Escolar Documentos

Profissional Documentos

Cultura Documentos

ADL Smart Grid 01

Enviado por

Minh VuDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

ADL Smart Grid 01

Enviado por

Minh VuDireitos autorais:

Formatos disponíveis

Telecom & Media Viewpoint

Smart Grid opportunities for telcos

New business models in the electricity market of the future for telcos

Existing electricity grids are not capable of satisfying the increasing demand for a reliable electricity supply in the long run. The growing proportion of decentralized electricity generation based on renewables is making electricity transport and distribution significantly more complex, yet the existing electricity network, which in many cases originates from the middle of the last century, is reaching its capacity and capability limits. A Smart Grid one that links innovative information and communication technologies with traditional electricity components will deliver intelligent and highly automated grid maintenance and management. New business models and emerging players will change the rules of the game!

Risks and challenges in the electricity network

Existing electricity supply is based on the principle that a large central power producer supplies electricity to the end consumer via a uni-directional power flow. But the rules of the game are changing. Consumers are becoming prosumers , not only consuming electricity but also producing electricity on a decentralized basis, in the form of solar power, for example. Thus, the flow of electricity has become bi-directional. Overall, the electricity market is following a trend from centralized power generation towards decentralized power generation based on renewables, which creates a high level of volatility in the electricity supply. The increasing volatility created by decentralized power generation presents a difficult challenge for the current electricity grid infrastructure and pushes it to its capacity and capability limits.These changes highlight the requirement for an intelligent Smart Grid and gives new players such as telecoms operators the opportunity to enter this highly dynamic environment.

Combining the two will create a grid capable of balancing demand and supply effectively a Smart Grid.

Characteristics of a Smart Grid

In order to meet future requirements, an intelligent network grid needs to have the following capabilities: :

Integration of growing renewables and decentralized generation Forecasting and balancing volatility of production and demand Fostering energy efficiency through transparency Integration of decentralized electricity storage (e.g. e-Cars) Optimization and automation of network management Leveraging technologies such as smart metering, virtual power plants etc.

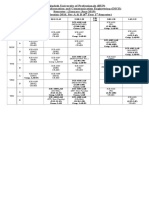

Anticipated Smart Grid market development

The process of transforming the traditional grid into a Smart Grid will be cost intensive. Major investment in the electricity grid infrastructure will be needed if it is to have the capabilities outlined above. It is predicted that the market for Smart Grid electricity will account for 42 billion USD worldwide and 13 billion USD in Europe in 2014 (see figure 1).

Smart Grid the answer to increasing risks and growing challenges

To meet the expectations of consumers and overcome the challenges of delivering a modern electricity supply, it is necessary to link the electricity network grid with state-of-the-art information and communication technologies and applications.

Telecom & Media Viewpoint

Figure 1: Predicted market for Smart Grid electricity

bn USD

60

Selected business opportunities for telcos

Arthur D. Little has analyzed a range of business models in the context of Smart Grid and evaluated their attractiveness and feasibility for telcos.

CAGR Europe

+11%

World CAGR

40 29 20 9 0 2010E 2011E World 33

+10%

37

40

42

Figure 2 shows a small selection of the business models analyzed while two business models are explored in detail below:

13

10

11

12

1) Next Generation Billing

The overall electricity billing market is about to change in several ways, with new regulations acting as a catalyst and accelerating change. Generally, the billing market will develop in three key dimensions:

2012E

2013E Europe

2014E

Source: GP Bullhound Investment Bank and Arthur D. Little analysis

Telcos have been through significant market changes in recent decades and have learnt to adapt. In a saturated market, they are now starting to move from mass-market products to more sophisticated and vertically integrated solutions as a means of addressing declining revenues in the residential telecoms market. However, their existing core competencies seem almost predestined for expansion into certain areas of Smart Grid, allowing them to gain a foothold in the electricity market. The existing automated meter reading business has not tempted telcos, since the low level of data traffic on SIMenabled meters makes average revenue per user (ARPU) unattractive. To address this, the fundamental business model for automated meter reading needs to be broadened to include billing and management services for the energy market and the end-customer. Moving from a connectivity-oriented business, which represents only 1015% of the value generated in this field, to a service provision model would allow operators to extend their share in the value chain up to 6070%. As telecoms operators are currently developing their skill sets and platforms, it seems it will be only a matter of time before they move en masse into this highly attractive area.

