Escolar Documentos

Profissional Documentos

Cultura Documentos

June 5, 2012 Marion Indiana City Council Minutes

Enviado por

MarionIndiana.netDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

June 5, 2012 Marion Indiana City Council Minutes

Enviado por

MarionIndiana.netDireitos autorais:

Formatos disponíveis

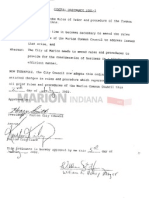

REGULAR MEETING MARION COMMON COUNCIL JUNE 5, 2012 7:00 P.M.

.M., CITY HALL The Common Council of the City of Marion, Indiana met in regular session on Tuesday, the 5th day of June, 2012 at the hour of 7:00 p.m. in the Council Chambers, City Hall. On the call of the roll the following members were shown to be absent or present as follows: Present: Troxell, Luzadder, Nevels, Whitticker, Thompson, Brunner, Smith, French and Batchelor. Absent: None. The minutes of the previous regular meeting of May 1, 2012 were presented. On a motion by Whitticker, 2nd by Smith, the minutes were approved as presented by a unanimous vote. COMMITTEE REPORTS: Councilwoman Madonna French told the Council, if they have paid their utility bill this month for the Marion Water Department, they may have seen this flyer. It came in the water bills and this is what she was speaking to them about at their last convened meeting. The Marion Utilities will have an open house on June 30th and plant tours of the facility will be from 10:00 am to 2:00 pm but what she thinks is a real exciting addition to this years event are three different seminars, talking about different aspects of the water. One is information on the Teays River Valley, which is their major source of underground water. The next one is on rain barrels and how we can use rain barrels to capture rain and use that for our gardens and lawns to save themselves a little bit of money on the utility. And then an explanation of the utility bill will be the third seminar that will be presented that day. So, she hopes theyll mark this on their calendar. Theyve put a lot of work into this. The employees are very involved in the planning of this event and so she hopes that they would take time to just go out for a little while anyway and learn more about our Marion Utilities, French said. Councilman Jim Brunner reported that the Park Board met yesterday and discussed a number of items. They could imagine with June being here. The parks are now in full bloom with all the activities for the next three months. The Garden House and the Gardens are 100% up and running. If anybody watching or listening tonight would be interested in using those facilities, theyve already had a number of weddings and receptions booked there. They can call 6629931 and get information. The Splash House, he believes, had a record opening weekend, thanks to the 90 degree weather. And he thought it was quite interesting, he was asking yesterday, they have 83 part-time employees, most of those are youth so its a great opportunity for a number of our youngsters in the community to obtain some gainful employment over the summer months. It seems like every year we add something new and this year the something new are the cabanas that they have added at the Splash House. They even kind of have a nice little area for your family or a group to gather and those are available just by checking with the folks at the Splash House. The Snack Shack is now open by the playground at the park and is up and running for the summer months. All the programs are scheduled for Matter Park and for the various parks this summer including the first one which is tennis. That begins next week and the Concerts in the Park will be beginning on June 28th. Jesse Brown, a local country artist, will be performing that opening night out at Matter Park. And they certainly want to wish the International Childrens Games kids good luck and Godspeed when they head over to Korea. In the month of July, theyre taking 18 youngsters for the sports of soccer and tennis. He knows Brad Luzadders got a lot of money laying around. Theyre still looking for about $10,000 so if hed write that check, theyll get them going. Very busy meeting yesterday and good to see all those things up and running, Brunner stated. Councilman Brad Luzadder said, on June 15th and 16th, he was called by the Community School of the Arts and their program called You Say Goodbye, I Say Hello and itll be representing the five seniors that have been a part of the organization for the past five years will be the stars of the show. If they like Beatles music, the entire show on Friday and Saturday are simultaneous. If you watch the show on Friday, youve got to come back on Saturday to find the end of the story and it was 100% written by the kids in our community so pretty excited about that. Tickets are on sale and the production is the 15th and 16th of June, Luzadder stated. Councilwoman Joselyn Whitticker told Batchelor, as he knows, they had a Street Committee meeting with Mr. Graft, media and also the City Council At-Large members and one other person was available and that was Fred Troxell. At

the present time, we have 65 areas, streets and pothole areas that were highlighted and still more being added of work that needs to be done to our streets, the infrastructure and so on, with the understanding we only have a certain amount of money and how far that money will go with the infrastructure and so on. She believes Mr. Luzadder and Mr. Thompson or Mr. Troxell could tell them how well the meeting went and they kept it within an hours time and discussed those things that needed to be discussed and so on. There are some questions still that they have about the grating and leveling of streets and so on but at least they did meet, they did talk and so on. 32nd Street is in the process of being completed at the present time. The areas of striping and so on, they are being there. Theres also questions that are out there still about the potholes that need to be done and why something hasnt been done. If you feel your street needs work, they need to be notified and then it may already be on the list and if its not, they will have it added to the list and it will go into a priority type of situation which is the worst and would probably cause the most damage to a vehicle. As far as the Economic Growth Council, Tim Eckerle will be speaking tonight and he can brief them on that and every member received a copy of their packet for June, Whitticker stated. Council President Don Batchelor said he had a couple of announcements. Next Tuesday at 6:00 p.m., they will be having a special Council meeting concerning the nepotism policy for the city. It will be here in the Council Chambers next Tuesday at 6:00 p.m. Also, they would like to acknowledge the career of Council member Henry Smith upon his retirement from Marion Community Schools after 42 years of teaching. They would like to commend him and wish him well in his retirement. Batchelor said he thinks they should give him a hand. Councilman Jim Brunner commented, if hes done his math correctly, that means hes, he thought he (Smith) was only about 39 years old so he must have started when he was really young. Congratulations Henry, Brunner told Smith. Mr. Batchelor then told the Council, a couple more notes they need to reference this evening during this here period is he would like to make the following observation relative to our procedures as they have operated in the past with the Council members. Procedures have been not every meeting is a public hearing. If they would like to be placed on the agenda, they would like for them to stop by the Clerks Office and put that request in. Also, citizens, they encourage them to come to their meetings and most of their meetings, when they have a public hearing, they have an opportunity to speak relative to whats on the agenda. And also, their concerns, they ask that they please dont hold their concerns until a Council meeting to get their concerns out there. They have email addresses, they have cell phone numbers, they have home phones and etcetera that they can contact them any day of the week, even at night or whatever the case may be but they ask them dont hesitate to make those phone calls because that information is available. They have a new, innovative, new website for the city and its very (inaudible). Its in detail and they can get a lot of information off of there and its readily available. And that applies to the Council members. They encourage them to be professional, respectful. Theyll start budget hearings here shortly and they hope and trust that they do ask good questions. They want them to ask the hard questions. They encourage them to do so. But they expect it to be in a professional manner and not embarrass or antagonize anyone. Those are some observations he wanted to make this evening because he was on the radio show a couple of weeks ago and he put it out there and he wanted to highlight that this evening, Batchelor said. Councilman Fred Troxell told Batchelor, on that issue, they voted in January, he thinks it was, to let the public ask questions or make comments. That was a unanimous vote, if hes not mistaken. Batchelor told Troxell, at that particular meeting. Thats not every meeting. Troxell stated, well, point of order. He told Mrs. Whitticker shed have to help him out on this. They had, in January, some questions that were asked by contractors and they were never answered and Joselyn Whitticker and he went to the Controller to get this answer. These people are here tonight and this is unfinished business. Mr. Batchelor said, okay, its not on the agenda and theyre not going to discuss it tonight. Troxell replied, it doesnt matter. Hes not out of order because he called a point of order. Batchelor said, but theyre not going to discuss that. Theyre going forward with the regular agenda. Mr. Troxell responded, theyre going to discuss it tonight though. Is that okay? Batchelor told Troxell, no, theyre not going to discuss it tonight. Troxell then told Batchelor, yes they are. Batchelor banged his gavel and said to move on to new business. NEW BUSINESS

