Escolar Documentos

Profissional Documentos

Cultura Documentos

Results Q1FY11 12

Enviado por

rao_gsv7598Descrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Results Q1FY11 12

Enviado por

rao_gsv7598Direitos autorais:

Formatos disponíveis

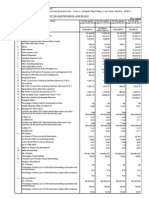

UNAUDITED STANDALONE FINANCIAL RESULTS FOR THE QUARTER ENDED ON 30/06/2011

` in Lakhs

Sr. Particulars No.

Three Months Ended 30/06/2011 (Unaudited) 436536 3903

Three Months Ended 30/06/2010 (Unaudited) 178984 1972

Year Ended 31/03/2011 (Audited)

Restated Three Months Ended 30/06/2010 {Unaudited} (Refer Note. 1) 398980 3344

1.

(a) Net Sales (b) Other Operating Income

1320991 14095

2.

3. 4. 5. 6. 8 7. 8.

Expenditure (a) (Increase) / Decrease in Stock in Trade and Work - in - Progress (b) Consumption of Raw Materials (c) Purchase of Traded Goods (d) Employees Cost (e) Depreciation (f) Power & Fuel (g) Freight & Handling Expenses (h) Other Expenditure (i) Total Expenditure Profit from Operations before Other Income & Interest (1-2) Other Income Profit before Interest (3+4) (PBIT) Interest Provision for diminution in value of investment Profit before Tax Expenses (5-6) Tax Expense (*Net of excess provision reversal of ` 12552 lakhs, related to earlier years)

(8637) 55262 3761 18406 22296 103667 76912 68355 340022 100417 2676 103093 7262 95831 27520 68311 27405

(3566) 25756 3297 7099 10155 41766 35861 28189 148557 32399 2851 35250 2786 32464 8191 24273 12449

(6184) 180533 12218 66650 76573 312259 255808 245471 1143328 191758 14572 206330 27711 178619 38196

(7940) 55063 4309 16854 21317 89144 76280 65288 320315 82009 5225 87234 7872 79362 23589 55773

9. Profit After Tax (7-8) 10. Paid-up equity share capital (Face Value `10/- Per Share) 11. Reserves 12. Earnings Per Share (EPS) (Not Annualised)

140423 27404 1038722

(a) Basic EPS (`) (b) Diluted EPS (`)

13.

24.93 24.92

19.50 19.49

62.74 62.72

Public Shareholding: - Number of Shares ('000s) - Percentage of Shareholding

94,717 34.56%

56,121 45.08%

94,667 34.54%

14. Promoters and promoter group shareholding (Excluding GDRs):

(a) Pledged / Encumbered - Number of Shares - Percentage of Shares (as a % of the total shareholding of promoter and promoter group) - Percentage of Shares (as a % of the total share capital of the company) (b) Non - encumbered - Number of Shares ('000s) - Percentage of Shares (as a % of the total shareholding of promoter and promoter group) - Percentage of Shares (as a % of the total share capital of the company)

173,605 100.00% 63.35%

68,193 100.00% 54.78%

173,605 100.00% 63.35% Page: 1/2

Notes:

1. 2.

Restated figures for three months ended on 30/06/2010 are aggregation of the Company's result and erstwhile Samruddhi Cement Limited ("Samruddhi"). Samruddhi was an independent company and was amalgamated with the Company w.e.f. 01/07/2010. The ESOS compensation committee has allotted 5,769 equity shares of ` 10/- each of the Company to the option grantees pursuant to the exercise of stock options under the Company's Employee Stock Option Scheme - 2006. As a result of such allotment, the paid-up Equity Share Capital of the Company increased from 274,041,665 equity shares of ` 10/- each to 274,047,434 equity shares of ` 10/- each. The Company is exclusively engaged in the business of cement and cement related products. The figures of the previous period have been regrouped wherever necessary. There were no investor complaints pending at the beginning of the quarter. 11 investor complaints were received during the quarter of which 9 were resolved. 2 complaints pending disposal as on 30/06/2011 have been resolved subsequently. The above results have been reviewed by the Audit Committee and approved by the Board of Directors at their meetings held on 27/07/2011. The Statutory Auditors have carried out a limited review of the above results as required under Clause 41 of the listing agreement with the stock exchanges For and on behalf of the Board of Directors

3. 4. 5.

