Escolar Documentos

Profissional Documentos

Cultura Documentos

Medicare Settlements

Enviado por

John HentschelTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Medicare Settlements

Enviado por

John HentschelDireitos autorais:

Formatos disponíveis

2014 Livingston Law Firm Retreat

John C. Hentschel

February 1, 2014

One of the most completely impenetrable

texts within human experience.

Cooper University Hospital v. Sebelius, 636 F.3d

44, 45 (3d. Cir. 2010)

Medicare Basics

Reporting Obligations

Reimbursements for Paid Medical

Expenses

Set Asides for Future Expenses

Best Practices

Guaranteed health insurance

Works like regular private

market insurance

Premiums

Copays

Deductibles

Out of pocket costs

65 and over who worked and

paid into system

Younger disabled (SSD more

than 24 months)

End stage renal failure

ALS

Inpatient hospital stays

2 night rule

90 day maximum

SNF in some cirmcumstances

Hospice stays

Generally no monthly premium if

10 years of FICA payments

Monthly premium (deducted from

SS)

Out patient services after deductible

($147 in 2013)

Physician services

Diagnostic imaging

Tests

Durable medical equipment

Optional if still working and covered

under private insurance

Private health insurance funded through

beneficiary premiums plus private monthly

premium

Additional coverages

Reduced copays and deductibles

Anyone with Part A or Part B eligibility

Designed and administered through

private insurers and regulated through

CMS

In addition to traditional Part A/B

coverages

Separate premiums

If a personal injury plaintiff is Medicare

eligible, obligations and duties are

triggered for all involved in the action

Plaintiff

Defendants

Insurers

Health care providers

42 USC 1395y(b)(2) - Beneficiaries of GHP

who get payments from NGHP, i.e.

primary plans

Liability insurance

No-fault insurance (med pay)

Workers compensation

Self insurance

IF Medicare pays for an item or service

that should have been paid by a primary

plan, reimbursement required per 42

CFR 411.22.

See Overview of the Recovery Process

flowchart

Right of action for CMS against responsible

parties

Insurer or self-insurer

TPA

Employer

Facility or provider

Attorneys (US v. Harris 2009 U.S. Dist. LEXIS 23956

(N.D. W.Va. 2009))

Double damages plus interest

Private right of action

Does not apply to Medicare Advantage (Part C) Plans,

(Parra v. Pacificare of Arizona, Inc., 715 F.3d 1146 (9

th

Cir. 2012))

Who pays first if I have a claim for no-fault or liability insurance?

No-fault insurance or liability insurance pays first and Medicare pays

second, if appropriate.

If doctors or other providers are told you have a no-fault or liability

insurance claim, they must try to get paid from the insurance company

before billing Medicare. However, this may take a long time.

If the insurance company doesnt pay the claim promptly (usually within

120 days), your doctor or other provider may bill Medicare. Medicare

may make a conditional payment to pay the bill, and then later get back

any payments the primary payer should have made.

Medicare and Other Health Benefits: Your Guide to Who Pays First,

CMS, p. 13

Unlike most liens, no notice requirement

Super lien, i.e., superior to al other claims

Benficiary should notify COBC of the

availability of other coverages

COBC notifies recovery contractor

Contractor will Conditional Payment

Summary (CPS)

When settlement reached, demand letter

sent

Payment to CMS within 60 days

Plaintiffs counsel, since 1980, has had

the responsibility to report to CMS the

existence of other potential sources of

payment for medical services and items

Section 111 of MMSEA added new

reporting requirements

To have CMS pay appropriately for Medicare-covered items

and services furnished to Medicare beneficiaries.

Allows CMS to determine who should be the primary payer of

services.

Responsible Reporting Entities

Insurers

Liability insurance

Workers compensation

No fault

Self insured entities

Attorneys are NOT RREs

Identity of claimant

Individual filing claim directly against

applicable plan

Individual filing a claim against an individual

or entity insured or covered by the applicable

plan

Any other information required by CMS

(42 USC 1395y(b)(B)(ii))

DOB, ICD-9 Diagnosis, Payment amounts

See Quick Reference Guide

E-file

Secure web portal

Quarterly

Triggered by settlement with

beneficiary

Assuming ORM or paying TPOC

$1k/day for non-compliance

SMART Act of 2012 42 USC 1395y(b)(9)

In 2014, HHS will establish a minimum amount

below which reporting and reimbursement is not

required

Medicares interests must be settled before

any settlement funds distributed (42 USC

1392y(b)(8)(iii))

Process of identifying all payments can

take time and should be done prior to final

settlement discussions

RRE needs up to date CPS prior to

resolving case

If settlement will not satisfy all of plaintiffs

obligations

Holds offer open for a specified period of

time to allow plaintiff to attempt to

compromise amount owed CMS

See 42 CFR 411.37 re: reduction of amount due

to CMS for procurement costs

Specify how CMS paid

Medicare named a payee on settlement draft

Funds escrowed

Hold harmless and indemnity

Apportionment?

