Escolar Documentos

Profissional Documentos

Cultura Documentos

AS 15 Revised

Enviado por

Yogeeshwaran PonnuchamyDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

AS 15 Revised

Enviado por

Yogeeshwaran PonnuchamyDireitos autorais:

Formatos disponíveis

AS-15( REVI SED 2005)

EMPLOYEES BENEFITS

PRESENTED By :-

Dr. RAJ. K. AGARWAL

FCA,FCS,AICWA,LLB, Phd.

RAKESH RAJ & ASSOCIATES

AS-15

(Revised 2005 Employees Benefit)

BASIC PRINCIPLE

-Recognize the expenses of benefit to employees

during their service Period, which may be paid.

Currently,

On Retirement, or

Post Retirement

AS-15 (REVI SED 2005- EMPLOYEES

BENEFI TS)

APPLICABILITY

With effect from accounting period commencing on or after

1.04.2006

Level I Enterprises -in entirety

Other than level I Enterprises - para 11 to 16, 46

having 50 or more employees and 139 not applicable

para 50 to 116 limited

applicability

less than 50 employees - do

instead of actuarial

valuation, some other

method may be used.

AS-15(Revised 2005-Employees Benefits)

SCOPE

-It Covers all employee Benefits as per

Formal agreement

Legislative requirement

Informal practice

-It does not cover

Profit Sharing Plans &

Employee benefit Plans e.g., ESOP

AS 15(Revised 2005- Employees Benefit)

NATURE OF BENEFITS

-Short term employees Benefits:

(payable within 12 months after providing Services)

- Wages, Salaries

- Leave Compensation

- Bonus

- Non Monetary Benefits

-Post Employment Benefits :

- Gratuity

- Pension/Superannuation

- Provident Fund

- Medical Facilities

AS 15(Revised 2005- Employees Benefit)

- Other long term Employee Benefits:

( Payable after 12 months of providing service)

- Long Service Leaves

- Bonuses

- Deferred Compensation

- Termination Benefits : Compensations and other benefits

on termination or pre mature

retirement.

AS 15(Revised 2005- Employees Benefit)

Short Term Employee Benefits

Salaries, wages and other non-monetary Benefits:

- To Account for in Current Period

- Not To Discount

Leaves : Fully Encashable - Full Provision

Lapsing - No Provision

Accumulating - Provision for

Expected Liabilities

Bonus : May be contingent upon future service

To provide for expected liability.

AS 15(Revised 2005- Employees Benefit)

Post Employment Benefits

Defined Contribution Plans

Defined Benefit Plans

AS 15(Revised 2005- Employees Benefit)

Defined Contribution Plans

- Liability of Enterprise : Periodic Contribution

e.g. Provident Fund.

- On Retirement Employee gets : Accumulated

Contribution and

Appreciation of Fund.

AS 15(Revised 2005- Employees Benefit)

Defined Benefit Plans

Benefit on Retirement or Post Retirement

- Expense to be provided during service period of

the employee.

Liability for Expense:

Unfunded Funded

- State Fund

- Trust Fund

- Insurance Fund

- Mutual Fund

( To Create Plan Asset)

AS 15(Revised 2005- Employees Benefit)

Group Gratuity Scheme of Insurers

Whether Defined Contribution Plan ?

Whether it provides insurance cover?

Or

It is only a plan Asset ?

AS 15(Revised 2005- Employees Benefit)

Non Vesting Benefits also to be provided :

e.g. Gratuity payable after completion of five

year of service but to be provided from Ist

Year

AS 15(Revised 2005- Employees Benefit)

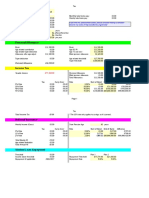

Defined Benefit Plans

Estimation of liability of Benefits

: Using Actuarial assumptions

Discounting to Determine present Value (A)

: Using Projected Unit credit

Method.

