Escolar Documentos

Profissional Documentos

Cultura Documentos

Polar Sports, Inc

Enviado por

Jennifer JacksonDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Polar Sports, Inc

Enviado por

Jennifer JacksonDireitos autorais:

Formatos disponíveis

Dr.

Ujjwal Mishra

Prof. A. C. Panda

Polar Sports, Inc

1. Overview/Facts

Polar sports, Inc. is into fashion skiwear

manufacturing business, which is seasonal and

very short product life.

As the products are seasonal the company

follows seasonal production scheduling method.

Now the company wants to shifts to level

production method, which will reduce the cost but

uncertain about the impact on other aspects of

the busies (i.e. Risk, Liquidity & Financing)

2. Industry Overview

The Ski apparel business is a seasonal business,

it is highly competitive and very low product life.

North Face, Burton, Karbon, Spyder Active

Sports, Sports obermeyer, Parda and Giorgio are

the major player in the apparel market

As the Market is highly competitive, some players

have shifted their production to Asia and Latin

America.

Due to High competition in both designing and

pricing, there is a high rate of company failure

3. Problem Statement

Should the management consider to shift level

production method from seasonal scheduling

production Method

4.Objective

Understanding and interpretation of financial

statements (Income statement, Balance sheet &

Cash flow statement)

To analyze the profitability and liquidity aspects of

the firm.

To estimate the funds required for a change in

production method.

5. Alternative

To consider for Level production Method

To follow the Existing, Seasonal Production

scheduling Method

To consider both the methods

Criteria

Risk of profitability and Liquidity

Source of Sort term financing and risk

Analysis (as per original case

exhibits)

Seasonal Production Level Production

Pros:

a) Requires minimum short term

financing

b) Less risk

c) Less inventory holding

Pros:

a) Reduces operating cost

Cons:

a) Increases operating Cost

Cons:

a) Requires more short term financing

b) High risk

c) High Inventory Holding.

Analysis

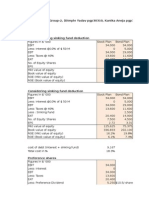

Net Savings From Level Production

Overtime wage premiums 480,000

Other direct labor savings 600,000

Net savings before financial charges, carrying costs,

inventory losses, and taxes 1,080,000

Increase in interest expenses 147,923

Reduction in interest income 16,140

Increase in storage cost 300,000

Net pretax savings 615,937

Less tax at 34% 209,418

Net savings 406,518

7. Suggestion

From the above analysis, it shows that the

company can save around $ 406,518 if the

company follows Level production method, instead of

Seasonal Production Method.

Hence the company should follow the level production

Method

Key Take away

Analysis of Financial statements

Divergence in Accounting Income and cash flow

Questions for Discussion

What factors must be considered by Mr. Weir for

deciding, whether to adopt Level production?

Solution:

1. Net saving from level production $406518 /-

2. The difference in profit between two production Plans $

1553141 /- under Level Production & 1146623 under

Seasonal Production.

3. Level production reduces COGS from 66 % to 60 %

Find out the total savings, if Level production is

adopted

Solution:

Total Savings From Level Production

1. Overtime wage premiums 480,000

2. Other direct labor savings 600,000

3. Total savings before financial charges, carrying

costs, inventory losses, and taxes 1,080,000

Does increased net income justifies the potential

risk that may arise due to increase in risk

Solution:

Yes, The net Income Justifies the Potential risk,

which is arising from the peak Inventory level of $

6,483,000 in the month of August.

Financing Risk: Bank

Can the company able to finance its production

activity

Solution:

1. Yes Mr. Weir has to convince the Bank regarding companies

financial strength, as it absorbs substantial inventory losses

and still repay the bank in Jan next year.

