Escolar Documentos

Profissional Documentos

Cultura Documentos

CSX Updated

Enviado por

msullivan90Descrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

CSX Updated

Enviado por

msullivan90Direitos autorais:

Formatos disponíveis

CSX

By:

Company Background

Stock Price

Major Competition

Micro and Macro Environment

Intensity of Rivalry

S.W.O.T Analysis

Recommendation

Agenda

Buy CSX @ $23.80

Price target

DCF: $26.___

Comps: $24.__-$___

Recommendation

Recent upgrades by FBR Capital & RBC

Avg. price target $26.54

Median price target $27.00

Analyst Ratings

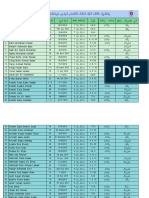

Stock Price Last 5 Years

2008 2009 2010 2011 2012

Highs $ 70.70 $ 50.80 $ 21.60 $ 27.06 $ 23.71

Lows $ 30.61 $ 20.70 $ 14.02 $ 17.69 $ 18.88

Dividends $ 0.77 $ 0.88 $ 0.98 $ 0.45 $ 0.54

6

Business

Provides rail-based transportation in 23 states in the

eastern US

Operates various distribution centers & connects non-

rail customers through transferring products to trucks

Approx. 21,000 miles of rail in the eastern US as well

as Ontario and Quebec

Main items transported include:

Crushed stones, food, consumer, agriculture, chemical

products and coal

6

Financial Info Sheet

NYSE: CSX

Sales: $11.756B

Fuel: $1.672B

14.2225% of sales

Labor & Fringe: $3.02B

25.689% of sales

Market Cap: $ 24.44B

Price/Trailing Earnings:

Price/Forward Earnings:

Price/Sales:

Price/Book:

Major

Comparables

Union Pacific Corp

Market Cap: $65.57B

Canadian National

Railway Company

Market Cap: $42.01B

Norfolk Southern

Market Cap: $23.70B

Canadian Pacific Railway

Limited

Market Cap: $21.99B

Sully

Comparable

Strengths: Capable of reaching 2/3rds of Americans

Ability to transport a diverse portfolio:

Grains, chemicals, autos, metals, paper, consumer

products

Weakness:

Increases in passenger train volume

Poor economic conditions

Increase regulation

Severe weather

Liability of hazardous material

S.W.O.T. Analysis

Opportunities:

Increase in global competiveness

Continued growth in manufacturing and energy

Provide the most fuel efficient way to ship

Threats:

Disruption in supply chain

Could increase prices

Fuel shortage by OPEC

Terrorism

S.W.O.T. Analysis

Threat of Entry

Location Advantages

Government Subsidies

Buyer Power

Who are the buyers?

Supplier Power

Who are they

Easily integrate forward?

Porters 5 Forces

Threat of Substitute

How close are the substitutes?

Intensity of Rivalry

Porters 5 Forces cont.

Decline in coal

Droughts

Diversify away from coal

Advancing product offering

News Worthy Material

GDP: Last Year $15.66 Trillion (2.2%, YOY)

Operations cover, Eastern U.S., Ontario and Quebec

21,000 mi. of Track

Access to 70 Ports

Fuel is the largest input for CSX

Monitor fuel prices

Political: EPA influential regulating body

Global: Economic conditions affect demand on

commodities

Micro Environment

Decline in coal due milder weathers

Macro Environment

Sully

Recommendation

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Quiet Time Guide 2009Documento2 páginasQuiet Time Guide 2009Andrew Mitry100% (1)

- Design of Swimming Pool PDFDocumento21 páginasDesign of Swimming Pool PDFjanithbogahawatta67% (3)

- Essentials of Economics 3Rd Edition Brue Solutions Manual Full Chapter PDFDocumento30 páginasEssentials of Economics 3Rd Edition Brue Solutions Manual Full Chapter PDFsilas.wisbey801100% (11)

- Open Quruan 2023 ListDocumento6 páginasOpen Quruan 2023 ListMohamed LaamirAinda não há avaliações