Billing data quantity will increase substantially as it approaches real-time data frequency Billing will become more sophisticated due to new tariff systems e.g. load-based tariffs Billing will grow in complexity due to electricity mobility which will trigger electricity roaming

Until recently, the billing market for household electricity was characterized by annual, manual metering of electricity consumption. With the new generation of online Smart Meters measuring consumption minute by minute, the quantity of pure data will increase 500.000-fold. In addition to the increase in data, the market anticipates a sophistication of the billing process, with tariff structures moving from flat towards time- and load-based tariffs (also known as individualized tariffs). As a result, the billing process needs to become intelligent enough to differentiate electricity consumption in accordance with diverse tariff structures, including tariff structures that change in real time. The process of sophistication is linked to increased complexity in the billing process, however electricity mobility, which will inevitably lead to some sort of electricity roaming, is also expected to be one of the key drivers of complexity. These trends and the changes they will bring about form an ideal opportunity for telcos to move into the electricity billing market. Importantly, telcoms enterprises possess expertise in complex billing as well as the infrastructure to deliver this, while utilities do not yet have the infrastructure nor the business processes to meet the changing requirements for billing and metering. Telcos are in a position to present themselves as service providers or could even start to compete with utilities and metering service providers.

1.4 Selected Opportunities Overview

Figure 2: Evaluation of potential business models

Opportunity

Next Generation 1 Billing Energy mgmt portal E-car Balance Power Energy Sourcing and Trading

Description

Smart metering and billing applications are making the energy billing process increasingly complex Telcos and IT companies can use its core expertise to support the utilities in deploying smart solutions In order to capture majority of potential savings coming out of Smart Grid, new energy platforms are needed Tecos and IT companies can gain from getting involved in the development and management of energy platforms The batteries of E-cars will be increasingly used to provide balance power to the electricity market Telcos and IT companies can take a position in the Ecars operations value chain On the top of specific energy trading competence, becoming a trader requires skills that DT group masters Telcos and IT companies can leverage the customer service competence to become a trader

Evaluation

High n Attractiveness 3 4 2 1

Low Low Feasibility High

Market attractiveness

The electricity billing market is expected to grow due to the greater sophistication of billing services. Moreover, from

n Schwarmstrom

High efficiency cogeneration based virtual power plants are becoming increasingly popular providing Telcos can run own cogen units or develop a solution for using the units for local load balancing

2 Smart Grid

Telecom & Media Viewpoint

January 1, 2010 all new buildings in Germany need to be equipped with smart meters. However, high competition among telcos, which all have the capabilities required to deliver metering services, is expected to produce relatively low margins in this market.

moment. Currently, this is available through a number of energy portals built by both top-tier and boutique telecommunication or IT companies. Tools such as Googles PowerMeter and Microsofts Hohm and dozens of other portals are undergoing constant development in order to fulfil customers needs. Energy management portals as they are today are not only demand-side management tools; they also contain integrated features such as targeted search, social integration and many others. Their ambition goes further: todays portals are offering a growing range of tools and services for their users and seem to have both the aspiration and the potential to become a new generation of platforms. Just as Facebook, Twitter, LinkedIn and other social networks form an integral part of peoples daily routine, future energy platforms could become a connecting point for a great number of other services. Currently, telcos have not found a significant inroad into the social network arena they merely serve as a connectivity provider for social networking applications. With Smart Grid services, telcos would have the chance to address this market much more efficiently, generating revenues from both application providers (e.g. provisioning of data) and customers (e.g. allowing a certain quality of service) in a single business.

Feasibility

In CRM and billing, there are many similarities between telcos and utilities, particularly when smart meters and flexible tariffs are taken into account. Moreover, existing customer relations can be exploited as a sales channel, and bundling electricity metering with other telco products would be feasible (e.g. home or office automation, remote-management-over-mobile devices etc.). However, telcos would need to develop competencies in grid connection, utilities tariffs etc.

1

Next generation billing

Evaluation of market attractiveness Evaluation of feasibility

high

Market volume Market growth Margin Competition Overall Attractiveness

low

Capability of the company Existing costumer relations Cost synergies

low

high

low

high

Not useful

useful

low high

high low

low

high

low

high

Overall feasibility

low

high

2) Energy management portal

The anticipated modernization of transmission and distribution grids means consumers will be much more involved in their energy consumption decisions and consequently have more control over their final energy bills. Generally, this will be enabled through three major drivers:

ADL_Report_20070209_A4_EN

Market attractiveness

Recently, energy management portals have caught the eye of many investors and have made it onto the hot list of businesses being watched by the M&A sector. What makes the energy management portals particularly interesting to investors is that the operators will gain a detailed insight into how consumers behave, which will create huge potential for marketing products and services of all kinds. There are roughly 200 million households in the EU alone. Telcos face an interesting business opportunity: they will become one of the few players able to gain access to a share of the entire energy management market. Their ability to utilize their existing network infrastructure and enabling capabilities to manage critical applications much more effectively will be a strong point of differentiation compared to application providers without their own network infrastructure.