Determine Fair Value of Plan Assets (B)

Difference of A-B to be carried in Balance Sheet as

Defined Benefit Liability.

AS 15(Revised 2005- Employees Benefit)

Defined Benefit Plans

Expenses to be provided in P&l Account to

Constitute :

- Current Service Cost

- Interest Cost

- Expected Return on plan asset

- Actuarial gain or losses

- Past Service Cost

- Effect of any curtailment or settlement

AS 15(Revised 2005- Employees Benefit)

Actuarial Assumptions

Demographic - Mortality

- Employee Turnover

Financial - Future Salary increase

- Discount rate

- Return on plan asset

- Medical Treatment Cost

- Change in cost of Medical Services

Discount rate to be as per return on Government

Bonds

AS 15(Revised 2005- Employees Benefit)

Special Features of Revised AS-15

Disclosure of Different Components of cost to be

charged to P& L Account.

Disclosure and break up of actuarial assumptions.

Discounting Rates as per yield on Government Bonds.

Actuarial Assumptions may be reviewed by

Management/ Auditors.

Benefit Obligations and plan asset to be separately

disclosed.

Management of plan assets is separately reflected.

AS 15(Revised 2005- Employees Benefit)

Disclosures

Nature of Defined Benefit plans and effect of

changes if any.

Break up and reconciliation of different components

of defined benefit obligation.

Break up and reconciliation of different components

or plan assets and return on assets.

Expenses recognized in P& L Account in different

components.

Main Actuarial assumptions used.

AS 15(Revised 2005- Employees Benefit)

Termination Benefits:

- To be Accounted for expenses immediately.

- VRS is a termination benefit.

- In case of VRS transitional provisions.

AS 15(Revised 2005- Employees Benefit)

Transitional provisions:

- Liability to be recognized as per revised

AS-15 as on 01-04-2006, to be adjusted

against revenue reserves.

- Liability as per pre-revised AS- 15 shall be

prior period expense.

- VRS up to 31-03-2010 : After that in the year

of incurrence.

T H A N K Y O U

Você também pode gostar

- 17 Essential Qualities of A Team PlayerDocumento17 páginas17 Essential Qualities of A Team PlayerYogeeshwaran PonnuchamyAinda não há avaliações

- Suggested Reading ListDocumento4 páginasSuggested Reading ListDiaa Eldin AliAinda não há avaliações

- CIMA Revison ClassesDocumento48 páginasCIMA Revison ClassesYogeeshwaran PonnuchamyAinda não há avaliações

- Illustrative Financial Statements O 201210Documento316 páginasIllustrative Financial Statements O 201210Yogeeshwaran Ponnuchamy100% (1)

- The Principle of Aim's LengthDocumento2 páginasThe Principle of Aim's LengthYogeeshwaran PonnuchamyAinda não há avaliações

- Interview Questions For CFODocumento25 páginasInterview Questions For CFOYogeeshwaran PonnuchamyAinda não há avaliações

- Toast Master - MentoringDocumento14 páginasToast Master - MentoringYogeeshwaran PonnuchamyAinda não há avaliações

- Law of Commercial PapersDocumento43 páginasLaw of Commercial PapersYogeeshwaran PonnuchamyAinda não há avaliações

- 279A UsingBodyLanguageInteractiveDocumento10 páginas279A UsingBodyLanguageInteractiveStanley CaoAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Chapter - 18 PFPDocumento4 páginasChapter - 18 PFPaliAinda não há avaliações

- UBS Global Wealth Report 2018 enDocumento60 páginasUBS Global Wealth Report 2018 enDavid KwokAinda não há avaliações

- Struktur & Skala Upah 15-4-17Documento32 páginasStruktur & Skala Upah 15-4-17ahmad wafyAinda não há avaliações

- Claim Form (Aadhar) : CompositeDocumento2 páginasClaim Form (Aadhar) : CompositeCyber MagicAinda não há avaliações

