Escolar Documentos

Profissional Documentos

Cultura Documentos

Negotiable Instruments ACT, 1881: Legal Aspects of Business

Enviado por

Vipul BatraDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Negotiable Instruments ACT, 1881: Legal Aspects of Business

Enviado por

Vipul BatraDireitos autorais:

Formatos disponíveis

NEGOTIABLE INSTRUMENTS

ACT, 1881

LEGAL ASPECTS OF BUSINESS

Presented To

Prof. A. Balasubramaniam

Presented By

Name Roll No.

Trushank Chavan 07

Shankar Gajare 17

Deepak Patil 42

Rohan Rane 49

Anushri Raut 50

INTRODUCTION TO NEGOTIABLE

INSTRUMENTS ACT, 1881

The Negotiable Instruments Act was enacted, in India, in 1881.

Prior to its enactment, the provision of the English Negotiable

Instrument Act were applicable in India, and the present Act is also

based on the English Act with certain modifications. It extends to the

whole of India except the State of Jammu and Kashmir. The Act

operates subject to the provisions of Sections 31 and 32 of the

Reserve Bank of India Act, 1934.

2

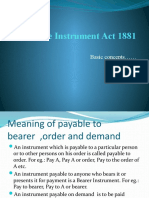

MEANING OF NEGOTIABLE

INSTRUMENT

The word negotiable means transferable by delivery, and

word instrument means a written document by which a right is

created in favour of some person. Thus, the term negotiable

instrument means a written document transferable by delivery.

According to Section 13 (1) of the Negotiable Instruments Act,

A negotiable instrument means a promissory note, bill of

exchange, or cheque payable either to order or to bearer. A

negotiable instrument may be made payable to two or more

payees jointly, or it may be made payable in the alternative to

one of two, or one or some of several payees [Section 13(2)].

3

FEATURES OF NEGOTIABLE

INSTRUMENTS

Writing and Signature

Money

Freely Transferable

Title of Holder Free from all Defects

Notice

Presumption

Special Procedure

Popularity

Evidence

4

TYPES OF NEGOTIABLE

INSTRUMENTS

There are two types of Negotiable Instruments:

1. Instruments Negotiable by Statute:

The Negotiable Instruments Act mentions only three kinds of

negotiable instruments (Section 13). These are:

1. Promissory Notes

2. Bills of Exchange, and

3. Cheques

2. Instruments Negotiable by Custom or Usage:

There are certain other instruments which have acquired

the character of negotiability by the usage or custom of trade.

For example: Exchequer bills, Bank notes, Share warrants,

Circular notes, Bearer debentures, Dividend warrants, Share

certificates with blank transfer deeds, etc.

5

PROMISSORY NOTES

Section 4 of the Act defines, A promissory note is an

instrument in writing (note being a bank-note or a currency note)

containing an unconditional undertaking, signed by the maker, to

pay a certain sum of money to or to the order of a certain person,

or to the bearer of the instruments.

The person who makes the promissory note and promises to

pay is called the maker. The person to whom the payment is to be

made is called the payee.

6

CHARACTERISTICS OF A

PROMISSORY NOTE

It is an Instrument in Writing

It is a Promise to Pay

Signed by the Maker

Other Formalities

Definite and Unconditional Promise

Promise to Pay Money Only

Maker must be a Certain Person

Payee must be Certain

Sum Payable must be Certain

It may be Payable on Demand or After a Definite Period of Time

It cannot be Made Payable to Bearer on Demand

7

PARTIES TO A PROMISSORY NOTE

Maker:

Maker is the person who promises to pay the amount stated in

the note.

Payee:

Payee is the person to whom the amount of the note is payable.

Holder:

He is either the payee or the person to whom the note may

have been endorsed.

8

SPECIMEN OF PROMISSORY NOTE

Rs. 10,000

Lucknow

April 10, 2013

Three months after date, I promise to pay Shri Ramesh (Payee) or to his order the sum of Rupees

Ten Thousand, for value received.

