Escolar Documentos

Profissional Documentos

Cultura Documentos

Government Intervention

Enviado por

tongai_mutengwa5194Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Government Intervention

Enviado por

tongai_mutengwa5194Direitos autorais:

Formatos disponíveis

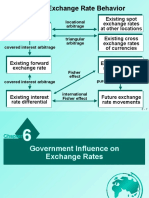

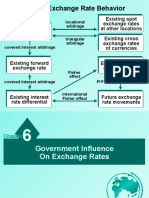

Part II Exchange Rate Behavior

Existing spot

exchange rates

at other locations

Existing cross

exchange rates

of currencies

Existing inflation

rate differential

Future exchange

rate movements

Existing spot

exchange rate

Existing forward

exchange rate

Existing interest

rate differential

locational

arbitrage

triangular

arbitrage

purchasing power parity

international

Fisher effect

covered interest arbitrage

covered interest arbitrage

Fisher

effect

Government Influence

On Exchange Rates

6

Chapter

C6 - 3

Chapter Objectives

To describe the exchange rate

systems used by various

governments;

To explain how governments can use

direct and indirect intervention to

influence exchange rates; and

To explain how government intervention

in the foreign exchange market can affect

economic conditions.

C6 - 4

Exchange Rate Systems

Exchange rate systems can be classified

according to the degree to which the rates

are controlled by the government.

Exchange rate systems normally fall into

one of the following categories:

fixed

freely floating

managed float

pegged

C6 - 5

In a fixed exchange rate system, exchange

rates are either held constant or allowed

to fluctuate only within very narrow bands.

Fixed

Exchange Rate System

C6 - 6

Pros: Work becomes easier for the MNCs.

Cons: Governments may revalue their

currencies. In fact, the dollar was

devalued more than once after the U.S.

experienced balance of trade deficits.

Cons: Each country may become more

vulnerable to the economic conditions in

other countries.

Fixed

Exchange Rate System

C6 - 7

In a freely floating exchange rate system,

exchange rates are determined solely by

market forces.

Pros: Each country may become more

insulated against the economic problems

in other countries.

Pros: Central bank interventions that may

affect the economy unfavorably are no

longer needed.

Freely Floating

Exchange Rate System

C6 - 8

Pros: Governments are not restricted by

exchange rate boundaries when setting

new policies.

Pros: Less capital flow restrictions are

needed, thus enhancing the efficiency of

the financial market.

Freely Floating

Exchange Rate System

C6 - 9

Cons: MNCs may need to devote

substantial resources to managing their

exposure to exchange rate fluctuations.

Cons: The country that initially

experienced economic problems (such as

high inflation, increasing unemployment

rate) may have its problems compounded.

Freely Floating

Exchange Rate System

C6 - 10

In a managed (or dirty) float exchange

rate system, exchange rates are allowed to

move freely on a daily basis and no official

boundaries exist. However, governments

may intervene to prevent the rates from

moving too much in a certain direction.

Cons: A government may manipulate its

exchange rates such that its own country

benefits at the expense of others.

Managed Float

Exchange Rate System

C6 - 11

In a pegged exchange rate system, the

home currencys value is pegged to a

foreign currency or to some unit of

account, and moves in line with that

currency or unit against other currencies.

Pegged

Exchange Rate System

C6 - 12

Dollarization

Dollarization refers to the replacement of a

local currency with U.S. dollars.

Dollarization goes beyond a currency

board, as the country no longer has a

local currency.

For example, Ecuador implemented

dollarization in 2000.

C6 - 13

Government Intervention

Each country has a government agency

(called the central bank) that may

intervene in the foreign exchange market

to control the value of the countrys

currency.

In the United States, the Federal

Reserve System (Fed) is the

central bank.

C6 - 14

Government Intervention

Central banks manage exchange rates

to smooth exchange rate movements,

to establish implicit exchange rate

boundaries, and/or

to respond to temporary disturbances.

Often, intervention is overwhelmed by

market forces. However, currency

movements may be even more volatile in

the absence of intervention.

C6 - 15

Direct intervention refers to the exchange

of currencies that the central bank holds

as reserves for other currencies in the

foreign exchange market.

Direct intervention is usually most

effective when there is a coordinated

effort among central banks.

