Escolar Documentos

Profissional Documentos

Cultura Documentos

Apollo Tyres and BKT

Enviado por

Koushik G SaiTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Apollo Tyres and BKT

Enviado por

Koushik G SaiDireitos autorais:

Formatos disponíveis

Fanatics

NMIMS, Mumbai

Dice of Zeus

Table of Contents:

Overview of the Indian Tyre Industry

Radialisation in the Indian Tyre Industry

Competition from Overseas and The End Users

Input costs of the Indian Tyre Industry

Porters Five Forces Analysis

Cooper deal

Pros of the Cooper Deal

Why not Cooper tyres

Threats for Apollo

Selection of the Target Company

Rationale behind the acquisition

Valuation of the deal on Standalone Basis

Overview of the Indian Tyre

Industry

Turnover of Indian Tyre Industry is Rs 43,000 crores as per ATMA for the FY 2011-12.

Tyre Export from India stands at 4209 crores.

There are over 40 tyre companies with the 10 large tyre companies accounting for 95% of total

tyre production.

Between March 2009 and March 2012, the industry is estimated to have added 62.4 million

tyres capacity, reflecting a CAGR of 16%, in order to bridge the demand gap

With the decline in the rubber prices form Rs 240 per kg in April 2011 to 160-170 during 2012-

13, domestic manufacturers were able to increase their profit margins with the bulk of their

revenue coming from replacement tyres segment.

Overall the Indian Tyre Industry domestic demand is estimated to have posted flat to marginal

volume de-growth (0% to -1%) during 2012-13.

The OEM segment in the domestic tyre industry reported around ~2% volume growth in

aggregate during 2012-13, as volume declines in Truck and Bus (T&B) segment (-23%) and

the tractor segment (-3%) was offset by growth in LCV (~11%), relatively modest growth in high

volume segment like passenger vehicles (PV, ~4%) and flat Motorcycle volumes.

The trends in the replacement segment were quite different, with healthy volume growth in T&B

segment and weak volumes in two-wheeler (2W) segment.

Radialisation in the Indian Tyre

Industry

Over the last few fiscals, the domestic tyre industry has been gearing up for the

imminent structural change in the T&B segment with cross ply tyres giving way to

the technically superior radial tyres.

Current Radialisation Level as a % of total tyre production is 98% for passenger car

tyres, 20% for LCVs and 18% for truck and bus segment.

Despite radialisations several advantages (additional mileage; fuel saving; improved

driving) other than in the passenger cars segment, radialisation is low in the other

segments.

This could be attributed due to several factors, viz. Indian roads generally not being

suitable for ideal plying of radial tyres; (older) vehicles produced in India not having

suitable geometry for fitment of radial tyres, unwillingness of consumer to pay higher

price for radial tyres etc. So, radialisation is only limited to the passenger cars

segment.

The future of radialisation will be governed by the following factors: Cost Benefit

Ratio, Road Development, Overload Control, User Education, Retreading

Infrastructure.

Competition from Overseas and The End

Users

Competition from Overseas Manufacturers:

After witnessing CAGR of 19% in import growth, tyre imports, especially from China, have declined

considerably in the FY 2011-12.

This is on the back of reduction in export subsidies and increasing cost inflation in China leading to erosion

of price competitiveness of Chinese tyres and significant rupee depreciation narrowing the price differential

between imported and domestic tyres.

The ramp up of domestic TBR capacities backed by massive domestic investments and slowdown in the

domestic T&B OEM market (major segment for imported TBRs) have also supported the moderation in TBR

imports.

End Users In The Tyre Industry:

Original Equipment Manufacturers This includes automobile manufacturers like Hero Honda, Maruti

Suzuki, Ashok Leyland, Tata Motors etc. The demand from the OEM market fluctuates directly in line with

end-use demand for the automobile/construction equipment segment; it is thus prone to a high degree of

cyclicality. The total tyre sales to OEMs are on an average 40-45% of the total sales.