Waiver of private right of action

Reporting particulars

Set-Aside Arrangement An administrative

mechanism used to allocate a portion of a

settlement, judgment or award for future

medical and/or future prescription drug

expenses. A set-aside arrangement may be in

the form of a Workers Compensation

Medicare Set-Aside Arrangement (WCMSA),

No-Fault Liability Medicare Set-Aside

Arrangement (NFSA) or Liability Medicare Set-

Aside Arrangement (LMSA).

42 CFR 411.46 provides that if lump-sum

settlement is intended to provide for all

future medical expenses due to a work-

related injury, Medicare payments for such

services are excluded until the expenses

equal the amount of the payment

A fund of money set aside at the time of

the settlement that must be exhausted to

pay for injury related treatment before

Medicare can be used

Protects Medicares future interests

Formally reviewed by CMS

Provides safe harbor for beneficiary and WC

insurer

$25,000/$250,000 thresholds

See Reference Guide

No legal authority requiring their use

Hybrid cases?

Texas?

See May 25, 2011 Handout from Region VI

Practical problems

Liability considerations in settlement

No apportionment of future medical benefits

Potential uses

Life care plan

Special needs trust

Cannot on own decide to require a set

aside

Must rely on cooperation with beneficiary

In interest to do so to avoid

Double damages and interest

Easy target

Caveat beware of those trying to sell

services!

Identify early as practicable if a claimant is

a Medicare beneficiary

Even if no benefits paid, notice still must be given

Medical records

RRE queries

Communication with claims rep and client

on obligations and strategy for compliance

Special Interrogatories

Have YOU applied for or are YOU eligible for Medicare benefits ?

Please state the date on which YOU first became entitled to

receive such benefits.

Please state YOUR Health Insurance Claim Number.

Please state YOUR Social Security Number,

Are any of the medical expenses related to YOUR injuries been

submitted to, or paid by, Medicare?

Have you been diagnosed with Lou Gehrigs disease?

Are YOU receiving treatment for end-stage renal disease or

kidney failure?

Have YOU applied for SSDI (Social Security Disability) benefits?

If YOU have applied for SSDI, state the date of application and

the current status of your application.

Document Requests

All documents which refer, reflect or pertain to

communication with Medicare, CMS or any of its

contractors specifically including, but not limited

to, notice to COBC, Rights and Responsibility

letters, conditional payment letters (with payment

summary forms), and correspondence regarding

relatedness.

A photocopy of the front and back of YOUR

current Medicare card.

Você também pode gostar

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Proving Medical Value Under HowellDocumento48 páginasProving Medical Value Under HowellJohn HentschelAinda não há avaliações

- WCAB Decision Re: Participation of Lien Holder Lien On Issue of Attorney's FeesDocumento8 páginasWCAB Decision Re: Participation of Lien Holder Lien On Issue of Attorney's FeesJohn HentschelAinda não há avaliações

- Acoem Releases Updated Position Paper On TheDocumento2 páginasAcoem Releases Updated Position Paper On TheJohn HentschelAinda não há avaliações

- Ault IADC Article-July 2011Documento11 páginasAult IADC Article-July 2011John HentschelAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Benefits Information - OptumRxDocumento5 páginasBenefits Information - OptumRxDoma PropertiesAinda não há avaliações

- Medical BillingDocumento229 páginasMedical BillingMohammad Apzar100% (6)

- Pharmacist (Haad/Doh) : Mahboob AliDocumento4 páginasPharmacist (Haad/Doh) : Mahboob AliMahboob AliAinda não há avaliações

- SMART Asthma TherapyDocumento4 páginasSMART Asthma TherapyKen Won100% (1)

