Escolar Documentos

Profissional Documentos

Cultura Documentos

Raising Capital in The Financial Markets: Ebf 1023 Basic Finance

Enviado por

lim hyTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Raising Capital in The Financial Markets: Ebf 1023 Basic Finance

Enviado por

lim hyDireitos autorais:

Formatos disponíveis

Raising Capital in

the Financial

Markets

EBF 1023 BASIC FINANCE

Q: What are SECURITIES?

Ans:

Financial Assets that Investors

purchase hoping to earn a high rate of

return.

Types of Securities

Treasury Bills and Treasury Bonds

Municipal Bonds

Corporate Bonds

Preferred Stocks

Common Stocks

Which of these are RISKY?

Which promise HIGH RETURNS?

Is there a relationship between RISK and RETURN?

Corporate Financing Sources

From 1999 through 2001, capital has been

raised through the following sources:

Corporate Bonds and Notes 76.9%

Equities 23.1%

Movement of Savings

Direct Transfer of Funds

Movement of Savings

Direct Transfer of Funds

saver

Movement of Savings

Direct Transfer of Funds

saver

firm

Movement of Savings

Direct Transfer of Funds

cash

saver

firm

Movement of Savings

Direct Transfer of Funds

cash

securities

saver

firm

Movement of Savings

Indirect Transfer using Investment

Banker

Movement of Savings

Indirect Transfer using Investment

Banker

investment

banker

Movement of Savings

Indirect Transfer using Investment

Banker

investment

banker

firm

Movement of Savings

Indirect Transfer using Investment

Banker

funds

investment

banker

firm

Movement of Savings

Indirect Transfer using Investment

Banker

funds

securities

investment

banker

firm

Movement of Savings

Indirect Transfer using Investment

Banker

funds

securities

saver

investment

banker

firm

Movement of Savings

Indirect Transfer using Investment

Banker

funds funds

securities

saver

investment

banker

firm

Movement of Savings

Indirect Transfer using Investment

Banker

securities

funds funds

securities

saver

investment

banker

firm

Movement of Savings

Indirect Transfer using a Financial

Intermediary

Movement of Savings

Indirect Transfer using a Financial

Intermediary

financial

intermediary

Movement of Savings

Indirect Transfer using a Financial

Intermediary

financial

intermediary

firm

Movement of Savings

Indirect Transfer using a Financial

Intermediary

funds

financial

intermediary

firm

Movement of Savings

Indirect Transfer using a Financial

Intermediary

funds

firm

securities

financial

intermediary

firm

Movement of Savings

Indirect Transfer using a Financial

Intermediary

funds

firm

securities

financial

intermediary

firm

saver

Movement of Savings

Indirect Transfer using a Financial

Intermediary

funds funds

firm

securities

financial

intermediary

firm

saver

Movement of Savings

Indirect Transfer using a Financial

Intermediary

funds

intermediary

securities

funds

firm

securities

financial

intermediary

firm

saver

What is Market??

Financial Market

Components

Public Offering

Firm issues securities, which are

made available to both individual

and institutional investors.

Private Placement (direct

placement)

Securities are offered and sold to a

limited number of investors.

Financial Market

Components

Primary Market

Market in which new issues of a

security are sold to initial buyers.

Secondary Market

Market in which previously issued

securities are traded.

Financial Market

Components

Money Market

Market for short-term debt

instruments (maturity periods of one

year or less).

Capital Market

Market for long-term securities

(maturity greater than one year).

Financial Market

Components

Organized Exchanges

Buyers and sellers meet in one

central location to conduct trades.

Over-the-Counter (OTC)

Securities dealers operate at many

different locations across the

country.

Investment Banking

How do investment

bankers help firms

issue securities?

Underwriting the issue.

Distributing the issue.

Advising the firm.

Distribution Methods

Negotiated Purchase

Issuing firm selects an

investment banker to underwrite

the issue.

The firm and the investment

banker negotiate the terms of the

offer.

Competitive Bid

Several investment bankers bid

for the right to underwrite the

firms issue.

The firm selects the banker

offering the highest price.

Distribution Methods

Best Efforts

Issue is not underwritten.

Investment bank attempts to

sell the issue for a

commission.

Privileged Subscription

Investment banker helps

market the new issue to a

select group of investors.

Usually targeted to current

stockholders, employees, or

customers.

Distribution Methods

Distribution Methods

Direct Sale

Issuing firm sells the securities directly

to the investing public.

No investment banker is involved.

