Escolar Documentos

Profissional Documentos

Cultura Documentos

Chapter 7 Pricing Strategies: You Don 'T Sell Through Price. You Sell The Price

Enviado por

Anonymous ibmeej90 notas0% acharam este documento útil (0 voto)

13 visualizações30 páginasMarketing Management

Título original

Pricing Strategies

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PPT, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoMarketing Management

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PPT, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

13 visualizações30 páginasChapter 7 Pricing Strategies: You Don 'T Sell Through Price. You Sell The Price

Enviado por

Anonymous ibmeej9Marketing Management

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PPT, PDF, TXT ou leia online no Scribd

Você está na página 1de 30

Chapter 7 Pricing Strategies

You dont sell through price. You sell the

price.

The Learning Objectives

Setting Pricing Policy

Price-adjustment Strategies

Price changes

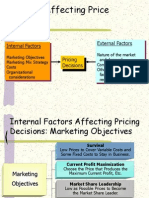

1.Pricing objectives

Survival

Maximum current profit

Maximum market share

Maximum market skimming

Product-quality leadership

Setting Pricing Policy

1. Selecting the pricing

objective

2. Determining demand

3. Estimating costs

4. Analyzing competitors

costs, prices, and offers

5. Selecting a pricing

method

6. Selecting final price

Types of Costs

Total Costs

Sum of the Fixed and Variable Costs for a Given

Level of Production

Fixed Costs

(Overhead)

Costs that dont

vary with sales or

production levels.

Executive Salaries

Rent

Variable Costs

Costs that do vary

directly with the

level of production.

Raw materials

The Three Cs Model

for Price Setting

Costs

Competitors

prices and

prices of

substitutes

Customers

assessment

of unique

product

features

Low Price

No possible

profit at

this price

High Price

No possible

demand at

this price

Some important pricing definitions

Utility: The attribute that

makes it capable of want

satisfaction

Value: The worth in terms

of other products

Price: The monetary

medium of exchange.

Value Example: Caterpillar

Tractor is $100,000 vs.

Market $90,000

$90,000 if equal

7,000 extra durable

6,000 reliability

5,000 service

2,000 warranty

$110,000 in benefits -

$10,000 discount!

Examples: new-product pricing

Market-skimming pricing

Market-penetration pricing

Market-skimming pricing

Setting a high price for a new product to skim

maximum revenues layer by layer from the

segments willing to pay the high price: the

company makes fewer but more profitable

sales.

The conditions:

1. A sufficient number of buyers have a high current

demand;

2. The unit costs of producing a small volume are not so

high that they cancel the advantage of charging what

the traffic will bear;

3. The high initial price does not attract more

competitors to market;

4. The high price communicates the image of a superior

product.

Market-penetration pricing

Setting a low price for a new product in order to

attract a large number of buyers and a large

market share.

The conditions:

1. The market is highly price sensitive,and a low

price stimulates market growth;

2. Production and distribution costs fall with

accumulated production experience;

3. A low price discourages actual and potential

competition.

Price sensitivity

Examples: product mix pricing

Product line pricing

Optional-product pricing

Captive-product pricing

By-product pricing

Cash rebates

Low-interest,longer warranties,free

maintenance

2.pricing-adjustment strategies

Discount and allowance pricing

Segmented pricing

Psychological pricing

Promotional pricing

Geographical pricing

Discount and allowance pricing

Cash discount

Quantity discount

Functional discount

Seasonal discount

allowance

Discriminatory Pricing

Time

Product-form

Customer Segment

Location

Psychological Pricing

Most Attractive?

Better Value?

Psychological reason to

price this way?

A

32 oz.

$2.19

B

26 oz.

$1.99

Assume Equal Quality

Geographical pricing

FOB-origin pricing

Uniform-delivered pricing

Zone pricing

Basing-point pricing

Freight-absorption pricing

Promotional Pricing

Loss-leader pricing

Special-event pricing

Cash rebates

Low-interest financing

Longer payment terms

Warranties & service contracts

Psychological discounting

3. Pricing changing

Initiating price cuts

Initiating price increases

Discussion

Please explain the reasons for price cuts.

Please explain the reasons for price increases.

Please describe the advantage and

disadvantage of price cuts and increases.

The reasons for price cuts

Excess capacity

Price competition

The reasons for price increases

Cost inflation

overdemand

Reactions to price changes

Customers reactions

Competitors reactions

Responding to competitors price

changes

Maintain price

Maintain price and add value

Reduce price

Increase price and improve quality

Launch a low-price fighter line

Price-Reaction Program for Meeting a

Competitors Price Cut

Has competitor

cut his price?

No

Hold our price

at present level;

continue to watch

competitors

price

Is the price

likely to

significantly

hurt our sales?

Yes

Is it likely to be

a permanent

price cut?

