Escolar Documentos

Profissional Documentos

Cultura Documentos

Week 1 Introduction

Enviado por

Vut BayTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Week 1 Introduction

Enviado por

Vut BayDireitos autorais:

Formatos disponíveis

2201AFE Corporate Finance

Week 1:

Introduction to Corporate Finance

Financial Statements, Taxes and Cash Flow

Working with Financial Statements

Readings: Chapters 1, 2 & 3

Agenda

Welcome to the 2201AFE Corporate Finance

Teaching team

Course comments

Assessment key dates

Lecture for this Week

Introduction to Corporate Finance

Financial Statements, Taxes and Cash Flow

Ratio Analysis

2

Teaching team

Course Convenor/Lecturer:

Dr Victor Wong

N50_0.48

V.Wong@griffith.edu.au

All emails should insert "2201AFE" at the start of subject.

Without this course code, we will not reply to your email.

Email Subject: 2201AFE (followed by your subject)

3

Teaching team

Tutors:

See Staff Information tab in Learning@Griffith

Key success tip:

Remember, your first point of contact is with your tutor!

4

Textbook

Title: Fundamentals of Corporate Finance (5

th

edition)

Authors:

Stephen Ross, Massachusetts Institute of

Technology

Mark Christensen, Synergies Consulting

Michael Drew, Griffith University

Spencer Thompson

Randolph Westerfield, University of Southern

California

Bradford Jordan, University of Kentucky

ISBN: 0070284954

Copyright year: 2011

Publisher: Mc-Graw Hill

http://highered.mcgraw-hill.com/sites/0070284954/

information_center_view0/

5

Course comments

Key ingredients to success in this course are:

Attend lectures plus your own learning and reading the

textbook.

Consistent tutorial effort, attendance and practicing

questions.

The material builds from week to week, work closely with

your tutor to ensure you are keeping up to date.

6

Assessments key dates

4 On-line Quizzes (20% weighting)

5% each; due in weeks 3, 6, 10, 13 (see course profile)

Mid-semester Exam (30% weighting)

1 hour and 30 min on 16 April 2013 during lecture time

Week 1 through Week 5 (Part 1) inclusive.

Final Exam (50% weighting)

2 hours and 30 min during End of Semester Exam Period

Whole of course, while paying some more attention to

concepts covered in Week 5 (Part 2) through Week 13

inclusive.

7

Calculators

It is critical for you to acquire a hand held calculator if you do not

own one already.

DO NOT purchase a programmable calculator as this is NOT allowed

in the examinations.

Here are some specifications that will get the job done for this

course:

Scientific calculator; simplicity is encouraged as the more keys you have the

higher the chance of mistakes.

Includes the add, subtract, multiply,

divide functions.

Includes the power and root functions.

Allows you to enclose brackets.

Includes the natural log or ln function.

8

Basic Algebra Reminders

Order of Operations: BODMAS

Brackets first then

Other grouping symbols (eg: LN(x), x

a

, x

-1

)

Division and

Multiplication next

Addition and

Subtraction last

9

Example

First we have to remove the square bracket

But before that we remove the round bracket by performing

the division

Then the power and subtraction in the square bracket

Multiplication by 5

Addition of 10

Answer = 5.001

10

? 1

10

3

5 10

7

=

(

(

|

.

|

\

|

+

Basic Algebraic Identities and Laws

Example: 3(2+5) = 32 + 35

Example: 9

1/2

= 9

Example: LN(3

2

) = 2*LN(3)

LN means Natural Logarithm with the base of e

LOG means logarithm with the base of 10

Both are on your calculators (LN is used in lecture examples)

11

ac ab c b a + = + ) (

x x =

2 / 1

) ( ) ( x LN a x LN

a

=

Basic Algebraic Identities and Laws

Useful Website for Algebra basics:

http://www.themathpage.com/alg/rules-of-algebra.htm

Go to Table of Contents

Select Topic (see for example Section 2 of Topic 9)

12

13

1. Introduction & Financial

Statements

2. Time Value of Money

3. Valuing Shares & Bonds

7. Mid-semester Exam

8. Some Lessons from Capital

Market History

11. Financial Leverage & Capital

Structure Policy

13. Options & Revision

9. Return, Risk & the Security

Market Line

5. Making Capital Investment

Decisions & Project Analysis

12. Dividends & Dividend Policy

6. Revision for Mid-sem Exam

4. Net Present Value & Other

Investment Criteria

10. Cost of Capital

Introduction to Corporate Finance

Chapter 1

14

Key Concepts and Skills

What is Corporate Finance?

