Escolar Documentos

Profissional Documentos

Cultura Documentos

Corporate Finance: Short-Term Finance and Planning

Enviado por

shahidul0Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Corporate Finance: Short-Term Finance and Planning

Enviado por

shahidul0Direitos autorais:

Formatos disponíveis

27-0

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

Corporate Finance

Ross Westerfield Jaffe

Sixth Edition

27

Chapter Twenty Seven

Short-Term Finance and

Planning

Prepared by

Gady Jacoby

University of Manitoba

and

Sebouh Aintablian

American University of

Beirut

27-1

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

Chapter Outline

27.1 Tracing Cash and Net Working Capital

27.2 Defining Cash in Terms of Other Elements

27.3 The Operating Cycle and the Cash Cycle

27.4 Some Aspects of Short-Term Financial Policy

27.5 Cash Budgeting

27.6 The Short-Term Financial Plan

27.7 Summary & Conclusions

27-2

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

Executive Summary

We are solidly into the third great question of

corporate finance.

How much short-term cash flow does a company need to

pay its bills?

This chapter introduces the basic elements of short-

term financial decisions:

It describes the short-term operating activities of the firm

It identifies alternative short-term financial policies

It outlines the basic elements in a short-term financial

plan

It describes short-term financing instruments

27-3

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

The Balance-Sheet Model of the Firm

Current Assets

Fixed Assets

1 Tangible

2 Intangible

Shareholders

Equity

Current

Liabilities

Long-Term

Debt

What long-

term

investments

should the

firm engage

in?

The Capital Budgeting Decision

27-4

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

The Balance-Sheet Model of the Firm

How can the firm

raise the money

for the required

investments?

The Capital Structure Decision

Current Assets

Fixed Assets

1 Tangible

2 Intangible

Shareholders

Equity

Current

Liabilities

Long-Term

Debt

27-5

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

The Balance-Sheet Model of the Firm

How much short-

term cash flow

does a company

need to pay its

bills?

The Net Working Capital Investment Decision

Net

Working

Capital

Current Assets

Fixed Assets

1 Tangible

2 Intangible

Shareholders

Equity

Current

Liabilities

Long-Term

Debt

27-6

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

27.1 Tracing Cash and Net Working Capital

Current Assets are cash and other assets that are

expected to be converted to cash with the year.

Cash

Marketable securities

Accounts receivable

Inventory

Current Liabilities are obligations that are expected

to require cash payment within the year.

Accounts payable

Accrued wages

Taxes

27-7

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

27.2 Defining Cash in Terms of Other Elements

Net Working

Capital

+

Fixed

Assets

=

Long-

Term

Debt

+ Equity

Net Working

Capital

= Cash

Other

Current

Assets

Current

Liabilities

+

Cash =

Long-

Term

Debt

+ Equity

Net Working

Capital

(excluding cash)

Fixed

Assets

27-8

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

27.2 Defining Cash in Terms of Other Elements

An increase in long-term debt and or equity leads

to an increase in cashas does a decrease in fixed

assets or a decrease in the non-cash components

of net working capital.

The Sources and Uses of Cash Statement follows

from this reasoning.

Cash =

Long-

Term

Debt

+ Equity

Net Working

Capital

(excluding cash)

Fixed

Assets

27-9

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

27.3 The Operating Cycle and the Cash Cycle

Time

Accounts payable period

Cash cycle

Operating cycle

Cash

received

Accounts receivable period Inventory period

Finished goods sold

Firm receives invoice Cash paid for materials

Order

Placed

Stock

Arrives

Raw material

purchased

27-10

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

27.3 The Operating Cycle and the Cash Cycle

In practice, the inventory period, the accounts

receivable period, and the accounts payable period

are measured by days in inventory, days in

receivables, and days in payables.

Cash cycle = Operating cycle

Accounts

payable

period

27-11

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

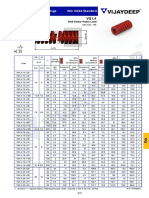

The Operating Cycle and the Cash Cycle: An Example

Consider the balance sheet and income statement for

Tradewinds Manufacturing shown in Table 27.1.

The operating cycle and the cash cycle can be determined for

Tradewinds after calculating the appropriate ratios for

inventory, receivables, and payables.

