Escolar Documentos

Profissional Documentos

Cultura Documentos

Credit Card Board Questions

Enviado por

grishma jadav0 notas0% acharam este documento útil (0 voto)

199 visualizações14 páginasCredit card providers often offer incentives such as frequent flyer points, gift certificates, or cash back (typically up to 1 percent based on total purchases) to try to attract customers to their programs. Low interest credit cards or even 0% interest credit cards are available.

Descrição original:

Direitos autorais

© Attribution Non-Commercial (BY-NC)

Formatos disponíveis

PPT, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoCredit card providers often offer incentives such as frequent flyer points, gift certificates, or cash back (typically up to 1 percent based on total purchases) to try to attract customers to their programs. Low interest credit cards or even 0% interest credit cards are available.

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PPT, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

199 visualizações14 páginasCredit Card Board Questions

Enviado por

grishma jadavCredit card providers often offer incentives such as frequent flyer points, gift certificates, or cash back (typically up to 1 percent based on total purchases) to try to attract customers to their programs. Low interest credit cards or even 0% interest credit cards are available.

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PPT, PDF, TXT ou leia online no Scribd

Você está na página 1de 14

Q1:- WHAT ARE THE VARIOUS

FACILITIES OFFERED TO A CREDIT AND

DEBIT CARD HOLDER?

ANSWER:-

• Because of intense competition in the credit card

industry, credit card providers often offer incentives

such as frequent flyer points, gift certificates, or

cash back (typically up to 1 percent based on total

purchases) to try to attract customers to their

programs.

• Low interest credit cards or even 0% interest credit

cards are available.

• The only downside to consumers is that the period of

low interest credit cards is limited to a fixed term,

usually between 6 and 12 months after which a higher

rate is charged.

• However, services are available which alert credit card

Q2:- New types of credit card available

in the market?

Answer:

• Credit Card: The basic form of credit card gives

credit to the user. The grace period varies from 20-50

days. One can choose to pay all dues at one go or

settle them in monthly installments. It also gives

various benefits like travel discounts, discount on

retail loans.

• Charge card: Its similar as that of the credit card but

its dues are to be paid on its due date. Settlement in

installments is not applicable.

• Global card: global card enables you to use your

credit card even when u are overseas. You can spend

in dollars and other foreign currency and still settle

dues in local currency. The credit limit is fixed on basic

travel quota BTQ we can withdraw cash up to 500 US

• Smart card: A smart card, combines credit card and

debit card properties. The contact pads on the card

enable electronic access to the chip. A smart card,

chip card, or integrated circuit card (ICC), is defined as

any pocket-sized card with embedded integrated

circuits which can process information.

• Corporate credit card: Issuers negotiate package

with major employers for issuance of credit cards to

their executives. They are issued under one umbrella

scheme and at heavily discounted annual fees.

corporate card negotiates extra privilege

• ATM card: Banks offer this card to its deposit holder

for free of cost. its used to withdraw cash from bank

accounts when bank counters are closed or even when

counters are open to save on time.

• Co-branded card: leading merchant

establishment banks especially chains have

started issuing co-branded cards. they offer extra

benefits to card holders. HPCL offers petrol /fuel

credit points as benefits. Jet airways offers extra

miles. Big bazaar and times of India also offers

various offers on events and entertainment

arranged by them.

• Online card: They are different cards for online

web based transactions it provides good security

against frauds. Small limits of rs.1000/- are ser on

such cards to prevent big online frauds. Original

credit card is not valid for online transactions.

Q3. Who are the parties to credit

card?

Explain about them.

Answer:

• Cardholder: The holder of the card used to make

a purchase; the consumer.

• Card-issuing bank: The financial institution or

other organization that issued the credit card to

the cardholder. This bank bills the consumer for

repayment and bears the risk that the card is

used fraudulently.

• Merchant: The individual or business accepting

credit card payments for products or services sold

to the cardholder

• Acquiring bank: The financial institution

accepting payment for the products or services

• Independent sales organization: Resellers (to

merchants) of the services of the acquiring bank.

• Merchant account: This could refer to the

acquiring bank or the independent sales

organization, but in general is the organization

that the merchant deals with.

• Credit Card association: An association of card-

issuing banks such as Visa, MasterCard,

Discover, American Express, etc. that set

transaction terms for merchants, card-issuing

banks, and acquiring banks.