Distribution Methods

Stock Issue Example:

Our firm needs to raise approximately

$100 million for expansion. Our stock

price is $20. We Select Merrill Lynch to

underwrite the issue for a 2%

underwriting spread.

What type of issue is this?

Its a negotiated purchase.

Stock Issue Example:

Our firm needs to raise approximately

$100 million for expansion. Our stock

price is $20. We Select Merrill Lynch to

underwrite the issue for a 2%

underwriting spread.

How many shares will be sold?

$100,000,000 / $20

= 5 million new shares of common stock.

Stock Issue Example:

Our firm needs to raise approximately

$100 million for expansion. Our stock

price is $20. We Select Merrill Lynch to

underwrite the issue for a 2%

underwriting spread.

What are the flotation costs?

Underwriting spread: 2% of $100 million

= $2 million.

Issuing costs: printing and engraving

costs; legal, accounting, and trustee

fees.

End of Lecture 3

Você também pode gostar

- Equity Investment for CFA level 1: CFA level 1, #2No EverandEquity Investment for CFA level 1: CFA level 1, #2Nota: 5 de 5 estrelas5/5 (1)

- Raising Capital in Financial MarketsDocumento38 páginasRaising Capital in Financial Marketsfaizanahmadnazir4309Ainda não há avaliações

- Lecture Week 3&4 - BFDocumento28 páginasLecture Week 3&4 - BFMuhammad HasnainAinda não há avaliações

- New Issue MarketDocumento31 páginasNew Issue MarketAashish AnandAinda não há avaliações

- Chapter 1-2Documento40 páginasChapter 1-2jakeAinda não há avaliações

- EBF PPT Part 1 Unit 2 Financial Systems NEU 2022Documento73 páginasEBF PPT Part 1 Unit 2 Financial Systems NEU 2022Trà My NguyễnAinda não há avaliações

- New Issue MarketDocumento33 páginasNew Issue MarketParul BajajAinda não há avaliações

- Investment BankingDocumento47 páginasInvestment BankingYudna YuAinda não há avaliações

- Lecture TwoDocumento28 páginasLecture TwoSajed RahmanAinda não há avaliações

- Group 1: Members: - Sujeet Pandey (Group Leader) - Rahul Kumar Gupta - Daya Jaiswal - Nita DavidDocumento66 páginasGroup 1: Members: - Sujeet Pandey (Group Leader) - Rahul Kumar Gupta - Daya Jaiswal - Nita Davidnita davidAinda não há avaliações

- Week 4Documento42 páginasWeek 4Maqsood AhmadAinda não há avaliações

- Constituents of The Financial System DD Intro NewDocumento17 páginasConstituents of The Financial System DD Intro NewAnonymous bf1cFDuepPAinda não há avaliações

- Chapter 1 Role of Financial Markets and InstitutionsDocumento42 páginasChapter 1 Role of Financial Markets and Institutionschinuuchu100% (2)

- CH 1Documento37 páginasCH 1xyzAinda não há avaliações

- 1 4 Introduction 2016-17Documento49 páginas1 4 Introduction 2016-17Debjit AdakAinda não há avaliações

- Chapter 2 Overview of The Financial SystemDocumento72 páginasChapter 2 Overview of The Financial SystemKokab Manzoor100% (1)

- 03 - The Role of Financial IntermediariesDocumento38 páginas03 - The Role of Financial IntermediariesIgad samudra Putra AbadiAinda não há avaliações

- Lecture 1 PDFDocumento18 páginasLecture 1 PDFJulio GaziAinda não há avaliações

- Unit II L2 Money Market InstrumentsDocumento67 páginasUnit II L2 Money Market InstrumentsHari chandanaAinda não há avaliações

- Financial ServicesDocumento40 páginasFinancial ServicesIsha Chandok100% (1)

- Capital MarketsDocumento19 páginasCapital MarketsCarla Jane Maitom TagoyAinda não há avaliações

- Unit - 1Documento131 páginasUnit - 1shaifali pandeyAinda não há avaliações

- Financial Institution & Market 1.0Documento70 páginasFinancial Institution & Market 1.0Kristi HerreraAinda não há avaliações

- Investment BankingDocumento64 páginasInvestment BankingSandeep YadavAinda não há avaliações

- Chapter 1 - IntroductionDocumento41 páginasChapter 1 - IntroductionMuhd Rizzwan0% (1)

- MANAGEMENT OF FINANCIAL SERVICES Unit 1Documento35 páginasMANAGEMENT OF FINANCIAL SERVICES Unit 1Goutham Singh0% (1)

- Financial Institutions and ServicesDocumento27 páginasFinancial Institutions and ServicesJayesh RathodAinda não há avaliações

