Escolar Documentos

Profissional Documentos

Cultura Documentos

Results Tracker 13.07.2012

Enviado por

Mansukh Investment & Trading SolutionsTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Results Tracker 13.07.2012

Enviado por

Mansukh Investment & Trading SolutionsDireitos autorais:

Formatos disponíveis

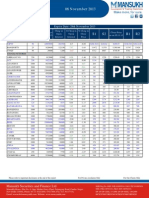

Results Tracker

Q1FY13

Friday, 13 July 2012 make more, for sure.

Results to be Declared on Friday, 13th July 2012

COMPANIES NAME

AP Paper Chokhani Sec CJ Gelatine Global Vectra HDFC Bank Hindustan Fluoro Interlink Petro Jay Bharat Marut HDFC Bank Kopran Mafatlal Fin Nalin Lease Remi Metals Sabero Organics HDFC Bank Thirumalai Chem Wendt India

Infosys

Quarter ended 201206 201106 Sales Other Income PBIDT Interest PBDT Depreciation PBT TAX Deferred Tax PAT Equity PBIDTM(%) 89090 4860 32610 0 32610 2140 30470 8430 0 22040 2870 36.6 69050 4150 24890 0 24890 1910 22980 6440 0 16540 2870 36.05 % Var 29.02 17.11 31.02 0 31.02 12.04 32.59 30.9 0 33.25 0 1.55 Year to Date 201206 89090 4860 32610 0 32610 2140 30470 8430 0 22040 2870 36.6 201106 69050 4150 24890 0 24890 1910 22980 6440 0 16540 2870 36.05 % Var 29.02 17.11 31.02 0 31.02 12.04 32.59 30.9 0 33.25 0 1.55 Year ended 201203 312540 18290 118900 0 118900 7940 110960 31100 0 79860 2870 38.04 201103 253850 11470 95610 0 95610 7400 88210 23780 0 64430 2870 37.66 % Var 23.12 59.46 24.36 0 24.36 7.3 25.79 30.78 0 23.95 0 1.01

The sales moved up 29.02% to Rs. 89090.00 millions for the June 2012 quarter as compared to Rs. 69050.00 millions during the year-ago period.A good growth in profit of 33.25% reported to Rs. 22040.00 millions over Rs. 16540.00 millions of corresponding previous quarter.Operating profit surged to 32610.00 millions from the corresponding previous quarter of 24890.00 millions.

TCS

Quarter ended 201206 201106 114106.5 86135.6 1692.6 34393.2 42.6 34350.6 0 34350.6 6374.7 0 27975.9 0 0 2574 26914.6 23.6 26891 1572.6 25318.4 4694.1 0 20624.3 1957.2 31.25 % Var 32.47 -34.24 27.79 80.51 27.74 0 35.67 35.8 0 35.65 -100 0 Year to Date 201206 114106.5 1692.6 34393.2 42.6 34350.6 0 34350.6 6374.7 0 27975.9 0 30.14 201106 86135.6 2574 26914.6 23.6 26891 1572.6 25318.4 4694.1 0 20624.3 1957.2 31.25 % Var 32.47 -34.24 27.79 80.51 27.74 0 35.67 35.8 0 35.65 -100 -3.54 Year ended 201203 388585.4 26851.8 140709 164 140545 6881.7 133663.3 23903.5 0 109759.8 1957.2 36.21 201103 292754.1 4947.3 92582.6 200.1 92382.5 5378.2 87004.3 11304.4 0 75699.9 1957.2 31.62 % Var 32.73 442.76 51.98 -18.04 52.13 27.96 53.63 111.45 0 44.99 0 14.5

Sales Other Income PBIDT Interest PBDT Depreciation PBT TAX Deferred Tax PAT Equity PBIDTM(%)

The Sales for the quarter ended June 2012 of Rs. 114106.50 millions rose by 32.47% from Rs. 86135.60 millions.A comparatively good net profit growth of 35.65% to Rs. 27975.90 millions was reported for the quarter ended June 2012 compared to Rs. 20624.30 millions of previous same quarter.OP of the company witnessed a marginal growth to 34393.20 millions from 26914.60 millions in the same quarter last year.