Government Intervention

C6 - 16

Government Intervention

Quantity of

S

1

D

1

D

2

Value

of

V

1

V

2

Fed exchanges $ for

to strengthen the

Quantity of

S

2

D

1

Value

of

V

2

V

1

Fed exchanges for $

to weaken the

S

1

C6 - 17

When a central bank intervenes in the

foreign exchange market without

adjusting for the change in money supply,

it is said to engaged in nonsterilized

intervention.

In a sterilized intervention, Treasury

securities are purchased or sold at the

same time to maintain the money supply.

Government Intervention

C6 - 18

Nonsterilized Intervention

Federal Reserve

Banks participating

in the foreign

exchange market

$ C$

To

Strengthen

the C$:

Federal Reserve

Banks participating

in the foreign

exchange market

$ C$

To Weaken

the C$:

C6 - 19

Sterilized Intervention

Federal Reserve

Banks participating

in the foreign

exchange market

$ C$

To

Strengthen

the C$:

Federal Reserve

Banks participating

in the foreign

exchange market

$ C$

To Weaken

the C$:

$

Financial

institutions

that invest

in Treasury

securities

T- securities

Financial

institutions

that invest

in Treasury

securities

$

T- securities

C6 - 20

Some speculators attempt to determine

when the central bank is intervening, and

the extent of the intervention, in order to

capitalize on the anticipated results of the

intervention effort.

Government Intervention

C6 - 21

Central banks can also engage in indirect

intervention by influencing the factors that

determine the value of a currency.

For example, the Fed may attempt to

increase interest rates (and hence boost

the dollars value) by reducing the U.S.

money supply.

Note that high interest rates adversely

affects local borrowers.

Government Intervention

C6 - 22

Governments may also use foreign

exchange controls (such as restrictions

on currency exchange) as a form of

indirect intervention.

Government Intervention

C6 - 23

Impact of Government Actions on Exchange Rates

Government Intervention

in

Foreign Exchange Market

Government

Monetary

and Fiscal Policies

Relative Interest

Rates

Relative Inflation

Rates

Relative National

Income Levels

International

Capital Flows

Exchange Rates

International

Trade

Tax Laws,

etc.

Quotas,

Tariffs, etc.

Government

Purchases & Sales

of Currencies

C6 - 24

Impact of Central Bank Intervention

on an MNCs Value

( ) ( ) | |

( )

=

n

t

t

m

j

t j t j

k

1 =

1

, ,

1

ER E CF E

= Value

E (CF

j,t

) = expected cash flows in currency j to be received

by the U.S. parent at the end of period t

E (ER

j,t

) = expected exchange rate at which currency j can

be converted to dollars at the end of period t

k = weighted average cost of capital of the parent

Direct Intervention

Indirect Intervention

C6 - 25

Exchange Rate Systems

Fixed Exchange Rate System

Freely Floating Exchange Rate System

Managed Float Exchange Rate System

Pegged Exchange Rate System

Currency Boards

Exposure of a Pegged Currency to Interest

Rate and Exchange Rate Movements

Dollarization

Chapter Review

C6 - 26

Chapter Review

A Single European Currency

Membership

Euro Transactions

Impact on European Monetary Policy

Impact on Business Within Europe

Impact on the Valuation of Businesses in

Europe

Impact on Financial Flows

Impact on Exchange Rate Risk

Status Report on the Euro

C6 - 27

Chapter Review

Government Intervention

Reasons for Government Intervention

Direct Intervention

Indirect Intervention

Exchange Rate Target Zones

C6 - 28

Chapter Review

Intervention as a Policy Tool

Influence of a Weak Home Currency on the

Economy

Influence of a Strong Home Currency on

the Economy

How Central Bank Intervention Can Affect

an MNCs Value

Você também pode gostar

- Fast Cash LoansDocumento4 páginasFast Cash LoansFletcher GorisAinda não há avaliações

- ITP - Foreign Exchange RateDocumento29 páginasITP - Foreign Exchange RateSuvamDharAinda não há avaliações

- Barangay Tax Code Sample PDFDocumento14 páginasBarangay Tax Code Sample PDFSusan Carbajal100% (2)

- Hsloadsharing 0345mu Evo-C 8200 LogDocumento9 páginasHsloadsharing 0345mu Evo-C 8200 Logtongai_mutengwa5194100% (1)

- 2019 Code of Ethics of The Medical Profession With AudioDocumento13 páginas2019 Code of Ethics of The Medical Profession With AudioManci Bito-onAinda não há avaliações

