Escolar Documentos

Profissional Documentos

Cultura Documentos

Ch04 Activity Based Costing

Enviado por

Daniel John Cañares LegaspiDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Ch04 Activity Based Costing

Enviado por

Daniel John Cañares LegaspiDireitos autorais:

Formatos disponíveis

J ohn Wiley & Sons, I nc.

2005

Prepared by

Dan R. Ward

Suzanne P. Ward

University of Louisiana at Lafayette

Managerial Accounting

Weygandt Kieso Kimmel

CHAPTER 4

ACTIVITY- BASED COSTING

CHAPTER 4

ACTIVITY-BASED COSTING

Study Objectives

ORecognize the difference between traditional

costing and activity based costing.

OIdentify the steps in the development of an

activity-based costing system.

OKnow how companies identify the activity cost

pools used in activity-based costing.

Study Objectives: Continued

OKnow how companies identify and use cost

drivers in activity-based costing.

OUnderstand the benefits and limitations of

activity-based costing.

ODifferentiate between

value-added and

non-value-added

activities.

Study Objectives:

Continued

OUnderstand the value of

using activity levels in

activity-based costing.

OApply activity-based

costing to service

industries.

PREVIEW OF CHAPTER 4

Traditional Costing and Activity-Based Costing

Traditional costing systems

The need for a new approach

Activity-based costing

Illustration of Traditional Costing

versus ABC

Unit costs under traditional costing

Unit costs under ABC

Comparing unit costs

PREVIEW OF CHAPTER 4

Continued

Activity-Based Costing: A Closer Look

Benefits/Limitations of ABC

When to use ABC

Value-added vs. Non-value-added activities

Classification of activity levels

Activity-Based Costing in Service Industries

Traditional costing example

Activity-based costing example

Appendix: Just-in-time Processing

Objective Elements - Benefits

ACTIVITY-BASED COSTING VERSUS

TRADITIONAL COSTING

Study Objective 1

Traditional Costing Systems

Allocates overhead using a single predetermined

rate.

Job order costing: direct labor cost is assumed

to be the relevant activity base.

Process costing: machine hours is the relevant

activity base.

Assumption was satisfactory when direct labor

was a major portion of total manufacturing costs.

Wide acceptance of a high correlation between

direct labor and overhead costs.

Traditional Costing Systems:

Continued

Direct labor is still often the appropriate basis

for assigning overhead costs when:

Direct labor constitutes a significant part of

total product cost

and

High correlation exists between direct labor and

changes in overhead costs.

Overhead Direct Labor Products

Costs Hours/Dollars

Need for a New Approach

Tremendous change in manufacturing and service

industries.

Decrease in amount of direct labor usage.

Significant increase in total overhead costs.

May be inappropriate to use plant-wide

predetermined overhead rates based on direct labor

or machine hours when a lack of correlation exists.

Complex manufacturing processes may require

multiple allocation bases; this approach is called

Activity-Based Costing (ABC).

Activity-Based Costing (ABC)

An overhead cost allocation system that allocates

overhead to multiple activity cost pools

and

Assigns the activity cost pools to products or

services by means of cost drivers that represent the

activities used.

Activity-Based Costing (ABC)

Terms

Activity: any event, action, transaction, or work

sequence that causes a cost to be incurred in

producing a product or providing a service.

Activity Cost Pool: a distinct type of activity.

For example: ordering materials or setting up

machines.

Cost Drivers: any factors or activities that have a

direct cause-effect relationship with the

resources consumed.

The Logic Behind ABC

Products consume activities,

and

activities consume resources.

Activity-Based Costing (ABC) Continued

ABC allocates overhead costs in two stages:

Stage 1: Overhead costs are allocated to activity

cost pools.

Stage 2: The overhead costs allocated to the cost

pools is assigned to products using cost

drivers.

The more complex a products manufacturing

operation, the more activities and cost drivers likely

to be present.

Activities and Related Cost Drivers

ABC System Design Lift Jack Company

Traditional Costing vs ABC

ABC does not replace an existing job

order/process cost system.

ABC does segregate overhead into various

cost pools to provide more accurate cost

information.

ABC, thus, supplements it does not replace

the traditional cost system.

