Escolar Documentos

Profissional Documentos

Cultura Documentos

01 Review of Share Capital Transactions

Enviado por

Alloysius ParilDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

01 Review of Share Capital Transactions

Enviado por

Alloysius ParilDireitos autorais:

Formatos disponíveis

Review of Share Capital Transactions

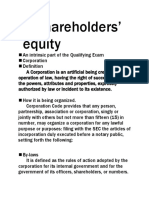

3 Primary Forms of Business Organizations

Proprietorship Partnership Corporation

Corporation: (Corporation Code of the Philippines Title I, Section 1)

An artificial being created by operation of law, having the right of succession and the powers, attributes and properties expressly authorized by law or incident to its existence

Review of Share Capital Transactions

Advantages of a Corporation

Accumulation of capital Limited liability Variety of ownership interests

Disadvantages of a Corporation

Difficult to create, organize and manage More reportorial requirements with the SEC Double taxation

Review of Share Capital Transactions

Share System

Authorized shares maximum number of shares that can be sold to the public Unissued shares unsold shares Issued shares shares that have been sold Outstanding owned by shareholders

Treasury reacquired shares; not an investment of the company

Retired shares previously issued, but then reacquired and cancelled

Review of Share Capital Transactions

Variety of Ownership Interests

Ownership rights: 1. To share proportionately in profits or losses

2. To share proportionately in management 3. To share proportionately in corporate assets upon liquidation

4. To share proportionately in any new issues of shares in the same class

Ordinary Shares: residual corporate interest that bears the ultimate risks and receives the benefits Preference Shares: certain preferences to earnings

Review of Share Capital Transactions

Ordinary Shares

Basic voting shares of the corporation Bears ultimate risks of loss Receives the benefits of success Not guaranteed dividends nor assets upon dissolution Dividends determined by board of directors

Preference Shares

Generally does not have voting rights Usually has a par or stated value Dividend preference over ordinary shares Preference over ordinary shares in the event of liquidation

Review of Share Capital Transactions

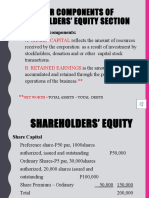

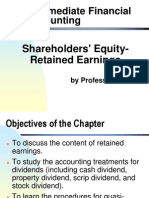

Equity - Residual interest in the assets of the company after deducting all liabilities Categories

Share capital legal capital

Share premium Retained earnings earned capital Other comprehensive income Treasury shares Non-controlling interest

Review of Share Capital Transactions

Issuance of Shares

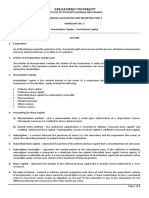

Par value ABC Corp. was organized with 500 000 ordinary shares authorized with a par value of P5 per share and 200 000, 8% preferred shares with a par value of P10. If ABC issues 20 000 shares for P12/share, prepare the journal entry

No par a. No stated value Suppose ABC is organized with the same number of shares but with no par value, journalize the previous transaction. b. With stated value If the no-par shares have a stated value of P3 per share, how will the entry differ from issuing them with no stated value?

Review of Share Capital Transactions

With other securities

a. ABC issued 25 000 ordinary shares and 10 000 preferred shares, which have a for a total consideration of P450 000. At the time of the transaction, ordinary shares were selling at P12/share and the preferred shares were selling at P20/share. b. ABC issued 5 000, P1 000 bonds for a total consideration of P4 800 000. 4 shares are issued for every bond sold. The fair value of each bond is P940 and the fair value of the shares is P300 000. *IFRS 2, par. 35 the entity shall measure the equity component of the compound

financial instrument as the difference between the fair value of the goods or services received and the fair value of the debt component, at the date when the goods or services are received.

Review of Share Capital Transactions

Non-Cash Transactions

a. ABC issued 30 000 ordinary shares to acquire a land with a cost of P400 000 and

a fair value of P700 000. The shares were selling at P15/share at the time of the transaction b. Suppose all information remained the same, only the land had an appraised value of P650 000. How would the journal entry differ?

Cost of Issuance

ABC issued 50 000 ordinary shares at P25/share. It incurred a total of P100 000

in professional fees in relation to the transaction. Tax rate is 10%. *IAS 32, par. 37 Transactions costs of an equity transaction shall be accounted for as a deduction from equity, net of any related income tax benefit.

