Escolar Documentos

Profissional Documentos

Cultura Documentos

Leadership Conf Nov 26 2014 - Final

Enviado por

Loredana Morosanu0 notas0% acharam este documento útil (0 voto)

54 visualizações32 páginasda

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PPTX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoda

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PPTX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

54 visualizações32 páginasLeadership Conf Nov 26 2014 - Final

Enviado por

Loredana Morosanuda

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PPTX, PDF, TXT ou leia online no Scribd

Você está na página 1de 32

WHIRLPOOL CORPORATION CONFIDENTIAL

EMEA LEADERSHIP TELECONFERENCE

NOVEMBER 26, 2013

1

WHIRLPOOL CORPORATION CONFIDENTIAL

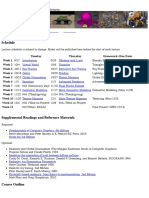

AGENDA

Welcome Esther Berrozpe

Full Year Outlook 2013 Sidnei Sanches

Profit Plan 2014 Esther Berrozpe

Sidnei Sanches

ELA: Built-in Marco Balliano

Q&A All

2

WHIRLPOOL CORPORATION CONFIDENTIAL

Key Financial Performance

QUARTER 4 EOP OUTLOOK

3

Q4 Nov Fcst vs Q4 Sept Fcst Q4 Nov Fcst vs Q3 Actual

USD

1

10.8 (9.2) (6.7) 4.9 9.2 0.4

10

Q3 (Actual) Volume PMR P4G Rev Gen SDA CS Q4 (Nov Fcst)

0.1%

1.2%

Warranty: (0.9)m$

Pension: (1.2)m$

Infra : (1.9)m$

Seasonality: (2.5)m$

Engineering: 0.5m$

O&T: 0.3m$

MDA (33)kU

USD

15

(1.8) (3.9) (2.7) 2.0 0.4 0.7

10

Q4 (Sep Fcst) Volume PMR P4G Rev Gen SDA CS Q4 (Nov Fcst)

1.8% 1.2%

Material: (4.0)m$

O&T/OCOS: 1.3m$

F(x)

Q4 Q4 Q3 Q4

Nov Fcst Sep Fcst Actual LY vs. Sep Fcst vs. Q3 ACT vs. Q4 LY

Units 3,313 3,360 3,058 3,214 (47) 255 99

Net Sales 824 875 780 794 (51) 43 30

asv 248.6 260.5 255.2 247.1 (11.8) (6.6) 1.5

11.8 % 11.9 % 10.8 % 12.1 % (0.1) pts 1.0 pts (0.3) pts

(10.4)% (10.1)% (10.6)% (11.1)% (0.3) pts 0.2 pts 0.7 pts

EOP Reported 10 15 1 8 (5) 9 2

1.3 % 1.8 % 0.1 % 1.0 % (0.5) pts 1.1 pts 0.3 pts

F(x) 1.33 1.33 1.33 1.30

Q4

SG&A %

% of Sales

US$ Million

Gross Margin %

WHIRLPOOL CORPORATION CONFIDENTIAL

FULL YEAR EOP OUTLOOK

4

Q1 Q2 Q3 Q4 FY FY FY FY

ACTUAL ACTUAL ACTUAL OUTLOOK OUTLOOK SEP FCST MAY FCST LYEAR

Units 2,566 2,918 3,060 3,313 11,858 12,000 12,087 11,546

Net Sales 668 732 778 824 3,001 3,085 3,115 2,874

11.4 % 11.3 % 10.8 % 11.8 % 11.3 % 11.4 % 12.3 % 9.9 %

(12.5)% (12.0)% (10.6)% (10.4)% (11.3)% (11.2)% (10.9)% (11.5)%

EOP Reported (8) (6) 1 10 (4) 1 40 (52)

(1.2)% (0.9)% 0.1 % 1.2% (0.1)% 0.0 % 1.3 % (1.8)%

F(x) 1.32 1.31 1.33 1.33 1.32 1.33 1.31 1.29

Gross Margin %

SG&A %

% of Sales

US$ Million

WHIRLPOOL CORPORATION CONFIDENTIAL

EXECUTIVE SUMMARY

Macro-economic environment unchanged, still uncertain and volatile

Industry demand expected to be flat overall; continuous decline in West Europe and

growth in East and MEA region

Step improvement in EMEA EOP driven primarily by MDA business

PMR and selective volume growth in key markets/categories

Restructuring plans(footprint and infrastructure)