Traditional Costing vs ABC

An Illustration

Study Objectives 2, 3, & 4

Atlas Company produces two automotive antitheft devices:

The Boot: a high volume item with sales totaling 25,000 per year

The Club: a low volume item with sales totaling 5,000 per year

Each product requires 1 hour of direct labor

Total annual direct labor hours (DLH) 30,000 (25,000 + 5000)

Direct labor cost $12 per unit for each product

Expected annual manufacturing overhead costs $900,000

Direct materials cost:

The Boot - $40 per unit

The Club - $30 per unit

Unit Costs Under Traditional Costing

Products

Manufacturing Costs The Boot The Club

Direct Materials $40 $30

Direct Labor 12 12

Overhead 30* 30*

Total unit cost $82 $72

* Predetermined overhead rate: $900,000/30,000 DLH = $30 per DLH

Overhead = predetermined overhead rate times direct labor hours

($30 X 1 hr. = $30)

Unit Costs Under ABC:

Step 1: Identify and Classify Activities and

Allocate Overhead to Cost Pools

Study Objective 3

Activity Cost Pools Estimated Overhead

Setting up machines $300,000

Machining 500,000

Inspecting 100,000

Total $900,000

Unit Costs Under ABC:

Step 2: Identify Cost Drivers

Study Objective 4

Expected Use

of Cost Drivers

Activity Cost Pools Cost Drivers Per Activity

Setting up machines Number of setups 1,500

Machining Machine hours 50,000

Inspecting Number of

Inspections 2,000

Unit Costs Under ABC:

Step 3: Compute Overhead Rates

Formula for Computing Activity-Based Overhead Rate:

Estimated Overhead Per Activity Activity-Based

Expected Use of Cost Drivers Per Activity Overhead Rate

Expected Use

Estimated of Cost Drivers Activity-Based

Activity Cost Pools Overhead Per Activity Overhead Rates

Setting up machines $300,000 1,500 setups $200 per setup

Machining 500,000 50,000 machine hrs. $ 10 per mach. hour

Inspecting 100,000 2,000 inspections $ 50 per inspection

Total $900,000

Unit Costs Under ABC:

Step 4: Assign Overhead Costs to Products

Part 1: Expected Use of Cost Driver Per Product

Expected Use

of Cost Drivers

per Product

Expected Use

Activity Cost of Cost Drivers

Pools Cost Driver Per Activity The Boot The Club

Setting up Number of

machines setups 1,500 setups 500 1,000

Machining Machine hours 50,000 hours 30,000 20,000

Inspecting Number of

inspections 2,000 inspections 500 1,500

Unit Costs Under ABC:

Step 4: Assign Overhead Costs to Products

Part 2: Assign Cost Pools to Products

The Boot

Expected Use of Activity-Based

Activity Cost Drivers X Overhead = Cost

Cost Pools per Product Rates Assigned

Setting up machines 500 $200 $100,000

Machining 30,000 10 300,000

Inspecting 500 50 25,000

Total costs assigned $425,000

Units produced 25,000

Overhead cost per unit $17

Unit Costs Under ABC:

Step 2: Assign Overhead Costs to Products

Part 2: Assign Cost Pools to Products

The Club

Expected Use of Activity-Based

Activity Cost Drivers X Overhead = Cost

Cost Pools per Product Rates Assigned

Setting up machines 1,000 $200 $200,000

Machining 20,000 10 200,000

Inspecting 1,500 50 75,000

Total costs assigned $475,000

Units produced 5,000

Overhead cost per unit $95

Comparison of Unit Costs

Traditional vs ABC

The Boot The Club

Traditional Traditional

Manufacturing Costs Costing ABC Costing ABC

Direct Materials $40 $40 $30 $30

Direct Labor 12 12 12 12

Overhead 30 17 30 95

Total Cost per Unit $82 $69 $72 $137

Overstated Understated

$13 $65

Activity-Based Costing:

A Closer Look

Study Objective 5

More accurate product costing through:

Use of more cost pools to assign overhead costs

Enhanced control over overhead costs

Better management decisions

Activity-Based Costing: A Closer Look

Limitations of ABC

Can be expensive to use

Some arbitrary allocations continue

Activity-Based Costing:

A Closer Look

Use ABC When One or More of the Following Exist:

Products differ greatly in volume/manufacturing complexity

Products lines are

Numerous

Diverse

Require different degrees of support services

Overhead costs are a significant portion of total costs

Significant change in manufacturing process or number of

products

Managers ignore data from existing system and instead use

bootleg costing data

Lets Review

Activity-based costing (ABC):

a. Can be used only in a process cost system

b. Focuses on units of production

c. Focuses on activities performed to

produce a product

d. Uses only a single basis of allocation

Lets Review

Activity-based costing (ABC):

a. Can be used only in a process cost system

b. Focuses on units of production

c. Focuses on activities performed to

produce a product

d. Uses only a single basis of allocation

Value-Added vs.