To,

Shri Ramesh,

B-20, Green Park,

Mumbai.

(Maker)

Stamp

Sd/-

Ram

9

BILL OF EXCHANGE

According to Section 5 of the act, A bill of exchange is an

instrument in writing containing an unconditional order signed by the

maker, directing a certain person to pay a certain sum of money only

to, or to the order of, a certain person or to the bearer of the

instrument. It is also called a Draft.

Special Benefits of Bill of Exchange:

A bill of exchange is a double secured instrument.

In case of immediate requirement, a Bill may be discounted with

a bank.

10

ESSENTIAL ELEMENTS OF BILL OF

EXCHANGE

It must be in Writing.

Order to pay

Drawee

Signature of the Drawer

Unconditional Order

Parties

Certainty of Amount

Payment in Kind is not Valid

Stamping

Cannot be made Payable to Bearer on Demand

11

PARTIES TO A BILL OF EXCHANGE

Drawer:

The maker of a bill of exchange is called the drawer.

Drawee:

The person directed to pay the money by the drawer is called

the drawee.

Payee:

The person named in the instrument, to whom or to whose order

the money are directed to be paid by the instruments are called

the payee.

12

SPECIMEN OF BILL OF EXCHANGE

Rs. 10,000

Mumbai

April 10, 2013

Three months after date pay to Ram (Payee) order the sum of Ten Thousand Rupees, for value

received.

To,

Sushil

B-20, Green Park,

Lucknow - 226020.

Stamp

Sd/- Ram

In case of need with

Canara Bank, Delhi.

(Drawer)

(Drawer)

Accepted

Sushil

13

CLASSIFICATION OF BILL OF

EXCHANGE

Inland and Foreign Bills [Section 11 and 12]

Inland Bill:

It is drawn in India on a person residing in India whether payable in or

outside India; or

It is drawn in India on a person residing outside India but payable in India.

Foreign Bill:

A bill drawn in India on a person residing outside India and made payable

outside India.

Drawn upon a person who is the resident of a foreign country.

14

CLASSIFICATION OF BILL OF

EXCHANGE (Cont.)

Time and Demand Bills:

Time Bill: A bill payable after a fixed time is termed as a time bill. A bill

payable after date is a time bill.

Demand Bill: A bill payable at sight or on demand is termed as a

demand bill.

Trade and Accommodation Bills:

Trade Bill: A bill drawn and accepted for a genuine trade transaction is

termed as trade bill.

Accommodation Bill: A bill drawn and accepted not for a genuine

trade transaction but only to provide financial help to some party is

termed as an accommodation bill.

15

CHEQUE

According to Section 6 of the act, A cheque is a bill of

exchange drawn on a specified banker and not expressed to be

payable otherwise than on demand. A cheque is also, therefore, a

bill of exchange with two additional qualification:

It is always drawn on a specified banker.

It is always payable on demand.

Special Benefits of Bill of Exchange:

A bill of exchange is a double secured instrument.

In case of immediate requirement, a Bill may be discounted with

a bank.

16

ESSENTIAL ELEMENTS OF A CHEQUE

In writing

Express Order to Pay

Definite and Unconditional Order

Signed by the Drawer

Order to Pay Certain Sum

Order to Pay Money Only

Certain Three Parties

Drawn upon a Specified Banker

Payable on Demand

17

PARTIES TO A CHEQUE

Drawer:

Drawer is the person who draws the cheque.

Drawee:

Drawee is the drawers banker on whom the cheque has been

drawn.

Payee:

Payee is the person who is entitled to receive the payment of a

cheque.

18

SPECIMEN OF CHEQUE

Pay ......

. Or Bearer

Rupees

Rs.

Kapoorthala Bagh,

Mumbai 400033

IFSCode:MAHB0000316

A/c No.