P4G execution

Cash generation driven by earnings and working capital improvement

TURN AROUND OF OUR MDA BUSINESS AND

ENHANCE GROWTH AND PROFITABILITY OF SDA AND CUSTOMER SERVICE

EMEA PROFIT PLAN 2014

5

WHIRLPOOL CORPORATION CONFIDENTIAL

KEY DRIVERS OF EMEA 2014 PROFIT PLAN

7% MDA volume growth in overall EMEA. with market share gains in key markets, i.e. France, Germany,

Poland, Central Europe and MEA

EMEA Gross Margin increasing by 4 points up to 15% on Net Sales, with positive progression from January,

through LfL price increase and mix improvement

MPI investment to support growth (especially distribution expansion and PMR) through pay-for-

performance spending

Rev gen investments growing by US $21M, focused on trade events, in store execution and on-line

activities

Aggressive P4G plan with strong productivity both in materials and manufacturing

Infrastructure cost below prior year by US $8M (excluding PEP impact) with full absorption of US$6M

inflation. Key drivers are HC reduction and savings in discretionary expenses. Continuous investment in

talent upgrade and people development

Restructuring savings below original plan in 2014 driven by lower volume in Side-by-side and delayed

execution of engineering savings; full recovery expected in 2015

Customer service and SDA delivering substantial improvement in EOP (+US $13M)

EMEA PROFIT PLAN 2014

6

WHIRLPOOL CORPORATION CONFIDENTIAL

KEY ASSUMPTIONS

EMEA PROFIT PLAN 2014

2013

Outlook

2014

PP

Variance

H

i

g

h

L

e

v

e

l

s

I

n

d

i

c

a

t

o

r

s

Industry Growth % (0.8)% 0.0%

Market Share (%) 8.3% 8.6% 0.3 pts

Volume MDA (M units) 11.0 11.8 7.0%

Volume SDA (M units) 0.7 1.0 33.6%

Production (M units) 8.6 8.9 3.5%

Revenues (Bi$) 3.0 3.3 10.0%

K

e

y

E

O

P

D

r

i

v

e

r

s

PMR (% of Net Sales) (1.7)% 1.5%

P4G Net (M$) 26 29

Restructuring (M$) 23 33

Rev Gen (% of Net Sales) 1.4% 2.0% (0.6) pts

US$ Fx (avg) 1.32 1.33

E

O

P

.

F

C

F

.

&

W

o

r

k

i

n

g

C

a

p

i

t

a

l

EOP EMEA (4) 125 129

(% of Net Sales) (0.1)% 3.8% 3.9 pts

FCF 65 110 45

(% of Net Sales) 2.2% 3.3% 1.1 pts

Working Capital Year end 8.7% 6.3% 2.4 pts

Year avg. 16.0% 14.0% 2.0 pts

7

WHIRLPOOL CORPORATION CONFIDENTIAL

EMEA FULL YEAR P&L

FY FY FY PP'14 vs OL13 OL13 vs 2012

Mln US$ PP 2014 OL 2013 2012 B / (W) B / (W)

Units 12,881 11,858 11,546 1,023 312

Net Sales 3,310 3,001 2,874 309 127

ASV 257.0 253.1 248.9 3.9 4.2

Cost of Sales 2,809 2,662 2,590 (148) (71)

% of Net Sal es 84.9% 88.7% 90.1% 3.8 pts 1.4 pts

Gross Margin 501 339 284 162 56

% of Net Sal es 15.1% 11.3% 9.9% 3.8 pts 1.4 pts

Total SG&A 372 339 332 (33) (8)

% of Net Sal es 11.2% 11.3% 11.5% 0.1 pts 0.2 pts

Amortization 4 4 4 0 0

Operating Profit 125 (4) (52) 128 48

% of Net Sales 3.8% (0.1%) (1.8%) 3.9 pts 1.7 pts

Net Hedge / FX (1) (7) (6) 5 (1)

All other OIOE (3) (4) (45) 1 41

IC OIOE 0 0 (1) 0 1

EBIT 120 (14) (104) 135 90

EBIT % of Net Sales 3.6% (0.5%) (3.6%) 4.1 pts 3.1 pts

Financial Performance

EMEA PROFIT PLAN 2014

2014 PLAN IS A KEY MILESTONE TOWARD LRP OBJECTIVES

8

WHIRLPOOL CORPORATION CONFIDENTIAL

EMEA EOP BY BUSINESS

EOP 2013 OL 2014 PP

MDA $ (115)M $ 0M

+$115M

SDA $ 63M $ 74M

+$ 11M

CS $ 47M $ 50M

+$ 3M

EMEA $ (4)M $ 125M

+$ 129M

EMEA PROFIT PLAN 2014

9

WHIRLPOOL CORPORATION CONFIDENTIAL

EOP CROSSOVER OL13 TO PP14

EMEA PROFIT PLAN 2014

EOP PP

2014

125

CS

3

SDA

11 (13)

BD/Ins.