. 3 . 3

million $2.5

million $8.2

inventory Average

sold goods of Cost

ratio turnover Inventory

. days 6 . 110

3.3

365

inventory in Days

27-12

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

The Operating Cycle and the Cash Cycle: An Example

(continued)

. 4 . 6

million $1.8

million $11.5

s receivable Average

sales Credit

turnover s Receivable

. 4 . 9

million $0.875

million $8.2

payables Average

sold goods of Cost

period deferral payable Accounts

. days 57

6.4

365

s receivable in Days

. days 8 . 38

9.4

365

payables in Days

27-13

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

The Operating Cycle and the Cash Cycle: An Example

(continued)

Operating cycle = Days in inventory + Days in receivables

= 110.6 days + 57 days = 167.6 days.

Cash cycle = Operating cycle Days in payable

= 167.6 days 38.8 days.

27-14

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

Interpreting the Cash Cycle

The cash cycle increases as the inventory and

receivables periods get longer.

The cash cycle decreases if the company is able to

stall payment of payables by lengthening the

payables period.

The cash cycle is related to profitability and

sustainable growth.

Increased inventories and receivables that may cause a

cash cycle problem will also reduce total asset turnover

and result in lower profitability.

The total asset turnover is directly linked to sustainable

growth (Ch.26): reducing total asset turnover lowers

sustainable growth.

27-15

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

27.4 Some Aspects of Short-Term

Financial Policy

There are two elements of the policy that a firm

adopts for short-term finance.

The Size of the Firms Investment in Current Assets

Usually measured relative to the firms level of total

operating revenues.

Flexible

Restrictive

Alternative Financing Policies for Current Assets

Usually measured as the proportion of short-term debt to

long-term debt.

Flexible

Restrictive

27-16

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

The Size of the Investment in Current Assets

A flexible policy short-term finance policy would

maintain a high ratio of current assets to sales.

Keeping large cash balances and investments in

marketable securities.

Large investments in inventory.

Liberal credit terms.

A restrictive short-term finance policy would

maintain a low ratio of current assets to sales.

Keeping low cash balances, no investment in marketable

securities.

Making small investments in inventory.

Allowing no credit sales (thus no accounts receivable).

27-17

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

Carrying Costs and Shortage Costs

$

Investment in

Current Assets ($)

Shortage costs

Carrying costs

Total costs of holding current

assets.

CA*

Minimum

point

27-18

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

Appropriate Flexible Policy

$

Investment in

Current Assets ($)

Shortage costs

Carrying costs

Total costs of holding current

assets.

CA*

Minimum

point

27-19

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

When a Restrictive Policy is Appropriate

$

Investment in

Current Assets ($)

Shortage

costs

Carrying costs

Total costs of holding current assets.

CA*

Minimum

point

27-20

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

Alternative Financing Policies for Current

Assets

A flexible short-term finance policy means low

proportion of short-term debt relative to long-term

financing.

A restrictive short-term finance policy means high

proportion of short-term debt relative to long-term

financing.

27-21

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

Alternative Financing Policies for Current

Assets

In an ideal world, short-term assets are always

financed with short-term debt and long-term assets

are always financed with long-term debt.

In this world, net working capital is always zero.

27-22

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

Financing Policy for an Idealized Economy

Long-term

debt plus

common

stock

$

Time

0 1 2 3 4 5

Current assets =

Short-term debt

Fixed assets:

a growing firm

Grain elevator operators buy crops after harvest, store them,

and sell them during the year. Inventory is financed with short-

term debt. Net working capital is always zero.

27-23

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

A Remark on Short-term Financing

Maturity mismatching produces rollover risk, the risk that

reduced short-term financing may not be available.

An example is the financial distress faced in 1992 by

Olympia and York (O and Y), a real estate development

firm.

O and Ys main assets were office towers.

Financing for these long-term assets was short-term bank loans and

commercial paper.

In 1992, investor fears about real estate prospects prevented O and Y

from rolling over its commercial paper.

The crises pushed O and Y into financial crisis and bankruptcy.

27-24

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

Current Assets and Liabilities in Practice

Advances in technology are changing the way

Canadian firms manage their assets.