473792 000240000 000000 10

SHANKAR GAJARE

Signature

Please sign above

19

D D M M Y Y Y Y

TYPES OF A CHEQUE

Bearer Cheque

Cross Cheque

Cheque Crossed Specially

Restrictive Crossing (A/c Payee Only)

20

NEGOTIATION

According to section 14 of the Act, when a promissory note,

bill of exchange or cheque is transferred to any person so as to

constitute that person the holder thereof, the instrument is said to be

negotiated. The main purpose and essence of negotiation is to

make the transferee of a promissory note, a bill of exchange or a

cheque the holder there of.

Negotiation thus requires two conditions to be fulfilled, namely:

There must be a transfer of the instrument to another person; and

The transfer must be made in such a manner as to constitute the

transferee the holder of the instrument.

21

MODES OF NEGOTIATION

Negotiation by delivery (Sec. 47):

Where a promissory note or a bill of exchange or a cheque is

payable to a bearer, it may be negotiated by delivery thereof.

Example: A the holder of a negotiable instrument payable to

bearer, delivers it to Bs agent to keep it for B. The instrument has

been negotiated.

Negotiation by endorsement and delivery (Sec. 48):

A promissory note, a cheque or a bill of exchange payable

to order can be negotiated only be endorsement and delivery.

Unless the holder signs his endorsement on the instrument and

delivers it, the transferee does not become a holder. If there are

more payees than one, all must endorse it.

22

ENDORSEMENT [SECTION 15]

The word endorsement in its literal sense means, writing on

the back of an instrument. But under the Negotiable Instruments Act it

means, the writing of ones name on the back of the instrument or

any paper attached to it with the intention of transferring the rights

therein. Thus, endorsement is signing a negotiable instrument for the

purpose of negotiation. The person who effects an endorsement is

called an endorser, and the person to whom negotiable instrument

is transferred by endorsement is called the endorsee.

Who may Endorse / Negotiate [Section 51]:

Every Sole maker, drawer, payee or endorsee, or all of several

joint makers, drawers, payees or endorsees of a negotiable instrument

may endorse and negotiate the same if the negotiability of such

instrument has not been restricted or excluded as mentioned in

Section 50.

23

ENDORSEMENT (Cont.)

Essentials of a Valid Endorsement:

It must be on the back or face of instrument or on a slip of paper

annexed thereto.

It must be signed by the endorser.

It must be completed by the delivery of the instrument.

It must be made by the holder of the instrument.

Kinds of Endorsement:

Blank or General Endorsement

Full or Special Endorsement

Partial Endorsement

Restrictive Endorsement

Conditional Endorsement

24

Você também pode gostar

- Notes ConsiderationDocumento5 páginasNotes Consideration3D StormAinda não há avaliações

- UNCITRAL Guide United Nations Commission On International Trade LawDocumento56 páginasUNCITRAL Guide United Nations Commission On International Trade Lawsabiont100% (2)

- Cma Exam Part 1 Study Planner Based On Gleim 2015 Review System NoteDocumento1 páginaCma Exam Part 1 Study Planner Based On Gleim 2015 Review System NoteAnna RomanAinda não há avaliações

- Presentation On Negotiable InstrumentDocumento38 páginasPresentation On Negotiable Instrumentacidreign0% (1)

- Set OffDocumento9 páginasSet OffAditya MehtaniAinda não há avaliações

- Types of SecuritiesDocumento17 páginasTypes of SecuritiesSouvik DebnathAinda não há avaliações

- Negotiable InstrumentsDocumento11 páginasNegotiable InstrumentsMahesh ChavanAinda não há avaliações

- Negotiable Instruments Cases PartialDocumento344 páginasNegotiable Instruments Cases PartialJust SanchezAinda não há avaliações

- Negotiable Instrument Act 1881Documento29 páginasNegotiable Instrument Act 1881Anonymous WtjVcZCgAinda não há avaliações

- Law of Limitation in BankingDocumento13 páginasLaw of Limitation in Bankingeknath2000100% (1)