RESOLUTION NO. 4-2012 The City Clerk read Resolution No. 4-2012 by title only. A Resolution authorizing the filing of an application to the Indiana Department of Transportation for a grant under Section 5311 of the Federal Transit Act of 1964, as amended. Chuck Martindale told the Council hes here this evening to seek approval of Resolution No. 4. Theyve been doing this every year since 1979. It authorizes the Mayor to file an application with the Indiana Department of Transportation for federal and state operating assistance to help fund the Transit System. These federal and state funds pay for approximately 70% of the operating expenses of the bus system, which is doing very well in terms of ridership and other things. The amount of money that Marion Transit is receiving this year is about $880,000 compared to $792,000 last year and it continues to go up every year because their ridership continues to increase. Last year, Marion Transit carried 313,000 passengers which is just about double what it was doing 10 years ago. So, a lot of it has to do with the fact that a lot of people cant afford to operate a vehicle or cant for physical reasons and, because theres free fares, everybody has an opportunity to ride the buses wherever they want to go. And its also one of the least expensive, in terms of public outlay, transit systems in the State of Indiana. So, hed be happy to answer any questions that they have. This is for the 2013 application. INDOTs going to require the application be filed in August, Martindale said. Councilman Henry Smith asked, do the buses have air conditioning? Martindale replied, they do. Sometimes they work and many times they dont work. He has yet to see a small transit bus have very good air conditioning for a long period of time. They are operating at 81% of capacity. These buses have a 16-seated capacity on them. They have five buses that operate 10 hours a day. John and his team are carrying between 1,400 and 1,500 passengers a day over five bus routes and that adds up to an average of 13 passengers per bus per hour every day and theyre 16 passenger buses so theyre at 81% of capacity. He wished our industries in the State of Indiana were at 81% capacity. Councilman Smith then asked, how far east do they go? Just to Ivy Tech? Martindale told Smith, they go to Ivy Tech and to the commercial area there. Smith asked, how far west? Is that to Alabama? John Lawson, Transit Manager, told Mr. Smith, itd be Michigan Avenue, sir. They go out 9th Street to Michigan, left on Michigan to 12th and then back to Miller Avenue then Miller Avenue to 16th Street. Smith asked, okay, how far north? The mall? Lawson said, if you go northwest, it would be the Marion Mall and actually Cambridge Square on State Road 15. And if you go to the east, it would be Highland Avenue to Bond Avenue. Councilman Brad Luzadder stated, bring him (Lawson) up to the mike so the public can hear him. Mr. Lawson then told the Council, to the west, they would go out 9th Street on the west point run and they also have a West Marion run so that would be to the northwest but to the southwest, the West Point bus goes out 9th Street, it goes as far west as Michigan Avenue, it turns left. They have an ADA in (inaudible) Trailer Court, if theyre familiar with that. Thats at 16th and Avon Avenue. On call, they do go as far as the trailer court at 16th and Avon Avenue but the regular route is 9th Street to Michigan Avenue, go south on Michigan Avenue to 12th Street. Its back to the east one block to, past the back of the old Malleable property to Miller Avenue and then out to 16th Street, 16th Street to the By-Pass and from there to Walmart. That would be to the southwest. Smith asked, so if he lived at the trailer court at Buffalo Avenue, 16th and Buffalo, then hed have to call to get a bus come out there then? Lawson said, right. They have to have that call because theyre a fixed route, curb-to-curb, ADA deviation only. Thats all the 5311 Grant allows them to do. And the reason for that is because theres other services that are paid by similar grants as we get, taxicab services, Life Stream, to do those things where they go to an address. They dont go door-to-door. Their drivers arent allowed to get up and go up and assist somebody. They have to make it to the curb and they have to be there on time. They cant sit and wait. So its a curb-to-curb fixed route and ADA deviation only. They do go to addresses for Americans with disabilities. Smith asked, now, how far south do they go? Lawson said, South Marion, they go as far as Marsh South on State Road 15. They have pick ups there. They come down Meridian Street to 38th Street. They go to the V.A. Hospital, through the Home Corner area. That would be their southeast route and extreme south. The University route actually would go out Washington Street, it goes to Washington Street to Harmon by the college, Harmon Street out to 50th, 50th Street across to the By-Pass and then back into the Meijers and Walmart areas again. They cover 85% of the City of Marion. Councilman Smith commented, so really there isnt any (inaudible) no one says the bus doesnt come near them then. Lawson replied, theyre pretty darn close and if they can walk two or three blocks, theyre about everywhere they can get to, honestly. Its pretty amazing. They run 10 routes a day with five buses. Councilwoman Joselyn Whitticker asked Lawson, isnt it also true if a person calls them in advance, they can be picked up? Lawson answered, if they have an ADA exception. Theyre very strict on them on that because they dont want them infringing on Life Streams ability to earn their income or a Safeway cab or he

