Escolar Documentos

Profissional Documentos

Cultura Documentos

Activity Based Management

Enviado por

Joswa Caxton0 notas0% acharam este documento útil (0 voto)

270 visualizações62 páginasActivity Based Management

ABM : Concept

Value Added Analysis Tree

Value added activity

Strategic activity

Support activity

Value added analysis in manufacturing

Investopedia: Activity-based management can be applied to different types of companies, including manufacturers, service providers, non-profits, schools and government agencies, and ABM can provide cost information about any area of operations in a business. In addition to improving profitability, the results of an ABM analysis can help a company produce more accurate budgets and financial forecasts

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PPTX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoActivity Based Management

ABM : Concept

Value Added Analysis Tree

Value added activity

Strategic activity

Support activity

Value added analysis in manufacturing

Investopedia: Activity-based management can be applied to different types of companies, including manufacturers, service providers, non-profits, schools and government agencies, and ABM can provide cost information about any area of operations in a business. In addition to improving profitability, the results of an ABM analysis can help a company produce more accurate budgets and financial forecasts

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PPTX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

270 visualizações62 páginasActivity Based Management

Enviado por

Joswa CaxtonActivity Based Management

ABM : Concept

Value Added Analysis Tree

Value added activity

Strategic activity

Support activity

Value added analysis in manufacturing

Investopedia: Activity-based management can be applied to different types of companies, including manufacturers, service providers, non-profits, schools and government agencies, and ABM can provide cost information about any area of operations in a business. In addition to improving profitability, the results of an ABM analysis can help a company produce more accurate budgets and financial forecasts

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PPTX, PDF, TXT ou leia online no Scribd

Você está na página 1de 62

R Joswa Caxton (13MM08)

Activity Based Management

ABM : Concept

Value Added Analysis Tree

Value added activity

Strategic activity

Support activity

Value added analysis in manufacturing

Syllabus

ABM: CONCEPT

A procedure that originated in the 1980s for analyzing the processes of a business to

identify strengths and weaknesses. Specifically, activity-based management seeks out

areas where a business is losing money so that those activities can be eliminated or

improved to increase profitability.

ABM analyzes the costs of employees, equipment, facilities, distribution, overhead and

other factors in a business to determine and allocate activity costs.

Investopedia: Activity-based management can be applied to different types of

companies, including manufacturers, service providers, non-profits, schools and

government agencies, and ABM can provide cost information about any area of

operations in a business. In addition to improving profitability, the results of an ABM

analysis can help a company produce more accurate budgets and financial forecasts.

Definition of ABM

Activity-Based Management (ABM) manages activities to improve the value of

products or services to customers and increase the firms competitiveness and

profitability.

ABM draws on ABC as its major source of information and focuses on the

efficiency and effectiveness of key business processes and activities.

Using ABM, management can pinpoint avenues for improving operations,

reducing costs, or increasing values to customers.

By identifying resources spent on customers, products, and activities, ABM

improves managements focus on the firms critical success factors and enhances its

competitive advantage.

BRIEFING ABM

ABM supports business excellence by providing information to facilitate long-term

strategic decisions about such things as product mix.

ABM allows product designers to understand the impact of different designs on

cost and flexibility and then to modify their designs accordingly.

ABM is more than an accounting tool; it's a system for continuous improvements.

The real value and power of ABM comes from the knowledge and information that

leads to better decisions and the leverage it provides to measure improvement.

BRIEFING ABM

ABM classification

ABM

Operational

ABM

Strategic

ABM

It enhances operation efficiency and asset utilization and lowers costs;

Operational ABM applications use management techniques such as

activity management, business process reengineering, total quality

management, and performance measurement.

ABM classification :Operational ABM

Strategic ABM attempts to alter the demand for activities and increase

profitability through improved activity efficiency.

Strategic ABM focuses on choosing appropriate activities for the

operation, eliminating nonessential activities and selecting the most

profitable customers.

Strategic ABM applications use management techniques such as process

design, customer profitability analysis, and value chain analysis.

ABM classification : Strategic ABM

ABCs Horizontal view of Org.

The cost of activities and business processes;

The cost of non-value-added activities;

Activity-based performance measures;

Accurate product/service cost (cost objects);

Cost drivers.

Outputs of ABM

The cost of activities and business processes

The basic output of the ABM system must be to provide relevant cost

information about activities.