- The Declaration of Independence: A Play for Many ReadersNo EverandThe Declaration of Independence: A Play for Many ReadersAinda não há avaliações

- Negotiable Instruments Act 1881Documento20 páginasNegotiable Instruments Act 1881Ankit Tiwari100% (1)

- Negotiable Instruments Act of IndiaDocumento164 páginasNegotiable Instruments Act of IndiaShome BhattacharjeeAinda não há avaliações

- Dishonour of Negotiable InstrumentsDocumento6 páginasDishonour of Negotiable InstrumentsMukul BajajAinda não há avaliações

- Difference Between Cheque Promissory Note and Bill of ExchangeDocumento2 páginasDifference Between Cheque Promissory Note and Bill of ExchangeMario Tuliao50% (2)

- Law of Contract PDFDocumento28 páginasLaw of Contract PDFtemijohnAinda não há avaliações

- The Negotiable Instruments LawDocumento16 páginasThe Negotiable Instruments LawMark Earl Santos100% (1)

- L31 Negotiable Instrument ActDocumento43 páginasL31 Negotiable Instrument ActNidhi WadaskarAinda não há avaliações

- Letter of CreditsDocumento8 páginasLetter of Creditsanur20Ainda não há avaliações

- Negotiable Instruments NotesDocumento39 páginasNegotiable Instruments NotesMehru KhanAinda não há avaliações

- Constitution of the State of Minnesota — 1876 VersionNo EverandConstitution of the State of Minnesota — 1876 VersionAinda não há avaliações

- Negotiable Instrument Act-1Documento56 páginasNegotiable Instrument Act-1Law LawyersAinda não há avaliações

- Debtor - Creditor AgreementDocumento19 páginasDebtor - Creditor AgreementGeorgeAinda não há avaliações

- Bill of ExchangeDocumento9 páginasBill of ExchangeMariyam MalsaAinda não há avaliações

- D-Negotiable Instrument ActDocumento37 páginasD-Negotiable Instrument Actharsh100% (1)

- Truth in Lending ActDocumento2 páginasTruth in Lending ActGabieAinda não há avaliações

- A Guide To The SIAC Arbitration Rules (Second Edition) (Choong, Mangan and Lingard Feb 2018)Documento18 páginasA Guide To The SIAC Arbitration Rules (Second Edition) (Choong, Mangan and Lingard Feb 2018)SHIVANI CHOUDHARY100% (1)

- Assignment 29 Indemnity Bond: Principal ObligeeDocumento4 páginasAssignment 29 Indemnity Bond: Principal ObligeeAksa Rasool100% (1)

- Indeminity and GuaranteeDocumento8 páginasIndeminity and GuaranteeAnbarasan Subu100% (2)

- Negotiation and AssignmentDocumento6 páginasNegotiation and AssignmentartiAinda não há avaliações

- Naked Guide to Bonds: What You Need to Know -- Stripped Down to the Bare EssentialsNo EverandNaked Guide to Bonds: What You Need to Know -- Stripped Down to the Bare EssentialsAinda não há avaliações

- Bills of ExchangeDocumento2 páginasBills of ExchangeSachin TiwariAinda não há avaliações

- Accounting Book 1 Lupisan Baysa Answer KeyDocumento176 páginasAccounting Book 1 Lupisan Baysa Answer KeyAngel ChuaAinda não há avaliações

- Negotiable Instrument Act 1881Documento22 páginasNegotiable Instrument Act 1881Akash saxenaAinda não há avaliações

- Tutorial 9 - Bills of ExchangeDocumento5 páginasTutorial 9 - Bills of Exchangemajmmallikarachchi.mallikarachchiAinda não há avaliações

- CHAPTER VII - Bank GuaranteesDocumento12 páginasCHAPTER VII - Bank Guaranteespriya guptaAinda não há avaliações

- An Introduction To International Commercial Arbitration FinalDocumento17 páginasAn Introduction To International Commercial Arbitration Finalarihant_219160175100% (1)