(2)

Rev. Gen.

(21)

Restr.

benefits

33

P4G

30

PMR

51

Volume

39

EOP

2013 OL

4

Special

Projecst

EOP (US $ M)

- 0.1% 3.8%

EOP, % of

Net sales

Includes US $10M

of PMR related to

R/S activities

AGGRESSIVE PLANS IN ALL LEVERS TO BRING OUR MDA BUSINESS TO BREAK-EVEN

MDA

773K

units

2013=1.4%

2014= 2.0%

MDA improvement of US $115M

10

WHIRLPOOL CORPORATION CONFIDENTIAL

EMEA TOTAL VOLUME

MDA INCREMENTAL VOLUME +775K

EMEA PROFIT PLAN 2014

'000 units 2013 2014 % Delta

MDA / CS 11,115 11,890 7.0% 775

Total BI 4,565 5,035 10.3% 470

Total FS 6,476 6,779 4.7% 303

CS 74 76 2.7% 2

SDA 741 990 33.6% 249

TOTAL VOLUME 11,858 12,881 8.6% 1,023

11

WHIRLPOOL CORPORATION CONFIDENTIAL

INDUSTRY AND WHIRLPOOL EVOLUTION 2012-2014

98 97 96 94 96 95 94

Whirlpool

price index

0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

-2.0%

-5.0%

0.2%

-0.4%

-2.3%

-0.8%

-2.0%

-1.1%

8.6%

8.7%

8.6%

8.5%

8.4%

8.3%

8.4%

8.4%

8.3%

8.2%

8.0%

8.1%

7.7%

7.9%

8.3%

Q1

Act

Q2

Act

Q3

Act

Q4

Act

FY

Act

Q1

OL

Q2

OL

ASSUMING FLAT INDUSTRY IN 2014, GROWTH IN BOTH MARKET SHARE AND PRICE INDEX

Indutry Sales units, % change vs. LY

Whirlpool Market share, %

1, Data for July and August, September data from GfK will be available end of November

Source: GfK, MDA-9, EU-23

95 94 94

Q3

OL

Q4

OL

FY

OL

2012 2013

95 96 97 96 96

2014

Q1

Act

Q2

Act

Q3

Act

1

Q4

OL

FY

OL

Outlook

FY

2012

FY

2013

FY

2014

EMEA PROFIT PLAN 2014

12

WHIRLPOOL CORPORATION CONFIDENTIAL

MDA VOLUME BY COUNTRY

Volume (Ths. units) PP 2014 2013 OL

Vs. 2013 OL

(units)

Vs. 2013 OL (%)

Northern Europe 862 799 62 7.8%

Benelux 655 626 29 4.6%

Germanics Area 1.755 1.670 85 5.1%

Switzerland 173 158 15 9.4%

NORTH AND CONTINETAL REGION 3.445 3.254 191 5.9%

France 1.675 1.604 71 4.4%

Italy 1.220 1.220 - -

Iberia 190 176 14 7.7%

Greece 85 75 10 14.0%

WEST & SOUTH REGION 3.170 3.083 87 2.8%

Poland & Baltic 677 608 69 11.3%

Central Europe 431 398 34 8.5%

Poland. Baltics & Central East 1.108 1.006 103 10.2%

Eastern Europe Region 422 378 44 11.6%

South East Europe 329 306 22 7.3%

EAST & SOUTH EAST EUROPE AREA 751 685 66 9.6%

ME & NWA AREA 852 811 41 5.0%

South Africa 720 620 100 16.1%

IKEA 1.510 1.345 165 12.2%

CENTRAL. EAST & MEA REGION 4.941 4.467 474 10.6%

OEM 228 214 14 6.7%

Total MDA 11.784 11.011 773 7.0%

EMEA PROFIT PLAN 2014

13

WHIRLPOOL CORPORATION CONFIDENTIAL

MDA MILC CROSSOVER 2013 TO PP 2014

Positive mix driven by:

Product mix in every country

Built in growth plan

Dish growth

New product launches: Dragon88/ Fjord project

Net Price Increase +1% LFL

Mix

(12)

TPI MILC

FY 2014

641

Mix

53

32

Volume

39

CPU Log.

