Escolar Documentos

Profissional Documentos

Cultura Documentos

Corporate Finance Chapter8

Enviado por

moinmemon1763Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Corporate Finance Chapter8

Enviado por

moinmemon1763Direitos autorais:

Formatos disponíveis

CHAPTER 8

WORKING CAPITAL MANAGEMENT

Presenters name

Presenters title

dd Month yyyy

1. INTRODUCTION

Working capital management is the management of the short-term investment

and financing of a company.

Goals:

- Adequate cash flow for operations

- Most productive use of resources

Copyright 2013 CFA Institute 2

Internal and External Factors that Affect Working Capital Needs

Internal Factors External Factors

Company size and growth rates

Organizational structure

Sophistication of working capital

management

Borrowing and investing

positions/activities/capacities

Banking services

Interest rates

New technologies and new products

The economy

Competitors

Bottom line: There are many influences on a companys need for working capital.

2. MANAGING AND MEASURING LIQUIDITY

Liquidity is the ability of the company to satisfy its short-term obligations using

assets that are readily converted into cash.

Liquidity management is the ability of the company to generate cash when

and where needed.

Liquidity management requires addressing drags and pulls on liquidity.

- Drags on liquidity are forces that delay the collection of cash, such as slow

payments by customers and obsolete inventory.

- Pulls on liquidity are decisions that result in paying cash too soon, such as

paying trade credit early or a bank reducing a line of credit.

Copyright 2013 CFA Institute 3

SOURCES OF LIQUIDITY

Primary sources of liquidity

- Ready cash balances (cash and cash equivalents)

- Short-term funds (short-term financing, such as trade credit and bank loans)

- Cash flow management (for example, getting customers payments

deposited quickly)

Secondary sources of liquidity

- Renegotiating debt contracts

- Selling assets

- Filing for bankruptcy protection and reorganizing.

Copyright 2013 CFA Institute 4

MEASURE OF LIQUIDITY

Copyright 2013 CFA Institute 5

LIQUIDITY RATIOS

Current ratio =

Current assets

Current liabilities

Ability to satisfy current

liabilities using current assets

Quick ratio =

Cash +

Shortterm

investments

+ Receivables

Current liabilities

Ability to satisfy current

liabilities using the most liquid

of current assets

RATIOS INDICATING MANAGEMENT OF CURRENT ASSETS

Receivables turnover =

Total revenue

Average receivables

How many times accounts

receivable are created and

collected during the period

Inventory turnover =

Cost of goods sold

Average inventory

How many times inventory is

created and sold during the

period

OPERATING AND CASH CONVERSION CYCLES

The operating cycle is the length of time it takes a companys investment in

inventory to be collected in cash from customers.

The net operating cycle (or the cash conversion cycle) is the length of time

it takes for a companys investment in inventory to generate cash, considering

that some or all of the inventory is purchased using credit.

The length of the companys operating and cash conversion cycles is a factor

that determines how much liquidity a company needs.

- The longer the cycle, the greater the companys need for liquidity.

Copyright 2013 CFA Institute 6

OPERATING AND CASH CONVERSION CYCLES

Copyright 2013 CFA Institute 7

Acquire

Inventory

for Credit

Sell

Inventory

for Credit

Collect on

Accounts

Receivable

Pay

Suppliers

Acquire

Inventory

for Cash

Sell Inventory for

Credit

Collect on

Accounts

Receivable

Operating Cycle Cash Conversion Cycle

OPERATING AND CASH CONVERSION CYCLES:

FORMULAS

Number of days of inventory =

Inventory

Average days

cost of goods sold

=

365

Inventory turnover

Average time it

takes to create

and sell

inventory

Number of days of receivables =

Receivables

Average days

revenues

=

365

Receivables turnover

Average time it

takes to collect

on accounts

receivable

Number of days of payables =

Accounts payable

Average days

purchases

=

365

Accounts payables turnover

Average time it

takes to pay its

suppliers

Operating cycle =

Number of days

of inventory

+

Number of days

of receivables

Net operating cycle

or

Cash conversion cycle

=

Number of days

of inventory

+

Number of days

of receivables

Number of days

of payables

8

EXAMPLE: LIQUIDITY AND OPERATING CYCLES

Compare the liquidity and liquidity needs for

Company A and Company B for FY2:

