Escolar Documentos

Profissional Documentos

Cultura Documentos

Audit Documentation

Enviado por

chintengo0 notas0% acharam este documento útil (0 voto)

21 visualizações10 páginasAUDIT Documentation AU 339 of the AICPA. Audit Documentation is the principal record of auditing procedures applied, evidence obtained, and conclusions reached by the auditor in the engagement. The quantity, type, and content of Audit Documentation are matters of the auditor's professional judgment.

Descrição original:

Direitos autorais

© Attribution Non-Commercial (BY-NC)

Formatos disponíveis

PPT, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoAUDIT Documentation AU 339 of the AICPA. Audit Documentation is the principal record of auditing procedures applied, evidence obtained, and conclusions reached by the auditor in the engagement. The quantity, type, and content of Audit Documentation are matters of the auditor's professional judgment.

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PPT, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

21 visualizações10 páginasAudit Documentation

Enviado por

chintengoAUDIT Documentation AU 339 of the AICPA. Audit Documentation is the principal record of auditing procedures applied, evidence obtained, and conclusions reached by the auditor in the engagement. The quantity, type, and content of Audit Documentation are matters of the auditor's professional judgment.

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PPT, PDF, TXT ou leia online no Scribd

Você está na página 1de 10

AUDIT DOCUMENTATION AU 339 of the AICPA

Presented by Mohammed J. Masoud CPA, MBA in acct Member of the AICPA, CalCPAs and ACFE In cooperation with the Palestine Association of the Certified Public Accountant For the period from August 8 to 10, 2005

Auditing Standards of Fieldwork

The first standard of fieldwork requires that the work is to be adequately planned and assistants, if any, are to be properly supervised the second standard of fieldwork: A sufficient understanding of internal control is to be obtained to plan the audit and to determine the nature, timing, and extent of tests to be performed The third standard of fieldwork is: Sufficient competent evidential matter is to be obtained through inspection, observation, inquiries, and confirmations to afford a reasonable basis for an opinion regarding the financial statements under audit.

What is Audit Documentation ?

Audit documentation is the principal record of

auditing procedures applied, evidence obtained, and conclusions reached by the auditor in the engagement.

The quantity, type, and content of audit documentation are matters of the auditors professional judgment Note: Audit documentation ( working papers) is the auditors property

Audit documentation serves mainly to:

a. Provide the principal support for the auditors report, including the representation regarding observance of the standards of fieldwork, which is implicit in the reference in the report to generally accepted auditing standards

b. Aid the auditor in the conduct and supervision of the audit.

Note: the second paragraph of the standard auditors report states We conducted our audit in accordance with auditing

standards generally accepted in the United States of America

What is the auditors responsibility?

Prepare and maintain audit documentation sufficient enough to show that standards of fieldwork have been observed Form and content should be designed to meet the circumstances of the particular audit documentation ( It depends !)

What is the auditors responsibility?

The auditor should adopt reasonable procedures to retain ( maintain) audit documentation for a period of time sufficient to:

1. Meet the needs of his or her practice 2. Satisfy any applicable legal or regulatory requirements for record retention

The procedures should enable the auditor to access electronic audit documentation throughout the retention period

What is the auditors responsibility?

Maintain confidentiality of informationethical, professional and legal implications Prevent unauthorized access to the audit documentation Not regard audit documentation as a part of, or a substitute for, the clients accounting records

Examples of Audit Documentation

Audit Programs Analyses Memoranda Letters of confirmation and representation Abstracts or copies of entity documents Schedules or commentaries prepared or obtained by the auditor

Form of Audit Documentation

Paper Electronic ; CD, Floppy disk, USP, Hard disk Other media ! Would this include audio format ? Legal implications

Sufficiency of Audit Documentation

Sufficient to

a. Enable members of the engagement team with supervision and review responsibilities to understand the nature, timing, extent, and results of auditing procedures performed and evidence obtained ( Example) b. Indicate the engagement team member(s) who performed and reviewed the work ( Example); and c. Show that the accounting records agree or reconcile with the financial statements or other information being reported on (Example)

Você também pode gostar

- Anointing and AuthorityDocumento3 páginasAnointing and AuthoritychintengoAinda não há avaliações

- 365 Wisdom Keys of Mike Murdock - Mike MurdockDocumento110 páginas365 Wisdom Keys of Mike Murdock - Mike MurdockMulaabi Amos Duncan100% (1)

- 40 40PrayerGuideERLC NAMB PDFDocumento46 páginas40 40PrayerGuideERLC NAMB PDFchintengoAinda não há avaliações