- Ericsson Axe PlatformDocumento27 páginasEricsson Axe Platformtongai_mutengwa5194100% (1)

- Evo8200 BSC CTHDocumento11 páginasEvo8200 BSC CTHtongai_mutengwa5194100% (4)

- EVO-C 8200 BSC Useful CommandsDocumento1 páginaEVO-C 8200 BSC Useful Commandstongai_mutengwa5194Ainda não há avaliações

- EVO-C 8200 BSC Useful CommandsDocumento1 páginaEVO-C 8200 BSC Useful Commandstongai_mutengwa5194Ainda não há avaliações

- Govt Influence On Exchange RateDocumento40 páginasGovt Influence On Exchange Rategautisingh100% (3)

- Speaking of TonguesDocumento12 páginasSpeaking of TonguesKenneth HughesAinda não há avaliações

- Govt Intervention in ForexDocumento27 páginasGovt Intervention in ForexAditya RajAinda não há avaliações

- Government Influence On Exchange RatesDocumento33 páginasGovernment Influence On Exchange RatesAli SheikhAinda não há avaliações

- Chapter 06aDocumento24 páginasChapter 06aRizaldy Aji MuzakkyAinda não há avaliações

- Government Influence On Exchange Rates Presented by (1) 11111111111111Documento16 páginasGovernment Influence On Exchange Rates Presented by (1) 11111111111111Faizan AbidAinda não há avaliações

- Government InterventionDocumento24 páginasGovernment InterventionMỹ Huỳnh Thị NgọcAinda não há avaliações

- Government Influence On Exchange RatesDocumento3 páginasGovernment Influence On Exchange RatesReza RaharjoAinda não há avaliações

- Mid Term FridayDocumento3 páginasMid Term FridayГригорий ЖебинAinda não há avaliações

- Trade Finance - Week 10-1Documento13 páginasTrade Finance - Week 10-1subash1111@gmail.comAinda não há avaliações

- FXM6-Chapter 6 on Exchange Rates and International Monetary SystemsDocumento6 páginasFXM6-Chapter 6 on Exchange Rates and International Monetary Systemsjon doeeAinda não há avaliações

- 70-398 International Finance SPRING 2023: Prof. Serkan AkgucDocumento36 páginas70-398 International Finance SPRING 2023: Prof. Serkan AkgucAmiko GogitidzeAinda não há avaliações

- Government Influence on Exchange RatesDocumento2 páginasGovernment Influence on Exchange RatesafniAinda não há avaliações

- Exchange Rate Determination Challenges LimitationsDocumento5 páginasExchange Rate Determination Challenges LimitationsSakshi LodhaAinda não há avaliações

- International Finance: Chapter 6: Government Influence On Exchange RatesDocumento31 páginasInternational Finance: Chapter 6: Government Influence On Exchange RatesAizaz AliAinda não há avaliações

- International Finance Question & AnswersDocumento22 páginasInternational Finance Question & Answerspranjalipolekar100% (1)

- AFW 3331 T1 Answers1Documento7 páginasAFW 3331 T1 Answers1Zhang MengAinda não há avaliações

- MF0006 International Financial Management Fall 2010Documento5 páginasMF0006 International Financial Management Fall 2010jhaavinashAinda não há avaliações

- Summary MKI Chapter 6Documento3 páginasSummary MKI Chapter 6DeviAinda não há avaliações

- Balance of Payments 2Documento5 páginasBalance of Payments 2PRINCEAinda não há avaliações

- Central Banking FunctionsDocumento36 páginasCentral Banking FunctionsmuluAinda não há avaliações

- Lecture PDFDocumento31 páginasLecture PDFLawish KumarAinda não há avaliações

- BBA607 - Role of International Financial InstitutionsDocumento11 páginasBBA607 - Role of International Financial InstitutionsSimanta KalitaAinda não há avaliações

- IFM Module 1Documento33 páginasIFM Module 1tamizharasidAinda não há avaliações

- International Finance ManagementDocumento30 páginasInternational Finance ManagementClaudia ChavarriaAinda não há avaliações

- Saman Jain C 228 WA No. - 1 ForexDocumento8 páginasSaman Jain C 228 WA No. - 1 ForexSaman JainAinda não há avaliações

- International Economics Third Mid TermDocumento5 páginasInternational Economics Third Mid TermLili MártaAinda não há avaliações

- Exchange Rate Movements: Changes in ExportsDocumento11 páginasExchange Rate Movements: Changes in ExportsamitAinda não há avaliações