The cost of non-value-added activities

A non-value added activity is an activity that is considered not to

contribute to customer value or to the organization's need.

This is defined as waste. Identification of waste is valuable to

management.

This crucial information output provides a focal point for improvement

efforts.

Outputs of ABM

Activity-based performance measures

In addition to cost information for business processes and activities, the

ABM system must report information and data on activity performance.

Knowing the total cost of activity is insufficient to measure activity

performance.

Activity measures of quality, cycle time, productivity and customer

service may also be required to judge activity performance.

Outputs of ABM

Accurate product/service cost (cost objects)

Because products and services consume resources at different

rates and require different levels of support, costs must be

accurately determined.

Cost drivers

A cost driver is any factor that causes a change in the cost of an activity.

An activity may have multiple cost drivers associated with it.

Outputs of ABM

ABM MODEL

ABM MODEL - Cost Accounting Management-

International (CAM-I)

Steps in ABM Implementation

Analysis of activities

Identify value-added and non-value-added activities

Analysis of critical activities

Compare activities with benchmarking

Improvement of activities

Reduce the time or effort required to perform an activity

Eliminate unnecessary activities

Select low-cost activities

Sharing of activities

Steps in ABM Implementation

Performance measurements

Identify the root cause of the problem

The 5 whys - Fix the problem, not treat

the symptom

Estimate cost and cost savings

Evaluate results

Steps in ABM Implementation

Activity Analysis

To be competitive a firm must assess each of its activities based on its need

by the product or customer, its efficiency, and its value content.

REASON FOR ANALYSIS

It is required to meet the specification of the product or service or satisfy

customer demand.

It is required to sustain the organization.

It is deemed beneficial to the firm.

Activity Analysis

Activity Analysis: The Heart of Cost Reduction

1. Activity elimination

2. Activity selection

3. Activity reduction

4. Activity sharing

Activity Analysis Can Reduce Costs Four Ways:

Value Added Analysis Tree

Analysis and

Classification

Value-

added

Activities

Nonvalue-

added

Activities

Activities

Reduce or

Eliminate

Continually Evaluate

and Improve

Value Added Analysis Tree

Activities that augment accuracy

That are necessary or required to meet

customer requirements or expectations.

That enhance purchased materials or

components of a product.

That contribute to customer satisfaction.

VA & NVA

That are critical steps in a business process.

That are performed to resolve or eliminate

quality problems.

That are performed upon request of a

satisfied customer.

That you would do more of, if time

permitted

A value-added activity is one that, if eliminated, would affect the accuracy and

effectiveness of the newscast and decrease total viewers as well as ratings for that time

slot.

Activities that augment delay

Can be eliminated without affecting the form, fit,

or function of the product or service.

Begin with prefix re (such as rework or

returned goods).

Result in waste and add little or no value to the

product or service.

Are performed due to inefficiencies or errors in

the process stream

VA & NVA

Are duplicated in another department or add

unnecessary steps to the business process.

Are performed to monitor quality problems.

Are performed due to a request of an unhappy

or dissatisfied customer.

Produce an unnecessary or unwanted output.

If given the option, you would prefer to do less

of.

A low-value-added activity is one that, if eliminated, would not affect the accuracy and

effectiveness of the newscast. The activity contributes nothing to the quest for viewer retention

VA & NVA

Activity Performance Measurement

Activity Performance Measurement

1. Efficiency

2. Quality

3. Time

Three Dimensions of Activity Performance

Operational Measures for Quality

1. Defects per unit

2. Number of defective units per total units produced

3. Percent of external failures

4. Pounds of scrap per total pounds of materials issued

Operational Measures for Efficiency

Output per materials

Output per labor hours

Output per persons employed

Output per kilowatt hours

Operational Measures for Time

Three Major cost elements:

1. Development costs: planning,

design, and testing

2. Production costs: conversion

activities

3. Logistics support costs:

advertising, distribution, warranty,

etc.

Planning Design Testing Production Logistics

100

90

75

25

Cost Commitment Curve

Life Cycle

Cost %

90 percent of life-cycle

costs are committed at this

point

Activity improvement

Integrating and linking ABM with existing performance measurement

systems, improvement initiatives, reward systems, value-based and core

competencies

Ensuring that system design specifications take into account techniques

such as benchmarking

transferring ownership of the system to line management;

Implementing and emphasizing continuous improvement;

Training managers on how to use the ABM information

Activity improvement

The Strategic Management

ABM and The

Strategic

Management

Process

Customer Profitability Analysis

Customer Profitability Analysis

Customer profitability analysis uses

activity-based costing to determine

the activities, costs, and profit associated

with serving particular customers.

