Escolar Documentos

Profissional Documentos

Cultura Documentos

Introduction

Enviado por

Jeyvie Cabrera OdiameDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Introduction

Enviado por

Jeyvie Cabrera OdiameDireitos autorais:

Formatos disponíveis

Introduction Carbon tax is an environmental tax that will be collected fromcarbon emitting products. It is a form of carbon pricing.

. Scientists have pointed to the potential effects on the climate system of releasing greenhouse gases (GHGs) into the atmospher. Since GHG emissions caused by the combustion of fossil fuels are closely related to the carbon content of the respective fuels, a tax on these emissions can be levied by taxing the carbon content of fossil fuels at any point in the product cycle of the fuel. Carbon tax offers a potentially cost effective means of reducing greenhouse gas emissions. Cap and trade system, on the other hand, is a market-based approach used to control pollution by providing economic incentives for achieving reductions in the emissions of pollutants. A central authority (usually a governmental body) sets a limit or cap on the amount of a pollutant that may be emitted. The limit or cap is allocated or sold to firms in the form of emissions permits which represent the right to emit or discharge a specific volume of the specified pollutant. Firms are required to hold a number of permits equivalent to their emissions. The total number of permits cannot exceed the cap, limiting total emissions to that level. Firms that need to increase their volume of emissions must buy permits from those who require fewer permits. The transfer of permits is referred to as a trade. In effect, the buyer is paying a charge for polluting, while the seller is being rewarded for having reduced emissions. Thus, in theory, those who can reduce emissions most cheaply will do so, achieving the pollution reduction at the lowest cost to society. Nowadays, world emission has significantly risen up. Climate changes are experienced all over the world and this is due to the increasing temperature that is brought by the trapped greenhouse gases in the atmosphere. If this scenario worsen, the only place where life is known to exist yet will die. To prevent it from happening, professionals in every field are thinking of ways to lessen carbon emission. Carbon tax and Cap and trade system are 2 of the best brainchilds of carbon emission reduction. Philippines, in a smaller scale, likewise contributes to this alarming rate of increase in carbon emission. We are actually included in the Top 25% of the worlds biggest carbon emitters ranging from 45 50th spot out of roughly 200 nations. In this case therefore, we also need to take part in reducing this carbon emission by any means. The researchers had therefore thought of implementing either of these two most popular ways of reducing carbon emission of the Philippines. Biggest carbon emitting companies in the Philippines will be interviewed and further analysis will be made for assessment of which would better help the Philippines carbon emission: Carbon tax or Cap and trade system?

Você também pode gostar

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

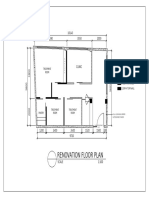

- Renovation Floor Plan: ClinicDocumento1 páginaRenovation Floor Plan: ClinicJeyvie Cabrera OdiameAinda não há avaliações

- Main Gate Design: PerspectiveDocumento3 páginasMain Gate Design: PerspectiveJeyvie Cabrera OdiameAinda não há avaliações

- FirefoxDocumento1 páginaFirefoxJeyvie Cabrera OdiameAinda não há avaliações

- WEB DECK PropertyDocumento1 páginaWEB DECK PropertyJeyvie Cabrera OdiameAinda não há avaliações

- Road Traffic SignsDocumento40 páginasRoad Traffic SignsRonald McRonaldAinda não há avaliações

- CLI SmokeDetectorEmergencyLightDocumento1 páginaCLI SmokeDetectorEmergencyLightJeyvie Cabrera OdiameAinda não há avaliações

- Total: Description 30% 60% 90% 100% I. Structural FramingDocumento1 páginaTotal: Description 30% 60% 90% 100% I. Structural FramingJeyvie Cabrera OdiameAinda não há avaliações

- Xiii 03Documento16 páginasXiii 03Jeyvie Cabrera OdiameAinda não há avaliações

- Steel TrussDocumento1 páginaSteel TrussJeyvie Cabrera OdiameAinda não há avaliações