6.

Mumbai Date: 27/07/2011

O. P. Puranmalka Whole-time Director

UltraTech Cement Limited

Regd Office: 2ndFloor, 'B' Wing, Ahura Centre,MIDC,Andheri (E), Mumbai -400093 An Aditya Birla Group Company

Você também pode gostar

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosAinda não há avaliações

- Bil Quarter 2 ResultsDocumento2 páginasBil Quarter 2 Resultspvenkatesh19779434Ainda não há avaliações

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosAinda não há avaliações

- Financial Results For Sept 30, 2015 (Standalone) (Result)Documento2 páginasFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Avt Naturals (Qtly 2012 12 31)Documento1 páginaAvt Naturals (Qtly 2012 12 31)Karl_23Ainda não há avaliações

- Sebi Million Q3 1213 PDFDocumento2 páginasSebi Million Q3 1213 PDFGino SunnyAinda não há avaliações

- MRF PNL BalanaceDocumento2 páginasMRF PNL BalanaceRupesh DhindeAinda não há avaliações

- Standalone Financial Results For September 30, 2016 (Result)Documento1 páginaStandalone Financial Results For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- FY11 - Investor PresentationDocumento11 páginasFY11 - Investor Presentationcooladi$Ainda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- An Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Documento1 páginaAn Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Muralis MuralisAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Sebi MillionsDocumento3 páginasSebi MillionsShubham TrivediAinda não há avaliações

- KFA Published Results March 2011Documento3 páginasKFA Published Results March 2011Abhay AgarwalAinda não há avaliações

- Standalone Consolidated Audited Financial Results For The Year Ended March 31, 2011Documento1 páginaStandalone Consolidated Audited Financial Results For The Year Ended March 31, 2011Santosh VaishyaAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- KFA - Published Unaudited Results - Sep 30, 2011Documento3 páginasKFA - Published Unaudited Results - Sep 30, 2011Chintan VyasAinda não há avaliações

- Avt Naturals (Qtly 2011 06 30) PDFDocumento1 páginaAvt Naturals (Qtly 2011 06 30) PDFKarl_23Ainda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Avt Naturals (Qtly 2011 03 31) PDFDocumento1 páginaAvt Naturals (Qtly 2011 03 31) PDFKarl_23Ainda não há avaliações

- PTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDocumento3 páginasPTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDeepak GuptaAinda não há avaliações

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Documento8 páginasStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results For December 31, 2015 (Result)Documento3 páginasFinancial Results For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- IFCI Dec09Documento3 páginasIFCI Dec09nitin2khAinda não há avaliações

- Audited Result 2010 11Documento2 páginasAudited Result 2010 11Priya SharmaAinda não há avaliações

- QR Sept10Documento1 páginaQR Sept10Sagar PatilAinda não há avaliações

- Sebi MillionsDocumento2 páginasSebi MillionsNitish GargAinda não há avaliações

- Result Q-1-11 For PrintDocumento1 páginaResult Q-1-11 For PrintSagar KadamAinda não há avaliações

- Unaudited Financial Results For The Quarter Ended 30Th June, 2011Documento1 páginaUnaudited Financial Results For The Quarter Ended 30Th June, 2011Ayush JainAinda não há avaliações

- NFL Results March 2010Documento3 páginasNFL Results March 2010Siddharth ReddyAinda não há avaliações

- Userfiles Financial 6fDocumento2 páginasUserfiles Financial 6fTejaswini SkumarAinda não há avaliações

- Financial Results & Limited Review For March 31, 2015 (Result)Documento5 páginasFinancial Results & Limited Review For March 31, 2015 (Result)Shyam SunderAinda não há avaliações

