Escolar Documentos

Profissional Documentos

Cultura Documentos

Accounting Primer Session 1

Enviado por

Neeraj MundayurDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Accounting Primer Session 1

Enviado por

Neeraj MundayurDireitos autorais:

Formatos disponíveis

SESSI

ON I

Accounting Primer June-July, 2012

1

Business organizations provide products and services, They convert inputs into

outputs by applying processes.

Merchandising or Trading organizations

Pantaloon, wal-mart, Amazon.com etc.

Manufacturing organizations

Amul, SONI, etc.

Services organizations

Work done by one person that benefits another. The recipient of a service can

experience its personally but cannot transfer it to another person.

Accounting Primer June-July, 2012

2

Forms of business organizations:

From commercial and legal angles, business may be organized in many

ways. The common forms of organizing business are:

Sole Proprietorship

Unlimited liability

No specific law to regulate the business

Partnership

Minimum two, maximum 20 persons trading together

Unlimited liability

Indian partnership act

Architects, lawyers , accountants etc.

Limited company

Legal entity: under the law it has most of the rights like human beings

Limited companies can be either public or private

Accounting Primer June-July, 2012

3

Private Company:

Minimum paid up capital of one lakh or such higher paid-up capital as may be

prescribed.

Restricts the right to transfer its shares

Limits the number of its members to fifty (50)

Prohibits any invitation to the public to subscribe for any shares in, or

debentures of the company.

Public company:

Is not a private company

Has a minimum paid-up capital of five lakh rupees or such higher paid-up

capital, as may be prescribed.

Accounting Primer June-July, 2012

4

Government Company:

Any company in which not less than fifty-one percent of the paid-up share

capital is held by the central government, or by any state government or

governments, or partly by the central government and partly by one or more

state governments

Foreign Company:

Is incorporated outside India

Has established a place of business with in India

Companies with license under section 25

Where it is proved to the satisfaction of the central government that an

association

Is about to be formed as a limited company for promoting commerce, art,

science, religion, charity or any other useful object .

Accounting Primer June-July, 2012

5

Companies

under Section

25

US companies

in India

Government

companies

Limited Liability Partnership (LLP)

Partner formed and registered under the limited liability partnership act,

2008.

Only individuals can be partners in a partnership, but an LLP can have

individuals or corporate bodies as partners.

In Class Activity:

List out companies under various categories mentioned above

Accounting Primer June-July, 2012

6

Annual

Report

MNCs in

India

Regulators

FIRST LLP

LLP

FAQ

Comparison between

LLP, Partnership and

Company.

What is Accounting:

Book-keeping:

Recording of transactions in a systematic manner.

Accounting:

Accounting often called the language of business

The main purpose of accounting is to ascertain profit or loss during a

specified period, to show financial position of the business on a

particular date and to have control over the firms property.

the art of recording, classifying and summarizing in a significant

manner in terms of money transactions and events which in part, at

least of a financial character and interpreting the results thereof.

American Institute of Certified Public Accountants

Accounting Primer June-July, 2012

7

Accounting Information and Economic Decisions:

The accounting system process business transactions to provide information to

various interested parties.

there are external and internal users of the information thus produced

Accounting information is useful in making number of decisions that affect the

income or wealth of individuals and organization.

Decisions that are based on accounting information

Decide when to buy, hold or sell an equity investment

Assess the stewardship or accountability of management

Assess the ability of the enterprise to pay and provide other benefits to its

employees

Determine tax policies

Determine distributable profits and dividends

Regulate the activities of enterprises

Accounting Primer June-July, 2012

8

The Accounting Information System

INPUTS

Business transactions

External events(change

in tax laws etc.)

