Escolar Documentos

Profissional Documentos

Cultura Documentos

BBM 205 Unit 1

Enviado por

汮豪Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

BBM 205 Unit 1

Enviado por

汮豪Direitos autorais:

Formatos disponíveis

Tutor Contact Details

Tutor Name:

Contact No.:

please remind students to call at least every 2/3 weeks

Email:

Time available for Telephone Tutoring:

Other Information:

WELCOME to

BBM205/05 Business Accounting 1

General Introduction of the course

Importance of meeting the Objectives set for

each unit

Tutorial Schedule and Time spent for study

Distribution of Marks for TMAs and Final

Exam

Course Materials (Course Guide, Unit 1-5,

Textbook)

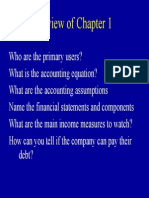

Overview of BBM205/05

The McGraw-Hill Companies, I nc., 2007

McGraw-Hill/I rwin

Unit 1

Accounting in Business

Objectives

Types of Business

Forms of Organisation

Activities in Organisation

Financing activities

Investing activities

Operating activities

1.1 The Importance of Accounting

Users of Accounting Information

External Users

Lenders

Shareholders

Governments

Consumer Groups

External Auditors

Customers

Internal Users

Managers

Officers/Directors

Internal Auditors

Sales Staff

Budget Officers

Controllers

Users of Accounting Information

External Users

Financial accounting provides

external users with financial

statements.

Internal Users

Managerial accounting provides

information needs for internal

decision makers.

Opportunities in Accounting

Financial

Preparation

Analysis

Auditing

Regulatory

Consulting

Planning

Criminal

investigation

Managerial

General accounting

Cost accounting

Budgeting

Internal auditing

Consulting

Controller

Treasurer

Strategy

Taxation

Preparation

Planning

Regulatory

Investigations

Consulting

Enforcement

Legal services

Estate plans

Accounting-

related

Lenders

Consultants

Analysts

Traders

Directors

Underwriters

Planners

Appraisers

FBI investigators

Market researchers

Systems designers

Merger services

Business valuation

Human services

Litigation support

Entrepreneurs

1.2 Fundamentals of Accounting

Financial accounting practice is governed by

concepts and rules known as accounting principles

Accounting Principles

Relevant

Information

Affects the decision of

its users.

Reliable Information Is trusted by

users.

Comparable

Information

Is helpful in contrasting

organizations.

Principles of Accounting

Now Future

Going-Concern Principle

Reflects assumption that the

business will continue

operating instead of being

closed or sold.

Cost Principle

Accounting information is

based on actual cost.

Objectivity Principle

Accounting information is

supported by independent,

unbiased evidence.

Revenue Recognition Principle

1. Recognize revenue when it is

earned.

2. Proceeds need not be in cash.

3. Measure revenue by cash

received plus cash value of items

received.

Monetary Unit Principle

Express transactions and events in

monetary, or money, units.

Business Entity Principle

A business is accounted for

separately from other business

entities, including its owner.

Principles of Accounting

Accounting Equation

Land

Equipment

Buildings

Cash

Vehicles

Store

Supplies

Notes

Receivable

Accounts

Receivable

Resources

owned or

controlled

by a

company

Assets

Taxes

Payable

Wages

Payable

Notes

Payable

Accounts

Payable

Creditors

claims on

assets

Liabilities

CAPITAL

Owner

Investments

Equity

Liabilities Equity Assets

= +

Expanded Accounting Equation

Revenues Expenses

Owner

Capital

Owner

Withdrawals

_

+

_

Owner's Equity

Liabilities Equity Assets

= +

Transaction Analysis Equation

The accounting equation MUST remain in

balance after each transaction.

Liabilities Equity Assets

= +

Transaction Analysis

The accounts involved are:

(1) Cash (asset)

(2) Owner Capital (equity)

Ahmad invests RM20,000 cash to start

the business.