- Chapter 6 Government Influence On Exchange RatesDocumento40 páginasChapter 6 Government Influence On Exchange Ratesakbar rahmat ramadhanAinda não há avaliações

- Week 9 NotesDocumento5 páginasWeek 9 NotesClement WaituikaAinda não há avaliações

- Fixed Exchange Rate System - Introduction: Monetary DisciplineDocumento3 páginasFixed Exchange Rate System - Introduction: Monetary DisciplineUmairAfzalAinda não há avaliações

- Fin 444 Chapter 6Documento28 páginasFin 444 Chapter 6arifAinda não há avaliações

- Fin - 444 - Chapter - 6 - GOVT. INFLUENCE ON EXCHANGE RATESDocumento45 páginasFin - 444 - Chapter - 6 - GOVT. INFLUENCE ON EXCHANGE RATESFahimHossainNitolAinda não há avaliações

- MF0006 - AKA-Set 1Documento12 páginasMF0006 - AKA-Set 1AmbrishAinda não há avaliações

- MGNM578: International Business Environment Exchange RatesDocumento29 páginasMGNM578: International Business Environment Exchange RatesAnkit ranaAinda não há avaliações

- Abm161 Lessons 8 9 2023Documento24 páginasAbm161 Lessons 8 9 2023Norhaliza D. SaripAinda não há avaliações

- Ifm 1Documento7 páginasIfm 1Nickson KamarajAinda não há avaliações

- Open Economy Macroeconomics Class 12 Notes CBSE Macro Economics Chapter 6 PDFDocumento5 páginasOpen Economy Macroeconomics Class 12 Notes CBSE Macro Economics Chapter 6 PDFganeshAinda não há avaliações

- International Finance Midterm TopicsDocumento13 páginasInternational Finance Midterm TopicsAnisa TasnimAinda não há avaliações

- Rbi Monetory TechniquesDocumento4 páginasRbi Monetory TechniquesDarshan JainAinda não há avaliações

- 2 - Types of Exchange RatesDocumento4 páginas2 - Types of Exchange Ratesyaseenjaved466Ainda não há avaliações

- Floating Exchange RateDocumento2 páginasFloating Exchange RateMuhammad FaizanAinda não há avaliações

- Explaining Exchange Rate RegimesDocumento9 páginasExplaining Exchange Rate RegimesBP JoshieAinda não há avaliações

- 4.5 Monetary Fiscal Policy (Week 5)Documento12 páginas4.5 Monetary Fiscal Policy (Week 5)Mohsin ALIAinda não há avaliações

- Financial Swaps Explained: Types, Uses & Risk ManagementDocumento27 páginasFinancial Swaps Explained: Types, Uses & Risk Managementsaurabh thakurAinda não há avaliações

- Part II Exchange Rate Behavior: Locational Arbitrage Triangular Arbitrage Covered Interest ArbitrageDocumento14 páginasPart II Exchange Rate Behavior: Locational Arbitrage Triangular Arbitrage Covered Interest Arbitragemajid aliAinda não há avaliações

- International Monetary System: PRESENTED BY:-Group-3 MembersDocumento27 páginasInternational Monetary System: PRESENTED BY:-Group-3 Membersshanky22Ainda não há avaliações

- Economics of Globalization HMZDocumento23 páginasEconomics of Globalization HMZMarioAinda não há avaliações

- How International Currency Excharge Rate WorksDocumento6 páginasHow International Currency Excharge Rate Worksggi2022.1928Ainda não há avaliações

- Unit - 4: Exchange Rate and Its Economic Effects: Learning OutcomesDocumento20 páginasUnit - 4: Exchange Rate and Its Economic Effects: Learning Outcomesganeshnavi2008Ainda não há avaliações

- Bretton Woods system explainedDocumento12 páginasBretton Woods system explainedAadi SarinAinda não há avaliações

- International FinanceDocumento83 páginasInternational Financesamrulezzz100% (1)

- Global Financial System: International InstitutionsDocumento21 páginasGlobal Financial System: International Institutionsapi-265248190% (1)

- The Financial Account. What Are The Primary Sub-Components of The Financial Account? Analytically, What Would Cause Net Deficits or Surpluses in These Individual Components?Documento5 páginasThe Financial Account. What Are The Primary Sub-Components of The Financial Account? Analytically, What Would Cause Net Deficits or Surpluses in These Individual Components?Khaleedd MugeebAinda não há avaliações

