Escolar Documentos

Profissional Documentos

Cultura Documentos

Past and Future of Private Retirement Options

Enviado por

National Press FoundationDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Past and Future of Private Retirement Options

Enviado por

National Press FoundationDireitos autorais:

Formatos disponíveis

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

1

Dallas L. Salisbury

CEO and President, EBRI

salisbury@ebri.org

202-775-6322

ERISA at 40 the state of retirement plans

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

DC 1974 DOJ Pre ERISA, DOL and PBGC Age 24

2

EBRI Founding 1978 9/28/2013 was 35

th

Anniversary..Age 64

40 Years of Research

and Policy Analysis:

Retirement, Health, Savings, and

Other Employee Benefits

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

EBRI

3

Descriptive Not Normative

Policy maker goals and objectives will determine their interpretation of whether

the numbers presented tell a good or bad story do not bias them

Let the data fall where it may (see last point)

Consider actual behavior and risks in assessing possible outcomes

Run multiple scenarios

Look at all scenarios/outcomes by multiple demographic variables

Try to avoid ever giving a single number which is almost always what

has been asked for - as the answer to a complex question

Disclose strengths and limitations of EBRI research and modeling and do

the same for research and modeling done by others

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

4

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 2014

THE MOST COMMON

REQUEST WE GET:

GIVE ME ONE NUMBER

FOR..

5

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 2014

In Conclusion

82% Coverage

47% Coverage

28% Coverage

6

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 2014

Seriously.

7

ERISA definition change: defined contribution plans are pensions and

a pension does not necessarily have to pay a life income stream

ERISA vesting change: every participant that spends a reasonable time in

a plan should get some benefit -- ideally vesting will be immediate and

the cash and accrual will be portable

ERISA funding change: the money should always be in the plan and mark

to market is the appropriate method of valuing assets and liabilities

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 2014

Seriously.ERISA had consequences..

intended and unintended.

8

ERISA definition change: defined contribution plans are pensions and

a pension does not necessarily have to pay a life income stream

ERISA vesting change: every participant that spends a reasonable time in

a plan should get some benefit -- ideally vesting will be immediate and

the cash and accrual will be portable

ERISA funding change: the money should always be in the plan and mark

to market is the appropriate method of valuing assets and liabilities

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 2014

Seriously.ERISA had consequences..

intended and unintended.with key realities in most

defined contribution plans

9

ERISA definition change: defined contribution plans are pensions and

a pension does not necessarily have to pay a life income stream

ERISA vesting change: every participant that spends a reasonable time in

a plan should get some benefit -- ideally vesting will be immediate and

the cash and accrual will be portable

ERISA funding change: the money should always be in the plan and mar

ppropriate method of valuing assets and liabilities

Voluntary decision on whether or not to sponsor a plan

Voluntary decision on how expensive a plan to adopt

Voluntary emphasis on allowing the worker to opt out

Of participation

Of fixed contribution amount

Of specified investment

Voluntary emphasis on allowing the worker to choose withdrawal timing

Voluntary emphasis on allowing the worker to choose benefit form

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 2014

Seriously.ERISA had consequences..

intended and unintended.with key realities in most

defined contribution plans

10

ERISA definition change: defined contribution plans are pensions and

a pension does not necessarily have to pay a life income stream

ERISA vesting change: every participant that spends a reasonable time in

a plan should get some benefit -- ideally vesting will be immediate and

the cash and accrual will be portable

ERISA funding change: the money should always be in the plan and mar

ppropriate method of valuing assets and liabilities

ERISA recognized that employers and workers have different ability to pay,

that one size does not fit all, that flexibility encourages sponsorship and

participation.

The form of the Affordable Care Act the variations in mandate by employer

size, the number of options vis level of plan cost and protection, the

amount/form of income related premium subsidies, the inclusion of Medicaid

for the poor.

Underlines why moving to mandatory private savings programs has not

happenedand

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

11

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

Total Participants By Plan Type (Active, Vested, Retired)

12

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

13

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

% Sponsorship, Participation and Vesting

1940 2012

0

10

20

30

40

50

60

70

1940 1950 1960 1970 1974 1979 1988 1998 2009 2012

Sponsorship Participation % Vested %

14

U.S. Bureau of the Census, various datasets, 19402013.

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

15

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

16

Employee Benefit Research Institute 2014

17

Public Pension Debate - Replays ERISA Reform Debate

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

For Many State and Local Workers Public Pensions

Offer Little Retirement Security, Urban Institute Study

Shows

18

The traditional pension plans generally

provide lucrative retirement incomes to

long-term employees but offer little

retirement security to workers who change

employers several times over their career,

Traditional plans tend to encourage older

employees to retire early, a problematic

feature as the work force grows older.

These plans may complicate government

efforts to recruit younger employers and

retain older ones.

