Escolar Documentos

Profissional Documentos

Cultura Documentos

Equity and Hybrid Instruments

Enviado por

Pranjit BhuyanDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Equity and Hybrid Instruments

Enviado por

Pranjit BhuyanDireitos autorais:

Formatos disponíveis

Prepared by

Ken Hartviksen

INTRODUCTION TO

CORPORATE FINANCE

Laurence Booth W. Sean Cleary

Chapter 19 Equity and Hybrid

Instruments

CHAPTER 19

Equity and Hybrid

Instruments

CHAPTER 19 Equity and Hybrid Instruments 19 - 3

Lecture Agenda

Learning Objectives

Important Terms

Shareholders Equity

Preferred Share Characteristics

Income Trusts

Warrants and Convertible Securities

Other Hybrids

Summary and Conclusions

Concept Review Questions

CHAPTER 19 Equity and Hybrid Instruments 19 - 4

Learning Objectives

You should understand the following:

The basic rights associated with share ownership

How these rights are distributed differently across different classes of

shareholders

How preferred shares differ from common shares and the different features

that may be associated with preferred shares

Why combining warrants with debt issues or issuing convertible bonds or

debentures can provide firms with attractive financing options

The wide variety of hybrid financing options available to firms, and how

they are constructed by combining the basic characteristics of debt and

equity to various degrees

CHAPTER 19 Equity and Hybrid Instruments 19 - 5

Important Chapter Terms

Adjustable rate convertible

subordinated securities

Canadian optional interest

notes

Cash flow bonds

Commodity bond

Conversion price

Conversion ratio

Conversion value

Cumulative provision

Dilution factor

Family trust

Floating rate preferred share

Floor value

Hard retraction

Hybrid security

Income bonds

Legal factor

Liquid Yield Option Notes

Low-yield notes

Non-voting shares

Original issue discount notes

Permanence factor

Pre-emptive right

Preferred securities

Prepaid bonds

CHAPTER 19 Equity and Hybrid Instruments 19 - 6

Important Chapter Terms

Residual owners

Restricted shares

Retractable preferred share

Soft retraction

Straight bond value (SBV)

Straight preferred share

Subjective factor

Subordination factor

Tax value of money

Warrants

The Nature of Equity Securities

Equity and Hybrid Instruments

CHAPTER 19 Equity and Hybrid Instruments 19 - 8

Equity Securities

Ownership interest in an underlying business, usually a

corporation.

With the 1980 revision of the Canada Business Corporations

Act, the term preferred share was removed from legal

parlance in Canada.

Par values were also removed since 1975 under the CBCA.

CBCA now allows corporations to issue any number of

classes of shares however, there must be:

One share class with voting rights

One share class with residual rights to dividends and

One share class with residual rights to assets upon dissolution.

NOTE: We often call common shares those shares with both voting rights

and residual rights to earnings and assets, but you will note that

technically, all those rights do not have to vest in a single share class.

CHAPTER 19 Equity and Hybrid Instruments 19 - 9

Preference Versus Common Shares

As previously noted, the term preference share was

stricken from CBCA in 1980.

Nevertheless, the term remains in usage to

describe:

A share class with some preference over the

common share class

However, there can be any number of classes of

shares with different rights and privileges.

CHAPTER 19 Equity and Hybrid Instruments 19 - 10

Preferred Shares

The Common Understanding of a Preferred Share

The term preferred share is now typically used to

describe a share class that:

Has no voting rights (unless the fixed dividend is in

arrears for a given period of time)

Offers to pay a fixed dividend (although such

dividends are not a legally enforceable claim)

Has a prior claim to the residual share class to

assets upon dissolution.

Additionally, most preferred shares also offer:

A cumulative feature wherein arrearages in dividends

must be paid before the common share class can

receive dividends

CHAPTER 19 Equity and Hybrid Instruments 19 - 11

Shareholders Equity

Shareholder Rights

When a corporation has only one share class, the

rights are equal in all respects and include:

The right to vote at any meeting of the shareholders

of the corporation;

To receive any dividend declared by the corporation;

To receive the remaining property of the corporation

upon dissolution.

Provincially incorporated firms operate under similar

provisions.

CHAPTER 19 Equity and Hybrid Instruments 19 - 12

Shareholders Equity

Voting Rights

At an annual general shareholders meeting (AGM) the

standing agenda includes a shareholders vote to:

Elect members of the board of directors

Appoint the external auditors of the firm

Receive the audited financial statements

If fundamental/major changes are proposed, a special

meeting of shareholders may be called (or typically, the AGM

will be called a AGM and Special meeting of shareholders)

and the shareholders may be asked to vote on:

Changes to the articles of incorporation

Changes to the bylaws of the corporation

Major changes in operations, financial structure, acquisition of

another firm, etc.

CHAPTER 19 Equity and Hybrid Instruments 19 - 13

Shareholders Equity

Preemptive Right

The preemptive right is the right of shareholders to maintain

proportional ownership in a company when new shares are

issued.

When companies raise new capital under these conditions,

they do so through a rights offering which gives the current

shareholders the first right of refusal on the issue of any new

shares.

The preemptive right, if it exists, usually is contained in the

articles of incorporation and is one of the rights of the share

classes that the firm has.