Yes

By more than 4%

Drop price to

competitors

price

By 2-4%

Drop price by

half of the

competitors

price cut

How much has

his price been

cut?

Yes

No No

By less than 2%

Include a

cents-off coupon

for the next

purchase

Assignment:

Read page P411---P415

Question 2, interactive marketing

applications ,P423

Você também pode gostar

- You Don 'T Sell Through Price. You Sell The PriceDocumento32 páginasYou Don 'T Sell Through Price. You Sell The PriceKumar AnkurAinda não há avaliações

- Chapter 7 Pricing Strategies: You Don 'T Sell Through Price. You Sell The PriceDocumento30 páginasChapter 7 Pricing Strategies: You Don 'T Sell Through Price. You Sell The Priceabhi7219Ainda não há avaliações

- Pricing Strategies-Preliminary Concepts: You Don't Sell Through Price. You Sell The PriceDocumento30 páginasPricing Strategies-Preliminary Concepts: You Don't Sell Through Price. You Sell The PriceBRIAN CORPUZ INCOGNITOAinda não há avaliações

- Chapter 7 Pricing StrategiesDocumento30 páginasChapter 7 Pricing StrategiesCalistus Eugene FernandoAinda não há avaliações

- Chapter 7 Pricing StrategiesDocumento30 páginasChapter 7 Pricing StrategiestafakharhasnainAinda não há avaliações

- You Don 'T Sell Through Price. You Sell The PriceDocumento27 páginasYou Don 'T Sell Through Price. You Sell The PricesakthivelAinda não há avaliações

- Pricing StrategiesDocumento22 páginasPricing Strategiesshamirun ShahniAinda não há avaliações

- Chapter 7 Pricing StrategiesDocumento30 páginasChapter 7 Pricing StrategiesMuhammad KazimAinda não há avaliações

- 6 PricingDocumento44 páginas6 PricingGourab Ray0% (1)

- PricingDocumento30 páginasPricingMslkAinda não há avaliações

- Module 4Documento23 páginasModule 4Kiran MamadapurAinda não há avaliações

- Pricin Stratergy CHNGDDocumento25 páginasPricin Stratergy CHNGDRaksha ShettyAinda não há avaliações

- PRICING CH SixDocumento31 páginasPRICING CH SixBelay AdamuAinda não há avaliações

- Pricing StrategyDocumento49 páginasPricing StrategyBalaji Sundar100% (1)

- Internal Factors External Factors Pricing DecisionsDocumento17 páginasInternal Factors External Factors Pricing DecisionssaurabhsaggiAinda não há avaliações

- Presentation Transcript: Developing Pricing StrategiesDocumento8 páginasPresentation Transcript: Developing Pricing StrategiesManas SarkarAinda não há avaliações

- How Do Consumers Process and Evaluate Prices?: Chapter 14: Developing Pricing Strategies and ProgramsDocumento4 páginasHow Do Consumers Process and Evaluate Prices?: Chapter 14: Developing Pricing Strategies and Programsankita_shreeramAinda não há avaliações

- Developing Pricing Strategies and Programs - PPT CH 13Documento36 páginasDeveloping Pricing Strategies and Programs - PPT CH 13MilindMalwade100% (2)

- Chapter 7 Pricing Strategies: You Don't Sell Through Price. You Sell The PriceDocumento30 páginasChapter 7 Pricing Strategies: You Don't Sell Through Price. You Sell The PriceAbdur RahmanAinda não há avaliações

- Marketing Mix: Price, Promotion and PlaceDocumento31 páginasMarketing Mix: Price, Promotion and PlaceHarinAinda não há avaliações

- Nilamadhab Mohanty CimpDocumento28 páginasNilamadhab Mohanty CimpShilpi ChoudharyAinda não há avaliações

- PricingDocumento68 páginasPricingHarishK.RamanAinda não há avaliações

- Pricing StrategyDocumento20 páginasPricing StrategyPradeep Choudhary100% (1)

- Object XMLDocumentDocumento41 páginasObject XMLDocumentSantosh SahAinda não há avaliações

- Pricing StrategyDocumento52 páginasPricing Strategyfirst channelAinda não há avaliações

- Chapter 4 - PricingDocumento25 páginasChapter 4 - PricingEashaa SaraogiAinda não há avaliações

- MKT646 CHAPTER 9 (Pricing Strategies - Programs)Documento18 páginasMKT646 CHAPTER 9 (Pricing Strategies - Programs)NurEllysNatashaAinda não há avaliações

- BA27 Topic1A Pricing Overview Part2 CompleteDocumento56 páginasBA27 Topic1A Pricing Overview Part2 CompleteHeirvy NicolasAinda não há avaliações

- Pricing Decisions September 3 2022Documento38 páginasPricing Decisions September 3 2022Sarvagya ChaturvediAinda não há avaliações