4

FX

(11)

MILC

FY 2013

536

LfL

MILC (US $M)

EMEA PROFIT PLAN 2014

14

DETAILED PMR PLAN DEFINED FOR EACH COUNTRY AT A TRADE PARTNER LEVEL

WHIRLPOOL CORPORATION CONFIDENTIAL

2014 PROFIT PLAN P4G

IMPORTANT COST REDUCTION CRITICAL TO DELIVER 2014 OBJECTIVES

Million $ Q1 Q2 Q3 Q4 FY

Materials + FPS 8.4 7.8 10,2 10.9 37.2

Conversion 0.7 3.9 4.0 3.2 11.7

O&T Capitalization (6.4) (9.0) 1.7 2.9 (10.9)

Freight & Warehouse 0.8 1.0 1.1 1.1 4.1

Quality 1.3 1.3 1.3 1.3 5.3

OCOS (1.1) 0.5 (0.6) 0.7 (0.4)

Corporate recharge (0.6) (0.6) (0.6) (0.6) (2.4)

PEP - (2.6) (3.2) (1.9) (7.6)

Infrastructure (2.2) (1.7) (2.3) (0.6) (6.8)

P4G MDA 0.9 0.5 11.6 17.2 30.3

Material 0.4 0.4 0.4 0.4 1.6

Logistics 0.3 0.3 0.3 0.3 1.2

Quality (0.3) (0.3) (0.3) (0.3) (1.3)

Infrastructure (0.6) (0.7) (0.7) (0.9) (2.9)

P4G SDA (0.3) (0.3) (0.4) (0.5) (1.5)

EMEA P4G 0.7 0.2 11.2 16.7 28.8

EMEA PROFIT PLAN 2014

15

WHIRLPOOL CORPORATION CONFIDENTIAL

EMEA PP2014 FULL YEAR FCF

NET EARNINGS AND WORKING CAPITAL MAIN DRIVERS OF CASH GENERATION

EMEA PROFIT PLAN 2014

US$ Mi l l i on

2012

Actual

2013

Outlook

2014

P.Plan

Net Earnings ($95) $0 $85

$0 $0 $0

Amort/Deprec $115 $92 $102

$0 $0

Funds from Operations $20 $92 $187

$0 $0 $0

Receivables ($49) $12 ($40)

Inventories $13 $14 $50

Payables ($44) $12 $44

$0 $0 $0

Working Capital ($79) $39 $54

$0 $0 $0

Other Op Accounts $35 $4 $31

Restructuring $13 $31 ($28)

$0 $0 $0

Cash from Op.Cycle ($11) $166 $245

$0 $0 $0

Capital Expenditure ($88) ($101) ($135)

$0 $0 $0

Free Cash Flow ($99) $65 $110

$0.0 $0.0 $0.0

FCF % of NS %(3.0) %2.2 %3.3

FULL YEAR

16

WHIRLPOOL CORPORATION CONFIDENTIAL

EMEA P&L PP14 BY QUARTER

Q1 Q2 Q3 Q4 FY

Mln US$ PP 2014 PP 2014 PP 2014 PP 2014 PP 2014

Units 2,831 3,137 3,349 3,564 12,881

Net Sales 736 813 859 902 3,310

ASV 260.1 259.2 256.4 253.2 257.0

Cost of Sales 639 699 720 751 2,809

% on Net Sal es 86.8% 85.9% 83.9% 83.3% 84.9%

Gross Margin 97 114 138 151 501

% on Net Sal es 13.2% 14.1% 16.1% 16.7% 15.1%

Total SG&A 88 96 92 96 372

% on Net Sal es 12.0% 11.8% 10.7% 10.7% 11.2%

Amortization 1 1 1 1 4

Operating Profit 8 17 46 54 125

% on Net Sales 1.1% 2.1% 5.3% 6.0% 3.8%

Net Hedge / FX (0) (0) (0) (0) (1)

All other OIOE (1) (1) (1) (1) (3)

IC OIOE 0 0 0 0 0

EBIT 7 16 45 53 120

EBIT % of Net Sales 0.9% 2.0% 5.2% 5.9% 3.6%

Financial Performance

EMEA PROFIT PLAN 2014

17

WHIRLPOOL CORPORATION CONFIDENTIAL

EMEA P&L YOY Q1 14 VS. Q1 13

Q1 Q1 vs. '13

Mln US$ PP 2014 ACT2013 B / (W)

Units 2,831 2,566 264

Net Sales 736 668 68

ASV 260.1 260.2 (0.2)

Cost of Sales 639 592 (47)

% of Net Sal es 86.8% 88.6% 1.8 pts

Gross Margin 97 76 21

% of Net Sal es 13.2% 11.4% 1.8 pts

Total SG&A 88 83 (5)

% of Net Sal es 12.0% 12.5% 0.5 pts

Amortization 1 1 (0)

Operating Profit 8 (8) 16

% of Net Sales 1.1% (1.2%) 2.3 pts

Net Hedge / FX (0) (2) 2

All other OIOE (1) 1 (1)

IC OIOE 0 (0) 0

EBIT 7 (10) 17

EBIT % of Net Sales 0.9% -1.5% 2.4 pts

Financial Performance

MDA 202Ku

13= 1.2%

14= 1.7%

USD

(8)

11 5 1 5 (4) 2 0 (3)

8

Q1 2013 Volume PMR P4G Restr.