Removal of the preemptive right from the articles of

incorporation requires approval by the shareholders at a

special meeting of shareholders.

CHAPTER 19 Equity and Hybrid Instruments 19 - 14

Shareholders Equity

Residual Rights

The right to receive a dividend, if declared by the

board of directors, and

The right to receive a pro rata share of any

remaining property upon dissolution of the

corporation after all other claims have been

satisfied.

CHAPTER 19 Equity and Hybrid Instruments 19 - 15

Shareholders Equity

Limited Legal Liability

Implicitly investors in shares in corporations have limited legal

liability.

In practice, this means that if the corporation fails, the worst-case

scenario for shareholders is that their shares will become worthless

(they lose what they paid for those shares).

If the firms activities outstrip its financial resources (for example, it is

found guilty of polluting and faces fines that it cannot pay, even when all

assets are liquidated) shareholders are not liable, and cannot be asked

to inject more funds into the firm, or to pay out of their own pockets for

damages.*

Limited legal liability ensures limited downside risk for shareholders

while at the same time, they enjoy unlimited upside potential for

growth in their investment (similar to call options discussed in

Chapter 12)

*NOTE: Even though shareholders have limited legal liability, this is not

true for members of the board of directors or the management team if

they are found responsible (liable) for damages or illegal acts through

decisions and/or errors of omission or commission.

CHAPTER 19 Equity and Hybrid Instruments 19 - 16

Shareholders Equity

Different Classes of Shares

The articles of incorporation spell out the number of share

classes and the rights of each share class.

The CBCA says that the three rights of shareholders do not

have to reside in one share class if there are multiple share

classes each right can be assigned to a different share

class, or shared between share classes.

Under the CBCA the firm will not use the terms common

preferred non-voting instead they will designate different

share classes with different rights:

A Class

B Class

C Class

CHAPTER 19 Equity and Hybrid Instruments 19 - 17

Shareholders Equity

Different Types of Shares

Non-voting / Restricted Shares

Participate in dividends with the common share class

Typically no voting rights or perhaps latent voting rights (the right

to vote in the case of arrears in dividends)

Common shares

Full voting rights

Participates in receipt of dividends

Is the residual share class after other creditors and share

classes.

Preferred shares

Stated dividend with a preference to dividends over the common

share class

Latent voting rights in the case of arrearage

Preference to assets upon dissolution over the common share

class.

CHAPTER 19 Equity and Hybrid Instruments 19 - 18

Shareholders Equity

Some Basic Ratios

Your text demonstrates the application of ratios to

the shareholders equity figures for Rothmans Inc.

Table 19 1 presents the equity figures for fiscal

years 2004, 2005, and 2006:

CHAPTER 19 Equity and Hybrid Instruments 19 - 19

Some Basic Ratios

Book Value per Share

$ Million

2004 2005 2006

Preferred stock 0 0 0

Capital stock 38.869 41.974 45.347

Retained earnings 129.628 151.734 68.513

Total shareholders' equity 168.497 193.708 113.860

Total liabilities and equity 496.757 528.528 449.075

Total common equity 168.497 193.708 113.860

Shares outstanding year end (million) 67.351 67.572 67.856

Book value per share ($) 2.5018 2.8667 1.6780

Diluted earnings per common share ($) 1.34 1.37 1.45

Common dividend per share ($) 0.8125 1.05 2.70*

*Includes a special dividend of $1.50

Table 19-1 Rothmans Inc. Shareholders' Equity

678 . 1 $

856 . 67

860 . 113 $

2006

= =

=

shares of Number

Equity Common

BVPS

CHAPTER 19 Equity and Hybrid Instruments 19 - 20

Some Basic Ratios

Market to Book Value

$ Million

2004 2005 2006

Preferred stock 0 0 0

Capital stock 38.869 41.974 45.347

Retained earnings 129.628 151.734 68.513

Total shareholders' equity 168.497 193.708 113.860

Total liabilities and equity 496.757 528.528 449.075

Total common equity 168.497 193.708 113.860

Shares outstanding year end (million) 67.351 67.572 67.856

Book value per share ($) 2.5018 2.8667 1.6780

Diluted earnings per common share ($) 1.34 1.37 1.45

Common dividend per share ($) 0.8125 1.05 2.70*

*Includes a special dividend of $1.50

Table 19-1 Rothmans Inc. Shareholders' Equity

07 . 12

678 . 1 $

25 . 20 $

/

2006

times

BVPS

P

B M

= =

=

A stock trading at 12 times

its book value indicates

that the stock is highly

regarding in financial

markets (usually because

of strong profits and growth

potential.)

CHAPTER 19 Equity and Hybrid Instruments 19 - 21

Some Basic Ratios

Dividend Yield

$ Million

2004 2005 2006

Preferred stock 0 0 0

Capital stock 38.869 41.974 45.347

Retained earnings 129.628 151.734 68.513

Total shareholders' equity 168.497 193.708 113.860

Total liabilities and equity 496.757 528.528 449.075

Total common equity 168.497 193.708 113.860

Shares outstanding year end (million) 67.351 67.572 67.856

Book value per share ($) 2.5018 2.8667 1.6780

Diluted earnings per common share ($) 1.34 1.37 1.45

Common dividend per share ($) 0.8125 1.05 2.70*

*Includes a special dividend of $1.50

Table 19-1 Rothmans Inc. Shareholders' Equity

13.3%

25 . 20 $

70 . 2 $

dividend) special (with = = =

P

DPS

Yield Dividend

In Table 22 2 dividend yields

vary from 0% to a high of

7.22% for Yellow Pages

Income Fund.