Understand the goals of financial management

The Agency problem

The role of financial markets

Financial Statements

Understanding Cash Flows

Ratio Analysis

15

What is Corporate Finance?

Corporate Finance is the study of ways to answer three

important questions:

What long-term investments should the firm take on?

Where will we get the long-term financing to pay for the

investment?

How will we share the rewards if the business is successful?

16

Financial Management Decisions

Capital budgeting Investment decision

What long-term investments or projects should the business

take on?

Capital structure Financing decision

How should we pay for our assets?

Should we use debt or equity?

Dividend Dividend decision

Should dividends be paid?

If so, how much?

17

The Investment Decision

Capital budgeting is the planning and control of cash

outflows in the expectation of deriving future cash inflows

from investments in non-current assets.

Involves evaluating the:

Size of future cash flows

Timing of future cash flows

Risk of future cash flows

18

The Financing Decision

A firms capital structure is the specific mix of debt and

equity used to finance the firms operations.

Decisions need to be made on both the financing mix and

how and where to raise the money.

Working capital management decisions involves managing

day to day activities.

19

The Dividend Decision

Involves the decision of whether to pay a dividend to

shareholders or maintain the funds within the firm for

internal growth.

Factors to consider:

Growth opportunities

Taxation

Shareholders preferences

20

The Goal of Financial Management

What should be the goal of a corporation?

Survival?

Avoid financial distress and bankruptcy?

Maximize profit?

Minimize costs?

Maximize market share?

Maximize the current value of the companys stock?

21

The Goal of Financial Management

The financial manager of a company makes decisions on

behalf of the shareholders.

Thus the correct goal is to maximise shareholders wealth.

That is, to maximise the value of the existing shares.

Does this mean we should do anything and everything to

maximize owner wealth?

22

The Agency Problem

Agency relationship

Principal hires an agent to represent his/her interest.

Shareholders (principals) hire managers (agents) to run the

company.

Agency problem

Conflict of interest between principal and agent.

Agency costs

Direct corporate expenditures that benefit management

but cost shareholders (e.g. purchasing unnecessary

corporate jet).

Indirect lost opportunity (e.g. shareholders think its a good

investment but manager perceive as too risky and fear of

losing their jobs).

23

Managing Managers

Managerial compensation

Incentives can be used to align management and shareholder

interests.

The incentives need to be structured carefully to make sure

that they achieve their goal.

Corporate control

The threat of a takeover may result in better management.

Other stakeholders

Governments, suppliers, employees.

24

Financial Markets

What is a Market?

A market is the means through which the buyers and sellers

are brought together.

Role of a Financial Market

To channel savings into investments.

Enable sale and purchase of financial assets.

Money vs. Capital markets

Primary vs. Secondary markets

25

Financial Markets

Money markets involve the trading of short-term debt securities

(less than 12 months).

Capital markets involve the trading of long-term debt securities

and shares (more than 12 months).

Primary markets involve the original sale of securities (e.g.

Initial Public Offer).

Secondary markets involve the continual buying and selling of

issued securities.

Australian Stock Exchange, New York Stock Exchange, London

Stock Exchange.

For some fascinating reading on how financial markets impact growth and economic

development see Rajan and Zingales, Financial Development and Growth, American Economic

Review, June 1988, pp 559 586

26

Financial Statements, Taxes and Cash Flow

Chapter 2

27

Balance Sheet

The balance sheet is a snapshot of the firms assets and

liabilities at a given point in time.

Balance Sheet Identity

Assets = Liabilities + Shareholders Equity

Assets Liabilities = Shareholders Equity

Net Working Capital (NWC)

= Current Assets Current Liabilities

Positive when the cash that will be received over the next 12

months exceeds the cash that will be paid out.

Usually positive in a healthy firm.

28

Balance Sheet

29

Current assets

Fixed assets

1. Tangible fixed assets

2. Intangible fixed assets

Current liabilities

Long-term debt

Shareholders equity

Total Value of Assets

Total Value of Liabilities

and Shareholders Equity

Net working

capital

Notes on Balance Sheet

Liquidity

Ability to convert to cash quickly without a significant loss in value.

Liquid firms are less likely to experience financial distress.

But liquid assets earn a lower return.

Trade-off to find balance between liquid and illiquid assets.

Market vs. Book Value

The balance sheet provides the book value of the assets, liabilities and

equity.

Market value is the price at which the assets, liabilities or equity can

actually be bought or sold.