2. Substitute of Bank credit is Polar could ask its trade suppliers

for terms longer than 30 days, i.e. 90 days credit term

Purchases which will help the company to generate around

90000

Você também pode gostar

- How To Crack The SystemDocumento21 páginasHow To Crack The Systemnubirakwe9100% (5)

- Flash - Memory - Inc From Website 0515Documento8 páginasFlash - Memory - Inc From Website 0515竹本口木子100% (1)

- Proforma Cash Flow Analysis and Recommendations for Chemalite IncDocumento8 páginasProforma Cash Flow Analysis and Recommendations for Chemalite IncHàMềmAinda não há avaliações

- Play Time Toy Company Financial AnalysisFebMarAprMayJunJulAugSepOctNovDecTotal10812614512512512514514581655192520571006900070.3782.1094.4881.4581.4581.4594.48950.031,078.401,254.331,340.34Documento16 páginasPlay Time Toy Company Financial AnalysisFebMarAprMayJunJulAugSepOctNovDecTotal10812614512512512514514581655192520571006900070.3782.1094.4881.4581.4581.4594.48950.031,078.401,254.331,340.34Brian Balagot100% (3)

- Hampton Machine Tool CompanyDocumento2 páginasHampton Machine Tool CompanySam Sheehan100% (1)

- Case Analysis Toy WorldDocumento11 páginasCase Analysis Toy WorldNiketa Jaiswal100% (1)

- Play Time Toy Financial AnalysisDocumento4 páginasPlay Time Toy Financial AnalysischungdebyAinda não há avaliações

- 128,000 forecasted sales in 2012Documento8 páginas128,000 forecasted sales in 2012chopra98harsh3311100% (4)

- Colorscope 1Documento6 páginasColorscope 1Oca Chan100% (2)

- Polar Sports Level Production AnalysisDocumento15 páginasPolar Sports Level Production Analysisjordanstack0% (1)

- Jackson Automotive Financial Crisis RecoveryDocumento3 páginasJackson Automotive Financial Crisis RecoveryErika Theng25% (4)

- Polar SportDocumento4 páginasPolar SportKinnary Kinnu0% (2)

- Case - Polar SportsDocumento12 páginasCase - Polar SportsSagar SrivastavaAinda não há avaliações

- Investment Analysis Polar Sports ADocumento9 páginasInvestment Analysis Polar Sports AtalabreAinda não há avaliações

- 2009 03 ICA Member DirectoryDocumento60 páginas2009 03 ICA Member DirectoryRay CollinsAinda não há avaliações

- Polar SportsDocumento15 páginasPolar SportsjordanstackAinda não há avaliações

- PLAY TIME TOY COMPANY CASH BUDGET AND INVENTORY SCHEDULEDocumento15 páginasPLAY TIME TOY COMPANY CASH BUDGET AND INVENTORY SCHEDULEjtang512100% (3)

- Audit Plan For CashDocumento5 páginasAudit Plan For CashDiana PrinceAinda não há avaliações

- Polar SportsDocumento9 páginasPolar SportsAbhishek RawatAinda não há avaliações

- Chapter - IDocumento36 páginasChapter - Iharman singhAinda não há avaliações

- Letter From PrisonDocumento10 páginasLetter From PrisonNur Sakinah MustafaAinda não há avaliações

- Continental CarriersDocumento6 páginasContinental CarriersVishwas Nandan100% (1)

- Play Time Toys. Supplement 1 (To Do) Pro Forma Income Statements Under Level Production (1991)Documento12 páginasPlay Time Toys. Supplement 1 (To Do) Pro Forma Income Statements Under Level Production (1991)cpsharma15Ainda não há avaliações

- Stryker Case - BriefDocumento4 páginasStryker Case - BriefCorinne Williams0% (4)

- Glaxo ItaliaDocumento11 páginasGlaxo ItaliaLizeth RamirezAinda não há avaliações

- Polar Sports, Inc SpreadsheetDocumento19 páginasPolar Sports, Inc Spreadsheetjordanstack100% (3)

- Jones Electrical Faces Cash Shortfall Despite ProfitsDocumento5 páginasJones Electrical Faces Cash Shortfall Despite ProfitsAsif AliAinda não há avaliações

- Loewen Group CaseDocumento2 páginasLoewen Group CaseSu_NeilAinda não há avaliações

- Polar Sports: Where Does Polar Sports Fit in The Course?Documento21 páginasPolar Sports: Where Does Polar Sports Fit in The Course?Hugo100% (1)

- Case Hansson Private LabelDocumento15 páginasCase Hansson Private Labelpaul57% (7)

- Hanson CaseDocumento14 páginasHanson CaseSanah Bijlani40% (5)

- Flash Memory IncDocumento7 páginasFlash Memory IncAbhinandan SinghAinda não há avaliações

- Consolidated Income and Cash Flow StatementsDocumento30 páginasConsolidated Income and Cash Flow StatementsrooptejaAinda não há avaliações