- Consolidated Terminals Inc V Artex G R No L 25748 PDFDocumento1 páginaConsolidated Terminals Inc V Artex G R No L 25748 PDFCandelaria QuezonAinda não há avaliações

- UAS English For Acc - Ira MisrawatiDocumento3 páginasUAS English For Acc - Ira MisrawatiIra MisraAinda não há avaliações

- Turnaround ManagementDocumento16 páginasTurnaround Managementpaisa321Ainda não há avaliações

- WFP AF Project Proposal The Gambia REV 04sept20 CleanDocumento184 páginasWFP AF Project Proposal The Gambia REV 04sept20 CleanMahima DixitAinda não há avaliações

- 10th Grade SAT Vocabulary ListDocumento20 páginas10th Grade SAT Vocabulary ListMelissa HuiAinda não há avaliações

- DLF New Town Gurgaon Soicety Handbook RulesDocumento38 páginasDLF New Town Gurgaon Soicety Handbook RulesShakespeareWallaAinda não há avaliações

- The Future of Freedom: Illiberal Democracy at Home and AbroadDocumento2 páginasThe Future of Freedom: Illiberal Democracy at Home and AbroadRidho Shidqi MujahidiAinda não há avaliações

- Dividend Discount ModelDocumento54 páginasDividend Discount ModelVaidyanathan Ravichandran100% (1)

- Gujarat Technological UniversityDocumento5 páginasGujarat Technological Universityvenkat naiduAinda não há avaliações

- Distribution Logistics Report 2H 2020Documento21 páginasDistribution Logistics Report 2H 2020IleanaAinda não há avaliações

- Shell - StakeholdersDocumento4 páginasShell - StakeholdersSalman AhmedAinda não há avaliações

- The Key To The Magic of The Psalms by Pater Amadeus 2.0Documento16 páginasThe Key To The Magic of The Psalms by Pater Amadeus 2.0evitaveigasAinda não há avaliações

- Brunon BradDocumento2 páginasBrunon BradAdamAinda não há avaliações

- Savage Worlds - Space 1889 - London Bridge Has Fallen Down PDFDocumento29 páginasSavage Worlds - Space 1889 - London Bridge Has Fallen Down PDFPablo Franco100% (6)

- E-Conclave Spon BrochureDocumento17 páginasE-Conclave Spon BrochureNimish KadamAinda não há avaliações

- Final Seniority List of HM (High), I.s., 2013Documento18 páginasFinal Seniority List of HM (High), I.s., 2013aproditiAinda não há avaliações

- Internship Report Mca Audit Report InternshipDocumento33 páginasInternship Report Mca Audit Report InternshipJohnAinda não há avaliações

- PAPER 2 RevisedDocumento36 páginasPAPER 2 RevisedMâyúř PäťîĺAinda não há avaliações

- Trade Promotion Optimization - MarketelligentDocumento12 páginasTrade Promotion Optimization - MarketelligentMarketelligentAinda não há avaliações

- Salesforce Salesforce AssociateDocumento6 páginasSalesforce Salesforce Associatemariana992011Ainda não há avaliações

- Civil Law 2 Module 1 Case #008 - Andamo vs. IAC, 191 SCRA 195Documento6 páginasCivil Law 2 Module 1 Case #008 - Andamo vs. IAC, 191 SCRA 195Ronald MedinaAinda não há avaliações

- SMART Train ScheduleDocumento1 páginaSMART Train ScheduleDave AllenAinda não há avaliações

- Pte Links N TipsDocumento48 páginasPte Links N TipsKuljinder VirdiAinda não há avaliações

- Script PDFDocumento1 páginaScript PDFWahid KhanAinda não há avaliações

- CDR Questionnaire Form: of The Project I.E. How The Objectives of The Project Was Accomplished in Brief.)Documento2 páginasCDR Questionnaire Form: of The Project I.E. How The Objectives of The Project Was Accomplished in Brief.)NASEER AHMAD100% (1)

- EnglishDocumento3 páginasEnglishYuyeen Farhanah100% (1)