investment in technical research to promote technology enhancement and reduce the cost of petrochemicals production.

The geographic distribution of the countrys oil refineries is also a factor that could undermine future growth and there are plans to build new refining capacity close to, or as part of, integrated petrochemicals complexes to provide reliable captive feedstock and reduce transport costs. Government agencies are also increasingly insisting on sufficient feedstock being incorporated into proposed projects for new petrochemicals production capacity. Plans for several industrial free trade zones around the country also include petrochemicals operations.

The industry is initiating efforts to promote safer and more environmentally friendly practices in the manufacturing, distribution and use of its products. In January 2006, the CPCIAs Responsible Care system, promoting health, safety and the environment, came into effect. This is a joint effort with the Association of International Chemical Manufacturers. According to CPCIA data, 60 people died in accidents in petroleum and petrochemicals operations in 2005, an increase of 29% y-o-y.

Production

China is the worlds leading synthetic fibres producer, ranking fourth in terms of synthetic rubber and fifth in both resins and ethylene production capacity. However, individual production facilities are scattered and output is considerably below the average for world-scale plants, resulting in higher unit production costs. One study conducted by the government estimated that consumption per unit of output for small plants was more than 76% higher than large plants. Estimates for average energy intensities for Chinas ethylene plants range from 73 to 90 gigajoules per tonne (GJ/t), based on a relatively heavy feedstock mix. This compares with about 68GJ/t for US steam cracking plants and 58GJ/t primary energy (including feedstock) in the Netherlands.

Business Monitor International Ltd

Page 33

China Petrochemicals Report Q2 2011

Alongside addressing production efficiencies, the structural reform of Chinas state-owned enterprises (SOEs) continues. Both the scale of the reform programme and the pace at which it is being implemented are unprecedented. Overall, changes have involved more than 200,000 SOEs, employing over 100mn workers, generating half the countrys industrial output and accounting for two-thirds of fixed assets.

An indication of the pace and depth of the reform programme within the petroleum and petrochemicals sector since the early 1990s may be found in the changes in the three key companies. These are China National Petroleum Corporation (CNPC) and its subsidiary PetroChina, China Petrochemicals Corporation (Sinopec Group) and China National Offshore Oil Corporation (CNOOC).

Table: Chinas Supply And Demand Volumes Of Major Petrochemical Products

Olefins Ethylene Propylene Polyolefins Polyethylene (PE) Polypropylene (PP) Aromatics Petro benzene Polyesters Purified terephthalic acid (PTA) Monoethylene glycol (MEG) Methanol

Production growth rate, 2007-2008, % -2 1

Production CAGR, 20032007, % 14 11

Apparent demand, 2008, 000tpa 10,963 10,270

Demand growth rate, 2007-2008, % 0 3

Demand CAGR, 20032007, % 16 13

-3 2

15 14

11,325 10,465

-2 -2

7 10

-3

15

3,936

-2

18

-8 0 3

26 18 35

14,997 7,001 12,329

-11 6 10

19 18 25

CAGR = compound annual growth rate. Source: ICIS, CBI Research and Consulting; China National Bureau of Statistics

The Sinopec Group was reorganised with the companys best assets combined to form China Petroleum and Chemical Corporation (Sinopec Corporation), which floated a stake in the public markets. Sinopecs businesses include oil and gas exploration and production, crude oil processing, oil products trading, transport, distribution and marketing, and petrochemicals products production, marketing and distribution. The governments restructuring of the Chinese chemical industry redistributed some of the countrys ethylene operations along geographical lines between Sinopec and PetroChina. Although the Chinese petrochemicals market has numerous opportunities due to strong economic growth, it is confronted with many challenges including strong competition, resource constraints and restrictive environmental regulations.

Business Monitor International Ltd

Page 34

China Petrochemicals Report Q2 2011

Against this backdrop, the Chinese petrochemicals sector is likely to:

Judicially exploit available resources

Encourage more foreign and private investment

Encourage restructuring of the industry to achieve economies of scale

Strive for technology innovation, with a focus on core technologies and expertise with intellectual property

Establish strong links with Middle East oil producers offering investment in petrochemicals projects in return for crude/refined product supplies.