- Week 2: Investment VehiclesDocumento37 páginasWeek 2: Investment Vehiclesmike chanAinda não há avaliações

- The Role of Financial Markets in Financial ManagementDocumento71 páginasThe Role of Financial Markets in Financial Managementapi-19482678Ainda não há avaliações

- Week 2 - SF: Role of Financial Markets and InstitutionsDocumento39 páginasWeek 2 - SF: Role of Financial Markets and Institutionsciara WhiteAinda não há avaliações

- 3 Investment BankingDocumento25 páginas3 Investment BankingBhupendra Kumar GautamAinda não há avaliações

- Newissuemarket 090919095525 Phpapp01Documento31 páginasNewissuemarket 090919095525 Phpapp01vikramrajuAinda não há avaliações

- Topic 2 - Long Term FinDocumento25 páginasTopic 2 - Long Term FinAina KhairunnisaAinda não há avaliações

- Chapter 2Documento22 páginasChapter 2aeyon Sha HiyaAinda não há avaliações

- L12 Investment BanksDocumento38 páginasL12 Investment Bankstientran.31211021669Ainda não há avaliações

- CH 1 Introduction To Investments Chap 1Documento60 páginasCH 1 Introduction To Investments Chap 1Moti BekeleAinda não há avaliações

- Chapter Two: An Overview of The Financial SystemDocumento43 páginasChapter Two: An Overview of The Financial SystemRaihan chowdhuryAinda não há avaliações

- Chapters of MushkinDocumento39 páginasChapters of MushkinShaheena SanaAinda não há avaliações

- Securities Markets: Ma. Roma Angela R. Miranda-Gaton, LPT, MMBMDocumento32 páginasSecurities Markets: Ma. Roma Angela R. Miranda-Gaton, LPT, MMBMjanrei agudosAinda não há avaliações

- Module 1.1 Financial MarketsDocumento60 páginasModule 1.1 Financial MarketssateeshjorliAinda não há avaliações

- Capital MarketDocumento20 páginasCapital MarketMedhansh ShindeAinda não há avaliações

- Fundamentals of Financial ManagementDocumento41 páginasFundamentals of Financial Managementesshaker doubleddAinda não há avaliações

- Finmar ReportingDocumento18 páginasFinmar ReportingJanna Rae BionganAinda não há avaliações

- Financial System - IntroductionDocumento31 páginasFinancial System - IntroductionVaidyanathan RavichandranAinda não há avaliações

- Abhishek Chaudhary Jatinder Dangwal Nupur Jain Ravinder Sharma Rishi Panwar Sakshi Chauhan Shashi Kumar Shankar Narayan BatabyalDocumento41 páginasAbhishek Chaudhary Jatinder Dangwal Nupur Jain Ravinder Sharma Rishi Panwar Sakshi Chauhan Shashi Kumar Shankar Narayan BatabyalSakshi ChauhanAinda não há avaliações

- Chapter 26 - Saving, Investment, and The Financial SystemDocumento66 páginasChapter 26 - Saving, Investment, and The Financial SystemFTU K59 Trần Yến LinhAinda não há avaliações

- Chapter 3, Basic Elements of Financial SystemDocumento27 páginasChapter 3, Basic Elements of Financial Systemmiracle123Ainda não há avaliações

- Merchant Banking: Financing Their ClientsDocumento25 páginasMerchant Banking: Financing Their ClientsAsad MazharAinda não há avaliações

- Lec 1Documento36 páginasLec 1AYUSHI KUMARIAinda não há avaliações

- Role of Financial Markets and InstitutionsDocumento30 páginasRole of Financial Markets and InstitutionsĒsrar BalócAinda não há avaliações

- Financialservices: Name - Kanikabhasin Roll No. - 01Documento20 páginasFinancialservices: Name - Kanikabhasin Roll No. - 01kanikaAinda não há avaliações

- SAPM I Unit Anna UniversityDocumento28 páginasSAPM I Unit Anna UniversitystandalonembaAinda não há avaliações

- Money Market by MostafaDocumento28 páginasMoney Market by Mostafamostafaali123Ainda não há avaliações

- International Financial SystemDocumento22 páginasInternational Financial SystemRegina LintuaAinda não há avaliações

- Banking Services: Includes All The Operations Provided by The Banks Including To TheDocumento7 páginasBanking Services: Includes All The Operations Provided by The Banks Including To TheChandrika DasAinda não há avaliações

- Newissuemarket 090919095525 Phpapp01Documento31 páginasNewissuemarket 090919095525 Phpapp01Dr-Afzal Basha HSAinda não há avaliações