Which is more important to the decision-making process?

Debt vs. Equity

Financial leverage deciding whether to use debt financing?

30

Balance Sheet

31

U.S. Corporation

2011 and 2012 Balance Sheets

($ in millions)

Assets Liabilities and Owners Equity

2011 2012 2011 2012

Current assets Current liabilities

Cash $104 $160 Accounts payable $232 $266

Accounts receivable $455 $688 Notes payable $196 $123

Inventory $553 $555 Total $428 $389

Total $1,112 $1,403

Long-term debt $408 $454

Fixed assets

Net plant & equipment $1,644 $1,709 Owners equity

Common stock and paid-in surplus $600 $640

Retained earnings $1,320 $1,629

Total $1,920 $2,269

Total assets $2,756 $3,112 Total liabilities and owners equity $2,756 $3,112

Income Statement

The income statement measures the performance of a firm

over a specified period of time.

Revenues Expenses = Income

Matching principle: shows revenue when it is realised and

matches the expenses required to generate the revenue.

32

Income Statement

33

U.S. Corporation

2012 Income Statement

($ in millions)

Net sales $1,509

Cost of goods sold 750

Depreciation 65

Earnings before interest and taxes 694

Interest paid 70

Taxable income 624

Taxes 212

Net income $412

Dividends $103

Addition to retained earnings 309

The Concept of Cash Flow

Cash Flow (CF) is one of the most important pieces of

information that a financial manager can derive from

financial statements

Cash Flow Identity:

CF from Assets = CF to Creditors + CF to Shareholders

Cash generated from using our assets =

Cash paid to those that finance the purchase of those

assets (Creditors + Shareholders)

34

Cash Flow from Assets

CFFA = CFC + CFS outside the company

CFFA = OCF NCS NWC inside the company

Cash Flow From Assets (CFFA)

= Operating Cash Flow (OCF)

Net Capital Spending (NCS)

Changes in Net Working Capital (NWC)

35

Cash Flow from Assets

CFFA = OCF NCS NWC inside the company

OCF = EBIT + Depreciation Taxes = $547

694 + 65 212 = 547

NCS = End Net Fixed Assets Begin Net Fixed Assets + Dep. = $130

1,709 1,644 + 65 = 130

NWC = Ending NWC Beginning NWC = $330

1,014 684 = 330

1,403(CA) 389(CL) 1,112(CA) 428(CL)

for 2012 for 2011

CFFA = 547 130 330 = $87

36

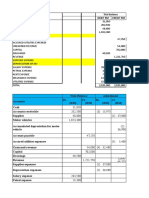

Cash Flow from Assets

Operating cash flow:

EBIT 694.00

+ Depreciation + 65.00

Taxes 212.00 $547.00

LESS:

Net capital spending:

Ending net fixed assets 1,709.00

Beginning net fixed assets 1,644.00

+ Depreciation + 65.00 $130.00

LESS:

Change in net working capital:

Ending net working capital 1,014.00

Beginning net working capital 684.00 $330.00

Cash Flow from Assets: $87.00

37

Cash Flow to Creditors and Shareholders

CFFA = CFC + CFS

CFC = Interest Paid Net New Borrowings

CFFA = CFC + CFS

CFS = Dividends Paid Net New Equity

38

Cash Flow to Creditors and Shareholders

CFC = Interest Paid Net New Borrowing = $24

70 46 = 24

Long term Debt: 454 Long term Debt: 408

for 2012 for 2011

CFS = Dividends Paid Net New Equity = $63

103 40 = 63

Common Shares: 640 Common Shares: 600

for 2012 for 2011

CFC + CFS = 24 + 63 = $87

39

Cash Flow to Creditors and Shareholders

Cash flow to creditors:

Interest paid 70.00

Net new borrowing 46.00

$24.00

PLUS:

Cash flow to shareholders:

Dividends paid 103.00

Net new equity raised 40.00

$63.00

Cash flow to creditors and shareholders = $87.00

40

Cash Flow Identity

CF Identity: CFFA = CFC + CFS

Left side of Identity:

CFFA = OCF NCS NWC = 547 130 330 = $87

Right side of Identity:

CFC + CFS = 24 + 63 = $87

41

Cash Flow Summary

1. The Cash Flow identity

Cash flow from assets = Cash Flow to Creditors (bondholders)

+ Cash Flow to Shareholders (owners)

2. Cash Flow from Assets

CFFA = Operating cash flow

Net capital spending

Change in net working capital (NWC)

where:

