Escolar Documentos

Profissional Documentos

Cultura Documentos

Chp09 Hedging and Volatility

Enviado por

Amsalu WalelignDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Chp09 Hedging and Volatility

Enviado por

Amsalu WalelignDireitos autorais:

Formatos disponíveis

K.Cuthbertson and D.

Nitzsche

1

FINANCIAL ENGINEERING:

DERIVATIVES AND RISK MANAGEMENT

(J. Wiley, 2001)

K. Cuthbertson and D. Nitzsche

LECTURE

Dynamic Hedging and the Greeks

1/9/2001

K.Cuthbertson and D.Nitzsche

Topics

Dynamic (Delta) Hedging

The Greeks

BOPM and the Greeks

K.Cuthbertson and D.Nitzsche

3

Dynamic Hedging

K.Cuthbertson and D.Nitzsche

Dynamic (Delta) Hedging

Suppose we have written a call option for C

0

=10.45 (with

K=100, o = 20%, r=5%, T=1) when the current stock price is

S

0

=100 and A

0

= 0.6368

At t=0, to hedge the call we buy A

0

= 0.6368 shares at So =

100 at a cost of $63.68. hence we need to borrow (i.e. go into

debt)

Debt , D

0

= A

0

S

0

- C

0

= 63.68 10.45 = $53.23

K.Cuthbertson and D.Nitzsche

Dynamic Delta Hedging

At t = 1 the stock price has fallen to S

1

= 99 with A

1

= 0.617.

You therefore sell (A

1

- A

0

) shares at S

1

generating a cash inflow

of $1.958 which can be used to reduce your debt so that your

debt position at t=1 is

53.23 - 1.958 = 51.30

The value of your hedge portfolio at t = 1(including the market

value of your written call):

V

1

=

= Value of shares held - Debt - Call premium

= = 0.0274 (approx zero)

But as S falls (say) then you sell on a falling marker ending up with

positive debt

( ) = A A =

A

1 1 1

S e D D

o

t r

o

) 01 . 0 ( 05 . 0

e

1 1 1 1

C D S A

K.Cuthbertson and D.Nitzsche

Dynamic Delta Hedging

OPTION ENDS UP OUT-OF-THE-MONEY (A

T

= 0 shares)

$ Net cost at T: D

T

= 10.19

% Net cost at T: (D

T

- C

0

) / C

0

= 2.46%

OPTION ENDS UP IN THE-MONEY (A

T

= 1 share)

$ Net cost at T: D

T

K = 111.29 100 = 11.29

% Net cost at T: (D

T

K - C

0

) / C

0

= 8.1%

% Cost of the delta hedge = risk free rate

%Hedge Performancer = sd( D

T

e

-rT

- C

0

) / C

0

K.Cuthbertson and D.Nitzsche

7

THE GREEKS

K.Cuthbertson and D.Nitzsche

8

Figure 9.2 : Delta and gamma : long call

0

0.2

0.4

0.6

0.8

1

1.2

1 11 21 31 41 51 61 71 81 91

0

0.005

0.01

0.015

0.02

0.025

0.03

0.035

Delta

Gamma

Stock Price (K = 50)

K.Cuthbertson and D.Nitzsche

9

THE GREEKS: A RISK FREE HOLIDAY ON THE ISLANDS

2

2

S

f

c

c

= I

o c

c f

= A

Gamma and Lamda

df ~ A.dS +(1/2) I (dS)

2

+ O dt + dr + A do

K.Cuthbertson and D.Nitzsche

10

HEDGING WITH THE GREEKS:

Gamma Neutral Portfolio

I = gamma of existing portfolio

I

T

= gamma of new options

I

port

= N

T

I

T

+ I = 0

therefore buy : N

T

= - I/I

T

new options

Vega Neutral Portfolio

Similarly : N

A

= -A / A

T

new options

K.Cuthbertson and D.Nitzsche

11

HEDGING WITH THE GREEKS

ORDER OF CALCULATIONS

1) Make existing portfolio either vega or gamma neutral

(or both simultaneously, if required in the hedge) by

buying/selling other options. Call this portfolio-X

2) Portfolio-X is not delta neutral. Now make portfolio-X delta

neutral by trading only the underlying stocks (cant trade

options because this would break the gamma/vega

neutrality).

K.Cuthbertson and D.Nitzsche

12

Hedging With The Greeks: A Simple Example

PortfolioA: is delta neutral but I = -300.

A Call option Z with the same underlying (e.g. stock) has a

delta = 0.62 and gamma of 1.5

.

How can you use Z to make the overall portfolio gamma and

delta neutral?

We require: n

z

I

z

+ I = O

n

z

= - I / I

z

= -(-300)/1.5 = 200

implies 200 long contracts in Z

The delta of this new portfolio is now

A = n

z

.A

z

= 200(0.62) = 124

Hence to maintain delta neutrality you must short 124

units of the underlying.

