Escolar Documentos

Profissional Documentos

Cultura Documentos

MCQ

Enviado por

Muhammad ShafiqDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

MCQ

Enviado por

Muhammad ShafiqDireitos autorais:

Formatos disponíveis

1.

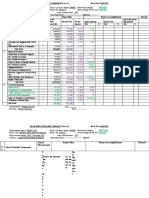

Fixed Cost: a. Changes with production b. Never changes even if production capacity is doubled c. None of the above 2. Conversion cost is: a. Material Cost + Overhead Cost b. Direct Labour + Material Cost c. Labour Cost + Overhead Cost 3. Process Costing is relevant to: a. Cement industry b. Job Order cost oriented Projects c. None of the above 4. Operating Profit is: a. Profit after deducting financial costs b. Profit after deducting taxes c. Profit after deducting normal operating expenses including depreciation 5. A good Cost Accounting System is: a. If it computes estimated cost only b. If it cannot be reconciled with financial accounts c. If it enables management to increase productivity and rationalize cost structure 6. Verification includes: a. Checking Vouchers b. Examining audit report c. None of the above 7. Stratified audit sample means: a. Randomly selected items for audit b. Purposively selected items for audit c. Items carefully selected from each group 8. Internal Control is totally synonymous with: a. Internal check b. Internal audit c. None of above 9. Audit of a bank is generally conducted through: a. Routine checking b. Couching c. Balance sheet audit 10. An auditor is liable for his annual audit of accounts o: a. Creditors b. Bankers c. Owners 11. Income Tax is levied on:

a. Agricultural Income b. Presumptive Income c. None of above 12. If a firm has paid super-tax, its partners may follow any one of the following behaviours: a. No need to pay income tax, even if the income exceeds the taxable limit. b. Pay income tax, even if the income does not exceed the taxable income. c. Pay income tax as required under the law. 13. A resident multinational company need not: a. Pay income tax, if it s caused under Double Taxation agreement. b. If it is not enjoying tax exemption under the Income Tax Ordinance, 1979 (Second Schedule). c. None of above 14. Income Tax rates are the same for: a. Limited Companies b. Banking Companies c. None of above 15. Super Tax on companies is: a. In vogue in Pakistan b. Not in vogue in Pakistan c. None of above 16. Current Ratio is calculated as: a. Fixed Assets/Current Liabilities b. Current Liabilities/Current Assets c. Current Assets/Current Liabilities 17. Short-term loan can be described as: a. If the period is three years b. If the period is less than one year c. If the period is over one year 18. A partnership, in todays Pakistan, under the current law can have the following number of partners: a. 50 b. 20 c. 100 19. Combination can be best described as: a. Restructuring of Capital of a Company b. Reduction of Capital of a Company c. Amalgamation of two different types of businesses 20. Sources of funds can be increased by: a. Describing selling prices b. Increasing expenditure c. None of above

Você também pode gostar

- Quality Assurance Kamera GammaDocumento43 páginasQuality Assurance Kamera GammawiendaintanAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- 13 Alvarez II vs. Sun Life of CanadaDocumento1 página13 Alvarez II vs. Sun Life of CanadaPaolo AlarillaAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Depression List of Pleasant ActivitiesDocumento3 páginasDepression List of Pleasant ActivitiesShivani SinghAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Refrigerator: Service ManualDocumento119 páginasRefrigerator: Service ManualMihaela CaciumarciucAinda não há avaliações

- Aircaft Avionics SystemDocumento21 páginasAircaft Avionics SystemPavan KumarAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Edgie A. Tenerife BSHM 1108: Page 1 of 4Documento4 páginasEdgie A. Tenerife BSHM 1108: Page 1 of 4Edgie TenerifeAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Quarterly Progress Report FormatDocumento7 páginasQuarterly Progress Report FormatDegnesh AssefaAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- 感應馬達安裝、保養使用說明書31057H402E (英)Documento17 páginas感應馬達安裝、保養使用說明書31057H402E (英)Rosyad Broe CaporegimeAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- PTS 18.52.08Documento60 páginasPTS 18.52.08azrai danialAinda não há avaliações

- Marine Advisory 03-22 LRITDocumento2 páginasMarine Advisory 03-22 LRITNikos StratisAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- English Language Paper 1 - Answer KeyDocumento5 páginasEnglish Language Paper 1 - Answer Keybangtansone1997Ainda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Soil Chapter 3Documento67 páginasSoil Chapter 3Jethrone MichealaAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Practice Problems Mat Bal With RXNDocumento4 páginasPractice Problems Mat Bal With RXNRugi Vicente RubiAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Photoperiodism Powerpoint EduDocumento12 páginasPhotoperiodism Powerpoint EduAlabi FauziatBulalaAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Group 7 Worksheet No. 1 2Documento24 páginasGroup 7 Worksheet No. 1 2calliemozartAinda não há avaliações

- OA Standard 050505Documento75 páginasOA Standard 050505fido_dagemAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Kes MahkamahDocumento16 páginasKes Mahkamahfirdaus azinunAinda não há avaliações

- Preservation and Collection of Biological EvidenceDocumento4 páginasPreservation and Collection of Biological EvidenceanastasiaAinda não há avaliações

- Wes Jackson PM PMP OhioDocumento10 páginasWes Jackson PM PMP Ohioraj jdsAinda não há avaliações

- Capstone-ModDocumento25 páginasCapstone-ModMohammad Ryyan PumbagulAinda não há avaliações

- OpenStax - Psychology - CH15 PSYCHOLOGICAL DISORDERSDocumento42 páginasOpenStax - Psychology - CH15 PSYCHOLOGICAL DISORDERSAngelaAinda não há avaliações

- RCM Design and ImplementationDocumento34 páginasRCM Design and ImplementationRozi YudaAinda não há avaliações

- Weekly Meal Prep GuideDocumento7 páginasWeekly Meal Prep Guideandrew.johnson3112Ainda não há avaliações

- Wago PCB Terminal Blocks and Connectors Catalog 7Documento105 páginasWago PCB Terminal Blocks and Connectors Catalog 7alinupAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Liquid Enema ProcedureDocumento3 páginasLiquid Enema Procedureapi-209728657Ainda não há avaliações

- Multilevel Full Mock Test 5: Telegramdagi KanalDocumento20 páginasMultilevel Full Mock Test 5: Telegramdagi KanalShaxzod AxmadjonovAinda não há avaliações

- Cheap TBE Inverter TeardownsDocumento33 páginasCheap TBE Inverter TeardownsWar Linux92% (12)

- HumareaderDocumento37 páginasHumareaderStefan JovanovicAinda não há avaliações

- Monitoring AlkesDocumento41 páginasMonitoring AlkesEndangMiryaningAstutiAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)