RESOLUTION NO. 4-2012 Continued thinks theres a new cab service in town so they cant, he means, if someone called them up and said, Hey, Im at 2323 W. 10th Street. I want you to pick me up on your 10:00 run. They cant do that. They have to be able to come where their bus stops are. Its fixed route. Now, if that person is an American with a disability and he is registered with his physician and the physician has filed a certification with Transportation and they have that on file and they call, they can deviate off route, go to 2323 W. 10th Street and pick up that disability thats registered with Transportation. Council President Don Batchelor asked, what about school-aged students? Do they have many riders who are school-aged students? Lawson told Batchelor, its actually increased their ridership tremendously. They noticed a tremendous amount of riders to McCulloch and thats normally on the Nebraska Street and the Washington Street runs. Theyre riding earlier and that has increased their route. Theyve chosen city transportation. They met earlier, actually they started two years ago when Mr. Edwards came and they found out, they wanted to go into a cooperation with the City of Marion and see if there was anything they could do on changing routes and they found out that is a no-no. They found out that schools get 5310 money and they have to provide that transportation as long as they get that money. Its not a state law that the City of Marion or the Marion Community Schools has to provide transportation. They dont have to but they do and as long as they receive 5310 money, they cant use 5311 services because they both receive those federal funds and they have specific duties assigned to them. So they dont ruin the integrity of the grant, what they can do is what they did. They posted on the internet all of their routes so that everybody at Marion Community Schools and their families could see where their routes went, they could see what time they were supposed to be there, figure out what time they had to be to school and now theyre at those designated stops. Thats worked out real well just posting it on the internet, Lawson said. Batchelor said, the City of Marion has been a great partner with the school system. Theyve tried to work (inaudible) because they expanded the nontransportation zone. Lawson stated, he loves the cooperation. Its tremendous. They cooperate with them also on 1812, which is a tremendous service not only for the citizens of Marion but for the entire county. Thats a great cooperation. They use Justice school for their staging area so its just, its fantastic. Councilman Reggie Nevels said he would like to thank Mr. Lawson and the bus department for spending a lot of time out at Prince Hall. He knows he didnt mention Prince Hall and he knows they really do count on his traveling service there so he wanted to thank them for keeping Prince Hall on their route. If he (Lawson) could pass out maps to all the Council members here, that will give them an idea of exactly where the bus service goes. Mr. Lawson told Nevels, they have a tremendous bus service there. They have some great people out there. If they have an opportunity to ride a bus, now hes serious, the drivers are family to these people and these people family to the drivers. Hes happy to say that we are one of the least expensive bus systems there is. We operate at about $3.50 per person. What is it, Anderson or Muncie, is at $12.50 a head and theyre with a tremendous amount more people than we have at this particular time. Were operating cheap, were able to keep the zero fares out there. It generates more federal and state money and when hes up next, he can also answer, he wants to share with them a couple of things that he thinks are just outstanding and would certainly be good news to them because it will save taxpayer dollars and investment from the City Council and hell explain to them when its his turn up here, Lawson said. Being no further questions or comments from the Council, motion was made by Whitticker to pass Resolution No. 4-2012. Motion was seconded by Brunner and carried by the following vote. Aye: Troxell, Luzadder, Nevels, Whitticker, Thompson, Brunner, Smith, French and Batchelor. Nay: None. APPROPRIATION ORDINANCE NO. 1-2012 1ST READING The City Clerk read Appropriation Ordinance No. 1-2012 by title only. An Ordinance of the City of Marion, Indiana appropriating certain funds for the City of Marion, Indiana and providing for the effective date thereof. From the General Fund to Transportation Department the amount of $1,769.58. Purpose: To pay for terminal repairs for 2012. John Lawson, Transit Manager, thanked the Council for this opportunity and as he said earlier, they have a perfect opportunity to share with them good news. They entered into an agreement with Clean Zone Marketing and the agreement was to sell advertising to put on their bus. What it did for the City of Marion, it allowed them to generate monies that they could use under the Transportation Rule that they could use and put back into transportation. The good part about it was, every dollar that they raise through Clean Zone Marketing through the advertising on the buses counts as their match for the City of Marion towards the 25% of the grant that they get. Hes happy to say they had received two months at $884.79 a month. They now have $1,769.58 in there. Hes asking tonight that money be

APPROPRIATION ORDINANCE NO. 1-2012 Continued transferred to the Transportation Department in the designated fund so that they can utilize that for other needs at the terminal. They had a June 1st target date but theyre behind on the roofing. As they can see, the new metal roofing is not here. They gave them now a new date of June 11th or 12th for the delivery and they also gave them, they had a cabinet and countertop delay and they also told them it would be the middle of the month. The new target to move in is July 1st and theyd like to have everything done when they move in there. He wanted to thank Councilman Thompson for joining them. He came through the other day and they had a lot of work going on. He walked through the terminal. Hed like to invite each of them to come down and see what the AARA money is doing for us in Marion. Theyve seen the buses and he told Mr. Smith every bus is air-conditioned and is working fine. They have an excellent maintenance man, Phil Shively, and he does a tremendous job and they all work. But come and see that terminal, honestly. Hes really proud of it and hes proud of the work that theyre doing and he cant wait to move in. Just think, in August of 2008, he came here and they were at just a little over 400 people a day. This year, he cant tell them exactly what the one day record is but they went from 400 people a day to 1,400 and 1,500 people a day. This new terminal will take them from 26 seating capacity to about 79. So, come and see it, Lawson told the Council. Councilwoman Madonna French asked Lawson, are they going to have some kind of a ribbon-cutting or open house when the terminal is finished? Lawson replied, he would imagine, yes, and the reason he says that is theyre very comfortable in the Vogels building. Its going well for them but its just not, they can see all the people standing outside. Its just not ready to handle the number of people that theyre transporting today. And whats unbelievable is, he can only see it growing. Theyre very far behind the European curve. They have used public transportation for years and they deliver thousands a day every day in municipalities so he thinks that the swing is, with the economy and the cost of fuel and insurance, automobiles, he thinks that swing now is coming our way. He thinks transportation numbers are going to continue to grow, Lawson said. Being no further questions for Mr. Lawson, motion was made by French to pass Appropriation Ordinance No. 1-2012 to 2nd reading and public hearing. Motion was seconded by Smith and carried by the following vote. Aye: Troxell, Luzadder, Nevels, Whitticker, Thompson, Brunner, Smith, French and Batchelor. Nay: None. GENERAL ORDINANCE NO. 7-2012 1ST READING The City Clerk read General Ordinance No. 7-2012 by title only. An Ordinance to designate an area within the City of Marion, Indiana, as an economic development target area, commonly known as 2106 S. Branson Street, Marion, Indiana. Janet Pearson, Assistant Director of Development Services, told the Council theyre bringing this evening before them a residential tax abatement and its for Habitat for Humanity. The property address is for 2106 S. Branson Street and the legal description is Lots 1 and 2 in Websters Prospect Hills Addition to the City of Marion. The approximate value for the property will be $63,000 and theyre asking for a three-year tax abatement. Council President Don Batchelor asked if anyone had any questions of Ms. Pearson. Councilman Fred Troxell said he didnt have a question but he does have a comment to make. Always on a tax abatement, they have a resolution declaring it an economic revitalization area for property tax. Now, his question is on this and hes always been opposed to a lot of tax abatements because some of these redeveloped areas is usually a nice way of saying a depressed area and he noticed over the years on the By-Pass, properties advertised for $400,000 were declared an economic, depressed area for redevelopment. So thats his comments on it. He wants people to know that when he votes. He may vote for this to the 2nd reading, he may not vote for it on the 2nd reading. But he wanted to make that clear so that people understood why they always have to have this resolution before they can have the abatement. And a lot of these areas are not depressed areas by any means so thats what he wanted to clarify, Troxell said. Councilwoman Joselyn Whitticker told Janet, while shes at the podium, she might explain what tax abatement is, how long that abatement will be and so on. Discuss what they discussed in their meeting, Whitticker said. Ms. Pearson replied, sure, shed be happy to. The threeyear tax abatement is for, these are residential tax abatements and the first year of the tax abatement, the taxes are 100% forgiven and the second year is 66% forgiven and the third year is 33% forgiven and then it goes to the regular taxes. In this particular case, this lot is owned by Habitat for Humanity and theyre a not-for-profit organization so they currently do not pay taxes so when Habitat builds the property, then at that point, theyll actually have a home and there will be taxes that will be there which will help the city as well. Whitticker asked, when do they start paying the full assessed value on the property they have? Pearson said, yes, after the 3rd year then the 4th year, they will receive their