Copyright 2013 CFA Institute 9

Company A Company B

FY2

FY1 FY2 FY1

Cash and cash equivalents 200 110 200

300

Inventory 500 450 900

900

Receivables 600 625 1,000

1,100

Accounts payable 400 350 600

825

Revenues 3,000 950 6,000

6,000

Cost of goods sold 2,500 750 5,200

5,050

EXAMPLE: LIQUIDITY AND OPERATING CYCLES

Copyright 2013 CFA Institute 10

Company A Company B

FY2

FY2

Current ratio 3.3 times 3.5 times

Quick ratio 2.0 times 2.0 times

Number of days of inventory 73.0 days 63.2 days

Number of days of receivables 73.0 days 60.8 days

Number of days of payables 57.3 days 42.1 days

Operating cycle 146.0 days 124.0 days

Cash conversion cycle 88.7 days 81.9 days

1. How do these companies compare in terms of liquidity?

2. How do these companies compare in terms of their need for

liquidity, based on their operating cycles?

3. MANAGING THE CASH POSITION

Management of the cash position of a company has a goal of maintaining

positive cash balances throughout the day.

Forecasting short-term cash flows is difficult because of outside, unpredictable

influences (e.g., the general economy).

Companies tend to maintain a minimum balance of cash (a target cash

balance) to protect against a negative cash balance.

Copyright 2013 CFA Institute 11

Examples of Cash Inflows and Outflows

Inflows

Receipts from operations, broken down by

operating unit, departments, etc.

Fund transfers from subsidiaries, joint ventures,

third parties

Maturing investments

Debt proceeds (short and long term)

Other income items (interest, etc.)

Tax refunds

Outflows

Payables and payroll disbursements, broken

down by operating unit, departments, etc.

Fund transfers to subsidiaries

Investments made

Debt repayments

Interest and dividend payments

Tax payments

MANAGING CASH

Managers use cash forecasting systems to estimate the flow (amount and

timing) of receipts and disbursements.

Managers monitor cash uses and levels.

- They keep track of cash balances and flows at different locations.

A companys cash management policies include

- Investment of cash in excess of day-to-day needs and

- Short-term sources of borrowing.

Other influences on cash flows:

- Capital expenditures

- Mergers and acquisitions

- Disposition of assets

Copyright 2013 CFA Institute 12

4. INVESTING SHORT-TERM FUNDS

Short-term investments are temporary stores of funds.

- Examples include U.S. Treasury Bills, eurodollar time deposits, repurchase

agreements, commercial paper, and money market mutual funds.

Considerations:

- Liquidity

- Maturity

- Credit risk

- Yield

- Requirement of collateral

Copyright 2013 CFA Institute 13

YIELDS ON SHORT-TERM SECURITIES

Yield Formula

Money market yield

Face value Purchase price

Purchase price

360

Number of days to maturity

Bond equivalent yield

Face value Purchase price

Purchase price

365

Number of days to maturity

Discount-basis yield

Face value Purchase price

Face value

360

Number of days to maturity

Copyright 2013 CFA Institute 14

The nominal rate is the stated rate of interest, based on the face value

of the security.

The yield is the actual return on the investment if held to maturity.

There are different conventions for stating a yield:

EXAMPLE: YIELDS ON

SHORT-TERM INSTRUMENTS

Suppose a security has a face value of $100 million and a purchase price of $98

million and matures in 180 days.