- BY: 37 MBA 09 43 MBA 09: Venika Saini Anuj GuptaDocumento31 páginasBY: 37 MBA 09 43 MBA 09: Venika Saini Anuj GuptaaditibakshiAinda não há avaliações

- AP-200Q (Quizzer - Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Documento10 páginasAP-200Q (Quizzer - Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Bernadette Panican100% (1)

- Negotiable Instruments Act, 1881Documento24 páginasNegotiable Instruments Act, 1881vikramjeet_22100% (1)

- Fundamentals Of Buy/Sell Investment Trading ProgramsNo EverandFundamentals Of Buy/Sell Investment Trading ProgramsAinda não há avaliações

- Work 1Documento216 páginasWork 1BipinAinda não há avaliações

- Out PDFDocumento38 páginasOut PDFfelixmuyoveAinda não há avaliações

- Unit 2 Sherman Antitrust Act of 1890Documento15 páginasUnit 2 Sherman Antitrust Act of 1890Prachi Tripathi100% (1)

- Bill of ExchangeDocumento5 páginasBill of ExchangeyosephworkuAinda não há avaliações

- The Story of The Buck Act: Security Number"Documento4 páginasThe Story of The Buck Act: Security Number"Bálint Fodor100% (1)

- Negotiable Instrument Act 1881Documento19 páginasNegotiable Instrument Act 1881Shaktikumar95% (19)

- 5112 Law 6 NegotiableInstrumentsDocumento199 páginas5112 Law 6 NegotiableInstrumentsRaghavendra Pundaleek ChittaAinda não há avaliações

- The Negotiable Instruments Act 1881Documento16 páginasThe Negotiable Instruments Act 1881vivekAinda não há avaliações

- Letter of Credit TypesDocumento3 páginasLetter of Credit Typesmanishtripathi1985Ainda não há avaliações

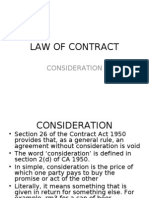

- Law of Contract: ConsiderationDocumento19 páginasLaw of Contract: ConsiderationJacob Black100% (1)

- Warehouse Law, Trust Receipt (SPL)Documento12 páginasWarehouse Law, Trust Receipt (SPL)Marjorie MayordoAinda não há avaliações

- Bill of Exchange Full ChapterDocumento10 páginasBill of Exchange Full ChapterMumtazAhmadAinda não há avaliações

- Binalay, Jude Alexis DDocumento18 páginasBinalay, Jude Alexis DChloe OberlinAinda não há avaliações

- Comparing The Agreements For Landry'sDocumento80 páginasComparing The Agreements For Landry'sDealBookAinda não há avaliações

- Business Law Week 6Documento20 páginasBusiness Law Week 6s wAinda não há avaliações

- Dishonour of NIDocumento36 páginasDishonour of NISugato C MukherjiAinda não há avaliações

- Secondary MarketDocumento15 páginasSecondary MarketShashank JoganiAinda não há avaliações

- Right of Lien by BankersDocumento13 páginasRight of Lien by Bankersgeegostral chhabraAinda não há avaliações

- Bankers Trust Co V Shapira (1980) - 1-W.L.R.-1274Documento10 páginasBankers Trust Co V Shapira (1980) - 1-W.L.R.-1274Tan KSAinda não há avaliações

- Once A Mortgage Always A Mortgage: SynopsisDocumento4 páginasOnce A Mortgage Always A Mortgage: SynopsisRupeshPandyaAinda não há avaliações

- The Next Five Years: What Investors Can ExpectDocumento52 páginasThe Next Five Years: What Investors Can ExpectJonAinda não há avaliações

- AB Bank - 2022Documento131 páginasAB Bank - 2022Mostafa Noman DeepAinda não há avaliações

- Axis Bank AptitudeDocumento94 páginasAxis Bank AptitudeladmohanAinda não há avaliações