Clearly Rothmans is on the

high end of this metric.

What makes this so surprising

is that we already know the

stock price is trading at a

significant multiple above

Book Value.

CHAPTER 19 Equity and Hybrid Instruments 19 - 22

Shareholders Equity

Dividends and Taxes

Dividends are attractive from an income taxation

point of view in Canada:

Dividends received by one corporation from another

corporation are not subject to tax at the corporate

level

Dividend income received by Canadians is subject to

the gross-up / dividend tax credit system that results

in very low rates of taxes on individuals with low to

moderate marginal tax rates (see the following slide)

CHAPTER 19 Equity and Hybrid Instruments 19 - 23

Taxation of Dividend Income

Lower Limit Upper

Limit

Basic Tax Rate on

Excess

Dividend

Income

Capital

Gains

$ - to $8,148 $ - 0.00% 0.00% 0.00%

$8,149 to 11,336 $ - 16.00 3.33 8.00

$11,337 to 14,477 510 28.10 5.63 14.05

$14,478 to 34,010 1,393 22.05 4.48 11.03

$34,011 to 35,595 5,700 25.15 8.36 12.58

$35,596 to 59,882 6,098 31.15 15.86 15.58

$59,883 to 68,020 13,664 32.98 16.86 16.49

$68,021 to 70,559 16,348 35.39 19.88 17.70

$70,560 to 71,190 17,246 39.41 22.59 19.70

$71,191 to 115,739 17,495 43.41 27.59 21.70

$115,740 and up 36,833 46.41 31.34 23.20

Source: Ernst & Young website: <www.ey.com>.

Table 3-6 Ontario Taxable Income

Marginal Rate on

The dividend

gross-up, tax credit

system makes

dividend income

the lowest taxed

investment income

in the lower tax

brackets.

Dividends are

taxed at a lower

rate than interest

in all tax brackets.

Preferred Shares

Equity and Hybrid Instruments

CHAPTER 19 Equity and Hybrid Instruments 19 - 25

Preferred Share Characteristics

Table 19 2 (on the following slide) reports on

yields on three different types of preferred shares in

Canada as at November, 2005:

Straight preferreds

Retractable preferreds

Floating rate preferreds

CHAPTER 19 Equity and Hybrid Instruments 19 - 26

Preferred Share Yields

Straight Preferreds (%)

Dividend yield 5.22

Long Canada yield 4.19

After tax spread (corp.) 2.50

After tax spread (indiv.) 1.34

Retractable Preferreds (%)

Dividend yield 3.33

Mid Canada yield 3.90

After tax spread (corp.) 0.80

After tax spread (indiv.) 0.20

Floating Rate Preferreds (%)

Dividend yield 3.24

BA (3 month) 3.40

After-tax spread (corp.) 1.03

After-tax spread (indiv.) 0.40

Source: Data f rom Nesbitt Burns, Preferred Share Statistics , December 2005.

Table 19-2 Preferred Share Yields, November 2005

CHAPTER 19 Equity and Hybrid Instruments 19 - 27

Types of Preferred Shares

Straight preferred

No maturity date

Pay a fixed dividend at regular intervals (quarterly)

Retractable preferred

Gives the investor the right to sell it back to the issuer

Typical retraction feature is 5 years

Floating rate preferred

Periodically (every 3 to 6 months) the dividend is reset by an

auction mechanism so that the yield will remain consistent with

current market interest rates.

In some cases the dividend is connected to the prime lending

rate and changes as the prime rate changes.

CHAPTER 19 Equity and Hybrid Instruments 19 - 28

Yield Spreads

Preferred shares offer higher yields than bonds

Greater default risk associated with an equity security

Bonds obligations are a legally enforceable claim (preferred

dividends are not)

Bondholders have a secured claim against assets of the

corporation in the event of dissolutionpreferred

shareholders are second to last in residual claims.

Tax Value of Money

Actual yield spreads are greater than the observable

spread on an after-tax basis because of the lower

tax rate on dividends than on interest income.

CHAPTER 19 Equity and Hybrid Instruments 19 - 29

Preferred Shares

The Cumulative Provision

A stipulation that no dividends can be paid on

common shares until preferred share dividends,

both current and arrears, are paid in full.

This feature is the reason boards of directors take

the payment of preferred dividends very seriously.

CHAPTER 19 Equity and Hybrid Instruments 19 - 30

Preferred Shares as a Hybrid Instrument

Although preferred shares are equity securities because they are

often seen as a higher yield (and risk) substitute for fixed income

securities.

They are often seen as a hybrid instrument because, while they are

equity from a residual claim point of view, and therefore have

significantly higher default risk, they do promise to offer a steady

stream of dividends (similar to a debt instrument, but treated

preferentially from a taxation perspective)

The higher the quality of the issuer, the more like debt preferred

stock is because of the lower likelihood of default and the greater

the likelihood of an uninterrupted stream of dividends in a high

quality issuer.