Non-Value-Added Activities

Study Objective 6

Activity Based Management (ABM):

An extension of ABC from a product costing

system to a management function

that focuses on reducing costs and improving

processes and decision making

A refinement of ABC used in ABM classifies

activities as either value-added or non-value-

added.

Value-Added vs.

Non-Value-Added Activities

Value-Added Activity

An activity that increases the worth

of a product or service such as:

Manufacturing Company Service Company

engineering design performing surgery

machining legal research services

assembly delivering packages

painting

packaging

Value-Added vs.

Non-Value-Added Activities

Non-Value-Added Activities

An activity that adds cost to, or increases the time

spent on, a product/service without increasing its

market value such as:

Manufacturing Company Service Company

Repair of machines Taking appointments

Storage of inventory Reception

Moving of raw materials, Bookkeeping/billing

assemblies, and finished goods Traveling

Building maintenance Ordering supplies

Inspections

Inventory Control

CLASSIFICATION OF

ACTIVITY LEVELS

Study Objective 7

OUnit-level activities:

Performed for each unit of production

OBatch-level activities:

Performed for each batch of product

OProduct-level activities:

Performed in support of an entire product line, but

not always performed every time a new unit or

batch is produced

OFacility-level activities:

Required to support or sustain an entire production

process

Hierarchy of Activity Levels

Four Levels Types of Activities Cost Drivers

Unit-Level Activities Machine-related: Machine Hours

Drilling, cutting, milling

Labor-related Direct labor hours/cost

Assembling, painting

Batch-Level Activities Equipment setups Number of setups/setup time

Purchase ordering Number of purchase orders

Inspection Number of inspections or

inspection time

Material handling Number of material moves

Product-Level Activities Product design Number of product designs

Engineering changes Number of changes

Facility-Level Activities Plant management Number of employees

salaries managed

Plant depreciation Square footage

Property taxes Square footage

Utilities Square footage

Activity-Based Costing

in Service Industries

Study Objective 8

Similarities with Manufacturing Firms

Overall objective:

I dentify key cost-generation activities and keep track of

quantity of activities performed for each service provided

General approach is to identify activities, cost pools,

and cost drivers

Labeling of activities as value-added or non-value-

added

Reduction of non-value-added activities

Activity-Based Costing

in Service Industries

Study Objective 8

Major difficulty to implementing

ABC:

A larger proportion of overhead

costs are company-wide costs

that cannot be directly traced to

specific services.

Activity-Based Costing in Service

Industries: Traditional Costing Example

CHECK AND DOUBLECHECK, CPAs

Annual Budget

Revenue $2,000,000

Direct labor $ 600,000

Overhead (expected) 1,200,000

Total Costs 1,800,000

Operating income $ 200,000

Estimated overhead

= Predetermined overhead rate

Direct labor cost

$1,200,000

= 200%

$600,000

Activity-Based Costing in Service

Industries:

ABC Costing Example

CHECK AND DOUBLECHECK, CPAs

Plano Molding Company Audit

Revenue $260,000

Less: Direct professional labor $ 70,000

Applied Overhead (200% x $70,000) 140,000 210,000

Operating Income $ 50,000

Activity-Based Costing in Service Industries:

ABC Costing Example

CHECK AND DOUBLECHECK, CPAs

Annual Overhead Budget

Expected Use

Activity Cost Estimated + of Cost Drivers = Activity-Based

Pools Cost Drivers Overhead Per Activity Overhead Rates

Secretarial support Direct Prof. hours $ 210,000 30,000 $7 per hour

Direct labor Fringe benefits Direct labor cost 240,000 $ 600,000 $0.40 per $1 labor

Printing and photocopying Working paper pages 20,000 20,000 $1 per page

Computer support CPU minutes 200,000 50,000 $4 per minute

Telephone and postage None (traced directly) 71,000 $ 71,000 Based on usage

Legal support Hours used 129,000 860 $150 per hour

Insurance Revenue billed 120,000 $2,000,000 $0.06 per $1 rev.