Replacement Market These are the end customers who replace old tyres of their vehicles. Replacement

demand for tyres depends on on-road vehicle population, road conditions, vehicle scrappage rules,

overloading norms, retreading intensity and miles driven. It is less cyclical than OEM demand and is

generally a higher-margin business for tyre manufacturers. On an average, replacement market accounts

for 45-50% of the total sales.

Input costs of the Indian Tyre

Industry

Tyre Industry is highly raw-material intensive. Raw materials cost

accounts for approx. 72% of Tyre Industry Turnover.

Natural Rubber is the key raw material of the tyre industry with a cost of

45% of all raw materials.

Customs duty on tyres has been reduced over the last few years with no

corresponding reduction in basic rate of customs duty on Natural Rubber

The other raw materials consumed by the tyre industry are crude

derivatives such as synthetic rubber, nylon tyre cord fabric, etc. Therefore,

rising crude oil prices increase raw material costs and affect the

profitability of the company.

Raw Material Availability:

No domestic Production of Butyl Rubber and Styrene Butadiene Rubber

(tyre grades), & EPDM.

Production of Nylon Tyre Cord Fabric, Polybutadiene Rubber, Rubber

Chemicals, Steel Tyre Cord, Polyester Tyre Cord insufficient to meet

domestic demand.

Tyre industry imports raw materials on account of the following factors:

duty-free imports permitted against export of tyres; domestic demand

not sufficient to meet complete requirement; technical and

commercial considerations;

business strategy to have multiple sources of supply.

Natural Rubber 44%

Nylon Tyre Cord

Fabric

19%

Carbon Black 12%

Rubber Chemicals 5%

Butyl Rubber 4%

PBR 5%

SBR 5%

Others 6%

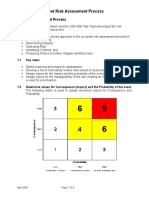

Porters Five Forces Analysis

Competition

Rivalry:

Medium

Availability

of

substitutes:

Medium

Buyers

Power: High

Entry

Barriers:

Medium

Suppliers

Power: High

Power of the Buyer: Indian Tyre industry has more than 40

players and so the buyers has many alternatives to choose

from and also there are no switching costs. Due to this, Tyre

manufacturers cannot pass on the increase raw material

costs to the buyers.

Power of the supplier: Major Raw material of the tyre

industry is natural rubber. The demand for natural rubber is

outpacing the production of natural rubber as a result

increasing the power of the suppliers.

Competitive Rivalry: The top 10 players hold more than 95%

market share, however the individual market share of the

companies are quite close to each other as a result they

cannot fully pass on any price rise to OEMs due to fear of

losing their market share.

Availability of Substitutes: If domestic prices are dearer

compared to the overseas market, the OEMs start buying

tyres from overseas markets like China. However, in case of

replacement tyres, consumers does not have this liberty.

Entry Barriers: As the industry is highly capital intensive and

even the margins are low, the chances of entry of new

players in this industry appears low. However, Automobile

manufacturers can enter this market through backward

integration as it is advantageous for them.

Pros of the Cooper Deal

Access to fast growing markets of North America and China: While its acquisition of

Netherlands-based Vredestein Banden in May 2009 gave Apollo a foothold in the European

markets, Cooper Tires will help the company spread its wings in the US.

Inline with Apollos goal of becoming a truly global company: Cooper derives about three-

fourths of its revenues from the North American markets. After this buy, Europe and US will together

bring in 55 per cent of Apollos consolidated revenues.

Both having a strong presence in the replacement category: Similar to Vredestein, Cooper

caters predominantly to the tyre replacement markets. Replacement segment is reasonably shielded

from the cyclical nature of new vehicle sales and replacement sales bring in higher margins.

Diversified product offerings: Cooper complements Vredestein in terms of product line. While the

latter focuses on winter and speciality tyres, these tyres contribute only to 10 per cent of the

revenues for the former. Cooper instead focuses on light vehicle tyres.

Coopers manufacturing base in China: It is advantageous to Apollo. Its reputation as a low-cost

manufacturing base and proximity to India and rubber producing nations of South-east Asia will

stand Apollo in good stead.