GENERAL ORDINANCE NO. 7-2012 Continued full tax statement and theyll be paying it in full. Mr. Batchelor then asked if anyone else had a question. Mr. Troxell said he had a question to counsel. If these people fail to keep the home, how do we recover those taxes? Its his understanding that, in the ordinance, if a person, business people, if they get a 10-year abatement and they dont live up to that then theyve got to pay the taxes that were due. Corporate Counsel Josh Howell told Troxell, that can be included in the ordinance or attached as a provision or something thats negotiated into it. In the enabling statute itself and he hasnt looked at this so hes thinking back several years ago, he doesnt recall any what you might call a clawback provision in the statutory language itself. He knows that from time to time, municipalities, including the City of Marion and other ones, have provisions like that in some economic development things to insure where someone makes a commitment in some way that they honor that and that the benefit that theyve gotten has to be repaid if they dont do exactly what theyve said. In a basic tax abatement, that language is not included and hes never seen it done in a residential tax abatement. Hes not telling them it cant be. He just has never seen it, Howell said. Troxell replied, no, he didnt mean residential. On businesses, theyve had in the past, he could bring some of them up, where they had been here for six, seven years, some of them were less than one year and left with equipment that was abated so thats the reason. He thought it was in their ordinance, Troxell said. Howell stated, its not in the code, and again, hes talking off the cuff. He doesnt believe its in the code section that enables it. They pass a new ordinance with each one of these. They could certainly include language of that sort at their discretion if they wanted to and he believes it has, in fact, been in some of the ordinances theyve passed but he wouldnt want to make some sort of statement about what percentage of them there were off the top of his head. Troxell thanked Howell and said, that was his question. Ms. Whitticker told Howell, right along that line, if they are good stewards, and thats what they have been elected as City Council members to be good stewards of the taxpayers money, it would behoove them to have that language there so that, if for some unreasonable or ungodly thing should happen and they are not able to pay off, theyve given them money and theyve walked away and theres no responsibility for them to pay that money back or something. This is not in any means reflective of Habitat but the economy and what we are collecting and so on and where our taxes are concerned, that bothers her. Shes along with Fred because she has a problem with abatements and with homes. Are we doing the same thing, and this goes back to Janet, and this is just a blanket statement. Are we being fair to the taxpayers who pay their taxes and so on, their property tax? Our budget is $27,800,000. Thats almost $28,000,000. Yet, in just property tax that we receive and disregarding the LOIT and so on because she was with Tammy Miller today and Mr. Bainbridge. We are getting close to $15,000,000 in taxes. If you do the figures on that, $15,000,000 subtract it from that $28,000,000, we are going to be at a deficit and those are the questions they have been raising all along. Where is the clause that says if they do not pay their bill, it still is considered a lien and they are liable for that because if we dont do that, we are going to, and that still wont insure that people will pay their bills but at least there is something there and she thinks its going to behoove them, from this point on, whether its redevelopment or anything else, that they add a clause that they are still liable for that and not walk away because they all understand how times are hard and so on. They also look at how much was given in and, as she said, she got this information from the County Commissioners and Mr. Troxell brought this up earlier about that and was told he didnt know what he was talking about and living beyond our means. Well when the budget comes, she really will have some questions she wants and concerns because they have and theyve been on the Council, three of them just went on the Council January 1 and they allowed some things to happen and they moved to suspend the rules and so on. She hasnt seen a shovel of dirt turned in some of these areas they said lets go ahead and not have anything after the second reading. You know, she considers herself a good steward of somebody elses money because shes a good steward of the few pennies she has and that bothers her and she really thinks that, from this point on, they need to have a clause that says if they dont pay their bills then the city will come after them because these are taxpayers dollars that they are using and if they are not willing to do that then they shouldnt have been elected to do the job. That really bothers her. And shes not getting on him (Howell) but what shes saying is they need to institute a policy that says we are sound, fiscal, conservatives and shes a Democrat and yes she is a fiscal conservative, especially of her dime and others dime because its too hard to get those dimes to equal to dollars and they cant continue to do business in the way theyve done business, Whitticker said. Mr. Howell replied, just one comment real briefly with regard to that. When they talk about tax abatement, he thinks its important to understand that the kind of clawback provision that hes talking about may not be appropriate in that and let him give them two different examples. First, when they abate property taxes,

