Escolar Documentos

Profissional Documentos

Cultura Documentos

Agency Theory: - Principal-Agent - The Firm

Enviado por

Saravana KumarTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Agency Theory: - Principal-Agent - The Firm

Enviado por

Saravana KumarDireitos autorais:

Formatos disponíveis

Agency Theory

Principal-Agent

The Firm

Principal [Uninformed]

Agent [Informed]

1. Moral hazard with hidden action

2. Moral hazard with post-contractual hidden

knowledge

3. Adverse selection

4. Signalling

5. Screening

Moral Hazard: Managers

1. Reputation

2. Risk-sharing contracts

3. Boiling in oil

4. Selling the store-LBO

5. Efficiency wages [higher]

6. Tournaments

7. Monitoring

8. Repetition [rainbow]

9. Changing type of agent

Adverse Selection:

Managers

1. Quality certification

2. Testing

3.Reputation

4. Social customs

Theory of the firm [Public

company]

Firm characterized by contract and not fiat

Joint input production, several input owners

How to ensure monitoring?

Appoint a Peak monitor

Contracts with all input owners

Residual claimant

Right to sell contractual residual status

Agency Theory: The Firm

Legal fiction that serves as a nexus for

contracting relationships

Divisible residual claims on assets and cash

flows that can be sold without permission of

other contracting individuals

Agency Costs

Principal and agent divergent interests

Principal can monitor

Agent can bond

Residual loss

Agency Theory: Conflicts

Outside Shareholder-Owner Manager

Bondholder-Shareholder

New Shareholder-Old Shareholder

Outside Shareholder-Owner

Manager

100% owner trades off Firm Value V* and

Value of On-the-job non-pecuniary

perquisites

What happens if claim is diluted to ?

Outsider will be willing to pay (1- ) V

Monitoring and bonding influence V

Outside Shareholder-Owner

Manager: Free Cash Flow Problem

For this purpose we will define Free Cash Flow as cash

flow in excess of positive NPV project needs

Acquiring-firm shareholders lost 12 cents around

acquisition announcements per dollar spent on acquisitions

in 1998-2001

Aggregate loss $240 billion

87 acquisitions lost more than 1 billion dollars each

These also lost $2.31 for every dollar spent on acquisition

Shareholders would have been better off if managers had

simply burnt cash/shares used for acquisition

Bondholder-Stockholder

Conflicts

Asset substitution

Under-investment

Short-sighted investment

Liquidation:

Single class of lenders

Multiple classes of lenders

BONDHOLDER-STOCKHOLDER CONFLICT

1. ASSET SUBSTITUTION

[INCENTIVE TO TAKE HIGHER RISKS]