Transaction Analysis

Assets = Liabilities + Equity

Cash Supplies Equipment

Accounts

Payable

Notes

Payable

Owner

Capital

20,000.00 20,000.00

20,000.00 0.00 0.00 0.00 0.00 20,000.00

20,000.00 = 20,000.00

Ahmad invests RM 20,000 cash to start

the business.

The accounts involved are:

(1) Cash (asset)

(2) Supplies (asset)

Transaction Analysis

Purchased supplies paying RM1,000

cash.

Transaction Analysis

Purchased supplies paying RM1,000 cash.

Assets = Liabilities + Equity

Cash Supplies Equipment

Accounts

Payable

Notes

Payable

Owner

Capital

(1) 20,000.00 20,000.00

(2) -1,000.00 1,000.00

19,000.00 1,000.00 0.00 0.00 0.00 20,000.00

20,000.00 = 20,000.00

The accounts involved are:

(1) Cash (asset)

(2) Equipment (asset)

Transaction Analysis

Purchased equipment for RM15,000

cash.

Transaction Analysis

Assets = Liabilities + Equity

Cash Supplies Equipment

Accounts

Payable

Notes

Payable

Owner

Capital

(1) 20,000.00 20,000.00

(2) -1,000.00 1,000.00

(3) -15,000.00 15,000.00

4,000.00 1,000.00 15,000.00 0.00 0.00 20,000.00

20,000.00 = 20,000.00

Purchased equipment for RM15,000

cash.

The accounts involved are:

(1) Supplies (asset)

(2) Equipment (asset)

(3) Accounts Payable (liability)

Transaction Analysis

Purchased Supplies of RM200 and

Equipment of RM1,000 on account.

Transaction Analysis

Assets = Liabilities + Equity

Cash Supplies Equipment

Accounts

Payable

Notes

Payable

Owner

Capital

(1) 20,000.00 20,000.00

(2) -1,000.00 1,000.00

(3) -15,000.00 15,000.00

(4) 200.00 1,000.00 1,200.00

4,000.00 1,200.00 16,000.00 1,200.00 0.00 20,000.00

21,200.00 = 21,200.00

Purchased Supplies of RM200 and

Equipment of RM1,000 on account.

Transaction Analysis

The accounts involved are:

(1) Cash (asset)

(2) Notes payable (liability)

Borrowed RM4,000 from 1st Malaysian

Bank.

Transaction Analysis

Assets = Liabilities + Equity

Cash Supplies Equipment

Accounts

Payable

Notes

Payable

Owner

Capital

(1) 20,000.00 20,000.00

(2) -1,000.00 1,000.00

(3) -15,000.00 15,000.00

(4) 200.00 1,000.00 1,200.00

(5) 4,000.00 4,000.00

8,000.00 1,200.00 16,000.00 1,200.00 4,000.00 20,000.00

25,200.00 = 25,200.00

Borrowed RM4,000 from 1st Malaysian

Bank.

Assets = Liabilities + Equity

Cash Supplies Equipment

Accounts

Payable

Notes

Payable

Owner

Capital

Bal. 8,000.00 1,200.00 16,000.00 1,200.00 4,000.00 20,000.00

8,000.00 1,200.00 16,000.00 1,200.00 4,000.00 20,000.00

25,200.00 = 25,200.00

Transaction Analysis

The balances so far appear below. Note that the

Balance Sheet Equation is still in balance.

Transaction Analysis

Now, lets look at transactions

involving revenue, expenses and

withdrawals.

The accounts involved are:

(1) Cash (asset)

(2) Revenues (equity)

Transaction Analysis

Provided consulting services receiving

RM3,000 cash.

Assets = Liabilities +

Cash Supplies Equipment

Accounts

Payable

Notes

Payable

Owner

Capital Revenue

Bal. 8,000.00 1,200.00 16,000.00 1,200.00 4,000.00 20,000.00

(6) 3,000.00 3,000.00

11,000.00 1,200.00 16,000.00 1,200.00 4,000.00 20,000.00 3,000.00

28,200.00 = 28,200.00

Equity

Transaction Analysis

Provided consulting services receiving

RM3,000 cash.