Richard Johnson, Urban Institute,

Director ,Program on Retirement Policy

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

19

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

20

Employee Benefit Research Institute 2014

Male Prime-Age (25-64) Workers Median

Tenure Trends, By Age, 1951-2010

3.5

2.7 2.7

4.5

7.6

6.0

6.7

7.3

6.5

6.1

5.5

5.3 5.2 5.2 5.3

7.6

11.4

11.5

11.8

10.1

9.4 9.5

9.6

8.1

8.2

8.5

9.3

13.0

14.5 14.6

15.3

14.5

13.4

10.5

11.2

10.2 10.2

9.8

9.5

10.1

10.4

3.2

2.8 2.9 3.0

2.8

2.7 2.8 2.8

3.2 3.2 3.1 3.1 3.0

5.1

7.0

5.0

6.9

8.8

11.0

12.8

9.1

11.2

14.7

0

2

4

6

8

10

12

14

16

18

1951 1963 1966 1973 1978 1983 1987 1991 1996 1998 2000 2002 2004 2006 2008 2010

Year

Y

e

a

r

s

o

f

T

e

n

u

r

e

Ages 25-34

Ages 35-44

Ages 45-54

Ages 55-64

Source: Data (for 1951, 1963, 1966, 1973, and 1978) from the Monthly Labor Review (September 1952, October 1963, January 1967,

December 1974, and December 1979); from press releases (for 1983, 1987, 1991, 1996, 1998, 2000, 2002, 2004, 2006, 2008, 2010) from the

U.S. Department of Labor, Bureau of Labor Statistics.

Employee Benefit Research Institute 2014

Female Prime-Age (25-64) Workers Median Tenure

Trends, by Age, 1951-2012

1.8

2.0

1.9

2.2

1.6

3.0

3.1 3.1

3.6

3.5

3.6 3.6

4.1

4.4

4.3

4.2

4.9

5.2

6.1

5.7

5.9 5.9

6.3

7.0

7.2

7.3

7.0

7.1

7.3

4.5

7.8

8.8

8.5

9.8

9.7

9.9

10.0

9.6

9.9

9.6

9.8

9.7

10.0

2.6

2.5 2.5 2.5

2.8 2.8

2.8

2.6 2.7

2.7

4.7

4.5

4.6

4.8

4.5 4.5

6.7

4.0

6.8

6.7

6.5

6.4

9.2

9.2

9.0

0

2

4

6

8

10

12

1951 1963 1966 1973 1978 1983 1987 1991 1996 1998 2000 2002 2004 2006 2008 2010 2012

Year

Y

e

a

r

s

o

f

T

e

n

u

r

e

Ages 25-34

Ages 35-44

Ages 45-54

Ages 55-64

Source: Data (for 1951, 1963, 1966, 1973, and 1978) from the Monthly Labor Review (September 1952, October 1963, January 1967,

December 1974, and December 1979); from press releases (for 1983, 1987, 1991, 1996, 1998, 2000, 2002, 2004, 2006, 2008, 2010, and 2012)

from the U.S. Department of Labor, Bureau of Labor Statistics.

Employee Benefit Research Institute 2014

Percentage of Wage and Salary Workers Ages 45-64 Who Had 25

or More Years of Tenure, by Age and Sector, 2004-2012

10.0%

9.5%

17.4%

15.1%

19.4%

15.4%

17.9% 18.0%

18.3%

25.4%

8.8%

8.9%

9.3%

13.2% 13.3%

12.8%

15.0%

16.4%

15.4%

15.3%

16.1%

24.3%

22.6%

25.8%

23.2%

15.2%

26.5%

23.5%

24.9%

21.8%

8%

10%

12%

14%

16%

18%

20%

22%

24%

26%

28%

2004 2006 2008 2010 2012

Ages 45 to 54-Private Sector Ages 45 to 54-Public Sector Ages 55 to 59-Private Sector

Ages 55 to 59-Public Sector Ages 60 to 64-Private Sector Ages 60 to 64-Public Sector

Source: Employee Benefit Research Institute estimates from the January 2004, 2006, 2008, 2010, and 2012 Current Population Surveys.

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

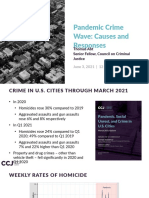

Systemic Reality: Many workers do not leave work by choice

24

Employee Benefit Research Institute 2014

People Retire Early for a Variety of Reasons, Though Over

Half of Retirees Cite Health Problems as a Factor

Why did you retire earlier than you had planned? (2013 Retirees retiring earlier than

planned n=127, percent yes)

55%

32%

23%

20%

20%

19%

9%

You had a health problem or disability

You could afford to retire earlier

You had to care for a spouse or another family

member

Changes at your company

You had another work-related reason

You wanted to do something else

Changes in the skills required for your job

25

Source: Employee Benefit Research Institute and Mathew Greenwald & Associates, Inc.,

1993-2013 Retirement Confidence Surveys.