Recruiting and training Direct Prof. Hours __210,000 30,000 $7 per hour

$1,200,000

Activity-Based Costing in Service Industries:

ABC Costing Example

CHECK AND DOUBLECHECK, CPAs

Plano Molding Company Audit

Activity-

Based-

Activity Cost Actual Use Overhead

Pools Cost Drivers of Drivers Rates Cost Assigned

Secretarial support Direct Professional hours 3,800 $ 7.00 $ 26,600

Direct labor Fringe benefits Direct labor cost $ 70,000 $ 0.40 28,000

Printing and photocopying Working paper pages 1,800 $ 1.00 1,800

Computer support CPU minutes 8,600 $ 4.00 34,400

Telephone and postage None (traced directly) 8,700

Legal support Hours used 156 $150.00 23,400

Insurance Revenue billed $260,000 $ 0.06 15,600

Recruiting and training Direct Prof. Hours 3,800 $ 7.00 26,600

$165,100

Activity-Based Costing in Service

Industries: ABC Costing Example

CHECK AND DOUBLECHECK, CPAs

Plano Molding Company Audit

Traditional Costing ABC

Revenues $260,000 $260,000

Expenses

Direct professional labor $ 70,000 $ 70,000

Applied overhead 140,000 165,100

Total expenses 210,000 235,100

Operating income $ 50,000 $ 24,900

Profit Margin 19% 10%

Summary of Study Objectives

O Recognize the difference between traditional and activity-based

costing.

Traditional system allocates overhead to products using

predetermined unit-based output rate.

ABC allocates overhead to activity cost pools and assigns cost

to products using cost drivers.

O Identify the steps in the development of an activity-based

costing system.

Step 1: Identify the major activities and allocate the overhead costs to

cost pools.

Step 2: Identify the cost driver highly correlated to the cost pool.

Step 3: Compute the overhead rate per cost driver.

Step 4: Assign cost pools to products or services using the overhead

rates.

Summary of Study Objectives

O Know how companies identify cost pools used in ABC.

Analyze each operation or process, document and time every task,

action, or transaction.

O Know how companies identify and use cost drivers in ABC.

Cost drivers identified for assigning activity cost pools must:

Accurately measure the consumption of the activity

Have related data easily available.

O Understand the benefits and limitations of ABC

Benefits:

Enhanced control over overhead costs

Better management decisions

Limitations:

Higher costs accompany multiple activity centers and cost

drivers

Some costs must still be allocated arbitrarily

Summary of Study Objectives

O Differentiate between value-added and non-value-added

activities.

Value-added activities increase the worth of a product or service.

Non-value-added activities add cost to, or increase the time spent

on, a product or service without increasing its market

value.

O Understand the value of using activity levels in ABC

Activities may be classified as:

Unit-level

Batch-level

Product-level

Facility-level

Failure to recognize this classification can result

in distorted product costing.

Summary of Study Objectives

O Apply ABC to service industries.

Same objective improved costing of services

provided.

The general approach to costing is also the

same:

analyze operations

identify activities

accumulate overhead costs by activity

cost pools

identify and use cost drivers to assign

cost to services

Appendix

Just-In-Time Processing (JIT)

A processing system dedicated to having the

right amount of materials, products, or parts

arrive as they are needed, thereby reducing

the amount of inventory.

Just-In-Time Processing

Goods Manufactured

Sales Order

Received

100 pairs of

sneakers...

got it!

Send rubber and

shoe laces directly

to the factory.

JIT Processing

Objective of J I T:

Eliminate all manufacturing inventories

Elements of JIT:

Dependable suppliers

Multi-skilled work force

Total quality control system

Benefits of JIT:

Reduced inventory

Enhanced product quality

Reduced rework and storage costs

Savings from improved flow of goods

Lets Review

An activity that adds costs to the product but

does not increase market value is a

a. Value-added activity

b. Cost driver

c. Cost-benefit activity

d. Nonvalue-added activity

Lets Review

An activity that adds costs to the product but

does not increase market value is a

a. Value-added activity

b. Cost driver

c. Cost-benefit activity

d. Nonvalue-added activity

COPYRIGHT

Copyright 2005 John Wiley & Sons, Inc. All rights reserved. Reproduction or

translation of this work beyond that permitted in Section 117 of the 1976 United

States Copyright Act without the express written consent of the copyright owner is

unlawful. Request for further information should be addressed to the Permissions

Department, John Wiley & Sons, Inc. The purchaser may make back-up copies for

his/her own use only and not for distribution or resale. The Publisher assumes no

responsibility for errors, omissions, or damages, caused by the use of these

programs or from the use of the information contained herein.