OEMs associations that do not overlap

A good track record of driving sales growth

Why not Cooper Tyres?

Problems with Cooper tyres Chinese partner: Cooper Tire has a JV with the Chengshan Group called Cooper

Chengshan Tire Co, in which Cooper is the majority shareholder with a stake of 65 percent. Its chairman Che

wants to acquire cooper tyres for himself, alternatively he is asking Apollo tyres to buy his share at nearly thrice

the price than what Apollo is ready to pay. Che did not allow Cooper tyres management to enter his factory in

China or handle them the financial details of the company even though he is a minority shareholder, which

speaks of the influence chairman Che has in China and the potential problems that could arise on going ahead

with the acquisition without his support.

Problems with USW: The union has around ten demands, which included coverage of two other plants (not

unionised) and one-time bonuses for all union members among several other conditions. By Apollos estimate,

the additional cost of meeting those demands was about $130-140 million. This also affects long term

sustainability as whatever is agreed to would go into union contracts which forever would have an implication on

the company.

High Leverage: Even if Apollo tyres was able to resolve the above issues, the leverage involved in the deal of

acquiring a company which is bigger than Apollo tyres will pose a significant risk on its balance sheet. Apollo is

paying 43% more than the market value for Cooper Tyres. The shares of the Apollo tyres fell significantly after

the announcement of the deal signalling the negative sentiments of the shareholders.

Due to these reasons, even though there are many pros to this deal, it is better for Apollo tyres to not go

ahead with this deal, rather prefer the acquisition of an Indian tyres manufacturer which can strengthen its Indian

operations and also help in its vision of becoming a global player

Threats for Apollo

Economic downturn or slowdown in the key markets - Europe

and India - leading to decreased volumes and capacity

utilisation.

Increased competition from global players like Michelin and

Bridgestone in India, particularly in the truck-bus radial tyre

category.

A quicker than expected decline in volumes within the truck-

bus cross ply segment, resulting in redundant capacities

needing investment to convert into other product segments.

Continued threat of raw material price volatility translating

into pressure on margins during a quick rise in raw material

prices.

Selection of the Target Company

These acquisitions of JK and CEAT as well as acquisition of MRF will come under the

scrutiny of CCI, as Acquisition of JK Tyres leads to acquiring more than 40% share in

the Truck & Bus segment with the second competitor MRF having only 21% market

share. And so the bargaining power of Apollo increases in this segment which CCI will

not allow. Same is the case with MRF and CEAT. These deals do not appear to be

possible.

Apollo tyres has not much presence in the 2&3 wheeler segment, so acquiring TVS

Srichakra or Falcon would provide it with good market share to compete with the

market leader MRF, but acquiring TVS Srichakra is not possible as TVS Srichakra is a

result of backward integration of TVS and so TVS will prefer not to sell. Falcon on the

other hand is in losses, and so need to be carefully evaluated before going ahead with

the acquisition of Falcon.

Remaining option is Balakrishna Industries Ltd, it caters to a niche segment and get its

90% revenue from US and Europe. Acquisition of Balakrishna will lead to Apollo

becoming the largest tyre manufacturer in India beating MRF. Balakrishna Industries is

also a non competitor of Apollo, leading to synergies.

Selection of the Target Company

One of the major reasons for Apollo tyres interest in acquiring Cooper Tyres is to enter new

geographical markets.

Apollo has its presence in Europe and Africa, so, only Indian tyre manufacturers who have their

presence in the other geographical markets or in a different segment in the existing markets

will create synergy.

CEAT has acquired the global rights of brand CEAT from Italian tyre maker Pirelli for Rs 55

crore. The acquisition will help CEAT enter new markets such as Latin America, Europe and

the US in the radial tyre segment. The tyre manufacturer use to export to Latin America and

Europe under brand name Altura before the acquisition. CEAT exports to USA, Africa, America,

Australia and other parts of Asia and can help Apollo in entering the global market using the

CEAT global brand name.

