Escolar Documentos

Profissional Documentos

Cultura Documentos

Quiz 1

Enviado por

sureshvadde3919Descrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Quiz 1

Enviado por

sureshvadde3919Direitos autorais:

Formatos disponíveis

Chapter 13

Money and Banking

After reading Chapter 13, MONEY AND BANKING, you should be able to: Explain the three functions of money: Medium of Exchange, Unit of Account, Store of Value. Understand the definition of Liquidity. Define the Narrow (M1) and Broad (M2) money-supply measures. Explain the role of a Financial Intermediary. Explain the main entries on a banks balance sheet and how banks earn profits. Explain the meaning of a Fractional Reserve Banking System. Discuss the institutional structure of the Federal Reserve. Define the Monetary Base. Explain how the system of banks can create deposits in excess of its reserves. Explain how the Fed can control the money supply using Open Market Operations, Reserve Requirements, and Discount Rates.

T Outline

I. Three Functions of Money A) Money is anything that serves the three functions of money: 1. Medium of Exchange: Money can be used to buy things and pay debts. 2. Unit of Value: Money is the unit in which prices are listed. 3. Store of Value: Money retains its purchasing powercan. B) Money is more efficient that barter since it eliminates the need for a Double Coincidence of Wants, which occurs where the buyer and the seller both want to obtain goods produced by the other. C) Liquidity refers to how quickly and with what risks an asset can be converted into money. The more liquid the asset the more closely it substitutes for money. D) The Narrow (M1) definition of money is the sum of currency, coins, checking account deposits held by the public, travelers checks, and other deposits upon which checks may be drawn. E) The Broad (M2) definition of money equals M1 plus savings deposits, small time deposits, money-market mutual-fund shares and a few other highly liquid assets.

Chapter 13

Money and Banking

131

II.

Banks A) Banks are Financial Intermediaries that link lenders and borrowers. B) The main assets of a bank are its loans, investments, and securities. Reserves (reserves are held at the Fed and as vault cash) are somewhat less than 2 percent of all assets. C) Banks liabilities are the deposits it has accepted from the public, including transactions or demand deposits, savings and time deposits, and other debts. D) Banks earn a profit from the Interest Rates Spread, which is the difference between the interest that banks pay on deposits and the interest rates they receive on their loans and other investments. E) Banks hold only a small fraction of their total deposits as reserves. This is known as a Fractional-Reserve Banking System. This system can lead to bank failure when the public loses confidence in the banks ability to meet any withdrawals.

III. The Federal Reserve A) The Federal Reserve (FED) is the central bank (a bank for banks) of the United States. 1. The Fed regulates and also assists the nations banking system. 2. The Fed controls the nations money supply. B) The seven-member Board of Governors, appointed by the President of the United States, directs the Fed. C) The Federal Open Market Committee (FOMC) consists of the seven Board members and presidents of five of the twelve regional Federal Reserve banks. The FOMC determines the amount of the nations money supply. D) Open Market Operations are purchases and sales of federal government securities on the Feds account. E) Reserve requirements are rules stating the amount of reserves banks must keep to back their deposits 1. The Fed sets Required Reserve Ratios, which tell the amount of reserves required for each dollar of deposits. 2. A banks deposits at the Fed plus its vault cash are the banks legal reserves. 3. Excess Reserves are reserves a bank holds beyond the quantity it is legally mandated to have. F) The Monetary Base is the sum of bank reserves on deposit at the Fed plus currency in circulation. 1. Whenever the Fed buys (sells) something, the monetary base expands (contracts). 2. The monetary base can be thought of as the Feds currency liability.