The accounts involved are:

(1) Cash (asset)

(2) Salaries expense (equity)

Transaction Analysis

Paid salaries of RM800 to employees.

Remember that the balance in the salaries

expense account actually increases.

But, equity decreases because expenses

reduce equity.

Transaction Analysis

Assets = Liabilities +

Cash Supplies Equipment

Accounts

Payable

Notes

Payable

Owner

Capital Revenue Expenses

Bal. 8,000.00 1,200.00 16,000.00 1,200.00 4,000.00 20,000.00

(6) 3,000.00 3,000.00

(7) -800.00 -800.00

10,200.00 1,200.00 16,000.00 1,200.00 4,000.00 20,000.00 3,000.00 -800.00

27,400.00 = 27,400.00

Equity

Remember that expenses decrease equity.

Paid salaries of RM800 to employees.

The accounts involved are:

(1) Cash (asset)

(2) Withdrawals (equity)

Transaction Analysis

A withdrawal of RM500 is made by the

owner.

Remember that the withdrawal account

actually increases.

But, total equity decreases because the

withdrawal reduces equity.

Transaction Analysis

Assets = Liabilities +

Cash Supplies Equipment

Accounts

Payable

Notes

Payable

Owner

Capital

Owner

Withdrawals Revenue Expenses

Bal. 8,000.00 1,200.00 16,000.00 1,200.00 4,000.00 20,000.00

(6) 3,000.00 3,000.00

(7) -800.00 -800.00

(8) -500.00 -500.00

9,700.00 1,200.00 16,000.00 1,200.00 4,000.00 20,000.00 -500.00 3,000.00 -800.00

26,900.00 = 26,900.00

Equity

Remember that withdrawals decrease equity.

A withdrawal of RM500 is made by the

owner.

Financial Statements

1. Income Statement

2. Statement of Changes in Equity

3. Balance Sheet

4. Cash Flow Statement

5. Notes to the Financial Statements

Financial Statement Relationships

Lets prepare the Financial Statements

reflecting the transactions we have

recorded for Ahmad Company.

Net income is the

difference

between

Revenues and

Expenses.

RM

Revenues:

Consulting revenue 3,000.00

Expenses:

Salaries expense 800.00

Net income 2,200.00

Ahmad Company

Income Statement

For Month Ended December 31, 2007

The income statement describes a

companys revenues and expenses along

with the resulting net income or loss over a

period of time due to earnings activities.

Income Statement

The net income of

RM2,200 increases

Owner's Equity by

RM2,200.

RM

Revenues:

Consulting revenue 3,000.00

Expenses:

Salaries expense 800.00

Net income 2,200.00

Ahmad Company

Income Statement

For Month Ended December 31, 2007

Statement of Changes in Equity

Ahmad Company

Statement of Owner's Equity

For Month Ended December 31, 2007

Capital, December 1, 2007 -

Plus: Investments by Owner 20,000

Net Income 2,200 22,200

22,200

Less: Withdrawals by owner 500

Capital, December 31, 2007 21,700

Cash 9,700.00 Accounts payable 1,200.00

Supplies 1,200.00 Notes payable 4,000.00

Equipment 16,000.00 Total liabilities 5,200.00

Owner Capital 21,700.00

Total assets 26,900.00

Total liabilities and equity

26,900.00

Assets Liabilities & Equity

Ahmad Company

Balance Sheet

December 31, 2007

The Balance Sheet describes

a companys financial position

at a point in time.