Você também pode gostar

- Value Chain Management Capability A Complete Guide - 2020 EditionNo EverandValue Chain Management Capability A Complete Guide - 2020 EditionAinda não há avaliações

- Activity-Based CostingDocumento24 páginasActivity-Based CostingAmrit PatnaikAinda não há avaliações

- Differential AnalysisDocumento6 páginasDifferential AnalysisGina Mantos GocotanoAinda não há avaliações

- Cost and Cost Classifications PDFDocumento5 páginasCost and Cost Classifications PDFnkznhrgAinda não há avaliações

- Job-Order Costing System ExplainedDocumento46 páginasJob-Order Costing System Explainednicero555Ainda não há avaliações

- Group Accounts - Cashflow Statement-1Documento19 páginasGroup Accounts - Cashflow Statement-1antony omondiAinda não há avaliações

- ch06, Accounting PrinciplesDocumento66 páginasch06, Accounting PrinciplesH.R. RobinAinda não há avaliações

- I. Product Costs and Service Costs: Absorption CostingDocumento12 páginasI. Product Costs and Service Costs: Absorption CostingLinyVatAinda não há avaliações

- Activity-Based Cost Management For Design and Development StageDocumento15 páginasActivity-Based Cost Management For Design and Development Stagebimbi purbaAinda não há avaliações

- Additional Aspects of Costing SystemsDocumento28 páginasAdditional Aspects of Costing SystemsKağan GrrgnAinda não há avaliações

- Cost Volume Profit AnalysisDocumento16 páginasCost Volume Profit AnalysisAMITS1014Ainda não há avaliações

- Module 2 Sub Mod 2 Standard Costing and Material Variance FinalDocumento31 páginasModule 2 Sub Mod 2 Standard Costing and Material Variance Finalmaheshbendigeri5945Ainda não há avaliações

- Lecture 11 - Investment PropertyDocumento17 páginasLecture 11 - Investment PropertyYogeswari RavindranAinda não há avaliações

- 03 Cost BehaviourDocumento24 páginas03 Cost BehaviourArindam DasAinda não há avaliações

- Absorption Costing Vs Variable CostingDocumento2 páginasAbsorption Costing Vs Variable Costingneway gobachew100% (1)

- Balanced Scorecard and Benchmarking StrategiesDocumento12 páginasBalanced Scorecard and Benchmarking StrategiesGaurav Sharma100% (1)

- Final Ratio Analysis (2) - 2Documento4 páginasFinal Ratio Analysis (2) - 2anjuAinda não há avaliações

- Short-Run Decision Making and CVP AnalysisDocumento43 páginasShort-Run Decision Making and CVP AnalysisHy Tang100% (1)

- Absorption Costing (Or Full Costing) and Marginal CostingDocumento11 páginasAbsorption Costing (Or Full Costing) and Marginal CostingCharsi Unprofessional BhaiAinda não há avaliações

- Digital Transformation in Companies - Challenges and Success FactorsDocumento16 páginasDigital Transformation in Companies - Challenges and Success FactorsUliana Baka100% (1)

- Makerere University College of Business and Management Studies Master of Business AdministrationDocumento15 páginasMakerere University College of Business and Management Studies Master of Business AdministrationDamulira DavidAinda não há avaliações

- Consolidated Financial StatementsDocumento7 páginasConsolidated Financial StatementsParvez NahidAinda não há avaliações

- Management Accounting Chap 003Documento67 páginasManagement Accounting Chap 003kenha2000Ainda não há avaliações

- Characteristics of Organizational Change: Organizational Development Finals ReviewerDocumento4 páginasCharacteristics of Organizational Change: Organizational Development Finals ReviewerMarvin OngAinda não há avaliações

- Investment AppraisalDocumento8 páginasInvestment AppraisaldeepkandelAinda não há avaliações

- ch03, Accounting PrinciplesDocumento78 páginasch03, Accounting PrinciplesH.R. Robin100% (2)

- SMChap 007Documento86 páginasSMChap 007Huishan Zheng100% (5)

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDocumento122 páginasInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownWhy you want to knowAinda não há avaliações

- As 26 Intangible AssetsDocumento45 páginasAs 26 Intangible Assetsjoseph davidAinda não há avaliações

- C.1. Purpose of BudgetingDocumento11 páginasC.1. Purpose of BudgetingTiyas KurniaAinda não há avaliações

- Process-Costing Systems: Answers To Review QuestionsDocumento51 páginasProcess-Costing Systems: Answers To Review QuestionsMark RevarezAinda não há avaliações

- Distinguish Between Marginal Costing and Absorption CostingDocumento10 páginasDistinguish Between Marginal Costing and Absorption Costingmohamed Suhuraab50% (2)