Customer Profitability Analysis

Orders

small

quantities.

Orders

frequently.

Often

changes

orders.

Required

special

packaging.

Demand

fast

service.

A costly customer

Identify most profitable customers.

Manage each customers costs-to-serve to a lower level.

Establish a surcharge for or re-pricing expensive costs-to-serve activities.

Reduce services for high cost-to-serve customers.

Introduce new products and services.

Improve the process of customer service.

Offer discounts to gain more volume with low costs-to-serve customers.

Select customer mixWhat types of customer should we market to? What

types should we not market to?

Choose types of after-sale services to provide.

Customer Profitability Analysis

Identifies activities and cost drivers to service customers before and after

sales, not including product costs.

customer-specific activities include:

Order processing costs.

Billing, collection, and payment processing costs.

Accounts receivable and carrying costs.

Customer service costs.

Return or allowance processing costs.

Restocking costs, Selling and marketing costs.

Customer Cost Analysis

Customer unit-level cost resources consumed for each unit sold to a

customer

Customer batch-level cost resources consumed for each sales

transaction

Customer-sustaining cost resources consumed to service a customer

regardless of the number of units or batches sold

Distribution-channel cost resources consumed in each distribution

channel the firm uses to service customers.

Sales-sustaining cost resources consumed to sustain sales and

service activities that cannot be traced to an individual unit, batch,

customer, or distribution channel.

Customer cost analysis

Focus on critical needs

Get top management support

The main cost system

Consider a separate model

The existing information system

The implementation team

Start with product costing

Guidance on implementing ABM

Case study :

G. E. Mustill (GEM)

G. E. Mustill (GEM) is a small company with 0.5 million annual

turnover.

It employs about 20 people and is located in Essex, England. The main

products of GEM are four types of machines ( viz. sander, splitter, shaper

and foiler) for the picture framing industry.

The foiler and sander machines are produced in different numbers of

heads varying from 1 to 6.

They produce machines in standard specifications and according to

customers requirements.

The company manufactures only 22% of parts of the machine in-house

and purchases 78% of parts from subcontractors and suppliers.

The assembly of all these parts is the main activity of the company

About GEM

The company works in a traditional way and all activities are performed

manually.

Information provided by an ABC system is used to find the opportunities of

improvement in organization at the activity level.

The analysis of activities involves classification of activities into value added

and non-value added and then compare these with that of the world class

company or the best practices.

Benchmarking with the best practice offers avenues for improvement in

value-added activities.

This also explains how management can use the cost drivers as the

performance measures and control the volume of cost drivers.

The ideal cost object is `products that are sold to customers. The cost of all

activities is calculated in a similar way to that of parts

About GEM

In this case study the problem is approached in three steps

Analysis of activities

Compare activities with benchmarking

Performance measurements

Approach

Marketing:

The annual cost o f marketing is 23 330 which is divided equally between

four types of machines.

Then, this amount is divided by eight because the annual sale of a four-head

foiler is eight machines. Therefore, the marketing cost for this product is

729.06.

Inventory carrying cost:

The cost driver for inventory carrying is the stock value.

The total s tock value in GEM is 20 000. For a four-head foiler, the stock

value is 1600. Hence, the inventory carrying cost for this machine is 491.20.

General analysis

Engineering support:

The cost driver for this activity is the time spent by the engineering support

staffs for a particular product.

For this machine, a total of 80 h is spent by the engineering staffs and hence

the cost of engineering support activity is 1480..

Assembly:

The assembly of the machine is per-formed manually.

The cost driver for assembly activity is the labour hours and the volume of the

cost driver is 82 h. This leads to the total assembly cost as 886.42.

General analysis

The total cost of a four-head foiler

ABC provides detailed information about the company and its activities

Analysis of activities

Once the cost of each activity is calculated, the next step is to identify the

value-added and non-value-added activities

Analysis of activities

It may not be possible to eliminate or reduce all nonvalue-adding activities at the

same time. The key is then to focus on the critical activities which form a major

portion of the total cost.

Analysis of activities

Purchasing:

World-class companies have a direct link with suppliers and subcontractors by the

electronic data exchange (EDI) system, and it places orders automatically

whenever materials are required.