Balance Sheet

Cash flows from operating activities:

Cash received from clients 3,000.00

Purchase of supplies -1,000.00

Cash paid to employees -800.00

Net cash provided by operating activities 1,200.00

Cash flows from investing activities:

Purchase of equipment -15,000.00

Net cash used in investing activities -15,000.00

Cash flows from financing activities:

Investment by owner 20,000.00

Borrowed at bank 4,000.00

Withdrawal by owner -500.00

Net cash provided by financing activities 23,500.00

Net increase in cash 9,700.00

Cash balance, December 1, 2007 0.00

Cash balance, December 31, 2007 9,700.00

Statement of Cash Flows

For Month Ended December 31, 2007

Ahmad Company

Statement of Cash Flows

Beliefs that

distinguish

right from

wrong

Accepted

standards of

good and bad

behavior

Ethics

EthicsA Key Concept

1.3 Ethics and Social Responsibility

Identify

ethical concerns

Analyze

options

Make ethical

decision

Use personal

ethics to

recognize ethical

concern.

Consider all good

and bad

consequences.

Choose best

option after

weighing all

consequences.

Guidelines for Ethical Decisions

Social Responsibility

Social responsibility is the concern for

the impact of actions on society.

Socially responsible accounting has

also grown in importance to the point

where an increasing number of

companies are including socially

relevant information when they publish

their financial statements.

1.4 Accounting Framework in Malaysia

Financial Reporting Foundation (FRF)

Malaysian Accounting Standards Board

(MASB)

Malaysian Accounting Standards Board

(MASB) cont.

Malaysian Institute of Accountants

(MIA)

Activities and Self-tests

Unit Practice Exercises

Practice makes perfect!

Tutorial Discussions

Preparing for TMA 1

Please download TMA 1 from

WawasanLearn, under the folder

Tutor-marked Assignments.

Students are welcomed to post any

questions and conduct discussions in

the e-forums in WawasanLearn.

Tutor to brief students on TMA 1

during Tutorial Session.

Outline on What to Prepare

for Tutorial 2

Unit 2: The Accounting Cycle

2.1 Analysing and Recording Process

2.2 Adjusting Accounts and Preparing

Financial Statements

2.3 The Accounting Cycle

Due in Tutorial 2.

Please attach the T-MA form together

with your assignment TMA1 and

submit to your tutor.

Tutorial 2 on : (date/time/place)

Reminder: Submission of TMA 1

Thank you!

Você também pode gostar

- Accounting and The Business EnvironmentDocumento26 páginasAccounting and The Business EnvironmentAhmad Fahrizal AsmyAinda não há avaliações

- Cambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersNo EverandCambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersNota: 2 de 5 estrelas2/5 (4)

- Audit Program - CashDocumento1 páginaAudit Program - CashJoseph Pamaong100% (6)

- CBSE Class 11 Accountancy Study MaterialDocumento148 páginasCBSE Class 11 Accountancy Study MaterialTarique Khan100% (9)

- Chapter 2 - The Accounting CycleDocumento36 páginasChapter 2 - The Accounting CycleAlan Lui50% (2)

- Assignment # 2 MBA Financial and Managerial AccountingDocumento7 páginasAssignment # 2 MBA Financial and Managerial AccountingSelamawit MekonnenAinda não há avaliações

- Accounting PrincipleDocumento24 páginasAccounting PrincipleMonirHRAinda não há avaliações

- Accounting and The Business EnvironmentDocumento46 páginasAccounting and The Business EnvironmentSatya JeetAinda não há avaliações

- Accounting NotesDocumento11 páginasAccounting Notesnerocko101Ainda não há avaliações

- CB Module 1Documento63 páginasCB Module 1Jen Faye Orpilla100% (5)

- Week 3Documento46 páginasWeek 3BookAddict721Ainda não há avaliações

- Bid Opening and EvaluationDocumento64 páginasBid Opening and EvaluationDavid Sabai100% (3)

- AST JSA Excavations.Documento3 páginasAST JSA Excavations.md_rehan_2Ainda não há avaliações

- TOPIC 6 - Bookeeping ProceduresDocumento31 páginasTOPIC 6 - Bookeeping Procedureseizah_osman3408100% (1)

- Usage of Word SalafDocumento33 páginasUsage of Word Salafnone0099Ainda não há avaliações