- Section VidDocumento25 páginasSection Vidsailendra123Ainda não há avaliações

- Current Exchange Rate Regime-2 Final1Documento14 páginasCurrent Exchange Rate Regime-2 Final1Aam aadmiAinda não há avaliações

- Domestic Market Operations and Liquidity Forecasting: Alexandra Baker and David JacobsDocumento8 páginasDomestic Market Operations and Liquidity Forecasting: Alexandra Baker and David JacobseconomicdelusionAinda não há avaliações

- Financial Forces in International BusinessDocumento5 páginasFinancial Forces in International BusinessPutry AgustinaaAinda não há avaliações

- Business Economics: Business Strategy & Competitive AdvantageNo EverandBusiness Economics: Business Strategy & Competitive AdvantageAinda não há avaliações

- TKHH LogDocumento182 páginasTKHH Logtongai_mutengwa5194Ainda não há avaliações

- Decreasing or Increasing Channel Elements On 3G SitesDocumento5 páginasDecreasing or Increasing Channel Elements On 3G Sitestongai_mutengwa5194Ainda não há avaliações

- Network Operations PDFDocumento3 páginasNetwork Operations PDFtongai_mutengwa5194Ainda não há avaliações

- How Spiritual Health Is Impaired by Neglect of Physical and Mental HealthDocumento7 páginasHow Spiritual Health Is Impaired by Neglect of Physical and Mental Healthtongai_mutengwa5194Ainda não há avaliações

- MO: INCREASING CE CAPACITY BY SWAPPING BPK AND BPC BOARDSDocumento5 páginasMO: INCREASING CE CAPACITY BY SWAPPING BPK AND BPC BOARDStongai_mutengwa5194Ainda não há avaliações

- LTE in Bullets - DL Bit RatesDocumento4 páginasLTE in Bullets - DL Bit RatesFeras ElbakriAinda não há avaliações

- Apg Mas SettingDocumento1 páginaApg Mas Settingtongai_mutengwa5194Ainda não há avaliações

- Health Check 2016Documento29 páginasHealth Check 2016tongai_mutengwa5194100% (1)

- Apg Mas SettingDocumento1 páginaApg Mas Settingtongai_mutengwa5194Ainda não há avaliações

- EVO-C RRC Load ControlDocumento2 páginasEVO-C RRC Load Controltongai_mutengwa5194100% (1)

- Apg Acs SettingDocumento1 páginaApg Acs Settingtongai_mutengwa5194Ainda não há avaliações

- Apg Acs SettingDocumento1 páginaApg Acs Settingtongai_mutengwa5194Ainda não há avaliações

- Adding A 2nd E1 On SDRDocumento8 páginasAdding A 2nd E1 On SDRtongai_mutengwa5194Ainda não há avaliações

- DCG Phebs02 20160215Documento1.436 páginasDCG Phebs02 20160215tongai_mutengwa5194Ainda não há avaliações

- 31 WRNC Rncequip V3.11.10 20141001Documento35 páginas31 WRNC Rncequip V3.11.10 20141001tongai_mutengwa5194Ainda não há avaliações

- Activating Hs Load Sharing On 0345MUDocumento1 páginaActivating Hs Load Sharing On 0345MUtongai_mutengwa5194Ainda não há avaliações

- U31 R18 Configuration Application Operation GuideDocumento110 páginasU31 R18 Configuration Application Operation Guidetongai_mutengwa5194Ainda não há avaliações

- ProjectParameter All 20150730145528Documento18 páginasProjectParameter All 20150730145528tongai_mutengwa5194Ainda não há avaliações

- Zxur9000 CP LoadsDocumento7 páginasZxur9000 CP Loadstongai_mutengwa5194Ainda não há avaliações

- SDR4.11Full Frequency Band Scan Enable GuideDocumento2 páginasSDR4.11Full Frequency Band Scan Enable Guidetongai_mutengwa5194Ainda não há avaliações

- Activity Benchmarks AccessDocumento2 páginasActivity Benchmarks Accesstongai_mutengwa5194Ainda não há avaliações

- 00-2 Contents Template (-+-+) - ++Documento1 página00-2 Contents Template (-+-+) - ++tongai_mutengwa5194Ainda não há avaliações

- Axe BSCDocumento55 páginasAxe BSCtongai_mutengwa5194100% (1)