- PDF Processed With Cutepdf Evaluation EditionDocumento2 páginasPDF Processed With Cutepdf Evaluation EditionShyam SunderAinda não há avaliações

- Advanced Financial Accounting & Reporting AnswerDocumento13 páginasAdvanced Financial Accounting & Reporting AnswerMyat Zar GyiAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results For The Quarter Ended 30 June 2012Documento2 páginasFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaAinda não há avaliações

- Avt Naturals (Qtly 2011 09 30) PDFDocumento1 páginaAvt Naturals (Qtly 2011 09 30) PDFKarl_23Ainda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Result)Documento5 páginasFinancial Results & Limited Review For Dec 31, 2014 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For June 30, 2015 (Company Update)Documento7 páginasFinancial Results & Limited Review For June 30, 2015 (Company Update)Shyam SunderAinda não há avaliações

- Avt Naturals (Qtly 2011 12 31) PDFDocumento1 páginaAvt Naturals (Qtly 2011 12 31) PDFKarl_23Ainda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- 634085163601250000financial Highlights0310-Correcte-1Documento2 páginas634085163601250000financial Highlights0310-Correcte-1arunnair1985Ainda não há avaliações

- SEBI Results Mar13Documento2 páginasSEBI Results Mar13Mansukh Investment & Trading SolutionsAinda não há avaliações

- Financial Results For Sept 30, 2015 (Standalone) (Result)Documento2 páginasFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- BHL Fin Res 2011 12 q1 MillionDocumento2 páginasBHL Fin Res 2011 12 q1 Millionacrule07Ainda não há avaliações

- Dabur Balance SheetDocumento30 páginasDabur Balance SheetKrishan TiwariAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Year Ended Quarter Ended: 30th June, 2014 UnauditedDocumento2 páginasYear Ended Quarter Ended: 30th June, 2014 UnauditedHitesh Pratap ChhonkerAinda não há avaliações

- Aplab Limited: Unaudited Standalone Financial Results For The Quarter & Nine Months Ended 31St December 2012Documento1 páginaAplab Limited: Unaudited Standalone Financial Results For The Quarter & Nine Months Ended 31St December 2012Tanmoy AcharyaAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento2 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Annual ReportDocumento1 páginaAnnual ReportAnup KallimathAinda não há avaliações

- Regd. Office: B-214, Phase II, Distt. Gautam Budh Nagar, Noida - 201305 (U.P.)Documento1 páginaRegd. Office: B-214, Phase II, Distt. Gautam Budh Nagar, Noida - 201305 (U.P.)nitin2khAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- FinancialResult 30062012Documento3 páginasFinancialResult 30062012Raghu NathAinda não há avaliações

- Oil and Natural Gas Corporation: Income StatementDocumento10 páginasOil and Natural Gas Corporation: Income StatementpraviskAinda não há avaliações

- Financial Results For Sept 30, 2015 (Standalone) (Result)Documento2 páginasFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Indiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010Documento1 páginaIndiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010hk_warriorsAinda não há avaliações

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento6 páginasFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Amie SyllabusDocumento10 páginasAmie SyllabuspvirgosharmaAinda não há avaliações

- Cooling TowerDocumento2 páginasCooling Towerrao_gsv7598Ainda não há avaliações

- Business PlanDocumento15 páginasBusiness Planrao_gsv7598Ainda não há avaliações

- Highway Bridge CollapseDocumento2 páginasHighway Bridge Collapserao_gsv7598100% (1)

- Stadium FailureDocumento1 páginaStadium Failurerao_gsv7598Ainda não há avaliações

- Rock Forming MineralsDocumento2 páginasRock Forming Mineralsrao_gsv7598Ainda não há avaliações

- How Rocks and Lights ConnectedDocumento34 páginasHow Rocks and Lights Connectedrao_gsv7598Ainda não há avaliações

- Installation and User's Guide For AIX Operating SystemDocumento127 páginasInstallation and User's Guide For AIX Operating SystemPeter KidiavaiAinda não há avaliações