- PricingDocumento13 páginasPricinghariselvarajAinda não há avaliações

- Pricing For International MarketingDocumento44 páginasPricing For International Marketingjuggy1812Ainda não há avaliações

- Business Studies Notes 4.3.4 PRICE MIX NAME: - DATE: - The Second P - PriceDocumento8 páginasBusiness Studies Notes 4.3.4 PRICE MIX NAME: - DATE: - The Second P - Priceabdulrahman alalawiAinda não há avaliações

- Pricing StrategiesDocumento14 páginasPricing StrategiesAnonymous ibmeej9Ainda não há avaliações

- Pricing in MarketingDocumento10 páginasPricing in MarketingSarah ShaikhAinda não há avaliações

- Designing Pricing StrategiesDocumento17 páginasDesigning Pricing Strategiesrahulravi4uAinda não há avaliações

- Price: Presented By: Sushil Nirbhavane Assistant ProfessorDocumento27 páginasPrice: Presented By: Sushil Nirbhavane Assistant ProfessorPranav choudharyAinda não há avaliações

- Bem102 7Documento22 páginasBem102 7Mellisa AndileAinda não há avaliações

- Pricing StrategiesDocumento11 páginasPricing StrategiesALIAinda não há avaliações

- 09 - Chapter 4Documento36 páginas09 - Chapter 4abhijit deyAinda não há avaliações

- Pricing DecisionsDocumento44 páginasPricing DecisionsTejaswiniAinda não há avaliações

- Marketing Management Group 6Documento31 páginasMarketing Management Group 6Hannah Jean EnabeAinda não há avaliações

- Chapter 7 Pricing Strategies: You Don't Sell Through Price. You Sell The PriceDocumento30 páginasChapter 7 Pricing Strategies: You Don't Sell Through Price. You Sell The PriceCalistus FernandoAinda não há avaliações

- Session 21 Pricing DecisionsDocumento18 páginasSession 21 Pricing DecisionsNarayana ReddyAinda não há avaliações

- Pricing Products: Pricing Considerations and ApproachesDocumento30 páginasPricing Products: Pricing Considerations and ApproachesVelluri Mahesh KumarAinda não há avaliações

- Pricing Concepts & Setting The Right PriceDocumento33 páginasPricing Concepts & Setting The Right PriceNeelu BhanushaliAinda não há avaliações

- Business Studies Chapter 12b PricingDocumento14 páginasBusiness Studies Chapter 12b Pricing牛仔danielAinda não há avaliações

- Chapter 13 (Marketing Mix - Price) - 11.19.35Documento21 páginasChapter 13 (Marketing Mix - Price) - 11.19.35Kelvin LauAinda não há avaliações

- Choosing The Right Pricing Strategy: Peter Ramsden Paramount Learning LTDDocumento26 páginasChoosing The Right Pricing Strategy: Peter Ramsden Paramount Learning LTDrudraarjunAinda não há avaliações

- Click To Edit Master Subtitle Style Pricing Products: Pricing Considerations and ApproachesDocumento18 páginasClick To Edit Master Subtitle Style Pricing Products: Pricing Considerations and ApproachessiddiqascribedAinda não há avaliações

- Pricing Strategy and Management: Professor Chip Besio Marketing 3340Documento30 páginasPricing Strategy and Management: Professor Chip Besio Marketing 3340Amitsinh Vihol100% (3)

- Initiating Price Increases and Responding To Competitors' Price IncreasesDocumento6 páginasInitiating Price Increases and Responding To Competitors' Price IncreasesDurgaChaitanyaPrasadKondapalli100% (9)

- Pricing DecisionsDocumento27 páginasPricing DecisionsChristopher JakeAinda não há avaliações

- Pricing To Capture ValueDocumento30 páginasPricing To Capture ValueArshad RS100% (1)

- Initiating Price IncreasesDocumento5 páginasInitiating Price IncreasesDurgaChaitanyaPrasadKondapalliAinda não há avaliações

- Chapter 5.2 PricingDocumento44 páginasChapter 5.2 PricingantehenAinda não há avaliações

- Factors of ProductionDocumento29 páginasFactors of Productionxhai vhieAinda não há avaliações

- University of Technical Education University of Sunderland: Ho Chi Minh City - 2009Documento16 páginasUniversity of Technical Education University of Sunderland: Ho Chi Minh City - 2009Đặng Thanh ThảoAinda não há avaliações

- Value-based Intelligent Pricing: Marketing and Business, #1No EverandValue-based Intelligent Pricing: Marketing and Business, #1Ainda não há avaliações

- Value-based Marketing Strategy: Pricing and Costs for Relationship MarketingNo EverandValue-based Marketing Strategy: Pricing and Costs for Relationship MarketingAinda não há avaliações