- 00-2 Contents Template (-+-+) - ++Documento1 página00-2 Contents Template (-+-+) - ++tongai_mutengwa5194Ainda não há avaliações

- BHM 657 Principles of Accounting IDocumento182 páginasBHM 657 Principles of Accounting Itaola100% (1)

- Kotak Mahindra Bank Limited FY 2020 21Documento148 páginasKotak Mahindra Bank Limited FY 2020 21Harshvardhan PatilAinda não há avaliações

- In The Supreme Court of India: Appellants: RespondentDocumento31 páginasIn The Supreme Court of India: Appellants: Respondentaridaman raghuvanshiAinda não há avaliações

- CHANDPURDocumento1 páginaCHANDPURMST FIROZA BEGUMAinda não há avaliações

- Satire in Monty PythonDocumento2 páginasSatire in Monty PythonJonathan Chen100% (4)

- Investment in Cambodia Prepared by Chan BonnivoitDocumento64 páginasInvestment in Cambodia Prepared by Chan BonnivoitMr. Chan Bonnivoit100% (2)

- 19bce0696 VL2021220701671 Ast02Documento7 páginas19bce0696 VL2021220701671 Ast02Parijat NiyogyAinda não há avaliações

- Astm D6440 - 1 (En)Documento2 páginasAstm D6440 - 1 (En)svvasin2013Ainda não há avaliações

- Ong Yong vs. TiuDocumento21 páginasOng Yong vs. TiuZen DanielAinda não há avaliações

- Direct Tax Computation and DeductionsDocumento21 páginasDirect Tax Computation and DeductionsVeena GowdaAinda não há avaliações

- Bangalore TravelDocumento1 páginaBangalore Travelgunjan1208Ainda não há avaliações

- Application Letter 17741Documento1 páginaApplication Letter 17741Ganga DharaAinda não há avaliações

- Comparative Religions Chart - KeyDocumento2 páginasComparative Religions Chart - Keyapi-440272030Ainda não há avaliações

- Umesh Narain Vs Tobacco Institute of IndiaDocumento73 páginasUmesh Narain Vs Tobacco Institute of IndiaThe Quint100% (2)

- Rules and Regulations On The Implementation of Batas Pambansa Blg. 33Documento9 páginasRules and Regulations On The Implementation of Batas Pambansa Blg. 33Martin Thomas Berse LaguraAinda não há avaliações

- Worksheet 2: Tell Whether The Bolded Words Are Synonyms, Antonyms, Homophones, or HomographsDocumento4 páginasWorksheet 2: Tell Whether The Bolded Words Are Synonyms, Antonyms, Homophones, or HomographsmunirahAinda não há avaliações

- Design of Road Overbridges: S C T RDocumento7 páginasDesign of Road Overbridges: S C T RHe WeiAinda não há avaliações

- Final Drawing in BUTM 2Documento1 páginaFinal Drawing in BUTM 2david46Ainda não há avaliações

- Case Analysis 2Documento2 páginasCase Analysis 2Allen Fey De JesusAinda não há avaliações

- NOUN VERB ADJECTIVE ADVERB PREPOSITION CONJUNCTION 2000KATADocumento30 páginasNOUN VERB ADJECTIVE ADVERB PREPOSITION CONJUNCTION 2000KATAazadkumarreddy100% (1)

- UCS-SCU22 BookDocumento36 páginasUCS-SCU22 BookRicardo Olmos MentadoAinda não há avaliações

- Principles of Cost Accounting 16th Edition Vanderbeck Solution ManualDocumento47 páginasPrinciples of Cost Accounting 16th Edition Vanderbeck Solution Manualcorey100% (30)

- How To Talk in An Arranged Marriage Meeting - 22 StepsDocumento3 páginasHow To Talk in An Arranged Marriage Meeting - 22 StepsqwertyasdfgAinda não há avaliações

- FO-R23-001 - R2 Subcontractor Registration FormDocumento6 páginasFO-R23-001 - R2 Subcontractor Registration FormKeneth Del CarmenAinda não há avaliações

- Davao City Water District vs. CSCDocumento15 páginasDavao City Water District vs. CSCJudy Ann BilangelAinda não há avaliações

- Rhetorical Analysis Final PaperDocumento5 páginasRhetorical Analysis Final Paperapi-534733744Ainda não há avaliações

- Awe SampleDocumento12 páginasAwe SamplerichmondAinda não há avaliações