J.K.Tyres acquired Mexican tyre major Tornel which has 3 plants in Mexico. Due to this,

acquisition by Apollo could lead to access to Mexico, markets of Latin America and a possible

foray into the US markets due to the close proximity of Mexico to US.

Rationale behind the acquisition of

Balakrishna Industries Ltd

Market penetration in US and Europe: 90% revenue of Balakrishna Industries Limited

comes from US and Europe. It will give the firm an entry in the US market.

The firm is relatively stable and generates good cash flow.

The category it caters to requires large number of products and the quantity required

for these products is small. Any new competition entering this market will require a lot

of capital investment.

They produce 100-120 skus every year which is highest produced by any company in

the world.

Their turn around time for a new product is 8 to 10 weeks, worlds fastest.

US economy is now starting the signs of improvement. This will boost the trade

prospect.

The high leverage this firm enjoys gives it very low WACC which is a great deal for

the shareholders of Apollo.

Rationale behind the acquisition of

Balakrishna Industries Ltd

Balkrishna Industries has lower operating costs due to its manufacturing plants situated in India.

The company's labour costs are nearly one-fifth of the costs incurred by global players. Labour

accounts for nearly 4% of the total costs for the company. Besides, the off highway tyre segment

is a high variety, low volume business, which requires a good distribution network for growth.

Their raw material logistic cost is low due to close proximity to worlds largest rubber growing

regions.

Some tyre majors including Continental and Goodyear exited the OTR and farm-tyre market in

the US in 2005-06 as labour costs began eating into profitability. This is an opportunity for

Balakrishna Industries.

BKT has a very low cost distribution model. Manufacturing is done only for confirmed orders.

Company sells to distributors at 30% discount to global leaders who in turn keep 5-10% margin

and pass on the rest cost benefit to end users. This creates distributors loyality.

Their new plant at Bhuj will provide them with 60% capacity to manufacture radial tyres which

enjoys 8-10% higher margins than cross ply. This plant is situated at a location which will also

give it great mobilization capability and advantage with respect to power supply.

Synergies:

Apollo tyre's sale has been stagnating in the off highway segment of tyres. This

acquisition will give it boost in this segment.

This will help de-risk dependence on the Indian market which is going through a

turbulent time.

This will also provide it with perfect synergy. Apollo Tyres and BKT are not

competitors in any segment. This will help Apollo Tyres cater to a larger audience.

Apollo Tyres will be able to leverage the supply chain and presence of BKT in the US

market to promote their own products which was their reason of trying to acquire

Cooper Tyres.

Combining with Apollo would give BKT opportunity of utilizing its Indias network

which is a market where BKT is now trying to enter.

Its will also give companies better synergy in the European and African market where

BKT is not present.

Revenue Share of Apollo geographically

Before and After Acquisition:

65%

23%

12%

India

Europe

South Africa

44%

25%

14%

13%

4%

India

Europe

South Africa

US

Asia

Segment wise revenue share of Apollo

Before and After the acquisition :

33%

48%

9%

9%

1%

Passenger Vehicles

Truck Bus

Off highway

Light Truck

others

24%

35%

34%

7%

1%

Passenger Vehicles

Truck Bus

Off highway

Light Truck

others

Valuation of the deal on Standalone

Basis

We assume that the BKT will run as a standalone company without any synergy with

Apollo Tyres.

Average revenue growth = 27%

Corporate tax rate = 30%

Risk free rate: 8.82% (10 year government bond yield rate)

Expected Market Return for India: 18.6% (according to NASDAQ)

Beta: 1.33 (reuters)

Cost of Equity using CAPM model : 22%

Post tax Cost of Debt: 1.7%

Debt to Equity Ratio - 1.45

WACC=11.765%

BKT has a market share of approx 6% in the international OTR segment.

International OTR segment is growing at a CAGR of 6%, whereas BKT sales are growing at a CAGR of 27%.

With such high growth, BKT will capture 20% of market share within 7 years.