- EBF 1023 Basic Finance: Asas KewanganDocumento41 páginasEBF 1023 Basic Finance: Asas Kewanganlim hyAinda não há avaliações

- Presentation1 3Documento96 páginasPresentation1 3kahenabiy3Ainda não há avaliações

- Anisation of The Financial SystemDocumento31 páginasAnisation of The Financial SystemNiharika SinghAinda não há avaliações

- FMCHAPTER ONE - PPT Power PT Slides - PPT 2Documento55 páginasFMCHAPTER ONE - PPT Power PT Slides - PPT 2Alayou TeferaAinda não há avaliações

- CSSR Analysis 2gDocumento25 páginasCSSR Analysis 2gZamroniMohammad100% (1)

- Essen 2Documento1 páginaEssen 2lim hyAinda não há avaliações

- TestingDocumento1 páginaTestinglim hyAinda não há avaliações

- Essential GuideDocumento2 páginasEssential Guidelim hyAinda não há avaliações

- CST 3gDocumento2 páginasCST 3glim hyAinda não há avaliações

- L3Documento2 páginasL3lim hyAinda não há avaliações

- Essential GuideDocumento2 páginasEssential Guidelim hyAinda não há avaliações

- 4 Year Bond Par Coupon 6% Interest 6%: Year Cash Flow PV CFDocumento2 páginas4 Year Bond Par Coupon 6% Interest 6%: Year Cash Flow PV CFlim hyAinda não há avaliações

- Lab 1 CMOS Inverter 2012Documento3 páginasLab 1 CMOS Inverter 2012lim hyAinda não há avaliações

- Total Result 146 54.3402777778Documento6 páginasTotal Result 146 54.3402777778lim hyAinda não há avaliações

- OneDocumento32 páginasOnelim hyAinda não há avaliações

- OneDocumento32 páginasOnelim hyAinda não há avaliações

- CSTDocumento4 páginasCSTlim hyAinda não há avaliações

- Re SelectionDocumento7 páginasRe Selectionlim hyAinda não há avaliações

- Time Object 28 - BB - Power - Util - Total 28 - Power - Utilization N12 - Power - Util - Nonhs N13 - Power - Util - Total W - Hs - Resourcelimit - PowerDocumento1 páginaTime Object 28 - BB - Power - Util - Total 28 - Power - Utilization N12 - Power - Util - Nonhs N13 - Power - Util - Total W - Hs - Resourcelimit - Powerlim hyAinda não há avaliações

- 1-21 Don'T Want Only Want The No. 19 For DL Lock Part 1 DL Need 22-35, and Also No 19 For Part 1Documento1 página1-21 Don'T Want Only Want The No. 19 For DL Lock Part 1 DL Need 22-35, and Also No 19 For Part 1lim hyAinda não há avaliações

- Setup TimeDocumento30 páginasSetup Timelim hyAinda não há avaliações

- Setup TimeDocumento30 páginasSetup Timelim hyAinda não há avaliações

- Book 1Documento32.767 páginasBook 1lim hyAinda não há avaliações

- Leaders and Managers Can Be Compared On The Following BasisDocumento2 páginasLeaders and Managers Can Be Compared On The Following Basislim hyAinda não há avaliações

- Circular WaveguideDocumento2 páginasCircular Waveguidelim hyAinda não há avaliações

- HTTPDocumento37 páginasHTTPlim hyAinda não há avaliações

- Assignment (Bastian)Documento1 páginaAssignment (Bastian)lim hyAinda não há avaliações

- Introduction To Antenna and Near-Field Simulation in CSTDocumento23 páginasIntroduction To Antenna and Near-Field Simulation in CSTtavoosiAinda não há avaliações

- Course Plan VLSI Design KNL 4343Documento3 páginasCourse Plan VLSI Design KNL 4343lim hyAinda não há avaliações

- Chapter 2 LectureDocumento56 páginasChapter 2 Lecturelim hyAinda não há avaliações

- TitleDocumento1 páginaTitlelim hyAinda não há avaliações

- Chapter 1 - LectureDocumento39 páginasChapter 1 - Lecturelim hyAinda não há avaliações

- Chapter 11Documento15 páginasChapter 11lim hyAinda não há avaliações

- ReadmeDocumento3 páginasReadmelim hyAinda não há avaliações

- Chapter 6 - Portfolio Evaluation and RevisionDocumento26 páginasChapter 6 - Portfolio Evaluation and RevisionShahrukh ShahjahanAinda não há avaliações