INVEST 8000 AT YEAR 0 IN 1-YEAR PROJECT

LOAN OUTFLOW OF 7000 IN YEAR 1

STATE PROB. PROJECT1 PROJECT2

GOOD 0.5 11000 18000

BAD 0.5 9000 2000

EXP. VALUE 10000 10000

PROJECT 2 HAS SAME SYSTEMATIC RISK AS 1

PROJECT1 PROJECT2

LENDER PAYOFF

GOOD 7000 7000

BAD 7000 2000

EXP. 7000 4500

EQUITY PAYOFF

GOOD 4000 11000

BAD 2000 0

EXP. 3000 5500

BONDHOLDER-STOCKHOLDER CONFLICT

2. UNDERINVESTMENT

EQUITY DISC RATE/INT RATE ZERO

NPV 0 1 2

100 A -50 100 50

25 B -75 100

A. ALL EQUITY FIRM

WILL ACCEPT BOTH

B. FIRM WITH DEBT OUTSTANDING

1 2

DEBT -20 -100

PAYOFF A+B

EQUITY 5 50

DEBT 20 100

B. FIRM WITH DEBT OUTSTANDING

1 2

DEBT -20 -100

PAYOFF A

EQUITY 80 0

DEBT 20 50

BONDHOLDER-STOCKHOLDER CONFLICT

3. SHORTSIGHTED INVESTMENT

EQUITY DISC RATE/INT RATE ZERO

1 2

DEBT -100 -40

EXISTING ASSETS

GOOD 50 60

BAD 50 10

ST PROJ 50 0

LT PROJ 20 40

ST PROJ EQUITY VALUE

GOOD 20

BAD 0

LT PROJ EQUITY VALUE

GOOD 10

BAD 0

WITH LT PROJECT, SUBORDINATE NEW DEBT

OF 30 IN YEAR 1 WITH PROMISED REPAYMENT

OF 50

BONDHOLDER-STOCKHOLDER CONFLICT

4. LIQUIDATION: SINGLE CLASS OF LENDERS

DEBT 500

FIRM VALUE

IMMEDIATE 480

NEXT YEAR

GOOD 600

BAD 200

Bondholder-Stockholder Conflict: Liquidation

with Multiple Classes of Lenders

Debt Obligations

Immediate Next Year

Debt holders 150,000 1,000,000

Venture Capitalist 0 200,000

1,200,000 if firm liquidated immediately

Payoff in the Event of Liquidation

Debt holders 1,150,000

Venture Capitalist 50,000

Stockholders 0

Bondholder-Stockholder Conflict: Liquidation

with Multiple Classes of Lenders

Next Year: States of the Economy

Immediate Favourable Unfavourable

Firm cash flows 1,500,000 500,000

Debt holders 150,000 1,000,000 500,000

Venture capitalist (150,000) 450,000 0

Stockholders 0 50,000 0

This assumes VC is promised 250,000 payment on 150,000

loan

Seasoned Equity Issue (Follow-

up Public Offer)

Myers-Majluf explanation for Pecking

Order

New Shareholder-Old

Shareholder

Managers know true future value of firm,

and of projects

Managers act in the interest of Old

shareholders

Old shareholders passive

Zero interest rate, no transaction costs

A: Issue Equity: No Positive

NPV Projects

DO NOTHING ISSUE EQUITY

GOOD BAD GOOD BAD

LIQUID ASSETS 50 50 150 150

ASSETS IN PLACE 200 80 200 80

VALUE OF FIRM 250 130 350 230

A1: Old Shareholders Payoffs:

Issue vs Do Nothing

DO NOTHING ISSUE EQUITY

GOOD NEWS 250 * 229.31

BAD NEWS 130 150.69 *

190/290*(350)=229.31

190/290*(230)=150.69

Is this an equilibrium?

B. Issue Equity: Positive NPV

Project

DO NOTHING ISSUE EQUITY

INVEST 100

GOOD BAD GOOD BAD

LIQUID ASSETS 50 50 50 50

ASSETS IN PLACE 200 80 300 180

NPV NEW PROJ. 0 0 20 10

VALUE OF FIRM 250 130 370 240

OLD SHAREHOLDERS' WEALTH

DO NOTHING=0.5*(250+130)=190

ISSUE/INVEST=0.5*(270+140)=205

B1: Old Shareholders Payoffs:

Positive NPV Project

DO NOTHING ISSUE EQUITY

INVEST 100

GOOD NEWS 250 * 248.69

BAD NEWS 130 161.31 *

205/305*(370)=248.69

205/305*(240)=161.31

Is this an equilibrium?

B2: Old Shareholders Payoffs:

Equilibrium

DO NOTHING ISSUE EQUITY

INVEST 100

GOOD NEWS 250 * 248.69

BAD NEWS 130 140.00 *

Você também pode gostar

- Agency Theory: Corporate Financial Management 3e Emery Finnerty StoweDocumento48 páginasAgency Theory: Corporate Financial Management 3e Emery Finnerty StoweBabar AdeebAinda não há avaliações

- 6capital Structure IIDocumento32 páginas6capital Structure IIKenneth KwokAinda não há avaliações

- The Business of Venture Capital: Insights from Leading Practitioners on the Art of Raising a Fund, Deal Structuring, Value Creation, and Exit StrategiesNo EverandThe Business of Venture Capital: Insights from Leading Practitioners on the Art of Raising a Fund, Deal Structuring, Value Creation, and Exit StrategiesAinda não há avaliações

- PFLec 2Documento12 páginasPFLec 2Aseem SwainAinda não há avaliações

- The Investment Advisor Body of Knowledge + Test Bank: Readings for the CIMA CertificationNo EverandThe Investment Advisor Body of Knowledge + Test Bank: Readings for the CIMA CertificationAinda não há avaliações