Assuming that their cheap labor advantage will slowly perish with time and after capturing a market share of 20%

it will be difficult for BKT to penetrate the market, we have assumed the company will grow at a CAGR of 6% after

4 years.

According to valuation done on the following slide the deal is worth close to

$3.2 billion.

Its market capital is only $0.7 billion.

There is a lot of debt and contingent liability in its books due to which its

shares are being undervalued.

Contingent liability is more than 170% of its net worth.

Recent capital expenditures allow it a large

increase in its capacity and cash flows.

Its new green field tyre plan in Bhuj will provide a

major increase in production capacity and also the

technology.

Promoter and promoter group hold 58% of its total

shares. By the way of a block deal a substantial

controlling stake in the company can be acquired.

Financing of the deal:

BKT has the capability of acquiring debt at a very low rate from European and US market. They

can easily hedge the risk with their own revenue which primarily comes from these regions.

The market capitalization of BKT is Rs3801 crores.

By raising Rs2790 crores at their Mauritious unit(same as in the case of Cooper) they will be

able to acquire more than 50% of their shares at 50% premium.

Looking at the enterprise value of the organization this is a viable option.

For acquiring 75% stake in the company at 50% premium they will require Rs 4276 cr.

This additional Rs 1500 crore can be raised by leveraging their stake in BKT from European or

the US market.

Currently BKT have a borrowing cost close to 2.5 to 3 percent.

References:

Balakrishna Industries Annual Reports.

Apollo Tyers annual Reports.

Investment Information and Credit Rating Agency of India

Limited.

Competition Commission of India Limited.

ATMA

Reuters

CRISIL

Moneycontrol.com

THANK YOU

Você também pode gostar

- Case Study On Apollo TyresDocumento14 páginasCase Study On Apollo TyresdeepakjmartinAinda não há avaliações

- ICRA Sector Analysis Conducted in February 2004Documento9 páginasICRA Sector Analysis Conducted in February 2004Varsha KandhwayAinda não há avaliações

- Apollo Tyre AssignmentDocumento16 páginasApollo Tyre AssignmentShahjahan Alam100% (1)

- MRF Tyre Industry Ver 4Documento23 páginasMRF Tyre Industry Ver 4Sushant Sehra33% (3)

- Tyre Industry in IndiaDocumento14 páginasTyre Industry in IndiaH Janardan PrabhuAinda não há avaliações

- JK Tyre Report (By Siddhant Malhotra)Documento65 páginasJK Tyre Report (By Siddhant Malhotra)Dev Parashar100% (1)

- Tyre Indusrty - 5 ForcesDocumento3 páginasTyre Indusrty - 5 ForcesRini RafiAinda não há avaliações

- Apollo Tyres Ltd. - Project Report On Working Capital Management.Documento83 páginasApollo Tyres Ltd. - Project Report On Working Capital Management.aakhir00736% (11)

- Final Report Passenger CarsDocumento20 páginasFinal Report Passenger CarsAditya Nagpal100% (1)

- B2B Tyre IndustryDocumento51 páginasB2B Tyre IndustryKundlik Nimase0% (2)

- Tyre Industry AnalysisDocumento14 páginasTyre Industry AnalysisRickMartinAinda não há avaliações

- JK Tyre Industries LTDDocumento15 páginasJK Tyre Industries LTDAlex KuruvillaAinda não há avaliações

- Porters Five Force Analysis of Ceat TyresDocumento4 páginasPorters Five Force Analysis of Ceat TyresSaguna DatarAinda não há avaliações

- MRF TyresDocumento22 páginasMRF TyresRakshitAgarwal100% (1)

- EicherDocumento16 páginasEicherBalaram ChampannavarAinda não há avaliações

- Ralco PROJECT REPORTDocumento67 páginasRalco PROJECT REPORTSahil Nayyar100% (2)

- Appolo TyresDocumento98 páginasAppolo TyresGobind Cj100% (3)

- Overview of Indian Cement Industry 2010Documento17 páginasOverview of Indian Cement Industry 2010shubhav1988100% (2)