Deployment of real-time pricing offering various energy price levels based on the particular base load Implementation of new technologies enabling online remote control of consumers entire appliance portfolio Availability of consumer behaviour analysis enabling adjustment of future consumption

Before the Smart Grid concept was born, consumers who wanted to save on energy bills had no options other than to limit use of their in-home devices. Thanks to the recent implementation of smart technologies, consumers will have other options for decreasing their energy budget and for contributing to more stability in the grid. Among these options are:

Demand response to various price signals whether to produce or consume energy at any given time Home Area Network connecting various smart devices that consume energy according to their default set-up or particular instruction by the end-user

Energy management portal

Evaluation of market attractiveness Evaluation of feasibility

high

Market volume Market growth Margin Competition Overall Attractiveness

low

Capability of the company Existing costumer relations Cost synergies

low

high

low

high

Not useful

useful

low high

high low

low

high

low

high

Overall feasibility

low

high

To become smarter energy consumers, customers will need constant access to information about the situation at any given

3 Smart Grid

Telecom & Media Viewpoint

Feasibility

Operating an energy management portal would not present a particularly complex challenge for telcos in terms of the infrastructure required and data handled. Existing telecommunications customer portals could even be developed and expanded to include energy management functions.

Contacts

Dr. Matthias von Bechtolsheim

Director Energy & Utilities Practice +49 611 7148 115 bechtolsheim.m@adlittle.com

Telcos should prepare carefully

The increasing interconnection of the traditional grid infrastructure and information and communication technologies is generating significant market changes and triggering the development of new business models. This translates into a great opportunity for established as well as emerging players to develop new business models and thus expand their business beyond its current horizon. However, while the changes present opportunities, traditional electricity market players also face the risk of losing market share to new and emerging players, particularly if Smart Grid becomes a key market for telcos in future. For telcos, Smart Grid is an opportunity to expand their business into the power market and become an established player in the electricity value chain. Telcos should analyze the whole set of potential business models (from limited connectivity services to full electricity management services) to identify the most promising options for generating margins on a long-term basis. The greatest challenge for telcos is to formulate a robust strategy and appropriate processes that allow them to act quickly and flexibly in response to the changing economic, technological and regulatory environment. This challenge is particularly difficult since the structure of the Smart Grid market is much more complex than that of telcos current core market. Telcos need to prepare carefully since their strategy will have to support the ultimate objective of identifying business models that are sustainable/profitable and deliver a competitive advantage. Arthur D. Littles Future Grid Strategy Kit encompasses the two dimensions that will inform strategy decisions: competitive advantage and market attractiveness. The kit allows telcos to make a systematic analysis of both the potential profitability of a business model and the feasibility and competitive advantage of the underlying company. Thus, the Future Grid Strategy Kit coupled with Arthur D. Littles energy and ICT expertise is the foundation for sound and successful preparation for an entry into the electricity market of the future.

Lars Meckenstock

Principal Energy & Utilities Practice +49 211 8609 514 meckenstock.lars@adlittle.com

Ansgar Schlautmann

Principal Telecommunications, Information, Media and High-Tech + 49 211 8609 166 schlautmann.ansgar@adlittle.com

Additional author of this Viewpoint is Pascal Quintus, Consultant Energy & Utilities Practice

Arthur D. Little

Arthur D. Little, founded in 1886, is a global leader in management consultancy; linking strategy, innovation and technology with deep industry knowledge. We offer our clients sustainable solutions to their most complex business problems. Arthur D. Little has a collaborative client engagement style, exceptional people and a firm-wide commitment to quality and integrity. The firm has over 30 offices worldwide. With its partner Altran Technologies Arthur D. Little has access to a network of over 17 ,000 professionals. Arthur D. Little is proud to serve many of the Fortune 100 companies globally, in addition to many other leading firms and public sector organizations. For further information please visit www.adl.com Copyright Arthur D. Little 2010. All rights reserved.