- F3 Final File 2021-2022 ADocumento147 páginasF3 Final File 2021-2022 AWWE Gaming0% (1)

- Zahra Maryam Ashri 2201918324 Latihan Soal Ke 1Documento3 páginasZahra Maryam Ashri 2201918324 Latihan Soal Ke 1Zahra Maryam AshriAinda não há avaliações

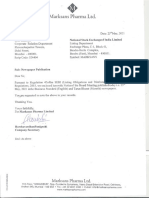

- Marksans Pharma LTD.: Date: 25"may, 2021Documento3 páginasMarksans Pharma LTD.: Date: 25"may, 2021Shrin RajputAinda não há avaliações

- S23 498 Class 9 PPT (Pre-Class)Documento23 páginasS23 498 Class 9 PPT (Pre-Class)Sion AudrainAinda não há avaliações

- Valuing Bonds: Corporate Finance Dr. Amnisuhailah Abarahan JANUARY, 2020Documento51 páginasValuing Bonds: Corporate Finance Dr. Amnisuhailah Abarahan JANUARY, 2020Muhammad AsifAinda não há avaliações

- Economics-: Stock Investing 101Documento2 páginasEconomics-: Stock Investing 101Tanishka Saluja0% (1)

- MindTap Catalog CompressedDocumento84 páginasMindTap Catalog Compresseddipak2401Ainda não há avaliações

- Akuntansi Keuangan Lanjutan - Akuntansi Penggabungan UsahaDocumento67 páginasAkuntansi Keuangan Lanjutan - Akuntansi Penggabungan UsahachendyAinda não há avaliações

- Chapter IV FeasibilityDocumento6 páginasChapter IV FeasibilityRomalyn MoralesAinda não há avaliações

- StudyQuestions 080118Documento6 páginasStudyQuestions 080118Jamie Ross0% (3)

- Listing of Securities-ReligareDocumento83 páginasListing of Securities-ReligarekartikAinda não há avaliações

- Sologenic OnepagerDocumento1 páginaSologenic OnepagerzhullkhadriansyaAinda não há avaliações

- Capital Structure: Questions and ExercisesDocumento4 páginasCapital Structure: Questions and ExercisesLinh HoangAinda não há avaliações

- Script For CMCP ReportingDocumento5 páginasScript For CMCP ReportingTrisha Mariz CayagoAinda não há avaliações

- FIN 515 Final ExamDocumento2 páginasFIN 515 Final ExamfggfdgdggfdAinda não há avaliações

- Test Bank Aa Part 2 2015 EdDocumento90 páginasTest Bank Aa Part 2 2015 EdTricia Mae FernandezAinda não há avaliações

- LBMA LPPM MOU April 2013Documento26 páginasLBMA LPPM MOU April 2013Tommy LiuAinda não há avaliações

- 2022 11 22 BJTMDocumento2 páginas2022 11 22 BJTMfirmanAinda não há avaliações

- Nordic EquitiesDocumento2 páginasNordic EquitiesBeing VikramAinda não há avaliações

- Finance 5Documento3 páginasFinance 5Jheannie Jenly Mia SabulberoAinda não há avaliações

- Discount: What Is A Discount?Documento3 páginasDiscount: What Is A Discount?Jonhmark AniñonAinda não há avaliações

- SAPMDocumento26 páginasSAPMJawed KhanAinda não há avaliações

- Cfi Business Valuation Modeling Final AssessmentDocumento3 páginasCfi Business Valuation Modeling Final AssessmentKARTHIK100% (2)

- Solution Manual For Interpreting and Analyzing Financial Statements 6th Edition by SchoenebeckDocumento24 páginasSolution Manual For Interpreting and Analyzing Financial Statements 6th Edition by SchoenebeckJonathonChavezbcsj100% (35)

- What Is Leveraged Buyout and How Does It Works?Documento4 páginasWhat Is Leveraged Buyout and How Does It Works?Keval ShahAinda não há avaliações

- Bank Nifty Option Strategies BookletDocumento28 páginasBank Nifty Option Strategies BookletMohit Jhanjee100% (1)

- Understanding Options Trading: The Australian SharemarketDocumento43 páginasUnderstanding Options Trading: The Australian SharemarketAndrewcaesarAinda não há avaliações

- Introduction To Investment AppraisalDocumento43 páginasIntroduction To Investment AppraisalNURAIN HANIS BINTI ARIFFAinda não há avaliações

- FAR 03 06 Biological AssetsDocumento3 páginasFAR 03 06 Biological AssetsCAROLINE BALDOZAinda não há avaliações