- Tools and Techniques of Cost ReductionDocumento27 páginasTools and Techniques of Cost Reductionপ্রিয়াঙ্কুর ধর100% (2)

- Topic 6 Business IncomeDocumento37 páginasTopic 6 Business IncomeMuhamad Safwan ZulkifliAinda não há avaliações

- Target Costing Presentation FinalDocumento57 páginasTarget Costing Presentation FinalMr Dampha100% (1)

- Marginal CostingDocumento30 páginasMarginal Costinganon_3722476140% (1)

- Topic 7 - Absorption & Marginal CostingDocumento8 páginasTopic 7 - Absorption & Marginal CostingMuhammad Alif100% (5)

- Cost Accounting Book of 3rd Sem Mba at Bec DomsDocumento174 páginasCost Accounting Book of 3rd Sem Mba at Bec DomsBabasab Patil (Karrisatte)100% (1)

- Chapter 9 - Inventory Costing and Capacity AnalysisDocumento40 páginasChapter 9 - Inventory Costing and Capacity AnalysisBrian SantsAinda não há avaliações

- Difference Between Absorption Costing and Marginal CostingDocumento4 páginasDifference Between Absorption Costing and Marginal CostingIndu GuptaAinda não há avaliações

- Maf5102 Fa Cat 2 2018Documento4 páginasMaf5102 Fa Cat 2 2018Muya KihumbaAinda não há avaliações

- Cost Accounting, Job Costing & Batch CostingDocumento10 páginasCost Accounting, Job Costing & Batch Costing✬ SHANZA MALIK ✬Ainda não há avaliações

- Break-Even Analysis/Cvp AnalysisDocumento41 páginasBreak-Even Analysis/Cvp AnalysisMehwish ziadAinda não há avaliações

- Managerial Accounting Hilton 6e Chapter 4 Solution PDFDocumento68 páginasManagerial Accounting Hilton 6e Chapter 4 Solution PDFNoor QamarAinda não há avaliações

- Assignment 1 PDFDocumento2 páginasAssignment 1 PDFHARIAinda não há avaliações

- BUS 5116 Portfolio Assignment WK 8Documento6 páginasBUS 5116 Portfolio Assignment WK 8TaiwokAinda não há avaliações

- Ch09 Inventory Costing and Capacity AnalysisDocumento13 páginasCh09 Inventory Costing and Capacity AnalysisChaituAinda não há avaliações

- Accounting Principles SolutionsDocumento15 páginasAccounting Principles SolutionsShi Pyeit Sone Kyaw0% (1)

- Measuring Performance With Financial and Non-Financial MetricsDocumento13 páginasMeasuring Performance With Financial and Non-Financial MetricsAyesha SohailAinda não há avaliações

- NotesDocumento155 páginasNotesZainab Syeda100% (1)

- Absorption Costing Vs Marginal CostingDocumento5 páginasAbsorption Costing Vs Marginal Costingsani02Ainda não há avaliações

- Differential Cost Analysis PDFDocumento4 páginasDifferential Cost Analysis PDFVivienne Lei BolosAinda não há avaliações

- The Role of Finacial ManagementDocumento25 páginasThe Role of Finacial Managementnitinvohra_capricorn100% (1)

- Capital Budgeting KSBDocumento59 páginasCapital Budgeting KSBSamridhi KukrejaAinda não há avaliações

- L28 29 Non Financial Measures of Performance EvaluationDocumento11 páginasL28 29 Non Financial Measures of Performance Evaluationapi-3820619100% (1)

- ABC Costing Lecture NotesDocumento12 páginasABC Costing Lecture NotesMickel AlexanderAinda não há avaliações

- Activity Based CostingDocumento52 páginasActivity Based CostingAfrina AfsarAinda não há avaliações

- Study Objectives: Activity-Based CostingDocumento48 páginasStudy Objectives: Activity-Based Costingsueern100% (1)

- Study Objectives Study ObjectivesDocumento59 páginasStudy Objectives Study ObjectivesAiza S. Maca-umbosAinda não há avaliações

- Activity Based Costing: By: Kasahun N. (M.SC.)Documento20 páginasActivity Based Costing: By: Kasahun N. (M.SC.)Mulugeta WoldeAinda não há avaliações

- The Trans-Pacific Partnership (Trade of Goods)Documento6 páginasThe Trans-Pacific Partnership (Trade of Goods)Daniel John Cañares LegaspiAinda não há avaliações