K.Cuthbertson and D.Nitzsche

13

BOPM and the Greeks

K.Cuthbertson and D.Nitzsche

14

Figure 9.5 : BOPM lattice

Index, j

Time, t

1,0 2,0 3,0 4,0

0,0

1,1

2,2

3,3

4,4

2,1 3,1 4,1

3,2 4,2

4,3

1 0 2 3 4

K.Cuthbertson and D.Nitzsche

15

BOPM and the Greeks

Gamma

S* = (S

22

+ S

21

)/2 and in the lower part, S** = (S

21

+ S

20

)/2.

Hence their difference is:

[9.32] = ] /2 =

10 11

10 11

00

S S

f f

= A

21 22

21 22

11

S S

f f

= A

20 21

20 21

10

S S

f f

= A

) ( ) [(

20 21 21 22

S S S S + + 2 / ) (

20 22

S S

10 11

00

A A

= I

K.Cuthbertson and D.Nitzsche

16

End of Slides

Você também pode gostar

- Chapter 23Documento21 páginasChapter 23Amsalu WalelignAinda não há avaliações

- NETSANETDocumento1 páginaNETSANETAmsalu WalelignAinda não há avaliações

- Address List of Major Ethiopian ExportersDocumento18 páginasAddress List of Major Ethiopian ExportersSami Tsedeke50% (6)

- Payment: USD 2,277.03: Bank DetailsDocumento1 páginaPayment: USD 2,277.03: Bank DetailsAmsalu WalelignAinda não há avaliações

- CH1 2011Documento44 páginasCH1 2011Amsalu WalelignAinda não há avaliações

- Chapter 15 of GlobeDocumento26 páginasChapter 15 of GlobeSyed Zakir Hussain ZaidiAinda não há avaliações

- DuraDocumento47 páginasDuraAmsalu WalelignAinda não há avaliações

- 6&7Documento17 páginas6&7Amsalu WalelignAinda não há avaliações

- Introduction To Statistical Quality ControlDocumento29 páginasIntroduction To Statistical Quality ControlmivranesAinda não há avaliações

- RCA Mini Guide PDFDocumento15 páginasRCA Mini Guide PDFIldzamar Haifa WardhaniAinda não há avaliações

- SPSS For BeginnersDocumento429 páginasSPSS For BeginnersBehrooz Saghafi99% (198)

- Applying Statistical Tools To Improve Quality in The Service SectorDocumento13 páginasApplying Statistical Tools To Improve Quality in The Service SectorabelendaleAinda não há avaliações

- Mathemtian and Astronomer - The Strategy of Discovering Laplace Transform Was To SolveDocumento2 páginasMathemtian and Astronomer - The Strategy of Discovering Laplace Transform Was To SolveAmsalu WalelignAinda não há avaliações

- Simple Linear Regression and Correlation Analysis: Chapter FiveDocumento5 páginasSimple Linear Regression and Correlation Analysis: Chapter FiveAmsalu WalelignAinda não há avaliações

- CH 3Documento16 páginasCH 3Amsalu WalelignAinda não há avaliações

- DateDocumento1 páginaDateAmsalu WalelignAinda não há avaliações

- PpaDocumento4 páginasPpaAmsalu WalelignAinda não há avaliações

- SDFGSDSDFDocumento14 páginasSDFGSDSDFAmsalu WalelignAinda não há avaliações

- DestaDocumento19 páginasDestaAmsalu WalelignAinda não há avaliações

- Need Assessment QuestionnaireDocumento2 páginasNeed Assessment QuestionnaireAmsalu WalelignAinda não há avaliações

- SPSS For BeginnersDocumento429 páginasSPSS For BeginnersBehrooz Saghafi99% (198)

- VCN CVNDocumento9 páginasVCN CVNAmsalu WalelignAinda não há avaliações

- Chapter 2Documento4 páginasChapter 2Amsalu WalelignAinda não há avaliações

- Generalized Ordered Logit Models: April 2, 2010 Richard Williams, Notre Dame Sociology, Gologit2 Support PageDocumento6 páginasGeneralized Ordered Logit Models: April 2, 2010 Richard Williams, Notre Dame Sociology, Gologit2 Support PageAmsalu WalelignAinda não há avaliações

- IOE 265 Probability and Statistics For Engineers - Winter 2004 Section 200Documento5 páginasIOE 265 Probability and Statistics For Engineers - Winter 2004 Section 200Amsalu WalelignAinda não há avaliações

- STAT10010 Tutorial 5. Week 7Documento1 páginaSTAT10010 Tutorial 5. Week 7Amsalu WalelignAinda não há avaliações

- Using Stata 11 & 12 For Logistic RegressionDocumento13 páginasUsing Stata 11 & 12 For Logistic RegressionAmsalu WalelignAinda não há avaliações

- Population. Usually, We Cannot Ask Everyone in Our Population (Like All ISU Students) So SampleDocumento2 páginasPopulation. Usually, We Cannot Ask Everyone in Our Population (Like All ISU Students) So SampleAmsalu WalelignAinda não há avaliações