- Tata Moters Company ProfileDocumento3 páginasTata Moters Company ProfileRishabh MakhariaAinda não há avaliações

- Tata MotorsDocumento29 páginasTata Motorsgoelabhishek90100% (2)

- MRF Introduction and Industry ProfileDocumento8 páginasMRF Introduction and Industry ProfileS.Abyisheik Reddy100% (2)

- Strategy (Michelin)Documento4 páginasStrategy (Michelin)Sameer AbbasAinda não há avaliações

- MRF (Company) : Madras Rubber Factory Commonly Known As MRF orDocumento6 páginasMRF (Company) : Madras Rubber Factory Commonly Known As MRF orAjudiya MeetAinda não há avaliações

- Porter's Five Forces Analysis - Indian Automobile Industry 2Documento60 páginasPorter's Five Forces Analysis - Indian Automobile Industry 2Ashish Mendiratta50% (2)

- MRFDocumento42 páginasMRFfaraz_005Ainda não há avaliações

- Main ProjectDocumento64 páginasMain Projectsandy1586Ainda não há avaliações

- Apollo Tyres Brand ImageDocumento61 páginasApollo Tyres Brand ImageShahzad SaifAinda não há avaliações

- Synopss Orignal of Ambuja CementDocumento25 páginasSynopss Orignal of Ambuja CementLovely Garima JainAinda não há avaliações

- JK Tyre1 PDFDocumento54 páginasJK Tyre1 PDFSujit Chandrashekhar HegdeAinda não há avaliações

- JK Mysore Intership ReportDocumento41 páginasJK Mysore Intership ReportSumanth Gowda100% (1)

- Company ProfileDocumento6 páginasCompany ProfilePushpanathan ThiruAinda não há avaliações

- Apollo Tyre Company: A Project Report ONDocumento55 páginasApollo Tyre Company: A Project Report ONMOHITKOLLI100% (1)

- Project WorkDocumento24 páginasProject Workyesham jainAinda não há avaliações

- Appolo TyreDocumento63 páginasAppolo Tyresanthoshchandu.santhoshmohan100% (2)

- Saja .K.a Apollo TyresDocumento52 páginasSaja .K.a Apollo TyresSaja Nizam Sana100% (1)

- UltraTech Cement LTD Financial AnalysisDocumento26 páginasUltraTech Cement LTD Financial AnalysisSayon DasAinda não há avaliações

- Company Brief PDFDocumento18 páginasCompany Brief PDFSansha BolarAinda não há avaliações

- Apollo Tyres LTD Project Report On Working Capital ManagementDocumento83 páginasApollo Tyres LTD Project Report On Working Capital Managementprateeksri1033% (3)

- Analysis of Tractor Industry in IndiaDocumento28 páginasAnalysis of Tractor Industry in Indiasunitmhasade83% (18)

- Marketing Stratergy Hero HondaDocumento57 páginasMarketing Stratergy Hero Hondaadityaraman84950% (2)

- Asian PaintsDocumento41 páginasAsian Paintssreenesh_pai100% (4)

- JK Tyre Marketing Strategies of JK Tyres LimitedDocumento96 páginasJK Tyre Marketing Strategies of JK Tyres LimitedPrashanth Singh50% (2)

- Strategic Management Project On Tata Motors: Under The Guidance of Prof. SubramaniamDocumento33 páginasStrategic Management Project On Tata Motors: Under The Guidance of Prof. SubramaniamMainali GautamAinda não há avaliações

- SWOT Analysis of Tata MotorsDocumento13 páginasSWOT Analysis of Tata MotorsShubham TiwariAinda não há avaliações

- Ultratech CementDocumento65 páginasUltratech CementSonam Borana0% (1)

- Ralson (India) LimitedDocumento11 páginasRalson (India) LimitedAmit KumarAinda não há avaliações

- Dice of Zeus: Fanatics NMIMS, MumbaiDocumento25 páginasDice of Zeus: Fanatics NMIMS, MumbaiShivangi RathiAinda não há avaliações