GENERAL ORDINANCE NO. 7-2012 Continued they only abate the increase in value. If he has a lot worth $10,000 that he is paying taxes on and he builds a $100,000 house on it, he doesnt get a $110,000 tax abatement. He gets $100,000 tax abatement. Its only the additional value. If he moves or doesnt pay his bills or whatever, that house is still sitting there and whoever comes along, its still going to be subject for tax. Hes not running off, the city hasnt given him any money that hes now taking and going somewhere with. Similarly, if hes a business and he gets a tax abatement on new equipment that he brings in, he doesnt believe that hes required, that hes required to get the abatement but unless they have some special rule, if he took that equipment and took it somewhere else, well its not here to be taxed anymore. He shouldnt get the abatement on that but generally theyre not going to be able to, he thinks they can require them to keep it here to get the abatement but if they take it somewhere else, obviously theyre not going to get abatement. When they talk about getting money back from people when theyve given them money, thats certainly the case. When they have offered them an inducement, a phase in over the tax period, the actual thing thats being taxed is there, whether they pay it or not, so the city still gets its benefit in the increase to the net value that then rolls on so hed want to think about it more before he tried to give them advice about including what he calls a clawback, thats just his own made up language, on a tax abatement type thing. Whitticker then said, well then maybe her question should be, should the city be in the business of abating homes? And she knows its a popular trend to do but they have the people who are in the areas that they have been giving a lot of the tax abatements have been done in areas where, really, those families could afford to pay taxes. When you take, and its being abated. That means whether its one year, three years or so on, their schools are not receiving that money nor is their library. Those are things that are important to citizens in a city and so on and, you know, it just bothers her and it has bothered her and it will continue to be a sore spot for her because she believes there are good, hard working people who scrape together dimes, their pennies, to pay their taxes, yet, people who are able to afford it and who are in certain areas get certain breaks that other people do not. Thats an inequity and theyre going to have to look at somehow or another of bridging that gap in that inequity because its not only at the local level, its across this country at the national level. But at a local level, as she said, the taxes that she checked into from Tammy Martin and Mr. Bainbridge, property taxes alone are right at $15,000,000. Their budget is $28,700,000. Its gone up 34%. Theyve got a problem, Whitticker said. Being no further questions for Ms. Pearson, motion was made by Nevels to pass General Ordinance No. 7-2012 to a 2nd reading and public hearing. Motion was seconded by Brunner and carried by the following vote. Aye: Troxell, Luzadder, Nevels, Whitticker, Thompson, Brunner, Smith, French and Batchelor. Nay: None. RESOLUTION NO. 5-2012 The City Clerk read Resolution No. 5-2012 by title only. Declaratory Resolution of the City Council of Marion, Indiana, declaring economic revitalization area for property tax deductions on real estate, commonly known as 2106 S. Branson Street, Marion, Indiana. Janet Pearson, Assistant Director of Development Services, told the Council this is the three-year residential tax abatement for Habitat for Humanity and its at 2106 S. Branson Street, Lots 1 and 2 in Websters Prospect Hill Addition to the City of Marion with a value of $63,000 for a three-year tax abatement. Councilman Fred Troxell said, again, he points out that, now this is for Mr. Howell, does this take in just this one residence, when they say revitalization area? Corporate Counsel Josh Howell told Troxell, the city has for a very long time now declared larger areas and then, because of the way the code is written, they can only have a certain percentage of the city designated at any given time, it does them as they become ready to do so. So this would be for just this parcel that theyre describing here, not for anything adjacent to it or any other part of the city. Its just this parcel and this parcel alone. Mr. Troxell said, well he wanted to point out to the public again the reason he raises this question is there was areas on the By-Pass that has this same resolution which they say its the same as a depressed area when its up, an area for revitalization for property taxes and properties that were priced, had the prices right on them out there adjacent and next to, $400,000 properties. Now, that area doesnt need to be revitalized. Any business (inaudible) come in, thats good but why should somebody get a tax abatement when they can afford that kind of a property. Mr. Howell replied, and whether or not to give them, thats a personal policy, obviously, rather than a legal question, which they can do at their leisure. He thinks the policy of the city has been, whether they have $10 or $10,000,000, they want to try and get them to spend it here and the more they have, the bigger impact that potentially has on them. He may be building a house for $250,000 and if the difference between him building it within the city limits and outside of the city

RESOLUTION NO. 5-2012 Continued limits is whether he gets a tax abatement or not, its just a fairness, he thinks, that comes into play, but once again, thats a policy decision for them (Council) if they want to be in the business of trying to court, what sort of investments they want to court. Thats a policy decision for this body and for the Administration. He can tell them how to do it but as their counsel he wouldnt have an opinion on whether or not it ought to be done. Thats a policy decision for them. Troxell said, well, no reflection on Habitat but he was at the Council meetings when this tax abatement first started three Administrations ago and a Councilman made a motion, it was for the businessmen downtown, tax abatement, remodeling whatever. They passed that ordinance. The businessmen on the By-Pass said that wasnt fair. If they give it downtown, they ought to get it there. They amended that tax abatement then the professional people downtown applied for it. It was the same situation. They amended it and took the professional people in on the By-Pass. The point hes making is it hurts the city, it hurts the property owners because they have to make that up. They take in so many dollars, it doesnt matter, they can go around and look at all the vacant houses now. They have to make up for that. They have to make up for tearing them down or repairing them or whatever. He made the statement in January that they need to live within their means, he always has. There were things he wanted that he didnt get but he survived and they need to take a look at that. They need to go back to that, as a Council, because like Mrs. Whitticker said, its going to catch up with us. 34% increase in the budget in the last eight years. They cant handle it anymore, Troxell said. At this time, Council President Don Batchelor said the Chair would entertain a motion for Resolution 5-2012. Whitticker said, before they move to that, she has a question. She asked Ms. Pearson if she would please tell them how the assessed value was done, for this property or any other property that comes up for sale in Marion. Pearson replied, assessments are done by the Assessors Office in the county. Whitticker asked, okay, based on what? In this case, how was this assessed value of $63,000 for this property arrived at? Pearson said, oh, the value of the property. That is a, Habitat for Humanity, thats the construction build so thats how that value comes about. Whitticker responded, on this property? This particular one? Pearson answered, this one, yes. Motion was then made by French to pass Resolution No. 5-2012. Motion was seconded by Smith and carried by the following vote. Aye: Troxell, Luzadder, Nevels, Whitticker, Thompson, Brunner, Smith, French and Batchelor. Nay: None. Tim Eckerle, Executive Director of the Grant County Economic Growth Council, to give presentation regarding the Grant for Grads Program. Mr. Eckerle told the Council he wanted to talk to them about an exciting new program that theyve launched. Prior to this, he wouldnt be attending if he didnt kill some trees. Theyll see a few slides, about a 45 slide presentation done by a gentleman from CBRE out of Atlanta. This gentleman has probably done more site locations in the State of Indiana than any other consultant. Hes put together his view of life in terms of what drives the economic development decision. They will see on the slide two where the words are of relatively different size, obviously, the size of the word indicates the impact on the decision-making matrix. Workforce is the single largest word, cost is the second largest word and economic incentives is the third largest word in terms of when a company is making an investment decision. Now, recognizing the one thing that truly sets any community apart from another is its talent and talent is defined by those looking to make investment by educational attainment. He knows theyve often heard him come and talk where he will say no one has ever asked him about basketball championships. Everybodys always asking him about SAT scores. So after a number of years and through some fortunate planning on their part, they were able to announce and rollout a program last week called Grant for Grads in which the Growth Council in conjunction with Affordable Housing is providing a $5,000 forgivable loan for any individual who takes a new job within Grant County and with a college degree and is new to Grant County. So they have to work and live in Grant County. Basically the forgivable loan rolls off after five years in terms of $1,000 per year. He would gladly answer any questions. He could talk to them about, they have five people who are in the process. He actually doesnt know their names but he will share the information he does have. He kind of likes not knowing a whole lot of the variables. The first of the five is going to be a new Taylor employee. Now, he questions whether they have a college degree because they have their degree from the University of Kentucky. IWU has a gentleman who is going to go to work for IWU. He has a Bachelors Degree from IWU. Marion General Hospital is hiring someone who has worked for them while going to college here and now has their degree. Shes going full-time. Marion Community Schools, a new teacher is going to be using the program. And then Kids Matter, the not-for-profit that took the old Dana Data Center, has an employee that looks to be one of the final five applicants for the first group. Theyve targeted to do about 20