- IndemnityDocumento10 páginasIndemnityAstik TripathiAinda não há avaliações

- Corp Accounting - Prac ProblemsDocumento5 páginasCorp Accounting - Prac ProblemsFigie KuAinda não há avaliações

- Basic Banking ConceptsDocumento17 páginasBasic Banking ConceptsVishnuvardhan VishnuAinda não há avaliações

- IIFL Project 2010Documento112 páginasIIFL Project 2010695269100% (3)

- Financial Report and ControlDocumento22 páginasFinancial Report and ControlRonggo SaputroAinda não há avaliações

- EBL Consumer FDR Form 2017Documento2 páginasEBL Consumer FDR Form 2017Ridwan Mohammed NurAinda não há avaliações

- (Adjusting Entries) The Ledger of Chopin Rental Agency On March 31 of The Current YearDocumento3 páginas(Adjusting Entries) The Ledger of Chopin Rental Agency On March 31 of The Current YearFlorencia IrenaAinda não há avaliações

- Chapter 1 & 2Documento33 páginasChapter 1 & 2ENG ZI QINGAinda não há avaliações

- Firequote - Alma Castillo and or Rodrigo MoralesDocumento7 páginasFirequote - Alma Castillo and or Rodrigo MoralesJasper SasaAinda não há avaliações

- Forecasting Financial StatementsDocumento58 páginasForecasting Financial StatementsEman KhalilAinda não há avaliações

- Financial Statements With Adjustments: Submitted To:-Ms. Palak Bajaj Submitted By:-Chirag VermaDocumento15 páginasFinancial Statements With Adjustments: Submitted To:-Ms. Palak Bajaj Submitted By:-Chirag VermaChiragAinda não há avaliações

- Reliance Nippon Life Asset Management Limited (Formerly, Reliance Capital Asset Management Limited)Documento486 páginasReliance Nippon Life Asset Management Limited (Formerly, Reliance Capital Asset Management Limited)lavAinda não há avaliações

- Shell Financial Data BloombergDocumento48 páginasShell Financial Data BloombergShardul MudeAinda não há avaliações

- Jeremyybardolazacabillo: Page1of3 016palentintostbrgypansol 9 0 0 9 - 0 7 6 4 - 4 9 Calambalaguna 4 0 2 7Documento4 páginasJeremyybardolazacabillo: Page1of3 016palentintostbrgypansol 9 0 0 9 - 0 7 6 4 - 4 9 Calambalaguna 4 0 2 7Jeremy CabilloAinda não há avaliações

- Quarterly Update Report Laurus Labs Q1 FY24Documento8 páginasQuarterly Update Report Laurus Labs Q1 FY24RAHUL NIMMAGADDAAinda não há avaliações

- Disclosure Checklist-Companies ActDocumento7 páginasDisclosure Checklist-Companies ActSarowar AlamAinda não há avaliações

- FUnding Requirement OnlineDocumento1 páginaFUnding Requirement OnlineSadu OmkarAinda não há avaliações

- The Scope of Marine InsuranceDocumento4 páginasThe Scope of Marine InsuranceseaguyinAinda não há avaliações

- How Much Should Beasley Record As Total Assets Acquired inDocumento1 páginaHow Much Should Beasley Record As Total Assets Acquired inMiroslav GegoskiAinda não há avaliações

- Module 3 - Accounts Receivable Part II - 111702467Documento11 páginasModule 3 - Accounts Receivable Part II - 111702467shimizuyumi53Ainda não há avaliações

- Reading Test Book AEUKDocumento51 páginasReading Test Book AEUKIrina KazakovaAinda não há avaliações

- Module 1, Assessment 1Documento31 páginasModule 1, Assessment 1praveena100% (2)

- Bank Statement 1)Documento4 páginasBank Statement 1)hbh2n8tgs4Ainda não há avaliações

- A Comparison Peer To Peer Lending Platforms in SinDocumento7 páginasA Comparison Peer To Peer Lending Platforms in SingitaAinda não há avaliações