132

Gregory Essentials of Economics, Sixth Edition

G) Banks can create money when the Fed expands the monetary base. 1. When the Fed expands the monetary base, banks have excess reserves. 2. When any one bank has excess reserves, it loans the excess, which thereby winds up as deposits in another bank. 3. After the deposit is made at the second bank, it has some excess reserves. This bank loans these excess reserves, which will end up as deposits in a third bank. 4. The banking system, as a whole, increases its loans and deposits until it no longer has undesired excess reserves. By so doing, the banking system creates more deposits than the initial increase in base money. 5. The Deposit Multiplier is the ratio of the change in deposits to excess reserves. This equals the reciprocal of the reserve requirement. IV. How the Fed Controls the Money Supply The Fed has three instruments it can use to control the money supply: A) Open-Market Operations are buying and selling by the Federal Reserve of federal government securities. 1. When securities are purchased, the monetary base expands and the money supply increases; when they are sold, the monetary base shrinks and the money supply falls. 2. Open-market operations are the Feds major tool of monetary control. B) When the Fed changes the Reserve Requirements imposed on banks, it alters the deposit multiplier. 1. If reserve requirements are increased (lowered), the deposit multiplier falls (rises), therefore shrinking (raising) the M1 money supply. 2. This tool is seldom used since it can create sudden shocks. C) The Discount Rate is the interest rate the Fed charges banks that borrow reserves. 1. If the Fed lowers (raises) the discount rate, banks borrow more (less), and the monetary base and money supply expands (contracts). 2. The Fed increases the discount rate to keep them in line with other interest rates. A change in the discount rate sends a signal to banks that credit will become tighter or looser.

T Review Questions

True/False

If the statement is correct, write true in the space provided; if it is wrong, write false. Below the question give a short statement that supports your answer. _____ 1. Financial intermediaries borrow funds from ultimate lenders and lend it to ultimate borrowers. One of the largest assets on banks balance sheets is demand deposits. A bank keeps on hand as reserves all of the money entrusted to it as deposits. The broad (M2) definition of money includes some assets excluded from the narrow (M1) definition.

_____ _____ _____

2. 3. 4.

Chapter 13

Money and Banking

133

_____ _____ _____

5. 6. 7.

The major component of M1 is checking accounts and other checkable deposits. The Federal Reserve is overseen by the seven-member Board of Governors. Open-market operations are the purchase or sale of government securities by commercial banks. Anytime the Fed buys something, it removes money from the economy. Commercial banks are completely free to determine the amount of reserves they keep on hand to back their deposits.

_____ _____

8. 9.

_____

10. The monetary base is changed whenever a bank customer withdraws funds from his or her checking account. 11. Each bank can create additional demand deposits equal in amount to its excess reserves. 12. A banks excess reserves equal its total reserves minus its required reserves. 13. An increase in the required reserve ratio increases the deposit multiplier. 14. If people decide they want to hold more currency and fewer demand deposits, the M1 money supply eventually falls. 15. Open-market purchases of government bonds by the Federal Reserve increase the nations money supply. 16. The discount rate is the interest rate the Federal Reserve pays on the reserves banks keep at the Federal Reserve.

_____ _____ _____ _____

_____

_____

Multiple Choice Questions

Circle the letter corresponding to the correct answer. 1. Which of the following assets is most liquid? (a) Shares of stock in IBM (b) US government securities (c) Land (d) Gold (e) Currency

134

Gregory Essentials of Economics, Sixth Edition

2.

Money must fulfill all of the following functions except (a) be a medium of exchange. (b) serve as the unit of value. (c) be a store of value. (d) be generally accepted as a means of purchasing commodities (e) The above are all functions of money. The M1 money supply equals (a) the sum of coins and currency. (b) the sum of coins, currency, travelers checks, checking accounts at banks, and other accounts upon which checks may be drawn. (c) the sum of coins, currency, travelers checks, checking accounts at banks, other accounts upon which checks may be drawn, and savings and time deposits. (d) the sum of all accounts upon which checks may be drawn. (e) the sum of currency in circulation and bank reserves held at the Federal Reserve. M1 increases when the Fed (a) raises the discount rate. (b) sells a government security. (c) raises the required reserve ratio. (d) buys a government security. (e) All of these actions lower the money supply. Which of the following statements about the Federal Reserve is false? (a) The Federal Reserve sets required reserve ratios that commercial banks must meet. (b) The Federal Reserve is overseen by the seven-member Board of Governors. (c) Federal Reserve actions can change the amount of the nations money supply. (d) The Federal reserve can increase or decrease the monetary base. (e) None of the above; that is, they are all true statements.

3.

4.

5.

Essay Questions

Write a short essay or otherwise answer each question. 1. 2. Why isnt the line of credit on credit cards counted as part of the nations money supply? Suppose the First Federal Bank has demand deposits of $100 million. If the required reserve ratio is 15 percent, what amount of reserves is First Federal required to keep? What if the required reserve ratio is 10 percent?