- Chapter 12Documento27 páginasChapter 12Kevin HenricoAinda não há avaliações

- 1344938487binder2Documento34 páginas1344938487binder2CoolerAdsAinda não há avaliações

- Prologue - Life InsuranceDocumento4 páginasPrologue - Life InsuranceCamila Andrea Sarmiento BetancourtAinda não há avaliações

- Income Tax ActDocumento711 páginasIncome Tax ActPikinisoAinda não há avaliações

- Ukpaye-2017-2018 - 18500Documento2 páginasUkpaye-2017-2018 - 18500Anonymous jEmTt5o6Ainda não há avaliações

- Go.353 DT 04.12.2010 - Procedure For Claiming Family PensionDocumento6 páginasGo.353 DT 04.12.2010 - Procedure For Claiming Family PensionNarasimha Sastry33% (3)

- Fringe Benefits and Job SatisfactionDocumento22 páginasFringe Benefits and Job SatisfactionAfnan Mohammed100% (1)

- Pay Slip For The Month of December-2017Documento1 páginaPay Slip For The Month of December-2017omkassAinda não há avaliações

- Rai Ic - Trad (9426)Documento30 páginasRai Ic - Trad (9426)jeffrey resos100% (1)

- Employee Declaration Form FY 2020-21Documento2 páginasEmployee Declaration Form FY 2020-21Harsha I100% (2)

- Chapter 2: Salaries.: Computation of Income Under The Head Income From "Salaries"Documento8 páginasChapter 2: Salaries.: Computation of Income Under The Head Income From "Salaries"Varun AadarshAinda não há avaliações

- ACC Instructions Final 26112013Documento47 páginasACC Instructions Final 26112013balwant_negi7520Ainda não há avaliações

- File by Mail Instructions For Your Federal Amended Tax ReturnDocumento14 páginasFile by Mail Instructions For Your Federal Amended Tax ReturnRyan MayleAinda não há avaliações

- Series 7 - Study LiteratureDocumento27 páginasSeries 7 - Study LiteratureAli Shafique100% (2)

- p4012 PDFDocumento208 páginasp4012 PDFninmonk999Ainda não há avaliações

- In Re ZialcitaDocumento6 páginasIn Re ZialcitaJunnieson BonielAinda não há avaliações

- Module 4 ECON AnnuityDocumento11 páginasModule 4 ECON AnnuityMIKE ARTHUR DAVIDAinda não há avaliações

- Appeal of Mrs. QuirosDocumento3 páginasAppeal of Mrs. QuirosPatrio Jr SeñeresAinda não há avaliações

- Candidates Information Booklet: WWW - Cpsa.ieDocumento12 páginasCandidates Information Booklet: WWW - Cpsa.ieDaniel CringusAinda não há avaliações

- PROTECTING Your Dreams With An Assured Income: Life InsuranceDocumento8 páginasPROTECTING Your Dreams With An Assured Income: Life InsuranceAnkit TibriwalAinda não há avaliações

- Home Loan Interest Deduction Under Section 24 of Income TaxDocumento6 páginasHome Loan Interest Deduction Under Section 24 of Income TaxshahpinkalAinda não há avaliações

- Erkurheleni Electricity TariffDocumento280 páginasErkurheleni Electricity TariffclintlakeyAinda não há avaliações

- Comment Letter ISO SEC Climate Disclosure Prop RulesDocumento35 páginasComment Letter ISO SEC Climate Disclosure Prop RulesBrandon Michael ChewAinda não há avaliações

- Age 60 Old-Age Pension (Pension de Retraite) : Age 60 With at Least 15 YearsDocumento4 páginasAge 60 Old-Age Pension (Pension de Retraite) : Age 60 With at Least 15 Yearsnanayaw asareAinda não há avaliações

- Latest PCDA Circular Feb 09Documento13 páginasLatest PCDA Circular Feb 09navdeepsingh.india884991% (46)

- Isp 1300 PDFDocumento8 páginasIsp 1300 PDFBintou DukureyAinda não há avaliações