Review of Share Capital Transactions

Cost of Issuance (IAS 32, par. 37) Transaction costs of an equity transaction

Deducted from equity Incremental costs directly attributable to the equity transaction *The costs of an equity transaction that is abandoned are recognized as expense.

Examples of cost of issuance Registration fees

Underwriter commissions Printing and clerical costs Legal and accounting fees

Review of Share Capital Transactions

Donation of Shares

a. To help the company in its operations, a total of 40 000 shares were donated to ABC. The shares have an average cost of P14. Fair value of each share is P20. b. The shares were subsequently reissued for P25/share.

Watered Shares

Issued for insufficient consideration Illegal

Review of Share Capital Transactions

Repurchase of Shares

*IAS 32, par. 33: If an entity reacquires its own equity instruments, those instruments (treasury shares) shall be deducted from equity. No gain or loss shall be recognized in profit or loss on the purchase, sale, issue , or cancellation of an entitys own equity instruments. Such treasury shares may be acquired and held by

the entity or by other members of the consolidated group. Consideration paid or

received shall be recognized directly in equity.

Review of Share Capital Transactions

Repurchase of Shares

a. ABC repurchased 50 000 of its own shares at P12/share. b. Suppose after one month, 5 000 of its shares were reissued at P12/share. c. Another 7 000 of its treasury shares were reissued at P10/share. Assume that (a) is the first treasury share transaction of ABC.

d. Another 8 000 treasury shares were reissued at P13/share.

e. Another 5 000 treasury shares were reissued at P8/share.

Review of Share Capital Transactions

ABC had the following balance at Dec. 31, 2012. Account Share capital - ordinary Bonds payable (net of 300 000 discount) Share premium - ordinary Preferred shares Share premium - preferred Share premium donated capital Treasury shares Retained earnings Prepare ABCs equity section Amount 725 000 4 700 000 1 745 000 100 000 80 000 1 000 000 300 000 8 500 000

Review of Share Capital Transactions

ABC Corporation Partial Statement of Financial Position 31-Dec-12 Equity Share capital - preference, P10 par, 8%, 10 000 shares issued and outstanding

100,000.00

Share capital - ordinary, P5 par, 145 000 shares issued, 120 000 shares outstanding

Share premium - preference Share premium - ordinary Share premium - donated capital Retained earnings Treasury shares (25 000 ordinary shares) Total equity

725,000.00 80,000.00 1,745,000.00 1,000,000.00

825,000.00

2,825,000.00 8,500,000.00 (300,000.00) 11,850,000.00

Você também pode gostar

- Chapter 7 Stockholers Equity FinalDocumento77 páginasChapter 7 Stockholers Equity FinalSampanna ShresthaAinda não há avaliações

- Accounting for Share Capital TransactionsDocumento6 páginasAccounting for Share Capital TransactionsJessa Mae Banse50% (2)

- Letter To Judge On Right To Travel PDFDocumento2 páginasLetter To Judge On Right To Travel PDFpanamahunt22Ainda não há avaliações

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideNo EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideAinda não há avaliações

- Conveyancing in JamaicaDocumento6 páginasConveyancing in JamaicaMichka SweetnessAinda não há avaliações

- Confra - Stockholders' EquityDocumento74 páginasConfra - Stockholders' EquityJoanSerranoMijares100% (1)

- Shareholders Equity Part 1Documento57 páginasShareholders Equity Part 1AlliahDataAinda não há avaliações

- tenSAI notes on share capital transactionsDocumento4 páginastenSAI notes on share capital transactionslooter198100% (2)

- Shareholder S' EquityDocumento55 páginasShareholder S' EquityRojParconAinda não há avaliações

- 62230126Documento20 páginas62230126ROMULO CUBIDAinda não há avaliações

- Consolidated Statement of Financial Position at Acquisition DateDocumento11 páginasConsolidated Statement of Financial Position at Acquisition DateJamhel MarquezAinda não há avaliações

- FEU Institute Accounting for Corporations ConceptsDocumento10 páginasFEU Institute Accounting for Corporations ConceptsFatima GuevarraAinda não há avaliações

- Constitutional Law II NotesDocumento89 páginasConstitutional Law II NotesJerome-Gina Rodriguez PalerAinda não há avaliações

- SHAREHOLDERS EQUITY EXPLAINEDDocumento45 páginasSHAREHOLDERS EQUITY EXPLAINEDJeong malyow0% (1)