This leads to a reduction in ordering cost, lead time and overall purchasing cost as

compared with that of manual order processing. Hence, there is room for

improvement in the purchasing activity of GEM.

Assembly:

The assembly activity is performed manually in GEM. Compared to an automatic

assembly activity, there are many chances of improvements.

The cost of automation should be justified based on the labour cost and response

time including tangible and intangible costs and benefits. .

Compare activities with benchmarking

Material handling:

The movement of materials between these stations is the cost driver. It is

possible to reduce this movement by using multipurpose machines (AS/R S,

robots, AGV s) to perform various operations.

The movement of materials can also be reduced by changing the layout of

machines. .

Machining operations:

GEM uses very old machines to perform basic activities like drilling, milling

etc. and these are labour intensive.

These machining operations can be compared with that of the CNC machine

tools.

Compare activities with benchmarking

Non-value-added activities are clearly identified. In GEM, the inventory

carrying activity is the major nonvalue-added activity which should be

eliminated.

However, it is difficult because the purchasing cost of the present system

will increase as the company places more purchased orders with the

objective to reduce inventories. Therefore, it indicates that the

purchasing activity should also improve.

The comparison of this purchasing activity with the best practice

(purchasing using EDI) indicates the scope for improvements.

Performance measurements

The costing at part level or subassembly level helps the

management in a make or buy decision. The analysis of

activities to identify value-added and non-value-added

activities and benchmarking at the activity level direct

improvement efforts in the right direction.

Conclusion

Implementing Activity-Based Management: Avoiding the Pitfalls : Institute of

Management Accountants (IMA)

DEVELOPING AND PROMOTING STRATEGY : Activity-based Management

An Overview : CIMA Technical briefing

Activity-based management in a small company: a case study by A.

GUNASEKARAN, R. MCNEIL and D. SINGH (PRODUCTION PLANNING &

CONTROL, 2000, VOL. 11, NO. 4, 391 399)

ACTIVITY-BASED COST MANAGEMENT - An Executives Guide by Gary

Cokins, publication : John Wiley & Sons, Inc.

Reference

THANK YOU

Você também pode gostar

- Management Accounting and The Business EnvironmentDocumento36 páginasManagement Accounting and The Business EnvironmentArmi Niña Bacho RoselAinda não há avaliações

- Strategic MangementDocumento59 páginasStrategic MangementAnand_Bhushan28Ainda não há avaliações

- Supply Chain Management OverviewDocumento104 páginasSupply Chain Management OverviewPiyush GuptaAinda não há avaliações

- Director of FinanceDocumento2 páginasDirector of Financeapi-76965023Ainda não há avaliações

- Starbucks Case Analysis Executive SummaryDocumento18 páginasStarbucks Case Analysis Executive Summarysatesh singhAinda não há avaliações

- BackflushingDocumento12 páginasBackflushingSwoyam Prakash SahooAinda não há avaliações

- Sales BudgetingDocumento9 páginasSales BudgetingAvishek DasguptaAinda não há avaliações

- MC Case 1 - Mountain DewDocumento1 páginaMC Case 1 - Mountain DewkaranAinda não há avaliações

- Us DFDTN 18 10 Case Antelope Run IncDocumento3 páginasUs DFDTN 18 10 Case Antelope Run IncAnonymous h5knn2Ainda não há avaliações

- Accounting Packages and Systems-Assignment-Spring TermDocumento18 páginasAccounting Packages and Systems-Assignment-Spring TermChocopie Thanh Tân PhanAinda não há avaliações

- Myths of Outsourcing McKinseyDocumento6 páginasMyths of Outsourcing McKinseyapi-3832481Ainda não há avaliações

- Strategy FormulationDocumento9 páginasStrategy Formulationapi-3774614100% (1)

- Value Creating PurchasingDocumento13 páginasValue Creating Purchasingmanish.cdmaAinda não há avaliações

- PP Repetitive ManifacturingDocumento293 páginasPP Repetitive Manifacturingsai varegeAinda não há avaliações

- Energy Company Balance Scorecard ExampleDocumento13 páginasEnergy Company Balance Scorecard ExampleIan Liu100% (1)

- Project G - Komatsu Case - Uploaded To ScribdDocumento7 páginasProject G - Komatsu Case - Uploaded To ScribdAnonymous VBGPd76IERAinda não há avaliações

- The Demand ReviewDocumento4 páginasThe Demand ReviewShwan ShalmashiAinda não há avaliações