- Interactive Scatter Plots in SPSSDocumento4 páginasInteractive Scatter Plots in SPSSAmsalu WalelignAinda não há avaliações

- Reliability Analysis-SpssDocumento5 páginasReliability Analysis-SpssJamie GuanAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Chapter4 Feasibility of Idea ContinueDocumento27 páginasChapter4 Feasibility of Idea ContinueCao ChanAinda não há avaliações

- Prospectus Affin Hwang Select Asia (Ex Japan) Quantum FundDocumento46 páginasProspectus Affin Hwang Select Asia (Ex Japan) Quantum FundElina TangAinda não há avaliações

- 6Ps of Marketing MixDocumento5 páginas6Ps of Marketing MixSatyabrata Sahu82% (11)

- Transaction Inquiry: Date & Time Value Date Description Debit Credit Reference No. SaldoDocumento2 páginasTransaction Inquiry: Date & Time Value Date Description Debit Credit Reference No. SaldoIntan BinalandAinda não há avaliações

- Manthan 2036 CDP Handbook PDFDocumento13 páginasManthan 2036 CDP Handbook PDFPranav CVAinda não há avaliações

- Case Study 1 - Signal Cable CompanyDocumento5 páginasCase Study 1 - Signal Cable CompanyTengku SuriaAinda não há avaliações

- Chapter 5 - Modern Portfolio ConceptsDocumento41 páginasChapter 5 - Modern Portfolio ConceptsShahriar HaqueAinda não há avaliações

- Bond ImmunizationDocumento14 páginasBond ImmunizationYasser HassanAinda não há avaliações

- Marketing-Principles - Study ResourcesDocumento12 páginasMarketing-Principles - Study ResourcesSenumi FonsekaAinda não há avaliações

- EcomomicDocumento103 páginasEcomomicZaheer AhmadAinda não há avaliações

- End Term Assignment Report On NykaaDocumento41 páginasEnd Term Assignment Report On NykaaannetteAinda não há avaliações

- Audit MCQs Book @mission - CA - InterDocumento148 páginasAudit MCQs Book @mission - CA - Intersantosh pandey100% (1)

- Group 9 Organizational MarketDocumento2 páginasGroup 9 Organizational MarketSofia NadineAinda não há avaliações

- ProblemDocumento8 páginasProblemCORES LYRICSAinda não há avaliações

- Adjusting THE AccountsDocumento51 páginasAdjusting THE AccountsShai Anne Cortez100% (1)

- The Impacts of Social Medias On Business OrganizationsDocumento4 páginasThe Impacts of Social Medias On Business OrganizationsMohan MohanAinda não há avaliações

- Business Plan PuffcloudDocumento76 páginasBusiness Plan PuffcloudfakhrurraziAinda não há avaliações

- Unit 4 - Market StructureDocumento6 páginasUnit 4 - Market StructureDarshan GedamAinda não há avaliações

- Stretch Your Data Management CapabilitiesDocumento13 páginasStretch Your Data Management Capabilities123assisAinda não há avaliações

- IFM Assignment On International Business Finance 2009Documento10 páginasIFM Assignment On International Business Finance 2009Melese ewnetie89% (9)

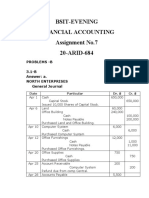

- Assignment No.7 AccountingDocumento7 páginasAssignment No.7 Accountingibrar ghaniAinda não há avaliações

- Unit 4 - RBV & Competences 1 - Main Lecture - TaggedDocumento12 páginasUnit 4 - RBV & Competences 1 - Main Lecture - TaggedLexie HoangAinda não há avaliações

- Standard Financial Analysis Tool: Project Name HereDocumento15 páginasStandard Financial Analysis Tool: Project Name HereBharath.v kumarAinda não há avaliações

- Solution For Construction AccountingDocumento2 páginasSolution For Construction AccountingAliah CyrilAinda não há avaliações

- AMM - Midwest Aluminum PremiumDocumento13 páginasAMM - Midwest Aluminum Premiumnerolf73Ainda não há avaliações

- Chapter 3 Fundamentals of Corporate Finance 9th Edition Test Bank PDFDocumento24 páginasChapter 3 Fundamentals of Corporate Finance 9th Edition Test Bank PDFChristian GoAinda não há avaliações

- Soya SauceDocumento8 páginasSoya Sauceizaru24Ainda não há avaliações

- Title DefenseDocumento5 páginasTitle DefenseJaqueline Mae AmaquinAinda não há avaliações

- Derivatives Questions and SolutionsDocumento55 páginasDerivatives Questions and SolutionsFaheem MajeedAinda não há avaliações

- Acc 2021 T1 Week 1 CO Accounts ENGDocumento9 páginasAcc 2021 T1 Week 1 CO Accounts ENGRyno de BeerAinda não há avaliações