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 2014

EBRI strives to move others away from:

QUOTING A SINGLE NUMBER AS INDICATIVE

OF STATUS OR SUCCESS OR FAILURE OF A

COMPLEX SYSTEM FOR A DIVERSE

POPULATION.

26

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 2014

A COMMON SINGLE NUMBER:

USING A SINGLE NUMBER AS INDICATIVE OF

SUFFICIENT SAVINGS OR INCOME - SUCH AS

AN 80% REPLACEMENT RATE - WHEN THE

REAL NUMBER/% DIFFERS BASED UPON

INDIVIDUAL CIRCUMSTANCES. AND, WHEN

THE 80% CAN APPLY TO DIFFERENT

OBJECTIVE MEASURES

DOES IT APPLY TO LIFETIME INCOME, OR

FINAL INCOME, OR BASIC EXPENSE NEEDS,

OR ???????????????

27

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

The reporter or marketing brochure or though leader

might say the Boston College CRR reports that 54.7%

of workers will not be able to maintain their pre-

retirement standard of living using an 80% of income

threshold.

Implication or sometimes stated conclusion:

The current voluntary system is not successful.

28

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 2014

A COMMON MISTAKE:

ACCEPTING AS TRUTH WHAT OTHERS SAY

OR WRITE WITHOUT INVESTIGATION,

LEADING TO MYTHOLOGY AND MISTAKES.

As Ronald Reagan said, Trust but Verify.

29

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

What does the one number not tell you?

30

How does the result vary by income or age or tenure?

No, the sample is too small for that level of detail, it is a macro model

Does the number assume future contributions to plans?

No, it does not, it uses a constant income to wealth ratio until each person

turns age 65 (in this simulation)

How does it deal with longevity and long term care

It assumes that everyone turns their assets into a life income annuity and

that everyone has long term care insurance

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

Probability of NOT running short of money in retirement depends on the

number of future years of eligibility for a defined contribution plan

(Gen Xers with Long Term Care and Home Health costs included)

Zero 1-9 10-19 20+

80 percent 19% 13% 10% 5%

90 percent 11% 10% 9% 6%

100 percent 40% 61% 73% 86%

0%

20%

40%

60%

80%

100%

2014

EBRI

Retirement

Readiness

Ratings

Percent of

simulated

expenses

31

Source: Employee Benefit Research Institute Retirement

Security Projection Model Version 1995

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

Probability of NOT running short of money in retirement depends

on relative pre-retirement income level and the expense threshold

(Boomers and Gen Xers with and without Long Term Care and Home Health costs included)

Lowest

quartile

with

LTC

Second

quartile

with

LTC

Third

quartile

with

LTC

Highest

quartile

with

LTC

Lowest

quartile

without

LTC

Second

quartile

without

LTC

Third

quartile

without

LTC

Highest

quartile

without

LTC

80 percent 25% 17% 11% 5% 25% 6% 2% 0%

90 percent 13% 13% 10% 7% 14% 11% 4% 0%

100 percent 17% 53% 72% 86% 30% 80% 94% 99%

0%

20%

40%

60%

80%

100%

2014

EBRI

Retirement

Readiness

Ratings

32

Source: Employee Benefit Research Institute Retirement

Security Projection Model Version 1995

Percent of

simulated

expenses

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

What (Some) Experts SayThe tax preferences for

pensions are upside down - - not by all definitions

IF you overlook the

actual impact of

nondiscrimination

tests and

contribution

limitsand ignore

the data that show

that balances stay

in close proportion

to compensation

34

Employee Benefit Research Institute 2014

Bad news sells papers. It also

sells market research.

-Professor Byron Sharp

35

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

Percentage of Those Age 65 or Older With Any DB

Pension Annuity Income, 1975-2011

25.2%

24.9%

26.7%

26.9%

29.6%

30.7%

33.2%

35.1%

37.0%

37.4%

35.3%

35.9%

34.9%

34.8%

35.4%

35.4%

35.4%

35.0%

34.5%

34.8%

22%

24%

26%

28%

30%

32%

34%

36%

38%

40%

1975 1977 1979 1980 1983 1985 1987 1989 1991 1993 1996 1998 2000 2002 2004 2006 2008 2009 2010 2011

Source: EBRI tabulations of the 1976-2012 Current Population Survey.