CHAPTER 19 Equity and Hybrid Instruments 19 - 31

Preferred Share Dividends

While the preferred dividend is not a legally-

enforceable financial obligations, issuers take the

payment of those dividends very seriously for a

number of reasons:

Failure to pay could jeopardize the firms future ability

to issue securities in the financial markets because of

a damaged reputation

Normally arrears in dividends need to be addressed

before the common share class can receive

dividends, and as arrearages grow, increasingly the

common shareholders will get concerned and voice

those concerns at the AGM.

CHAPTER 19 Equity and Hybrid Instruments 19 - 32

Preferred Share Ratings

Dominion Bond Rating Service (DBRS)

Preferred Rating Bond Equivalent Rating

1. PFD 1 AAA - AA

2. PFD 2 A

3. PFD 3 highly rated BBB

4. PFD 4 lower rated BBB and BB

5. PFD 5 B or lower rated bonds

Income Trusts

Equity and Hybrid Instruments

CHAPTER 19 Equity and Hybrid Instruments 19 - 34

Income Trusts

Strong Popularity Driven by Tax Considerations

A tax efficient financial structure allowing distribution of pre-

tax corporate cash flows to trust investors resulting in:

Greater cash distributions to unitholders than the same firm

using a traditional capital structure involving debt and equity

Elimination of double taxation (which is the reason for the

greater cash distributions because they are being made before

tax).

Represents a popular form of equity financing representing

more than half the IPOs in Canada in the 2000s

As of March 2006:

238 income trusts listed on the TSX

Total market capitalization of income trusts $192 billion

representing 10% of the quoted market value of the TSX

CHAPTER 19 Equity and Hybrid Instruments 19 - 35

Income Trusts

The Ministers Announced Change in Tax Treatment

Finance Minister Jim Flaherty made an unexpected

announcement regarding income trusts on October 31, 2006

It was unexpected because the Conservative Party had

campaigned on a promise not to tax income trusts in the 2006

federal election.

Existing income trusts (prior to November 1, 2006) will

continue to enjoy the tax benefits of that structure until 2011.

Newly created income trusts will be taxed like normal

corporations.

In the first few days following the announcement almost $30

billion in market capitalization was lost as income trust unit

values fell dramatically.

Warrants

Equity and Hybrid Instruments

CHAPTER 19 Equity and Hybrid Instruments 19 - 37

Warrants

A long-term option to purchase new shares in a corporation at a

specified price.

The corporate finance equivalent of call options that are used to

raise new capital for a firm.

Have long maturities and may be perpetual (no maturity date)

Warrants are issued by the firm.

The exercise price of the warrant at the time of issue is normally

greater than the current stock price of the firm.

Warrants are often packaged with the sale of other new securities

(preferred stock or bonds) and are equity sweetners allowing the

holder to exercise them to buy new shares in the company, and

thereby participate in the growth of the firm along with shareholders.

(Table 19 3 illustrates the first five warrants outstanding on Canadian exchanges in August,

2006)

CHAPTER 19 Equity and Hybrid Instruments 19 - 38

Warrant Listings

Company Stock

Close

Symbol Stock

Exchange

Exercise

Price

Recent

Close

Bid/

Ask

Intrinsic

Value

Time

Value

Years

Left

Expiry

Date

Agnico-

Eagles

Mines Ltd 40.420 AEM.WT.U TSX US$19.000 US$19.500 US$19.5 18.920 3.147 1.3

Nov. 14,

2007

Ascendant

Copper

Corp

0.500 ACX.WT TSX 2.500 0.150 0.150 -2.000 0.150 4.3

Nov.21,

2010

Aumega

Discoveries

Ltd

0.090 AUM.WT TSX-VEN 0.400 0.010 0.010 -0.310 0.010 0.5

Feb. 16,

2007

Avnel Gold

Mining Ltd

1.100 AVK.WT TSX 1.060 0.550 0.550 0.040 0.510 3.9

June 30,

2010

Baja Mining

Corp

1.500 BAJ.WT TSX-VEN 1.150 1.270 1.270 0.350 0.920 2.7

Apr. 19,

2009

Source: Data f rom Financial Post , August 29, 2006.

Table 19-3 Warrant Listings

CHAPTER 19 Equity and Hybrid Instruments 19 - 39

Warrants versus Options

Warrants

Issued by the firm to investors

Issued to raise new capital for the

firm (capital formation purpose)

Traded in the secondary market

between investors

Long-term or perpetual option

At the time of issue the exercise

price is typically greater than the

current stock price (so the warrant

does not have an intrinsic value

immediately)

Exchange-traded Call Options

Created by investors interacting

with the options exchange as the

counterparty

No capital formation, instead used

as an instrument of hedging or

speculating

Short-term option

May be created out-of-the-money,

at-the-money, or in-the-money.

CHAPTER 19 Equity and Hybrid Instruments 19 - 40

Warrant Valuation

Using payoff diagrams normally associated with call

options we can describe visually how warrants are

valued.

(See the diagram on the following slide)

CHAPTER 19 Equity and Hybrid Instruments 19 - 41

Warrants

The Value of a Warrant

$50

exercise

price

Warrant

Value

0

Stock Price

At the time of issue

the warrant will

have a speculative

(time) value only

because the market

value of the stock is

less than the

exercise price.