Chapter 13

Money and Banking

135

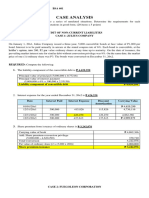

For the next 5 questions, assume the required reserve ratio is 10 percent. 3. Suppose the balance sheet of Mellon bank is initially given by Assets Vault Cash Reserves at Fed Loans $80 $70 $750 Liabilities Transactions deposits $900

What are Mellons total reserves? Its required reserves? Its excess reserves? If Mellon decided it wanted to increase its loans by the maximum possible, how much can Mellon increase its loans? 4. 5. Continuing from Question 3, suppose Mellon made the maximum loan possible to U.S. Steel. After Mellon made the loan, but before U.S. Steel has spent the loan, what is Mellons balance sheet? From Question 4, suppose U.S. Steel withdraws its loan by taking cash. After U.S. Steel withdraws its loan, what is Mellons balance sheet? What are Mellons total reserves? Its required reserves? Its excess reserves? Suppose U.S. Steel uses the proceeds of its loan to pay its electric bill (in cash) to its electric company, Duquesne Light. If Duquesne Light deposits this in its checking account with Pittsburgh National Bank, what will be the banks balance sheet after the deposit if its balance sheet before the deposit is Assets Vault Cash Reserves at Fed Loans 7. $40 $30 $630 Liabilities Transactions deposits $700

6.

Using the balance sheet in Question 6, before Duquesne Light deposited its funds in Pittsburgh National Bank, what were the banks total reserves? Required reserves? Excess reserves? By how much could the bank increase its loans? After the funds are deposited, what are the banks total reserves? Required reserves? Excess reserves? By how much can Pittsburgh National increase its loans? If the required reserve ratio is 10 percent, what is the deposit multiplier? If the Fed raises the monetary base and excess reserves by $1000, by how much can the money supply ultimately change? If the required reserve ratio is 20 percent, what can be the increase in the money supply from the $1000 change? The boxed example in this chapter uses the concept of moral hazard to explain the Asian Crisis of 1997 and 1998. Write an essay explaining how the belief in an ultimate lender of last resort, such as the International Monetary Fund, helped create the Asian Crisis.

8.

9.

136

Gregory Essentials of Economics, Sixth Edition

T Answers to Review Questions

True/False

1. 2. 3. 4. 5. 6. 7. 8. 9. True. A bank is a good example of an intermediary: it borrows from people (the ultimate lenders) by accepting their deposits and then loans to other individuals or firms (the ultimate borrowers). False. Transactions (demand) deposits are a liabilitynot an assetto the bank because the deposits are owned by others. The bank must pay them back to their owners upon request. False. Banks keep on hand as reserves only about 2 percent of the total deposits. True. These assets include time deposits, savings deposits, and shares in money-market mutual-funds. True. Checkable deposits, including demand deposits, comprise about 70 percent of M1. True. Members of the board are appointed for fourteen-year terms by the President of the United States. False. Open market operations are the purchase or sale of government securities by the Federal Reserve. False. Anytime the Fed buys something, it injects money into the economy. False. The Fed sets legally required reserve ratios that constrain banks to hold at least a certain level of reserves.

10. False. The monetary base is changed only when the Federal Reserve injects or withdraws currency or bank reserves. 11. True. Each bank is free to create additional demand deposits by loaning the amount of its excess reserves to a customer. 12. True. This is the definition of excess reserves. 13. False. The deposit multiplier equals the reciprocal of the required reserve ratio, so an increase in the required reserve ratio lowers the deposit multiplier. 14. True. When people withdraw more currency from banks, banks reserves fall. In order to maintain their required level of reserves, banks must reduce the loans they grant. This reduction sets off a multiple contraction of the M1 money supply. 15. True. The Fed pays for its purchases by either increasing the amount of currency (thereby raising M1 directly) or by increasing the reserves accounts banks maintain at the Fed. This latter action raises banks excess reserves, thereby leading to a multiple expansion of the M1 money supply. 16. False. The discount rate is the interest rate the Federal Reserve charges banks when the banks borrow reserves from it.

Chapter 13

Money and Banking

137

Multiple Choice Questions

1. 2. 3. 4. 5. (e) Currency is the most liquid of any asset. (e) If an asset meets these functions, it is considered money. (b) This is the definition of M1. (d) Purchasing a government security is an open-market operation that raises the base money supply and banks excess reserves. This leads to a multiple expansion of the money supply. (e) All of the statements about the Federal Reserve are correct and, because the Federal Reserve plays a significant role in the nations economy, all of the statements are important.