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

Percentage of Income Attributable to Pension

Income for Those Age 65 or Older, 1975-2011

14.4%

14.6%

14.8%

15.3%

15.8%

15.6%

17.7%

17.7%

19.5%

20.8%

19.6%

19.9%

19.1%

20.2%

20.8%

19.3%

19.7%

19.2%

19.7%

19.8%

12%

13%

14%

15%

16%

17%

18%

19%

20%

21%

22%

1975 1977 1979 1980 1983 1985 1987 1989 1991 1993 1996 1998 2000 2002 2004 2006 2008 2009 2010 2011

Source: EBRI tabulations of the 1976-2012 Current Population Survey.

Employee Benefit Research Institute 2014

38

Use of a single average or a single median to judge the success or failure of SSA,

voluntary savings, etc. will always mislead policy makers and skew perceptions.

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

Quintiles of LSD equivalents from 2010 defined benefit

participants ages 65-70 from CPS

p20 p40 p60 p80

defined benefit $63,086 $145,714 $257,143 $445,714

$-

$50,000

$100,000

$150,000

$200,000

$250,000

$300,000

$350,000

$400,000

$450,000

$500,000

39

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

Quintiles of 2010 year end 401(k) balances for ages 60-65

by tenure category

p20 p40 p60 p80

10-20 $7,919.32 $24,339.53 $58,232.72 $139,737.29

20-30 $13,198.78 $51,365.58 $115,854.63 $252,965.72

>30 $13,804.18 $62,219.10 $147,473.53 $320,820.65

$-

$50,000.00

$100,000.00

$150,000.00

$200,000.00

$250,000.00

$300,000.00

$350,000.00

40

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

Quintiles of 2010 year end combined 401(k) and IRA

balances for ages 60-65 by tenure category (for 401(k)

participants with at least one IRA)

p20 p40 p60 p80

10-20 $46,831 $111,094 $206,883 $370,688

20-30 $77,049 $180,400 $318,403 $533,853

>30 $121,739 $260,186 $437,827 $735,813

$-

$100,000

$200,000

$300,000

$400,000

$500,000

$600,000

$700,000

$800,000

41

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

Average Employer Expenditures for Retirement Plans - % of

Total Compensation Civilian Workers

0

0.5

1

1.5

2

2.5

3

3.5

4

4.5

5

1959 1970 1980 1990 2004 2010 2013

Total

DB

DC

42

Source: Authors Compilation from BLS.gov

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

43

PAYABLE Monthly Benefit Levels as Percent of Career-

Average Earnings by Year of Retirement at age 62

0

10

20

30

40

50

60

70

1960 1980 2000 2020 2040 2060 2080

Low Earner ($19,388 in 2010; 25th percentile)

Medium Earner ($43,084 in 2010; 56th percentile)

High Earner ($68,934 in 2010; 81st percentile)

Max Earner ($106,800 in 2010; 100th percentile)

Source: 2010 OASDI Trustees Report

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

Takeaways

There is not a retirement crisis for the nation

If there is deemed to be one today, there has been one for the history

of the nation, a continuous crisis

There have always been savings, income and care shortfalls for the

largest segment of the population

World experience is that a universal mandatory system is the lowest

cost and most effective, but funding has never failed to be a

problem/challenge for any nation

World experience is that annuity based programs are the most cost

effective, but increasingly people want their money for their control

in all nations

US DB plans have moved to lump sums for 40 years, and DC have

always resulted in lump sums, responding to individual choice, but

making good across society outcomes more difficult and expensive

ChooseTo $ave and $ave Four Your Future get more important

with each passing day, week, month, year.

44

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 201

DC 1974 DOJ Pre ERISA, DOL and PBGC Age 24

45

EBRI Founding 1978 9/28/2013 was 35

th

Anniversary..Age 64

40 Years of Research

and Policy Analysis:

Retirement, Health, Savings, and

Other Employee Benefits

Employee Benefit Research Institute 2014 Employee Benefit Research Institute 2014

EBRI : Just the Facts

www.ebri.org

www.choosetosave.org

Você também pode gostar

- Private Retirement Plans in The PhilippinesDocumento55 páginasPrivate Retirement Plans in The Philippineschane15100% (2)

- Employee Benefits AccountingDocumento11 páginasEmployee Benefits AccountingNelva Quinio33% (3)

- Sept Briefing National Institute For Retirement SecurityDocumento37 páginasSept Briefing National Institute For Retirement Securitypcapineri8399Ainda não há avaliações

- HR BestPracticesDocumento62 páginasHR BestPracticessaravanans100% (10)

- CH 07 Wages and Salaries AdministrationDocumento54 páginasCH 07 Wages and Salaries AdministrationNisha BagadAinda não há avaliações

- Retention Strategies in ITESDocumento12 páginasRetention Strategies in ITESmunmun4Ainda não há avaliações

- Employee Motivation: Drive Primary LeverDocumento29 páginasEmployee Motivation: Drive Primary LeverMalovika Shri AgrawalAinda não há avaliações