- Operation Management of - CEAT Tyres of India LTD ImtDocumento87 páginasOperation Management of - CEAT Tyres of India LTD Imtdragon77175% (4)

- Indian Tyre Industry: Segments For The Tyre Industry Are Two-Wheelers, Passenger Cars and Truck and Bus (T&B)Documento10 páginasIndian Tyre Industry: Segments For The Tyre Industry Are Two-Wheelers, Passenger Cars and Truck and Bus (T&B)Sunaina AgrawalAinda não há avaliações

- Ceat LTD: Industry AnalysisDocumento3 páginasCeat LTD: Industry AnalysisAkshay KarandeAinda não há avaliações

- Analysis of External Business Environment: 1) Bargaining Power of SupplierDocumento21 páginasAnalysis of External Business Environment: 1) Bargaining Power of SupplierTanya RaghavAinda não há avaliações

- Bridgestone and MRF Tyre IndustryDocumento84 páginasBridgestone and MRF Tyre IndustryKunal DesaiAinda não há avaliações

- The Overall Market Value For Specialty Tires Is Expected To Grow With A CAGR of 4.2% For The Next 5 Years To Reach Nearly USD 21.5 Billion in 2020Documento10 páginasThe Overall Market Value For Specialty Tires Is Expected To Grow With A CAGR of 4.2% For The Next 5 Years To Reach Nearly USD 21.5 Billion in 2020varu bhandariAinda não há avaliações

- Industry AnalysisDocumento6 páginasIndustry AnalysisMichael SapriioAinda não há avaliações

- By Ankush Roy (13068) Dipankar Patir (13074) Evangeline K. Jyrwa (13076) Saurabh Agarwal (13102) Soupa Soundararajan (13109) Gaurav Arora (13118)Documento224 páginasBy Ankush Roy (13068) Dipankar Patir (13074) Evangeline K. Jyrwa (13076) Saurabh Agarwal (13102) Soupa Soundararajan (13109) Gaurav Arora (13118)Anirban BanerjeeAinda não há avaliações

- Overview of Indian Tyre IndustryDocumento64 páginasOverview of Indian Tyre IndustryNitesh KumarAinda não há avaliações

- Final IRPDocumento65 páginasFinal IRPcoolashz50% (2)

- Indian Tyre Industry: The Tyre Makers in India Is Gearing Up To Intensify Its Role in The Modernisation PhaseDocumento11 páginasIndian Tyre Industry: The Tyre Makers in India Is Gearing Up To Intensify Its Role in The Modernisation Phaseakshay guptaAinda não há avaliações

- ICRA Sector Analysis Conducted in February 2004Documento5 páginasICRA Sector Analysis Conducted in February 2004suneshs709Ainda não há avaliações

- IF - Final Money MarketsDocumento63 páginasIF - Final Money MarketsKoushik G SaiAinda não há avaliações

- Qualitative Aspects and Preventive Methods Involved in The Construction of The CWPH Project by IVRCL at The NTECL SiteDocumento43 páginasQualitative Aspects and Preventive Methods Involved in The Construction of The CWPH Project by IVRCL at The NTECL SiteKoushik G SaiAinda não há avaliações

- PS1 ReportDocumento30 páginasPS1 ReportKoushik G SaiAinda não há avaliações

- Green Buildings SOPDocumento50 páginasGreen Buildings SOPKoushik G Sai100% (2)

- Fundamental Analysis of Airtel ReportDocumento29 páginasFundamental Analysis of Airtel ReportKoushik G SaiAinda não há avaliações

- Green Buildings SOPDocumento50 páginasGreen Buildings SOPKoushik G Sai100% (2)

- V-Mart Retail R 02032020Documento8 páginasV-Mart Retail R 02032020Yusuf MalikAinda não há avaliações

- 4 Fleet Risk Assessment ProcessDocumento4 páginas4 Fleet Risk Assessment ProcessHaymanAHMEDAinda não há avaliações