- Cornerstones of A Happy Home-Pres Gordon B.Hinkley PDFDocumento16 páginasCornerstones of A Happy Home-Pres Gordon B.Hinkley PDFchintengo100% (1)

- 100 Ways To Boost Your Self-Confidence OnlyGillDocumento224 páginas100 Ways To Boost Your Self-Confidence OnlyGillcrisrar11100% (7)

- Book 8Documento1 páginaBook 8chintengoAinda não há avaliações

- Afro Brief No 125Documento16 páginasAfro Brief No 125chintengoAinda não há avaliações

- AICM July 2015 Hi-Res Final PDFDocumento57 páginasAICM July 2015 Hi-Res Final PDFchintengoAinda não há avaliações

- Facebook - Getting Ur - PER (..Documento3 páginasFacebook - Getting Ur - PER (..simrsAinda não há avaliações

- 1045 KJV Commentary Bible Large Print PDF PDFDocumento61 páginas1045 KJV Commentary Bible Large Print PDF PDFchintengoAinda não há avaliações

- Conducting CourseDocumento106 páginasConducting CourseDennis Vigil Caballero100% (3)

- Ab SG Apr15 Comp RGBRDocumento68 páginasAb SG Apr15 Comp RGBRchintengoAinda não há avaliações

- 7 Forgetting The Past 30MBDocumento40 páginas7 Forgetting The Past 30MBchintengoAinda não há avaliações

- Ab Int Nov14 Comp Rgb300Documento68 páginasAb Int Nov14 Comp Rgb300chintengoAinda não há avaliações

- Acca Magazine Decem 08Documento76 páginasAcca Magazine Decem 08Theo Lopes GarciaAinda não há avaliações

- 5 I Heard God Today 52MB PDFDocumento40 páginas5 I Heard God Today 52MB PDFchintengoAinda não há avaliações

- 21st Century Part 1Documento30 páginas21st Century Part 1va2luv100% (1)

- AB UK - Feb14 - Comp - RGB PDFDocumento84 páginasAB UK - Feb14 - Comp - RGB PDFchintengoAinda não há avaliações

- 2 - Revelation of God in Jesus - 23.01.2013 PDFDocumento6 páginas2 - Revelation of God in Jesus - 23.01.2013 PDFchintengoAinda não há avaliações

- Ab SG Apr15 Comp RGBRDocumento68 páginasAb SG Apr15 Comp RGBRchintengoAinda não há avaliações

- 100 Inspirational Books Everyone Should ReadDocumento8 páginas100 Inspirational Books Everyone Should ReadKhalid Khan100% (1)

- Conducting CourseDocumento106 páginasConducting CourseDennis Vigil Caballero100% (3)

- List of ACCA Employers: Serial # Company Address-1 Address-2 Address-3 Town Website Approval LevelDocumento6 páginasList of ACCA Employers: Serial # Company Address-1 Address-2 Address-3 Town Website Approval LevelchintengoAinda não há avaliações

- PrayersDocumento24 páginasPrayerschintengo100% (1)

- Ab Uk Nov14 Comp rgb300 PDFDocumento84 páginasAb Uk Nov14 Comp rgb300 PDFchintengoAinda não há avaliações

- Acca f2 BPP 205 2016 Practice KitDocumento68 páginasAcca f2 BPP 205 2016 Practice KitchintengoAinda não há avaliações

- A Compendious French GrammarDocumento390 páginasA Compendious French Grammarbharanivldv991% (11)

- When Bad Grammar Happens To Good People - How To Avoid Common Errors in EnglishDocumento60 páginasWhen Bad Grammar Happens To Good People - How To Avoid Common Errors in EnglishchintengoAinda não há avaliações

- AB MY Mar14 Comp 150Documento68 páginasAB MY Mar14 Comp 150chintengoAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Company Law Topic 3Documento33 páginasCompany Law Topic 3Mauricio AndradeAinda não há avaliações

- Case Digest CTTODocumento17 páginasCase Digest CTTOIsah CabiosAinda não há avaliações

- Purchasing Audit PDocumento5 páginasPurchasing Audit PnedsonkawangaAinda não há avaliações

- Multiple Choice QuestionsDocumento11 páginasMultiple Choice QuestionsttoraddoraAinda não há avaliações

- MPD Complete Investigation of Officer Heimsness Shooting of Paul Heenan 2012Documento782 páginasMPD Complete Investigation of Officer Heimsness Shooting of Paul Heenan 2012Isthmus Publishing CompanyAinda não há avaliações