- S&op PDFDocumento4 páginasS&op PDFjjimenez3000Ainda não há avaliações

- Hoshin KanriDocumento3 páginasHoshin KanrisaifieAinda não há avaliações

- Organisational Change - BPM - OracleDocumento13 páginasOrganisational Change - BPM - OracleFrederico Afonso FragosoAinda não há avaliações

- Cross 1988Documento11 páginasCross 1988deltanueveAinda não há avaliações

- HBSP Resources EM Lyon - April 2017Documento24 páginasHBSP Resources EM Lyon - April 2017vothiquynhyen100% (1)

- Report On Service and Maintenance ModuleDocumento2 páginasReport On Service and Maintenance ModuleSithara PsAinda não há avaliações

- Analysis of Production Lines Bottlenecks PDFDocumento15 páginasAnalysis of Production Lines Bottlenecks PDFtsholofelo motsepeAinda não há avaliações

- Strategy FormulationDocumento31 páginasStrategy FormulationAftAb AlAm50% (2)

- Strategic Finance Syllabus 2017Documento9 páginasStrategic Finance Syllabus 2017Alifya ZahranaAinda não há avaliações

- AnnataDocumento2 páginasAnnataDidi RKAinda não há avaliações

- Strategic Management and Projects - Doc 2nd Draft.4.3 (2) .Doc FeddDocumento212 páginasStrategic Management and Projects - Doc 2nd Draft.4.3 (2) .Doc FeddTaddyBestAinda não há avaliações

- C5Documento52 páginasC5lia lestary100% (1)

- SUBJECT: Strategic Management Presentation Topic:: Strategy Formulation and ChoiceDocumento52 páginasSUBJECT: Strategic Management Presentation Topic:: Strategy Formulation and ChoicePrashant DubeyAinda não há avaliações

- Unit-5-Strategic ManagementDocumento31 páginasUnit-5-Strategic ManagementSumatthi Devi ChigurupatiAinda não há avaliações

- 13.SCM - Make Vs BuyDocumento2 páginas13.SCM - Make Vs BuyWah KhaingAinda não há avaliações

- J229-Enterprise Risk Management at InfosysDocumento5 páginasJ229-Enterprise Risk Management at InfosysRishikaAinda não há avaliações

- A Stakeholder Approach and Business EthicsDocumento16 páginasA Stakeholder Approach and Business EthicsLiora Claire AngelicaAinda não há avaliações

- What Is "Strategy"?Documento33 páginasWhat Is "Strategy"?prabin ghimireAinda não há avaliações

- Balanced Scorecard PaperDocumento10 páginasBalanced Scorecard Paperkiki mimiAinda não há avaliações

- Nibco's-Big Bang Sap ImplemetationDocumento21 páginasNibco's-Big Bang Sap ImplemetationSilvester67% (3)

- Business Portfolio AnalysisDocumento66 páginasBusiness Portfolio AnalysisPrashant Kalaskar100% (1)

- Management Control System: DR Rashmi SoniDocumento35 páginasManagement Control System: DR Rashmi SoniPriyanka ReddyAinda não há avaliações

- Wow Your C-Suite: With Eight Key Strategies For Your S&OP ProcessDocumento18 páginasWow Your C-Suite: With Eight Key Strategies For Your S&OP ProcessSivaAinda não há avaliações

- IBM - Ansoff Matrix, Space Atrix & Swot MatrixDocumento15 páginasIBM - Ansoff Matrix, Space Atrix & Swot MatrixWatisenla Noella PongenAinda não há avaliações

- Make or Buy ApproachDocumento4 páginasMake or Buy Approachporseena100% (1)

- Strategic Plan Format TemplateDocumento10 páginasStrategic Plan Format TemplateFiola WilliamsAinda não há avaliações

- AT Kearney ERP MythsDocumento11 páginasAT Kearney ERP MythsSamirAinda não há avaliações

- Business Process ReengineeringDocumento9 páginasBusiness Process ReengineeringGunjan NarulkarAinda não há avaliações

- 3.6.7 - UAT Test Script Details - AXDocumento11 páginas3.6.7 - UAT Test Script Details - AXVishal VermaAinda não há avaliações

- Focussed FactoryDocumento13 páginasFocussed FactoryjcspaiAinda não há avaliações

- AS 17 Segment Reporting - Objective Type Question PDFDocumento44 páginasAS 17 Segment Reporting - Objective Type Question PDFrsivaramaAinda não há avaliações