- ch07 2023 Evaluating Employee Job PerformanceDocumento21 páginasch07 2023 Evaluating Employee Job PerformanceAbram TinAinda não há avaliações

- Wacc CalculationsDocumento106 páginasWacc CalculationsRishi BhansaliAinda não há avaliações

- Wanhui Ins 1-13-2020 WP PSIDocumento28 páginasWanhui Ins 1-13-2020 WP PSIBrian Ferndale Sanchez GarciaAinda não há avaliações

- MN3042QA Assignment Brief 3 With Grading SchemeDocumento5 páginasMN3042QA Assignment Brief 3 With Grading SchemeleharAinda não há avaliações

- WF 8.1.13 PDFDocumento11 páginasWF 8.1.13 PDFChad Thayer VAinda não há avaliações

- ABS Pricing Guide - August 2006Documento6 páginasABS Pricing Guide - August 2006yukiyurikiAinda não há avaliações

- Project ClosureDocumento8 páginasProject ClosureAnonymous 74EiX2MzgcAinda não há avaliações

- University of Mumbai Study of Capital BudgetingDocumento84 páginasUniversity of Mumbai Study of Capital BudgetingOmkar GaikwadAinda não há avaliações

- AssignmentDocumento3 páginasAssignmentS Saif SiddiqueAinda não há avaliações

- Assignment - Joie de VivreDocumento2 páginasAssignment - Joie de VivreÐaniyal KazmiAinda não há avaliações

- Internship Report Credit Management in Janata BankDocumento53 páginasInternship Report Credit Management in Janata BankKuasha Nirob81% (21)

- BRM BodyDocumento33 páginasBRM BodyAlisha OberoiAinda não há avaliações

- Performance Appraisal ProjectDocumento36 páginasPerformance Appraisal ProjectSurekha SrinivasAinda não há avaliações

- Cips L4M4 V4.2 (1) - 1Documento11 páginasCips L4M4 V4.2 (1) - 1Mohamed ElsirAinda não há avaliações

- Credit Attributes of Project FinanceDocumento5 páginasCredit Attributes of Project FinanceAndreea CismaruAinda não há avaliações

- Pinto Pm2 Ch03Documento22 páginasPinto Pm2 Ch03Focus ArthamediaAinda não há avaliações

- Oee 3Documento2 páginasOee 3AngelikaAinda não há avaliações

- Blanco RAROC Risk Capital 09 04Documento11 páginasBlanco RAROC Risk Capital 09 04MouBunchiAinda não há avaliações

- Bmhr5103 AssignmentDocumento21 páginasBmhr5103 AssignmentANISAinda não há avaliações

- AGREE II-Global Rating Scale (AGREE II-GRS) Instrument: InstructionsDocumento2 páginasAGREE II-Global Rating Scale (AGREE II-GRS) Instrument: Instructionsgerencia clinicaAinda não há avaliações

- D 610 - 95 - Rdyxmc1sruq - PDFDocumento9 páginasD 610 - 95 - Rdyxmc1sruq - PDFPaulo SantosAinda não há avaliações

- 2023 4AssignmentTwoInstructionsS12023-updatedDocumento5 páginas2023 4AssignmentTwoInstructionsS12023-updatedQuyên NgôAinda não há avaliações

- Reinsurance: PresentationDocumento23 páginasReinsurance: Presentationanon_61950307100% (1)

- MOCK TEST 1 Operations Management RevisedDocumento5 páginasMOCK TEST 1 Operations Management Revisedmkios123321Ainda não há avaliações

- Commercial Transportation Working Analysis HDFC Bank - 2011Documento72 páginasCommercial Transportation Working Analysis HDFC Bank - 2011rohitkh28Ainda não há avaliações

- CRISIL Governance and Value Creation RatingsDocumento7 páginasCRISIL Governance and Value Creation RatingsPrachi AggarwalAinda não há avaliações

- Msme PDFDocumento192 páginasMsme PDFAravind Sunitha100% (2)

- SecuritizationDocumento46 páginasSecuritizationHitesh MoreAinda não há avaliações