- Accounting for Share Capital in CorporationsDocumento57 páginasAccounting for Share Capital in CorporationsMarriel Fate Cullano75% (8)

- 49 Gamilla v. Burgundy Realty CorporationDocumento1 página49 Gamilla v. Burgundy Realty CorporationLloyd Edgar G. ReyesAinda não há avaliações

- IAS 8 Accounting Policies - Changes in Accounting Estimates and Errors PDFDocumento20 páginasIAS 8 Accounting Policies - Changes in Accounting Estimates and Errors PDFMichelle TanAinda não há avaliações

- Far Pet Class - Mock Quiz CorporationDocumento11 páginasFar Pet Class - Mock Quiz CorporationNia BranzuelaAinda não há avaliações

- Chapter 15 - Accounting For CorporationsDocumento22 páginasChapter 15 - Accounting For CorporationsAlizah BucotAinda não há avaliações

- FAR Module (Corporation)Documento54 páginasFAR Module (Corporation)Rey HandumonAinda não há avaliações

- Fidic InfoDocumento39 páginasFidic InfoAMTRIS50% (2)

- Case #1 Bobie Rose D. V. Frias vs. Alcayde G.R. No. 194262, February 28, 2018 Tijam, J.: FactsDocumento16 páginasCase #1 Bobie Rose D. V. Frias vs. Alcayde G.R. No. 194262, February 28, 2018 Tijam, J.: FactsJayAinda não há avaliações

- Exam - SHE, RE & Share Based CompensationDocumento4 páginasExam - SHE, RE & Share Based CompensationJohnAllenMarilla100% (2)

- Biraogo vs. Nograles and LimkaichongDocumento4 páginasBiraogo vs. Nograles and Limkaichongblue_blue_blue_blue_blueAinda não há avaliações

- Shareholders-Equity - Part 1Documento29 páginasShareholders-Equity - Part 1cj bAinda não há avaliações

- 03 Share Split and Treasury SharesDocumento17 páginas03 Share Split and Treasury SharesAlloysius ParilAinda não há avaliações

- On-Line Lesson 1 Part 2Documento28 páginasOn-Line Lesson 1 Part 2Kimberly Claire AtienzaAinda não há avaliações

- Shareholders' EquityDocumento18 páginasShareholders' EquityKristia AnagapAinda não há avaliações

- FINACT2 Handout No. 5 2019Documento6 páginasFINACT2 Handout No. 5 2019Janysse CalderonAinda não há avaliações

- Accumulated Profits or LossesDocumento6 páginasAccumulated Profits or LossesMayaAinda não há avaliações

- Orporations: Share Capital, Retained Earnings, and Financial ReportingDocumento10 páginasOrporations: Share Capital, Retained Earnings, and Financial ReportingkakaoAinda não há avaliações

- Corporation: Shareholders EquityDocumento38 páginasCorporation: Shareholders EquityKristen IjacoAinda não há avaliações

- Notes 02 CorporationDocumento7 páginasNotes 02 CorporationPaulo DonesAinda não há avaliações

- Chap6 150401024123 Conversion Gate01 PDFDocumento54 páginasChap6 150401024123 Conversion Gate01 PDFrosalie gelbolingoAinda não há avaliações

- Corporations Part 3Documento20 páginasCorporations Part 3Miss LunaAinda não há avaliações

- Shareholder's Equity ProblemsDocumento4 páginasShareholder's Equity ProblemsKHAkadsbdhsgAinda não há avaliações

- 06.module & Task-Share Capital PDFDocumento8 páginas06.module & Task-Share Capital PDFJohn Lery YumolAinda não há avaliações

- Analyzing Common Stocks MethodsDocumento17 páginasAnalyzing Common Stocks MethodsJacinta Fatima ChingAinda não há avaliações

- Accounting For Shareholders Equity KINGDocumento11 páginasAccounting For Shareholders Equity KINGAlexis KingAinda não há avaliações

- RECORDING Shares 1 Issue & DividendsDocumento4 páginasRECORDING Shares 1 Issue & DividendsDonald SAinda não há avaliações

- Shareholders Equity ComponentsDocumento11 páginasShareholders Equity ComponentsJoshua MolinaAinda não há avaliações

- Shareholder's EquityDocumento18 páginasShareholder's EquityShashank0% (1)

- Shareholder's Equity-Share Capital - 0Documento35 páginasShareholder's Equity-Share Capital - 0lilienesieraAinda não há avaliações