- The 401(K) Owner’S Manual: Preparing Participants, Protecting FiduciariesNo EverandThe 401(K) Owner’S Manual: Preparing Participants, Protecting FiduciariesAinda não há avaliações

- Employee Benefits Part 1 QuizDocumento4 páginasEmployee Benefits Part 1 QuizJamie Rose Aragones83% (6)

- JULY 22 2021 - RWE - Michele Jonnson Funk - FINALDocumento21 páginasJULY 22 2021 - RWE - Michele Jonnson Funk - FINALNational Press FoundationAinda não há avaliações

- Wages and Salary AdministrationDocumento20 páginasWages and Salary AdministrationChhaiyaAgrawal100% (2)

- Employee Benefits Related Standards: Pas 19 - Employee Benefits Pas 26 - Accounting & Reporting by Retirement Benefit PlansDocumento10 páginasEmployee Benefits Related Standards: Pas 19 - Employee Benefits Pas 26 - Accounting & Reporting by Retirement Benefit PlansallyssajabsAinda não há avaliações

- Real-World Evidence: How Big Data Is Changing Scientific StandardsDocumento41 páginasReal-World Evidence: How Big Data Is Changing Scientific StandardsNational Press Foundation100% (3)

- HR 2020 Policies and Procedures Annex 1Documento74 páginasHR 2020 Policies and Procedures Annex 1Hieu HaAinda não há avaliações

- JULY 22 2021 - RWE - Nandita MitraDocumento19 páginasJULY 22 2021 - RWE - Nandita MitraNational Press FoundationAinda não há avaliações

- Project ProposalDocumento3 páginasProject Proposalanil_mba_hrAinda não há avaliações

- Pas 19 - Employee BenefitsDocumento25 páginasPas 19 - Employee BenefitsBritnys NimAinda não há avaliações

- Human Resource Policies and ProcedureDocumento119 páginasHuman Resource Policies and ProcedurekrishnaAinda não há avaliações

- Real World' Evidence: A Dangerous DelusionDocumento32 páginasReal World' Evidence: A Dangerous DelusionNational Press FoundationAinda não há avaliações

- Work-life Balance at IVRCL - "WLBDocumento99 páginasWork-life Balance at IVRCL - "WLByugandhar0167% (12)

- Challenges For A HR Professional in BPODocumento4 páginasChallenges For A HR Professional in BPOsubbaramnaicker9379Ainda não há avaliações

- MFRS 119 Employee BenefitsDocumento38 páginasMFRS 119 Employee BenefitsAin YanieAinda não há avaliações

- Work Life Balance ProjectDocumento95 páginasWork Life Balance Projectsonia100% (3)

- Insurance CompaniesDocumento11 páginasInsurance CompaniesPricia AbellaAinda não há avaliações

- Incentives Payment Methodology ExplainedDocumento6 páginasIncentives Payment Methodology ExplainedKamlesh JagadhaneAinda não há avaliações

- Documents - MX Summer Internship Report 558448ff2d136Documento85 páginasDocuments - MX Summer Internship Report 558448ff2d136Kamal TyagiAinda não há avaliações

- 4,5,6 Points of HRM Project - Ayesha KhanDocumento8 páginas4,5,6 Points of HRM Project - Ayesha KhanAbdul HaseebAinda não há avaliações

- Benchmarking of Employee Benefits in The Indian Social SectorDocumento115 páginasBenchmarking of Employee Benefits in The Indian Social Sectorashwani_1980Ainda não há avaliações

- Employee Benefits Provided by Majoriy of The BPO CompaniesDocumento6 páginasEmployee Benefits Provided by Majoriy of The BPO CompaniesDivya Raman100% (1)

- Attrition ReportDocumento18 páginasAttrition Reporthihiten100% (3)

- Aon - 2023 - Designing Tomorrow Personalizing EVP Benefits and Total RewardsDocumento5 páginasAon - 2023 - Designing Tomorrow Personalizing EVP Benefits and Total RewardsMuhammad Akmal HossainAinda não há avaliações

- Guide's Certificate: Salary Policy in Sudha Dairy (TIMUL), Muzaffarpur" Has Been PreparedDocumento13 páginasGuide's Certificate: Salary Policy in Sudha Dairy (TIMUL), Muzaffarpur" Has Been PreparedAjay KumarAinda não há avaliações

- Summer Internship ReportDocumento68 páginasSummer Internship Reportgsevenxt100% (2)

- Effectiveness of Provident Funds for Nicera EmployeesDocumento33 páginasEffectiveness of Provident Funds for Nicera EmployeesBenedict Patrick PeñaAinda não há avaliações

- Index: Executive SummaryDocumento43 páginasIndex: Executive SummarySuresh Babu ReddyAinda não há avaliações