Benefits

Rev Gen SDA CS Talent

Upgrade

Q1 2014

PP

- 1.2%

1.1%

EMEA PROFIT PLAN 2014

18

WHIRLPOOL CORPORATION CONFIDENTIAL

EMEA P&L SEQUENTIAL Q1 14 VS. Q4 13

Q1 Q4 vs OL'13

Mln US$ PP 2014 OL 2013 B / (W)

Units 2,831 3,313 (482)

Net Sales 736 824 (88)

ASV 260.1 248.6 11.4

Cost of Sales 639 727 88

% of Net Sal es 86.8% 88.2% 1.5 pts

Gross Margin 97 97 0

% of Net Sal es 13.2% 11.8% 1.5 pts

Total SG&A 88 86 (2)

% of Net Sal es 12.0% 10.4% (1.6) pts

Amortization 1 1 (0)

Operating Profit 8 10 (2)

% of Net Sales 1.1% 1.2% (0.1) pts

Net Hedge / FX (0) (0) (0)

All other OIOE (1) (1) 0

IC OIOE 0 0 (0)

EBIT 7 9 (2)

EBIT % of Net Sales 0.9% 1.1% (0.2) pts

Financial Performance

MDA (485)Ku

Material: 4.7m$

Conversion: 2.0m$

Expenses: 0.7m$ 13= 0.6%

14= 1.7%

EMEA PROFIT PLAN 2014

19

WHIRLPOOL CORPORATION CONFIDENTIAL

PMR CROSSOVER Q4-2013 TO Q1-2014

MILC

Q1-2014

146

Mix

14

TPI

5

LfL

6

Volume

(13)

MILC

Q4-2013

134

MILC (US $M)

VOLUME SEASONALITY MORE THAN OFFSET BY PMR ACTIONS

EMEA PROFIT PLAN 2014

47

MILC/

unit (US $)

55

20

WHIRLPOOL CORPORATION CONFIDENTIAL

AGENDA

Welcome Esther Berrozpe

Full Year Outlook 2013 Sidnei Sanches

Profit Plan 2014 Esther Berrozpe

Sidnei Sanches

ELA: Built-in Marco Balliano

Q&A All

21

WHIRLPOOL CORPORATION CONFIDENTIAL

EMEA ELA

OPERATIONAL LEVERS

STRATEGIC LEVERS

FUTURE

(not now)

Stop volume loss, selective growth & PMR focus

P4G acceleration

Working Capital efficiency

Built-in growth

True product leadership

Radical fixed cost reduction & simplification

Current Profit Pools growth & MEA expansion

PEOPLE

True brand leadership

Brand portfolio

optimization

Brand preference

growth

New business

development

B2C

New profit pools

New channels /

trade partners

Talent, leadership and engagement

2014 2015 2016 2013

22

WHIRLPOOL CORPORATION CONFIDENTIAL

AMBITION TO REGAIN NUMBER TWO POSITION IN BUILT-IN BY 2017

* Including IKEA

Source: Whirlpool internal data, GfK data, BCG analysis

#3 in EMEA Built-in market... ... #2 in EMEA Built-in market

13% market share

*

... ... to 16% - 17% market share

4.6 million sold units... ... 6.0 6.5 million sold units

750 million Euro net sales... ... 1 1,1 billion Euro net sales

5 million Euro operating profit... ... 90 100 million Euro operating profit

to 2017 From 2013E...

23

WHIRLPOOL CORPORATION CONFIDENTIAL

CONSUMERS FAVOR BI APPLIANCES OVER FS DUE TO AESTHETICS

Purchased MDA product categories and reasons for choice of BI / FS

"Which appliance did you buy? As free-standing (FS) or Built-in (BI)?" "Why as free-standing or Built-in"

35%

8%

9%

13%

34%

23%

14%

16%

65%

Microwave

oven

23%

Hobs 80%

Ovens 78%

Dishwasher 70%

Refrigerator /

Cooler

31%

4%

Source: 80 interviews with consumers from Italy, France, Germany and Poland who bought a kitchen within the last three years conducted September 2013; BCG analysis

Why FS: "Elegancy of the appliance", "Too big to built it in", "Price"

Why BI: "Predefined in kitchen layout"

Not bought Bought as FS Bought as BI

Why BI:

"Predefined in kitchen layout"

"Space optimization"

"Esthetics"

Why FS: "Flexibility with regards to position"

Why BI: "Predefined in kitchen layout", "Esthetics"

24

WHIRLPOOL CORPORATION CONFIDENTIAL

AS A CONSEQUENCE, BI GAINING SHARE OVER FS

France Italy Germany Poland Consumer behavior

7.46

35%

65%

6.63

33%

2008

67%

2012 2012

74%

11.92

25%

2008

75%

13.07

26%

11.99

2008

43%

54%

57%

13.89

46%

2012

69%

31%

2008 2012

4.08

78%

4.35

22%

Built-in

Free-standing MDA

1

market vol.

(in Mn. units)

1. MDA 9 product categories excluding hoods 2. Based on 80 interviews per market with consumers who bought a kitchen within the last three years conducted September 2013

Source: GfK, Consumer research, BCG analysis

More and more built-

in product offerings in

relevant price set for

consumers

Exception Italy:

postponement of

kitchen investments

due to macro-

economic downturn

Built-in preferred to

freestanding mainly

due to esthetics

2

Development of BI

share since '08

25

WHIRLPOOL CORPORATION CONFIDENTIAL

UNEVENLY SPREAD INCOME ACROSS POPULATION LEADING TO

POLARIZATION OF PRICE SEGMENTS

Poland

55 %

1.2

52 %

19 %

18 %

11 %

Germany

6.1

14 %

16 %

15 %

France

3.2

48 %

19 %

19 %

14 %

Italy

2.2

47 %

18 %

23 %

12 %

Price segments 2012 ... ... per focus country (in % of total country volume)

All focus countries

12.7 Mn. units

6.6

(52%)

2.1

(17%)

2.3

(18%)

1.7

(14%)

Note: Analysis includes main BI product categories Cooking, Hobs, Cooling and Dishwashers; data as of end of 2012

Source: WHR KitchenAid strategy analysis from June 2013, GFK, central project team, BCG analysis

Change vs. 2008

+1.1ppts

High end

(PI >150)

-1.8ppts

Core

(PI 90-110)

+1.7ppts

Value

(PI <90)

-1.0ppts

Core Plus

(PI 110-150)

26

WHIRLPOOL CORPORATION CONFIDENTIAL

Across countries, online most important infor-mation

source (exemplary for BI hob purchase

1

) ...

... and online sales growing rapidly since 2010 (total

volume of focus countries in Mn. units)

In-store

information

18%

Brochures &

catalogues

17%

General

magazines

9%

Family and

friends

14%

Sales

assistant

35%

Internet 51%

1. Which of the following sources of information did you use to gather information about your current built-in hob? 2. And what kind of internet website did you visit to gather information?

Source: Research Plus Study: Cooking U&H Hob Shopper Insight, Feb 2012 (Quantitative web survey with structured questionnaire of 20min, carried out in last 2 weeks of November 2011);

GFK data as of end of 2012 MDA 9 excluding hoods ; BCG analysis

Traditional

sales

Internet

sales

2012

13.3

11.8

(89%)

1.5

(11%)

2010

12.4

11.5

(93%)

0.9

(7%)

Share of online sales

1% / 32k units

16% / 563k units

10% / 613k units

25% / 311k units

ONLINE DEVELOPED INTO MAIN INFORMATION SOURCE AS SALES

CHANNEL ALSO GROWING RAPIDLY

+625k

27

WHIRLPOOL CORPORATION CONFIDENTIAL

Capture market growth

Assumptions on market growth modeled for each channel

and country with market teams

Graph illustrative

2017 2013

THREE TYPES OF GROWTH CONSIDERED TO PROJECT 2017 SALES

Gain share

Defined bottom-up together with market teams draft list of

focus trade partners per initiative defined

Gain share

IKEA

Benefit from organic IKEA growth

Three volume growth types

Capture

market growth

One market execution plan

Source: WHR / BCG BI growth project team

28

WHIRLPOOL CORPORATION CONFIDENTIAL

Initiative Description

Optimize brand

portfolio

Position KAid at attractive price point in the premium segment' to tap larger part of

high-end market & deploy optimized brand portfolio

Gain share

initiatives

Enablers

Grow volumes with

selected trade partners

Gain volume through few selected trade partner deals leveraging on our Value

Brands (e.g. co-operation with pan-EU DIY or local large furniture trade)