- Candidates For Internship Program For 1st Term AY 2015-2016Documento1 páginaCandidates For Internship Program For 1st Term AY 2015-2016Daniel John Cañares LegaspiAinda não há avaliações

- Gen Banking LawDocumento11 páginasGen Banking LawDaniel John Cañares LegaspiAinda não há avaliações

- Bank Secrecy LawDocumento2 páginasBank Secrecy LawDaniel John Cañares LegaspiAinda não há avaliações

- IntelDocumento11 páginasIntelDaniel John Cañares LegaspiAinda não há avaliações

- Table of Contents - Tech DraftDocumento2 páginasTable of Contents - Tech DraftDaniel John Cañares LegaspiAinda não há avaliações

- Certificate of Recognition: Charrevie M. TingsonDocumento2 páginasCertificate of Recognition: Charrevie M. TingsonDaniel John Cañares LegaspiAinda não há avaliações

- PCAOB Auditing Standards Chapter 5Documento35 páginasPCAOB Auditing Standards Chapter 5Daniel John Cañares Legaspi100% (1)

- BEHASCIDocumento2 páginasBEHASCIDaniel John Cañares LegaspiAinda não há avaliações

- Santa Rosa Science and Technology High School Values Education ExamDocumento1 páginaSanta Rosa Science and Technology High School Values Education ExamPrinces Paula Mendoza BalanayAinda não há avaliações

- City University of PasayDocumento2 páginasCity University of PasayDaniel John Cañares LegaspiAinda não há avaliações

- SOE Week Sportsfest 2014 Schedule November 24-28Documento2 páginasSOE Week Sportsfest 2014 Schedule November 24-28Daniel John Cañares LegaspiAinda não há avaliações

- Scatter Plot: 10000 F (X) 7.6826983136x 2 - 10550.0630855715x + 10546.0342910681 R 0.9999999728Documento6 páginasScatter Plot: 10000 F (X) 7.6826983136x 2 - 10550.0630855715x + 10546.0342910681 R 0.9999999728Daniel John Cañares LegaspiAinda não há avaliações

- Stra ManDocumento137 páginasStra ManDaniel John Cañares LegaspiAinda não há avaliações

- Introduction of The CompanyDocumento7 páginasIntroduction of The CompanyDaniel John Cañares LegaspiAinda não há avaliações

- Data DictionaryDocumento4 páginasData DictionaryDaniel John Cañares LegaspiAinda não há avaliações

- Chapter 3. Decision Analysis Section 3.1. Decision Trees With Conditional ProbabilitiesDocumento12 páginasChapter 3. Decision Analysis Section 3.1. Decision Trees With Conditional ProbabilitiesDaniel John Cañares LegaspiAinda não há avaliações

- Phoenix Wright Ace Attorney Trials and TribulationDocumento54 páginasPhoenix Wright Ace Attorney Trials and TribulationjinzoningenAinda não há avaliações

- CentralizeDocumento2 páginasCentralizeDaniel John Cañares LegaspiAinda não há avaliações

- Partnership ReviewerDocumento21 páginasPartnership ReviewerDaniel John Cañares Legaspi100% (1)

- Prinmar SurveyDocumento1 páginaPrinmar SurveyDaniel John Cañares LegaspiAinda não há avaliações

- October 2014 CPALE TopnotchersDocumento2 páginasOctober 2014 CPALE TopnotchersRockacerAinda não há avaliações

- Resume FormatDocumento2 páginasResume FormatJessicaGonzalesAinda não há avaliações

- PhotoshootDocumento1 páginaPhotoshootDaniel John Cañares LegaspiAinda não há avaliações

- Del Mundo Q and ADocumento2 páginasDel Mundo Q and ADaniel John Cañares LegaspiAinda não há avaliações

- 23 Marcon, Louise Margarette 24 Millar, AllyssaDocumento2 páginas23 Marcon, Louise Margarette 24 Millar, AllyssaDaniel John Cañares LegaspiAinda não há avaliações

- Rgf-Glossary of Terms-Chapter 14-Withholding TaxesDocumento1 páginaRgf-Glossary of Terms-Chapter 14-Withholding TaxesanggandakonohAinda não há avaliações

- Chapter 6Documento2 páginasChapter 6Daniel John Cañares LegaspiAinda não há avaliações

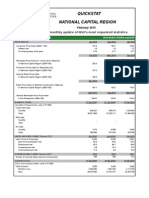

- Quickstat National Capital Region: A Monthly Update of NSO's Most Requested StatisticsDocumento3 páginasQuickstat National Capital Region: A Monthly Update of NSO's Most Requested StatisticsDaniel John Cañares LegaspiAinda não há avaliações