Business Monitor International Ltd

Page 35

China Petrochemicals Report Q2 2011

Table: Cracker Capacity, 2006-2013 (000tpa)

2006e CNOOC PetroChina Daging PetroChina Fushun PetroChina Jilin PetroChina Lanzhou PetroChina Liaoyang Sinopec Beijing (Yanshan) Sinopec Guangzhou Sinopec Maoming Sinopec Nanjing (Yangzi) Sinopec Puyang Sinopec Qilu Sinopec Shanghai Sinopec Zhenhai Sinopec Tianjin Secco Petrochemical (BP/Sinopec) Exxon/Aramco Fujian CNOOC/Shell Huizhou CNPC Fushun BASF/YPC Nanjing Chengdu Ethylene Sinopec Wuhan Sinopec/KPC Others Total 140 800 145 530 880 130 710 200 1,000 850 180 720 845 na 200 900 na 800 na 600 na na na 600 10,230

2007 140 800 145 530 880 130 860* 200 1,000 850 180 720 845 na 200 900 na 800 na 600 na na na 450 10,230

2008 140 800 145 530 880 130 860* 200 1,000 850 180 720 845 na 1,000 900 800 800 850

2009 140 800 145 530 880 130 860* 200 1,000 850 180 720 845 1,000 1,000 1,100 800 800 850

2010f 140 800 145 530 880 130 860* 200 1,000 850 180 720 845 1,000 1,000 1,100 800 800 850

2011f 140 800 145 530 880 130 860* 200 1,000 850 180 720 845 1,000 1,000 1,100 800 800 850

2012f 140 800 145 530 880 130 860* 200 1,000 850 180 720 845 1,000 1,000 1,100 800 800 850

2013f 140 800 145 530 880 130 860* 200 1,000 850 180 720 845 1,000 1,000 1,100 800 800 850

600 na na na 450 12,680

600 na na na 450 13,680

600 na na na 450 13,680

600 na na 1,000 450 14,680

600 800 800 1,000 450 16,280

600 800 800 1,000 450 16,280

e = forecast; * Assumes Yanshan purchase of Dongfang approved; na = not available/applicable; Estimate/forecast; start date not confirmed; Assumes CNPC start-up on schedule otherwise total = 11,830. Source: World Cracker Report, companies, BMI

Business Monitor International Ltd

Page 36

China Petrochemicals Report Q2 2011

Industry Trends And Developments

Major planned investments between 2009 and 2014 will see ethylene and polymer production capacity increase dramatically. Some of the largest investments are in the south eastern and eastern provinces of Guangdong, Fujian, Zhejiang and Jiangsu as well as the Shanghai municipality. Xinjiang in the north west is also a major investment destination for the industry, due to its proximity to Central Asian oil and gas fields.

Table: Chinas Petrochemicals Sector Ethylene Projects

Company Shanghai Secco Petrochemical Co (Secco) Fujian Refining & Petrochemical Co (FREP) Liaoning Huajin Tongda Chemical Tianjin Petrochemical/Sabic Zhenhai Refining and Chemical Co (ZRCC) Baotou Shenhua Coal Chemicals Dushanzi Petrochemical BASF-YPC Co Dalian Shide Group Daqing Petrochemical Fushun Petrochemical Dow Chemical/Shenhua PetroChina Sichuan Petrochemical(PSP) Shanghai Petrochemical Co (SPC) Sinopec Hainan Refining & Chemical Co (HRCC) Sinopec/SK Corp Shenyang Paraffin Wax Chemical Co Ltd Sinopec Beijing Yanshan Petrochemical Co (BYPC) Sinopec Corp

Province Shanghai Fujian Liaoning Tianjin Zhejiang Inner Mongolia Xinjiang Jiangsu Liaoning Heilongjiang Liaoning Shaanxi Sichuan Shanghai Hainan Hubei Liaoning Beijing Sichuan

Location na Quanzhou Panjin Tianjin Ningbo Baotou Dushanzi Nanjing Dalian Daqing Fushun Yulin Pengzhou Jinshan na Wuhan Shenyang Beijing na

Capacity, tpa 200,000* 800,000 450,000 1,000,000 1,000,000 300,000 1,000,000 750,000* 1,300,000 600,000 800,000 500,000 800,000 600,000 1,000,000 800,000 135,000 1,300,000* 340,000

Completion 2009 2009 2009 2009 2010 2010 2010 2010 2011 2011 2011 2012 2012 2012 2012 2012 na na na

* Expansion; na = not available/applicable. Source: BMI, Company sources

Business Monitor International Ltd

Page 37

China Petrochemicals Report Q2 2011

Table: Chinas Petrochemicals Sector PE Projects

Product HDPE LLDPE LLDPE LDPE LLDPE LLDPE LLDPE LLDPE LLDPE LLDPE HDPE HDPE LLDPE LLDPE HDPE LLDPE