• Transaction network: The system that

implements the mechanics of the electronic

transactions. May be operated by an independent

company, and one company may operate

multiple networks.

• Transaction processing networks include:

Cardnet, Nabanco, Omaha, Paymentech, NDC

Atlanta, Nova, Vital, Concord EFSnet, and

VisaNet.

• Affinity partner: Some institutions lend their

names to an issuer to attract customers that have

a strong relationship with that institution, and get

paid a fee or a percentage of the balance for each

card issued using their name. Examples of typical

affinity partners are sports teams, universities,

charities, professional organizations, and major

retailers.

• Information: The flow of information and money

between these parties — always through the card

Q4. Discuss the advantages and

disadvantages of credit cards to its

member and its bank.

Answer: ADVANTAGE

To Members/Cardholders

• Convenience: It is very convenient to carry a card as

compared to cash. Its acceptance is better than

cheques. Risk of theft is less and if stolen, stoppage

and recovery is better than cash and cheque. It is

even more convenient for unplanned purchases and

needs as one may not carry enough cash every time.

• Spot credit: As and when needed, credit is available.

Its pre negotiated (decided) credit limit which can be

availed of whenever desired. Credit is free of interest

till first immediate billing cycle. This improves

purchasing power.

• Easy payments: Minimum balance payment for each

bill is a must. Over and above this, it is cardholder’s

ability and willingness to pay for each card bill.

• ATM cash: Cash can be withdrawn from ATMs as and

when required. This is very important feature in

countries like India where cash usage is more as

compared to other modes of payments. Thus card

improves liquidity and credibility of the cardholders.

• Reward points and discounts: These are additional

benefits provided by issuer for usage of card. Reward

points can be converted to discount and gifts as per

the catalogue of the issuer.

• Privileges: Access to VIP lounges at the airport and

star hotels is an additional privilege for the cardholder.

• Other loans: Bankers provide personal loans, car

loans, etc. with some priority and ease if cardholders

payment history is good.

• Balance transfer: Bankers encourage cardholders to

transfer their outstanding dues to other issuers card to

their bank card. This transfer is again at a concession

rate of interest.

• Insurance: Most bankers insure the life of

cardholders at a concessional rate of interest and

assign insurance proceeds towards outstanding bill on

the card. In case of eventuality, insurance proceeds

meet bankers outstanding dues and remainder

amount is paid to the heirs of the cardholder.

To bank/issuers

• Profit: APR is high on credit cards as these are high

risk unsecured loans. If cards are issued with proper

due diligence then defaults is less and banker’s profit

in the card business are high.

• New customers: New customers get hooked to

bankers as cardholders. It is easy to sell them other

products such as housing loans, auto loans, bank

assurance products later on.

• Brand image: Card issuing bank creates better brand

images in the minds of its customer as compared to

other banks.

• ATM sharing fees: Bankers who establish their own

ATMs get sharing fees from other banks if other banks

Disadvantages

To Members/Cardholders

• Some people have been swindled by giving their

credit card numbers to dishonest salespeople over the

phone.

• It becomes a loan when the credit becomes due and

you do not pay for it.

• Adding monthly interest charges means you pay more

for the goods and services.

• Overspending: Consumers can fall into the habit of

using credit cards to extend their income.

• Cost: Cost of card is high. Annual fee, APR, penalties,

lost card replacement charges is significant.

• Habitual borrowing: With popularity of card, stigma

on loans as negative feature of life, has vanished.

Borrowing and enjoying life is no longer looked down

upon. Unknowingly everyone has become a habitual

borrower. Incidentally no religious book approves of

this style of living.

• Fraud risk: Credit card are used as a smart idea by

the frauds. Stolen or misplaced credit cards are used

for shopping, ATM transactions and also online

purchases.

To bank/issuers

• Risk: cards are unsecured loans. Recovery

mechanism does not have any recourse on assets.

Legal backup thus limited. Establishing a recovery

system within these limitations is a high cost affair.

• Servicing cost: cards are technology oriented . cards

are costly. Issuance process, billing and payment

processing is a laborious and costly affair.

• Utilization dependency: banks earn well on cards

are used frequently by the holders. Indian psyche is

not very tuned to careless use. Cards which are not

used much are in fact cost burden on the bank.