Over time the stock price

may increase and when it

exceeds the exercise price

of the warrant, the

warrant value will have

both intrinsic value and

speculative (time) value.

CHAPTER 19 Equity and Hybrid Instruments 19 - 42

Payoff to Warrant Holders

Using a Variant of the Standard Options Pricing Model

Where:

n =existing number of shares

m = number of shares issued on exercise of the warrants

X = exercise price of the warrant

V = stock price of the firm without the warrant

This equation says that after the warrants are exercised, the value of the firm must be the

value without the warrants (V) plus the proceeds to the firm from the exercise of the

warrants (mX), for a total value of V + mX. (The weighted average of the former stock price

and the warrant exercise price)

The percentage owned by the warrant holders is m/(n+m), whereas the cost to them is

exercise value of mX.

mX)-mX (V

m n

m

holders warrant to Payoff +

+

= [ 19-1]

CHAPTER 19 Equity and Hybrid Instruments 19 - 43

Payoff to Warrant Holders

Equation 19 1 reduces to 19 2 when we multiply the exercise value

mX by (n+m)/(n+m):

The first term m / (n+m) is the dilution factor.

Therefore the value of the warrant is the dilution factor times the

value of the secondary market call (whether you use the Black-

Scholes or binomial option pricing model)

nX) (V

m n

m

holders warrant to Payoff

+

= [ 19-2]

CHAPTER 19 Equity and Hybrid Instruments 19 - 44

Warrants

As long-term options warrants trade at significant premiums

over their intrinsic value.

This is known as a time (speculative) premium

They are often used as sweetners to make other financial

securities more attractive to investors by being issued as a

package together with debt or preferred stock.

If warrants are NOT detachable, issuing bonds plus a warrant

is similar to issuing convertible bonds (the holder holds a

traditional bond, but an option to purchase equity and thereby

participate in the growth of the firm)

Convertible Securities

Equity and Hybrid Instruments

CHAPTER 19 Equity and Hybrid Instruments 19 - 46

Convertible Bonds

Bonds that are convertible into a specified number of common

shares at the option of the convertible holder.

When converted, the bonds are exchanged for common

shares (bonds are no longer outstanding)

The firm does not obtain additional financing through conversion.

The debt level of the firm is reduced through conversion.

The convertible feature is a sweetner used to encourage

investors to invest in the convertible and so convertibles tend

to be issued by higher risk firms.

Convertibles are issued with a maturity date, however, they

are also usually callable to ensure conversion does occur.

(See Table 19 4 for some examples.)

CHAPTER 19 Equity and Hybrid Instruments 19 - 47

Convertible Bond Listings

Issuer Symbol Coupon Maturity Last

Price

Parity Yield to

Maturity

Premium Conver

sion

Ratio

Conver

sion

Price

Symbol Share

Price

Tuesday

August

28, 2006

ACE

Aviation ACE.NT.A 4.25% 1-Jun-2035 94.50 67.19 4.60% 40.66% 2.23 44.88 ACE.A 30.15

Advantage

Energy

AVN.DB 10.00% 1-Nov-2007 134.62 132.78 -15.82% 1.33% 7.52 13.30 AVN.UN 17.67

Agricore

AU.DB 9.00% 30-Nov-2007 106.25 102.13 3.81% 4.03% 13.33 7.50 AU 7.66

Alamos

Gold

AGI.DB 5.50% 15-Feb-2010 172.00 154.91 -11.05% 9.83% 18.87 5.30 AGI 8.30

Alexis

Nihon

AN.DB 6.20% 30-Jun-2014 100.80 93.92 6.07% 7.08% 7.33 13.65 AN.UN 12.85

Source: Data f rom Financial Post , August 29, 2006.

Table 19-4 Convertible Bond Listings

CHAPTER 19 Equity and Hybrid Instruments 19 - 48

Conversion Price

The conversion price (CP) is the price at which a

convertible security can be converted into common

shares based on its conversion ratio.

The conversion ratio (CR) is the number of shares that a

convertible security could be exchanged for.

CR

Par

CP =

[ 19-3]

CHAPTER 19 Equity and Hybrid Instruments 19 - 49

Conversion Value (CV)

The Conversion Value (CV) is the value of a convertible

security if it is immediately converted into common shares.

This value is denoted as parity in the Convertible Bond

listings.

Obviously, if CV < Bond Price, conversion is not

advantageous to the convertible holder.

P CR CV =

[ 19-4]

CHAPTER 19 Equity and Hybrid Instruments 19 - 50

Convertible Premium

The convertible premium is the percentage the

share must increase in order for conversion to make

sense:

Premium e Convertibl

CV

CV P

= [ 19-5]

CHAPTER 19 Equity and Hybrid Instruments 19 - 51

Straight Bond Value (SBV)

Convertible bonds are bonds that have an inherent value in

themselves.

The conversion feature of the bond is considered an option, in

addition to the basic bond value.

) 1 (

1 ) 1 (

1

1

SBV

n

b b

n

b

k

F

k

k

I

+

+

(

(

(

(

+

=

[ 19-6]

CHAPTER 19 Equity and Hybrid Instruments 19 - 52

Floor Value (FV)

The Floor Value (FV) is the lowest price a convertible bond will sell

for, which is equal to the larger of its straight bond value and its

conversion value.