1. What is the money market yield on this security?

Money market yield =

$100 $98

$98

360

180

= 4.0816%

2. What is the bond equivalent yield on this security?

Bond equivalent yield =

$100 $98

$98

365

180

= 4.1383%

3. What is the discount-basis yield on this security?

Discountbasis yield =

$100 $98

$100

360

180

= 4%

Copyright 2013 CFA Institute 15

SHORT-TERM INVESTMENT STRATEGIES

Short-Term Investment

Strategies

Active

Matching

Strategy

Mismatching

Strategy

Laddering

Strategy

Passive

Copyright 2013 CFA Institute 16

SHORT-TERM INVESTMENT POLICY

List and explain the reason the portfolio exists and

describe general attributes.

Purpose

Describe the executives who oversee the portfolio

managers (inside and outside) and describe what

happens if the policy is not followed.

Authorities

Describe the types of securities to be considered in the

portfolio and any restrictions or constraints.

Limitations or

Restrictions

List the credit standards for holdings (for example, refer

to short-term or long-term ratings).

Quality

Auditing and reporting may be included.

Other Items

Copyright 2013 CFA Institute 17

5. MANAGING ACCOUNTS RECEIVABLE

Objectives in managing accounts receivable:

- Process and maintain records efficiently.

- Control accuracy and security of accounts receivable records.

- Collect on accounts and coordinate with treasury management.

- Coordinate and communicate with credit managers.

- Prepare performance measurement reports.

Companies may use a captive finance subsidiary to centralize the accounts

receivable functions and provide financing for the companys sales.

Copyright 2013 CFA Institute 18

EVALUATING THE CREDIT FUNCTION

Consider the terms of credit given to customers:

- Ordinary: Net days or, if a discount for paying within a period,

discount/discount period, net days (for example, 2/10, net 30).

- Cash before delivery (CBD): Payment before delivery is scheduled.

- Cash on delivery (COD): Payment made at the time of delivery.

- Bill-to-bill: Prior bill must be paid before next delivery.

- Monthly billing: Similar to ordinary, but the net days are the end of the

month.

Consider the method of credit evaluation that the company uses:

- Companies may use a credit-scoring model to make decisions of whether

to extend credit, based on characteristics of the customer and prior

experience with extending credit to the customer.

Copyright 2013 CFA Institute 19

MANAGING CUSTOMERS RECEIPTS

The most efficient method of managing the cash flow from customers depends

on the type of business.

Methods of speeding the deposit of cash collected by customers:

- Using a lockbox system and concentrating deposits

- Encouraging customers to use electronic fund transfers

- Point of sale (POS) systems

- Direct debt program

For check deposits, performance can be monitored using a float factor:

Float factor =

Average daily float

Average daily deposit

- The float is the amount of money in transit.

- The float factor measures how long it takes for checks to clear. The larger the

float factor, the better.

Copyright 2013 CFA Institute 20

EVALUATING ACCOUNTS

RECEIVABLE MANAGEMENT

Aging schedule, which is a breakdown of accounts by length of time

outstanding:

- Use a weighted average collection period measure to get a better picture of

how long accounts are outstanding.

- Examine changes from the typical pattern.

Number of days receivable:

- Compare with credit terms.

- Compare with competitors.

Copyright 2013 CFA Institute 21

6. MANAGING INVENTORY

The objective of managing inventory is to determine and maintain the level of

inventory that is sufficient to meet demand, but not more than necessary.

Motives for holding inventory:

- Transaction motive: To hold enough inventory for the ordinary production-to-

sales cycle.

- Precautionary motive: To avoid stock-out losses.

- Speculative motive: To ensure availability and pricing of inventory.

Approaches to managing levels of inventory:

- Economic order quantity: Reorder pointthe point when the company orders

more inventory, minimizing the sum of order costs and carrying costs.

- Just in time (JIT): Order only when needed, when inventory falls below a

specific level

- Materials or manufacturing resource planning (MRP): Coordinates production

planning and inventory management.

Bottom line: The appropriateness of an inventory management system depends on

the costs and benefits of holding inventory and the predictability of

sales.