Essay Questions

1. Credit cards merely allow their owners very easy and convenient access to a loan. Ultimately the loan must be repaid using money, either currency or checking account money. Thus the credit limit on credit cards is a loan limit and not part of the money supply. When the required reserve ratio is 15 percent, $15 million in reserves is required [($100 million) (.15)]. When the reserve ratio is 10 percent, $10 million must be kept as reserves. Lowering the reserve requirement reduces the legally required amount of reserves. Such a decrease gives banks more excess reserves that they may use to loan out, thereby creating more money. Total reserves are $150 (the sum of vault cash plus reserves at the Fed). Required reserves are $90 (the required reserve ratio, .10, times the total amount of transactions [demand] deposits, $900). Excess reserves are $60 (the difference between total reserves and required reserves). Mellon may increase its loans by $60. A bank may increase its loans by the amount of its excess reserves. Assets Vault Cash $80 Reserves at Fed $70 Loans $810 Liabilities Transactions deposits $960

2.

3.

4.

The new balance sheet is given above. Mellon has loaned $60 to U.S. Steel by opening a checking account for U.S. Steel in the amount of the loan. Thus total transactions deposits (checking accounts) rise by $60 and total loans rise by $60. 5. Assets Vault Cash Reserves at Fed Loans $20 $70 $810 Liabilities Transactions deposits $900

As shown above, U.S. Steel withdraws its loan by reducing its checking account by $60, so transactions deposits fall by $60. Since U.S. Steel takes its funds in the form of currency, vault cash falls by $60. Mellons total reserves are $90 (the sum of vault cash plus reserves at Fed). Required reserves are $90 (the required reserve ratio times the total deposits). Its excess reserves are $0 (the difference between actual and required reserves). Mellon now has no excess reserves with which to make loans.

138

Gregory Essentials of Economics, Sixth Edition

6. Assets Vault Cash Reserves at Fed Loans $100 $30 $630 Liabilities Transactions deposits $760

The balance after the deposit is shown above. Duquesne Light deposits the $60 in its checking account, so transactions deposits, as well as cash, rise by $60. 7. Before the Deposit Total reserves $70 Required reserves $70 Excess reserves $0 Maximum loan $0 After the Deposit Total reserves $130 Required reserves $76 Excess reserves $54 Maximum loan $54

As shown above, notice that Pittsburgh National Bank is now in a position to increase its loans. Were it to do so, the money supply would continue to grow. 8. The deposit multiplier is 10. It equals 1/(required reserve ratio) or 1 / (0.1) = 10. If the monetary base is increased, the money supply can ultimately change by the deposit multiplier (10) times the change in the monetary base ($1,000) or by $10,000. If the required reserve ratio is 20 percent, the deposit multiplier is 5. Thus, if the monetary base is raised by $1,000, the money supply ultimately can change by $5,000. As the required reserve ratio is increased, banks are forced to retain more of any additional deposit as reserves. Hence they loan out less, so the money supply does not increase by as much as when the required reserve ratio is smaller. When lenders believe that there is a lender-of-last-resort, such as the International Monetary Fund, they will be willing to grant risky loans without much research on the underlying solvency of borrowers because they can rely on being automatically bailed out by the lender-of-last-resort. This tendency to make risky loans in this situation has been termed a moral hazard problem.

9.

T Additional Questions

1. Explain what happens to M1 and M2 as a result of the following: (a) Heather takes money out of her checking account and puts it into her savings account. (b) Rick sells a corporate bond and uses the proceeds to buy a CD (a small time deposit) (c) Nicole writes a check to buy a US government bond.

Chapter 13

Money and Banking

139

2.

Consider the following bank statement: Assets Reserves Loans Securities Other Assets (a) (b) (c) (d) $400 $3,500 $2,000 $500 Liabilities Demand Deposits $2,000 Time Deposits $4,000 Net Worth

If the required reserve ratio on demand deposits is 10% how much are required reserves? How much excess reserves is the bank holding? What is the bank net worth? By how much can this bank increase the money supply? Explain.

3.