Every convertible will always have a floor value (FV) because it will

always sell for no less than the larger of the straight bond value and

its conversion value.

In practice, convertibles usually sell a higher prices because of the

time value of the conversion option.

) , ( CV SBV Max FV =

[ 19-7]

CHAPTER 19 Equity and Hybrid Instruments 19 - 53

Convertible Bond Valuation

A Graphic Illustration of the Valuation Relationships

Convertible

Bond Value

0

SBV

Actual

Convertible

value

Conversion

price

Stock Price

Floor

Value

CHAPTER 19 Equity and Hybrid Instruments 19 - 54

Convertible Financing

Convertible financing helps firms obtain capital at a lower

coupon rate at the time of issue.

This is because the buyer is receiving an equity call option

equal to the time premium.

In the event the value of the stock remains below parity, the

firm has obtained cheap debt

In the event the value of the stock exceeds parity, the firm

receives cheap equity (they sold equity at a price greater than

what they could have sold it at the time of issue)

The outcome, whether in the firms favour or not depends on

the subsequent movement of the stock price until

conversion/maturity/call.

(See Figure 19 1 for a graphic depiction of the ACE Holdings situation)

CHAPTER 19 Equity and Hybrid Instruments 19 - 55

Convertible Scenarios

19-1 FIGURE

ACE Share price

$35

P>$44.88

Conversion:

Cheap Equity

No Conversion:

Cheap Debt

P<$44.88

This what-if scenario indicates that convertibles are rarely the right decision,

but they are never the wrong decision because the firm gets either cheap debt

or cheap equity financing.

Other Hybrid Securities

Equity and Hybrid Instruments

CHAPTER 19 Equity and Hybrid Instruments 19 - 57

Other Hybrids

Warrants, convertible bonds and convertible

preferred shares are the most common hybrid

securities.

Financial innovation takes place in order for

companies to issue securities that meet the needs

of investors in the marketplace.

In this manner, firms that might not be able to raise

capital with traditional financing means are able to

do so, OR, they are able to raise capital in a form

that better suits their cash flow preferences.

CHAPTER 19 Equity and Hybrid Instruments 19 - 58

Other Hybrids

Categorizing Hybrids

DBRS uses four factors help to determine whether a hybrid

instrument is more like debt or more like equity:

1. Permanence factor

Common stock is perpetual, where as CP is very short-term

2. Subordination factor

Place on the prior of claims against income and assets

3. Legal factor

Whether the claim on income is legally enforceable or not

4. Subjective factor

The purpose of the company when it issues the securities.

Following a description of other hybrids we will present a

hierarchy of securities.

CHAPTER 19 Equity and Hybrid Instruments 19 - 59

Other Hybrids

Creative Hybrids: Some Examples

Income bonds

Cash flow bonds

Commodity bonds

Original issue discount bonds (OIDs) or low-yield

notes

Liquid Yield Option Notes (LYONs)

Adjustable Rate Convertible Subordinated Securities

(ARCS)

Preferred securities

Canadian optional interest notes (COINS)

CHAPTER 19 Equity and Hybrid Instruments 19 - 60

Other Hybrids

Creative Hybrids: Income Bonds

Income bonds

Bonds issued after a reorganization with the interest

tied to some cash flow level for the firm and with quite

long maturity dates

Payments are not tax deductible in Canada and as

classified by CRA as dividends.

Seen as a desperation play as the issuer may not

have much tax incentive to issue real bonds (little

taxable income because of loss carried forward

provisions under the Income Tax Act)

CHAPTER 19 Equity and Hybrid Instruments 19 - 61

Other Hybrids

Creative Hybrids: Cash Flow Bonds

Cash flow bonds

Bonds sold in the United States that have the same

objects as do income bonds in Canada.

Maturity dates are long

Interest payments are conditional on the firm meeting

certain thresholds

CHAPTER 19 Equity and Hybrid Instruments 19 - 62

Other Hybrids

Creative Hybrids: Commodity Bonds

Commodity bonds

A bond whose interest or principal is tied to the price

of an underlying commodity such as gold.

CHAPTER 19 Equity and Hybrid Instruments 19 - 63

Other Hybrids

Creative Hybrids: Original Issue Discount Bonds

Original issue discount bonds (OIDs) or low-yield notes

Bonds that sell at a discount from par value when issued by

firms.

The company doesnt pay coupon interest annually, simply a

bullet payment on maturity.

Investors must report accrued interest income if the bond is

held in a taxable account (often, though investors place these

types of investments in tax-deferred (registered plans)

investment accounts and thereby dont have to pay interest until

the funds are with drawn) RESPs and RRSPs.

Investors have grown to like non-coupon bearing bonds because

there is no reinvestment rate problem (the ex post yield on the

bonds will equal the ex ante forecast if there is no default on the

issue)

(Table 19 5 illustrates the OID bond interest compared to a normal bond)

CHAPTER 19 Equity and Hybrid Instruments 19 - 64

Creative Hybrids

Principal "Interest"

2 $4.24 $46.65 $4.24

3 4.24 51.32 4.67

4 4.24 56.45 5.13

5 4.24 62.09 5.64

6 4.24 68.30 6.21

7 4.24 75.13 6.83

8 4.24 82.64 7.551

9 4.24 90.91 8.26

10 46.65 100.00 9.09

Table 19-5 OID versus Regular Bond Payments

OID Bond

Regular Bond

CHAPTER 19 Equity and Hybrid Instruments 19 - 65

Other Hybrids

Creative Hybrids: Liquid Yield Option Notes

Liquid Yield Option Notes (LYONs)

Low-yield notes that are combined with a convertible

feature and are accretive convertibles, because the

principal accretes or increases over time.