Leverage retail / online

growth

Benefit from Retail/Online BI growth with a dedicated replacement offering,

supported by a differentiating 360 degree campaign

Leverage Online /

Digital

Optimize own website (including e.g. planning tools) to capture and steer consumers

in new purchase-path

Identify strong players to 'run with the runners' and support them to succeed in the

marketplace

Ensure sustainable

product leadership

Continuously update product line-up across all categories and manage quality

Reinforce consumer &

customer perception

Meet rising expectations re availability and service level and ensure appropriate

level of brand invest

Conduct changes to

organizational

structure

Implement structural changes on organizational level (central and in markets) to

enable WHR's sales organization to exploit the potential

4 SHARE-GAIN INITIATIVES AND 4 ENABLERS WILL CREATE BI

LEADERSHIP

A

B

C

D

E

F

G

H

Capture selected "high-

volume" accounts

Sustain profitable

Kitchen specialist

business

Source: WHR / BCG BI growth project team

29

WHIRLPOOL CORPORATION CONFIDENTIAL

VOLUME PROJECTED TO GROW FROM 4.6M TO 6.3M UNITS

NET SALES TO INCREASE FROM 725M TO 1,1BN

263

222

210

Volume (in k units)

6,500

6,000

5,500

5,000

0

Baseline 2013

Market growth

IKEA

A: KitchenAid

B: High volume

C: Retail growth

D: Sustain Kitchen

2017

6,260

4,606

160

500

300

2013

4,606

A

B

C

D

1. Assumed to take 40% of additional Whirlpool volumes above market growth from Electrolux (incl. Electrolux IKEA business), 30% from value brand players, 20% from BSH; stretch case

Note: PMR impact included on base business as outlined in LRP

Source: WHR / BCG BI growth project team

Resulting BI market position and

market share Volume and value projection

725

45

56

57

46

789

26

46

1,064

xx Net sales (in m)

2013 2017

#1 ~26% ~25%

#2 ~17% ~16%

#3 ~13% ~15%

Gain share from

1

:

Electrolux

DeDietrich

Neff/Siemens

Other value brand

players

30

WHIRLPOOL CORPORATION CONFIDENTIAL

P&L OP PROJECTED TO INCREASE FROM 0M TO 93M IN '17

2013 2014 2015 2016 2017

Volume (k units) 4.606 5.040 5.375 5.830 6.260

Net Sales (m) 725 810 878 975 1.064

Additonal initiative TPI (m) - (2) (5) (6) (7)

COGS (m)

(555) (594) (620) (665) (703)

MILC (m) 170 214 253 304 354

MILC (%) 23% 26% 29% 31% 33%

Overhead

1

(m) (169) (181) (190) (196) (201)

OP (m) 0 33 63 108 153

PMR Risks

4

(m) - 0 (20) (40) (60)

OP after safety buffer (m) 0 33 43 68 93

thereof due to cost effects

2

(m)

thereof due to PMR effects

3

(m)

16 32 50 68

15 30 46 61

1. Includes Warranty costs, SG&A, O&T, Intercompary results, FX impact, Concessions 2. Includes TCP and Fixed cost leverage effects 3. Includes Lfl and Mix effects 4. In line with LRP

Note: figures include 2% YoY productivity gain & 61m PMR benefit as outlined in LRP (2017 vs. 2013) which is stretched equally across years

Source: WHR / BCG BI growth project team

31

WHIRLPOOL CORPORATION CONFIDENTIAL

AGENDA

Welcome Esther Berrozpe

Full Year Outlook 2013 Sidnei Sanches

Profit Plan 2014 Esther Berrozpe

Sidnei Sanches

ELA: Built-in Marco Balliano

Q&A All

32

Você também pode gostar

- Vintage Leather Briefcasesatchel PART 2Documento90 páginasVintage Leather Briefcasesatchel PART 2Loredana Morosanu100% (3)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- 27-30 Sudden Death of A Premature New-Born With Hypoplastic Left Heart Syndrome. Morfological Study of The HeartDocumento4 páginas27-30 Sudden Death of A Premature New-Born With Hypoplastic Left Heart Syndrome. Morfological Study of The HeartLoredana MorosanuAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- 23-26 An Autopsy Case of Decompression Sickness. Hemorrhages in The Fat Tissue and Fat EmbolismDocumento4 páginas23-26 An Autopsy Case of Decompression Sickness. Hemorrhages in The Fat Tissue and Fat EmbolismLoredana MorosanuAinda não há avaliações

- 19-22 Aortoenteric Fistula A Possible Cause of Sudden DeathDocumento4 páginas19-22 Aortoenteric Fistula A Possible Cause of Sudden DeathLoredana MorosanuAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Guidance - Third Party Human Capital Providers - January 2024Documento3 páginasGuidance - Third Party Human Capital Providers - January 2024rahmed78625Ainda não há avaliações