Copyright 2013 CFA Institute 22

EVALUATING INVENTORY MANAGEMENT

Measures

- Inventory turnover ratio.

- Number of days of inventory

When comparing turnover and number of days of inventory among companies,

the analyst should consider the different product mixes among companies.

Copyright 2013 CFA Institute 23

7. MANAGING ACCOUNTS PAYABLE

Accounts payable arise from trade credit and are a spontaneous form of credit.

Credit terms may vary among industries and among companies, although

these tend to be similar within an industry because of competitive pressures.

Factors to consider:

- Companys centralization of the financial function

- Number, size, and location of vendors

- Trade credit and the cost of alternative forms of short-term financing

- Control of disbursement float (i.e., amount paid but not yet credited to the

payers account)

- Inventory management system

- E-commerce and electronic data interchange (EDI), which is the customer-

to-business payment connection through the internet

Copyright 2013 CFA Institute 24

THE ECONOMICS OF TAKING A

TRADE DISCOUNT

The cost of trade credit, when paid during the discount period, is 0%.

The cost of trade credit, when paid beyond the discount period, is

Cost of trade credit = 1 +

Discount

1 Discount

365

Number of days beyond

the discount period

1

Example: If the credit terms are 2/10, net 40, and the company pays on the

30th day,

Cost of trade credit = 1 +

0.02

0.98

365

20

1 = 44.585%

Although paying beyond the net period reduces the cost of trade credit further,

it brings into question the companys creditworthiness.

Copyright 2013 CFA Institute 25

EVALUATING ACCOUNTS

PAYABLE MANAGEMENT

The number of days of payables indicates how long, on average, the company

takes to pay on its accounts.

We can evaluate accounts payable management by comparing the number of

days of payables with the credit terms.

Copyright 2013 CFA Institute 26

8. MANAGING SHORT-TERM FINANCING

The objective of a short-term financing strategy is to ensure that the company

has sufficient funds, but at a cost (including risk) that is appropriate.

Sources of financing (from Exhibit 8-15):

Copyright 2013 CFA Institute 27

Bank Sources Nonbank Sources

Uncommitted line of credit

Regular line of credit

Overdraft line of credit

Revolving credit agreement

Collateralized loan

Discounted receivables

Bankers acceptances

Factoring

Asset-based loan

Commercial paper

WHICH SHORT-TERM FINANCING?

Characteristics that determine the choice of financing:

- Size of borrower

- Creditworthiness of borrower

- Access to different forms of financing

- Flexibility of borrowing options

Asset-based loans are loans secured by an asset

Copyright 2013 CFA Institute 28

Accounts Receivable

Blanket lien

Assignment of accounts

receivable

Factoring

Inventory

Inventory blanket lien

Trust receipt arrangement

Warehouse receipt

arrangement

COSTS OF BORROWING

Cost of a loan without fees:

Cost =

Interest

Loan amount

Cost of a loan with a commitment fee:

Cost =

Interest + Commitment fee

Loan amount

Cost of a loan with a dealers commission and bank-up costs:

Cost =

Interest + Dealers commission + Backup costs

Loan amount

If the interest is all-inclusive, it means that the loaned amount includes interest, so

the denominator is (Loan amount Interest), which has the effect of increasing the

cost of the loan.

Copyright 2013 CFA Institute 29

EXAMPLE: COST OF BORROWING

Suppose a one-year loan of $100 million has a commitment fee of 2% and an

interest rate of 4%. What is the cost of this loan?

Cost =

Interest + Commitment fee

Loan amount

Cost =

0.04 $100 + (0.02 $100)

$100

=

$6

$100

= 6%

What is the cost of this one-year loan if the loaned amount is all-inclusive?

Cost =

Interest + Commitment fee

Loan amount Interest and fee

Cost =

0.04 $100 + (0.02 $100)

$94

=

$6

$94

= 6.383%

Copyright 2013 CFA Institute 30

9. SUMMARY

Major points covered:

Understanding how to evaluate a companys liquidity position.