With new techniques, such as just-in-time inventory

and business-to-business (B2B) sales, industrial

firms are moving away from flexible policies and

toward a more restrictive approach to current assets.

Current liabilities are also declining as a percentage

of total assets.

Firms are practising maturity hedging as they match

lower current liabilities with decreased current

assets.

27-25

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

27.5 Cash Budgeting

A cash budget is a primary tool of short-run

financial planning.

The idea is simple: Record the estimates of cash

receipts and disbursements.

Cash Receipts

Arise from sales, but we need to estimate when we

actually collect.

Cash Outflow

Payments of Accounts Payable

Wages, Taxes, and other Expenses

Capital Expenditures

Long-Term Financial Planning

27-26

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

27.5 Cash Budgeting

The cash balance tells the manager what borrowing

is required or what lending will be possible in the

short run.

The cash balance figures for Fun Toys appear in

Table 27.6.

Fun Toys had established a minimum cash balance

of $5 million to facilitate transactions and to protect

against unexpected contingencies.

27-27

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

The Short-term Financial Plan/Risks

There are tools for assessing the degree of

forecasting risks and identifying their components

that are most critical to a financial plans success or

failure.

For example, Air Canada uses simulation analysis

in forecasting its cash needs. The simulation is

useful in capturing the variability of cash flow

components in Canadas airline industry.

27-28

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

The Short-term Financial Plan/Short-term Borrowing

Example: Chapters Online

The firms internet division sold books, CD-Roms,

DVDs, and videos through its website.

In September1999, the company went public, raising

equity at an offering price of $13.5/share.

In August 2000, analysts calculated Chapters Onlines

burn rate, the rate at which the firm was using cash, to

determine its cash position.

The stock price had fallen from the offering price of

$13.5 to $2.80 per share within a year.

Analysts focused on the availability of short-term

borrowing to improve the firms financial position.

27-29

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

27.6 The Short-Term Financial Plan (continued)

The most common way to finance a temporary cash

deficit is to arrange a short-term, operating loan.

Operating loans can be either unsecured or secured

by collateral.

Secured Loans

Accounts receivable financing can be either assigned or

factored.

Securitized receivables, is a new approach to receivables

financing. For example, Sears Canada Ltd. sold its

receivables to Sears Canada Receivables Trust (SCRT).

SCRT issued debentures and commercial paper backed

by a diversified portfolio of receivables.

Inventory loans use inventory as collateral.

27-30

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

27.6 The Short-Term Financial Plan (continued)

Other Sources

Commercial paper:

Commercial paper: consists of short-term notes issued by

large and highly rated firms.

Firms issuing commercial paper in Canada generally have

borrowing needs over $20 million.

Dominion Bond Rating Service rates commercial paper

similarly to bonds.

Bankers acceptances:

Bankers acceptances are a variant of commercial paper.

Bankers acceptances are more widely used than

commercial paper in Canada because Canadian chartered

banks enjoy stronger credit ratings than all but the largest

corporations.

27-31

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

27.7 Summary & Conclusions

This chapter introduces the management of short-

term finance.

We examine the short-term uses and sources of cash as

they appear on the firms financial statements.

We see how current assets and current liabilities arise in

the short-term operating activities and the cash cycle of

the firm.

From an accounting perspective, short-term finance

involves net working capital.

27-32

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

27.7 Summary & Conclusions

Managing short-term cash flows involves the

minimization of costs.

The two major costs are:

Carrying coststhe interest and related costs incurred by

overinvesting in short-term assets such as cash.

Shortage coststhe cost of running out of short-term

assets.

The objective of managing short-term finance and

short-term financial planning is to find the optimal

tradeoff between these two costs.

27-33

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

27.7 Summary & Conclusions

In an ideal economy, the firm could perfectly

predict its short-term uses and sources of cash and

net working capital could be kept at zero.

In the real world, net working capital provides a

buffer that lets the firm meet its ongoing

obligations.

The financial manager seeks the optimal level of

each of the current assets.

27-34

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

27.7 Summary & Conclusions

The financial manager can use the cash budget to

identify short-term financial needs.

The cash budget tells the manager what borrowing

is required or what lending will be possible in the

short run.

The firm has available to it a number of possible

ways of acquiring funds to meet short-term

shortfalls, including unsecured and secured loans.