- Chapter 11 12 13 Khitij FinalDocumento37 páginasChapter 11 12 13 Khitij Finalmahakagrawal3Ainda não há avaliações

- Module 12-Recruiting Diverse WorkforceDocumento43 páginasModule 12-Recruiting Diverse WorkforceAlma AgnasAinda não há avaliações

- How To "Pensionize" Any IRA or 401 (K) PlanDocumento19 páginasHow To "Pensionize" Any IRA or 401 (K) PlanPhil PhillipsAinda não há avaliações

- Employment Unemployment in IndiaDocumento31 páginasEmployment Unemployment in IndiaAbhishek gupta100% (11)

- Edited - CHAPTER IDocumento6 páginasEdited - CHAPTER IMylen PelinAinda não há avaliações

- Emerging Trends in Human Resources: Top 10 Workplace Trends For 2006-2007 According To HR ProfessionalsDocumento50 páginasEmerging Trends in Human Resources: Top 10 Workplace Trends For 2006-2007 According To HR ProfessionalsSowmya BhatAinda não há avaliações

- Research Paper On Employee Welfare PDFDocumento4 páginasResearch Paper On Employee Welfare PDFefe6zst5100% (3)

- Compensation IMIK 2022 Session 1 2 3Documento26 páginasCompensation IMIK 2022 Session 1 2 3Nikhil VermaAinda não há avaliações

- Repurposing Project ReportDocumento9 páginasRepurposing Project Reportapi-301376882Ainda não há avaliações

- Comparison AnalysisDocumento169 páginasComparison AnalysissuccessinmpAinda não há avaliações

- Anoop Insurance in IndustryDocumento67 páginasAnoop Insurance in IndustrychootAinda não há avaliações

- Project Report ON Employee Welfare Activities In: Deepti Prajapati BBA (VTH Semester)Documento88 páginasProject Report ON Employee Welfare Activities In: Deepti Prajapati BBA (VTH Semester)Santosh JhaAinda não há avaliações

- Workforce Planning During Bleak Times: A Public Sector ViewDocumento7 páginasWorkforce Planning During Bleak Times: A Public Sector ViewGwen RussellAinda não há avaliações

- Chapter 11 Compensation and BenefitsDocumento43 páginasChapter 11 Compensation and BenefitsSunnieeAinda não há avaliações

- The Business Case For Workplace FlexibilityDocumento51 páginasThe Business Case For Workplace FlexibilityvladmotantauAinda não há avaliações

- HUMAN RESOURCE MANAGEMENT TOPICSDocumento11 páginasHUMAN RESOURCE MANAGEMENT TOPICSShihab KhanAinda não há avaliações

- Chapter 11 - Compensation and BenefitsDocumento41 páginasChapter 11 - Compensation and BenefitsSunnieeAinda não há avaliações

- How To "Pensionize" Any IRA or 401 (K) PlanDocumento22 páginasHow To "Pensionize" Any IRA or 401 (K) PlanLuis PereiraAinda não há avaliações

- Summer Internship Project ON Employee Welfare Practices AT Odisha Power Generation Corporation Limited, BBSRDocumento84 páginasSummer Internship Project ON Employee Welfare Practices AT Odisha Power Generation Corporation Limited, BBSRyo vkAinda não há avaliações

- LDExec FIN PDFDocumento4 páginasLDExec FIN PDFTinaStiffAinda não há avaliações

- Employee-Motivation-Impact-of-Incentives-to-Employee-Productivity-in-CF-Manufacturing-Corporation-1 (1) (Repaired)Documento69 páginasEmployee-Motivation-Impact-of-Incentives-to-Employee-Productivity-in-CF-Manufacturing-Corporation-1 (1) (Repaired)Faye CruzAinda não há avaliações

- Module IV OBHRMDocumento23 páginasModule IV OBHRMsuhani devpuraAinda não há avaliações

- 1 - Corporate Package - Detailed DocumentDocumento22 páginas1 - Corporate Package - Detailed DocumentKanchan ManhasAinda não há avaliações

- NHRD HR Showcase 2020Documento206 páginasNHRD HR Showcase 2020Suraj TiwariAinda não há avaliações

- HRM CompensationDocumento46 páginasHRM CompensationShassotto Chatterjee100% (2)

- Compensation and Benefits: MBA Sem 4Documento25 páginasCompensation and Benefits: MBA Sem 4Sidharth ChoudharyAinda não há avaliações

- Prabhakar HR NTPC Singrauli MP 486890 IV SEM. FINAL PROJECTDocumento100 páginasPrabhakar HR NTPC Singrauli MP 486890 IV SEM. FINAL PROJECTPRABHAKAR DUBEYAinda não há avaliações

- Wages and SalaryDocumento18 páginasWages and Salaryjanhavi kaduAinda não há avaliações