CHAPTER 19 Equity and Hybrid Instruments 19 - 66

Other Hybrids

Creative Hybrids: Adjustable Rate Convertible Subordinated Securities

Adjustable Rate Convertible Subordinated Securities

(ARCS)

Securities that have fixed principal and maturity, and

interest that normally comprises a fixed interest rate

and some function of the dividend paid in the previous

six months

Typically convertible into common shares

CHAPTER 19 Equity and Hybrid Instruments 19 - 67

Other Hybrids

Creative Hybrids: Preferred Securities

Preferred securities

Not preferred shares

Securities generated by a company by creating a 100

percent owned subsidiary that issues the shares then

loans the proceeds to the parent company, for whom

the interest is tax deductible;

Interest flows to the subsidiary, where it is not taxed,

and is used to make dividend payments.

CHAPTER 19 Equity and Hybrid Instruments 19 - 68

Other Hybrids

Creative Hybrids: Canadian Optional Interest Notes

Canadian optional interest notes (COINS)

99-year bonds that are sold at their par values of

$100, on which the firm immediately prepays the

interest from years 11 to 99 on issue, leaving it with a

net inflow and allowing it to continue to deduct annual

interest payments of $100, even though it has

effectively borrowed less.

CHAPTER 19 Equity and Hybrid Instruments 19 - 69

A Financing Hierarchy

Table 19 6 shows a synopsis of the main securities

discussed in this chapter and shows using a rating system

how like equity they are.

Equities are rated as 100% because they are equity

Commercial papers are rated -100% because they are the most

debt-like.

Figure 19 2 shows the spectrum of financing options

available to corporations and expresses them in terms of risk

to the investor, and the required return investors demand (this

translates into the returns the firm must offer in order to

access that type of capital)

(See the following two slides)

CHAPTER 19 Equity and Hybrid Instruments 19 - 70

A Financing Hierarchy

Equity Share (%)

Common shares 100

Mandatory convertible preferred shares* 90

Straight preferred shares 50

Trust preferred shares 40

Convertible preferred shares 20

Re-marketed preferred shares

-10

Normal convertible debt -50

Accreting convertible bonds (LYONS) -60

Very long term bonds -70

Medium term bonds -80

Auction preferred shares -90

Commercial paper -100

* Pref erred shares f or which conversion into common shares is structured to be automatic.

Pref erred shares that af ter f ive to seven years, are repriced and resold.

Table 19-6 S&P Financing Rankings

CHAPTER 19 Equity and Hybrid Instruments 19 - 71

Other Hybrids

Financing Hierarchy Costs

19-2 FIGURE

Mortgage

Debt

Straight

Preferred

Shares

Common

Equity

Convertible

Bonds

Convertible

Preferred

Shares

Long-term

Unsecured Debt

Cost

CP

Risk

MTNs

Bank

Loans

CHAPTER 19 Equity and Hybrid Instruments 19 - 72

Summary and Conclusions

In this chapter you have learned:

That securities are financial contracts and their risk depends on the

structure of the contract

Basic issues are tax treatment and equity weight

Common stock imposes the least risk on a firm because it imposes no

legally binding cash flow commitments and never matures,

consequently, common stock provides a cushion to senior debt and

other commitments that is required in order to attract these other, more

risky sources of financing.

Commercial Paper and Bankers Acceptances place the greatest

financial risk on the firm because they place a fixed, time-delimited

(short-term) financial and contractual obligation on the firm, including

repayment of principal.

An offsetting advantage of CPs and BAs is the tax-deductibility of

interest expense.

Between these two extremes, hybrid financial instruments combine the

characteristics of both debt and equity.

Concept Review Questions

Equity and Hybrid Instruments

CHAPTER 19 Equity and Hybrid Instruments 19 - 74

Concept Review Question 1

Rights Associated with Equity Securities

What are the basic rights associated with equity

securities? How do these differ across different

categories of classes of equities?

CHAPTER 19 Equity and Hybrid Instruments 19 - 75

Copyright

Copyright 2007 John Wiley & Sons

Canada, Ltd. All rights reserved.

Reproduction or translation of this work

beyond that permitted by Access

Copyright (the Canadian copyright

licensing agency) is unlawful. Requests

for further information should be

addressed to the Permissions

Department, John Wiley & Sons Canada,

Ltd. The purchaser may make back-up

copies for his or her own use only and

not for distribution or resale. The author

and the publisher assume no

responsibility for errors, omissions, or

damages caused by the use of these files

or programs or from the use of the

information contained herein.