- August 2015Documento96 páginasAugust 2015Cleaner MagazineAinda não há avaliações

- CNG Fabrication Certificate16217Documento1 páginaCNG Fabrication Certificate16217pune2019officeAinda não há avaliações

- Delta PresentationDocumento36 páginasDelta Presentationarch_ianAinda não há avaliações

- Descriptive Statistics - SPSS Annotated OutputDocumento13 páginasDescriptive Statistics - SPSS Annotated OutputLAM NGUYEN VO PHIAinda não há avaliações

- Awais Inspector-PaintingDocumento6 páginasAwais Inspector-PaintingMohammed GaniAinda não há avaliações

- Canopy CountersuitDocumento12 páginasCanopy CountersuitJohn ArchibaldAinda não há avaliações

- Danh Sach Khach Hang VIP Diamond PlazaDocumento9 páginasDanh Sach Khach Hang VIP Diamond PlazaHiệu chuẩn Hiệu chuẩnAinda não há avaliações

- Bill Swad's Wealth Building Strategies - SwadDocumento87 páginasBill Swad's Wealth Building Strategies - Swadjovetzky50% (2)

- Presentation - Prof. Yuan-Shing PerngDocumento92 páginasPresentation - Prof. Yuan-Shing PerngPhuongLoanAinda não há avaliações

- Amazon Case StudyDocumento22 páginasAmazon Case StudySaad Memon50% (6)

- Shopnil Tower 45KVA EicherDocumento4 páginasShopnil Tower 45KVA EicherBrown builderAinda não há avaliações

- INTERNSHIP PRESENTATION - Dhanya - 2020Documento16 páginasINTERNSHIP PRESENTATION - Dhanya - 2020Sanitha MichailAinda não há avaliações

- Agoura Hills DIVISION - 6. - NOISE - REGULATIONSDocumento4 páginasAgoura Hills DIVISION - 6. - NOISE - REGULATIONSKyle KimAinda não há avaliações

- WhatsApp Chat With JioCareDocumento97 páginasWhatsApp Chat With JioCareYásh GúptàAinda não há avaliações

- EW160 AlarmsDocumento12 páginasEW160 AlarmsIgor MaricAinda não há avaliações

- Algorithm - WikipediaDocumento34 páginasAlgorithm - WikipediaGilbertAinda não há avaliações

- MOFPED STRATEGIC PLAN 2016 - 2021 PrintedDocumento102 páginasMOFPED STRATEGIC PLAN 2016 - 2021 PrintedRujumba DukeAinda não há avaliações

- Payment of GratuityDocumento5 páginasPayment of Gratuitypawan2225Ainda não há avaliações

- Microeconomics: Production, Cost Minimisation, Profit MaximisationDocumento19 páginasMicroeconomics: Production, Cost Minimisation, Profit Maximisationhishamsauk50% (2)

- Go Ask Alice EssayDocumento6 páginasGo Ask Alice Essayafhbexrci100% (2)

- DR-2100P Manual EspDocumento86 páginasDR-2100P Manual EspGustavo HolikAinda não há avaliações

- Health Informatics SDocumento4 páginasHealth Informatics SnourhanAinda não há avaliações

- PW Unit 8 PDFDocumento4 páginasPW Unit 8 PDFDragana Antic50% (2)

- Sacmi Vol 2 Inglese - II EdizioneDocumento416 páginasSacmi Vol 2 Inglese - II Edizionecuibaprau100% (21)

- Te 1569 Web PDFDocumento272 páginasTe 1569 Web PDFdavid19890109Ainda não há avaliações

- Bismillah SpeechDocumento2 páginasBismillah SpeechanggiAinda não há avaliações

- Sun Nuclear 3D SCANNERDocumento7 páginasSun Nuclear 3D SCANNERFranco OrlandoAinda não há avaliações

- ECO 101 Assignment - Introduction To EconomicsDocumento5 páginasECO 101 Assignment - Introduction To EconomicsTabitha WatsaiAinda não há avaliações

- Aman 5Documento1 páginaAman 5HamidAinda não há avaliações