Operating cash flow = Earnings before interest and taxes (EBIT) + Depreciation Taxes

Net capital spending = Ending net fixed assets Beginning net fixed assets

Change in NWC = Ending NWC Beginning NWC

3. Cash Flow to Creditors (bondholders)

CFC = Interest paid Net new borrowing

4. Cash Flow to Shareholders (owners)

CFS = Dividends paid Net new equity raised

42

Working with Financial Statements

Chapter 3

43

Three financial statements

44

Balance Sheet

______________

Assets

=

Liabilities

+

Equity

Income

Statement

______________

Sales

+ Other Revenues

Expenses

= Profit before tax

Income tax

= Net profit

Cash Flows

Statement

______________

Net cash flows:

+ Operating

+ Investing

+ Financing

= Net change

Sample Balance Sheet

45

2012 2011 2012 2011

Cash 696 58 Accounts Payable 307 303

Accounts Receivable 956 992 Notes Payable 26 119

Inventory 301 361 Other Current Liabilities 1,662 1,353

Other Current Assets 303 264 Total Current Liabilities 1,995 1,775

Total Current Assets 2,256 1,675 Long-term Debt 843 1,091

Net Fixed Assets 3,138 3,358 Equity 2,556 2,167

Total Assets 5,394 5,033 Total Liabilities & Equity 5,394 5,033

Sample Income Statement

46

Revenues 5,000

Cost of Goods Sold 2,006

Expenses 1,740

Depreciation 116

Earnings Before Interest and Taxes 1,138

Interest Expense 7

Taxable Income 1,131

Taxes 442

Net Income 689

Earnings per share = 3.61

Dividends per share = 1.08 (190.9m shares)

Sources and Uses of Cash Flow

Sources

Cash inflow occurs when we sell something

Decrease in asset account

Accounts receivable, inventory, and net fixed assets

Increase in liability or equity account

Accounts payable, other current liabilities, and common stock

Uses

Cash outflow occurs when we buy something

Increase in asset account

Accounts receivable, and other current assets

Decrease in liability or equity account

Notes payable and long-term debt

47

Cash Flow Statement

Statement that summarizes the sources and uses of cash.

Changes divided into three major categories:

Operating Activity includes net income and changes in

most current accounts.

Investment Activity includes changes in fixed assets.

Financing Activity includes changes in notes payable, long-

term debt and equity accounts as well as dividends.

48

Cash Flow Statement

Operating activities

+ Net profit

+ Depreciation

+ Any decrease in current assets (except cash)

+ Increase in accounts payable

Any increase in current assets (except cash)

Decrease in accounts payable

Investment activities

+ Ending non-current assets

Beginning non-current assets

+ Depreciation

49

Financing activities

Decrease in notes payable

+ Increase in notes payable

Decrease in long-term debt

+ Increase in long-term debt

+ Increase in ordinary shares

Dividends paid

Sample Cash Flow Statement

50

Cash, beginning of year 58 Financing Activity

Operating Activity Decrease in Notes Payable (U) -93

Net Income 689 Decrease in LT Debt (U) -248

Plus: Depreciation 116 Decrease in Equity (minus RE) (U) -94

Decrease in A/R (S) 36 Dividends Paid (U) -206

Decrease in Inventory (S) 60 Net Cash from Financing -641

Increase in A/P (S) 4 Net Increase in Cash (1175+104-641) 638

Increase in Other CL (S) 309 Cash End of Year (58+638) 696

Less: Increase in CA (U) -39

Net Cash from Operations 1,175

Investment Activity Change in RE: 689 206 = 483

Sale of Fixed Assets (S) 104 Decrease in Equity: 2,556 2,167 483= -94

Net Cash from Investments 104

Sale of FA: 3,138 3,358 + 116 = -104

Ratio Analysis

Ratios also allow for better comparison through time or

between companies.

Ratios are used both internally and externally.

Be aware!

There is a large number of possible ratios.

Different people compute ratios in different ways.