- Franklin V Minister of Town and Country Planning (1948) Ac 87 416Documento2 páginasFranklin V Minister of Town and Country Planning (1948) Ac 87 416Sonal Gupta100% (1)

- Primer On Protocol For Explosive Related Incidents InvestigationDocumento21 páginasPrimer On Protocol For Explosive Related Incidents InvestigationGeremiah Calma90% (21)

- Procedure Patent Registration India 6 StepsDocumento3 páginasProcedure Patent Registration India 6 StepsBuvarasuAinda não há avaliações

- 1957 The Floating OperaDocumento117 páginas1957 The Floating OperaAnastasia ZhidenovaAinda não há avaliações

- Wesleyan University - Philippines: Mabini Extension, Cabanatuan CityDocumento3 páginasWesleyan University - Philippines: Mabini Extension, Cabanatuan CityJendrius RamosAinda não há avaliações

- Buisson DocumentsDocumento6 páginasBuisson DocumentsWWLTVWebteamAinda não há avaliações

- Language Planning and Placenaming in Australia by Flavia HodgesDocumento21 páginasLanguage Planning and Placenaming in Australia by Flavia HodgesCyril Jude CornelioAinda não há avaliações

- Writing Argumentative EssaysDocumento3 páginasWriting Argumentative EssaysmalulytaAinda não há avaliações

- Case Study 84Documento2 páginasCase Study 84taneja855Ainda não há avaliações

- BOC Personnel Orders Transferring 228 PersonnelDocumento5 páginasBOC Personnel Orders Transferring 228 PersonnelPortCallsAinda não há avaliações

- Amira College ProjectDocumento12 páginasAmira College ProjectAnkitAinda não há avaliações

- Air Transportation Laws in the PhilippinesDocumento8 páginasAir Transportation Laws in the PhilippinesAbegail Protacio GuardianAinda não há avaliações

- List of Various Committees and Commissions PDFDocumento4 páginasList of Various Committees and Commissions PDFVarun Gopal50% (2)

- ComplaintDocumento6 páginasComplaintDeadspinAinda não há avaliações

- Auditing Theory Test BankDocumento8 páginasAuditing Theory Test BankSam Rafz67% (3)

- 62 - DBP Pool of Accredited Insurance Companies v. Radio Mindanao Network, Inc.Documento3 páginas62 - DBP Pool of Accredited Insurance Companies v. Radio Mindanao Network, Inc.Katrina Janine Cabanos-ArceloAinda não há avaliações

- Modified Variation Order Management Model For Civil Engineering Construction ProjectsDocumento119 páginasModified Variation Order Management Model For Civil Engineering Construction ProjectsAhed NabilAinda não há avaliações

- Rorty, Richard - Analytic Philosophy and NarrativeDocumento34 páginasRorty, Richard - Analytic Philosophy and NarrativeBasil Lipcan0% (1)

- 5.4 Later Speech Stages:Rule Formation For Negatives, Questions, Passives & Other Complex StructuresDocumento2 páginas5.4 Later Speech Stages:Rule Formation For Negatives, Questions, Passives & Other Complex StructuresFitriAndriyaniAinda não há avaliações

- Quiz CDIDocumento3 páginasQuiz CDIShyra Manalo CastilloAinda não há avaliações

- Randolph Parsad v. Charles Greiner, Superintendent, Sing Sing Correctional Facility, Eliot Spitzer, Attorney General of New York, 337 F.3d 175, 2d Cir. (2003)Documento13 páginasRandolph Parsad v. Charles Greiner, Superintendent, Sing Sing Correctional Facility, Eliot Spitzer, Attorney General of New York, 337 F.3d 175, 2d Cir. (2003)Scribd Government DocsAinda não há avaliações

- SPCMB v. Anti-Money Laundering Council, G.R. No. 216914, December 6, 2016Documento2 páginasSPCMB v. Anti-Money Laundering Council, G.R. No. 216914, December 6, 2016Arl GamazonAinda não há avaliações

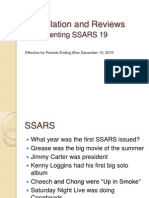

- SSARS 19 - Compilation and ReviewsDocumento72 páginasSSARS 19 - Compilation and ReviewsCharles B. HallAinda não há avaliações

- CDI 1 Unit 3Documento3 páginasCDI 1 Unit 3Stefanio Estal100% (1)

- Hennepin County Full ReportDocumento31 páginasHennepin County Full ReportKARE 11Ainda não há avaliações