- WBDG Hospitals & Care HomesDocumento394 páginasWBDG Hospitals & Care Homesaqua2376Ainda não há avaliações

- Covered Lives SummaryDocumento8 páginasCovered Lives Summarygaurav_johnAinda não há avaliações

- In-Patient Pharmacy Dispensing PersonnelDocumento3 páginasIn-Patient Pharmacy Dispensing Personneljanr123456Ainda não há avaliações

- Indian Pharmaceutical IndustryDocumento7 páginasIndian Pharmaceutical Industrykhem_singhAinda não há avaliações

- Austin AnaplastologyDocumento3 páginasAustin AnaplastologyAustin Publishing GroupAinda não há avaliações

- Running Head: Health Disparities 1 Erin Mcniel November 10, 2015 Kaplan University Health Disparities in The ElderlyDocumento5 páginasRunning Head: Health Disparities 1 Erin Mcniel November 10, 2015 Kaplan University Health Disparities in The ElderlyErinAinda não há avaliações

- Kakoloti - Key Issues Facing The Health Sector in The Next Five Years (2007)Documento19 páginasKakoloti - Key Issues Facing The Health Sector in The Next Five Years (2007)Dinesh PatelAinda não há avaliações

- Basics of Evaluation and ManagementDocumento45 páginasBasics of Evaluation and ManagementRoaring King100% (2)

- Cms 2567 05-13-08Documento41 páginasCms 2567 05-13-08jawtrey100% (3)

- 1Documento90 páginas1MARY ROSE ONGLEO DABOAinda não há avaliações

- UTSW Written Response To SettlementDocumento2 páginasUTSW Written Response To SettlementreesedunklinAinda não há avaliações

- FHIR and LOINCDocumento78 páginasFHIR and LOINCDaniel VreemanAinda não há avaliações

- Anitha Resume 2022Documento2 páginasAnitha Resume 2022syed ShadullahAinda não há avaliações

- Report On Educational Workshop OnDocumento3 páginasReport On Educational Workshop OnMakhanVermaAinda não há avaliações

- Ap - Licensure RN LPNDocumento20 páginasAp - Licensure RN LPNRonnel BenavidezAinda não há avaliações

- Blue Shield CA Employee Enrollment Template v20160101Documento8 páginasBlue Shield CA Employee Enrollment Template v20160101Anonymous RLktVcAinda não há avaliações

- Pecial Eature: Transitions in Pharmacy Practice, Part 3: Effecting Change-The Three-Ring CircusDocumento7 páginasPecial Eature: Transitions in Pharmacy Practice, Part 3: Effecting Change-The Three-Ring CircusSean BlackmerAinda não há avaliações

- Real Time 270/271 Payer List: Payer Name Payer ID NotesDocumento9 páginasReal Time 270/271 Payer List: Payer Name Payer ID NotesRam KumarAinda não há avaliações

- Ayushman Bharat Yojana: National Health Protection SchemeDocumento28 páginasAyushman Bharat Yojana: National Health Protection SchemeKailash NagarAinda não há avaliações

- American Health Care Act SummaryDocumento2 páginasAmerican Health Care Act SummaryStephen Loiaconi50% (2)

- 3 Definition and Prevalence of Dentofacial Deformities 2014 Orthognathic SurgeryDocumento8 páginas3 Definition and Prevalence of Dentofacial Deformities 2014 Orthognathic SurgeryiweourvgiuAinda não há avaliações

- GMHBA Cancellation FormDocumento1 páginaGMHBA Cancellation FormjikoljiAinda não há avaliações

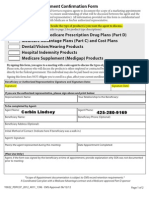

- 2013 Scope of Appointment Form - CORBINDocumento2 páginas2013 Scope of Appointment Form - CORBINCorbin LindseyAinda não há avaliações

- Health Care Reform Individual Insurance RequirementDocumento2 páginasHealth Care Reform Individual Insurance RequirementKimberly M MinetteAinda não há avaliações

- Florida Medicaid Pharmacy Claims AnalysisDocumento203 páginasFlorida Medicaid Pharmacy Claims AnalysisMatthew Daniel NyeAinda não há avaliações

- Delivery of Physical Therapy in The Acute Care Setting - A Population Based StudyDocumento17 páginasDelivery of Physical Therapy in The Acute Care Setting - A Population Based StudyCatalina EspiGaAinda não há avaliações