- Ace Technology Services: 44, Sunset Chambers, 14 Road, Parle (W), Mumbai - 400049Documento2 páginasAce Technology Services: 44, Sunset Chambers, 14 Road, Parle (W), Mumbai - 400049Akram MohiddinAinda não há avaliações

- Session 9 Managing Organizational Change and Diversity Current IssuesDocumento28 páginasSession 9 Managing Organizational Change and Diversity Current IssuesNouhaila NaoumAinda não há avaliações

- 4 Recruitment and SelectionDocumento14 páginas4 Recruitment and SelectionkartiktrivediAinda não há avaliações

- A Project Report A Project Report A Project Report A Project ReportDocumento85 páginasA Project Report A Project Report A Project Report A Project ReportVasim VhoraAinda não há avaliações

- Flexible Work Timing: A Relief To EmployeeDocumento25 páginasFlexible Work Timing: A Relief To EmployeeDinesh ChahalAinda não há avaliações

- ICICI Ready Project To PrintDocumento38 páginasICICI Ready Project To PrinthelpdeskbillldhAinda não há avaliações

- Pay Equity and Remmuneration Policies. Group ProjectDocumento29 páginasPay Equity and Remmuneration Policies. Group Projectmaria morenoAinda não há avaliações

- Covering Cyberconflict: Disinformation, Ransomware, and Hacking For Non-ExpertsDocumento11 páginasCovering Cyberconflict: Disinformation, Ransomware, and Hacking For Non-ExpertsNational Press FoundationAinda não há avaliações

- Price Hike? Covering China's Food Security StrategyDocumento7 páginasPrice Hike? Covering China's Food Security StrategyNational Press FoundationAinda não há avaliações

- Vaccine Equity Planner Demo Deck (July 13 2021)Documento10 páginasVaccine Equity Planner Demo Deck (July 13 2021)National Press FoundationAinda não há avaliações

- JULY 22 2021 - RWE - Ebere OnukwughaDocumento11 páginasJULY 22 2021 - RWE - Ebere OnukwughaNational Press FoundationAinda não há avaliações

- Covering The IRSDocumento31 páginasCovering The IRSNational Press FoundationAinda não há avaliações

- JULY 22 2021 - RWE - John Concato FinalDocumento36 páginasJULY 22 2021 - RWE - John Concato FinalNational Press FoundationAinda não há avaliações

- Emulating Randomized Clinical Trials With Non-Randomized Real-World Evidence StudiesDocumento26 páginasEmulating Randomized Clinical Trials With Non-Randomized Real-World Evidence StudiesNational Press FoundationAinda não há avaliações

- The Assessment Gap: Racial Inequalities in Property TaxationDocumento78 páginasThe Assessment Gap: Racial Inequalities in Property TaxationNational Press FoundationAinda não há avaliações

- JUNE 22 2021 - SemiconductorsDocumento21 páginasJUNE 22 2021 - SemiconductorsNational Press FoundationAinda não há avaliações

- JUNE 18 2021 - Robert GlicksmanDocumento25 páginasJUNE 18 2021 - Robert GlicksmanNational Press FoundationAinda não há avaliações

- MAY 28 2021 - William KovacicDocumento69 páginasMAY 28 2021 - William KovacicNational Press Foundation100% (1)

- MAY 25 2021 - Jason Furman - UpdatedDocumento62 páginasMAY 25 2021 - Jason Furman - UpdatedNational Press FoundationAinda não há avaliações

- Reporters Panel With Mike Lindbloom: Covering Roads and Bridges and The Cars That Drive On ThemDocumento8 páginasReporters Panel With Mike Lindbloom: Covering Roads and Bridges and The Cars That Drive On ThemNational Press FoundationAinda não há avaliações

- MAY 25 2021 - Jason Furman - UpdatedDocumento62 páginasMAY 25 2021 - Jason Furman - UpdatedNational Press FoundationAinda não há avaliações

- Pedestrian and Driver Safety - and How To Cover ItDocumento35 páginasPedestrian and Driver Safety - and How To Cover ItNational Press FoundationAinda não há avaliações

- Reporters Panel With Aileen Cho: Covering Roads and Bridges and The Cars That Drive On ThemDocumento4 páginasReporters Panel With Aileen Cho: Covering Roads and Bridges and The Cars That Drive On ThemNational Press FoundationAinda não há avaliações

- JUNE 3 2021 - Criminal Justice - DreierDocumento7 páginasJUNE 3 2021 - Criminal Justice - DreierNational Press FoundationAinda não há avaliações

- Infrastructure and Transportation: Where We've Been, Where We're GoingDocumento27 páginasInfrastructure and Transportation: Where We've Been, Where We're GoingNational Press FoundationAinda não há avaliações