Você também pode gostar

- Free PPT Templates: InsertDocumento2 páginasFree PPT Templates: Insertshahidul0Ainda não há avaliações

- Presentation 4gdfgfdgfdgfd231Documento2 páginasPresentation 4gdfgfdgfdgfd231shahidul0Ainda não há avaliações

- Free PPT Templates: InsertDocumento2 páginasFree PPT Templates: Insertshahidul0Ainda não há avaliações

- Free PPT Templates: Insert The Title of Your Presentation HereDocumento2 páginasFree PPT Templates: Insert The Title of Your Presentation Hereshahidul0Ainda não há avaliações

- Free PPT Templates: Insert The Title of Your Presentation HereDocumento2 páginasFree PPT Templates: Insert The Title of Your Presentation Hereshahidul0Ainda não há avaliações

- Free PPT Templates: Insert The Title of Your Presentation HereDocumento3 páginasFree PPT Templates: Insert The Title of Your Presentation Hereshahidul0Ainda não há avaliações

- Section Break: Insert Your Subtitle HereDocumento41 páginasSection Break: Insert Your Subtitle Hereshahidul0Ainda não há avaliações

- Free PPT Templates: Insert The Sub Title of Your PresentationDocumento14 páginasFree PPT Templates: Insert The Sub Title of Your Presentationshahidul0Ainda não há avaliações

- Free PPT Templates: Insert The Title of Your Presentation HereDocumento3 páginasFree PPT Templates: Insert The Title of Your Presentation Hereshahidul0Ainda não há avaliações

- Free PPT Templates: Insert The Title of Your Presentation HereDocumento2 páginasFree PPT Templates: Insert The Title of Your Presentation Hereshahidul0Ainda não há avaliações

- Click To Edit Master Subtitle StyleDocumento4 páginasClick To Edit Master Subtitle Styleshahidul0Ainda não há avaliações

- Business StyleDocumento10 páginasBusiness Styleshahidul0Ainda não há avaliações

- TeamDocumento4 páginasTeamshahidul0Ainda não há avaliações

- Click To Edit Master Title StyleDocumento4 páginasClick To Edit Master Title Styleshahidul0Ainda não há avaliações

- Free PPT Templates: Insert The Sub Title of Your PresentationDocumento48 páginasFree PPT Templates: Insert The Sub Title of Your Presentationshahidul0Ainda não há avaliações

- Click To Edit Master Subtitle StyleDocumento8 páginasClick To Edit Master Subtitle Styleshahidul0Ainda não há avaliações

- Strengths Weaknesses: - Edit Text Here - Edit Text Here - Edit Text Here - Edit Text HereDocumento1 páginaStrengths Weaknesses: - Edit Text Here - Edit Text Here - Edit Text Here - Edit Text Hereshahidul0Ainda não há avaliações

- Effective PresentationsDocumento4 páginasEffective Presentationsshahidul0Ainda não há avaliações

- Presentation Title: Subheading Goes HereDocumento4 páginasPresentation Title: Subheading Goes Hereshahidul0Ainda não há avaliações

- Internship ReportDocumento11 páginasInternship Reportshahidul0Ainda não há avaliações

- Flow ChartDocumento2 páginasFlow Chartshahidul0Ainda não há avaliações

- Click To Edit Master Subtitle StyleDocumento4 páginasClick To Edit Master Subtitle Styleshahidul0Ainda não há avaliações

- Customer Development Process: Custome R Discover y Custome R Validatio N Custome R Creation Compan y BuildingDocumento2 páginasCustomer Development Process: Custome R Discover y Custome R Validatio N Custome R Creation Compan y Buildingshahidul0Ainda não há avaliações

- Presentation Title: Your Company InformationDocumento2 páginasPresentation Title: Your Company Informationshahidul0Ainda não há avaliações

- Powerpoint Chart Object: East West North SouthDocumento1 páginaPowerpoint Chart Object: East West North Southshahidul0Ainda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- 20151201-Baltic Sea Regional SecurityDocumento38 páginas20151201-Baltic Sea Regional SecurityKebede MichaelAinda não há avaliações

- Invidis Yearbook 2019Documento51 páginasInvidis Yearbook 2019Luis SanchezAinda não há avaliações