51

Categories of Financial Ratios

Short-term solvency or liquidity ratios

Long-term solvency or financial leverage ratios

Asset management or turnover ratios

Profitability ratios

Market value ratios

52

Financial Leverage Ratios

Total Debt Ratio:

Debt / Assets OR D / A OR Liabilities / Assets

Example for 2012: (1,995 + 843) / 5,394 = 0.5261

Debt/Equity Ratio:

Debt / Shareholder Equity OR D / E OR (D/A) / (1-D/A)

Example for 2012: 2,838 / 2,556 = 1.11

Equity Multiplier:

Assets / Shareholder Equity OR A / E OR D / E+1

where A = D + E

Example for 2012: 5,394 / 2,556 = 2.11

53

Turnover Ratios

Total Asset Turnover:

Sales / Total Assets

Example For 2012: 5,000 / 5,394 = 0.93

NWC Turnover:

Sales / Net Working Capital

Example For 2012: 5,000 / (2,256 1,995) = 19.2

Fixed Asset Turnover:

Sales / Net Fixed Asset

Example For 2012: 5,000 / 3,138 = 1.6

54

Profitability Measures

Profit Margin:

Net Income / Sales

Example: 689 / 5,000 = 13.8%

Return on Assets (ROA):

Net Income / Total Assets

Example: 689 / 5,394 = 12.8%

Return on Equity (ROE):

Net Income / Total Equity

Example: 689 / 2,556 = 26.7%

55

Market Value Measures

Market Price for one share = $87.65

# of Shares outstanding = 190.9 m

Market Value (equity)

Market price for one share # of Shares Outstanding

For 2012: 87.65 190.9 = $16,732.4 m

EPS = Earnings per Share or Earnings for 1 share

Net income / # of shares outstanding

For 2012: 689 / 190.9 = 3.61

56

Market Value Measures

PE Ratio:

Price per share / Earnings per share

Market value / Earnings

For 2012: 87.65 / 3.61 = 24.28

OR 16,732.4 / 689 = 24.28

Market-to-book Ratio:

Market price per share / Book value per share

Market value of equity / Book value of equity

For 2012: 87.65 / (2,556 / 190.9) = 6.56

OR 16,732.4 / 2,556 = 6.56

57

Why Evaluate Financial Statements?

Internal uses

Performance evaluation compensation and comparison

between divisions

Planning for the future guide in estimating future cash

flows

External uses

Creditors

Suppliers

Customers

Stockholders/Shareholders

58

Benchmarking

Ratios are not very helpful by themselves; they need to be

compared to something.

Time-Trend Analysis

Used to see how the firms performance is changing through

time.

Peer Group Analysis

Compare to similar companies or with the industry.

59

Potential Problems

There is no underlying theory, so there is no way to know

which ratios are most relevant

Benchmarking is difficult for diversified firms

Globalization and international competition makes

comparison more difficult because of differences in

accounting regulations

Varying accounting procedures, i.e. FIFO vs. LIFO

Different fiscal years

Extraordinary events

60

Next Week

Next week we examine one of the central tenants of

modern finance the time value of money.

Next week is perhaps the most important lecture of the

course!

Bring your calculators and formula sheets!

61

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Animal and HumanDocumento1 páginaAnimal and HumanVut BayAinda não há avaliações

- Part BDocumento6 páginasPart BVut BayAinda não há avaliações

- Beauty ContestDocumento1 páginaBeauty ContestVut BayAinda não há avaliações

- Pte Essay TopicDocumento3 páginasPte Essay TopicVut BayAinda não há avaliações

- 2201AFE VW Week 13 Options & Revision For Final Exam S1, 2013Documento59 páginas2201AFE VW Week 13 Options & Revision For Final Exam S1, 2013Vut BayAinda não há avaliações

- 2201AFE VW Week 13 Options & Revision For Final ExamDocumento38 páginas2201AFE VW Week 13 Options & Revision For Final ExamVut BayAinda não há avaliações

- 2201AFE VW Week 9 Return, Risk and The SMLDocumento50 páginas2201AFE VW Week 9 Return, Risk and The SMLVut BayAinda não há avaliações

- 2201AFE VW Week 11 Financial Leverage & Capital Structure PolicyDocumento49 páginas2201AFE VW Week 11 Financial Leverage & Capital Structure PolicyVut BayAinda não há avaliações

- 2201AFE VW Week 12 Dividends & Dividend PolicyDocumento44 páginas2201AFE VW Week 12 Dividends & Dividend PolicyVut BayAinda não há avaliações

- 2201AFE VW Week 10 Cost of CapitalDocumento47 páginas2201AFE VW Week 10 Cost of CapitalVut BayAinda não há avaliações

- 2201AFE VW Week 8 Some Lessons From Capital Market HistoryDocumento47 páginas2201AFE VW Week 8 Some Lessons From Capital Market HistoryVut BayAinda não há avaliações

- Hand Washing Survey 2002Documento8 páginasHand Washing Survey 2002Vut BayAinda não há avaliações