- Block 2 Cutting ListDocumento6 páginasBlock 2 Cutting ListJeyvie Cabrera OdiameAinda não há avaliações

- AFAS20 020 Guidelines For Build Your Business BYB Programs PDFDocumento5 páginasAFAS20 020 Guidelines For Build Your Business BYB Programs PDFJeyvie Cabrera OdiameAinda não há avaliações

- Floor Plan 2 PDFDocumento1 páginaFloor Plan 2 PDFrichelleAinda não há avaliações

- How To Install Android Version of PruonephDocumento6 páginasHow To Install Android Version of PruonephJeyvie Cabrera Odiame60% (5)

- Annex ADocumento2 páginasAnnex AJeyvie Cabrera OdiameAinda não há avaliações

- Materials Engineer Reviewer Min Req - 2Documento88 páginasMaterials Engineer Reviewer Min Req - 2Zner NivlekAinda não há avaliações

- Change Order ClaimsDocumento1 páginaChange Order ClaimsJeyvie Cabrera OdiameAinda não há avaliações

- Concrete Lean Concrete: (Note: Cement - Owner Supplied Material)Documento1 páginaConcrete Lean Concrete: (Note: Cement - Owner Supplied Material)Jeyvie Cabrera OdiameAinda não há avaliações

- Dimension Extra Bars Stirrups: Scale NTSDocumento1 páginaDimension Extra Bars Stirrups: Scale NTSJeyvie Cabrera OdiameAinda não há avaliações

- Non Sense Shit This IsDocumento1 páginaNon Sense Shit This IsJeyvie Cabrera OdiameAinda não há avaliações

- To (For Approval)Documento1 páginaTo (For Approval)Jeyvie Cabrera OdiameAinda não há avaliações

- Bid Bulletin No. 02 - AGS Model Units - Permits PDFDocumento1 páginaBid Bulletin No. 02 - AGS Model Units - Permits PDFJeyvie Cabrera OdiameAinda não há avaliações

- Lookup SumproductDocumento3 páginasLookup SumproductJeyvie Cabrera OdiameAinda não há avaliações

- A B C D E F H G I: Ground Floor PlanDocumento1 páginaA B C D E F H G I: Ground Floor PlanJeyvie Cabrera OdiameAinda não há avaliações

- Floor PlanDocumento1 páginaFloor PlanJeyvie Cabrera OdiameAinda não há avaliações

- ReadmeDocumento1 páginaReadmeJerald DacumosAinda não há avaliações

- RevisionDocumento1 páginaRevisionJeyvie Cabrera OdiameAinda não há avaliações

- ReadmeDocumento1 páginaReadmeJerald DacumosAinda não há avaliações

- Non - Sense DocumentDocumento1 páginaNon - Sense DocumentJeyvie Cabrera OdiameAinda não há avaliações

- WORK OUT 4b - Bolted, Riveted & Welded Connections PDFDocumento1 páginaWORK OUT 4b - Bolted, Riveted & Welded Connections PDFJeyvie Cabrera OdiameAinda não há avaliações

- SXDocumento3 páginasSXJeyvie Cabrera OdiameAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- PM Award Nomination Form AffidavitabolitionDocumento7 páginasPM Award Nomination Form AffidavitabolitionInformation Point KapurthalaAinda não há avaliações

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Documento1 páginaW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)AnesAinda não há avaliações

- FATCA/CRS Declaration Form - (Individual)Documento3 páginasFATCA/CRS Declaration Form - (Individual)ansfaridAinda não há avaliações

- LilliputDocumento17 páginasLilliputSharn GillAinda não há avaliações

- DILG Region IV Credit Cooperative: 822 Quezon Avenue, Bgy. Paligsahan, Quezon CityDocumento5 páginasDILG Region IV Credit Cooperative: 822 Quezon Avenue, Bgy. Paligsahan, Quezon CityRowena MarabellaAinda não há avaliações