- Shareholder's EquityDocumento18 páginasShareholder's EquityTrisha TeAinda não há avaliações

- Accounting for Equity Transactions in a CorporationDocumento37 páginasAccounting for Equity Transactions in a CorporationJulius B. OpriasaAinda não há avaliações

- What are Financial StatementsDocumento51 páginasWhat are Financial Statementskrys_elleAinda não há avaliações

- ACC 221 SHE EditedDocumento90 páginasACC 221 SHE EditedHazel PachecoAinda não há avaliações

- Accounting Quizzes Answer KeyDocumento11 páginasAccounting Quizzes Answer KeyRae SlaughterAinda não há avaliações

- Auditing Problems: RequiredDocumento2 páginasAuditing Problems: RequiredvhhhAinda não há avaliações

- Quiz On AccountingDocumento19 páginasQuiz On Accountingdiane pandoyosAinda não há avaliações

- Requirements: Prepare Journal Entries To Record The Foregoing Transactions. Identify The Entries by Letter (A - F)Documento2 páginasRequirements: Prepare Journal Entries To Record The Foregoing Transactions. Identify The Entries by Letter (A - F)happy240823Ainda não há avaliações

- Retained Earnings: Dividends ExplainedDocumento76 páginasRetained Earnings: Dividends ExplainedKristine DoydoraAinda não há avaliações

- On Line Lesson 2 Treasury StocksDocumento26 páginasOn Line Lesson 2 Treasury StocksKimberly Claire AtienzaAinda não há avaliações

- Chapter 13Documento11 páginasChapter 13Maya HamdyAinda não há avaliações

- IFRS 3 Business CombinationDocumento15 páginasIFRS 3 Business CombinationAquino KimalexerAinda não há avaliações

- Corporation QuizDocumento13 páginasCorporation Quizjano_art21Ainda não há avaliações

- CH 15 Kieso Slides (8e)Documento54 páginasCH 15 Kieso Slides (8e)Fitriyeni OktaviaAinda não há avaliações

- College of Accountancy & FinanceDocumento5 páginasCollege of Accountancy & FinanceCecille GuillermoAinda não há avaliações

- Difference between interim and final dividendsDocumento2 páginasDifference between interim and final dividendsTaylor Kongitti PraditAinda não há avaliações

- 432 Chapter 15 Notes 2015Documento68 páginas432 Chapter 15 Notes 2015AoranKanAinda não há avaliações

- Financial Accounting:: Tools For Business Decision Making, 4th EdDocumento76 páginasFinancial Accounting:: Tools For Business Decision Making, 4th EdirquadriAinda não há avaliações

- Accounting Capital+Stock+TransactionsDocumento17 páginasAccounting Capital+Stock+TransactionsOckouri BarnesAinda não há avaliações

- Introduction To Accounting 2 Organization and Capital Stock TransactionsDocumento17 páginasIntroduction To Accounting 2 Organization and Capital Stock Transactionsalice horanAinda não há avaliações

- Accounting Chapter 9Documento7 páginasAccounting Chapter 9Angelica Faye DuroAinda não há avaliações

- Stock Dividend: Date of PaymentDocumento6 páginasStock Dividend: Date of PaymentmercyvienhoAinda não há avaliações

- Chapter 21 and 22 (Complete)Documento6 páginasChapter 21 and 22 (Complete)Leah ValdezAinda não há avaliações

- Handout On Chapter 12 Corporations PDFDocumento9 páginasHandout On Chapter 12 Corporations PDFJeric TorionAinda não há avaliações

- Ias 16Documento4 páginasIas 16Alloysius ParilAinda não há avaliações

- A Study On The Sensitivity of Stock Options' Premium To Changes in The Underlying Stock's Dividend YieldDocumento27 páginasA Study On The Sensitivity of Stock Options' Premium To Changes in The Underlying Stock's Dividend YieldAlloysius ParilAinda não há avaliações

- 02 Options, Rights and WarrantsDocumento16 páginas02 Options, Rights and WarrantsAlloysius ParilAinda não há avaliações

- Stockholders' EquityDocumento68 páginasStockholders' EquityAlloysius Paril100% (1)

- Questions On Shareholders' EquityDocumento36 páginasQuestions On Shareholders' EquityAlloysius ParilAinda não há avaliações