PROCESSING

Accounting principles

Accounting standards

Management estimates

Laws and regulations

Companies act and

income tax act

Accounting records

OUTPUTS

Profit and loss account

Balance sheet

Cash flow statement

Explanatory notes

Management

commentary

Tax returns

Regulatory filings

USERS

Shareholders

Security analysts

Banks ,Rating

agencies

Managers, Employees

Suppliers, Customers

Government,

Regulators

Media

Accounting Primer June-July, 2012

9

Users of Accounting Information

Investors

Enables the investors to identify promising investment opportunities

Financial reports

Lenders

Banks

Debenture holders

Credit evaluation benchmarks

Security Analysts, Rating Agencies and other Information Specialists

Equity Analysts

Bond Analysts

Stock brokers

Credit rating agencies

Managers

Planning and controlling operations

Monitor the key financial indicators

Accounting Primer June-July, 2012

10

Customers

Suppliers for their future purchases and after sale support

Government and Regulatory Authorities

SEBI

IRDA

TRAI

RBI

The Public

Financial statements assist the public by providing information about the trends

and recent developments in the prosperity of the enterprise and the range of its

activities

Political parties

Public affair groups

Consumer groups

Newspapers

Television channels

Environment protection groups

Anti-business activities etc.

Accounting Primer June-July, 2012

11

Basis of Accounting:

Cash Basis

Accrual Basis

Cash Basis

Actual cash receipts and Actual cash payments are recorded

Credit transactions are not recorded at all until the cash is actually received

or paid

The receipts and payments account prepared in case of non-trading

concerns such as a charitable institution, a club, a school, a college etc.

Professional men like a lawyer, a doctor, a chartered accountant etc. can be

cited as the best example of cash system

Accounting Primer June-July, 2012

12

Accrual Basis:

On the accrual basis of accounting, the income whether received or not but

has been earned or accrued during the period forms part of the total income

of that period.

Similarly

If the firm has taken benefit of a particular service, but has not paid within

that period, the expense will relate to the period in which the service has

been utilized and not to the period in which payment for it is made.

Thus net income for a period is the result of matching of revenue realized in

the period and costs expired during the period.

This basis of accounting gives complete picture of the financial transactions

of the business and makes a record of all transactions relating to a period.

All the companies require to maintain their accounts on accrual basis of

accounting.

Accounting Primer June-July, 2012

13

Business transaction

Debtor

Creditor

Capital

Goods Assets

liabilities Equity

Income

Expenditure

Drawings Loss

Profit

Turnover Capital expenditure

Revenue expenditure

Deferred revenue

expenditure

Bad debts

Inventory Reserve Provision

Basic Terminology

SO MANY TERMS REFER MATERIAL

Accounting Primer June-July, 2012

14

Você também pode gostar

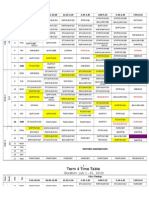

- Revised TT July 1st-31stDocumento4 páginasRevised TT July 1st-31stNeeraj MundayurAinda não há avaliações

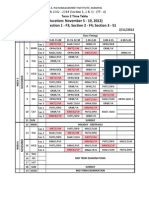

- (Duration: November 20 - December 02, 2012) Venues: Section 1 - F3 Section 2 - F4 Section 3 - G2Documento8 páginas(Duration: November 20 - December 02, 2012) Venues: Section 1 - F3 Section 2 - F4 Section 3 - G2Neeraj MundayurAinda não há avaliações

- (Duration: November 5 - 19, 2012) Venues: Section 1 - F3 Section 2 - F4 Section 3 - S1Documento8 páginas(Duration: November 5 - 19, 2012) Venues: Section 1 - F3 Section 2 - F4 Section 3 - S1Neeraj MundayurAinda não há avaliações

- Mid-Term Exam ScheduleDocumento1 páginaMid-Term Exam ScheduleNeeraj MundayurAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Segmentation Sample - BanksDocumento1 páginaSegmentation Sample - BanksGayatri RaneAinda não há avaliações

- Notes On Mishkin Chapter 8 (Econ 353, Tesfatsion)Documento10 páginasNotes On Mishkin Chapter 8 (Econ 353, Tesfatsion)Karthikeyan PandiarasuAinda não há avaliações

- Literature Review Foriegn ExchangeDocumento9 páginasLiterature Review Foriegn Exchangeonline free projects0% (1)

- INFO8000 Fall 2023 Individual Assignment-2Documento2 páginasINFO8000 Fall 2023 Individual Assignment-2kaurrrjass1125Ainda não há avaliações