- 2201AFE VW Week 6 Mid-Semester Exam InfoDocumento19 páginas2201AFE VW Week 6 Mid-Semester Exam InfoVut BayAinda não há avaliações

- Week 4 Net Present ValueDocumento39 páginasWeek 4 Net Present ValueVut BayAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (120)

- Assignment 3.1 FARDocumento11 páginasAssignment 3.1 FARJames Brian F PoserioAinda não há avaliações

- File 1 - Overview IFRS 17Documento30 páginasFile 1 - Overview IFRS 17mcahya82Ainda não há avaliações

- Question DIB Oct 17Documento24 páginasQuestion DIB Oct 17shopno100% (1)

- General JournalDocumento5 páginasGeneral Journalmonicaaa melianaaaAinda não há avaliações

- Group Activities Income StatmentDocumento3 páginasGroup Activities Income StatmentMarwin NavarreteAinda não há avaliações

- Statement of Cash Flow by KiesoDocumento85 páginasStatement of Cash Flow by KiesoSiblu HasanAinda não há avaliações

- Insurance Claim AccountDocumento12 páginasInsurance Claim AccountKadam Kartikesh50% (2)

- Unit 1 Practice Exam 1Documento8 páginasUnit 1 Practice Exam 1milk shakeAinda não há avaliações

- Kieso15e Testbank ch03Documento47 páginasKieso15e Testbank ch03softplay12100% (2)

- UBT - CBA - Final ProjectDocumento24 páginasUBT - CBA - Final ProjectLUKE WHITEAinda não há avaliações

- Chapter 3 - Fundamentals of Corporate Finance 9th Edition - Test BankDocumento24 páginasChapter 3 - Fundamentals of Corporate Finance 9th Edition - Test BankKellyGibbons100% (4)

- Indian Institute of Management Rohtak: End Term ExaminationDocumento14 páginasIndian Institute of Management Rohtak: End Term ExaminationaaAinda não há avaliações

- Financial AnalysisDocumento22 páginasFinancial Analysisnomaan khanAinda não há avaliações

- FYP Financial Statement Analysis Interpretations Alfa LavalDocumento56 páginasFYP Financial Statement Analysis Interpretations Alfa LavalJothi BasuAinda não há avaliações

- Equity InvestmentsDocumento20 páginasEquity InvestmentsNoella Marie BaronAinda não há avaliações

- CH 11Documento30 páginasCH 11Jean-Paul MoubarakAinda não há avaliações

- Accounts Trial Balance Debit RM Credit RMDocumento9 páginasAccounts Trial Balance Debit RM Credit RMashaAinda não há avaliações

- Cma Data 2017-18 F Guk (2Documento69 páginasCma Data 2017-18 F Guk (2ramyAAinda não há avaliações

- Property, Plant Equipment-IAS 16Documento21 páginasProperty, Plant Equipment-IAS 16Shoaib SakhiAinda não há avaliações

- Amendment in Schedule III at Icsi Indore On 28052022Documento29 páginasAmendment in Schedule III at Icsi Indore On 28052022kandmoreAinda não há avaliações

- Practice Exam Chapters 1-8 Solutions: Problem 1Documento7 páginasPractice Exam Chapters 1-8 Solutions: Problem 1Atif RehmanAinda não há avaliações

- Financial of The Balance Sheet: BOOK - II (20 Marks)Documento13 páginasFinancial of The Balance Sheet: BOOK - II (20 Marks)sanskriti kathpaliaAinda não há avaliações

- Business PlanDocumento27 páginasBusiness PlanCJ Paz-ArevaloAinda não há avaliações

- Account Must Do List For May 2021Documento129 páginasAccount Must Do List For May 2021Akshay PatilAinda não há avaliações

- Chapter 4Documento12 páginasChapter 4jeo beduaAinda não há avaliações

- Student Handbook ACC3015 2018 - 19 DLDocumento123 páginasStudent Handbook ACC3015 2018 - 19 DLThara DasanayakaAinda não há avaliações

- Advance Financial Management - Financial Tools - Written ReportDocumento36 páginasAdvance Financial Management - Financial Tools - Written Reportgilbertson tinioAinda não há avaliações

- Test Bank-HarrisonDocumento47 páginasTest Bank-HarrisonDenyielAinda não há avaliações

- ModelDocumento103 páginasModelMatheus Augusto Campos PiresAinda não há avaliações

- CH 15Documento63 páginasCH 15clarysage13100% (1)