- ABC MemoDocumento4 páginasABC MemoPriyanshi PatelAinda não há avaliações

- BACT 302 Activity Based CostingDocumento25 páginasBACT 302 Activity Based CostingLetsah BrightAinda não há avaliações

- Chapter 4 The 3 Es of Operation Al ExcellenceDocumento13 páginasChapter 4 The 3 Es of Operation Al ExcellenceJimmy Ong Ah HuatAinda não há avaliações

- f5 Smart NotesDocumento98 páginasf5 Smart Notessakhiahmadyar100% (1)

- Exam 2 Practice QuestionDocumento3 páginasExam 2 Practice QuestionJaceAinda não há avaliações

- Group Case Study 1 - ABC Sietron Furniture SDN BHDDocumento18 páginasGroup Case Study 1 - ABC Sietron Furniture SDN BHDizzarulshazwanAinda não há avaliações

- Budgeting Chapter Explains Key ConceptsDocumento20 páginasBudgeting Chapter Explains Key ConceptsSunny Kumar10Ainda não há avaliações

- Pillsbury: Customer Driven ReengineeringDocumento20 páginasPillsbury: Customer Driven ReengineeringAakashRaval100% (1)

- Management Accounting Practices of Philippine SMEsDocumento21 páginasManagement Accounting Practices of Philippine SMEspamela dequillamorteAinda não há avaliações

- Process-Oriented Costing System Optimizes Siemens Motor Works ProfitsDocumento5 páginasProcess-Oriented Costing System Optimizes Siemens Motor Works ProfitsNikhil Jindal100% (1)

- Chapter 2: Management Accounting and The Business EnvironmentDocumento2 páginasChapter 2: Management Accounting and The Business EnvironmentEmma Mariz Garcia100% (1)

- Manusia LemahDocumento8 páginasManusia LemahKhoirul MubinAinda não há avaliações

- ACCAF5 - Qbank2017 - by First Intuition Downloaded FromDocumento384 páginasACCAF5 - Qbank2017 - by First Intuition Downloaded FromAbdul Jabbar Al-Shaer100% (4)

- CH 12 ABC Costing ExampleDocumento33 páginasCH 12 ABC Costing ExampleSweetu Nancy100% (1)

- Chapter 10: Fundamentals of Cost ManagementDocumento13 páginasChapter 10: Fundamentals of Cost ManagementaweysAinda não há avaliações

- Lecture 3 Costing and Costing TechniquesDocumento43 páginasLecture 3 Costing and Costing TechniquesehsanAinda não há avaliações

- Blocher 9e Chap001Documento34 páginasBlocher 9e Chap001adamagha703Ainda não há avaliações

- Chapter 6 - A London BoroughDocumento8 páginasChapter 6 - A London BoroughCharm RegultoAinda não há avaliações

- Case Concerning Volume-Based Costing Versus Activity-Based CostingDocumento2 páginasCase Concerning Volume-Based Costing Versus Activity-Based CostingNahid Hussain AdriAinda não há avaliações

- FIKRISHA RESEARCH Final Project (Repaired)Documento45 páginasFIKRISHA RESEARCH Final Project (Repaired)Eng-Mukhtaar CatooshAinda não há avaliações

- Chapter 14Documento25 páginasChapter 14ibraAinda não há avaliações

- Abc QustionsDocumento5 páginasAbc QustionsWynie AreolaAinda não há avaliações

- Activity Based Costing ExampleDocumento7 páginasActivity Based Costing ExamplePrasanna DanguiAinda não há avaliações

- Wilkerson CompanyDocumento26 páginasWilkerson CompanyChris Vincent50% (2)

- Activity Based CostingDocumento17 páginasActivity Based CostingArpit GargAinda não há avaliações

- ABM Cost Management Tools Chapter ReviewDocumento51 páginasABM Cost Management Tools Chapter ReviewVivekRaptorAinda não há avaliações

- Highly Competitive Warehouse ManagemetDocumento251 páginasHighly Competitive Warehouse Managemetjimdacalano191150% (2)

- Activity Based Costing SystemDocumento18 páginasActivity Based Costing SystemMAXA FASHIONAinda não há avaliações

- Managerial Accounting Assignment PDFDocumento4 páginasManagerial Accounting Assignment PDFanteneh tesfawAinda não há avaliações