Calculating and interpreting operating and cash conversion cycles.

Evaluating overall working capital effectiveness of a company and comparing it

with that of other peer companies.

Identifying the components of a cash forecast to be able to prepare a short-

term (i.e., up to one year) cash forecast.

Copyright 2013 CFA Institute 31

SUMMARY (CONTINUED)

Understanding the common types of short-term investments and computing

comparable yields on securities.

Measuring the performance of a companys accounts receivable function.

Measuring the financial performance of a companys inventory management

function.

Measuring the performance of a companys accounts payable function.

Evaluating the short-term financing choices available to a company and

recommending a financing method.

Copyright 2013 CFA Institute 32

Você também pode gostar

- Budget 2013Documento15 páginasBudget 2013api-108000636Ainda não há avaliações

- Equity Chapter6Documento65 páginasEquity Chapter6moinmemon1763Ainda não há avaliações

- BudgetDocumento2 páginasBudgetmoinmemon1763Ainda não há avaliações

- SR No. Name of The Registered Company Address of The CompanyDocumento1 páginaSR No. Name of The Registered Company Address of The Companymoinmemon1763Ainda não há avaliações

- Budget Analysis 2013-14Documento106 páginasBudget Analysis 2013-14Saurav SinghAinda não há avaliações

- CML Vs Sml1Documento1 páginaCML Vs Sml1moinmemon1763Ainda não há avaliações

- Treasury Bills (T-Bills) Meaning:: Prepared by Mohuddin Memon 1Documento7 páginasTreasury Bills (T-Bills) Meaning:: Prepared by Mohuddin Memon 1moinmemon1763Ainda não há avaliações

- Feasibility StudyDocumento19 páginasFeasibility Studymoinmemon1763100% (1)

- FMIDocumento2 páginasFMImoinmemon1763Ainda não há avaliações

- Revised Schedule VI 28feb2011Documento23 páginasRevised Schedule VI 28feb2011Thameem Ul AnsariAinda não há avaliações

- CML & SMLDocumento2 páginasCML & SMLmoinmemon1763Ainda não há avaliações

- AlcoholDocumento1 páginaAlcoholmoinmemon1763Ainda não há avaliações

- Child Labour Final 2 1231095242881677 1Documento27 páginasChild Labour Final 2 1231095242881677 1sashi08Ainda não há avaliações

- Accounting StandardsDocumento4 páginasAccounting Standardsmoinmemon1763Ainda não há avaliações

- AA Update Revised Schedule VI Feb12Documento60 páginasAA Update Revised Schedule VI Feb12moinmemon1763Ainda não há avaliações

- Tata Acquiring Global FootprintDocumento2 páginasTata Acquiring Global Footprintmoinmemon1763Ainda não há avaliações

- Swot of AirasiaDocumento13 páginasSwot of AirasiaShirley LinAinda não há avaliações

- Icicigroup 100106093828 Phpapp01Documento22 páginasIcicigroup 100106093828 Phpapp01moinmemon1763Ainda não há avaliações

- Sample1coverletterDocumento1 páginaSample1coverlettermoinmemon1763Ainda não há avaliações

- Case StudyDocumento1 páginaCase Studymoinmemon1763Ainda não há avaliações

- Shehnaaz HusainDocumento18 páginasShehnaaz Husainmoinmemon1763Ainda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Amb 336 Case Study AnalysisDocumento10 páginasAmb 336 Case Study Analysisapi-336568710Ainda não há avaliações

- Indonesian Railways Law and StudyDocumento108 páginasIndonesian Railways Law and StudyGonald PerezAinda não há avaliações

- S Poddar and Co ProfileDocumento35 páginasS Poddar and Co ProfileasassasaaAinda não há avaliações

- List of Companies: Group - 1 (1-22)Documento7 páginasList of Companies: Group - 1 (1-22)Mohammad ShuaibAinda não há avaliações