- Chapter 1Documento43 páginasChapter 1Shah NidaAinda não há avaliações

- Financial & Managerial Accounting: Course Code: MBA 631 Credit Hours: 2 YSCDocumento44 páginasFinancial & Managerial Accounting: Course Code: MBA 631 Credit Hours: 2 YSCgebre meskelAinda não há avaliações

- Learning Guide Learning Guide: Nefas Silk Poly Technic CollegeDocumento36 páginasLearning Guide Learning Guide: Nefas Silk Poly Technic CollegeNigussie BerhanuAinda não há avaliações

- Finaccl1 120205210417 Phpapp0254Documento105 páginasFinaccl1 120205210417 Phpapp0254mukesh697Ainda não há avaliações

- Accounting & Financial AnalysisDocumento35 páginasAccounting & Financial AnalysisVishal Ranjan100% (2)

- Week 1 OneslideperpageDocumento73 páginasWeek 1 OneslideperpageBarry AuAinda não há avaliações

- Chapter 1Documento38 páginasChapter 1mukundentegloriaAinda não há avaliações

- Accounting Principles: Second Canadian EditionDocumento39 páginasAccounting Principles: Second Canadian EditionRehan IqbalAinda não há avaliações

- Acc 6 CH 01Documento46 páginasAcc 6 CH 01Md. Rubel HasanAinda não há avaliações

- 17 Maintain Business RecordsDocumento39 páginas17 Maintain Business RecordsYohannes AdmasuAinda não há avaliações

- Financial Accounting Bbaw2103 Final 2Documento18 páginasFinancial Accounting Bbaw2103 Final 2mel100% (1)

- Week 1 - Introduction and Balance Sheet PDFDocumento84 páginasWeek 1 - Introduction and Balance Sheet PDFHisham ShihabAinda não há avaliações

- Accounting Principles: Second Canadian EditionDocumento39 páginasAccounting Principles: Second Canadian Editionfredrick_5467Ainda não há avaliações

- NLKTDocumento21 páginasNLKTAnh DuongAinda não há avaliações

- Tutorial 4Documento8 páginasTutorial 4yongjin95Ainda não há avaliações

- Chapter 1 & 2Documento33 páginasChapter 1 & 2ENG ZI QINGAinda não há avaliações

- Session 3 PDFDocumento24 páginasSession 3 PDFmilepnAinda não há avaliações

- Accounting Concepts and Costing (MGTE 21243) Lesson 01: Concepts of Financial AccountingDocumento4 páginasAccounting Concepts and Costing (MGTE 21243) Lesson 01: Concepts of Financial Accountingpulitha kodituwakkuAinda não há avaliações

- Chapter 1Documento28 páginasChapter 1Gazi JayedAinda não há avaliações

- Coaching Session 2 - Basic Accounting-Accounting Equation and The Double-Entry SystemDocumento7 páginasCoaching Session 2 - Basic Accounting-Accounting Equation and The Double-Entry SystemLin GulbeAinda não há avaliações

- Introduction To Accounting 22.5.2013Documento62 páginasIntroduction To Accounting 22.5.2013Gray CeeAinda não há avaliações

- Accounting EquationDocumento36 páginasAccounting EquationHadi HarizAinda não há avaliações

- Accounting EquationDocumento41 páginasAccounting EquationDristi RayAinda não há avaliações

- Accounting Equation: Fundamentals of ABM 1Documento97 páginasAccounting Equation: Fundamentals of ABM 1ediwowAinda não há avaliações

- Financial Accounting Answers June 2022Documento8 páginasFinancial Accounting Answers June 2022sanhitaAinda não há avaliações

- Fa2 (Mba)Documento53 páginasFa2 (Mba)Muhbat Ali JunejoAinda não há avaliações

- Introduction To Financial Accounting: Key Terms and Concepts To KnowDocumento16 páginasIntroduction To Financial Accounting: Key Terms and Concepts To KnowAmit SharmaAinda não há avaliações

- Chapter II A For ManagersDocumento46 páginasChapter II A For ManagersAsħîŞĥLøÝåAinda não há avaliações