this first year. Theyve actually been impressed by the number of applicants and the variety. They had some concerns, initially, that there would be one employer that would dominate or one geographical area but it looks like theyre going to have a nice spread. Its also, of the five, theres only one renter. The rest of them are home buyers so its a little different trend than they thought theyd see as well. Hed gladly answer any questions they may have, Eckerle said. Councilwoman Joselyn Whitticker told Eckerle, go ahead and give some more information about the (inaudible), how long they have to be on the job and so on. Eckerle stated, when they sat down and did what they thought were going to be their final rules, they did it in abstract. They chose 100 days. They may see some (inaudible) where they talk about 100 days. That was assuming that they would come back to January 1. It doesnt seem to be a workable number so theyre looking at an employee has to be within the first 180 days of employment. It becomes a realistic factor. One, you get a better sense of the employer, wants them as a full-time employee. Two, just the hassle of starting a new job, moving to a community, it gives them some time to work through the process. And also allows them the great challenge, for instance, one of these candidates previously worked as a part-time employee and was offered a full-time position. Obviously, could (inaudible) part-time, while they were going to school, they couldnt afford a house but now they can afford a house. When do you start their initial employment count date? So it gives them a little more flexibility in that so theyre looking at 180 days. They will allow, in working with some of the larger employers and theyve marketed this to all the employers and had them involved in their focus groups, they saw this as an opportunity for an employee that may have been currently leasing a property or driving in, commuting, and this provides them an opportunity to keep them long-term so that they classify, some companies would classify these employees as flight risks. That is they have the potential to leave their firm so they asked them to put in a provision that up to three years, in essence through their probationary period, someone could apply and they would do that on a case-by-case basis. At some point, an existing employer, if its an existing employee, they may ask the employer to provide a cash match as well. Councilman Henry Smith said, say he didnt have his degree and hes working and, still yet, is he entitled to it after he gets his degree? Mr. Eckerle told Smith, after he gets his degree. And he takes a new job within the company. Assuming, the case that they have here so far, and again, they will look at each and every one as they go forward, this is an experiment. Initially, they had people that were working part-time while they were going to school and then they became full-time employees upon graduation. Actually, this one isnt going to become full-time until August. Smith told Eckerle, now he said that they have go get another position. What if he stays in that position but? Eckerle replied, they would have to look at that. Right now, what theyve been looking at with the examples they have, the real world examples they have, people have been going from being a contracted employee to being a full-time employee, from being a part-time employee to being a full-time employee so they would look at a permanent change status. Theyre playing with the language. Theyre trying to work their way through. They made a presentation in front of the County Council. Obviously, they have been schooled in every scheme known to man because they came with a number of ways that this process could be perverted that theyd not thought about. Thats clearly an issue theyll have to look at. Again, its going to be on a case-by-case basis. Its a first come, first serve program. Smith stated, okay, so basically they have a limit. Eckerle responded, yes, of roughly 20, depending on how the money breaks between renters vs. homeowners. Councilman Reggie Nevels asked, is there a grandfather clause in this? Eckerle told Nevels, no, hes a grandfather and he cant get it. Its bad enough, its going to pain him that theyre going to allow somebody from the University of Kentucky to be among the first. Councilman Fred Troxell said, he has a question or a comment. He thinks he (Eckerle) said Mr. Lawson always has all the answers (inaudible). Personally, he (Troxell) thinks hes (Eckerle), in his opinion, too early on this one because were going into a budget session and he cant make a decision like this when they dont even know that they can afford it. Eckerle told Troxell, well, theyre not asking them for any resources. This is coming from the Growth Councils resources. Troxell stated, but that money originally came from Marion. Mr. Eckerle told Mr. Troxell, no it didnt. Well, some of it may have. Theyre using a portion of their Economic Development Income Tax that the County Tax Council, which is impaneled by all the Legislative bodies, dedicated revenue stream. Troxell commented, okay, well still, theres money involved and its going to be somebodys money and evidentially theyre involved or he (Eckerle) wouldnt be down here asking their opinion or their approval. Eckerle responded, well, (inaudible) collaboration so theyre always out seeking peoples involvement and opinion. When they developed this program, they sat down with the Grant County Local Elected Officials in November and the only snowstorm that hit Sweetser that night and walked it through how they were thinking about and designing the program. Its also a means of marketing because obviously theyre reaching out to the community