Please refer to important disclosures at the end of this report For Private circulation Only For Our Clients Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431 PMS Regn No. INP000002387

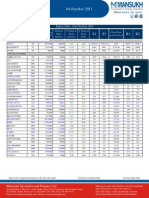

Results Tracker

Q1FY13 make more, for sure.

Data Source : ACE Equity

NAME

Varun Gupta Pashupati Nath Jha Vikram Singh

DESIGNATION

Head - Research Research Analyst Research Analyst

E-MAIL

varungupta@moneysukh.com pashupatinathjha@moneysukh.com vikram_research@moneysukh.com

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Mansukh Securities and Finance Ltd (hereinafter referred as MSFL) is not soliciting any action based on it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any person in any form. The report is based upon information that we consider reliable, but we do not represent that it is accurate or complete. MSFL or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. MSFL or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and noninfringement. The recipients of this report should rely on their own investigations. MSFL and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. This information is subject to change without any prior notice. MSFL reserves the right to make modifications and alterations to this statement as may be required from time to time. Nevertheless, MSFL is committed to providing independent and transparent recommendations to its clients, and would be happy to provide information in response to specific client queries.

Please refer to important disclosures at the end of this report

For Private circulation Only

For Our Clients Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431 PMS Regn No. INP000002387

Você também pode gostar

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Technical Analysis: Presented by Anita Singhal 1Documento41 páginasTechnical Analysis: Presented by Anita Singhal 1anita singhalAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Case Digests TaxDocumento10 páginasCase Digests TaxAron PanturillaAinda não há avaliações

- Finact 3 Asuncion, Janice Buduan, Dianne Jane Lubiton, Joshua QUESTION - Problem 15-1Documento16 páginasFinact 3 Asuncion, Janice Buduan, Dianne Jane Lubiton, Joshua QUESTION - Problem 15-1Jane Michelle Eman86% (7)

- Long Term InvestingDocumento8 páginasLong Term InvestingkrishchellaAinda não há avaliações

- Letter of Intent TemplateDocumento5 páginasLetter of Intent TemplateRaj DuraiAinda não há avaliações

- Portfolio Management ServicesDocumento24 páginasPortfolio Management ServicesASHI100% (5)

- A Study On Performance of Equity Linked Savings SchemesDocumento136 páginasA Study On Performance of Equity Linked Savings Schemeslovineaso83% (6)

- How To Read Your StatementDocumento10 páginasHow To Read Your StatementprakashthamankarAinda não há avaliações

- Kamikaze Spain PDFDocumento86 páginasKamikaze Spain PDFRodrigo Bordini Correa100% (3)

- JP Morgan Case StudyDocumento29 páginasJP Morgan Case StudyChiranshu KumarAinda não há avaliações

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDocumento5 páginasF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Results Tracker 08.11.2013Documento3 páginasResults Tracker 08.11.2013Mansukh Investment & Trading SolutionsAinda não há avaliações

- Equity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionDocumento3 páginasEquity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Results Tracker 09.11.2013Documento3 páginasResults Tracker 09.11.2013Mansukh Investment & Trading SolutionsAinda não há avaliações

- F&O Report 08 November 2013 Mansukh Investment and Trading SolutionDocumento5 páginasF&O Report 08 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Derivative 07 November 2013 by Mansukh Investment and Trading SolutionDocumento3 páginasDerivative 07 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Equity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionDocumento3 páginasEquity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDocumento3 páginasDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Results Tracker 07.11.2013Documento3 páginasResults Tracker 07.11.2013Mansukh Investment & Trading SolutionsAinda não há avaliações