- Chapter 6Documento21 páginasChapter 6Abdiwahab AbdikadirAinda não há avaliações

- Capital StructureDocumento31 páginasCapital StructureBagusSuciptoAinda não há avaliações

- Session 2Documento31 páginasSession 2Ken AdamsAinda não há avaliações

- Revaluation and DisolutionDocumento31 páginasRevaluation and DisolutionERICK MLINGWAAinda não há avaliações

- Balance Sheet Part1Documento35 páginasBalance Sheet Part1Swati PorwalAinda não há avaliações

- Balance Sheet: Manac I Session 2Documento32 páginasBalance Sheet: Manac I Session 2Dhana Sekar SrinivasanAinda não há avaliações

- Unit 2 Financial Statement AnalysisDocumento17 páginasUnit 2 Financial Statement AnalysisalemayehuAinda não há avaliações

- Capital StructureDocumento60 páginasCapital StructureSayeedMdAzaharulIslamAinda não há avaliações

- Chapter 15Documento21 páginasChapter 15Neel PeswaniAinda não há avaliações

- 7SOGSS FM LECTURE 7 Sources of Finance 1Documento60 páginas7SOGSS FM LECTURE 7 Sources of Finance 1Right Karl-Maccoy HattohAinda não há avaliações

- CF-II Session 3hDocumento22 páginasCF-II Session 3hfew.fearlessAinda não há avaliações

- 01 Module I - Parts 1 To 5Documento26 páginas01 Module I - Parts 1 To 5Nicole TaysonAinda não há avaliações

- Module 2B. Debt RestructuringDocumento17 páginasModule 2B. Debt RestructuringAaron MañacapAinda não há avaliações

- Tradeoff Theory and Signalling TheoryDocumento15 páginasTradeoff Theory and Signalling TheorymakeyourcosmosAinda não há avaliações

- CF - Chapter 17Documento25 páginasCF - Chapter 17huanbilly2003Ainda não há avaliações

- Accounting-Ppt - Building Blocks of AccountingDocumento28 páginasAccounting-Ppt - Building Blocks of Accountinginaraimam.2003Ainda não há avaliações

- Corporate Finance Term PaperDocumento11 páginasCorporate Finance Term PaperbashirAinda não há avaliações

- Dr. Anshul Verma: Opic Alance HeetDocumento51 páginasDr. Anshul Verma: Opic Alance Heetpandiya913Ainda não há avaliações

- Preparation & Analysis of Cash Flow StatementsDocumento27 páginasPreparation & Analysis of Cash Flow StatementsAniket PanchalAinda não há avaliações

- Capital Structure PolicyDocumento41 páginasCapital Structure PolicyBalindo KhanaAinda não há avaliações

- Parrino Corp Fin 5e PPT Ch16Documento51 páginasParrino Corp Fin 5e PPT Ch16astridAinda não há avaliações

- LiquidationDocumento20 páginasLiquidationCHANCHALAinda não há avaliações

- MBS Corporate Finance 2023 Slide Set 4Documento112 páginasMBS Corporate Finance 2023 Slide Set 4PGAinda não há avaliações

- MM& Agency ProbalemDocumento43 páginasMM& Agency Probalemmaheswara448Ainda não há avaliações

- 02 CapStr Basic NiuDocumento28 páginas02 CapStr Basic NiuLombeAinda não há avaliações

- Financial Management - Theory and PracticeDocumento8 páginasFinancial Management - Theory and PracticeDavis PimpizyAinda não há avaliações

- Advanced Corporate Finance (Econm 2032) : Piotr Korczak P.Korczak@bristol - Ac.ukDocumento12 páginasAdvanced Corporate Finance (Econm 2032) : Piotr Korczak P.Korczak@bristol - Ac.ukDavissen MoorganAinda não há avaliações

- Befa Unit - VDocumento22 páginasBefa Unit - VMahesh BabuAinda não há avaliações

- MA-Ratio AnalysisDocumento74 páginasMA-Ratio AnalysisShobhita AgarwalAinda não há avaliações

- ACFI1003 - Lecture 7 Corporations and The Share MarketDocumento43 páginasACFI1003 - Lecture 7 Corporations and The Share Market王亚琪Ainda não há avaliações