Assume the required reserve ratio is 5%. By how much could the money supply increase by if the Federal Reserve made an open market purchase of $5 billion? What would happen to the money supply if they sold $3 billion of government securities? In the discussion in your textbook it was assumed that banks hold no excess reserves and all money is redeposited back into the bank. In essence people are holding no currency. What would happen to the magnitude of the multiplier if banks held some excess reserves and the public held some currency? What would you think would happen to the multiplier at Christmas time? Why?

4.

Answers

1. (a) M1 will fall but M2 will remain the same. Remember that M1 is part of M2. (b) M1 stays the same but M2 will increase since small time deposits are part of M2. (c) M1 and M2 falls. Government bonds are not included in M1 or M2. M1 falls since she pays for the bond out of her checking account and M2 falls because M1 is part of M2. (a) (b) (c) (d) Required reserves are 10% of the $2,000 in demand deposits or $200. The bank holds $200 in excess reserves: $400 total minus $200 required. The banks net worth is equal to $400: the $6,400 in assets minus the $6,000 in liabilities. The bank can make $200 worth of loans. Thus, the money supply would increase by $200.

2.

3.

In both cases the multiplier, which is equal to 1/required reserve ratio, is 20. Therefore, if the Fed makes an open market purchase of $5 billion, the money supply could increase by $100 billion. If they made an open market sale of $3 billion, the money supply could fall by $60 billion. If banks hold on to excess reserves rather than lend out the money, the money creation process will generate less than if they held no excess reserves. Therefore, the multiplier would be smaller. Also, if the public holds onto some currency rather than depositing in the bank, the banks ability to make new loans would decrease and therefore, the multiplier will be smaller. During Christmas time the multiplier could fall since people increase the amount of currency they hold relative to the amount of demand deposits.

4.

Você também pode gostar

- Group Business Research Report DESCRIPTIONDocumento25 páginasGroup Business Research Report DESCRIPTIONRATIKA ARORAAinda não há avaliações

- Chapter 29 SOLUTIONS TO TEXT PROBLEMSDocumento6 páginasChapter 29 SOLUTIONS TO TEXT PROBLEMSHoàngTrúcAinda não há avaliações

- Money, Banking, and Monetary Policy: ObjectivesDocumento9 páginasMoney, Banking, and Monetary Policy: ObjectivesKamalpreetAinda não há avaliações

- Money Is Defined As Any Asset That People Are Willing To Accept in Exchange For Goods andDocumento4 páginasMoney Is Defined As Any Asset That People Are Willing To Accept in Exchange For Goods andVũ Hồng PhươngAinda não há avaliações

- Monetary Policy WorksheetDocumento9 páginasMonetary Policy WorksheetTony KimAinda não há avaliações

- Ch25 (Money, The Price Level, and Inflation)Documento66 páginasCh25 (Money, The Price Level, and Inflation)MKMikeAinda não há avaliações

- Note On Monet PolDocumento21 páginasNote On Monet Polaudace2009Ainda não há avaliações

- Lecture 21 (19th Jan, 2009)Documento16 páginasLecture 21 (19th Jan, 2009)sana ziaAinda não há avaliações

- Final Exam Money and Banking - Representative QuestionsDocumento12 páginasFinal Exam Money and Banking - Representative QuestionsSeba BustoAinda não há avaliações

- Case, Fair and Oster Chapter 10 Problems Money Supply and Federal ReserveDocumento3 páginasCase, Fair and Oster Chapter 10 Problems Money Supply and Federal ReserveRayra AugustaAinda não há avaliações

- Chapter Fifteen Money and Banking: Answers To End-Of-Chapter QuestionsDocumento7 páginasChapter Fifteen Money and Banking: Answers To End-Of-Chapter QuestionsnickAinda não há avaliações

- Lecture No.6 (Updated - For CLASS)Documento26 páginasLecture No.6 (Updated - For CLASS)Deep ThinkerAinda não há avaliações

- THE MONETARY SYSTEM Chapter 29Documento5 páginasTHE MONETARY SYSTEM Chapter 29HoàngTrúcAinda não há avaliações

- Chapter 25 - The Money Supply and The Federal Reserve SystemDocumento3 páginasChapter 25 - The Money Supply and The Federal Reserve SystemRudyanto SihotangAinda não há avaliações

- Money, The Price Level, and InflationDocumento61 páginasMoney, The Price Level, and InflationGianella Zoraya Torres AscurraAinda não há avaliações