- Covid Impact On African-American Businesses: Hand In-No Hand OutDocumento17 páginasCovid Impact On African-American Businesses: Hand In-No Hand OutNational Press FoundationAinda não há avaliações

- Barry Ford Presentation National Press Foundation 6.2.21Documento9 páginasBarry Ford Presentation National Press Foundation 6.2.21National Press FoundationAinda não há avaliações

- MAY 21 2021 - Cheryl ThompsonDocumento6 páginasMAY 21 2021 - Cheryl ThompsonNational Press FoundationAinda não há avaliações

- Yasmin HurdDocumento41 páginasYasmin HurdNational Press FoundationAinda não há avaliações

- JUNE 3 2021 - Criminal Justice - AbtDocumento7 páginasJUNE 3 2021 - Criminal Justice - AbtNational Press FoundationAinda não há avaliações

- Toni Draper SlideDocumento1 páginaToni Draper SlideNational Press FoundationAinda não há avaliações

- National Press Foundation May 26 Patrice WilloughDocumento11 páginasNational Press Foundation May 26 Patrice WilloughNational Press FoundationAinda não há avaliações

- MAY 25 2021 - ElaineWuDocumento12 páginasMAY 25 2021 - ElaineWuNational Press FoundationAinda não há avaliações

- PAS 19 Employee BenefitsDocumento62 páginasPAS 19 Employee BenefitsBenj FloresAinda não há avaliações

- Personal Financial Planning Attitudes: A Preliminary Study of Graduate StudentsDocumento7 páginasPersonal Financial Planning Attitudes: A Preliminary Study of Graduate StudentsAlia Suraya AhmadAinda não há avaliações

- CFAS Module 8Documento42 páginasCFAS Module 8Eu NiceAinda não há avaliações

- Contributory, Funded (Managed by A Trustee) or Unfunded (Managed by The Employer), and Defined Contribution Plan or Defined Benefit PlanDocumento5 páginasContributory, Funded (Managed by A Trustee) or Unfunded (Managed by The Employer), and Defined Contribution Plan or Defined Benefit PlanJustine VeralloAinda não há avaliações

- Keeping The Promise: State Solutions For Government Pension ReformDocumento45 páginasKeeping The Promise: State Solutions For Government Pension ReformALECAinda não há avaliações

- Pension Accounting PDFDocumento8 páginasPension Accounting PDFMuhammad Faran KhanAinda não há avaliações

- AC 2202 CHAPTER 17 NotesDocumento8 páginasAC 2202 CHAPTER 17 NotesKemuel TantuanAinda não há avaliações

- Employee Benefits Pas 19Documento44 páginasEmployee Benefits Pas 19Joanne Rey OcanaAinda não há avaliações

- BSNL Superannuation RulesDocumento15 páginasBSNL Superannuation RuleskumudpandaAinda não há avaliações

- ABC of Retirement PlanningDocumento80 páginasABC of Retirement PlanningMarkoAinda não há avaliações

- My Literature ReviewDocumento10 páginasMy Literature ReviewAjAinda não há avaliações

- Rothschild Annual Report 2007 - 08 - FinalDocumento61 páginasRothschild Annual Report 2007 - 08 - FinalellokosAinda não há avaliações

- 기출 기관IPS 2015Documento11 páginas기출 기관IPS 2015soej1004Ainda não há avaliações

- Retirement BenefitsDocumento9 páginasRetirement Benefitszaw khaingAinda não há avaliações

- GRI 201 - Economic Performance 2016Documento19 páginasGRI 201 - Economic Performance 2016roninrcpAinda não há avaliações

- Topic 13 - Retirement PlanningDocumento54 páginasTopic 13 - Retirement PlanningArun GhatanAinda não há avaliações

- The Clat Post March 2023 Final 02739e1a429cdDocumento123 páginasThe Clat Post March 2023 Final 02739e1a429cdBhuvan GamingAinda não há avaliações

- FMCC225 - Financial Accounting 3 Final Examination 1 Sem. S/Y 2020-20221 Name: - Section: - Multiple ChoiceDocumento3 páginasFMCC225 - Financial Accounting 3 Final Examination 1 Sem. S/Y 2020-20221 Name: - Section: - Multiple ChoiceChristian QuidipAinda não há avaliações

- Beechy CH 20 Intermediate AccountingDocumento41 páginasBeechy CH 20 Intermediate AccountingLeizza Ni Gui DulaAinda não há avaliações

- ACCO1115 - May 2017 - EXAMDocumento9 páginasACCO1115 - May 2017 - EXAMSarah RanduAinda não há avaliações

- Report - ResilDocumento46 páginasReport - ResilNamrata NagarajAinda não há avaliações

- Ias 19 NotesDocumento41 páginasIas 19 NotesTanyahl MatumbikeAinda não há avaliações