- Birla Institute of Technology: Master of Business AdministrationDocumento16 páginasBirla Institute of Technology: Master of Business Administrationdixit_abhishek_neoAinda não há avaliações

- Monetary PolicyDocumento10 páginasMonetary PolicyAshish MisraAinda não há avaliações

- Yc Vy BCM LB VTGJ O6 MDocumento5 páginasYc Vy BCM LB VTGJ O6 MAbhi saxenaAinda não há avaliações

- Community Inclusion CurrenciesDocumento27 páginasCommunity Inclusion CurrenciesalAinda não há avaliações

- There Is Revaluation of Assets Equal To P50,000Documento2 páginasThere Is Revaluation of Assets Equal To P50,000Joana TrinidadAinda não há avaliações

- BPCF KCR Placement - Signed ASzDocumento5 páginasBPCF KCR Placement - Signed ASzAJay MJAinda não há avaliações

- Accounting Multiple Choice Questions#1: A) B) C) D)Documento13 páginasAccounting Multiple Choice Questions#1: A) B) C) D)Gunjan RajdevAinda não há avaliações

- Money Vocabulary: Term MeaningDocumento6 páginasMoney Vocabulary: Term MeaningNadiaKasimAinda não há avaliações

- Final Advaccount Dec12Documento13 páginasFinal Advaccount Dec12BAZINGAAinda não há avaliações

- ICICI Financial StatementsDocumento9 páginasICICI Financial StatementsNandini JhaAinda não há avaliações

- Case StudyDocumento2 páginasCase Studyaly catAinda não há avaliações

- Eco1a Module4 PDFDocumento31 páginasEco1a Module4 PDFMel James Quigtar FernandezAinda não há avaliações

- Technical Bid R-Seti HassanDocumento131 páginasTechnical Bid R-Seti Hassanexecutive engineer1Ainda não há avaliações

- Presented By: Deepika Borgaonkar MMS - HR Roll No.54Documento12 páginasPresented By: Deepika Borgaonkar MMS - HR Roll No.54Deepika BorgaonkarAinda não há avaliações

- Inflation: Samir K MahajanDocumento9 páginasInflation: Samir K MahajanKeval VoraAinda não há avaliações

- AAPub Auc 063015 NCRDocumento22 páginasAAPub Auc 063015 NCRCedric Recato DyAinda não há avaliações

- I. Objective: Property Held Under An Operating LeaseDocumento5 páginasI. Objective: Property Held Under An Operating Leasemusic niAinda não há avaliações

- Raising Finance From International MarketsDocumento55 páginasRaising Finance From International MarketsamujainAinda não há avaliações

- Ch. 31 Forecasting and Managing Cash FlowsDocumento4 páginasCh. 31 Forecasting and Managing Cash FlowsRosina KaneAinda não há avaliações

- Cash System and Procedure Part 1Documento8 páginasCash System and Procedure Part 1Rohit BhaduAinda não há avaliações

- Role of Banks in Indian EconomyDocumento2 páginasRole of Banks in Indian EconomyPriyanka MuppuriAinda não há avaliações

- Qatar Listed Stocks Handbook IIIDocumento59 páginasQatar Listed Stocks Handbook IIIrazacbqAinda não há avaliações

- The General Banking Law of 2000 Section 35 To Section 66Documento14 páginasThe General Banking Law of 2000 Section 35 To Section 66Carina Amor ClaveriaAinda não há avaliações

- Myperfectice Level3Documento22 páginasMyperfectice Level3Nagendra Babu Naidu100% (2)

- Philippine National Bank - Audited Financial Statements - 31dec2022 - PSEDocumento153 páginasPhilippine National Bank - Audited Financial Statements - 31dec2022 - PSEElsa MendozaAinda não há avaliações

- AEC 103 - Intermediate Accounting: Assignment 3 Accounts Receivable and Estimation of Doubtful AccountDocumento4 páginasAEC 103 - Intermediate Accounting: Assignment 3 Accounts Receivable and Estimation of Doubtful Accountjames bryan angklaAinda não há avaliações