- Derivative 30 October 2013 by Mansukh Investment and Trading SolutionDocumento3 páginasDerivative 30 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDocumento5 páginasF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDocumento3 páginasDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Equity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionDocumento3 páginasEquity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocumento5 páginasF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Equity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionDocumento3 páginasEquity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Derivative 31 October 2013 by Mansukh Investment and Trading SolutionDocumento3 páginasDerivative 31 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocumento5 páginasF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Derivative 25 October 2013 by Mansukh Investment and Trading SolutionDocumento3 páginasDerivative 25 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Equity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionDocumento3 páginasEquity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Equity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionDocumento3 páginasEquity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Derivative 08 October 2013 by Mansukh Investment and Trading SolutionDocumento3 páginasDerivative 08 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocumento5 páginasF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Equity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionDocumento3 páginasEquity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocumento5 páginasF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocumento5 páginasF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Equity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionDocumento3 páginasEquity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Derivative 28 October 2013 by Mansukh Investment and Trading SolutionDocumento3 páginasDerivative 28 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocumento5 páginasF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Equity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionDocumento3 páginasEquity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Derivative 24 October 2013 by Mansukh Investment and Trading SolutionDocumento3 páginasDerivative 24 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- PT Yulie Sekurindo Tbk. Securities SummaryDocumento2 páginasPT Yulie Sekurindo Tbk. Securities SummaryIshidaUryuuAinda não há avaliações

- AP Review LiabDocumento10 páginasAP Review LiabTuya DayomAinda não há avaliações

- Nikhil Chandran-Swot-analysis-of-asset-classes - Task 2Documento6 páginasNikhil Chandran-Swot-analysis-of-asset-classes - Task 2Nikhil ChandranAinda não há avaliações

- Pe Irr 06 30 15Documento4 páginasPe Irr 06 30 15Fortune100% (1)

- ADM710 - Programa 2011Documento2 páginasADM710 - Programa 2011romlyslesh5736Ainda não há avaliações

- R Money Sip Presentation by Ravish Roshandelhi 1223401016149009 9Documento19 páginasR Money Sip Presentation by Ravish Roshandelhi 1223401016149009 9Yukti KhoslaAinda não há avaliações

- XixidDocumento7 páginasXixidMark CastañedaAinda não há avaliações

- Dickinson 2011 Corp Life Cycle PDFDocumento45 páginasDickinson 2011 Corp Life Cycle PDFLiem NguyenAinda não há avaliações

- Finance Term Project DescriptionDocumento11 páginasFinance Term Project DescriptionLaura MohiuddinAinda não há avaliações

- Bank RatiosDocumento5 páginasBank RatiosSubba RaoAinda não há avaliações

- Revised Syllabus for TY BCom Business EconomicsDocumento5 páginasRevised Syllabus for TY BCom Business EconomicsDarshit V VoraAinda não há avaliações

- Team Health Stock ReportDocumento59 páginasTeam Health Stock ReportDennis LiAinda não há avaliações

- Ace Tours Worldwide - LTDDocumento5 páginasAce Tours Worldwide - LTDEthicaAinda não há avaliações

- Financial Instruments Definition and TypesDocumento9 páginasFinancial Instruments Definition and TypesShreeamar SinghAinda não há avaliações

- 06 Sharing Firm Wealth Dividends Share Repurchases and Other PayoutsDocumento2 páginas06 Sharing Firm Wealth Dividends Share Repurchases and Other PayoutsErica DizonAinda não há avaliações

- A Presentation On: Trading StrategiesDocumento26 páginasA Presentation On: Trading StrategiessumitkjhamAinda não há avaliações

- P6-32 S6-35 AKL 2 BakerDocumento3 páginasP6-32 S6-35 AKL 2 BakerDwik SanAinda não há avaliações

- Understanding Financial Statements of Life Insurance Corporation of IndiaDocumento50 páginasUnderstanding Financial Statements of Life Insurance Corporation of IndiaSaurabh TayalAinda não há avaliações

- W2 WCorporateDocumento14 páginasW2 WCorporateWay2 WealthAinda não há avaliações

- Birla Sun Life InsuranceDocumento17 páginasBirla Sun Life InsuranceKenen BhandhaviAinda não há avaliações