- Fundamentals of Accounting I OsuDocumento66 páginasFundamentals of Accounting I OsuAbdi kasimAinda não há avaliações

- Chap 01-Introduction To AccountingDocumento56 páginasChap 01-Introduction To AccountingJean CoulAinda não há avaliações

- Accounting ProfessionalDocumento92 páginasAccounting ProfessionalVikasAinda não há avaliações

- SSGPDocumento60 páginasSSGPElaika DomingoAinda não há avaliações

- Dmba104 - Financial and Management Accounting 1Documento15 páginasDmba104 - Financial and Management Accounting 1dazzlerakanksha1230Ainda não há avaliações

- IntroductiontoaccountingDocumento209 páginasIntroductiontoaccountingBOCMANAGER100% (1)

- Nabeel Accounting PresentationDocumento21 páginasNabeel Accounting PresentationUmair TariqAinda não há avaliações

- Financial Statement Project 1 1Documento38 páginasFinancial Statement Project 1 1ABHISHEK SHARMAAinda não há avaliações

- Mba025 Set1 Set2 520929319Documento16 páginasMba025 Set1 Set2 520929319tejas2111Ainda não há avaliações

- 1.1 Evolution of Accounting 1.2 Accounting Concepts and PrinciplesDocumento5 páginas1.1 Evolution of Accounting 1.2 Accounting Concepts and PrinciplesNawaz AhamedAinda não há avaliações

- Accounting Equation (Edited)Documento32 páginasAccounting Equation (Edited)Nor Zarina MohamadAinda não há avaliações

- AFB Lecture 1Documento15 páginasAFB Lecture 1Ana-Maria GhAinda não há avaliações

- Brand Generation College Dep't of Accounting and Financial: Basic Accounts Work Level IIDocumento31 páginasBrand Generation College Dep't of Accounting and Financial: Basic Accounts Work Level IIhundegemechu68Ainda não há avaliações

- Chapter No 2: AccountingDocumento2 páginasChapter No 2: AccountingSohaib AnjumAinda não há avaliações

- Lesson 2 - Transactions and Accounting EquetionDocumento5 páginasLesson 2 - Transactions and Accounting EquetionMazumder SumanAinda não há avaliações

- Financial Accounting - An Ice Breaker: BY: Mohit Dhawan Asst. Prof. (Finance) & Asst. Dean (MGT.) INMANTEC, GhaziabadDocumento64 páginasFinancial Accounting - An Ice Breaker: BY: Mohit Dhawan Asst. Prof. (Finance) & Asst. Dean (MGT.) INMANTEC, GhaziabadMohit DhawanAinda não há avaliações

- MR Ranjit SinghDocumento77 páginasMR Ranjit SinghMonu MehanAinda não há avaliações

- Homework QuestionsDocumento17 páginasHomework QuestionsAAinda não há avaliações

- Working Capital ManagementDocumento67 páginasWorking Capital ManagementAam aadmiAinda não há avaliações

- Branch AccountingDocumento8 páginasBranch AccountingMasoom FarishtahAinda não há avaliações

- Borang Skema Pemarkahan Hbef4303, Hbef4106-2Documento1 páginaBorang Skema Pemarkahan Hbef4303, Hbef4106-2汮豪Ainda não há avaliações

- New Microsoft Office Word Document 3Documento1 páginaNew Microsoft Office Word Document 3汮豪Ainda não há avaliações

- New Microsoft Office Word Document 2Documento1 páginaNew Microsoft Office Word Document 2汮豪Ainda não há avaliações

- DadsaddadsaDocumento1 páginaDadsaddadsa汮豪Ainda não há avaliações

- Computer Pricelist PDFDocumento2 páginasComputer Pricelist PDF汮豪Ainda não há avaliações

- BOQ-Lighting Control System-Swiss PharmaDocumento1 páginaBOQ-Lighting Control System-Swiss PharmaTalha FarooqAinda não há avaliações

- Food Safety OfficerDocumento3 páginasFood Safety OfficerGyana SahooAinda não há avaliações