• Payment habits: APR interest earnings are

significant provided part of billed amount is rolled over

to the next billing. If many customers pay full bill

every time, there is no APR earning for bank.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- REVIEW OF THE ACCOUNTING PROCESS OM Chapter 1Documento29 páginasREVIEW OF THE ACCOUNTING PROCESS OM Chapter 1shanAinda não há avaliações

- Consignee Copy: PO Box 620, Micro Corporation Daska Road Pakki Kotli SialkotDocumento1 páginaConsignee Copy: PO Box 620, Micro Corporation Daska Road Pakki Kotli SialkotSarang TradersAinda não há avaliações

- Logistics & Distribution Management: Name Roll No. Organization Position HeldDocumento18 páginasLogistics & Distribution Management: Name Roll No. Organization Position HeldVikas SinglaAinda não há avaliações

- The Nigerian Financial System at A Glance - Monetary Policy DepartmentDocumento356 páginasThe Nigerian Financial System at A Glance - Monetary Policy DepartmentAgbons EbohonAinda não há avaliações

- Quatra UsermanualDocumento32 páginasQuatra UsermanualSokratesAinda não há avaliações

- Week 2-3 QuizDocumento11 páginasWeek 2-3 QuizMyrna Maluping KhanAinda não há avaliações

- Microfinance in IndiaDocumento12 páginasMicrofinance in IndiaRavi KiranAinda não há avaliações

- SOFP HartaDocumento1 páginaSOFP Hartaワンピ ースAinda não há avaliações

- Chand 1Documento14 páginasChand 1angus1439Ainda não há avaliações

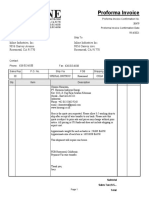

- Proforma InvoiceDocumento2 páginasProforma InvoiceRichard TitipbeliinAinda não há avaliações

- Banking and Finance Project-1Documento37 páginasBanking and Finance Project-1ADITYA DHONEAinda não há avaliações

- E-Commerce and Social Media ImpactDocumento11 páginasE-Commerce and Social Media ImpactShane MastroAinda não há avaliações

- MGFP BrochureDocumento26 páginasMGFP BrochureAbhinesh KumarAinda não há avaliações

- Novatek Layer Mash - Rfq-Kcsa-9492 PDFDocumento1 páginaNovatek Layer Mash - Rfq-Kcsa-9492 PDFKennedy MsimukoAinda não há avaliações

- Inventory Management System of GrofersDocumento66 páginasInventory Management System of Grofersvarsha meena100% (1)

- Master Data:: Bulk Upload - ZME11Documento32 páginasMaster Data:: Bulk Upload - ZME11veeramaniAinda não há avaliações

- Oleh Riza Safitri Pembimbing Desmiyawati Dan Meilda WigunaDocumento14 páginasOleh Riza Safitri Pembimbing Desmiyawati Dan Meilda WigunaSabina SabinaAinda não há avaliações

- Pharmacy ManagementDocumento10 páginasPharmacy ManagementLâm Tường NguyễnAinda não há avaliações

- Firstcry WriteupDocumento2 páginasFirstcry Writeuph20230845Ainda não há avaliações

- Original Campus: Direct Debit Request New Customer FormDocumento2 páginasOriginal Campus: Direct Debit Request New Customer FormXiomara EscobarAinda não há avaliações

- Valuation Report RADocumento8 páginasValuation Report RAvedadAinda não há avaliações

- Adyen Shareholder Letter FY23 H2Documento49 páginasAdyen Shareholder Letter FY23 H2Ashutosh DessaiAinda não há avaliações

- Statement Syahinur Nov 2020Documento13 páginasStatement Syahinur Nov 2020Penguin KuningAinda não há avaliações

- Ank ResumeDocumento2 páginasAnk ResumeGouresh ChauhanAinda não há avaliações

- Airtel Case Study PDFDocumento412 páginasAirtel Case Study PDFrishabh shuklaAinda não há avaliações

- Proof of Cash SolutionsDocumento4 páginasProof of Cash SolutionsyowatdafrickAinda não há avaliações

- V13 Manual 1.0Documento336 páginasV13 Manual 1.0lp456Ainda não há avaliações

- Visa User ManualDocumento133 páginasVisa User ManualJacobOlawaleAinda não há avaliações

- History of IDBI BankDocumento65 páginasHistory of IDBI BankKumar SwamyAinda não há avaliações