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Blueprint For ProsperityDocumento31 páginasBlueprint For ProsperityNémeth Dávid100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Foreign Market Entry StrategiesDocumento21 páginasForeign Market Entry StrategiesPrakash Kumar.s100% (4)

- W9-990 Tax Form 2016 MEDLIFE (2016-2017) PDFDocumento1 páginaW9-990 Tax Form 2016 MEDLIFE (2016-2017) PDFAnonymous 6ZE5pGAinda não há avaliações

- DRIVATIVES Options Call & Put KKDocumento134 páginasDRIVATIVES Options Call & Put KKAjay Raj ShuklaAinda não há avaliações

- Civil Procedure CasesDocumento4 páginasCivil Procedure CaseslchieSAinda não há avaliações

- Definingvalueandmeasuringhr 12997516872189 Phpapp01Documento45 páginasDefiningvalueandmeasuringhr 12997516872189 Phpapp01amizahdAinda não há avaliações

- Business Case For MDMDocumento18 páginasBusiness Case For MDMvinay10356Ainda não há avaliações

- Pool Asset ManagementDocumento10 páginasPool Asset ManagementpawanAinda não há avaliações

- Bob Iger vs. Bob Chapek - Inside The Disney Coup - WSJDocumento13 páginasBob Iger vs. Bob Chapek - Inside The Disney Coup - WSJNicolas SarkozyAinda não há avaliações

- SEBI's Role in Capital MarketDocumento57 páginasSEBI's Role in Capital MarketSagar Agarwal100% (9)

- Dipu MedicalDocumento1 páginaDipu MedicalPranjit BhuyanAinda não há avaliações

- TZBT LRQCMG ONg DwoDocumento6 páginasTZBT LRQCMG ONg DwoPranjit BhuyanAinda não há avaliações

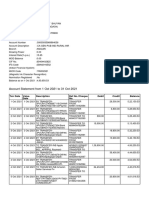

- Account Statement From 1 Nov 2021 To 30 Nov 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocumento4 páginasAccount Statement From 1 Nov 2021 To 30 Nov 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancePranjit BhuyanAinda não há avaliações

- DiversificationDocumento2 páginasDiversificationPranjit BhuyanAinda não há avaliações

- Investment ManagementDocumento38 páginasInvestment ManagementPranjit BhuyanAinda não há avaliações

- Management Information SystemDocumento98 páginasManagement Information SystemPranjit BhuyanAinda não há avaliações

- Project ON Life Insurance Corporati ONDocumento34 páginasProject ON Life Insurance Corporati ONVirendra JhaAinda não há avaliações

- Raymond Presentation FinalDocumento23 páginasRaymond Presentation FinalAbizer KachwalaAinda não há avaliações

- 1 The Black-Scholes Formula For A European Call or Put: 1.1 Evaluation of European OptionsDocumento15 páginas1 The Black-Scholes Formula For A European Call or Put: 1.1 Evaluation of European Optionshenry37302Ainda não há avaliações

- CP Craplan ApproveDocumento50 páginasCP Craplan ApproveArchit210794Ainda não há avaliações

- NBS Bank Limited IPO Prospectus PDFDocumento119 páginasNBS Bank Limited IPO Prospectus PDFKristi DuranAinda não há avaliações

- Capital BudgetingDocumento12 páginasCapital Budgetingdebjyoti_das_6100% (1)

- Financial Management (Keshav Kasyap)Documento5 páginasFinancial Management (Keshav Kasyap)keshav kashyapAinda não há avaliações

- Ebit Eps Approach1Documento9 páginasEbit Eps Approach1Shikhar MehraAinda não há avaliações

- Group 7 - Homework Chapter 2 - Project SelectionDocumento10 páginasGroup 7 - Homework Chapter 2 - Project SelectionThuỷ VươngAinda não há avaliações

- 01 - Forex-Question BankDocumento52 páginas01 - Forex-Question BankSs DonthiAinda não há avaliações

- Ducati Realease Investindustrial 20120418Documento2 páginasDucati Realease Investindustrial 20120418cherikokAinda não há avaliações

- An Study On Commercial Banks of Ethiopia: Determinants of Nonperforming Loan: EmpiricalDocumento109 páginasAn Study On Commercial Banks of Ethiopia: Determinants of Nonperforming Loan: EmpiricalMAHLET ZEWDEAinda não há avaliações

- 07363769410070872Documento15 páginas07363769410070872Palak AgarwalAinda não há avaliações

- Notes - Chapter 4Documento6 páginasNotes - Chapter 4OneishaL.HughesAinda não há avaliações

- Governmental Entities: Introduction and General Fund AccountingDocumento99 páginasGovernmental Entities: Introduction and General Fund AccountingSamah Refa'tAinda não há avaliações

- MAHANGILA Group 2 (Tax Avenues)Documento15 páginasMAHANGILA Group 2 (Tax Avenues)Eben KinaboAinda não há avaliações

- SMCH 05Documento73 páginasSMCH 05FratFool100% (1)

- Senate Hearing, 110TH Congress - Examining The Effectiveness of U.S. Efforts To Combat Waste, Fraud, Abuse, and Corruption in IraqDocumento283 páginasSenate Hearing, 110TH Congress - Examining The Effectiveness of U.S. Efforts To Combat Waste, Fraud, Abuse, and Corruption in IraqScribd Government DocsAinda não há avaliações

- C C C !" # # $C% & #'C%Documento12 páginasC C C !" # # $C% & #'C%Sneha ShahAinda não há avaliações

- Ultratech Cement Working TemplateDocumento42 páginasUltratech Cement Working TemplateBcomE AAinda não há avaliações