- Terracog Global Positioning System: Conflict and Negotiation On Project AerialDocumento13 páginasTerracog Global Positioning System: Conflict and Negotiation On Project AeriallibrastrikersAinda não há avaliações

- Chap 7 Tanner - Organizing The Sales Force & Reporting Relationships 080217Documento35 páginasChap 7 Tanner - Organizing The Sales Force & Reporting Relationships 080217Osama Riaz100% (1)

- Business Policy and Strategy PDFDocumento13 páginasBusiness Policy and Strategy PDFAnmol GuptaAinda não há avaliações

- Boundaryless OrganizationDocumento26 páginasBoundaryless OrganizationSharmi RoyAinda não há avaliações

- StarbucksDocumento9 páginasStarbucksallen1191919Ainda não há avaliações

- Strategic MGT MidtermDocumento15 páginasStrategic MGT MidtermFayaz ThaheemAinda não há avaliações

- Accenture High Performance Cost AccountingDocumento16 páginasAccenture High Performance Cost AccountingogbomoshoAinda não há avaliações

- Activity Based ManagementDocumento2 páginasActivity Based ManagementMuhammad YameenAinda não há avaliações

- CHP 19 - Ab&tcDocumento18 páginasCHP 19 - Ab&tcjayrjoshiAinda não há avaliações

- Business Process Performance MeasurementDocumento31 páginasBusiness Process Performance MeasurementShivkarVishalAinda não há avaliações

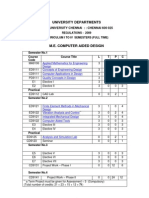

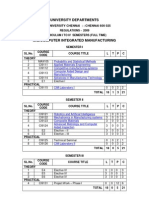

- University Departments: Anna University Chennai:: Chennai 600 025Documento47 páginasUniversity Departments: Anna University Chennai:: Chennai 600 025tauqeerabbasAinda não há avaliações

- 3G Prepaid Datacard ServiceDocumento4 páginas3G Prepaid Datacard ServiceShiva RamAinda não há avaliações

- M.E. Quality Engineering and Management SyllabusDocumento39 páginasM.E. Quality Engineering and Management SyllabusJoswa CaxtonAinda não há avaliações

- M.E. Mechatronics SyllabusDocumento38 páginasM.E. Mechatronics SyllabusJoswa CaxtonAinda não há avaliações

- M.E. Refrigeration and Air Conditioning SyllabusDocumento38 páginasM.E. Refrigeration and Air Conditioning SyllabusJoswa Caxton75% (4)

- M.E. Product Design & DevelopmentDocumento50 páginasM.E. Product Design & DevelopmentJoswa CaxtonAinda não há avaliações

- M.E. Internal Combustion Engineering SyllabusDocumento35 páginasM.E. Internal Combustion Engineering SyllabusJoswa CaxtonAinda não há avaliações

- Regu2009 ChennaiDocumento17 páginasRegu2009 ChennaipsnasabariAinda não há avaliações

- M.E. MANUFACTURING ENGINEERING AU SyllabusDocumento35 páginasM.E. MANUFACTURING ENGINEERING AU SyllabusJoswa CaxtonAinda não há avaliações

- M.E. Industrial Engineering SyllabusDocumento46 páginasM.E. Industrial Engineering SyllabusJoswa CaxtonAinda não há avaliações

- M.E. ENERGY ENGINEERING SyllabusDocumento44 páginasM.E. ENERGY ENGINEERING SyllabusJoswa CaxtonAinda não há avaliações

- Mathemagics Workbook - Chapter OneDocumento7 páginasMathemagics Workbook - Chapter OneJoswa CaxtonAinda não há avaliações

- M.E. Computer Aided Design SyllabusDocumento50 páginasM.E. Computer Aided Design SyllabusJoswa CaxtonAinda não há avaliações

- Puter Integrated Manufacturing SyllabusDocumento41 páginasPuter Integrated Manufacturing SyllabusJoswa CaxtonAinda não há avaliações

- BE/Btech Cgpa Calculator - Anna University Affiliated CollegesDocumento6 páginasBE/Btech Cgpa Calculator - Anna University Affiliated CollegesJoswa CaxtonAinda não há avaliações

- AutomobileDocumento33 páginasAutomobilemarinerajesh3022Ainda não há avaliações

- Meaning of Transfer PricingDocumento2 páginasMeaning of Transfer Pricingpanda_alekh100% (1)