- Japan Airlines v. CA GR 118664 Aug 7, 1998Documento3 páginasJapan Airlines v. CA GR 118664 Aug 7, 1998Rod PagdilaoAinda não há avaliações

- Sarigumba V SandiganbayanDocumento17 páginasSarigumba V SandiganbayanKTAinda não há avaliações

- Code of Conduct For Advocates in IndiaDocumento9 páginasCode of Conduct For Advocates in IndiaArushi SinghAinda não há avaliações

- Dispute Settlement in The World Trade Organization - Wikipedia, The Free EncyclopediaDocumento9 páginasDispute Settlement in The World Trade Organization - Wikipedia, The Free EncyclopediaAthar's PageAinda não há avaliações

- Satyabrata Ghose v. Mugneeram Bangur & Co. AIR 1954 SC 44: Mid Semester Assignment Submitted ToDocumento5 páginasSatyabrata Ghose v. Mugneeram Bangur & Co. AIR 1954 SC 44: Mid Semester Assignment Submitted Tovarun vasantAinda não há avaliações

- Adjudication Order in Respect of M/s Ambe Hotel & Resorts LimitedDocumento8 páginasAdjudication Order in Respect of M/s Ambe Hotel & Resorts LimitedShyam SunderAinda não há avaliações

- Aries Waterproofing (Reply)Documento3 páginasAries Waterproofing (Reply)Maryknoll MaltoAinda não há avaliações

- Re Gold Corp. Exchange Ltd.Documento8 páginasRe Gold Corp. Exchange Ltd.vikas raj100% (2)

- File 4070Documento5 páginasFile 4070NEWS CENTER MaineAinda não há avaliações

- Simplehuman v. Itouchless - Motion To DismissDocumento31 páginasSimplehuman v. Itouchless - Motion To DismissSarah BursteinAinda não há avaliações

- Hamaker v. BlanchardDocumento4 páginasHamaker v. BlanchardMatt LedesmaAinda não há avaliações

- Letter To Governor Kasich Concerning OPSBDocumento28 páginasLetter To Governor Kasich Concerning OPSBDennis AlbertAinda não há avaliações

- Civil Authority Ingress Egress Coverage. Clark Schirle. The Brief - Winter - 2018Documento5 páginasCivil Authority Ingress Egress Coverage. Clark Schirle. The Brief - Winter - 2018Kuch HogaAinda não há avaliações

- 9 PNB V Andrada Electric & Engineering Co., GR No. 142936, April 17, 2002Documento9 páginas9 PNB V Andrada Electric & Engineering Co., GR No. 142936, April 17, 2002Edgar Calzita AlotaAinda não há avaliações

- Unilever Philippines (PRC), Inc. vs. The Honorable Court of Appeals, Et AlDocumento7 páginasUnilever Philippines (PRC), Inc. vs. The Honorable Court of Appeals, Et AljafernandAinda não há avaliações

- United States Court of Appeals Seventh CircuitDocumento5 páginasUnited States Court of Appeals Seventh CircuitScribd Government DocsAinda não há avaliações

- Family LawDocumento15 páginasFamily LawJUHI BHUTANI100% (1)

- Estafa and Preliminary AttachmentDocumento9 páginasEstafa and Preliminary AttachmentShe AsorioAinda não há avaliações

- Arthur S. Bechhoefer v. U.S. Department of Justice Drug Enforcement Administration, Robert Nearing and Jeffrey Gelina, 209 F.3d 57, 2d Cir. (2000)Documento10 páginasArthur S. Bechhoefer v. U.S. Department of Justice Drug Enforcement Administration, Robert Nearing and Jeffrey Gelina, 209 F.3d 57, 2d Cir. (2000)Scribd Government DocsAinda não há avaliações

- Customer Complaint Form for Legal ActionDocumento2 páginasCustomer Complaint Form for Legal ActionTayyab Hassan tararAinda não há avaliações

- 15) Ty v. People, 439 SCRA 220Documento11 páginas15) Ty v. People, 439 SCRA 220Nurlailah AliAinda não há avaliações

- Petitioner Vs Vs Respondents Rolando P Quimbo The Solicitor GeneralDocumento9 páginasPetitioner Vs Vs Respondents Rolando P Quimbo The Solicitor Generalaspiringlawyer1234Ainda não há avaliações

- Atty faces suspension for negligence, failure to file appealDocumento26 páginasAtty faces suspension for negligence, failure to file appealCelestine GonzalesAinda não há avaliações