- Leveraged Buyout Structures and ValuationDocumento35 páginasLeveraged Buyout Structures and Valuationsamm123456100% (1)

- AFM - Lecture 1 2 3 NotesDocumento24 páginasAFM - Lecture 1 2 3 NotesArvind Ujjwal MehthaAinda não há avaliações

- ACC 440 Investments II: Prof Steve OrpurtDocumento22 páginasACC 440 Investments II: Prof Steve OrpurtgaochcangAinda não há avaliações

- Statement of Financial Position, Also Referred To As The Balance SheetDocumento7 páginasStatement of Financial Position, Also Referred To As The Balance SheetRhonamae GabisanAinda não há avaliações

- C1 LiabilitiesDocumento20 páginasC1 LiabilitiesJomar MarananAinda não há avaliações

- 14 - Chapter 17 - Capital - Structure - Limits E10-1Documento32 páginas14 - Chapter 17 - Capital - Structure - Limits E10-1VÂN HỒ BÙI NGỌCAinda não há avaliações

- Financial Instrument - Kam (Part1)Documento70 páginasFinancial Instrument - Kam (Part1)Kamaruzzaman Mohd100% (1)

- Unit JDocumento55 páginasUnit Jsprayzza tvAinda não há avaliações

- Capital Structure and Firm ValueDocumento31 páginasCapital Structure and Firm ValuealimithaAinda não há avaliações

- SOFPDocumento41 páginasSOFPAsimAfzalAinda não há avaliações

- Bad Debts and Provision For Doubtful DebtDocumento22 páginasBad Debts and Provision For Doubtful DebtNauman HashmiAinda não há avaliações

- FAR Chap1Documento11 páginasFAR Chap1Lachi MolalaAinda não há avaliações

- 17 Dec Capital Structure TheoriesDocumento39 páginas17 Dec Capital Structure TheoriesKritika BhattAinda não há avaliações

- R R D DE R E DE R R R D DE: Modigliani-Miller TheoremDocumento13 páginasR R D DE R E DE R R R D DE: Modigliani-Miller TheoremPankaj Kumar BaidAinda não há avaliações

- Topic Review NotesDocumento3 páginasTopic Review NotesMikaella BengcoAinda não há avaliações

- Topic 1 Overview of Financial Management and Financial EnvironmentDocumento68 páginasTopic 1 Overview of Financial Management and Financial EnvironmentMicaella Fevey BandejasAinda não há avaliações

- Corporate Liquidation Problem SetDocumento7 páginasCorporate Liquidation Problem SetMary Rose ArguellesAinda não há avaliações

- What Is A Balance SheetDocumento26 páginasWhat Is A Balance SheetAbhirup SenguptaAinda não há avaliações

- Accounting For Corporations: ACT B861FDocumento61 páginasAccounting For Corporations: ACT B861FCalvin MaAinda não há avaliações

- Session 3&4 IA 2021Documento93 páginasSession 3&4 IA 2021Ashley NguyenAinda não há avaliações

- Liabilities: Kryztle Shammaine A. RosauroDocumento8 páginasLiabilities: Kryztle Shammaine A. RosauroKring ZelAinda não há avaliações

- Session - 2Documento19 páginasSession - 2Manan AgarwalAinda não há avaliações

- Corporate Finance Till Test 1Documento39 páginasCorporate Finance Till Test 1YogeeshAinda não há avaliações

- Tutorial 1 (With Solution)Documento5 páginasTutorial 1 (With Solution)Aiden YingAinda não há avaliações

- Balance Sheet M&MDocumento3 páginasBalance Sheet M&MPrateek JainAinda não há avaliações

- NTPC Limited - Balance Sheet (In Rs. Crores)Documento21 páginasNTPC Limited - Balance Sheet (In Rs. Crores)krishbalu172164Ainda não há avaliações

- Exercise in Manaco 2Documento2 páginasExercise in Manaco 2Gracelle Mae Oraller100% (1)

- LaporanKeuanganWIKA30September2018Documento164 páginasLaporanKeuanganWIKA30September2018arrizal firdausAinda não há avaliações

- FAR3Documento3 páginasFAR3Patrice Elaine PillaAinda não há avaliações

- Financial Accounting Q&aDocumento4 páginasFinancial Accounting Q&aGlen JavellanaAinda não há avaliações