through their internet presence. They thought they (Council) would want to know about this. You know, you do the cost benefit number. You look at one of these employees, again, because of the County Option Income Tax, theres 2.25% of their income thats subject to taxation. If theyre making $50,000 or if they have two school kids, thats $12,000 to Marion Community Schools, each and every year theyre there. Troxell told Eckerle, he sits here and hes looked at the records of the failures weve had. Now he said this is experimental, right? Mr. Eckerle said, yes. Troxell stated, okay, they have a right to question it. Eckerle responded, hes not objecting to questions. Hes giving them answers to hopefully demonstrate that theyve given serious consideration to this why theyre doing this. Clearly, they looked at a cost benefit analysis. Right now, Grant County is one of the leading importers of labor in the state. People live outside of the community and drive in to work here and so this is to get at that. One of the reasons they did a survey about four years ago, before they worked with their dear friends at Arbor Homes to bring them to the community and one of the things they found was that people were not looking to move here because they got their job after they got their house so this is a means to offset some of that. Theres lots of examples out there in todays world of people turning down corporate moves because they cant sell their house. This will provide them an additional $5,000 to sell the house and move to a new community. Councilman Troxell said, see, hes an ex-employee of GM. At one time, they had 3,600 employees out there. Now theyve got 1,500, maybe 1,600. All of them but 80 employees are driving in from Michigan and Ohio. Now he just got this report from the President today. Anyway, a lot of these people dont intend to land in Marion. This is one of the things they have to look at. Eckerle told Troxell, well thats what theyre trying to convince them to do, provide them a reason to want to move here. He means, thats why theyre working with Marion Community Schools and doing the Young Entrepreneurs Program. Hes pleased to announce that today they announced their next class of 15 students at Marion and 15 at Mississinewa so theyre looking at doing (inaudible) to provide people reasons to relocate. Obviously, if youre late in your career and your family, you have teenage daughters who are seniors in high school, youre not going to relocate but if youre early in your career, theyre trying to provide people reasons to move because they feel thats important as well as the management team feels its important. Troxell said, well thats one of the reasons they started tax abatement and that never happened really. If it had been true, if it had done what they wanted it to do, theyd have probably had 40,000 people in Marion but it didnt work. Council President Don Batchelor told the Council, Mr. Eckerle, he came tonight to share, introduce a program that they are launching there at the Growth Council. He didnt come here seeking approval or anything of that nature. He just came to provide them with this information thats in their packet tonight. Eckerle added, but they do welcome their comments and observations because clearly, as with Councilman Smiths questions, those are things they had to ponder through as they looked at this. And they also hope that they would then find them more young people or anyone with, again, college degrees to move to the community. Its everyones job to provide people reasons to live in the community and make them all be a part of the community. When you really get down to it, one of the things that sets the community apart is the people itself, and again, its the workforce. Theyre competing against communities that have, right now theyre doing, depending on what statistics you look at, theyre doing fairly well in terms of growth and in terms of (inaudible), people having Bachelors Degrees. Compared to the rest of the state, theyre slightly above the state average but the other communities theyre competing with on a regular basis, particularly in the Finley, Ohio area, which is one we tend to compete with a lot, that have a much higher success rate. Mr. Troxell told Eckerle, he realizes, you know, weve got Taylor and IWU both and its going to be hard to retain a lot of those kids in our area but hopefully we do. Eckerle responded, well again, this is the first step in doing that. He means, he lived in Chicago and the number one producing engineering state in the entire country is Illinois. The number one state for losing engineers is Illinois. So, he means, this is a battle being fought all across the Midwest. But its probably the most important battle theyre fighting as a community. Councilman Brad Luzadder told Mr. Eckerle he wanted to say thank you for doing this. He thinks anything they can do to continue to attract new people to their community, any way they can make a betterment of life for people here in the community or bring new people into the community means new money is coming into the community and he applauds the Economic Growth Council for putting out this program. He looks forward to seeing the rest of the 15 before the end of the year and look for more of that to come. He thinks its extremely important that they continue to strive to advertise and they, as a Council, should be the cheerleaders for this city and not point fingers but they should be the ones inviting people to come to our community. So he applauds him and thanks him, Luzadder told Eckerle. Mr. Eckerle told Luzadder, thank you. He forgot to point out one thing and he appreciates Councilman Troxell reminding him about Taylor and Indiana Wesleyan. If you think about this,

those students and their families have invested probably $100,000 over the last four years. He means, economic impact from those (inaudible) are probably second to only manufacturing in the community in terms of economic impact. In essence, theyve said that this is a community that they find desirable. If they only captured 15%, he thinks theyre capturing. Professor Layman has done some research and he wants to say his capture rate is, if they would only move it 5%, he means, its not a huge number of students because theyre only graduating roughly a couple hundred a year but if they increase it 100, this program pays for itself. He means, thats the bottom line. It is the most direct and quickest way to generate additional County Option Income Tax for them and additional school income for their public schools. Mr. Troxell said he didnt mean to come on as a naysayer. Hes been called a naysayer by previous Administrations and to Mr. Luzadder and Mr. Batchelor, he has a reason for asking questions and if its about spending money, he told Mr. Eckerle, he has to ask those questions. Eckerle told Troxell, he didnt object to that. Also included in the packet is their strategic marketing plan that theyre in the process of revamping. Erin Wheeler has been leading this effort. As always, they welcome any comments or suggestions they may have. They may notice that, for those that remember what the previous one looked like that they did two and a half years ago, they added a new column on entrepreneurs and they also created some additional metrics as well as events and things. But they would welcome any suggestions they may have. Theyre always trying to learn from their competing communities. Its a very competitive world we live in. If they take the time and go through Mr. Sangsters slides and he also can give them all 55 that he didnt give them, which is equally as exciting, they will find them very illuminating about how decisions are made and what the impacts are. But again, he wants to go back, he knows they spent a long night talking about tax abatement. Thats considered an economic incentive and thats a third most important factor in a site decision making matrix. And thats usually the make or break, very early on decision. So again, theyd welcome their comments, suggestions. They appreciate their time. They appreciate their support and collaboration, Eckerle stated. Councilwoman Joselyn Whitticker said she is on the Economic Growth Council Committee and she serves as a liaison and Tim knows this. She will not say anything to Tim that she would not say to anybody else. She doesnt have a problem with saying something to a persons face and when they discussed this, and this was not the first discussion this morning, theyve had about four discussions and each time, she raised very pertinent questions and one thing that needs to be brought out tonight is this. Just as Tim said, for a student to go through Taylor or IWU, theyre talking about $100,000 investment. When her kid went to Michigan State four and a half years there, the total cost was $125,000 and that was in 2004 when he graduated. So understanding putting money into the community so that people understand and what the total outcome is and the issue of saying something, its not because there are people who are going to question and Tim, thank you very much for handling himself. Fred, thank you very much for raising these questions because people do have questions. People need to understand what is going on and any other comments, nobody was sniping or anything else. He was raising questions that are pertinent, that need to be brought out to the community and thats why at different points, she prompted Tim to talk about, before they can get a penny of that money, its going to be 180 days. Thats nine months in a year that they have been in this community, buying food, attending church and so on, paying some kind of common sales tax. So there are a lot of things involved. And she says to both gentlemen, to Tim and to Fred, thank you for being very upfront and so on because there will be people who question whats going on. Fred would not raise the questions he has nor would she to Tim and so on unless other people had not raised them. So any other comment was naysaying because both, any comment thats brought before this board where its put out means theres transparency then people dont feel that there is a mistrust and theyre not doing what theyre supposed to do. The integrity of both of these gentlemen has been on the line. Both showed leadership and so on. So anything else need not have been said. So, thank you, both of you, Whitticker said. Being no further business to come before the Council, on a motion by Luzadder, 2nd by French, the meeting adjourned. Time being 8:10 p.m.