- Question For ReviewDocumento6 páginasQuestion For ReviewNila AyuniaAinda não há avaliações

- Macro Tut 5Documento7 páginasMacro Tut 5TACN-2M-19ACN Luu Khanh LinhAinda não há avaliações

- The Money Supply Process and The Money MultipliersDocumento18 páginasThe Money Supply Process and The Money MultipliersLekhutla TFAinda não há avaliações

- Parkinmacro8 (25) 1200Documento20 páginasParkinmacro8 (25) 1200nikowawa100% (1)

- Practice Set 9 AnswersDocumento7 páginasPractice Set 9 AnswersRomit BanerjeeAinda não há avaliações

- MoneyDocumento15 páginasMoneyadilnewaz75Ainda não há avaliações

- Ch29 Chapter Answers AidDocumento9 páginasCh29 Chapter Answers AidAshura ShaibAinda não há avaliações

- Tche 303 - Money and Banking Tutorial 9Documento3 páginasTche 303 - Money and Banking Tutorial 9Phương Anh TrầnAinda não há avaliações

- The Money Supply and The Federal Reserve SystemDocumento18 páginasThe Money Supply and The Federal Reserve SystemYuri AnnisaAinda não há avaliações

- Practice Set 9 Dem GSCMDocumento7 páginasPractice Set 9 Dem GSCMRomit BanerjeeAinda não há avaliações

- Macroeconomics Unit 4 Multiple ChoiceDocumento13 páginasMacroeconomics Unit 4 Multiple ChoiceAleihsmeiAinda não há avaliações

- Central Banking, The Federal Reserve, and The Money Market: FunctionsDocumento1 páginaCentral Banking, The Federal Reserve, and The Money Market: Functionsapi-237746849Ainda não há avaliações

- The Supply of MoneyDocumento12 páginasThe Supply of MoneyJoseph OkpaAinda não há avaliações

- Tute-9 FMTDocumento6 páginasTute-9 FMTHiền NguyễnAinda não há avaliações

- Fin - Market Midterm ExamsDocumento6 páginasFin - Market Midterm ExamsMaurizze BarcarseAinda não há avaliações

- + Script (LTTCTT)Documento13 páginas+ Script (LTTCTT)Khoi Nguyen TuanAinda não há avaliações

- ACFINA3 FinalExam QuestionsDocumento7 páginasACFINA3 FinalExam QuestionsRachel LeachonAinda não há avaliações

- EconomicsDocumento20 páginasEconomicsNatural Spring WaterAinda não há avaliações

- Tiếng Anh PtDocumento19 páginasTiếng Anh Ptbechipp2002Ainda não há avaliações

- The Monetary System LatestDocumento31 páginasThe Monetary System LatestDila OthmanAinda não há avaliações

- Monetary Economics Problem SetDocumento3 páginasMonetary Economics Problem SetRibuAinda não há avaliações

- Lecture 7 Eco 192 e IAU Online LectureNotes PowerPoint Presentation Part 2 Central Bank and Monetary PolicyDocumento52 páginasLecture 7 Eco 192 e IAU Online LectureNotes PowerPoint Presentation Part 2 Central Bank and Monetary PolicyEmre ÖzünAinda não há avaliações

- Tche 303 - Money and Banking Tutorial 9: CurrencyDocumento4 páginasTche 303 - Money and Banking Tutorial 9: CurrencyNguyen VyAinda não há avaliações

- Chapter 3 - Money and Banking PDFDocumento5 páginasChapter 3 - Money and Banking PDFPankaj SharmaAinda não há avaliações

- Quiz 565Documento5 páginasQuiz 565Haris NoonAinda não há avaliações

- ESP2 - Unit 8 Central Banking - KEYDocumento7 páginasESP2 - Unit 8 Central Banking - KEYVeo Veo ChanAinda não há avaliações

- Test Your Understanding of Material For The FinalDocumento10 páginasTest Your Understanding of Material For The FinalDegoAinda não há avaliações

- Macroeconomics 11th Edition Parkin Solutions ManualDocumento21 páginasMacroeconomics 11th Edition Parkin Solutions Manualdencuongpow5100% (22)

- Chapter #2: Summary: NBPS: Non-Bank Private Sector. MBI's: Monetary Banking InstitutionsDocumento4 páginasChapter #2: Summary: NBPS: Non-Bank Private Sector. MBI's: Monetary Banking InstitutionscesarangomezAinda não há avaliações