- Investment Practice ProblemsDocumento14 páginasInvestment Practice ProblemsmikeAinda não há avaliações

- Re & BVDocumento3 páginasRe & BV-100% (1)

- Financial Management On Catfish Farms (PDFDrive)Documento61 páginasFinancial Management On Catfish Farms (PDFDrive)AmiibahAinda não há avaliações

- Lufthansa Annual Report 2010Documento242 páginasLufthansa Annual Report 2010philippe8brunoAinda não há avaliações

- Test Bank SCFDocumento114 páginasTest Bank SCFAnnabelle RafolsAinda não há avaliações

- Exercise#1 Earlmathew VisarraDocumento2 páginasExercise#1 Earlmathew VisarraMathew VisarraAinda não há avaliações

- Impact of Financial Statements To The Decision-Making of Small and Medium EnterprisesDocumento108 páginasImpact of Financial Statements To The Decision-Making of Small and Medium EnterprisesJanna Mari FriasAinda não há avaliações

- Dokumen - Tips Hospital Chart of AccountsDocumento38 páginasDokumen - Tips Hospital Chart of AccountsRizwan HassanAinda não há avaliações

- Chapter 5Documento18 páginasChapter 5Student 235Ainda não há avaliações

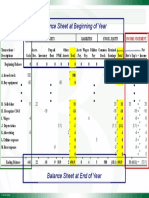

- Balance Sheet at Beginning of Year: Cash FlowDocumento1 páginaBalance Sheet at Beginning of Year: Cash FlowluisAinda não há avaliações

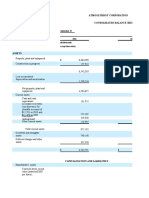

- Atmos Energy Corporation Consolidated Balance Sheets: September 30Documento7 páginasAtmos Energy Corporation Consolidated Balance Sheets: September 30Betty M. VargasAinda não há avaliações

- DuPont Analysis - Definition - Formula - Model - Example - Interpretation - Chart - Advantages and Disadvantages - CalculatorDocumento7 páginasDuPont Analysis - Definition - Formula - Model - Example - Interpretation - Chart - Advantages and Disadvantages - CalculatorAkash SinghAinda não há avaliações

- HOEC - Hindustan Oil Exploration CompanyDocumento16 páginasHOEC - Hindustan Oil Exploration CompanySai SavanthAinda não há avaliações

- A Study of Financial Performance Through RatiosDocumento91 páginasA Study of Financial Performance Through RatiosPrashanth PBAinda não há avaliações

- Afar - Tutorial - QuestionsDocumento5 páginasAfar - Tutorial - QuestionsRalph Anthony MakinanoAinda não há avaliações

- FY19 - QBDT Client - Lesson 1 - Get Started - BDB - v4Documento26 páginasFY19 - QBDT Client - Lesson 1 - Get Started - BDB - v4Nyasha MakoreAinda não há avaliações

- Accounting Standard (AS) 30 Financial Instruments: Recognition and MeasurementDocumento22 páginasAccounting Standard (AS) 30 Financial Instruments: Recognition and MeasurementkarthickvitAinda não há avaliações

- ACCY 303 - Midterm ExaminationDocumento12 páginasACCY 303 - Midterm ExaminationCORNADO, MERIJOY G.Ainda não há avaliações

- Chapter Two The Accounting CycleDocumento30 páginasChapter Two The Accounting CycleFantayAinda não há avaliações

- BNL StoreDocumento19 páginasBNL StoreAnshuman PandeyAinda não há avaliações

- Annual Report 2022Documento77 páginasAnnual Report 2022Varun KhannaAinda não há avaliações

- Ypas Ar 2014Documento134 páginasYpas Ar 2014Monica LuhurAinda não há avaliações

- Fernbank Letter To EU (OPAP) (05.18.11)Documento5 páginasFernbank Letter To EU (OPAP) (05.18.11)mattpauls100% (1)

- Generative AI: The Insights You Need from Harvard Business ReviewNo EverandGenerative AI: The Insights You Need from Harvard Business ReviewNota: 4.5 de 5 estrelas4.5/5 (2)

- Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyNo EverandDigital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyNota: 4 de 5 estrelas4/5 (51)

- Scary Smart: The Future of Artificial Intelligence and How You Can Save Our WorldNo EverandScary Smart: The Future of Artificial Intelligence and How You Can Save Our WorldNota: 4.5 de 5 estrelas4.5/5 (55)

- AI Superpowers: China, Silicon Valley, and the New World OrderNo EverandAI Superpowers: China, Silicon Valley, and the New World OrderNota: 4.5 de 5 estrelas4.5/5 (398)

- The Master Algorithm: How the Quest for the Ultimate Learning Machine Will Remake Our WorldNo EverandThe Master Algorithm: How the Quest for the Ultimate Learning Machine Will Remake Our WorldNota: 4.5 de 5 estrelas4.5/5 (107)

- 100M Offers Made Easy: Create Your Own Irresistible Offers by Turning ChatGPT into Alex HormoziNo Everand100M Offers Made Easy: Create Your Own Irresistible Offers by Turning ChatGPT into Alex HormoziAinda não há avaliações

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumNo EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumNota: 3 de 5 estrelas3/5 (12)

- Four Battlegrounds: Power in the Age of Artificial IntelligenceNo EverandFour Battlegrounds: Power in the Age of Artificial IntelligenceNota: 5 de 5 estrelas5/5 (5)

- The Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyNo EverandThe Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyAinda não há avaliações

- The E-Myth Revisited: Why Most Small Businesses Don't Work andNo EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andNota: 4.5 de 5 estrelas4.5/5 (709)

- System Error: Where Big Tech Went Wrong and How We Can RebootNo EverandSystem Error: Where Big Tech Went Wrong and How We Can RebootAinda não há avaliações

- YouTube Secrets: The Ultimate Guide on How to Start and Grow Your Own YouTube Channel, Learn the Tricks To Make a Successful and Profitable YouTube ChannelNo EverandYouTube Secrets: The Ultimate Guide on How to Start and Grow Your Own YouTube Channel, Learn the Tricks To Make a Successful and Profitable YouTube ChannelNota: 4.5 de 5 estrelas4.5/5 (48)

- The Bitcoin Standard: The Decentralized Alternative to Central BankingNo EverandThe Bitcoin Standard: The Decentralized Alternative to Central BankingNota: 4.5 de 5 estrelas4.5/5 (41)

- Data-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseNo EverandData-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseNota: 3.5 de 5 estrelas3.5/5 (12)

- The AI Advantage: How to Put the Artificial Intelligence Revolution to WorkNo EverandThe AI Advantage: How to Put the Artificial Intelligence Revolution to WorkNota: 4 de 5 estrelas4/5 (7)

- Artificial Intelligence: The Insights You Need from Harvard Business ReviewNo EverandArtificial Intelligence: The Insights You Need from Harvard Business ReviewNota: 4.5 de 5 estrelas4.5/5 (104)

- Who's Afraid of AI?: Fear and Promise in the Age of Thinking MachinesNo EverandWho's Afraid of AI?: Fear and Promise in the Age of Thinking MachinesNota: 4.5 de 5 estrelas4.5/5 (13)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNNo Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNNota: 4.5 de 5 estrelas4.5/5 (3)

- Artificial Intelligence: The Complete Beginner’s Guide to the Future of A.I.No EverandArtificial Intelligence: The Complete Beginner’s Guide to the Future of A.I.Nota: 4 de 5 estrelas4/5 (15)

- An Ugly Truth: Inside Facebook's Battle for DominationNo EverandAn Ugly Truth: Inside Facebook's Battle for DominationNota: 4 de 5 estrelas4/5 (33)

- Architects of Intelligence: The truth about AI from the people building itNo EverandArchitects of Intelligence: The truth about AI from the people building itNota: 4.5 de 5 estrelas4.5/5 (21)

- How to Do Nothing: Resisting the Attention EconomyNo EverandHow to Do Nothing: Resisting the Attention EconomyNota: 4 de 5 estrelas4/5 (421)

- The $100 Startup by Chris Guillebeau: Summary and AnalysisNo EverandThe $100 Startup by Chris Guillebeau: Summary and AnalysisNota: 4 de 5 estrelas4/5 (8)