Você também pode gostar

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Proposed Marion, Indiana City Council Public Comment OrdinanceDocumento4 páginasProposed Marion, Indiana City Council Public Comment OrdinanceMarionIndiana.netAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- June 5, 2012 Marion Indiana City Council AgendaDocumento1 páginaJune 5, 2012 Marion Indiana City Council AgendaMarionIndiana.netAinda não há avaliações

- June 19, 2012 Marion, Indiana City Council MeetingDocumento1 páginaJune 19, 2012 Marion, Indiana City Council MeetingMarionIndiana.netAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Marion, Indiana City Council RulesDocumento7 páginasMarion, Indiana City Council RulesMarionIndiana.netAinda não há avaliações

- May 15, 2012 Marion Indiana City Council Meeting CancellationDocumento1 páginaMay 15, 2012 Marion Indiana City Council Meeting CancellationMarionIndiana.netAinda não há avaliações

- 2012 Marion, Indiana Redevelopment Commission ApplicationsDocumento4 páginas2012 Marion, Indiana Redevelopment Commission ApplicationsMarionIndiana.netAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- May, 1 2012 Marion, Indiana City Council AgendaDocumento1 páginaMay, 1 2012 Marion, Indiana City Council AgendaMarionIndiana.netAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- 2012 Marion, Indiana Tax LevyDocumento12 páginas2012 Marion, Indiana Tax LevyMarionIndiana.netAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Mari ON Mari ON: I NDI ANA I NDI ANADocumento10 páginasMari ON Mari ON: I NDI ANA I NDI ANAMarionIndiana.netAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Marion, Indiana Unemployment StatisticsDocumento2 páginasMarion, Indiana Unemployment StatisticsMarionIndiana.netAinda não há avaliações

- April 3, 2012 Marion, Indiana City Council AgendaDocumento1 páginaApril 3, 2012 Marion, Indiana City Council AgendaMarionIndiana.netAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Republic Vs CA 107 SCRA 504Documento2 páginasRepublic Vs CA 107 SCRA 504Neon True BeldiaAinda não há avaliações

- PDF Template Non Disclosure Agreement Nda TemplateDocumento4 páginasPDF Template Non Disclosure Agreement Nda TemplateFanny Romm Meneses100% (1)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Surigao Electric v. Municipality of Surigao: Cherie Mae F. AguinaldoDocumento2 páginasSurigao Electric v. Municipality of Surigao: Cherie Mae F. AguinaldoMilagros AguinaldoAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Memo3 Meva Devi Vs JagannathDocumento11 páginasMemo3 Meva Devi Vs JagannathTaruna ShandilyaAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Quinicot vs. PeopleDocumento10 páginasQuinicot vs. PeopledenvergamlosenAinda não há avaliações

- Insular Lumber Co V CtaDocumento2 páginasInsular Lumber Co V CtaGin Francisco100% (2)

- Republic v. Sandiganbayan, G.R. No. 148154 (2007)Documento6 páginasRepublic v. Sandiganbayan, G.R. No. 148154 (2007)Mike SazAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- 1983 Civil Rights (Recovered)Documento43 páginas1983 Civil Rights (Recovered)JeromeKmtAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Attorneys For Petitioner State of WyomingDocumento65 páginasAttorneys For Petitioner State of Wyomingnate_raymondAinda não há avaliações

- Personal Accident Insurance Reply Form pMzYOhRAje PDFDocumento3 páginasPersonal Accident Insurance Reply Form pMzYOhRAje PDFDoren John BernasolAinda não há avaliações

- Vested and Contingent InterestDocumento13 páginasVested and Contingent InterestUtkarsh SinghAinda não há avaliações

- 02-27-2018 Refusal LetterDocumento4 páginas02-27-2018 Refusal LetterER NavdeepAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Notes On Labor OrganizationsDocumento4 páginasNotes On Labor OrganizationsRustom IbanezAinda não há avaliações

- LK LK LMDocumento66 páginasLK LK LMgem baeAinda não há avaliações

- PF Policy AluDocumento13 páginasPF Policy AlukedarAinda não há avaliações

- RepresentationDocumento2 páginasRepresentationLET LETAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Non Profit Sample Compensation PolicyDocumento2 páginasNon Profit Sample Compensation PolicyRea AssociatesAinda não há avaliações

- Russell v. VestilDocumento2 páginasRussell v. VestilMaureen CoAinda não há avaliações

- Schedule E - Saudi Law IKDocumento5 páginasSchedule E - Saudi Law IKwangruiAinda não há avaliações

- Datatreasury Corporation v. Wells Fargo & Company Et Al - Document No. 542Documento4 páginasDatatreasury Corporation v. Wells Fargo & Company Et Al - Document No. 542Justia.comAinda não há avaliações

- Satellite Communication Policy in India 1997Documento3 páginasSatellite Communication Policy in India 1997Latest Laws TeamAinda não há avaliações

- Salem Advocates Bar Association VDocumento17 páginasSalem Advocates Bar Association Vabhishekchhabra36250% (4)

- Bautista v. SilvaDocumento25 páginasBautista v. SilvaMarkee Nepomuceno AngelesAinda não há avaliações

- Acusación de Fraude y RoboDocumento6 páginasAcusación de Fraude y RoboNicole GutierrezAinda não há avaliações

- Persons 102Documento222 páginasPersons 102Stacy Shara OtazaAinda não há avaliações

- 20 - The US Congress Role and FunctionsDocumento7 páginas20 - The US Congress Role and Functionsasad100% (1)

- Criminal Law Test BankDocumento260 páginasCriminal Law Test BankClif Mj Jr.Ainda não há avaliações

- Faggan Singh Kulaste - WikipediaDocumento11 páginasFaggan Singh Kulaste - WikipediaSrinath SrAinda não há avaliações

- Manila Electric Company, vs. Nelia A. BarlisDocumento6 páginasManila Electric Company, vs. Nelia A. BarlisDNAAAinda não há avaliações

- Cbse Important Board Delhi Year Wise Question Paper For SSTDocumento14 páginasCbse Important Board Delhi Year Wise Question Paper For SSTmeowAinda não há avaliações