- Money and Banking 13Documento5 páginasMoney and Banking 13EdenA.MataAinda não há avaliações

- Money Creation and The Banking SystemDocumento14 páginasMoney Creation and The Banking SystemminichelAinda não há avaliações

- Money and BankingDocumento10 páginasMoney and BankingMaruf AhmedAinda não há avaliações

- Chap - 27.the Monetary SystemDocumento47 páginasChap - 27.the Monetary SystemellieAinda não há avaliações

- Chapter 13 & 14 Money, Banks, The Federal Reserve System and Monetary PolicyDocumento7 páginasChapter 13 & 14 Money, Banks, The Federal Reserve System and Monetary PolicyDiamante GomezAinda não há avaliações

- TUT Macro Unit 6 (Answer)Documento3 páginasTUT Macro Unit 6 (Answer)张宝琪Ainda não há avaliações

- Week 1 - Money Supply ProcessDocumento22 páginasWeek 1 - Money Supply ProcessIlham AtmajaAinda não há avaliações

- Week 1 - Money Supply ProcessDocumento22 páginasWeek 1 - Money Supply ProcessIlham AtmajaAinda não há avaliações

- Econ Notes 3Documento13 páginasEcon Notes 3Engineers UniqueAinda não há avaliações

- Chapter 4 - Activities and Charactristics Under Depository InstitutionsDocumento7 páginasChapter 4 - Activities and Charactristics Under Depository Institutionssonchaenyoung2Ainda não há avaliações

- Practice Quizzes Topic 7-C29Documento5 páginasPractice Quizzes Topic 7-C29phươngAinda não há avaliações

- Unit 6 Money and BankingDocumento70 páginasUnit 6 Money and BankingTrần Diệu MinhAinda não há avaliações

- A. Money and The Banking SystemDocumento9 páginasA. Money and The Banking SystemShoniqua JohnsonAinda não há avaliações

- Essen ch21 PresentationDocumento21 páginasEssen ch21 PresentationVidya AsAinda não há avaliações

- Class 12 Macro Economics Chapter 3 - Revision NotesDocumento4 páginasClass 12 Macro Economics Chapter 3 - Revision NotesPappu BhatiyaAinda não há avaliações

- 2021 07 10 EOD File ChangeDocumento22 páginas2021 07 10 EOD File Changelalit bhandariAinda não há avaliações

- 2.1. Finance & Financial Statement Analysis by CA Pramod JainDocumento69 páginas2.1. Finance & Financial Statement Analysis by CA Pramod JainAnjaneyulu SadhuAinda não há avaliações

- ICO Sample Paper 1 Class 11 - Free PDF DownloadDocumento21 páginasICO Sample Paper 1 Class 11 - Free PDF DownloadNitya AggarwalAinda não há avaliações

- JP Morgan PresentationDocumento22 páginasJP Morgan PresentationramleaderAinda não há avaliações

- Credit Scoring Model For Smes in India: 1. Calculation of RatiosDocumento4 páginasCredit Scoring Model For Smes in India: 1. Calculation of RatiosKushal KapoorAinda não há avaliações

- Weekly Commentary BlackRockDocumento6 páginasWeekly Commentary BlackRockelvisgonzalesarceAinda não há avaliações

- 1T6 S4hana2022 BPD en AeDocumento121 páginas1T6 S4hana2022 BPD en AeVinay KumarAinda não há avaliações

- Assignment QuestionDocumento3 páginasAssignment QuestionMohd Tajudin DiniAinda não há avaliações

- Abbie Merry VecinaBSA 6011Documento7 páginasAbbie Merry VecinaBSA 6011elleeeewoodssssAinda não há avaliações

- CRISIL Mutual Fund Ranking MethodologyDocumento6 páginasCRISIL Mutual Fund Ranking Methodologyranjan sharmaAinda não há avaliações

- MCQ - Negotiable Instruments PDFDocumento9 páginasMCQ - Negotiable Instruments PDFErika LanezAinda não há avaliações

- MbaDocumento3 páginasMbaThiru VenkatAinda não há avaliações

- Partnership - FormationDocumento16 páginasPartnership - Formationnaufal bimoAinda não há avaliações

- Term Exam 2edited Answer KeyDocumento10 páginasTerm Exam 2edited Answer KeyPRINCESS HONEYLET SIGESMUNDOAinda não há avaliações