- ICAO Procurement Code PDFDocumento14 páginasICAO Procurement Code PDFCarlos PanaoAinda não há avaliações

- Soal Pas Sastra Inggris Xi Smester 2 2024Documento10 páginasSoal Pas Sastra Inggris Xi Smester 2 2024AsahiAinda não há avaliações

- Module 5 Ipr RMDocumento48 páginasModule 5 Ipr RMravirayappaAinda não há avaliações

- Functions of RBIDocumento8 páginasFunctions of RBIdchauhan21Ainda não há avaliações

- NY State Official Election ResultsDocumento40 páginasNY State Official Election ResultsBloomberg PoliticsAinda não há avaliações

- Joseph Burstyn, Inc. v. Wilson (1951)Documento6 páginasJoseph Burstyn, Inc. v. Wilson (1951)mpopescuAinda não há avaliações

- Chap 5 TluanDocumento3 páginasChap 5 TluanHuymi NguyễnAinda não há avaliações

- Gender and Human Rights-5Documento18 páginasGender and Human Rights-5Fahad AmeerAinda não há avaliações

- RocDelhiSTK5 24112017Documento32 páginasRocDelhiSTK5 24112017Ronit KumarAinda não há avaliações

- Policy and Guidelines FOR Use of Nabh Accreditation/ Certification MarkDocumento10 páginasPolicy and Guidelines FOR Use of Nabh Accreditation/ Certification MarkShanu KabeerAinda não há avaliações

- Family Law Tutorial 3Documento13 páginasFamily Law Tutorial 3SHRADDHA BAITMANGALKARAinda não há avaliações

- Subject Mark: Education Notification 2020-2021Documento1 páginaSubject Mark: Education Notification 2020-2021ghyjhAinda não há avaliações

- Historical Development of Land Disputes and Their Implications On Social Cohesion in Nakuru County, KenyaDocumento11 páginasHistorical Development of Land Disputes and Their Implications On Social Cohesion in Nakuru County, KenyaInternational Journal of Innovative Science and Research TechnologyAinda não há avaliações

- Imex CaseDocumento17 páginasImex Caseipsita pandaAinda não há avaliações

- Interpretation of StatutesDocumento8 páginasInterpretation of StatutesPradeepkumar GadamsettyAinda não há avaliações

- Bank of The Philippine Islands and Ana C. Gonzales vs. Spouses Fernando V. Quiaoit and Nora L. QuiaoitDocumento7 páginasBank of The Philippine Islands and Ana C. Gonzales vs. Spouses Fernando V. Quiaoit and Nora L. QuiaoitWins BanzAinda não há avaliações

- Ted Bundy: by Kay and HannahDocumento13 páginasTed Bundy: by Kay and HannahRaoul GaryAinda não há avaliações

- Wine South Africa 2011-04Documento84 páginasWine South Africa 2011-04alejandroAinda não há avaliações

- Illustration 1: Trial Balance As On 31' March 2015 Rs. Credit RsDocumento3 páginasIllustration 1: Trial Balance As On 31' March 2015 Rs. Credit RsDrpranav SaraswatAinda não há avaliações

- Article On Hindu Undivided Family PDFDocumento14 páginasArticle On Hindu Undivided Family PDFprashantkhatanaAinda não há avaliações

- Bidding Documents (Two Stage Two Envelopes-TSTE) TorgharDocumento63 páginasBidding Documents (Two Stage Two Envelopes-TSTE) TorgharEngr Amir Jamal QureshiAinda não há avaliações

- Business law-Module+No.2Documento34 páginasBusiness law-Module+No.2Utkarsh SrivastavaAinda não há avaliações

- United States Court of Appeals Third CircuitDocumento9 páginasUnited States Court of Appeals Third CircuitScribd Government DocsAinda não há avaliações

- Terms and Conditions (AutoRecovered)Documento1 páginaTerms and Conditions (AutoRecovered)Jainah JaparAinda não há avaliações