- Jackson Automotive Systems ExcelDocumento5 páginasJackson Automotive Systems Excelonyechi2004Ainda não há avaliações

- Salem CaseDocumento4 páginasSalem CaseChris Dunham100% (3)

- Sr. No Name Roll No Programme: Case Analysis Section 2 Toffee Inc. Course: Operations Management (Tod 221)Documento6 páginasSr. No Name Roll No Programme: Case Analysis Section 2 Toffee Inc. Course: Operations Management (Tod 221)Harshvardhan Jadwani0% (1)

- Pacific Grove Spice Company SpreadsheetDocumento7 páginasPacific Grove Spice Company SpreadsheetAnonymous 8ooQmMoNs10% (1)

- New Heritage Doll Company Report: Design Your Own Doll Project Best ChoiceDocumento5 páginasNew Heritage Doll Company Report: Design Your Own Doll Project Best ChoiceRahul LalwaniAinda não há avaliações

- Polar Sports 5 PDFDocumento18 páginasPolar Sports 5 PDFPaolo SergioAinda não há avaliações

- Investment Analysis - Polar Sports (A)Documento9 páginasInvestment Analysis - Polar Sports (A)pratyush parmar100% (13)

- New DollDocumento2 páginasNew DollJuyt HertAinda não há avaliações

- Scientific Glass ExcelDocumento13 páginasScientific Glass ExcelSakshi ShardaAinda não há avaliações

- Heritage CaseDocumento3 páginasHeritage CaseGregory ChengAinda não há avaliações

- Ma Case WriteupDocumento4 páginasMa Case WriteupMayank Vyas100% (1)

- Pacific Grove Spice Company Case Write UpDocumento3 páginasPacific Grove Spice Company Case Write UpVaishnavi Gnanasekaran100% (4)

- Case Study - Destin Brass Products CoDocumento6 páginasCase Study - Destin Brass Products CoMISRET 2018 IEI JSCAinda não há avaliações

- Polar Sports Inc.Documento4 páginasPolar Sports Inc.Talia100% (1)

- New Heritage Doll Company Financial AnalysisDocumento31 páginasNew Heritage Doll Company Financial AnalysisSoundarya AbiramiAinda não há avaliações

- American Lawbook Corporation (A)Documento9 páginasAmerican Lawbook Corporation (A)Adwitiya Datta20% (5)

- Pacific Grove Spice Company Case CalculationsDocumento11 páginasPacific Grove Spice Company Case CalculationsMinh Hà33% (3)

- PolarSports Solution PDFDocumento8 páginasPolarSports Solution PDFaotorres99Ainda não há avaliações

- PRIMO BENZINA Financial Ratios 2006-2009Documento13 páginasPRIMO BENZINA Financial Ratios 2006-2009P3 Powers100% (1)

- Polar SportsDocumento7 páginasPolar SportsShah HussainAinda não há avaliações

- Polar Sports X Ls StudentDocumento9 páginasPolar Sports X Ls StudentBilal Ahmed Shaikh0% (1)

- Pacific Grove Spice CompanyDocumento3 páginasPacific Grove Spice CompanyLaura JavelaAinda não há avaliações

- Standard variable costs and break-even analysis for Iphone 4Documento13 páginasStandard variable costs and break-even analysis for Iphone 4Bernard EugineAinda não há avaliações

- Pacific Grove Spice CompanyDocumento7 páginasPacific Grove Spice CompanySajjad Ahmad100% (1)

- Toy World - ExhibitsDocumento9 páginasToy World - Exhibitsakhilkrishnan007Ainda não há avaliações

- Paginas Amarelas Case Week 8 ID 23025255Documento4 páginasPaginas Amarelas Case Week 8 ID 23025255Lesgitarmedit0% (1)

- Beta Management Company r2Documento17 páginasBeta Management Company r2Yash AgarwalAinda não há avaliações

- FINANCIAL FORECAST GUIDEDocumento16 páginasFINANCIAL FORECAST GUIDEMariann Jane GanAinda não há avaliações

- Optimizing Cash Flow Through Accounts Payable ManagementDocumento9 páginasOptimizing Cash Flow Through Accounts Payable Managementarzoo26Ainda não há avaliações

- Assignment # 1 Corporate Finance Fall 2011Documento6 páginasAssignment # 1 Corporate Finance Fall 2011Madiha BhuttaAinda não há avaliações