- Mahusay Bsa-315major-Output-1Documento3 páginasMahusay Bsa-315major-Output-1Jeth MahusayAinda não há avaliações

- Human Resources 3Documento104 páginasHuman Resources 3Harsh 21COM1555Ainda não há avaliações

- MeasurementDocumento2 páginasMeasurementJolaica DiocolanoAinda não há avaliações

- Engineering EconomicsDocumento31 páginasEngineering EconomicsWall_CAinda não há avaliações

- CMA DataDocumento36 páginasCMA DataPramod GuptaAinda não há avaliações

- Usage Patterns of Credit Card Holders in AhmedabadDocumento141 páginasUsage Patterns of Credit Card Holders in AhmedabadAshraj_16Ainda não há avaliações

- Summary of The Bill: Disconnection Notice and Bill ForDocumento2 páginasSummary of The Bill: Disconnection Notice and Bill ForDebabrata DasAinda não há avaliações

- Introduction To Corporate Finance: Mcgraw-Hill/IrwinDocumento35 páginasIntroduction To Corporate Finance: Mcgraw-Hill/IrwinNotesfreeBookAinda não há avaliações

- Lynxci SCREENDocumento25 páginasLynxci SCREENAnonymous 7ijfVbAinda não há avaliações

- CUB - Account DetailsDocumento1 páginaCUB - Account DetailsAsim DasAinda não há avaliações

- Bangladesh Bank Appendix 5Documento133 páginasBangladesh Bank Appendix 5anika100% (1)

- Iob Losing Public Money 30L EpisodeDocumento6 páginasIob Losing Public Money 30L EpisodeNavnit NarayananAinda não há avaliações

- FRMUnit IDocumento17 páginasFRMUnit IAnonAinda não há avaliações

- Case On Bond EvaluationDocumento12 páginasCase On Bond EvaluationZubairia Khan86% (14)

- Currency Converter: EUR/ZAR DetailsDocumento1 páginaCurrency Converter: EUR/ZAR DetailsNombeko MbavaAinda não há avaliações

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNNo Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNNota: 4.5 de 5 estrelas4.5/5 (3)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNo EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNota: 4.5 de 5 estrelas4.5/5 (14)

- Creating Shareholder Value: A Guide For Managers And InvestorsNo EverandCreating Shareholder Value: A Guide For Managers And InvestorsNota: 4.5 de 5 estrelas4.5/5 (8)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNo EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNota: 3.5 de 5 estrelas3.5/5 (8)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthNo EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthNota: 4 de 5 estrelas4/5 (20)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursNo EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursNota: 4.5 de 5 estrelas4.5/5 (8)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisNo EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisNota: 5 de 5 estrelas5/5 (6)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNo EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamAinda não há avaliações

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNota: 4.5 de 5 estrelas4.5/5 (32)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingNo EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingNota: 4.5 de 5 estrelas4.5/5 (17)

- Financial Risk Management: A Simple IntroductionNo EverandFinancial Risk Management: A Simple IntroductionNota: 4.5 de 5 estrelas4.5/5 (7)

- Finance Basics (HBR 20-Minute Manager Series)No EverandFinance Basics (HBR 20-Minute Manager Series)Nota: 4.5 de 5 estrelas4.5/5 (32)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsNo EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsNota: 5 de 5 estrelas5/5 (1)

- Mind over Money: The Psychology of Money and How to Use It BetterNo EverandMind over Money: The Psychology of Money and How to Use It BetterNota: 4 de 5 estrelas4/5 (24)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelAinda não há avaliações

- Value: The Four Cornerstones of Corporate FinanceNo EverandValue: The Four Cornerstones of Corporate FinanceNota: 4.5 de 5 estrelas4.5/5 (18)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetNo EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetNota: 5 de 5 estrelas5/5 (2)

- The Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsNo EverandThe Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsAinda não há avaliações

- Product-Led Growth: How to Build a Product That Sells ItselfNo EverandProduct-Led Growth: How to Build a Product That Sells ItselfNota: 5 de 5 estrelas5/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistNo EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistNota: 4.5 de 5 estrelas4.5/5 (73)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistNo EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistNota: 4 de 5 estrelas4/5 (32)

- Finance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)No EverandFinance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)Nota: 4 de 5 estrelas4/5 (5)