- Using The Cost of Quality Approach For SoftwareDocumento6 páginasUsing The Cost of Quality Approach For SoftwareJayaletchumi MoorthyAinda não há avaliações

- Entrepreneurship Marking Scheme Commerce Subjects XII 2007Documento18 páginasEntrepreneurship Marking Scheme Commerce Subjects XII 2007Uttkarsh JaiswalAinda não há avaliações

- Marketing 1Documento47 páginasMarketing 1Kanza KhanAinda não há avaliações

- Asset Light ModelDocumento15 páginasAsset Light ModelNguyen Hoang AnhAinda não há avaliações

- Profit and LossDocumento11 páginasProfit and LossSanjeet MohantyAinda não há avaliações

- Iil Annual Report 2017pdfDocumento124 páginasIil Annual Report 2017pdfHassan KazmiAinda não há avaliações

- Case Study - Primus 97 Insurance RestructuringDocumento50 páginasCase Study - Primus 97 Insurance Restructuringgauravgupta3093Ainda não há avaliações

- Verma Panel FindingsDocumento17 páginasVerma Panel FindingsNaga Mani MeruguAinda não há avaliações

- Wintel Simulation Anish Naveen Venga Prianshi Selvaraj MirankDocumento4 páginasWintel Simulation Anish Naveen Venga Prianshi Selvaraj MirankAnish Kaulgud100% (1)

- Chapter 18 Business Expansion PowerpointDocumento16 páginasChapter 18 Business Expansion Powerpointapi-384311544Ainda não há avaliações

- Business Planning Musgrave SampleDocumento2 páginasBusiness Planning Musgrave Sampleunplug3d0% (1)

- OCR F297 Toolkit June 2013 PDFDocumento42 páginasOCR F297 Toolkit June 2013 PDFjobobo12100% (1)

- Statement of Comprehensive Income (Income Statement)Documento29 páginasStatement of Comprehensive Income (Income Statement)Alphan SofyanAinda não há avaliações

- HRM-III Excel AssignmentDocumento2 páginasHRM-III Excel AssignmentGaurav ChaudharyAinda não há avaliações

- Project - Viva On Financial Analysis of Indian BankDocumento36 páginasProject - Viva On Financial Analysis of Indian Banksanthoshni100% (5)

- Equity Incentive Compensation Plans For An LLCDocumento15 páginasEquity Incentive Compensation Plans For An LLClonghornsteveAinda não há avaliações

- Viraj Profiles LTD, Mumbai Vs Department of Income Tax On 21 October, 2015Documento30 páginasViraj Profiles LTD, Mumbai Vs Department of Income Tax On 21 October, 2015Gangadhar PatilAinda não há avaliações

- Effects of Management Accounting Practices On Financial Performance of Manufacturing Companies in Kenya PeterDocumento74 páginasEffects of Management Accounting Practices On Financial Performance of Manufacturing Companies in Kenya PeterRupesh More100% (1)

- 360dealtemplate No. 2Documento18 páginas360dealtemplate No. 2Tony DofatAinda não há avaliações

- Comparative Analysis of Financial Statement of Two CompaniesDocumento24 páginasComparative Analysis of Financial Statement of Two Companiesrexieace75% (4)

- ZachDocumento17 páginasZachapi-242784130Ainda não há avaliações

- Automation in Food ProcessingDocumento9 páginasAutomation in Food ProcessingMohamad KhamizanAinda não há avaliações

- CH15MANDocumento50 páginasCH15MANEmranul Islam ShovonAinda não há avaliações

- Jacobs Coffee Aldi CaseDocumento2 páginasJacobs Coffee Aldi CaseAnsgar John BrenninkmeijerAinda não há avaliações

- Binary Options Strategies How Make Money in Binary Options TradingDocumento269 páginasBinary Options Strategies How Make Money in Binary Options TradingThomas Jan78% (9)

- Project Report On Financial Analysis of HCLDocumento32 páginasProject Report On Financial Analysis of HCLSugun Sahdev100% (2)

- Marginal AnalysisDocumento9 páginasMarginal AnalysisJAPAinda não há avaliações

- Ambit BFSI SectorUpdate ICICIandAxis 05mar2014Documento37 páginasAmbit BFSI SectorUpdate ICICIandAxis 05mar2014Sameer SawantAinda não há avaliações