- Sales Forecast Spreadsheet TemplateDocumento6 páginasSales Forecast Spreadsheet TemplateNithya RajAinda não há avaliações

- How High Would My Net-Worth Have To Be. - QuoraDocumento1 páginaHow High Would My Net-Worth Have To Be. - QuoraEdward FrazerAinda não há avaliações

- Basel III: Bank Regulation and StandardsDocumento13 páginasBasel III: Bank Regulation and Standardskirtan patelAinda não há avaliações

- Original PDF Global Problems and The Culture of Capitalism Books A La Carte 7th EditionDocumento61 páginasOriginal PDF Global Problems and The Culture of Capitalism Books A La Carte 7th Editioncarla.campbell348100% (41)

- Thyrocare Technologies Ltd. - IPODocumento4 páginasThyrocare Technologies Ltd. - IPOKalpeshAinda não há avaliações

- Gul Ahmed ReportDocumento1 páginaGul Ahmed ReportfahadaijazAinda não há avaliações

- PPLCDocumento5 páginasPPLCarjun SinghAinda não há avaliações

- BOOKING INVOICE M06AI22I08332696 To Edit 1Documento2 páginasBOOKING INVOICE M06AI22I08332696 To Edit 1AkshayMilmileAinda não há avaliações

- Mill Test Certificate: Run Date 21/12/2021 OR0019M - JAZ User ID E1037Documento1 páginaMill Test Certificate: Run Date 21/12/2021 OR0019M - JAZ User ID E1037RakeshParikhAinda não há avaliações

- ERUMGROUP 2019 - General PDFDocumento20 páginasERUMGROUP 2019 - General PDFAlok KaushikAinda não há avaliações

- MEC 1st Year 2020-21 EnglishDocumento16 páginasMEC 1st Year 2020-21 EnglishKumar UditAinda não há avaliações

- Mortgage 2 PDFDocumento5 páginasMortgage 2 PDFClerry SamuelAinda não há avaliações

- Zesco Solar Gyser ProjectDocumento23 páginasZesco Solar Gyser ProjectGulbanu KarimovaAinda não há avaliações

- Soft Power by Joseph S NyeDocumento19 páginasSoft Power by Joseph S NyemohsinshayanAinda não há avaliações

- KjujDocumento17 páginasKjujMohamed KamalAinda não há avaliações

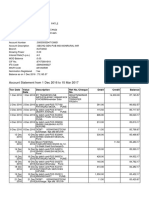

- Account statement showing transactions from Dec 2016 to Feb 2017Documento4 páginasAccount statement showing transactions from Dec 2016 to Feb 2017AnuAnuAinda não há avaliações

- Caution against sharing access to our websiteDocumento23 páginasCaution against sharing access to our websiteramshere2003165Ainda não há avaliações

- ACC 690 Final Project Guidelines and RubricDocumento4 páginasACC 690 Final Project Guidelines and RubricSalman KhalidAinda não há avaliações

- Urbanized - Gary HustwitDocumento3 páginasUrbanized - Gary HustwitJithin josAinda não há avaliações

- Final Exam - Module 2: Smooth Chin Device CompanyDocumento16 páginasFinal Exam - Module 2: Smooth Chin Device CompanyMuhinda Fredrick0% (1)

- Company accounts underwriting shares debenturesDocumento7 páginasCompany accounts underwriting shares debenturesSakshi chauhanAinda não há avaliações

- Final DraftDocumento47 páginasFinal Draftjaspal lohiaAinda não há avaliações

- RenatoPolimeno Resume 2010 v01Documento2 páginasRenatoPolimeno Resume 2010 v01Isabela RodriguesAinda não há avaliações

- MB m.2 Amd 9series-GamingDocumento1 páginaMB m.2 Amd 9series-GamingHannaAinda não há avaliações

- The Welcome Magazine FLORENCEDocumento52 páginasThe Welcome Magazine FLORENCEJohn D.Ainda não há avaliações