- Es 590Documento35 páginasEs 590Adnan BeganovicAinda não há avaliações

- Organisational Structure of NetflixDocumento2 páginasOrganisational Structure of NetflixAnkita Das57% (7)

- MB0048 Operation Research Assignments Feb 11Documento4 páginasMB0048 Operation Research Assignments Feb 11Arvind KAinda não há avaliações

- Product Information DIGSI 5 V07.50Documento56 páginasProduct Information DIGSI 5 V07.50g-bearAinda não há avaliações

- U-Blox Parameters Setting ProtocolsDocumento2 páginasU-Blox Parameters Setting Protocolspedrito perezAinda não há avaliações

- High-Definition Multimedia Interface SpecificationDocumento51 páginasHigh-Definition Multimedia Interface SpecificationwadrAinda não há avaliações

- Safe and Gentle Ventilation For Little Patients Easy - Light - SmartDocumento4 páginasSafe and Gentle Ventilation For Little Patients Easy - Light - SmartSteven BrownAinda não há avaliações

- Logbook) Industrial Attachment Brief To Students-3Documento6 páginasLogbook) Industrial Attachment Brief To Students-3geybor100% (1)

- Statement of Facts:: State of Adawa Vs Republic of RasasaDocumento10 páginasStatement of Facts:: State of Adawa Vs Republic of RasasaChristine Gel MadrilejoAinda não há avaliações

- 036 ColumnComparisonGuideDocumento16 páginas036 ColumnComparisonGuidefarkad rawiAinda não há avaliações

- LIC Form - Intimation of Death Retirement Leaving ServiceDocumento1 páginaLIC Form - Intimation of Death Retirement Leaving ServicekaustubhAinda não há avaliações

- Literature Review 2500 WordsDocumento6 páginasLiterature Review 2500 Wordsvvjrpsbnd100% (1)

- Rectangular Wire Die Springs ISO-10243 Standard: Red Colour Heavy LoadDocumento3 páginasRectangular Wire Die Springs ISO-10243 Standard: Red Colour Heavy LoadbashaAinda não há avaliações

- TP913Documento5 páginasTP913jmpateiro1985Ainda não há avaliações

- LEBV4830Documento371 páginasLEBV4830anton100% (1)

- 11.traders Virtual Mag OTA July 2011 WebDocumento68 páginas11.traders Virtual Mag OTA July 2011 WebAde CollinsAinda não há avaliações

- ZX400LCH 5GDocumento16 páginasZX400LCH 5Gusmanitp2Ainda não há avaliações

- Ababio v. R (1972) 1 GLR 347Documento4 páginasAbabio v. R (1972) 1 GLR 347Esinam Adukpo100% (2)

- MTBE - Module - 3Documento83 páginasMTBE - Module - 3ABHIJITH V SAinda não há avaliações

- Model: The Most Accepted and Respected Engine-Driven Cooler in The Gas Compression IndustryDocumento2 páginasModel: The Most Accepted and Respected Engine-Driven Cooler in The Gas Compression IndustryparathasiAinda não há avaliações

- LIC - Jeevan Labh - Brochure - 9 Inch X 8 Inch - EngDocumento13 páginasLIC - Jeevan Labh - Brochure - 9 Inch X 8 Inch - Engnakka_rajeevAinda não há avaliações

- Preventive Maintenance Checklist: Tool Room & Production SawsDocumento2 páginasPreventive Maintenance Checklist: Tool Room & Production SawsValerio Ambrocio IsmaelAinda não há avaliações

- OL2068LFDocumento9 páginasOL2068LFdieselroarmt875bAinda não há avaliações

- GRE Computer Science SyllabusDocumento2 páginasGRE Computer Science SyllabusSameer Ahmed سمیر احمدAinda não há avaliações

- Raspberry Pi Installing Noobs OSDocumento3 páginasRaspberry Pi Installing Noobs OSEXORCEAinda não há avaliações

- Datasheet HFS60Documento3 páginasDatasheet HFS60RajeswaranAinda não há avaliações

- In Coming MailDocumento4 páginasIn Coming Mailpoetoet100% (1)

- Question: To What Extent Do You Agree or Disagree?Documento5 páginasQuestion: To What Extent Do You Agree or Disagree?tien buiAinda não há avaliações