- Statement of Facts:: State of Adawa Vs Republic of RasasaDocumento10 páginasStatement of Facts:: State of Adawa Vs Republic of RasasaChristine Gel MadrilejoAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Global Grants Community Assessment FormDocumento3 páginasGlobal Grants Community Assessment Formlalitya xavieraAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Partes Oki - MPS5501B - RSPL - Rev - HDocumento12 páginasPartes Oki - MPS5501B - RSPL - Rev - HJaiber Eduardo Gutierrez OrtizAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Crystallization of Para-Xylene in Scraped-Surface CrystallizersDocumento11 páginasCrystallization of Para-Xylene in Scraped-Surface Crystallizersanax22Ainda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Successfully Allocating Risk and Negotiating A PPP ContractDocumento12 páginasSuccessfully Allocating Risk and Negotiating A PPP ContractWilliam Tong100% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Invidis Yearbook 2019Documento51 páginasInvidis Yearbook 2019Luis SanchezAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- CS 148 - Introduction To Computer Graphics and ImagingDocumento3 páginasCS 148 - Introduction To Computer Graphics and ImagingMurtaza TajAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Project Proposal - Articulation SessionsDocumento8 páginasProject Proposal - Articulation SessionsJhay-are PogoyAinda não há avaliações

- Licensed Practical Nurse, LPN, Nurse Tech, Nurse Aide, Nursing ADocumento4 páginasLicensed Practical Nurse, LPN, Nurse Tech, Nurse Aide, Nursing Aapi-121395809Ainda não há avaliações

- Tech Bee JavaDocumento57 páginasTech Bee JavaA KarthikAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Part List SR-DVM70AG, SR-DVM70EUDocumento28 páginasPart List SR-DVM70AG, SR-DVM70EUAndrea BarbadoroAinda não há avaliações

- Telemeter-Electronic Brochure Flexible Heaters WebDocumento12 páginasTelemeter-Electronic Brochure Flexible Heaters WebXavierAinda não há avaliações

- Determination of Sales Force Size - 2Documento2 páginasDetermination of Sales Force Size - 2Manish Kumar100% (3)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Trahar (2013) - Internationalization of The CurriculumDocumento13 páginasTrahar (2013) - Internationalization of The CurriculumUriel TorresAinda não há avaliações

- Heirs of Tancoco v. CADocumento28 páginasHeirs of Tancoco v. CAChris YapAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- 1.2 Installation of SSH Keys On Linux-A Step-By Step GuideDocumento3 páginas1.2 Installation of SSH Keys On Linux-A Step-By Step GuideMada ChouchouAinda não há avaliações

- Print Design Business Model CanvasDocumento3 páginasPrint Design Business Model CanvasMusic Da LifeAinda não há avaliações

- SecureCore Datasheet V2Documento2 páginasSecureCore Datasheet V2chepogaviriaf83Ainda não há avaliações

- D.E.I Technical College, Dayalbagh Agra 5 III Semester Electrical Engg. Electrical Circuits and Measurements Question Bank Unit 1Documento5 páginasD.E.I Technical College, Dayalbagh Agra 5 III Semester Electrical Engg. Electrical Circuits and Measurements Question Bank Unit 1Pritam Kumar Singh100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Organisational Structure of NetflixDocumento2 páginasOrganisational Structure of NetflixAnkita Das57% (7)

- Analytical Profiles Drug Substances and Excipien T S: Harry G. BrittainDocumento693 páginasAnalytical Profiles Drug Substances and Excipien T S: Harry G. BrittainNguyen TriAinda não há avaliações

- Occupational Stress Questionnaire PDFDocumento5 páginasOccupational Stress Questionnaire PDFabbaskhodaei666Ainda não há avaliações

- M98 PVT 051 7546.bakDocumento96 páginasM98 PVT 051 7546.bakmarkbillupsAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Genesis and Development of The Network Arch Consept - NYDocumento15 páginasGenesis and Development of The Network Arch Consept - NYVu Phi LongAinda não há avaliações

- OSN 8800 6800 3800 V100R011C00 Alarms and Performance Events Reference 01Documento1.544 páginasOSN 8800 6800 3800 V100R011C00 Alarms and Performance Events Reference 01Oscar Behrens ZepedaAinda não há avaliações

- Beneparts Quotation BYBJ192388 20191024Documento1 páginaBeneparts Quotation BYBJ192388 20191024احمد عبدهAinda não há avaliações

- Introduction To Content AnalysisDocumento10 páginasIntroduction To Content AnalysisfelixAinda não há avaliações

- 6398 14990 1 PBDocumento8 páginas6398 14990 1 PBKent Ky GillaAinda não há avaliações