- Assignment Lecture 1Documento5 páginasAssignment Lecture 1jaiminAinda não há avaliações

- SBI Apprentice 17 Sep 2021 Shift1 Memory Based EnglishDocumento24 páginasSBI Apprentice 17 Sep 2021 Shift1 Memory Based EnglishArghya MohantaAinda não há avaliações

- Current Affairs Capsule - January-2023Documento37 páginasCurrent Affairs Capsule - January-2023Sravya NamaAinda não há avaliações

- Commercial Banking FunctionsDocumento26 páginasCommercial Banking FunctionsMd Mohsin AliAinda não há avaliações

- Wireless Broadband Contract SME Izwi ConnectixDocumento6 páginasWireless Broadband Contract SME Izwi ConnectixkanchanabalajiAinda não há avaliações

- Treasury Management: Indian and International PerspectiveDocumento24 páginasTreasury Management: Indian and International PerspectiveSahil WadhwaAinda não há avaliações

- Financing Your Franchised BusinessDocumento17 páginasFinancing Your Franchised BusinessDanna Marie BanayAinda não há avaliações

- PCI DSS NotificationDocumento2 páginasPCI DSS NotificationRajaAinda não há avaliações

- 20. THPT-Đồng-Đậu-Vĩnh-Phúc-Lần-1-2019Documento18 páginas20. THPT-Đồng-Đậu-Vĩnh-Phúc-Lần-1-2019Quynh NguyenAinda não há avaliações

- Reserve Requirements Empirical Nov 2011Documento35 páginasReserve Requirements Empirical Nov 2011Ergita KokaveshiAinda não há avaliações

- Exercise Chapter 7 Accounting Fraud and Internal ControlDocumento6 páginasExercise Chapter 7 Accounting Fraud and Internal Controlukandi rukmanaAinda não há avaliações

- Questionaire-Internal Control-1Documento7 páginasQuestionaire-Internal Control-1Mirai KuriyamaAinda não há avaliações

- Pierre Lassonde PresentationDocumento21 páginasPierre Lassonde Presentationrichardck61100% (1)

- IBC - Problems and Perspective - Article ICFAIDocumento14 páginasIBC - Problems and Perspective - Article ICFAIAnjaniAinda não há avaliações

- Brief Analysis of Some Merchant Banks in IndiaDocumento6 páginasBrief Analysis of Some Merchant Banks in IndiaParul PrasadAinda não há avaliações

- Accounting MCQsDocumento7 páginasAccounting MCQssaeedqk100% (7)

- Practice Set: Audit of Cash and Cash EquivalentsDocumento2 páginasPractice Set: Audit of Cash and Cash EquivalentsANGELU RANE BAGARES INTOLAinda não há avaliações

- Convert Purchases to EMIs on LIC Credit CardDocumento2 páginasConvert Purchases to EMIs on LIC Credit CardvijaykannamallaAinda não há avaliações

- Satyam Scam Who Is Responsible?Documento3 páginasSatyam Scam Who Is Responsible?ravish419Ainda não há avaliações

- CFPB - Spanish Style Guide GlossaryDocumento77 páginasCFPB - Spanish Style Guide GlossaryAleksandra SaidowskaAinda não há avaliações

- Schemewise Loan OutstandingDocumento2 páginasSchemewise Loan OutstandingDhineshkumar SAinda não há avaliações

- Hire purchase and installment sale transactions explainedDocumento12 páginasHire purchase and installment sale transactions explainedShwetta GogawaleAinda não há avaliações

- Bankingsystem Structureinpakistan:: Prepared by & Syed Ali Abbas Zaidi MoinDocumento12 páginasBankingsystem Structureinpakistan:: Prepared by & Syed Ali Abbas Zaidi MoinmoeenAinda não há avaliações

- ACC112 Midterm RevisionDocumento17 páginasACC112 Midterm Revisionhabdulla_2Ainda não há avaliações

- Annual Report 2015: The Way ForwardDocumento316 páginasAnnual Report 2015: The Way ForwardAsif RafiAinda não há avaliações

- Banking Industry AnalysisDocumento25 páginasBanking Industry Analysisluvujaya67% (3)

- Ex-Parte Order in The Matter of Unicon Capital Services Pvt. Ltd.Documento8 páginasEx-Parte Order in The Matter of Unicon Capital Services Pvt. Ltd.Shyam SunderAinda não há avaliações