- Confederation of Coconut Vs Aquino DigestDocumento3 páginasConfederation of Coconut Vs Aquino DigestPrincess Rosshien HortalAinda não há avaliações

- Ch. 2 Master Budget-Rev-2Documento27 páginasCh. 2 Master Budget-Rev-2solomon adamu100% (1)

- Case 5Documento25 páginasCase 5Red TigerAinda não há avaliações

- Essentials of Corporate Finance 8th Edition Ross Solutions ManualDocumento7 páginasEssentials of Corporate Finance 8th Edition Ross Solutions ManualBryanHarriswtmi100% (57)

- Module 3 BailmentDocumento18 páginasModule 3 BailmentVaibhav GadhveerAinda não há avaliações

- Actividad 7 1040 FormDocumento2 páginasActividad 7 1040 FormKevin ÁlvarezAinda não há avaliações

- Econ Assignment AnswersDocumento4 páginasEcon Assignment AnswersKazımAinda não há avaliações

- Release Notes Insurance 471 (FS-CM, FS-CD) EDocumento133 páginasRelease Notes Insurance 471 (FS-CM, FS-CD) EViviana GuimarãesAinda não há avaliações

- MODULE 5 Final Income Taxation PDFDocumento6 páginasMODULE 5 Final Income Taxation PDFJennifer AdvientoAinda não há avaliações

- DTC Agreement Between Cayman Islands and United KingdomDocumento13 páginasDTC Agreement Between Cayman Islands and United KingdomOECD: Organisation for Economic Co-operation and DevelopmentAinda não há avaliações

- Tax 1 - Ass No. 2Documento6 páginasTax 1 - Ass No. 2De Guzman E AldrinAinda não há avaliações

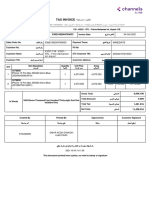

- OrderInvoice - 53821082004769033Documento1 páginaOrderInvoice - 53821082004769033Yoyo ToyoAinda não há avaliações

- Lecture 5 S Forecasting Financial StatementsDocumento39 páginasLecture 5 S Forecasting Financial StatementsAstrid TanAinda não há avaliações

- Role of Regional Rural Banks in Economic DevelopmentDocumento3 páginasRole of Regional Rural Banks in Economic DevelopmentSudheer Kumar RachakondaAinda não há avaliações

- Property Possession and UsufructDocumento19 páginasProperty Possession and UsufructArgel Joseph Cosme100% (1)

- Declaratory Relief On The Validity of BIR RMC No. 65-2012Documento25 páginasDeclaratory Relief On The Validity of BIR RMC No. 65-2012CJAinda não há avaliações

- MBill 9789772009 AUG '08Documento19 páginasMBill 9789772009 AUG '08SkreddyAinda não há avaliações

- AssesmentDocumento12 páginasAssesmentMaya Keizel A.Ainda não há avaliações

- Market Failures and Government InterventionDocumento20 páginasMarket Failures and Government InterventionGiorgi TediashviliAinda não há avaliações

- Excel Skills - Cashbook & Bank Reconciliation TemplateDocumento17 páginasExcel Skills - Cashbook & Bank Reconciliation TemplateLawrence MaretlwaAinda não há avaliações

- Cambridge International General Certificate of Secondary EducationDocumento8 páginasCambridge International General Certificate of Secondary EducationUzma TahirAinda não há avaliações

- IELTS Writing Task 2Documento28 páginasIELTS Writing Task 2nanaba06Ainda não há avaliações

- Judicial Technicality and Efficacyof Clubbing ProvisionDocumento5 páginasJudicial Technicality and Efficacyof Clubbing ProvisionKunwarbir Singh lohatAinda não há avaliações

- Agoda Confirmed Booking at Empire Guest HouseDocumento1 páginaAgoda Confirmed Booking at Empire Guest HouseWahidAinda não há avaliações

- Gitanjali Gems Annual Report FY2012-13Documento120 páginasGitanjali Gems Annual Report FY2012-13Himanshu JainAinda não há avaliações