www.adl.com/Smart_Grid

Você também pode gostar

- Class Routine Final 13.12.18Documento7 páginasClass Routine Final 13.12.18RakibAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Stress: Problem SetDocumento2 páginasStress: Problem SetDanielle FloridaAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- National Pension System (NPS) - Subscriber Registration FormDocumento3 páginasNational Pension System (NPS) - Subscriber Registration FormPratikJagtapAinda não há avaliações

- Bombas KMPDocumento42 páginasBombas KMPReagrinca Ventas80% (5)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- How To Install 64 Bits IDES On 32 Bits OSDocumento1 páginaHow To Install 64 Bits IDES On 32 Bits OSMuhammad JaveedAinda não há avaliações

- Dayco-Timing Belt Training - Entrenamiento Correa DentadaDocumento9 páginasDayco-Timing Belt Training - Entrenamiento Correa DentadaDeiby CeleminAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Scan WV1DB12H4B8018760 20210927 1800Documento6 páginasScan WV1DB12H4B8018760 20210927 1800Sergio AlvarezAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Credit Card Authorization Form WoffordDocumento1 páginaCredit Card Authorization Form WoffordRaúl Enmanuel Capellan PeñaAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Antenna Systems - Standard Format For Digitized Antenna PatternsDocumento32 páginasAntenna Systems - Standard Format For Digitized Antenna PatternsyokomaAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Chapter Two: General Design ConsiderationsDocumento27 páginasChapter Two: General Design ConsiderationsTeddy Ekubay GAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Void Engineers (Convention: Mage The Ascension)Documento6 páginasVoid Engineers (Convention: Mage The Ascension)Beth0% (1)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- En 1993 09Documento160 páginasEn 1993 09Vio ChiAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Unit 3Documento5 páginasUnit 3Narasimman DonAinda não há avaliações

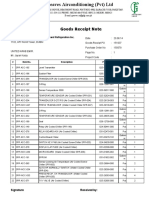

- Goods Receipt Note: Johnson Controls Air Conditioning and Refrigeration Inc. (YORK) DateDocumento4 páginasGoods Receipt Note: Johnson Controls Air Conditioning and Refrigeration Inc. (YORK) DateSaad PathanAinda não há avaliações

- Green ThumbDocumento2 páginasGreen ThumbScarlet Sofia Colmenares VargasAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- HAFOMA Presentation 2022 ENGDocumento9 páginasHAFOMA Presentation 2022 ENGVeljko MilicevicAinda não há avaliações

- TransistorDocumento3 páginasTransistorAndres Vejar Cerda0% (1)

- FPGA Implementation For Humidity and Temperature Remote Sensing SystemDocumento5 páginasFPGA Implementation For Humidity and Temperature Remote Sensing SystemteekamAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- TinkerPlots Help PDFDocumento104 páginasTinkerPlots Help PDFJames 23fAinda não há avaliações

- CS3501 Compiler Design Lab ManualDocumento43 páginasCS3501 Compiler Design Lab ManualMANIMEKALAIAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Manitou 1350RDocumento4 páginasManitou 1350RcandlaganAinda não há avaliações

- Unit 13 Dialogue Writing: ObjectivesDocumento8 páginasUnit 13 Dialogue Writing: ObjectivesAkg GuptAinda não há avaliações

- Pamphlet 89 Chlorine Scrubbing SystemsDocumento36 páginasPamphlet 89 Chlorine Scrubbing Systemshfguavita100% (4)

- Classroom Management PlanDocumento14 páginasClassroom Management PlancowlesmathAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Turbine Start-Up SOPDocumento17 páginasTurbine Start-Up SOPCo-gen ManagerAinda não há avaliações

- Biography Worksheet: Name: Gerardo Angeles MartinezDocumento1 páginaBiography Worksheet: Name: Gerardo Angeles MartinezAlejandro AngelesAinda não há avaliações

- Chapter 3 - Methods of Circuit Analysis and Circuit TheoremsDocumento125 páginasChapter 3 - Methods of Circuit Analysis and Circuit TheoremsNaim NizamAinda não há avaliações

- INJkon 01 4.0 ManualDocumento93 páginasINJkon 01 4.0 ManualJansirani SelvamAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Centrifugal Pumps: Turbo Machines Amit Pathania Roll No:09309 Mechanical EngineeringDocumento4 páginasCentrifugal Pumps: Turbo Machines Amit Pathania Roll No:09309 Mechanical EngineeringAmit PathaniaAinda não há avaliações

- Analysis Chart - Julie Taymor-ArticleDocumento3 páginasAnalysis Chart - Julie Taymor-ArticlePATRICIO PALENCIAAinda não há avaliações